- Development activities in several international offshore and shallow water mark NOV’s optimism.

- Rapid growth in high-spec onshore rig day rates and expected returns due to capacity constraints and steady demand.

- Competitors’ volume growth and cost hikes due to supply chain issues would keep the revenue and operating margin under pressure in the near term.

- Although cash flows were negative in FY2022, it expects to turn it around in FY2023.

Analyzing NOV’s Strategies

In the Q4 2022 earnings call, NOV’s management outlined some challenges and many positives that will appear in 2023. While it emphasized the long-term bullish outlook in the energy sector, reactivating the offshore industry will be full of challenges. The 2020-2021 downturn eroded the offshore drilling capacity significantly as the drilling contractors cold-stacked rigs and laid-off workers. The company estimates that 386 offshore drilling rigs have been scrapped since 2011. The financing of offshore projects was also questioned. So, after the multi-year underinvestment, the offshore industry, when offered more viable and profitable investment opportunities, will face challenges to restart long-idled drilling assets. Read our previous article about NOV to know more.

Among the current opportunities, the company highlights development activities in Brazil, West Africa, and Guyana, as shallow water activity in Mexico, the Arabian Gulf, and India. It also expects brownfield tiebacks in the Gulf of Mexico and the North Sea. Now, in the US, operators are converting rig drilling fleet to higher capability AC rigs, and fit-for-purpose frac spreads. This did not happen in the international market in the past. However, the Middle East and Argentina have started adopting such technology.

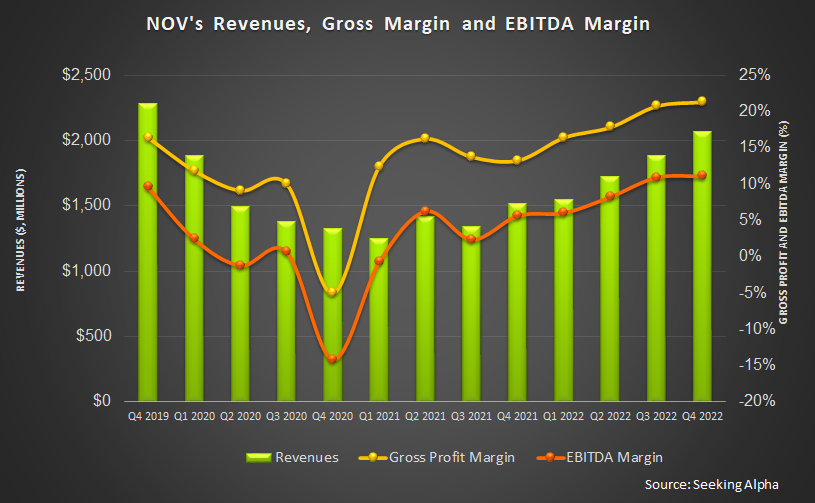

This has started reflecting in the company’s performance. In 2022, international markets outpaced North America. NOV’s international markets saw 14% sequential revenue growth versus 4% in North America. The adjusted EBITDA in Q4 2022 was $231 million, representing 20% sequential growth. The company’s book-to-bill was 1.1x as of December 31, 2022, which was 16% higher than Q3 2022.

Industry Activity

Although there is no scarcity in demand, supply has been limited owing to capital, labor, and supply chain constraints. New investments have been implemented to replace the higher wear and tear that simul frac operations typically face. In the US, the company estimates that the high-spec onshore rig day rates can reach $40,000 daily and generate 20% returns. Returns on new frac fleets can even approach 40%.

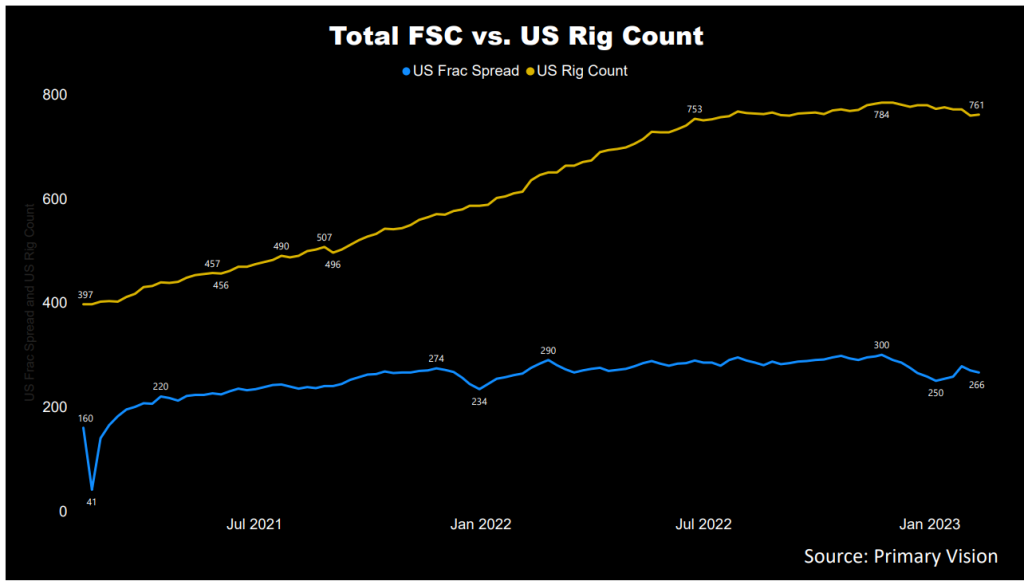

As estimated by Primary Vision, the frac spread count (or FSC) reached 266 by the second week of February and has inched marginally down over the past year. Over the past month, we saw 14 frac fleets removed from the count in the US. A falling frac count is negative for NOV’s growth.

The Near-Term Challenges And Opportunities

In Q4, NOV completed 15 offshore rig reactivation projects and has recently launched 23 new reactivation, recertification, and upgrade projects. There is renewed interest in floater activity. However, demand for newbuilds can take time. This is because, in the current environment, the operators are reactivating highly capable warm stacked rigs. Over the past three quarters, utilization and day rates for conventional rigs and equipment have improved. Operators will need their fleets to reach sufficiently high levels of utilization, day rates, and more advanced technology before new builds become active.

Over the past few years, NOV’s competitors have loaded plants over the past few years, leading to NOV’s sales volume reduction. So, the company offered discounts to maintain market share. Despite the pricing hikes over the past few quarters, its operating margin growth has been underwhelming. The company recently rolled back the pricing discounts, leading to higher net price increases. Margin continues to remain under pressure due to the inflationary cost condition prevailing in the industry.

The Q1 2023 Outlook

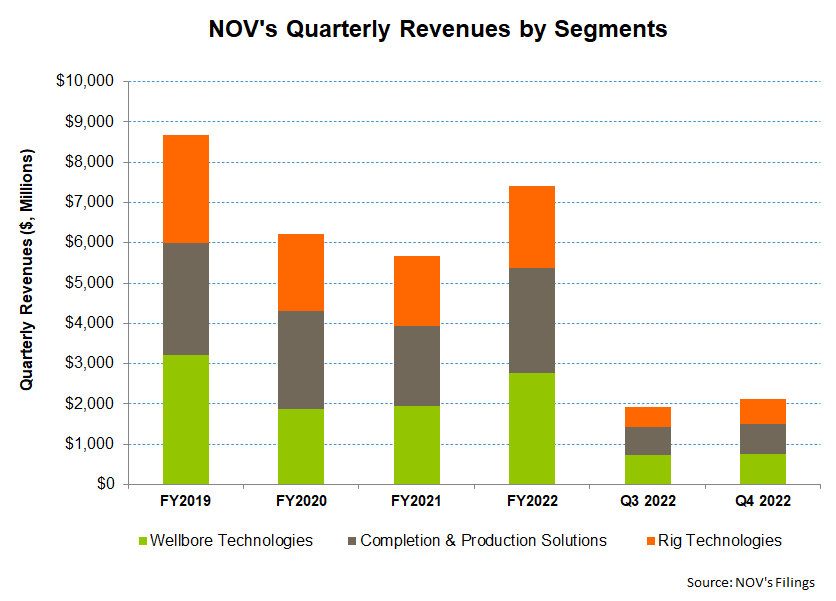

An improving global oilfield activity in drilling technologies will benefit the Wellbore Technologies segment in Q1 2023. However, the typical slowdown will offset the growth. So, the management expects revenues and EBITDA in this segment to remain unchanged in Q1 compared to Q4 2022.

The Completion & Production Solutions will suffer from the typical seasonality and several large projects nearing completion that would pull down sales. So, revenues in Q1 can see a mid-single-digit revenue fall while also EBITDA margins can contract.

While the Rig Technologies segment has several growth drivers, those factors would actually take effect after Q1. During Q1, the adverse effects of seasonality and the timing of projects would contract revenues by 10%-15% with decremental margins in the 30%-range.

Q4 2022 Segment Performance Drivers

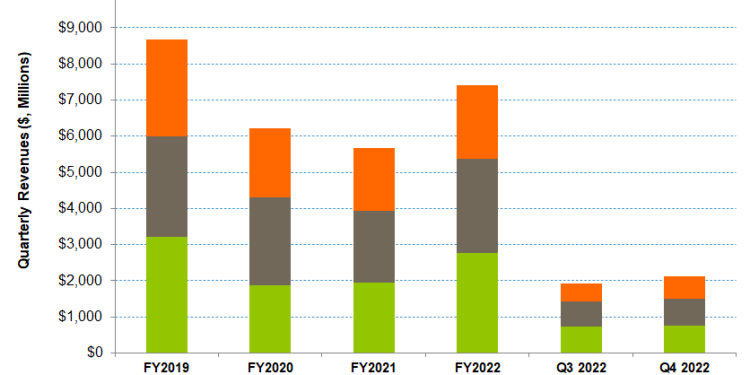

In Q4, NOV’s revenues increased by 10% compared to Q3 2022. The Wellbore Technologies segment (accounting for 36% of Q4 revenues) saw revenues rise by 3% quarter-over-quarter. The segment also saw operating income prop up by 49% during this period. Robust demand in international markets resulted in the topline and profit rises. However, supply chain disruptions delayed product deliveries, partially offsetting the revenue growth.

Revenues in the Completion & Production Solutions segment increased by 8% quarter-over-quarter in Q4, while the operating profit more than doubled. In this segment, a higher backlog of offshore projects and increased demand for completion equipment drove the result in Q4. As of December 31, the backlog in this segment increased by 8% over the previous quarter, with a book-to-bill of 1.18x.

The Rig Technologies segment saw 21% topline growth in Q4 over Q3 – the highest growth among the segments. During Q4, it saw improved demand for aftermarket parts and services and increased capital equipment deliveries. The segment’s operating profit also saw the steepest rise (264% up). The backlog for capital equipment orders for Rig Technologies totaled $2.79 billion as of December 31, 2022. The book-to-bill ratio was almost one, representing a steady revenue generation from the backlog.

Dividend And Dividend Yield

NOV pays an annual dividend of $0.20 per share at the current rate. It translates to a 0.86% forward dividend yield. Schlumberger (SLB) pays a yearly dividend of $1.00, which equals a forward dividend yield of 1.90%.

Negative Cash Flows And Debt Reduction

The company’s leverage (debt-to-equity) was 0.34x, slightly higher than its peers’ (CHX, FTI, WHD) average. Since mid-2015, it has reduced gross debt by $2.6 billion.

NOV’s cash flow from operations (or CFO) remained steeply negative in FY2022, in contrast to a healthy CFO a year ago. Although revenues increased in the past year, a steep rise in working capital contributed to a weak CFO. As a result, free cash flow was sharply negative in FY2022. In 2023, the company expects to become free cash flow positive. Also, in FY2023, it plans to increase capital expenditures by 29% in 2023 due to new product development.

Learn about NOV’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.