- Patterson-UTI Energy plans to convert legacy pressure pumps to Tier 4 dual fuel to reduce costs and emissions.

- It will continue to reprice rig contracts at the more favorable leading-edge day rate.

- Q4’s impressive operating margin growth would be challenging to sustain in Q1 as it exits natural gas-heavy operations in some basins.

- In FY2023, the company expects capex to be $550 million, 58% of which would belong to contract drilling in maintenance and rig reactivations.

Utilization And Challenges

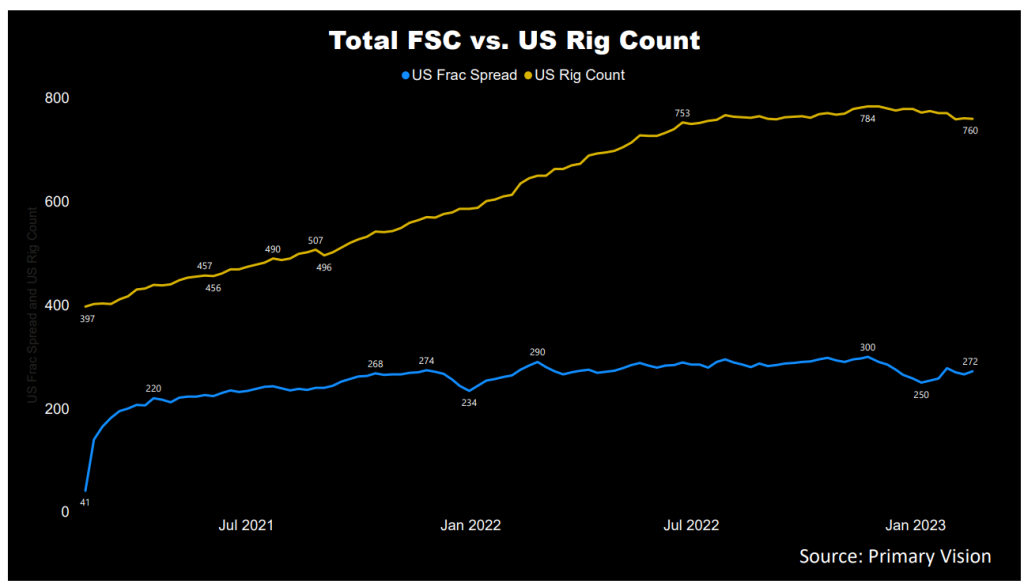

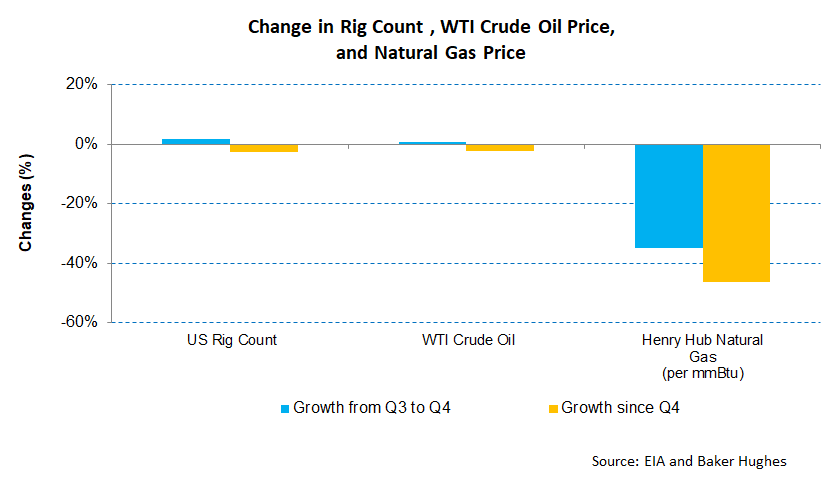

As estimated by Primary Vision, the frac spread count went down by 4% in the past year until the third week of February, while the US rig count went up by 18% in this period. The crude oil price remains volatile with a downward bias. Mirroring Halliburton’s (HAL) And Schlumberger’s (SLB) views, PTEN’s management continues to believe in the early stages of a multi-year upcycle. Robust demand generated by high demand and high utilization would increase leading-edge pricing in 2023. So, the company will find opportunities to reprice drilling rig contracts higher along with the leading-edge rates.

However, constraints on natural gas takeaway capacity have hurt the company’s natural gas operation, which is limited to the Northeast. However, the company’s Northeast operations are hedged, and the drilling rigs are under long-term contracts. Outside of Northeast, the company may abandon some of its natural gas-heavy operations, which can squeeze its rig count. However, utilization of Tier 1 super-spec rigs and pricing will remain high.

What Are The Indicators Signaling?

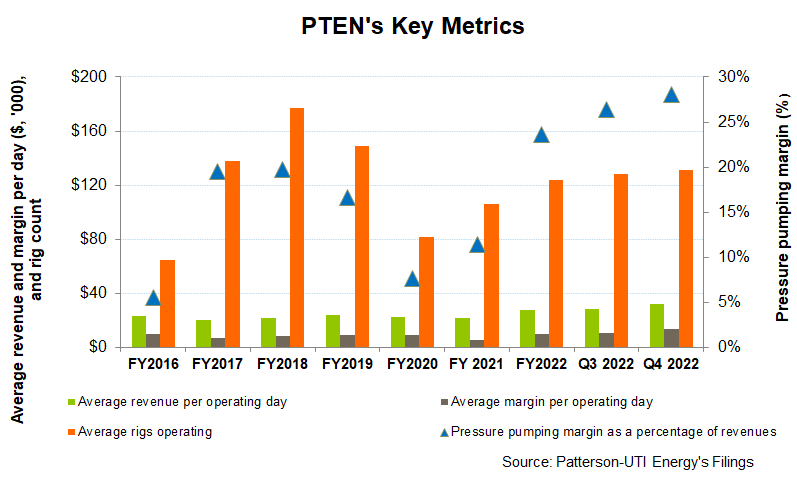

PTEN expects to operate ~87 rigs under a term contract in Q1, while for FY2023, it has 56 rigs under a term contract. In Q4, it added three rigs, which took the count to 131. In the US, year-over-year average rig revenue per day increased by 44% because contracts were renewed at more favorable pricing than projected.

According to PTEN’s management, the current rig utilization is sufficient to support the leading-edge pricing recovery seen over the past few quarters. However, it does not expect any change in leading-edge pricing, although the company will continue to reprice rig contracts signed in early-2022 to the 2023 rate. As of December 31, 2022, the future day rate drilling revenue increased by 17% compared to a quarter ago.

Pressure Pumping Outlook

In 2023, the imbalance between demand and supply in pressure pumping will remain due to supply constraints. Because the advanced Tier 4 dual-fuel engines take more time to reactivate while the amount of horsepower per spread increases, the availability of pressure pumping spreads will remain. PTEN plans to convert engines to Tier 4 dual fuel to reduce operational costs and emissions. The vertical integration of engineering key components and the company’s Mpower measurements and data transmission systems would improve operators’ ability to drill wells faster. The share of rotary steerable work has increased from 13% to 21% in the past year, contributing to a higher margin.

The company continues to invest in lithium battery hybrid solutions (EcoCell) and automated engine management systems (CORTEX) for drilling operations. The company recently tested hydrogen as a fuel, which would significantly reduce emissions in the future.

Contract Drilling Segment: Analyzing Outlook And Performance

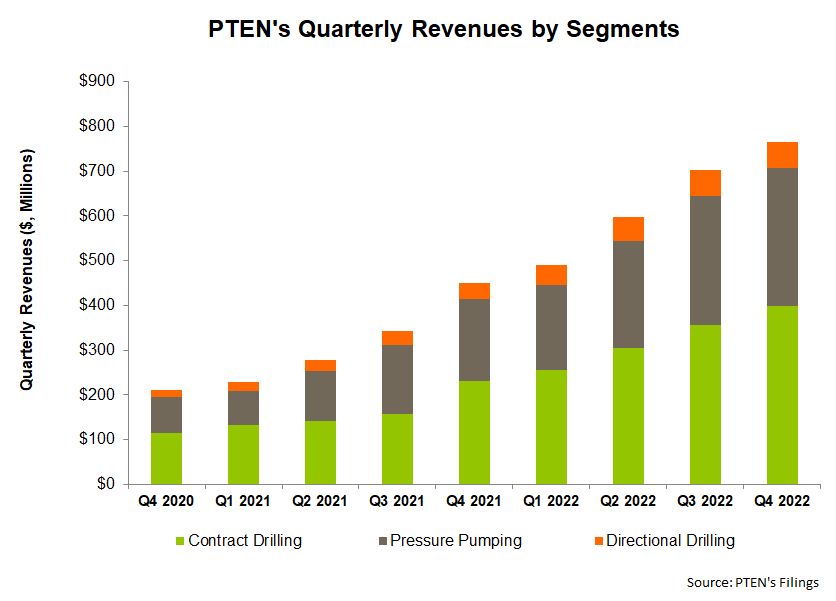

In Q4 2022, PTEN’s average revenue per operating day increased (11% up) quarter-over-quarter as it renewed contracts at more favorable pricing. This led to a steep 28% rise in the average margin. Operating costs, however, remained nearly unchanged.

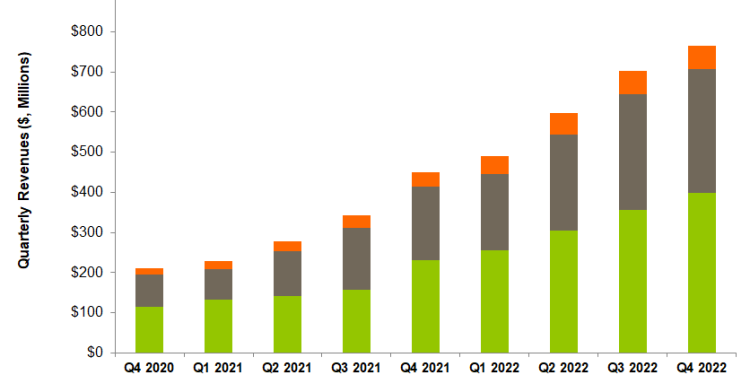

Pressure-pumping revenues, which increased sequentially by 7% in Q4, can see an operating performance deceleration due to weather disruption. So, revenues in this segment can decrease by 9% in Q1 2023. The segment gross profit, which increased by 13% in Q4, can deflate by 16% in Q1.

Dividend

PTEN pays an annual dividend of $0.32 per share, resulting in a forward dividend yield of 1.9%. Helmerich & Payne’s (HP) dividend yield (2.15%) is higher. It keeps following through with its key strategy is to raise shareholders’ returns through dividends and share buybacks.

Capex And Debt

In FY2022, PTEN’s cash flow from operations (or CFO) increased manifold compared to a year ago, led by the year-over-year revenue rise in the past year. Free cash flow also turned positive in the past year. In FY2023, the company expects capex to be $550 million. Contract drilling would constitute 58% of this, while pressure pumping would account for 42%. Approximately $200 million of the drilling capex is budgeted for maintenance and rig reactivations. With a further increase in capex, revenue opportunities for the existing rig fleet will rise because of a higher share of high-margin premium drill pipe.

Learn about PTEN’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.