- RES’s hydraulic fracturing fleet (net) count will likely remain unchanged in 2023.

- However, the fleet portfolio mix changes as it targets a 75% ESG-friendly fleet by 2024.

- Both segments’ operating income growth was encouraging in Q4, which can lead to strong FCF recovery.

- The company doubled its quarterly dividend in 2023.

A Fleet Strategy Update

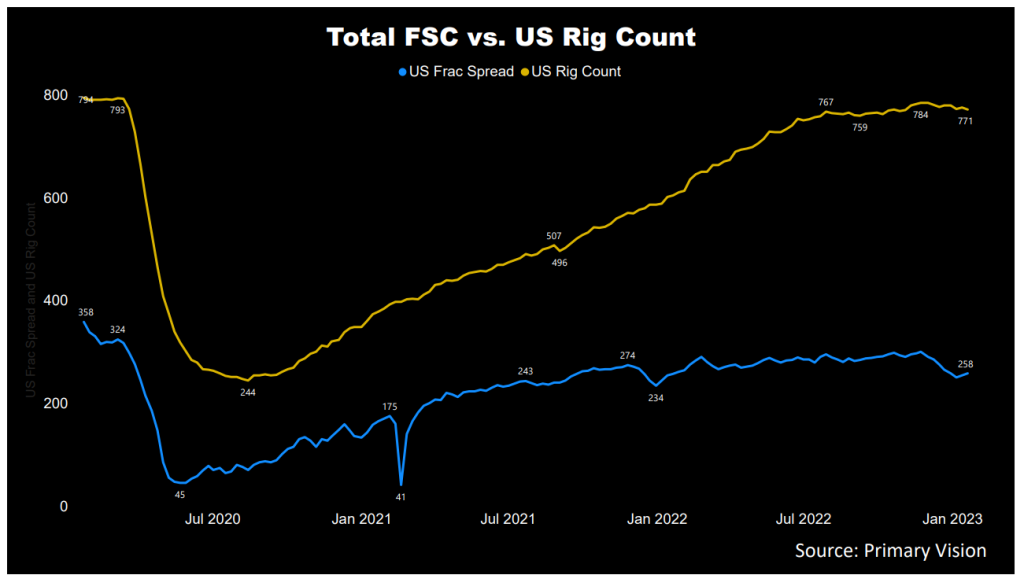

At the start of 2023, RPC’s (RES) management seemed to be taking a cautious approach. It plans to focus on investing in its completion-oriented businesses so that capacity addition does not outpace demand. It operated ten horizontal pressure pumping fleets in Q4 and does not look to add any more in 2023. Until Q3, it had deployed nine frac fleets. Following the under-investment over the past few years, the industry now sees an orientation toward drilling rigs while demand for completion has soaked up the available frac spread. Still, many upstream players have been disciplined in their capex commitment.

RES, while keeping its fleet count unchanged, may restructure the portfolio. It plans to upgrade or refurbish its fleets gradually. Five of its fleets are ESG-friendly, including Tier 4 DGB, Tier 2 DGB, and five Tier 2 diesel pumps. So, about half of its fleets are ESG-compliant now. By Q2 2024, it expects to increase the ESG-friendly composition’s share to ~75%.

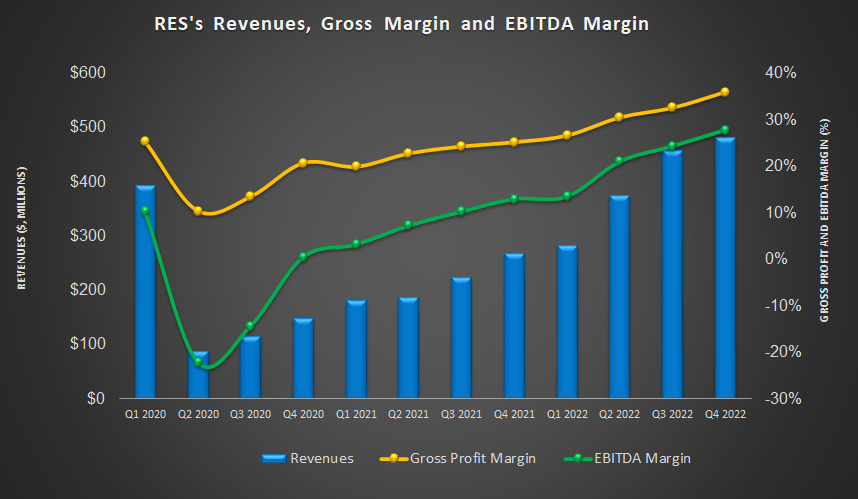

Investors may note that RES has been increasing the pricing of its services over the past few quarters. The growth remained steady in Q4, led by the demand for efficient frac spreads. So, the typical Q4 slowdown did not affect it, and the white space in the calendar was minimal. So, improved job mix and efficiency mark the company’s operating performance. Read our previous article to know more about RPC.

Analyzing Industry Indicators

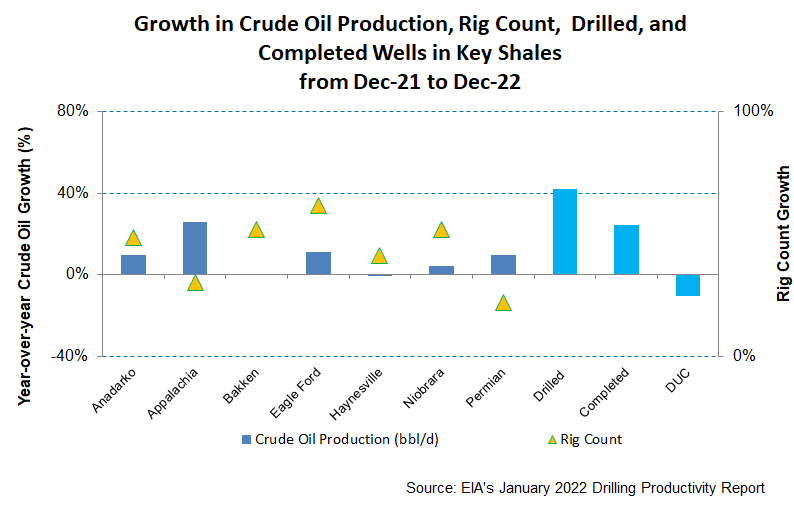

In the past year, until December 2022, the completed wells count growth (25% up) underperformed the drilled well count (42% up). But, the drilled but uncompleted wells declined (10% down). Appalachia (25.7% up) and Eagle Ford (11.2% up) topped among the shales that saw higher crude oil production in the past year. During this timeframe, crude oil production in Haynesville decreased (1% down).

Despite crude oil prices’ uncertain run over the past couple of months, the average crude oil production in these shales went up 9% in the past year until December 2022. In the past year, the US rig count pressed ahead (28% up) of the US frac spread count (0.4% up), as estimated by Primary Vision. So, the short-term indicators are somewhat volatile.

What Were The Q4 Drivers?

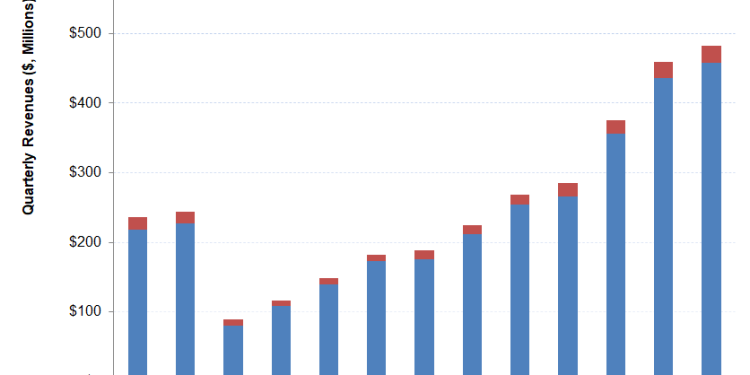

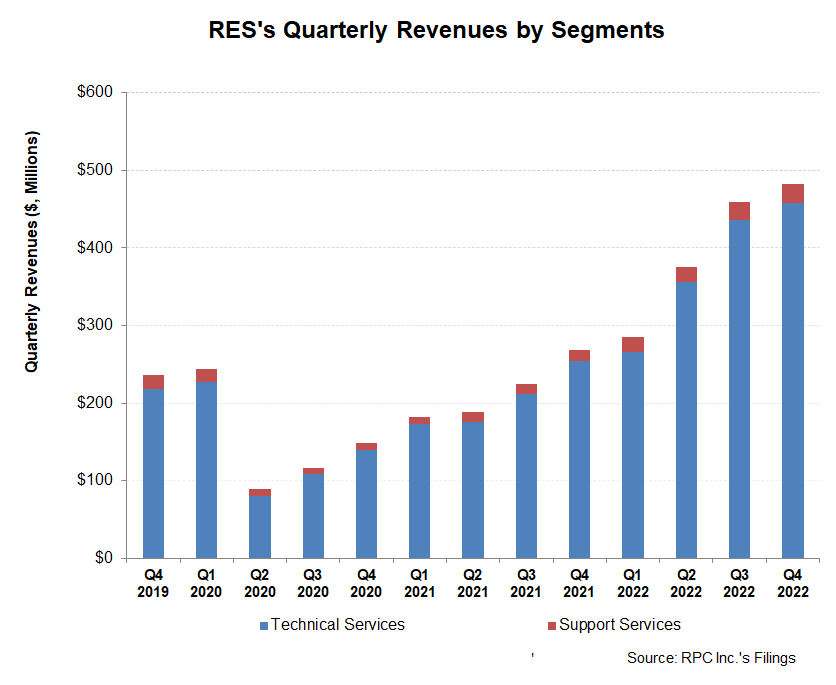

In Q4 2022, Technical Services revenues increased by 5% compared to Q3 2022. Higher customer activity levels, pricing hikes, and reactivated frac fleet led to sequential revenue growth. The segment’s operating income improved significantly (24% up) in Q4.

The Support Services segment saw a muted revenue growth (1% up) in Q4, while the operating income surged by 27% due to higher equipment utilization. Overall, the company’s cost of revenues (as a percentage of revenues) decreased by 340 basis points due to an improved job mix and more robust pricing.

Capex Growth, Cash Flows, And Liquidity

As of September 30, 2022, RES had no debt and positive cash & cash equivalents balance ($126 million). To guard against any liquidity strain, the company can tap from its robust liquidity (revolving credit facility plus cash & equivalents). The company recently doubled its quarterly dividend to $0.04 per share, which translates into a 0.42% dividend yield.

Learn about RES’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.