- PUMP has announced its first two electric fleet orders and will deploy the fifth Tier IV Dynamic Gas Blending fleet shortly.

- On top of the natural gas price’s weakness, the adverse effects of seasonality, holiday, and the winter storm affected Permian production.

- However, it began 2023 on a strong note with the reactivation of its 15th frac fleet and repricing.

- Although free cash flow was negative in FY2022, lower capex can turn it around in FY2023.

The Frac Fleet Outlook

ProPetro Holding’s (PUMP) management expects a speedy transition to modern ESG-compliant fleets soon. As discussed in our previous article, in November 2022, PUMP acquired Silvertip, which provides wireline perforating and pump-down services. It also added complementary, dedicated pump-down assets with substantial cross-selling opportunities to its portfolio. Following the acquisition, the company announced its first two electric fleet orders and deployed the fifth Tier IV Dynamic Gas Blending or DGB fleet. By 2023-end, it is expected to have seven Tier IV DGB fleets and four electric fleets, meaning two-thirds of its fleet will have natural gas-burning and electric capabilities.

In January, PUMP started repricing its frac fleets, but not before it curtailed one of its active fleets for maintenance purposes. In Q4, it also experienced the adverse effects of seasonality, holiday, and the winter storm. The storm affected many energy operators in the Permian, leading to lower demand for its services in Q4. So, the full effect of repricing may get delayed. Still, it could maintain the frac fleet utilization at 14.5 fleets – in line with the expectation. In Q1 2023, the management expects effective utilization at 14.5 to 15.5 fleets.

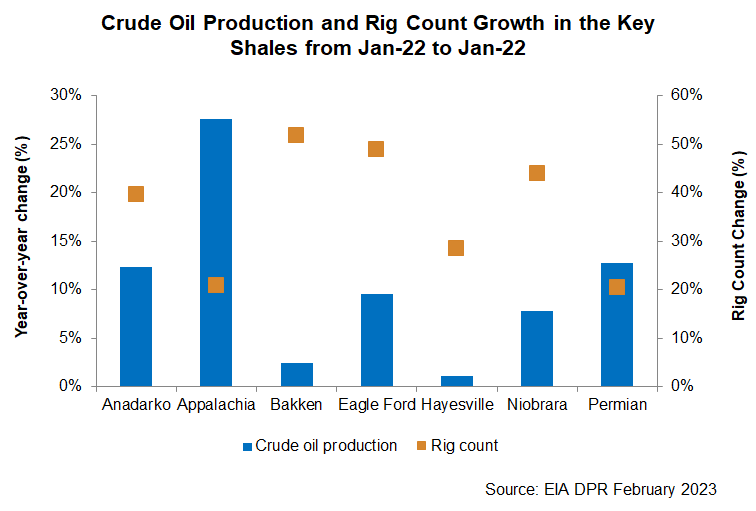

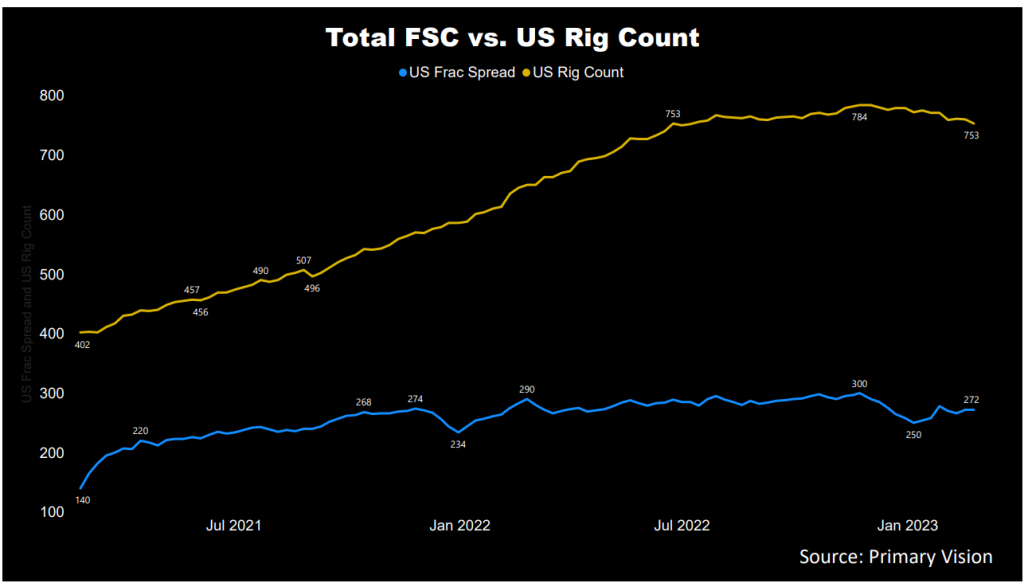

According to the EIA’s estimates, crude oil production will likely increase by 2.8% in the seven key shales in March 2023 compared to the January 2023 output. Crude oil production increased 11% in the key unconventional shales in the past year. The Permian production increased by 13% during this period, while the rig count increased by 21%. Investors may note that much of PUMP’s assets in operations are Permian-centric, and it wants to participate further in the electrification of pumps (e-francs) in this region. According to Primary Vision, the frac spread count has decreased by 3.4% to 272 compared to the start of the year. The lower frac count can pull down PUMP’s topline in Q1 2023.

The 2023 Outlook

PUMP started January with a strong note based on the repositioning and repricing efforts, even though utilization did not improve due to inclement weather. At the same run rate, it earned $136 million in revenues in January, which could fetch ~$400 million in Q1, or ~15% higher than Q4 2022. On top of that, it generated $20 million in revenues from Silvertip in January, one of the highest. It will start benefiting from the reactivated 15th fleet in February for the rest of the quarter. Overall, demand for PUMP’s services is expected to remain robust in 2023, contributing to increased topline and operating profit for the year.

Explaining Other Key Strategies

PUMP’s sole focus on the Permian has largely insulated from the steep drop in the natural gas price over the past few months. Since 2023, the natural gas price has dwindled by 54% versus a 5% fall in crude oil prices. So, even if large drilling programs and demand for frac services temporarily decline in gas-focused basins, there is a sufficient demand-supply gap in the Permian, which, because of multi-year underinvestment in the region, should accommodate more players relocating in this region. But more importantly, PUMP should stay ahead of the future competition because of superior and advanced pressure pumping fleets (electric and DGB Tier IV).

The spread between diesel and natural gas prices validates PUMP’s fleet transition strategy due to the trend to displace diesel in customers’ completion programs. ProPetro is pursuing the strategy on a larger scale which would unlock additional free cash flow generation capability. It will also pursue opportunistic strategic acquisitions (e.g., Silvertip) to generate strong shareholder returns. We think the company is on a firm footing to benefit in the medium term despite the relative stagnation in drilling activity in the near term.

The Value Drivers In Q4

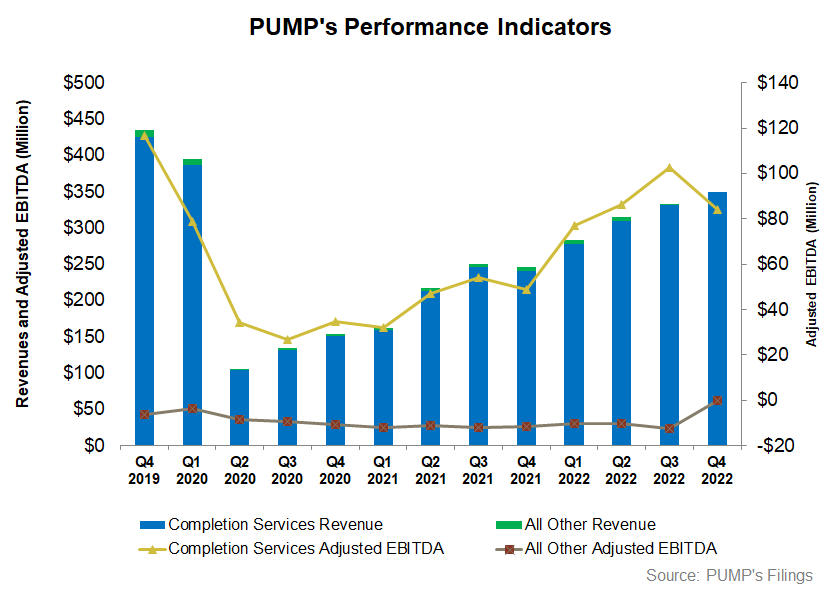

PUMP’s quarter-over-quarter revenue growth was 4.8% in Q4, primarily due to pricing increases and added revenue from Silvertip. In November 2022, PUMP acquired Silvertip – a Permian wireline perforating and pump-down service provider. However, PUMP’s effective fleet utilization declined to 14.5 in Q4 from 14.8 in Q4, partially offsetting the revenue growth.

The adjusted EBITDA margin contracted by 370 basis points in Q4 compared to Q2 due to additional supply chain purchases, higher costs in the service lines, and the Silvertip acquisition. The adverse effect of seasonality and the costs of activating another fleet led to 3.4% higher sequential costs in Q4. Despite higher costs, its net income improved to $0.12 per share in Q4 compared to $0.10 in Q3.

Balance Sheet and Cash Flow Analysis

In FY2022, PUMP’s cash flow from operations (or CFO) increased by 94% compared to a year ago, primarily led by the revenue increase. Despite that, its free cash flow (or FCF) turned negative in FY2022 because of a significant capex rise. In FY2023, the company’s capex is projected to decrease by at least 14% versus FY2022, after it had increased significantly in FY2022. It will continue to invest in the fleet revitalization and strategic investments, but it appears it has already made the majority of investments in FY2022. So, in FY2023, lower capex would result in a higher free cash flow.

PUMP’s total liquidity as of December 31 was $155 million (including cash and available capacity under an asset-based credit facility). As of that date, it had no debt. This makes it significantly safer than some overly leveraged peers (PTEN, LBRT, and NBR).