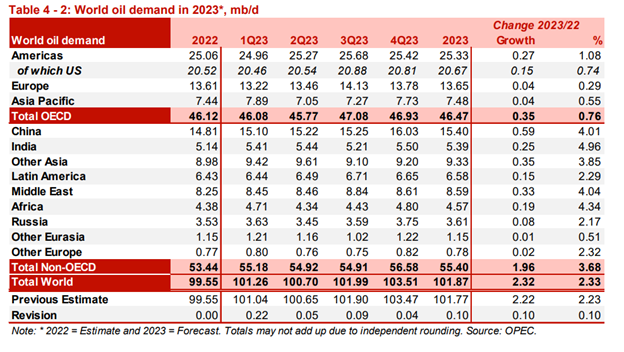

The recent OPEC report is calling for an increase in crude demand throughout 2023 based on China’s reopening. We believe that China’s demand spike is overstated, and as they ramp up we will see other facilities cut runs and pare back activity. This will limit the expected spike in crude demand and hinder some of the shift higher in expectations. The driving season is also setting up to be disappointing as consumers face a worsening situation with CPI and PPI accelerating again. The demand side is going to be capped as economic pressures mount further and more rate hikes roll through the global markets.

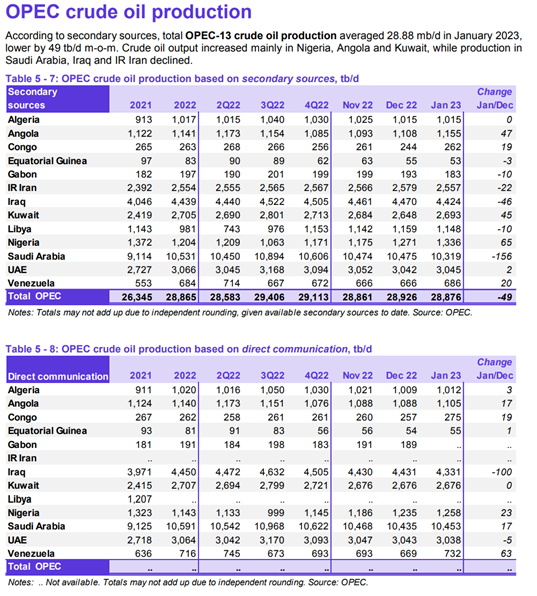

Even as demand comes under fire, supply isn’t ramping anywhere in the world at this point. OPEC+ is very happy to keep the current range in Brent, which is why they will maintain volumes well below quotas. West Africa is increasing some of their exports, but production is over 1M below current quotas. Iraq increased their OSPs slightly but are WELL below the KSA adjustments. Iraq differentials are still well below normal while KSA diffs are setting seasonal record highs. This is going to support some flows from the Middle East while we see term flows diminishing in the near term from KSA.

The physical market has been bouncing around a bit- we started off with some strength to close out Jan and the first two days of Feb. Buying dried up and prices dropped rapidly to entice some purchases to clear some of the growing stockpiles. This led to a big sweep of buying over a 5 day period that has now been satisfied resulting in another drop in activity.

PLATTS:

- Vitol offered 330k bbl of Angola’s Dalia on CFR Rotterdam basis for March 5-15 arrival at 30c/bbl less than Dated Brent: person monitoring window

- Cargo to be discharged from Ardeche

- Declined from -25c/bbl on Feb. 13, -20c on Feb. 10, -15c on Feb. 8, +5c on Feb. 7, +20c on Feb. 6, +40c on Feb. 3

- A similar cargo — with volume of 375k bbl — was offered at +45c on Feb. 2, +55c on Feb. 1

Angola increased sales for April, but they have yet to clear March with little movement currently happening after a quick 12 sales. The problem remains the back and forth in the market, and the consistent builds we are seeing on the refined product market. The builds will persist- especially on the gasoline/light distillate front, while competition increases on middle distillate/ diesel with Russia/China pushing more into the market. As the additional barrels come to market, the only strength (diesel) gets hit hard and reduces total margins and profitability hurting runs and underlying crude demand.

The U.S. announced they were going to maintain their scheduled release from the SPR (strategic petroleum reserve) that was setup in 2015. “The non-emergency sale from the SPR was mandated by 2015 legislation, and the Energy Department had sought to stop some of those releases to refill the emergency reserve. The sale is in accordance with a budget mandate enacted in 2015 for the current fiscal year, said a spokesperson for the Department of Energy.” There were expectations that the sale was going to be cancelled following the releases that took place over the last year. The DoE wanted Congress to stop the sale of the 26M barrels, and there are ongoing conversations to stop the sales that are slated to happen through 2027. “The Department’s request comes on the heels of successful efforts to cancel some 140 million barrels of sales from the reserve mandated by Congress over fiscal 2024 through fiscal 2027 to help pay for unrelated legislative initiatives. Turk said the department is “having ongoing conversations” about canceling the fiscal 2023 sales as well. The Energy Department is planning on moving forward with the fiscal 2023 sale, according to a person familiar with the matter.” It’s important to remember that these sales were already slated to occur, and there will be a renewed push to reduce sales as builds continue around the world.

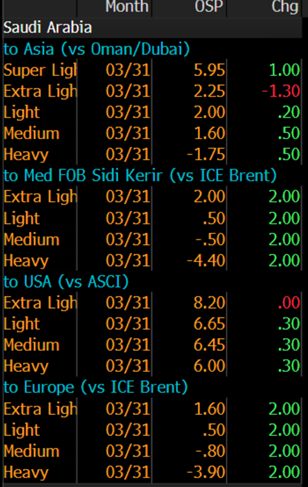

Saudi Arabia unexpectedly raised their OSPs (Official Selling Prices) to all locations with the largest pumps going to Europe.

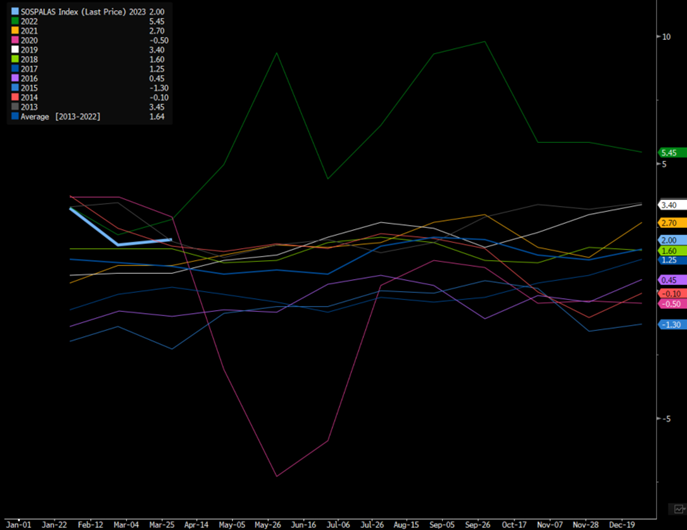

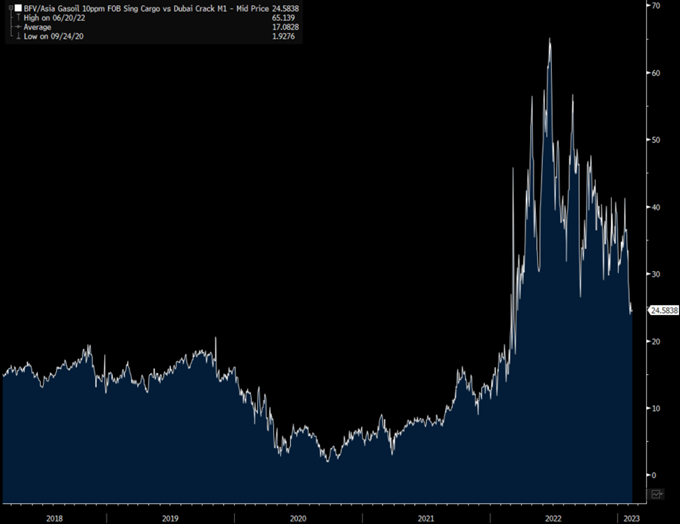

Saudi raised them to Asia as well, which is going to put more pressure on refiners already struggling with falling crack spreads. The market reacted by buying ZERO incremental barrels- Armaco allocated their full March crude oil term volumes to buyers across Asia, but there was no additional demand. Typically, we will see some additional cargoes being picked up, but following the spike in pricing those barrels are being left in the market. Margins are already being compressed with the drop in middle distillate, and this will be another pressure point for Asian refiners. Companies/countries that are purchasing Urals and ESPO will have another big advantage because it will increase the spread and pad margins. The increase in in Light Crude to Asia is still within historics, but the problem is related to the record amount of light disty in stroage mixed with growing storage of middle disty.

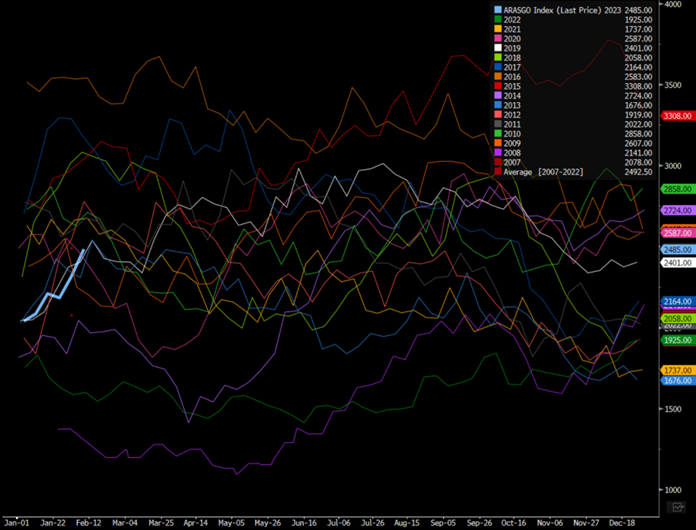

Middle East Arab Light Crude Saudi to Asia OSP Spread vs Average Oman/Dubai FOB

The increases to Europe and U.S. are still at record levels and will limit new orders. We have already heard from several European refiners cutting their term amounts and reducing their purchases from the Middle East further. We expect that to resonate throughout Asia as well and leave more Middle Eastern crude in floating storage. Some of the additional barrels will be used to make more product as another train comes online in Kuwait. “Kuwait aims to raise exports of refined products including diesel and jet fuel to Europe this year. Those extra volumes will go a small way to helping the continent deal with any shortages that arise from Sunday’s ban on almost all refined fuels from Russia, part of a strategy to punish Moscow for its invasion of Ukraine. “We are essentially bringing in a wall of distillates, diesel fuel oil to those markets, specifically into Europe, to fill up the supply gaps we are seeing,” Sheikh Nawaf said. Many of the extra flows will come from Kuwait’s massive, 615,000 barrel-a-day Al Zour refinery. The first of three lines, or trains as they’re known in the industry, is now operating. The second should start producing fuels in the coming weeks and the last one in the second quarter, the CEO said.”

The Middle East has been shifting their strategy since 2014 where they decided to build/ expand their refining and petrochemical footprint instead of purely exporting crude. The rise in OSPs could be a way to reduce broader demand to keep more crude local and sell the higher value product.

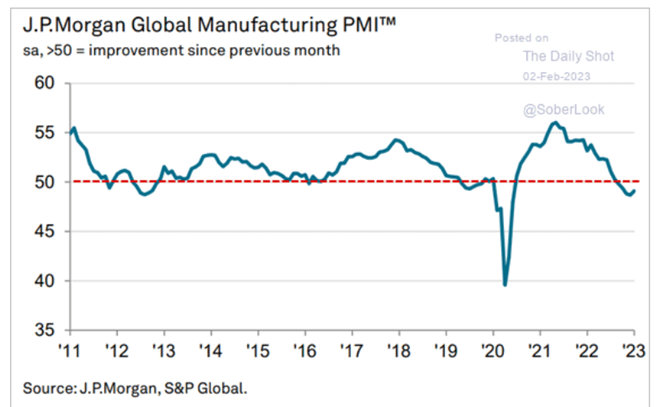

OPEC updated their estimates and raised its projection for the amount of crude it will need to pump this year by 250,000 barrels a day to an average of 29.42 million a day, it said in a monthly report. Based on OPEC’s current output rates, markets are set to be broadly balanced this year. According to the group, “Global oil consumption will increase by 2.3 million barrels a day — or 100,000 a day more than projected a month ago — to an average of 101.87 million barrels a day this year, OPEC said. OPEC reduced its estimate for supplies outside the group in 2023 by 150,000 barrels a day to 67 million barrels a day.” The biggest factors in the mix will be Chinese activity and global growth estimates. We still remain cautious global growth as manufacturing activity stays in contraction territory. The pressure created by limited manufacturing activity will shrink underlying demand for crude as refined product demand softens.

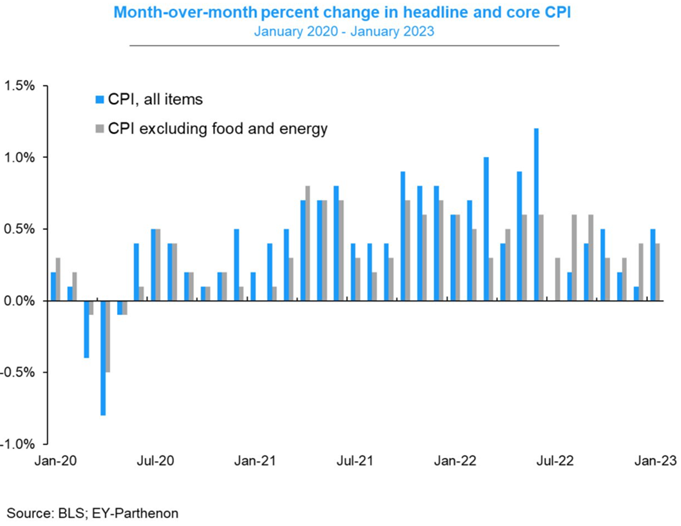

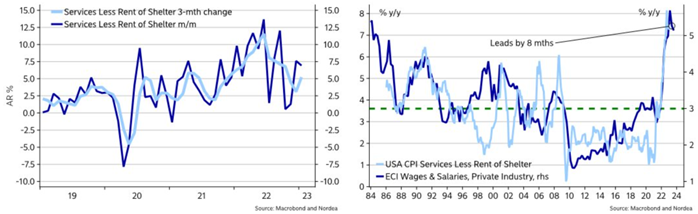

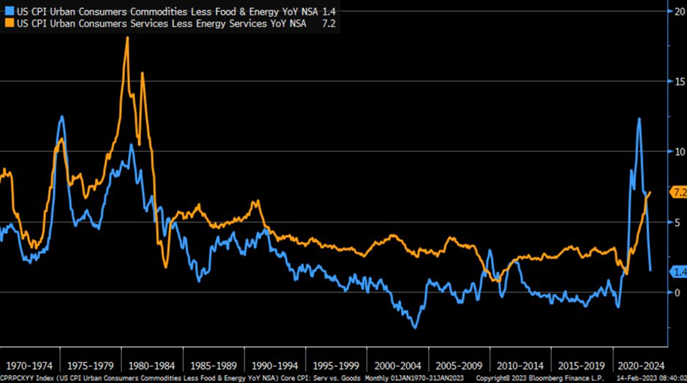

The consumer is another problem point given the weakness in real wages and inflation pressure holding firm around the world. U.S. inflation accelerated again last month, which we was our base case- and we still see it holding firm, especially on the core and “sticky” front. Service costs and wage expense are staying strong, which is going to keep the consumer on the sidelines.

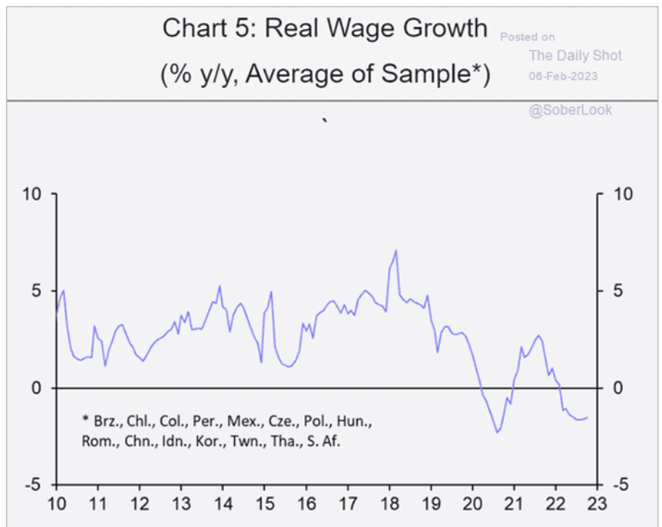

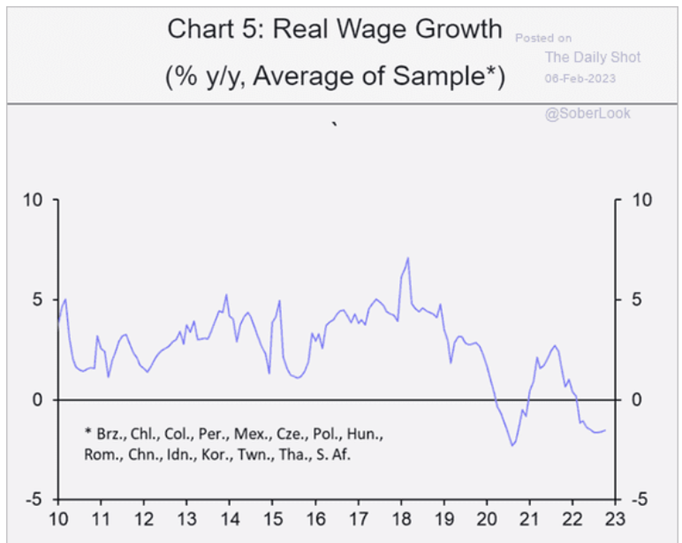

The reason for the broader concern is driven by the broad impacts this is having- not just on the U.S. Global real wages are staying weak and limiting the amount of spending, which is building inventories and shrinking new orders/retail sales.

Before we jump into the Russia news, we are getting some adjustments to the physical market with additional reductions.

Vitol offered Dalia at a deeper discount to Dated Brent on the Platts window. Gabon is scheduled to reduce exports of Rabi Light crude to 61k b/d in March from 102k b/d in February.

PLATTS:

- Vitol offered 330k bbl of Angola’s Dalia on CFR Rotterdam basis for March 5-15 arrival at 25c/bbl less than Dated Brent: person monitoring window

- Cargo to be discharged from Ardeche

- Declined from -20c/bbl on Feb. 10, -15c on Feb. 8, +5c on Feb. 7, +20c on Feb. 6, +40c/bbl on Feb. 3

- A similar cargo — with volume of 375k bbl — was offered at +45c on Feb. 2, +55c on Feb. 1

While we had some softness in WAF and the Middle East, activity in the North Sea/Europe remained fairly firm.

Total bid for Forties and Shell offered at higher levels than the most recent activity in the Platts window.

- Total bid Forties for March 4-8 at Dated +15c, FOB: trader monitoring Platts

- Company also bid same grade for Feb. 25-March 3 at Dated flat

- Shell offered Forties at March 6-10 at Dated +$1.70, CIF Rotterdam and for March 1-3 at Dated +30c

- Forties was last offered at -35c, FOB on Feb. 8

The Brent vs Dubai spread continues to tighten making Middle Eastern crude “more” expensive and will drive less spot or extra term purchases (as we talked about earlier with no term buying from KSA). We expect to see floating storage rising in the Middle East, and the movement lower in the Brent pricing should make WAF a good bellwether of physical crude demand. Most of the grades are priced off of dated brent, and as pricing gets more competitive vs ME- it will be the preferred barrel. This will make WAF floating storage and sales important for the next few weeks.

The crude markets remain volatile with another round of uncertainty thrown into the mix by Russia. “Russia plans to cut its oil output by 500,000 barrels a day next month, following through on a threat to retaliate against western energy sanctions and sending oil prices sharply higher. The move threatens to renew turmoil in the oil market, which had so far taken disruption to Russian supplies in stride. It further tightens supply constraints from OPEC+, which Saudi Arabia had already led into a 2 million barrel-a-day production cut last year in an effort to buoy prices. Delegates from the group signaled they won’t take any action to fill in the gap created by Russia.” This may seem like Russia is “getting” aggressive against the West, but we have to look at flows because Russia may have no choice except reduce production.

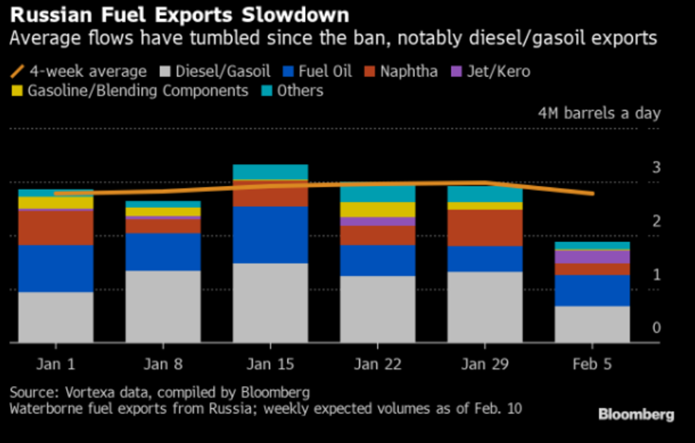

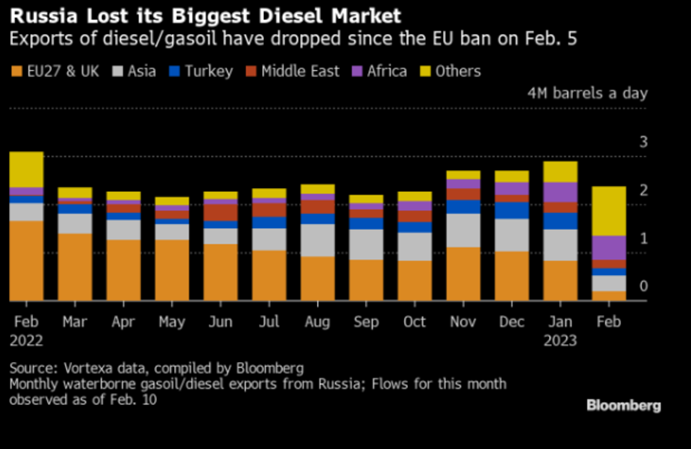

The EU rolled out their next round of sanctions on refined products (mostly diesel and gasoil) coming from Russia. The EU27 was the largest buyer of Russian product that is now displaced and must find a new home. The below chart puts into perspective the number of refined flows that make it into the export market. There has been a fairly steep drop off of exports as we approached the deadline for the price cap.

Russia has a finite amount of storage capacity, and there is a limit to the amount of exports that can happen at a given time. A port can only handle so much traffic at any given time, and there will have to be a choice on what product is loaded- crude or refined product. There may be some slips that can only handle or the other, but the increase in inherent ship traffic will still limit underlying flows.

This just means that Russia CANNOT export the same level of crude and refined product that was being moved by both pipe and ship. As more oil and product moves to ship Russia will have to make a decision, and it will result in a reduction in crude production. As diesel, gasoline, and gasoil get stuck at the coast- storage will build up and cause refiners to reduce utilization rates. As rates fall, it causes more crude to be left in the Russian markets and put into storage. Russian crude is already struggling to maintain flows so the mixture of reduced run rates will result in an even bigger glut of crude left onshore. The additional level of crude caused by run cuts will overwhelm export infrastructure and storage- so instead of letting the market drive production cuts- Russia can “claim” they are doing it to impact the crude markets.

The below chart puts into perspective the amount of product that has to be redirected to new markets. This is a sizeable chunk that will be pushed into the export markets, so it makes sense to see announced production cuts.

The important piece of information will be the amount of crude exports vs production. There is a good chance that crude exports will remain stable even as production is reduced because oil no longer going into refiners will have to find a home. We don’t see announced production cut reducing any volume in the broader market.

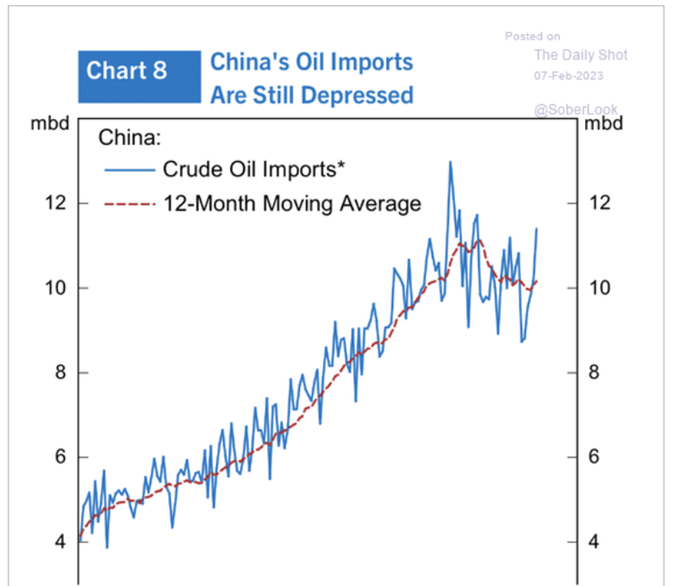

The global markets have seen builds accelerate faster than expected, and we are starting to see some adjustments to storage estimates. We have about a 60M barrels crude and products inventory build in Europe and the US to date, which isn’t bullish at all vs the prevailing narrative. China may be drawing somewhat (from high levels!) but still these ‘China demand will rise by 1-3 mbpd’ calls are grossly overstated. We have seen a very steady amount of Chinese buying that is still within a historical range of buying.

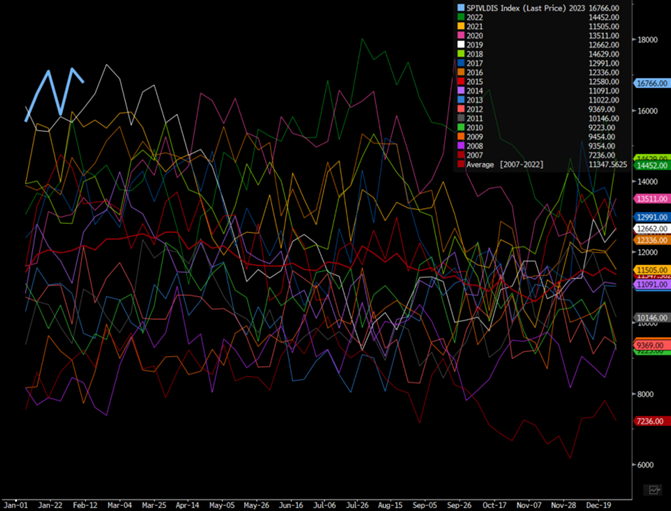

China Supertanker Crude Imports

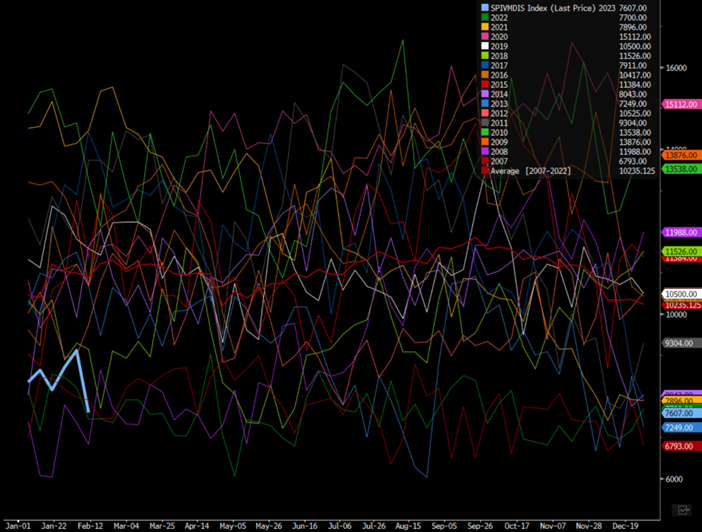

There still remains a record amount of gasoline/light distillates in storage in Asia and Europe that is keeping crack spreads compressed.

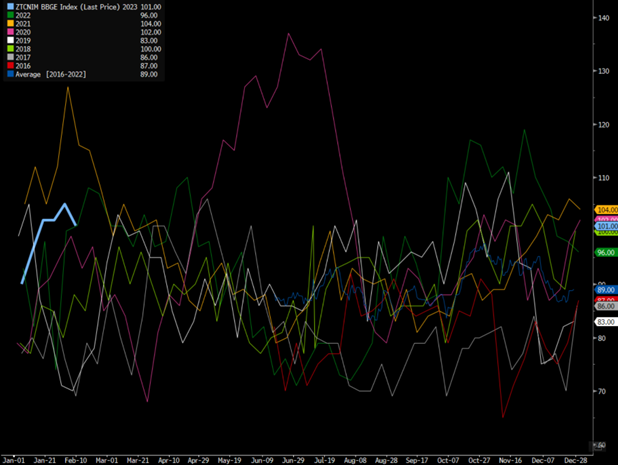

ARA Gasoline Inventory

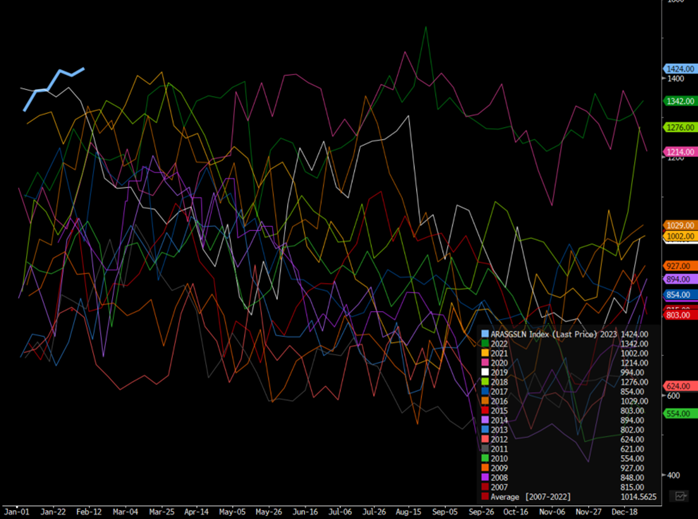

ARA Gasoil Inventory

As Russian product struggles to find a home, we have seen middle distillate (diesel) stocks begin to rise quickly in the same areas around the world.

Singapore Light Distillate Storage

Singapore Middle Distillate Storage

We continue to see more pressure on global crack spreads as the last remaining strong point- middle distillate/diesel- weakens across the board. It’s still strong versus historical levels, but the light distillate/gasoline side hurts the total crack spread. As gasoil weakens further (our base case), it will cause more pain for refiners resulting in economic run cuts. This can come by way of straight up reductions or maintenance being pulled forward ahead of schedule.

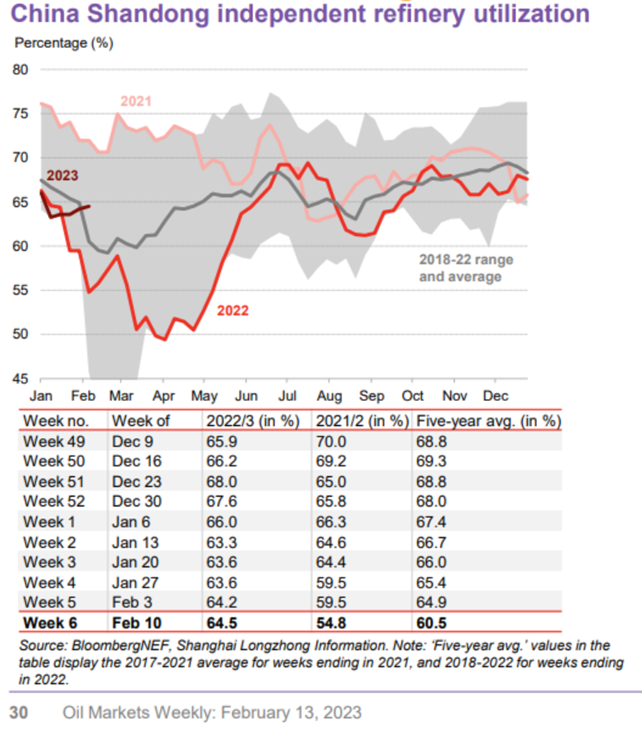

We have been discussing how China’s refiners were going to maintain operation above seasonal norms driven by local shifts in demand and the ability to export.

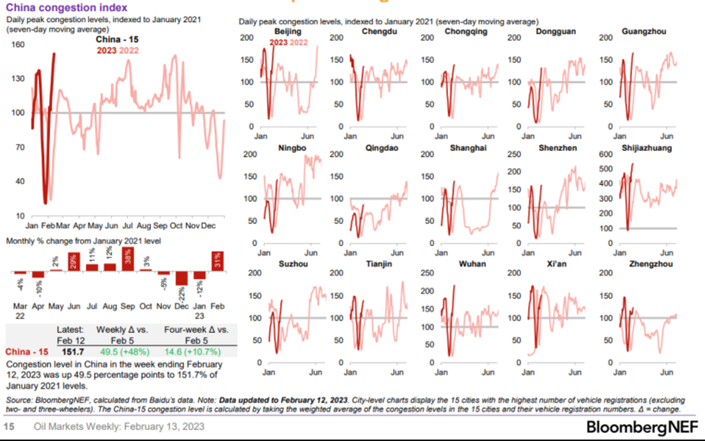

February has kicked off a very strong start to the month, but it will be important to see how it closes out. There was a mixture of pent-up demand and travel that pushed activity higher, but we should see it pull back closer to last year as we head into the rest of the month. Demand will remain elevated as people shift back to normal routines and come back from Lunar New Year.

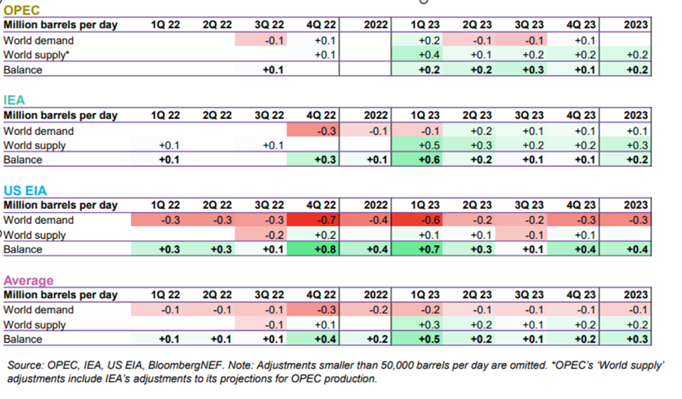

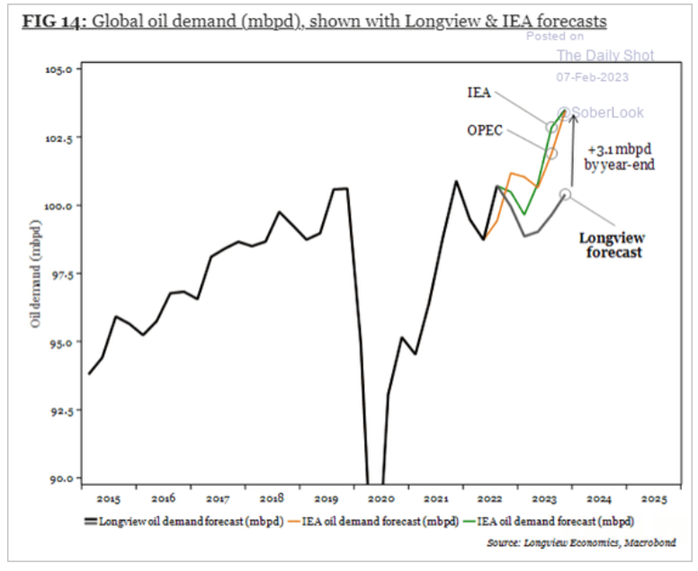

When we look at storage levels, there is a continuing expectation of builds across the system in 2023. The EIA is the most recent to increase their estimates for balances in 2023. As more pressure grows across the economy, we expect to see some increase in expectations even as Russia “cuts” production.

There are more people coming out an adjusting their estimates for global oil demand with the most recent being Longview. If the IEA and OPEC even reduce their estimates by 1M barrels a day, you can get an idea at how quickly we will see builds accrue in the global markets.

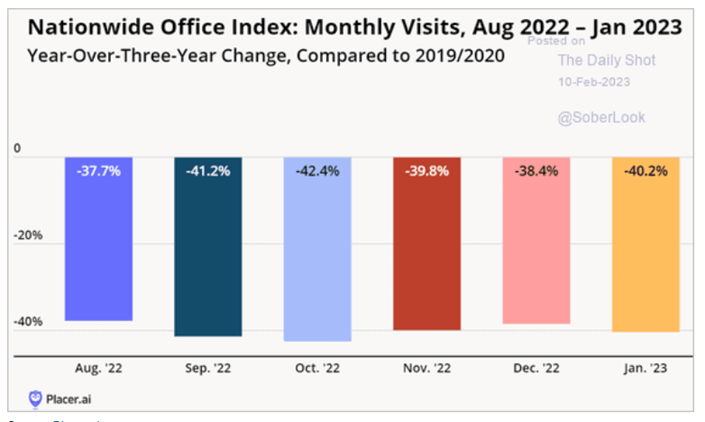

Even as China comes back, other nations continue to change their everyday routines. The U.S. is just another example of a country seeing a permanent shift in work from home vs in-person. Even as the prevalence of COVID has fallen away and fears have all but disappeared, people are STILL not returning to the office in any meaningful way. We have said since 2020 that the business environment would become more reliant on flexible schedules, which has played out almost perfectly.

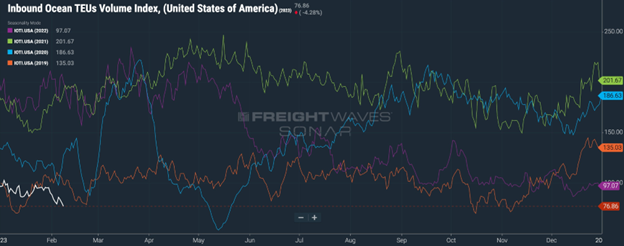

There is also a broad slowdown in trucking and shipping data that supports our view that global trade is falling. Container imports bound for the U.S. are below pre-COVID levels, and we see these levels being maintained as inventories keep rising.

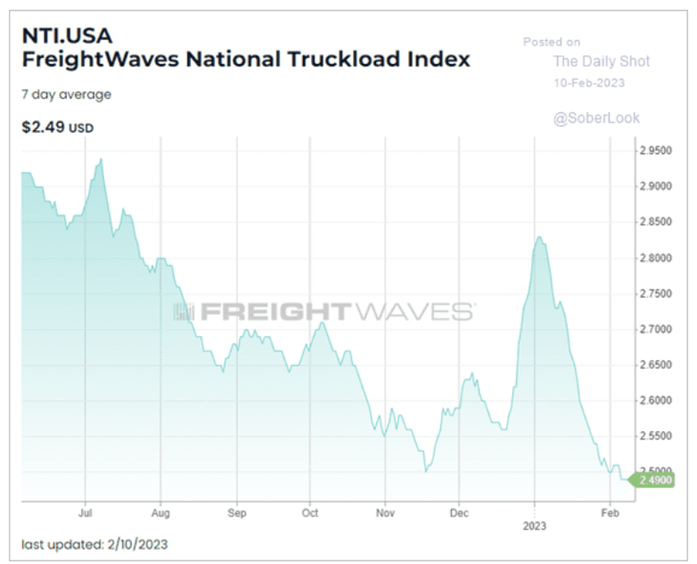

The national truckload index shows more discounts across the board as there is less demand for trucks.

When we look at crude shifts, we still see headwinds in the oil markets. As we mentioned before, crude flows into China have increased but still remain below the highs achieved prior to COVID. There was a big rush of buying West African crudes that saw some tightness in pricing, but the purchases have slowed following the last sweep.

The problem for West Africa and the Middle East is the amount of Russian crude that keeps getting dumped into the markets. We have said for MONTHS that the price cap wouldn’t stop the flow of urals and ESPO into the market, but keep barrels competitive in the market. The below chart shows the weighted average of Urals and ESPO that will keep India and China buying. These flows will enable refiners to also undercut other refiners in the market and keep flows elevated in both entities. They have the ability to purchase steeply discounted crude with options to sell directly in country or capture more market share abroad.

The U.S. is facing a growing challenge as margins keep getting compressed. As crude prices push back to the top of the range, we will see pressure to the downside of as well as valuations of E&Ps come under fire. Margins are getting tight as costs continue to creep higher with labor, steel, and other input costs shifting up again.

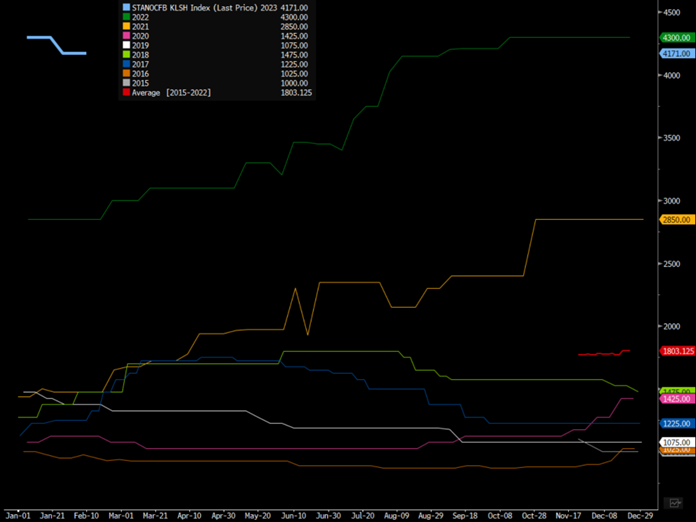

The below chart is just one example of how elevated prices are versus historics. We don’t see any near-term reduction in prices as companies try to pass on as much cost as possible. The inability to pass on much limits the signing of long term OFS contracts and keeps people active on the spot market.

Here is a great quote from NOV earnings- “But right now, there are two key constraints: money and supply chain. The freshly restructured offshore drilling contractor industry has little access to or appetite for external capital to rebuild itself. Despite 30% headline project cost increases since 2020, E&Ps are becoming more confident in their economics in the energy-security-challenged new reality we are living in. But they are finding one more cost they need to dial in, and thats a way to finance the refurbishment of offshore drilling rigs, through both higher day rates and mobilization fees. National oil companies and integrated majors, supplemented by shipyards offering bareboat charters and, importantly, Eastern Hemisphere sovereign wealth funds, are the emerging sources of capital that we foresee underwriting the Big Offshore Drilling Restart.

The second constraint is supply chain, broadly. COVID-driven workforce disruptions, lack of critical components, and expensive, unreliable freight have injected new execution risk into all shipyard projects in Asia and elsewhere. And not just for offshore rigs, FPSOs also face higher execution costs and risks, as we hear from our Completions and Production Solutions customers.”

“Our consolidated revenues from North American land customers increased only 1% sequentially. After rising sharply in the first part of the year, the U.S. rig count has now found a near-term ceiling a touch below 800 rigs, constrained by, among other things, the availability of labor. North American E&Ps are citing service availability as the biggest risk to the achievement of their production targets, but our oilfield service customers tell us that crew availability is the real root cause. U.S. oilfield wages in West Texas and North Dakota are up 20% to 50%, along with higher per diems, higher oil-based mud bonuses, higher overtime, as crews are chronically shorthanded and they work extra hours to cover the unfilled positions. But new hires are hard to find. And the crews that are successful in hiring new green hands are less safe and demonstrably less efficient.

$4,000 per ton casing is another constraint, and its contributing to 40% higher costs per foot for E&Ps.”

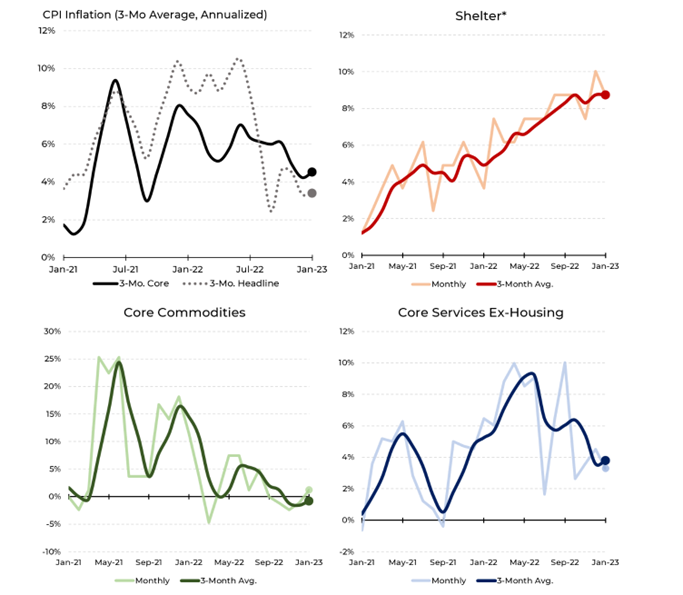

There isn’t a magic bullet in the market especially as inflation bounced again, and given the movement higher- we are moving our base case for the Fed funds rate to the top of our range 5.25% from 5%. All of the “sticky” points of inflation are moving higher across wages and services, which is going to pin core inflation higher for longer.

Some of the key metrics highlighted by Powell as data points setting up their policy are below. Each one is moving in the wrong direction by either shifting higher or pausing the decline and flatlining. Core commodities actually shifted higher, for the first time in a few months as more pressure comes into base materials, crude, and refined products.

The big one to watch will be core services that saw another shift higher and staying in levels we haven’t seen since the late 70’s early 80’s.

There won’t be any pivot any time soon!

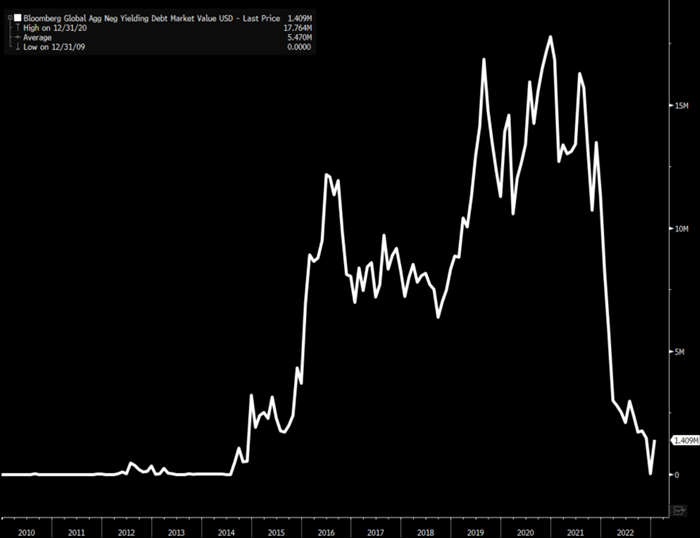

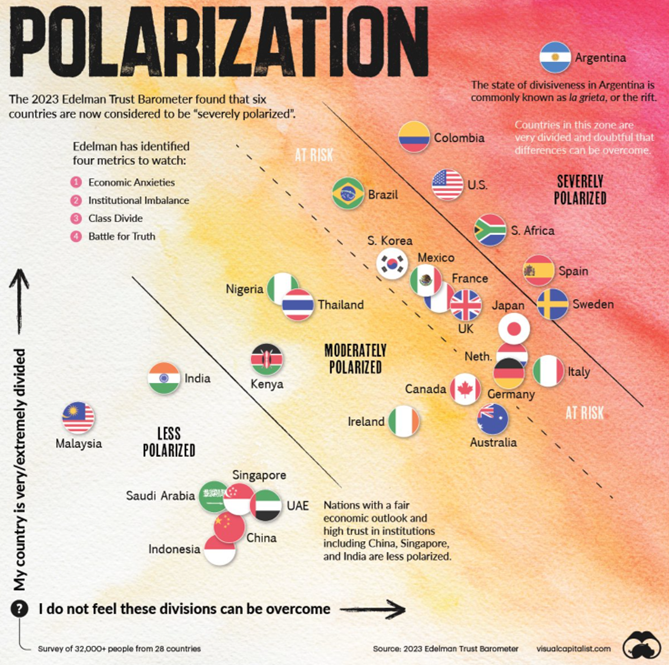

In 2021, we talked a lot about how the polarization of the world was going to go into overdrive. Income inequality has been expanding for decades, which has been a core driver of the anger within nations. The COVID response sent a flood of liquidity into the market from both fiscal and monetary directions. It was a blast of liquidity that came directly from governments in subsidies and straight cash while central banks dropped interest rates further and launched into the largest coordinated effort in quantitative easing we have ever seen. This took negative yielding debt to a peak of $17.764T, but it was something that started WAY before we even knew how to spell the word “COVID.” The QT (Quantitative Easing) policy errors kicked off in earnest during the financial crisis, but was only expanded over the course of the following several decades. Any time a central bank even hinted at a “tightening” the market would freak out and the CBs would “back-off” their policy adjustments. This just increased the markets addiction to low rates and free money creating the absurdity of the chart below. It’s also worth noting that the below chart of “negative yielding debt” only encompasses bonds that ACTUALLY traded negative on a nominal level and not on a real level- or rather “adjusted for inflation.”

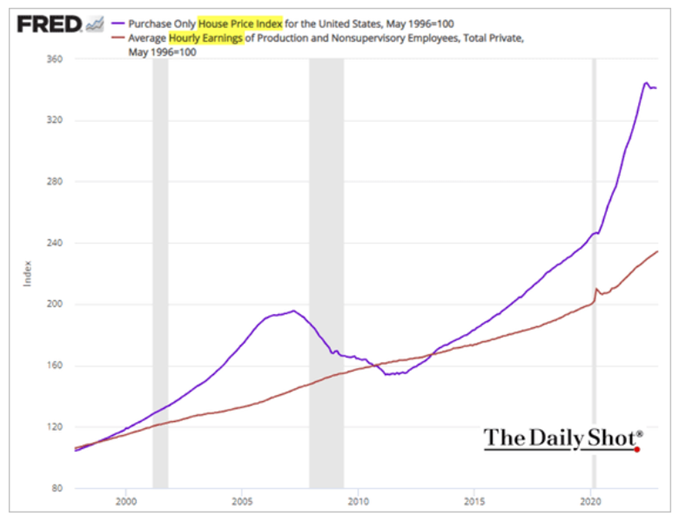

The rise of inflation impacts the poor all the way up to the middle class the most versus any income bracket. Wages typically fail to cover the additional “cost” that comes along with inflation, and unless you are fully invested in an offsetting asset- your buying power will keep being reduced. The below chart puts into perspective just how far off the earnings power is to the purchase price of a home. Asset prices have BALLOONED across the board, and it limits the ability for individuals to cross income brackets.

In the “good old days”, people would purchase a “starter” home to build up equity and eventually sell to move up to a bigger home or into a different region. This appreciation enabled many in the lower middle class and middle class to increase asset values by trading up. Even with elevated mortgage rates back in the 80’s, the savings rate was still well over 10% and helped to offset the cost of inflation. In 2023, we still have inflation of over 6% with savings rates at .25%.

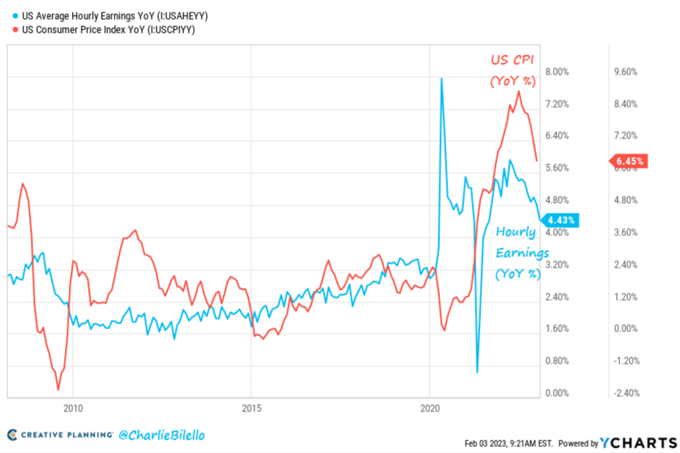

The below chart does a great job putting into perspective on how inflation has been draining the purchase power of individuals going back to 2008. “US Avg Hourly Earnings increased 4.4% YoY in January, the slowest growth rate since Aug 2021. This is the 22nd consecutive month where inflation outpaced the growth in wages (YoY), a decline in prosperity for the American worker and the primary reason why the Fed will hike again.” Even though the job market remains tight, we aren’t seeing wages keep pace with the rate of inflation, and when we go back through time- there has been a slow bleed from the purchasing power of the average consumer.

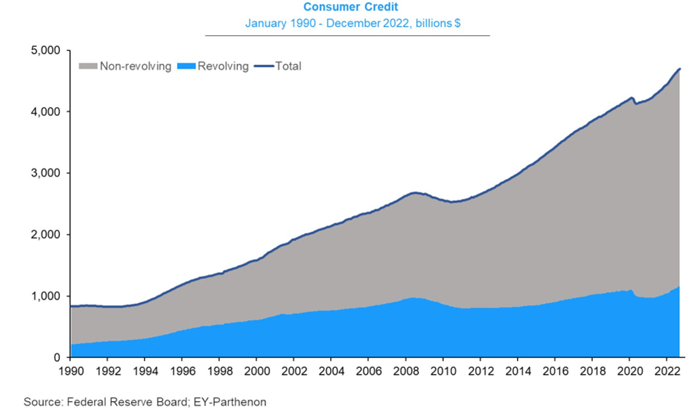

The consumer has had to rely more and more on debt and credit card spending to make up for the shortfalls. We have quickly surged past the short-lived decline of credit card debt as excess savings was worked through quickly, and consumers relied heavily on credit to close the gap in livings costs.

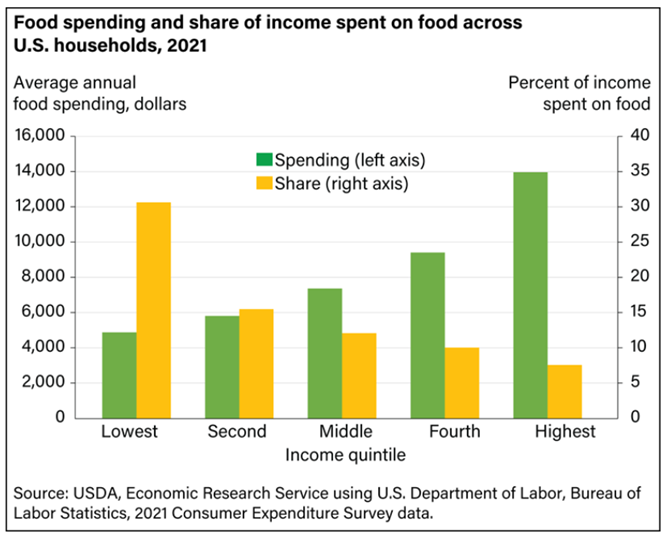

The pressure grows when you consider how much money is spent on food every year, and on average the amount the average U.S. consumer spends per $1 on food has increased. Pre-COVID the average person spent $.17-$.24 depending on bracket, and that has shifted significantly to $.27-$.34. This is a big number when you consider the drain on discretionary spending this creates. The below chart puts into context just how much food inflation impacts the poor and middle class. It’s a huge drain on spending power, and given the bounce in food inflation- the impacts are far from over. “In 2021, households in the lowest income quintile spent an average of $4,875 on food (representing 30.6 percent of income), while households in the highest income quintile spent an average of $13,973 on food (representing 7.6 percent of income).”

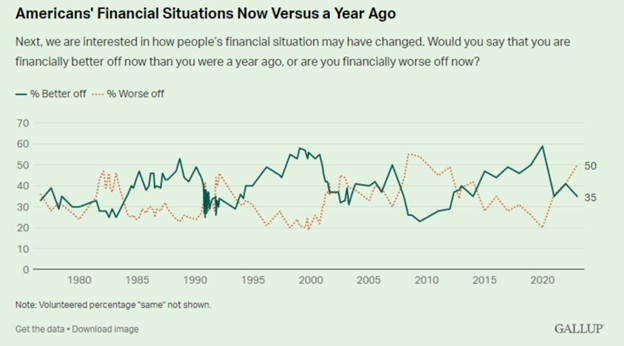

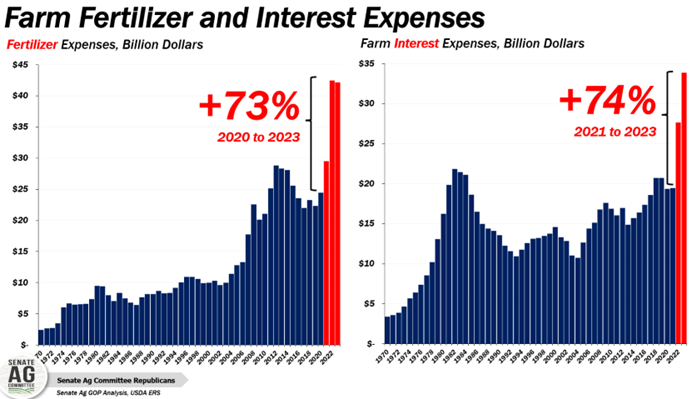

The changing dynamics are impacting so many people, and all of the data is showing the same pressure points. “In the latest Gallup survey, 50% of Americans says they are financially worse off than last year — the highest level since 2009.” It shouldn’t be surprising to see the biggest impacts occurring on those in the lower income bracket, but you can see the pain bleeds into all directions.

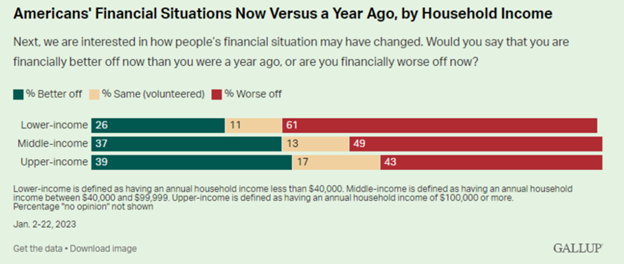

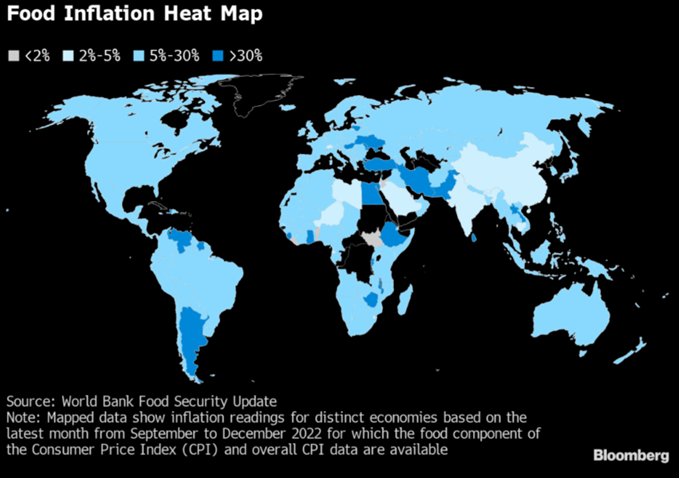

All of the leading indicators for food aren’t improving, in fact, they are getting worse as we move into the new year. “Beverages & Food production rose for the second month running, with the rate of expansion picking up to the fastest since July 2022. Input cost inflation remained elevated, however, and was slightly stronger than in December.” Anyone that has been to the food store can attest to the rise in costs, and the movement in prices seems relentless.

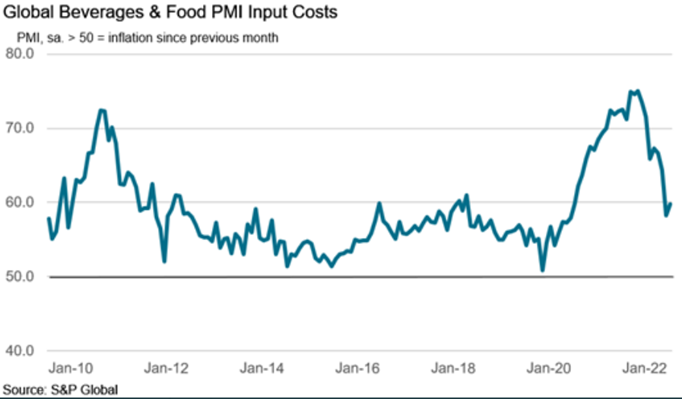

The cost to the farmer is moving in the WRONG direction, and will pin prices near the highs and likely cause a much bigger reversal over the next few months. There are so many components and input costs that go into the food that we eat, and we are seeing another acceleration of cost increases that will pin these prices to the highs.

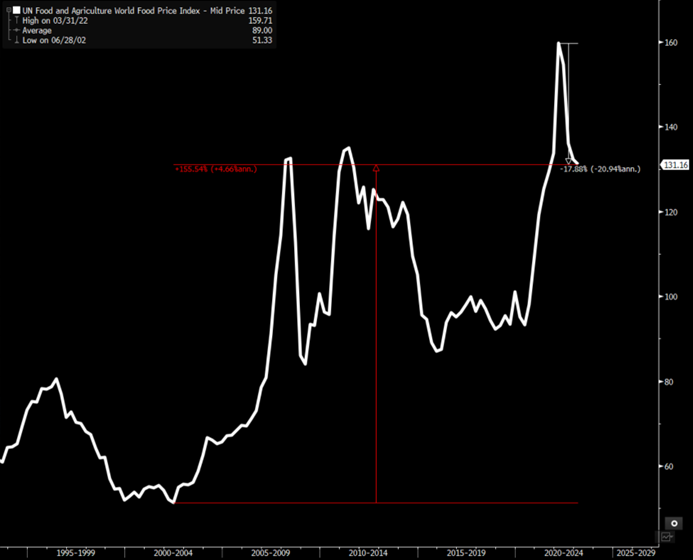

It’s why I laugh when the headlines talk about how “Food and Agriculture World Food Prices” have fallen almost 18%. Sure- they have dropped back from all time highs- but it’s important to zoom out when evaluating the whole story. Since the lows of the early 2000,s we have seen a steady rise in prices of 155% or 4.6% annualized to this point. We are still above the prices that sparked the “Arab Spring”, and this is happening in lockstep of falling wages and rising global inflation on ALL THINGs- not just food.

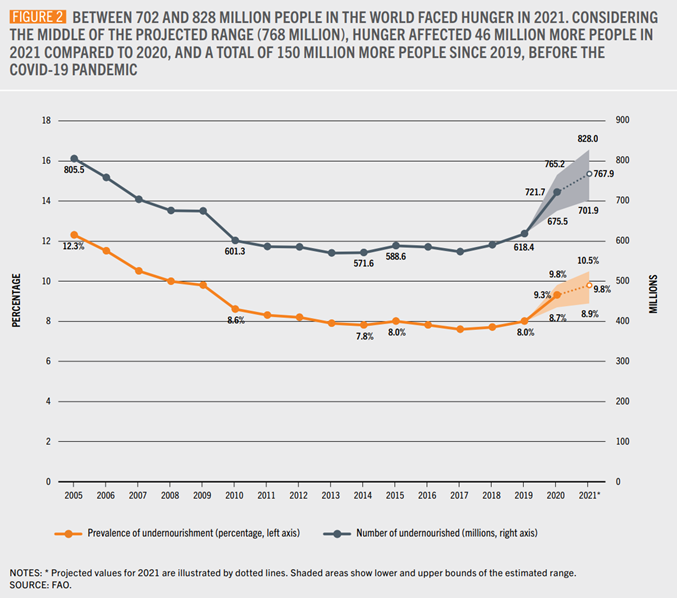

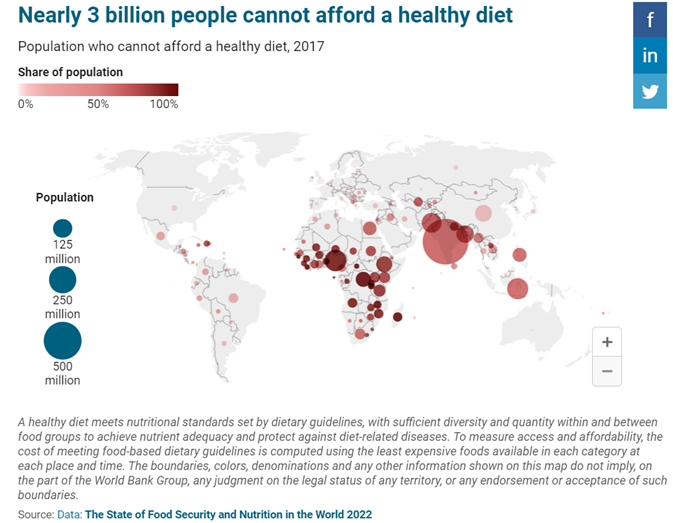

So far we have only discussed America, the richest country in the world and a land mass capable of feeding itself. What happens when you are an emerging market relying on the international market? There has been a steady rise of impacts to the global market with about 800M people facing hunger in 2021, which we know has only worsened with food prices, inflation, and weakening real wages.

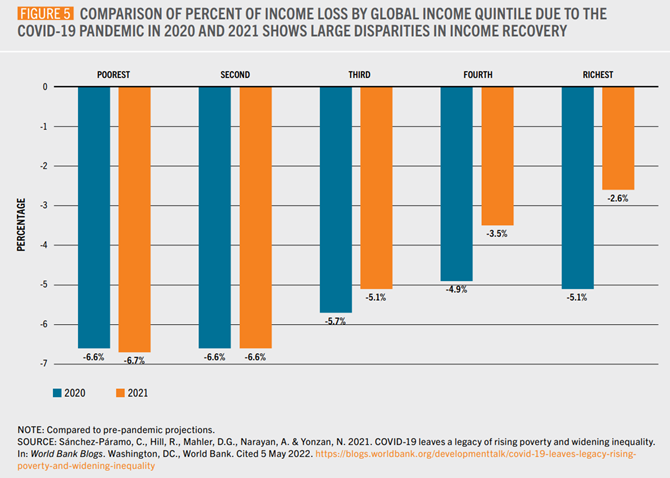

There is a huge disparity between income recovery that is driven by location, local support, central banks, and a slew of other economic drivers. The poor to “middle income” nations are struggling the most, and will fail to get back to pre-pandemic levels. The world is facing mounting headwinds with fiscal drag and tightening monetary policy that will hinder economic expansion. As the income capacity falls, the ability to purchase basic food becomes hindered and drives more local pressure and anger.

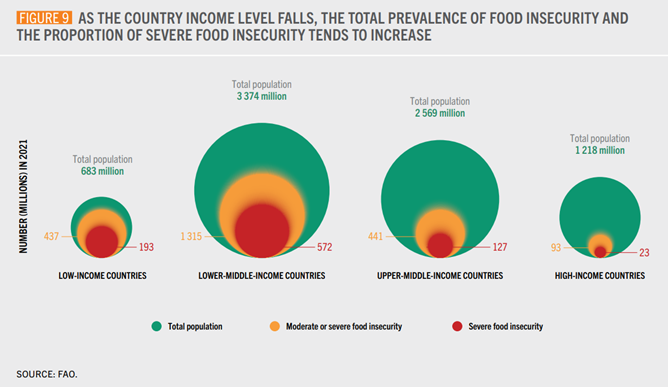

This doesn’t mean that Central Banks should waiver because stagnate growth and our current predicament was created by irresponsible rate and liquidity policies. Inflation (created by lose monetary policy) has been grossly underreported for years and is finally coming to the forefront. Inflation has a disproportionate effect on the poor, and we are seeing this hit the hardest on the food level.

Real wages around the world have fallen with Emerging Markets experiencing the biggest drop in their earnings power. The strength in the U.S. Dollar and rise in food prices hits the hardest for countries that rely on global markets. The “cost” of purchasing abroad increases as the dollar strengthens and their local currencies flounder and weaken.

Global subsidies and government support increased substantially during COVID, and it increased again in 2023 as food shortages have become more pervasive.

Countries have put up more “gates” and “hurdles” for the export of food to ensure there is enough for local consumption. India is just one example of a country that limited the export of wheat and rice, which we described as a protectionist drive. We were proven right in later January as the below announcement was made:

“State-run Food Corp. of India will release 3m tons of wheat in the open market during the next two months to cushion consumers from rising grain and flour prices, according to a statement by the food ministry.

- A panel of ministers, headed by Home Minister Amit Shah, approved the sale on Wednesday: statement

- Wheat from the state reserves will be offered to flour millers and bulk buyers via an electronic auction process for a maximum quantity of 3,000 tons per buyer per auction

- The grain will also be sold to state governments

- Food Corp. will also offer wheat to state-run companies, cooperatives, National Cooperative Consumers’ Federation of India Ltd. and National Agricultural Cooperative Marketing Federation of India Ltd. without auction at 23.5 rupees a kilogram

- The buyers will be required to convert wheat into flour and sell to consumers at a maximum retail price of 29.5 rupees per kg”

This was a clear step to cool off inflation, but to also ensure that people are placated. Many governments understand the importance of ensuring their constituents are fed because that is how you stay in power. The last thing any government wants is a food riot because people will topple governments and go to war to address food shortages. Just think the lengths you would go to ensuring your family can eat.

“Domestic food-price inflation is still soaring, with people in low and middle-income countries particularly hard-hit, according to the World Bank. The most recently available monthly data between September and December 2022 shows rates of increase above 5% in almost all economies around the globe, irrespective of their level of income.” As budgets run dry, governments are finding it harder to address the shortfalls and provide the subsidizes people need to feed their families.

La Nina is shifting weather patterns (again) and causing some severe issues with Argentinian and Brazilian crops. The food situation is deteriorating and creating a broad powder keg…

The world is facing a huge shift in polarization as the divide grows. The pressure has been growing for over thirty years, but it has reached a fever pitch as people feel disenfranchised. Income mobility is at a near standstill, which is having an outsized impact as inflation bites hard. People want answers, solutions, a path forward… anything to help alleviate the stress of the current markets. This leads people to “grab” onto anything that might deliver a change, and unfortunately, it doesn’t matter how radical it may be. Politicians will take advantage of this “fear” to drive a wedge between factions and drive their own narrative/agenda even if its to the detriment of the country or the broader populace. The flames are being fanned from all directions driving the shift in the polarization camp.

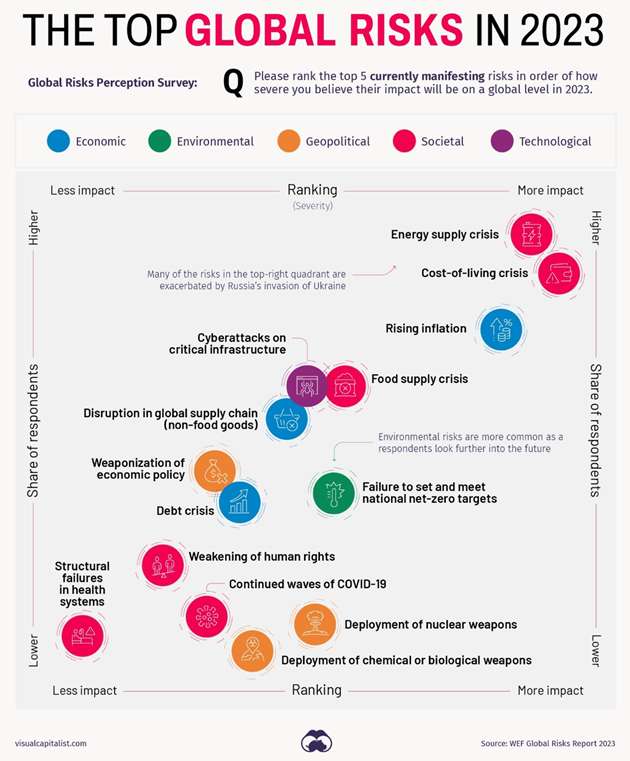

While I may disagree with the level of polarization some of these countries are labeled, the countries are all moving in the wrong direction. As stress increases internally, the drive to isolate and turn inwards only grows. It starts with food and quickly spreads to other natural resources to ensure local “stability” or at least prolong that as long as possible. Each country will also react differently based on local dynamics driven by internal factions, tribes, or outside influence. Food and underlying inflation only fan the flames of anger because it results in less economic mobility. It shouldn’t be a surprise that the biggest threat for people is tied DIRECTLY to inflation, ability to earn money, and food. The below top risks are driving the polarization and anger to new heights, and given the issues across many supply chains- there is no quick solution or near term way to alleviate the problems.

There is a way to try to capitalize on these shifts, and they are the largest providers of food in the world: Bunge (BG) and Archer Daniels (ADM). Bunge reported today with strong results and another positive read through to 2023: “Looking ahead to 2023, we expect the market environment to be similar to 2022 with many of the same drivers still in place. That includes a globally tight crop supply, strong demand for our core protein meal and vegetable oil products, and the continued impact of global trade of commodity price volatility and supply chain disruptions. We also expect to see global demand for feedstocks and related services for renewable fuels continue to grow. Based on what we see in the market in the forward curves today, we expect full-year adjusted EPS of at least $11 per share for 2023.” Based on everything we highlighted above, there is going to be a lot of support for companies that can achieve economies of scale and sourcing.

Both companies are finding ways to connect farmers with consumers and creating more efficiencies with technology synergies.

Archer Daniels had a similar take on the market with margins improving across their core businesses.

“2022 was a truly outstanding year for ADM. As we look forward to 2023, we expect another very strong year. There are a number of market factors that we see as relevant for shaping our performance. We still see tightness in supply and demand balances in key products and regions. We see strong demand for vegetable oil, driven largely by robust demand for biodiesel and renewable diesel. Resilient food demand should drive higher volumes and margins in starches, sweeteners and wheat milling. We see continued strong demand for ethanol, including positive discretionary blending economics.

And as Vikram mentioned, we expect 10-plus-percent constant currency OP growth from Nutrition. We have a strong playbook powered by our deep expertise and our unparalleled footprint and capabilities to manage a dynamic market environment. Our healthy balance sheet provides ongoing optionality as we continue to pull the levers under our control to deliver results. And we expect positive contributions from productivity and innovation initiatives across the company that will help us drive value in 2023. Taken together, we expect to deliver another very strong year in 2023.”

This year is shaping up to be another tight one for crops, which is going to create more opportunities for each company to maximize their supply chains. Size and scale matters when supply chains are tight and favorable/large offtakers become paramount. Both of these companies provide product to the largest food processors (such as Pepsi) down to bio-diesel markets that remain tight.

Now is the time to invest further in the fertilizer and food processing space!