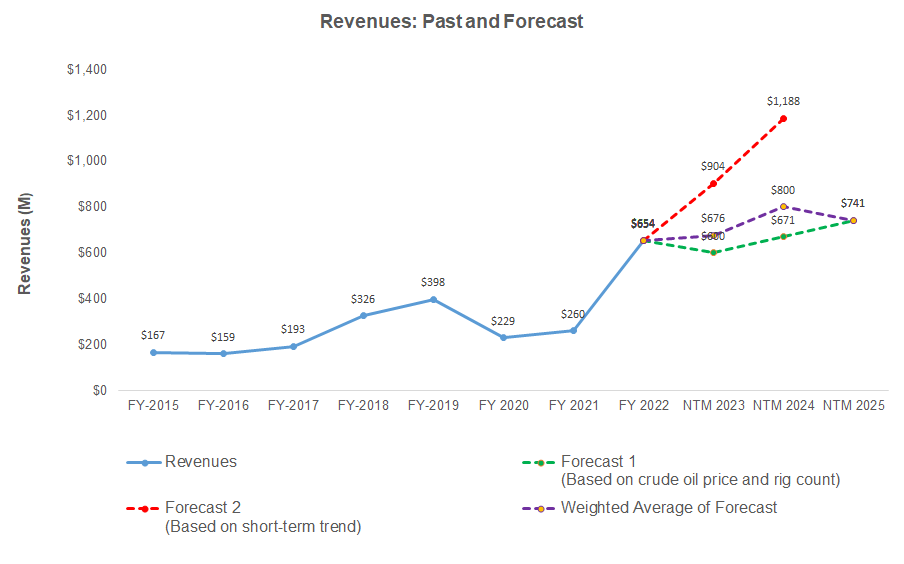

- The regression equation suggests mild revenue growth for BOOM in NTM 2023 but an acceleration in NTM 2024.

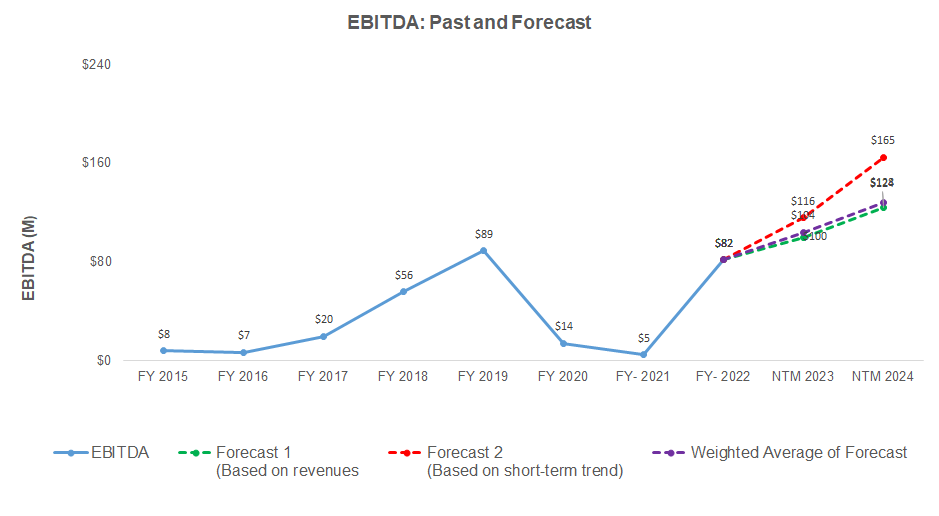

- EBITDA can increase steadily in NTM 2023 and NTM 2024.

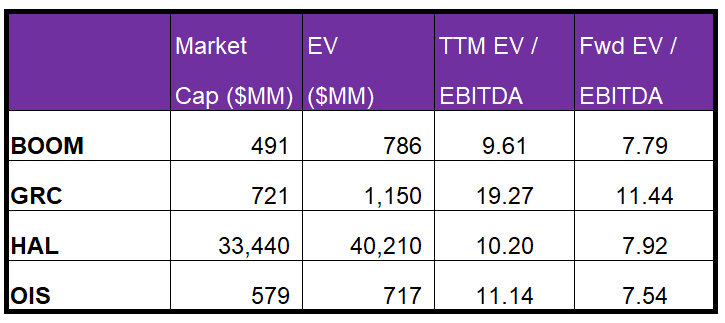

- On a relative basis, the stock is reasonably valued.

Part 1 of this article discussed DMC Global’s (BOOM) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation consisting of crude oil price, total rig count, and BOOM’s revenues for the past eight years and eight quarters, we expect revenues to increase by a meager 3% in NTM 2023 and jump to 18% in NTM 2024. For the short-term trend, we have also considered seasonality.

The linear regression model using the forecast revenues suggests its EBITDA will increase by 27% in NTM 2023. The growth rate may decrease marginally in NTM 2024 but is still healthy (24% up).

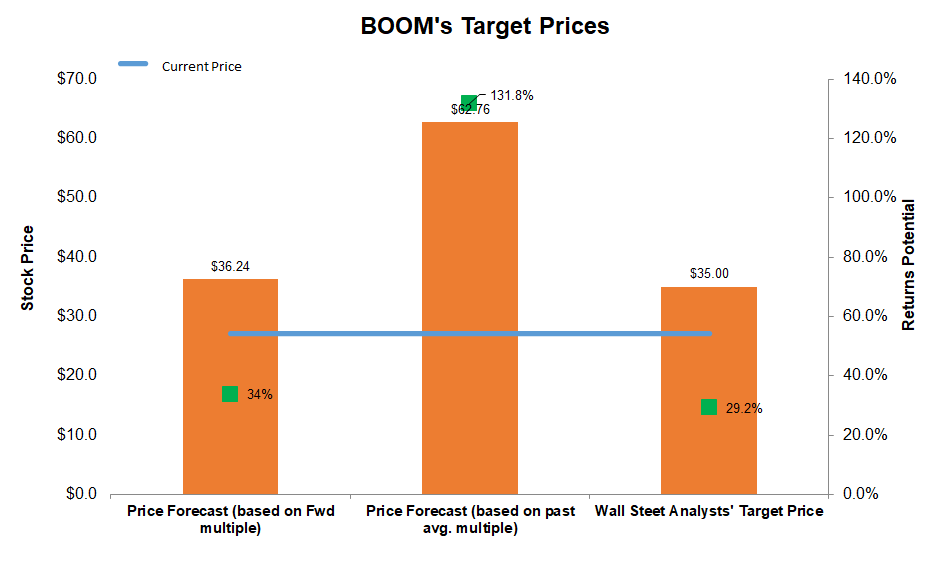

Relative Valuation And Target Price

Returns potential using the past average multiple (132% upside) is higher than the returns potential using the forward EV/EBITDA multiple (7.8x) (34% upside). Wall Street analysts also expect similar returns (29% upside) from the stock.

BOOM’s EV/EBITDA multiple (9.6x) is lower than peers’ (GRC, HAL, and OIS) average of 13.5x. This justifies the less steep forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA. So, the stock is reasonably valued at the current price.

The sell-side analysts’ target price for BOOM is $35, which, at the current price, has a return potential of 29%. Out of three, two sell-side analysts rated BOOM a “buy” or a “strong buy,” one rated it a “hold,” and none a “sell” in the past 90 days.

What’s The Take On BOOM?

In the DynaEnergetics segment, increased demand for North America’s well-completion industry and capacity expansion resulted in higher DS-perforating system sales in 2022. However, the positive effect on the operating income was low due to inventory write-offs and reserves. In Arcadia, the higher-end residential market continues to bear the impact of higher input costs, which is expected to ease in 2H 2023. In NobleClad, although the marketing efforts have increased, it is still some way from benefiting from the operating margin growth. As a result of these challenges, the stock price significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

Nonetheless, the DynaStage DS factory-assembled perforating systems will sell at a premium over the competitive products. BOOM’s rising backlog is a robust signal of better revenue visibility into 2023. Based on relative valuation, we think the stock is reasonably valued at the current level.