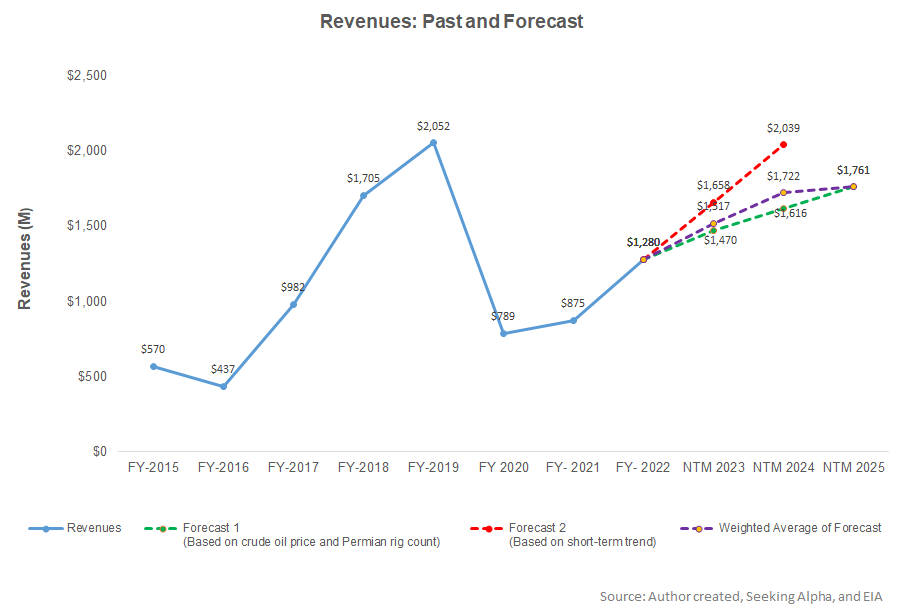

- Our regression equation suggests steady revenue growth for PUMP in the next two years.

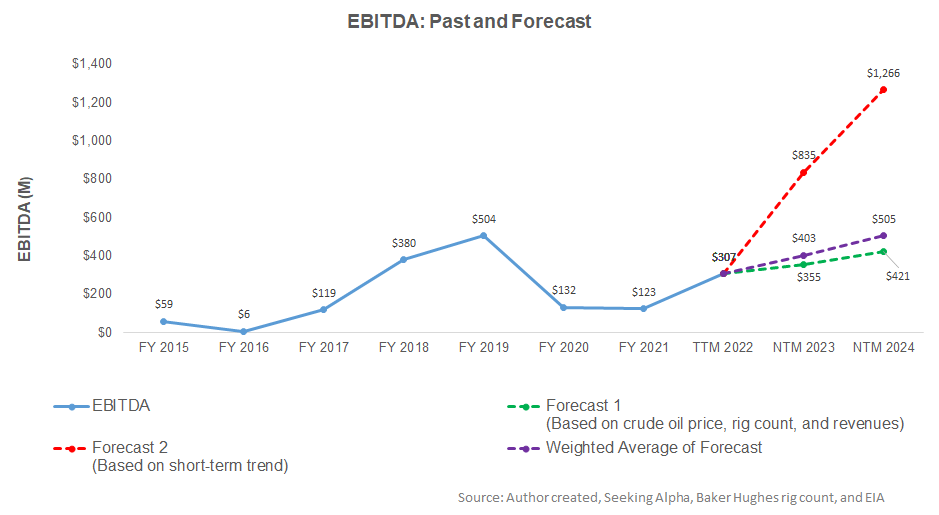

- EBITDA, too, can increase sharply in NTM 2023 and NTM 2024.

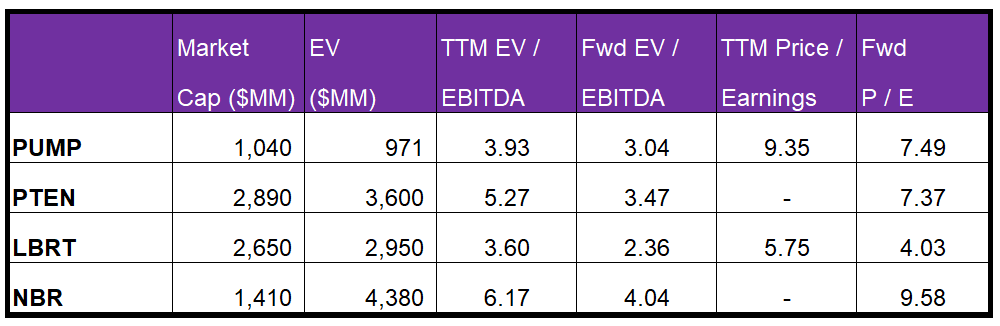

- On a relative basis, the stock is reasonably valued.

Part 1 of this article discussed ProPetro Holding’s (PUMP) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between the key industry indicators (crude oil price and Permian rig count) and PUMP’s reported revenues for the past eight years and the previous four quarters, we expect revenues to increase by 19% in the next 12 months (or NTM 2023). In NTM 2024, it can expand further by 13%, and its revenues can stagnate in NTM 2025. For the short-term trend, we have also considered seasonality.

Based on the regression model, we expect the company’s EBITDA to increase by 31% in NTM 2023 and 25% in NTM 2024.

Target Price And Relative Valuation

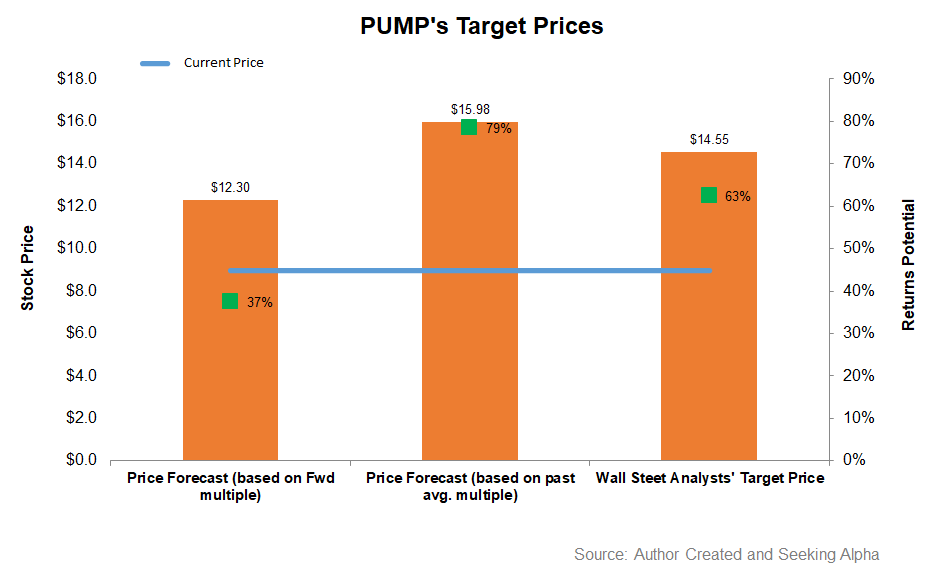

We have calculated the EV using the forward multiple and the past average multiple. Returns potential (37% upside) using the forward EV/EBITDA multiple (3.04x) is lower than the past average (79% returns potential) and Wall Street’s sell-side analyst expectations (63% upside) from the stock.

PUMP’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than its peers, which indicates its EBITDA growth would be lower than its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple than the peers. The company’s EV/EBITDA multiple (3.9x) is lower than its peers’ (PTEN, LBRT, and NBR) average (5.0). So, the stock is reasonably valued versus its peers at this level.

The sell-side analysts’ target price for PUMP is $14.6, which, at the current price, has a return potential of 63%. Out of 11, six sell-side analysts rated PUMP a “buy” or a “strong buy,” four rated it a “hold,” and only one a “sell.”

What’s The Take On PUMP?

On its way to becoming DGB-dominant fleet provider, PUMP expects to have two-thirds of its fleet will have natural gas-burning and electric capabilities in 2023. Even though utilization may not improve in the near term due to inclement weather, the repositioning and repricing efforts should yield positive results in the medium term. In November 2022, it acquired Silvertip, which supplemented its position as the leading completions-focused oilfield service company. Based on organic revenue and Silvertip’s performance in January and early February, we can expect a steady operating performance in Q1. Over the medium-to-long term, PUMP should stay ahead of the future competition because of superior and advanced pressure pumping fleets.

However, there are a few bumps on the near horizon. The adverse effects of seasonality, holiday, the winter storm, and natural gas prices’ steep decline in 2023 can curtain production and intensify competition in the Permian. The economic uncertainty can cast a shadow on PUMP’s (or any other oilfield service company’s) outlook. The stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. So, it must continue to pursue the strategy to displace diesel in customers’ completion fleets. While negative free cash flow in FY2022, a lower capex, and higher operating profit can lead to improved cash flows in 2023. Given the relative valuation, the stock can warrant a “hold” in the medium term.