- STEP has diversified to natural gas plays like Haynesville because of the potential US LNG export facilities.

- It acquired four ultra-deep capacity coiled tubing units.

- However, in the US, the company’s utilization was low at the start of 2023 because of the fall in natural gas prices and excess fracturing capacity.

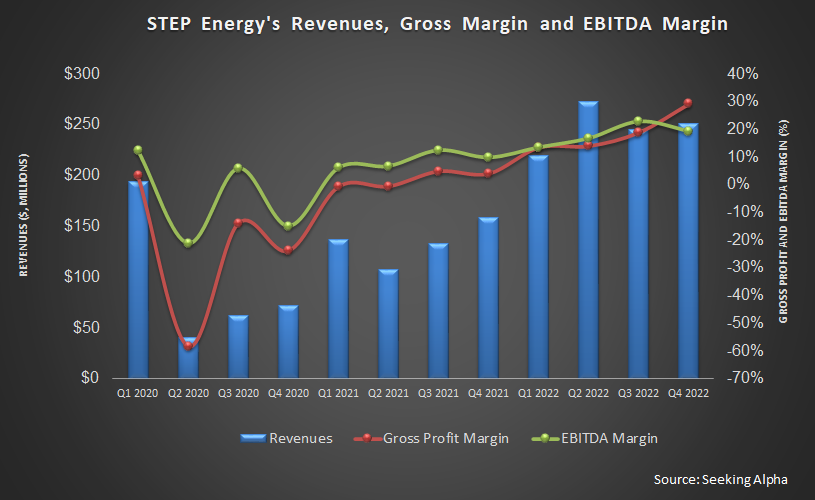

- STEP’s cash flows increased substantially in FY2022.

LNG And Other Strategies In Canada

In North America, STEP’s management trusts the opportunities in the pressure pumping space. For example, the LNG market is touted to be the growth story in various international geographies in the medium term. So, along with its traditional Permian-centric business model, it has branched out to Haynesville natural gas play because of the potential US LNG export facilities.

Natural gas, driven by energy consumers’ natural shift to natural gas, should elevate the price dynamics. Even though the growth story has been dented because of natural gas price’s more-than 50% dip in 2023 due to poor demand in Europe, the new LNG capacity, slated to be coming online in 2024 and onwards, can double US exports from the current 10-12% to nearly 20%. In Canada, the anticipated start-up of Canada’s first LNG project and other initiatives are expected to reach over 2 Bcf a day of target export capacity by 2025-2026. The export capacity target can even double to 4 Bcf per day.

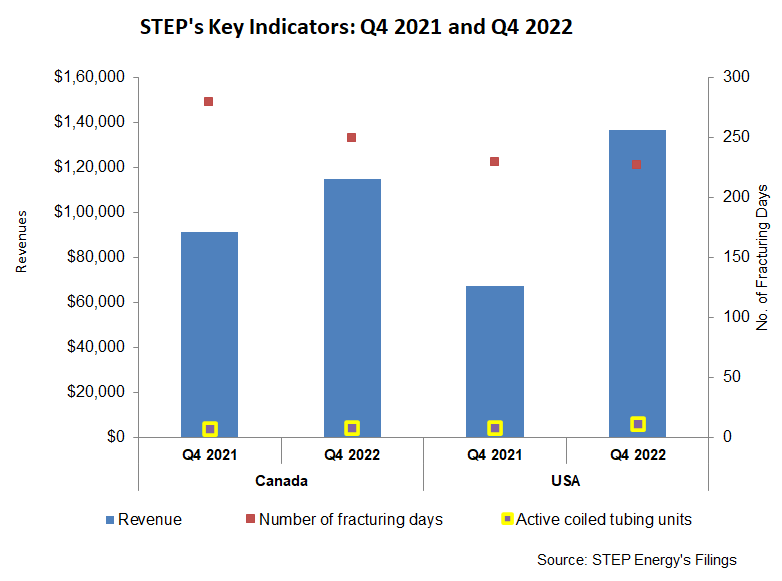

In FY2022, STEP concentrated on increasing and diversifying its asset base as it acquired four ultra-deep capacity coiled tubing units. At the same time, it arranged pre-funding for a tier four dual fuel frac spread upgrade. The efforts resulted in solid revenue and adjusted EBITDA in Q4. The growing reach of the well and fracturing market and its size and scale are keys to success in coiled tubing. The company added a coiled tubing unit to nine in Canada in the past year. Because of the spring break in Canada in Q1, some work will be shifted to Q2, including several large pads. So, in Q2, it expects to take delivery of its first upgraded Tier 4 dual fuel frac fleet in this region. One of the reasons why it pins so much hope in Canada is because of the agreements signed with the Blueberry River First Nations, which would perform the bulk of the stimulation operations. The company had a relatively slow start in the US because of the fall in natural gas prices and excess fracturing capacity, which led to margin compression in this region.

The company’s active coiled tubing units are spread across Alberta and northeast British Columbia in Canada. The company currently operates three frac spreads in the US across the Permian. Read our previous article to know why these frac spreads are in higher demand.

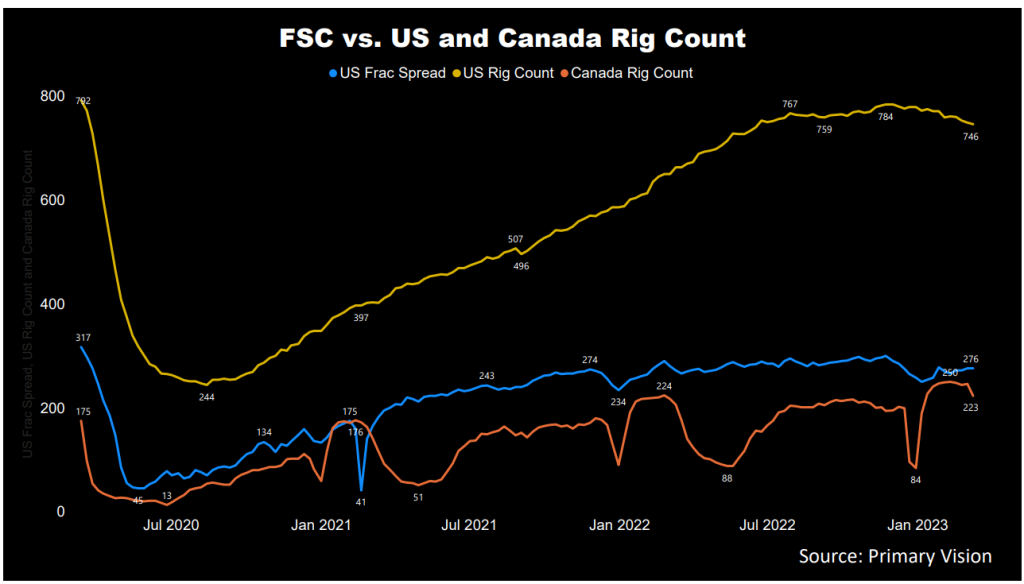

However, one of the downsides for STEP in Q4 was the low US frac fleet utilization due to significant drilling delays. Typically, large, multi-well pads take 20 to 30 days to complete. Since many energy operators are reluctant to increase their capex budget organically in 2023 or may increase only sparingly, utilization may not improve much shortly. Plus, the early February storms in Canada affected, too. However, US fracturing activity is expected to continue into Q2, boosting utilization.

Coiled tubing utilization, on the other hand, has been strong, except for a few hiccups in the US Rockies and North Dakota. In Q4, the company’s coiled tubing units in the US increased to 12, up from 10 in Q3 2022. In late Q1 and early Q2 2023, the company’s US fleet is expected to continue to be utilized.

Industry Activity

The US rig count has increased by 13% in the past year, although it has dipped in Q1 2023. The crude oil price has not moved much so far in 2023. As estimated by Primary Vision, the frac spread count underperformed the rig count’s growth, clocking just a 1.5% rise.

The Q4 Drivers And Segment Performance

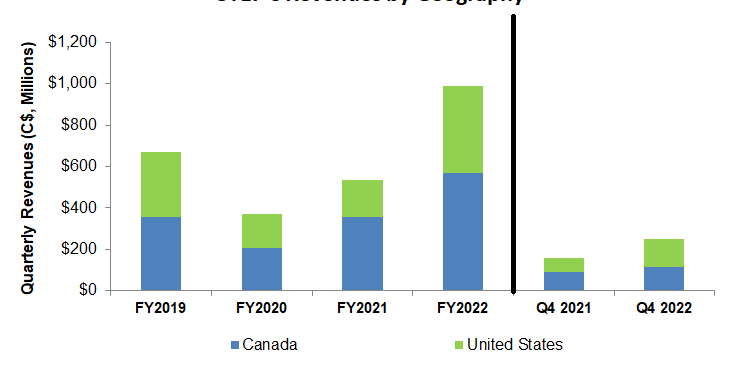

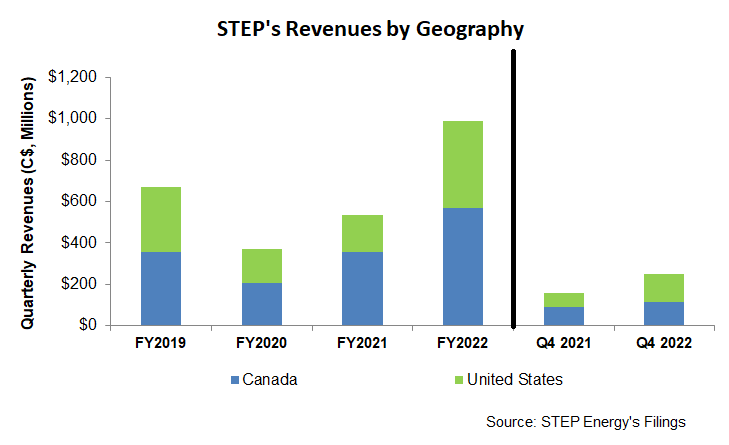

Revenues from STEP’s Canada in fracturing and Coiled tubing increased in Q4 2022. Year-over-year, revenues in Canada increased by 26% in Q4. As the company focused on large multi-well pads in the natural gas-focused plays in Montney and Duvernay, its coiled tubing services have been strong. The rig count in Canada was also down in Q4, leading to a 17% quarter-over-quarter fall in fracturing activity. Plus, lower activity and shift in job mix resulted in the reduction in proppant pumped. So, a lower level of fracturing activity in Canada during Q4 resulted in low utilization. The spring bear-up can also push the activity level to Q2 2023 from Q1.

Year-over-year, revenues in the US more than doubled in Q4 2022. Although the legacy mechanical rigs saw lower activity levels, the high-spec rig market remained strong, particularly in the Permian basin. Coiled tubing utilization was also strong. Even though the spring break-up may impact activity at the company’s northern coiled tubing bases in Colorado and North Dakota, utilization will likely stay sharp.

Cash Flows And Debt

STEP’s cash flow from operations (or CFO) more than doubled in FY2022 compared to a year ago, led by significantly higher revenues in the past year. Although capex increased, free cash flow increased by 83%. Improved cash flow enabled the company to reduce leverage. In 2023, the company’s capex budget will be $103.2 million, 24% higher than FY2022. Much of the capex is geared towards replacing major components for daily operations and fleet refurbishments. From Q3 to Q4, STEP’s debt-to-equity fell to 0.46x from 0.53x. Its reduced net debt to $138 million. It has shed $170 million from its debt balance since 2018.

Learn about STEP’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.