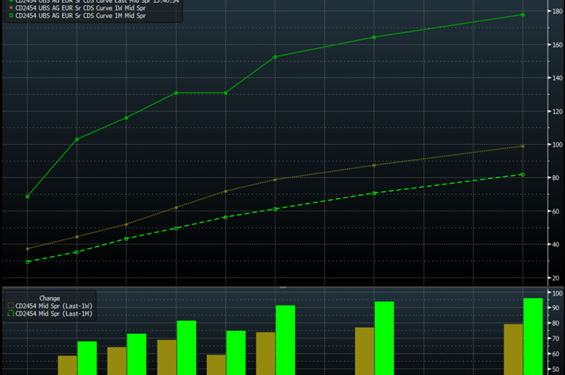

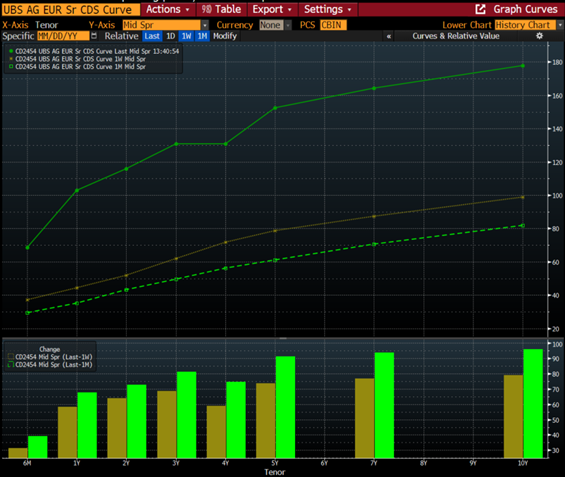

The market is trying to digest the problems circling around the financial industry, which is very fluid at the moment. UBS “officially” purchased Credit Suisse over the weekend following additional support from the Swiss Central Bank. CS has struggled since ’08 with multiple restructuring and bailouts/ lines of credit since the Great Financial Crisis. It isn’t surprising to see UBS absorb CS, but the question becomes- can UBS handle the unwind of Credit Suisse exposure. UBS has seen their Credit Default Spreads (CDS) blow out as investors are concerned CS could weaken UBS to a large degree. CDS’s are essentially insurance packages in case a company, country, or bond default.

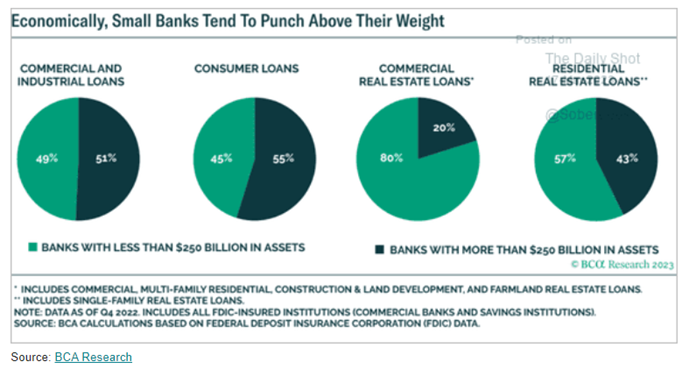

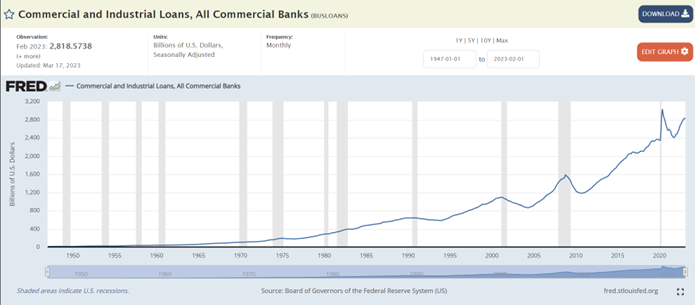

There is a hope that the contagion will be contained, but there is renewed pressure on the small banks in the U.S. as First Republic Bank comes under pressure again. There is an ongoing battle because SVB (Silicon Valley Bank) and Signature Bank (SBNY) haven’t traded since being halted on March 9th and 10th respectively. This has sparked renewed fears around short covering and option expiry, which is creating more chaos in the other small/medium banks and regionals. We believe that the pain is far from over given the pressure at the regional bank level. Small banks are some of the largest underwriters of commercial and industrial loans (C&I loans) as well as commercial and residential real estate. The consumer piece is also coming under pressure since those loans are usually by way of credit cards or lines of credit against homes or other hard assets. I think that asset prices have a long way to fall, which will put more pressure on the loan books at these banks.

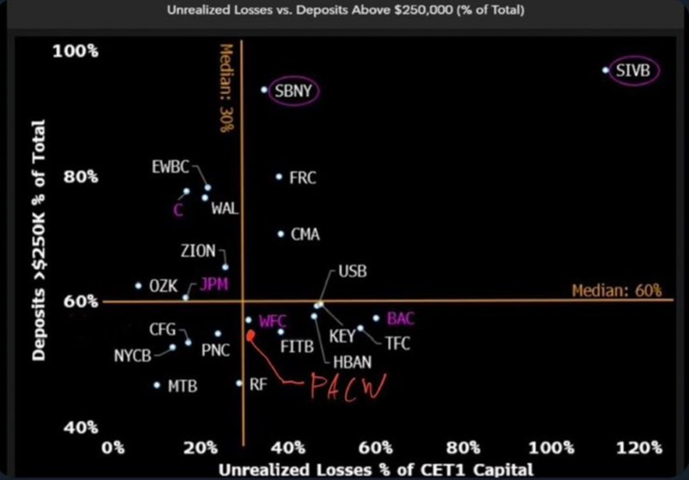

There is some opportunity for the best small banks that have managed their portfolios to come out on top. The best place companies remain MTB (M&T Bank) and PNC- they have the least exposure to deposits over $250k and don’t have the unrealized losses like the rest of the group. These two banks will be able to balance the next few months and pick up valuable assets. There were more rumors today that FRC (First Republic Bank) will be selling more assets to raise capital to secure deposits. We expect to see more portfolios come to market, and it will only strength the banks that have managed their risk and loan books.

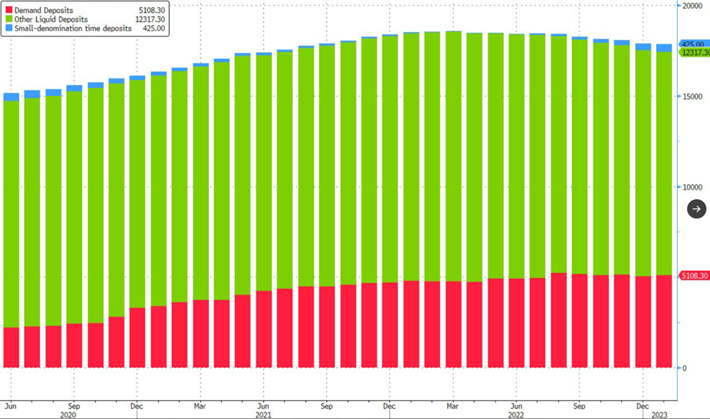

It will be very difficult for the Fed or the U.S. government to backstop all of the unsecured deposits. There is about $18T in deposits with only $125B in the FDIC (Federal Deposit Insurance Fund). The Fed has assembled the potential to backstop about $2T but that would just be another massive QE injection that would send inflation surge again.

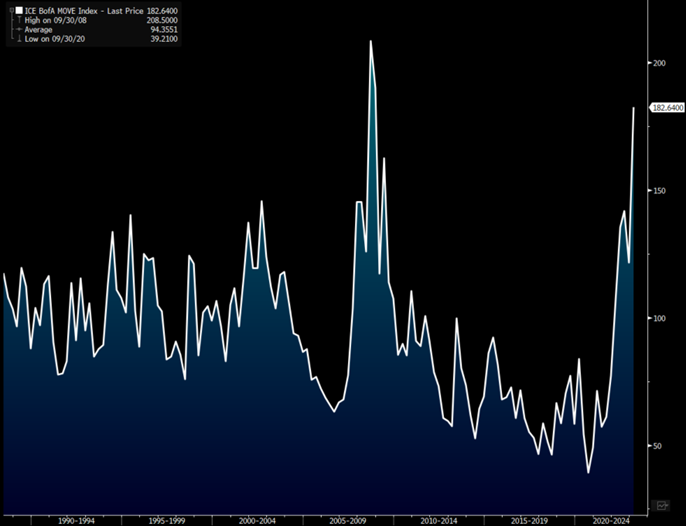

Bond volatility has surged new heights as it approaches levels not seen since 2008. As global volatility increases, there will be bigger reductions in risk assets as companies and consumers pull back more aggressively.

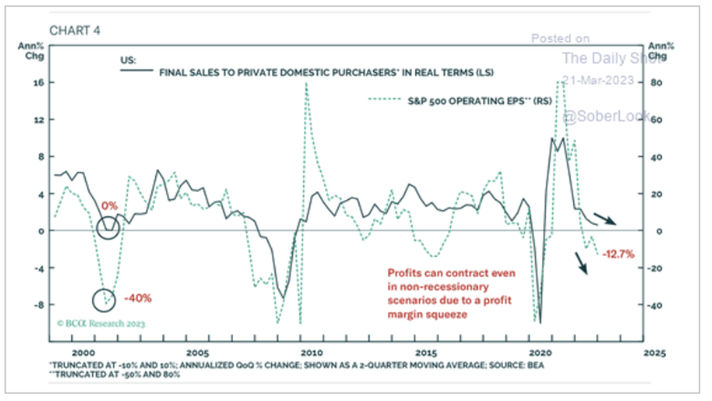

The additional stress across the market is going putting more downside pressure on earnings, and we expect to see another shift lower in the stock market. This will setup more “fear” and reduce economic activity further.

In the U.S., we have final sales of private domestic purchases falling rapidly, which will weigh on earnings and margin. The next down wave will be rapid, and result in more fear permeating the system as many investors (especially retail) remain long equities.

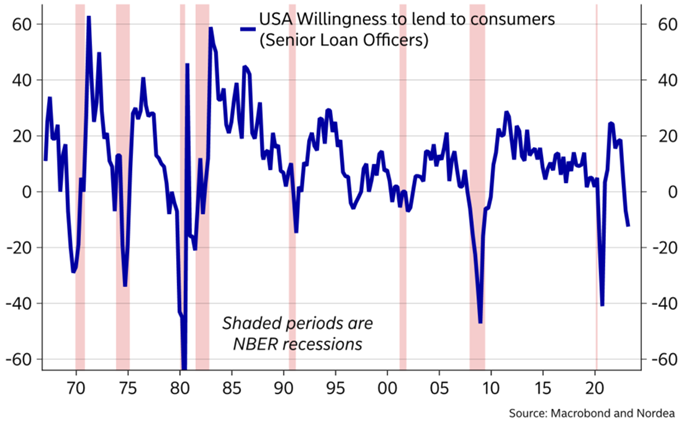

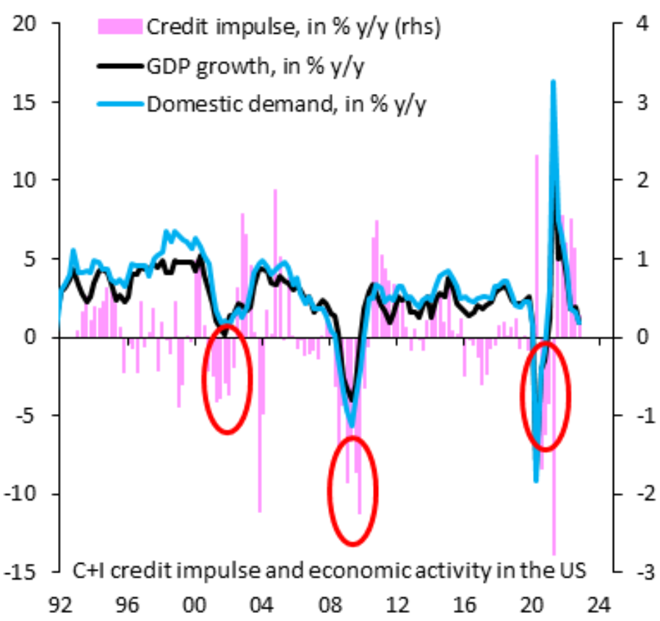

As the bad debt expense rises, the banks have less money to lend out as they need to keep more cash on the balance sheet to account for the write-downs. This has created a broad freeze in new loans and underwriting, which will take the credit impulse down significantly in the near term. The problem is- the willingness to lend was already in recession territory the past couple of weeks BEFORE the regional bank chaos began. The shifts in liquidity, concern around deposit bases, illiquidity of hedges, and weakening loan portfolio is going to shrink that even faster.

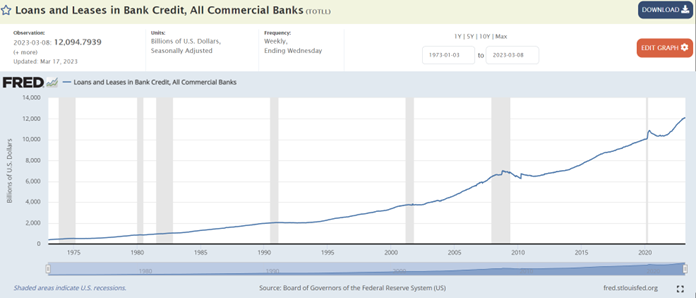

Just like everything else in today’s financially manipulated world, loans and leases in bank credit are at record levels so any shift in asset valuation can have huge ramifications. Leverage is great when it’s all sending us higher, but the moment it turns lower, the losses added up rapidly.

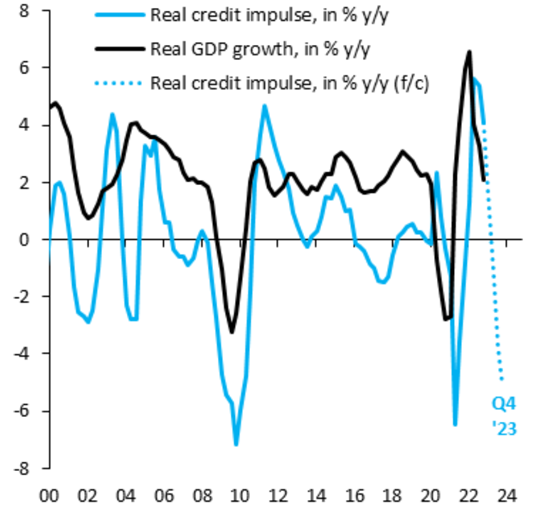

As credit growth dries up, we are going to see a sizeable drop in real credit growth, which will take GDP down with it as well. Essentially what matters for growth (black line) is the credit impulse (blue) with the second derivative being credit. If we assume stabilizing credit and avoid an outright credit crunch, the second derivative turns very negative regardless and still risks a broad U.S. recession. We have pointed out in the past that a recession was unavoidable, and we believed it would be a shallow and prolonged draw down. We are still keeping that as our base case, but the stress is growing that can send us lower much faster. The Fed is launching initiatives that will “slow” the drop but it won’t by any means reverse the problem. The bank failures are the SYMPTOM and not the CAUSE! We have highlighted from day one that banks/investors were failing to do the necessary due diligence, evaluating risk, hedging appropriately all because of their access to ZIRP and endless QE. The moment many of these zombie companies could no longer roll their debt- it would all come crashing down. As we have said, rates rising fix a lot of problems and we need to purge the system.

The US is now a classic credit impulse story. Usually, it’s hard to disentangle demand vs supply in the credit impulse – the change in the flow of credit – but SVB and ensuing pressure on US regional banks is a true exogenous shock that will drive the impulse sharply negative.

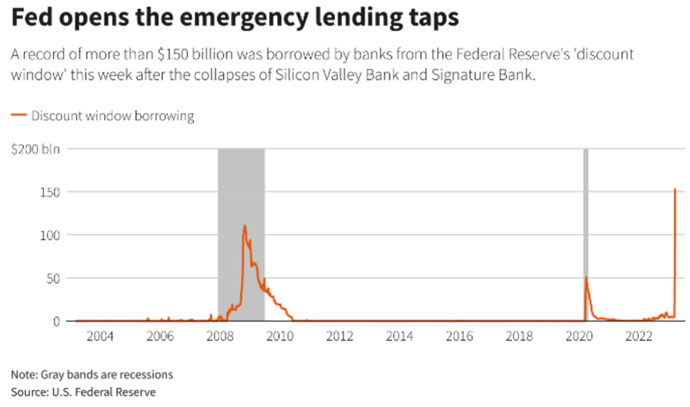

The Fed dumped a ton of liquidity into the market last week, and added about $297B assets on their balance sheet last week. This essentially erased half of the QT that has taken place since April’22 and all of it was done in a single week. We also saw a surge of U.S. banks borrowing from the Fed’s discount window to a level that dwarfs the GFC and COVID shocks. It totaled about $152B with the recent record being in 2008 at $112B.

This tightening scenario is a key reason why the Financial Conditions index took a HARD turn lower and is the tightest since March 2020.

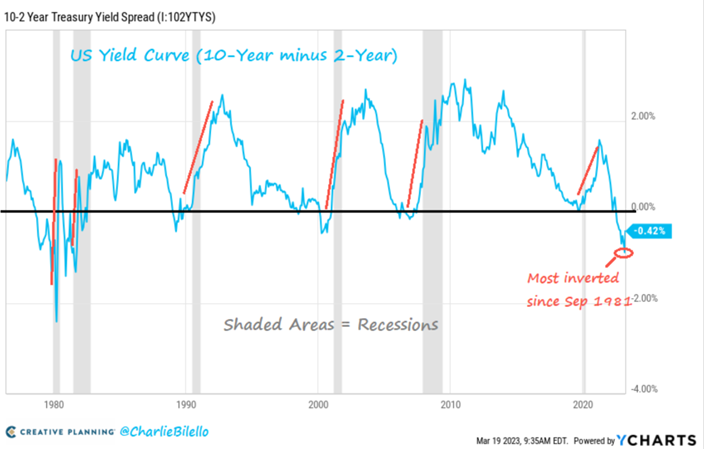

The yield curve inversion reached it’s steepest levels going back to the early 1980’s and has now started to snap back higher as the market starts to price in underlying rate cuts being pulled forward. “During the last 6 US recessions, we saw the Yield Curve (10s minus 2s) steepen aggressively as the Fed entered a rate cutting cycle. The market is pricing in the same today, pointing to a Fed Funds Rate of 3% by the end of 2024.” The problem with the view that the Fed will cut is the presence of inflation still in the system, and we are still well below “full employment.” The ECB raised rates by 50bps with the BoE likely to raise another 25bps. This puts the Fed in a position to raise rates a quarter of a point, but they may choose to “wait” and do nothing at this point. The problem is- if they do nothing- we can expect another surge in inflation to come on the back of the decision over the next few months.

The uncertainty surrounding the world is also playing out in U.S. CDS’s as the value of them surged.

The Fed finds itself in a tough spot as they have trained people to believe in a “Fed Put.” Greenspan started the party back in 1987 as the introduction of ZIRP or at least very low rates would create a way to “break the business cycle” and not have down drafts the same way we did in the early part of the century. The Fed and U.S. Government doesn’t or at least SHOULDN’T backstop all losses. But, we have created an entire generation of individuals that take blind risk and think they will be bailed out when everything evaporates. Low rates and free money created a play ground for terrible portfolio, risk, and hedging management.

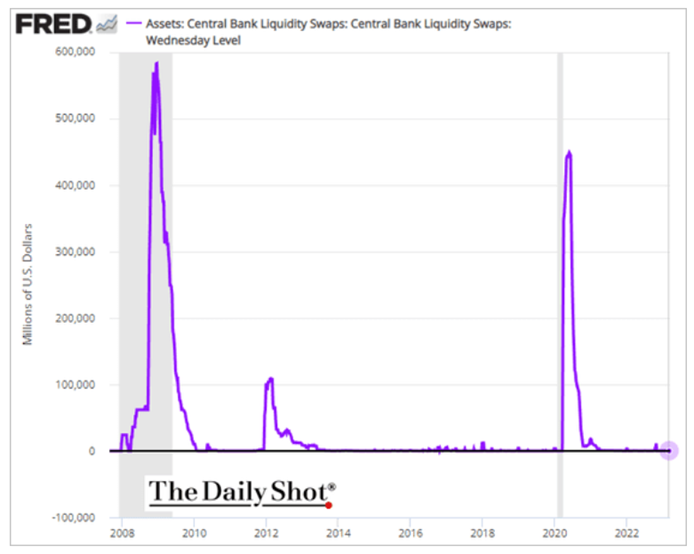

The Fed is currently constructing a “new” backstop that could have a scope approaching $2T, but early indications show they would want to use it to protect the six banks with the highest amount of uninsured deposits- which is closer to $460B. ““The usage of the Fed’s Bank Term Funding Program is likely to be big,” strategists led by Nikolaos Panigirtzoglou in London wrote in a client note Wednesday. While the largest banks are unlikely to tap the program, the maximum usage envisaged for the facility is close to $2 trillion, which is the par amount of bonds held by US banks outside the five biggest, they said.” The Fed has also opened up the liquidity swap lines for international use, which is tapped for shortages of USD abroad.

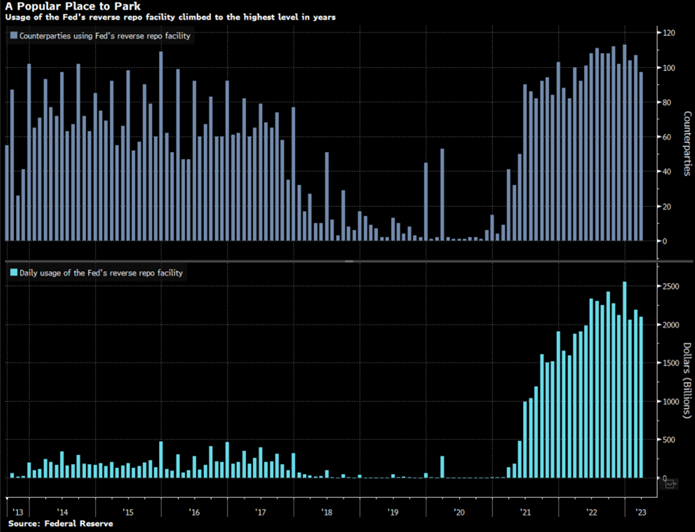

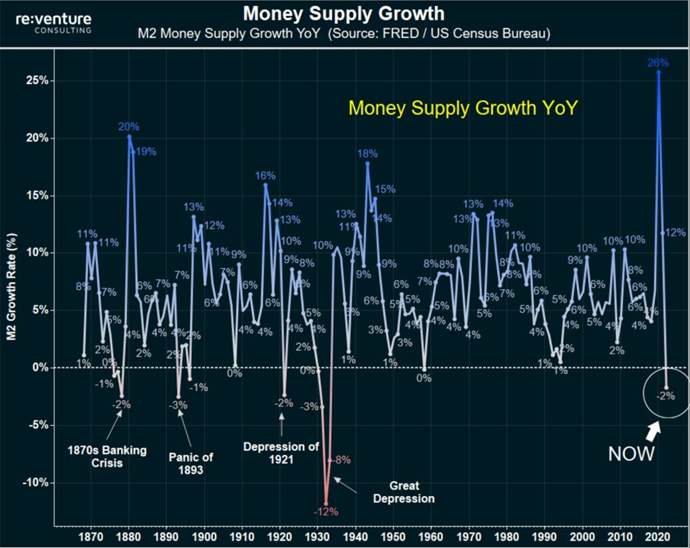

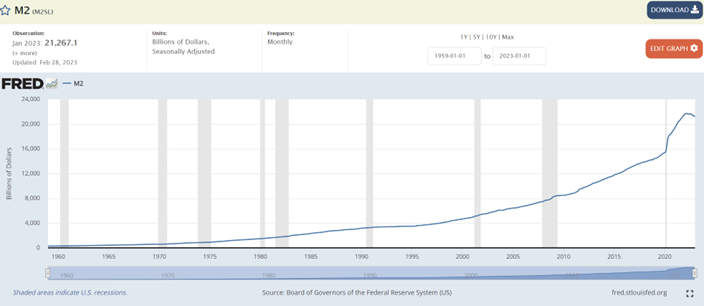

There is a common factor talking about how M2 has shrunken after massive increases over the last 20 years, and we still have over $2T sitting in the RRP.

We have done nothing but increase the money supply for the last 60+ years expanding the amount of liquidity in the market steadily. Until 2020, when Central Banks and Governments released all hell into the market and sent the money supply to the moon. We need to pull some of this froth from the market, but as you can see from the insanity- many banks, investors, and corporations aren’t prepared for the party to end yet. “Just one more hit” seems to be the view from around the world, but at some point we need to end this monetary experiment as the Law of Diminishing Returns catch up to us rapidly.

The below chart puts into context just how “small” that drop was and yet people have now lost their minds.

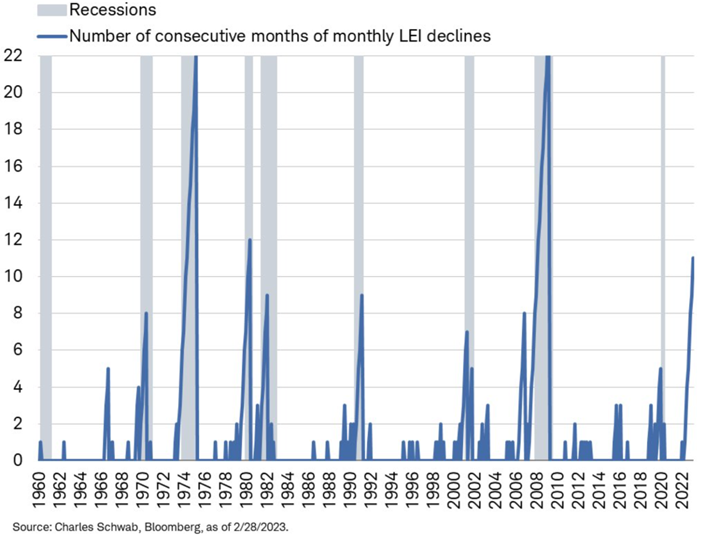

Even before all of this unfolded, the leading economic index has been dropping with it’s 11th straight month of declines. The streak has never been seen without an economy already being in or heading into a recession.

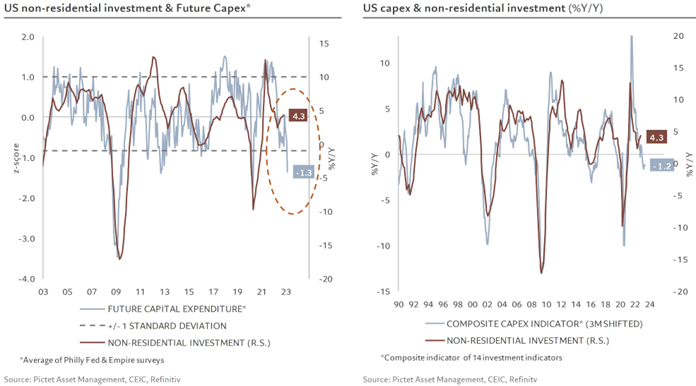

The shift in the banking world and underlying economic headwinds are sending CAPEX expectations through a floor after already assumed to be lower.

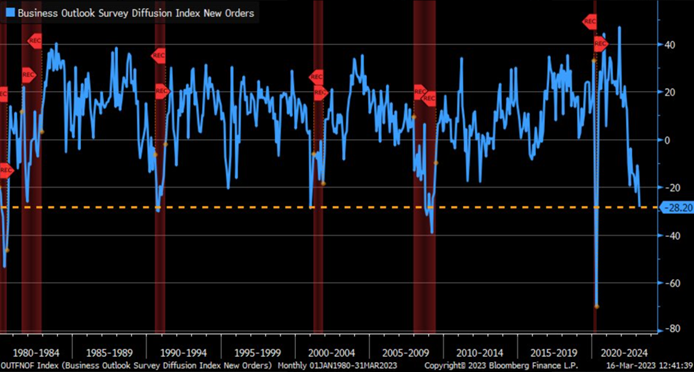

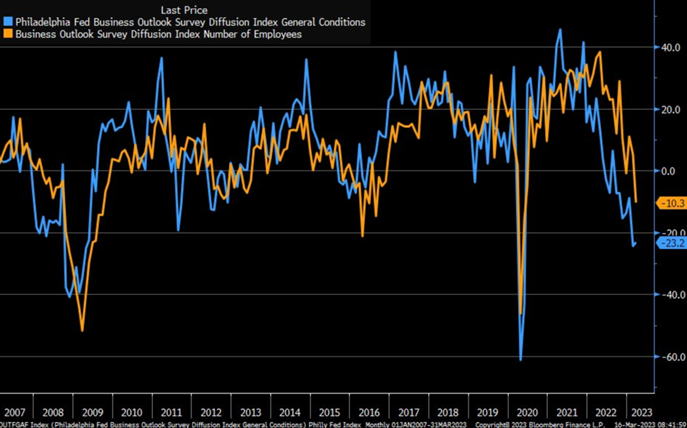

Even before the banking sector chaos unfolded, we had more negative prints from the Philly and NY Fed. New orders component of the Philly Fed Index sank further into contraction in March; now at level firmly consistent with prior recessions.

The broader index “rose” to -23.2 from last month’s -24.3, but was well below estimates of -15 as pressure continued to grow outside of the current problems unfolding.

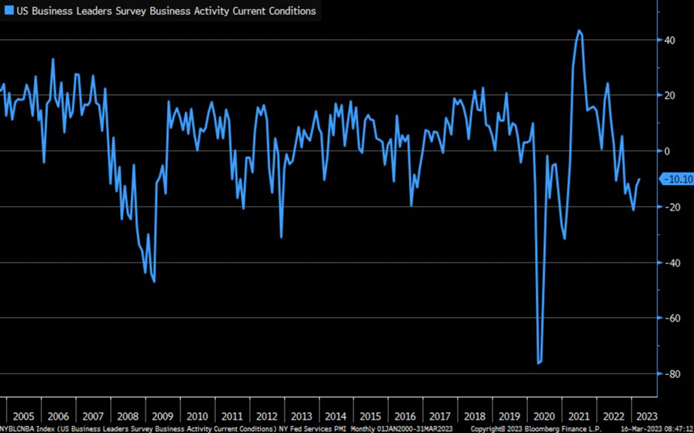

The March NY Fed Business Activity data recorded something similar after “rising” to -10.1 vs last months -12.8.

Many of these data points don’t reflect the problems that still remain in the system- including the exposure to unsecured deposits.

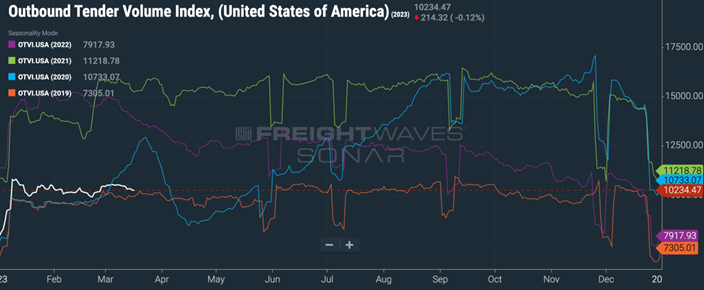

As the economy slows, we see more pressure to the downside in diesel pricing and underlying cracks as storage builds and shipping, trucking, and rail demand diminish. We have been highlighting how trucking data keeps disappointing to the downside, and we are going to cross over below 2019 very quickly. For those that have been following us since 2019, we talked extensively how 2019 was the start of a broader economic slowdown so even these comps are “easy” but yet we are going to turn below it within the next month. As inventories caught up and purchases slowed, (based on credit impulses, regional fed, and international flows) the need to move goods dropped off rapidly, which will put more pressure on corporate balance sheets. The regional fed data has signaled a broad range of pressure, and many of these readings were taken BEFORE the banking system buckled.

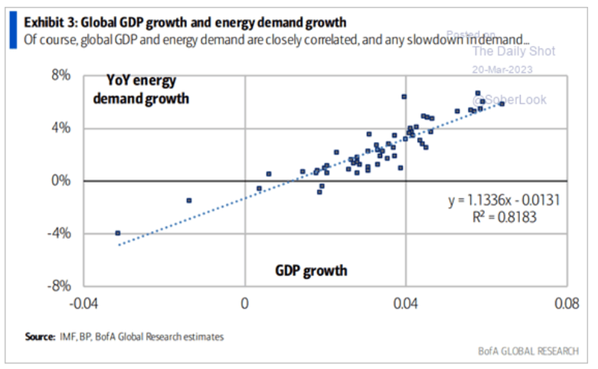

Crude demand is inherently tied to the growth of GDP, and I don’t think there are many strong narratives swirling around the world at the moment. We have been talking about the pressure in crude demand as expectations for the global economy was overstated.

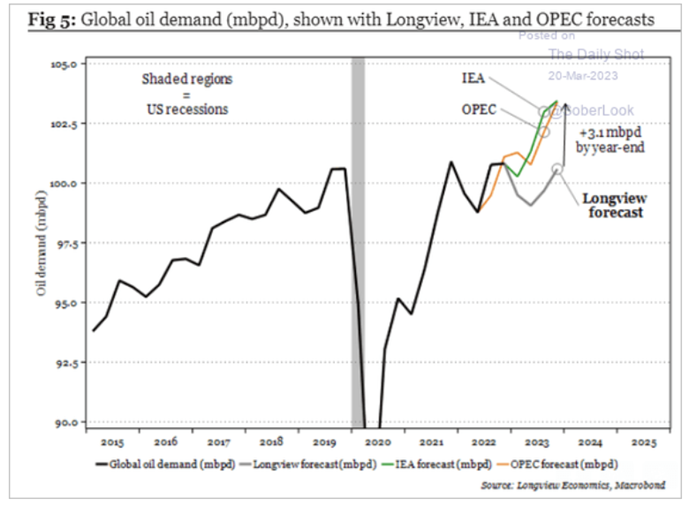

We aren’t alone in our view that global oil demand is going to disappoint in 2023, and I think that outlook is becoming more likely as the financial issues roil global markets.

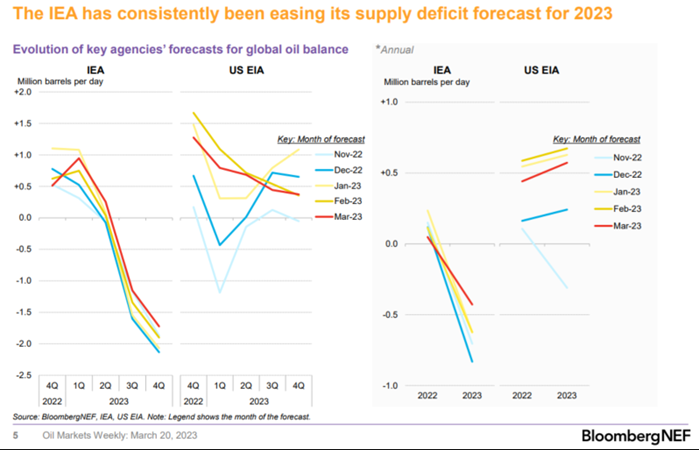

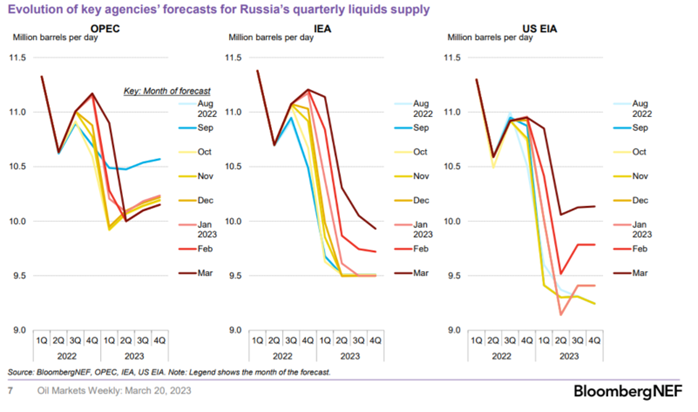

Some of the more “bullish” agencies are starting to adjust their estimates for supply deficits as they rapidly adjust economic expectations. For us, we have been very clear that as rates went up things would break and the global market would slow- so we just have people moving closer to our views.

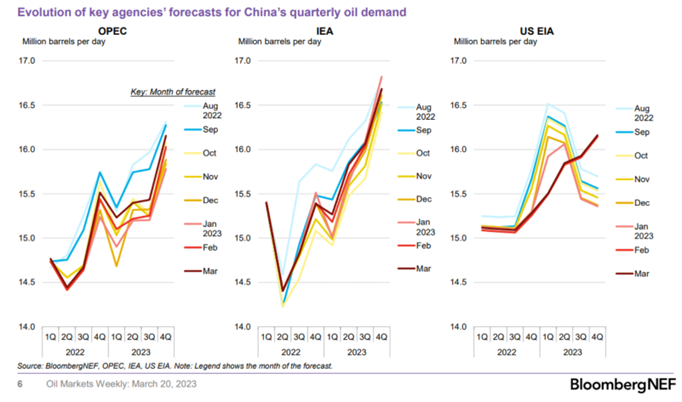

A key point of the shift was the view that Chinese demand would grow while all other crude demand held strong in other markets. We have stated time and time again that as China increase buying and underlying demand- there would be slowdowns in other areas- especially Asia Ex-China.

Even as Chinese demand expectations have risen, they are falling short of broader estimates the market had baked into their models.

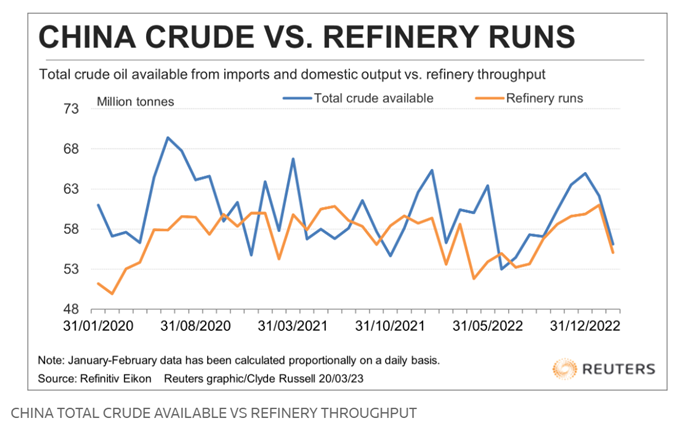

There was a view that China was going to draws from the SPR, but instead the recent data indicates China continued to increase their SPR. “China still added more crude oil to inventories in the first two months of the year, despite lower imports and higher refinery processing rates. About 270,000 barrels per day (bpd) of crude was added to commercial or strategic inventories over January and February, according to calculations based on official data. This was down from the 1.19 million bpd in December and the 740,000 bpd for 2022 as a whole.” We are still seeing more demand (as we assumed), but it’s still outpacing refinery runs as things remain a bit slower vs broader expectations.

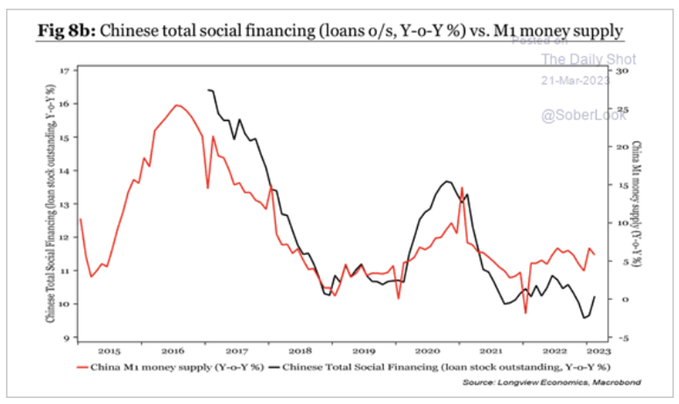

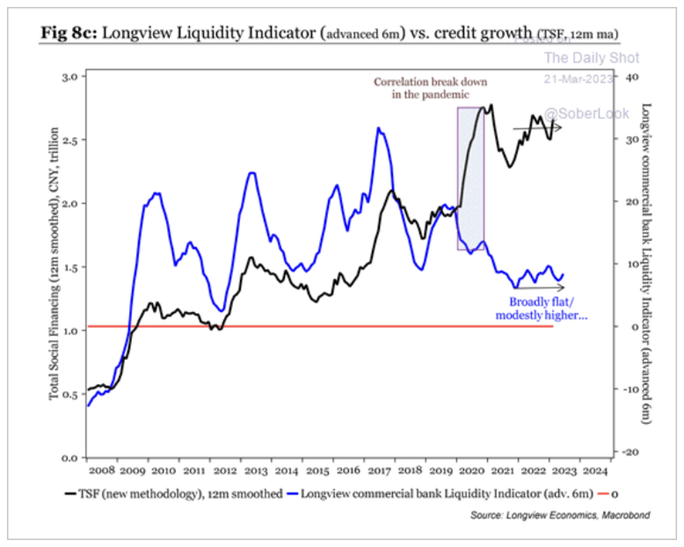

China hasn’t been able to meaningfully “stimulate” their economy with additional slowdowns coming in aluminum and steel production- both great bellwethers for underlying activity and economic strength. Underlying money supply and liquidity injections have still been underwhelming vs expectations in the market, while they are right inline with our expectations.

The below chart also puts into context how the liquidity situations has been fairly flat with little benefit to the upside. We have been saying that the PBoC is looking to maintain a steady credit impulses that still pulls liquidity from the system.

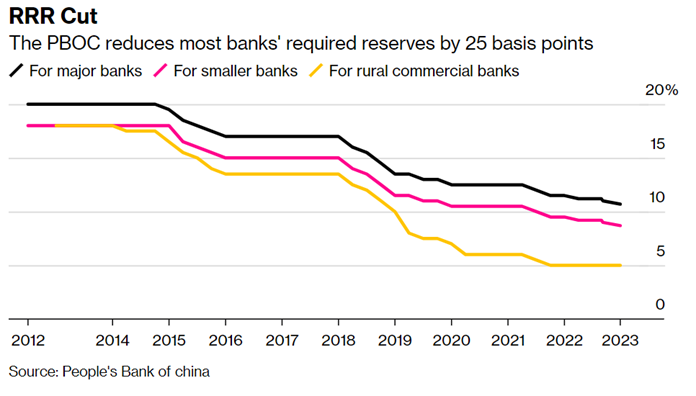

Even the recent actions taken by the PBoC will have limited impact because the scope of the cuts were reserved for major and some smaller banks while rural banks were left with limited support. This will be something to watch because a core component to Xi’s plan is to invest heavily in the rural markets, but these are also areas we have highlighted with significant accounting irregularities and “Double counting” across asset sales and assets used as collateral.

We remain cautious the “Chinese Reopening Story” as it has failed to pull a meaningful amount of crude off the water as physical crude markets have weakened and refinery crack spreads have softened.

I think the below Reuters backdrop sums up very well what is happening across broader demand cycles. Things are a bit mixed, and just not as bullish as the market was initially factoring into their models. As the

“The slower flow into storage tanks does support the market’s bullish view for a rebound in China’s oil demand in 2023 as the world’s largest crude importer stimulates and reopens its economy after growth was crimped last year by the now abandoned strict zero-COVID policy.

But the fact that China is still building inventories also sounds a note of caution as it suggests that even as they ramp up processing rates, refiners still have bulging stockpiles to draw upon should the price of imported oil rise to levels they deem too high.

Exports of refined oil products – which included diesel, gasoline, aviation fuel and marine fuel – soared 74.2% in the January-February period from a low base a year earlier to nearly 12.7 million tonnes, according to official data.

Putting all the data together gives a somewhat mixed picture, as crude oil imports are still soft, refinery processing is strong, but a larger share of what was processed was exported to take advantage of high regional fuel prices, especially for diesel.

It’s likely that China’s oil demand will rise in coming months as the economy continues its uneven recovery, but the question is whether this rise in fuel consumption will be met by additional crude imports, or whether refiners will dip into inventories.”

Another key component for us was Russia maintaining exports, which is now also being baked into underlying forecasts.

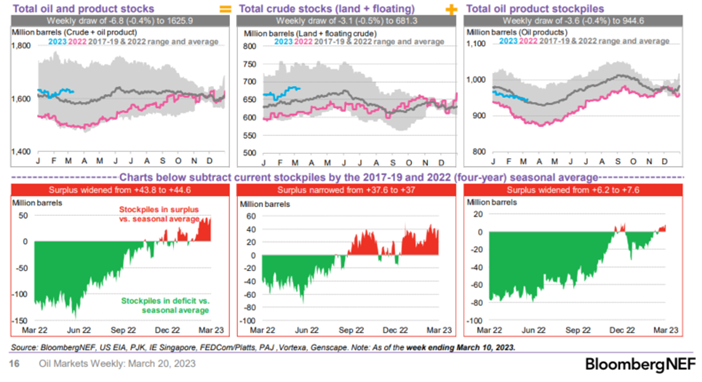

As everything slows, we believed that total oil products stockpiles were going to shake off the normal seasonal drop and reflect builds globally. We see the surplus widening- not by a huge margin- but rather staying flat with slight increases as seasonal norms typically show declines.

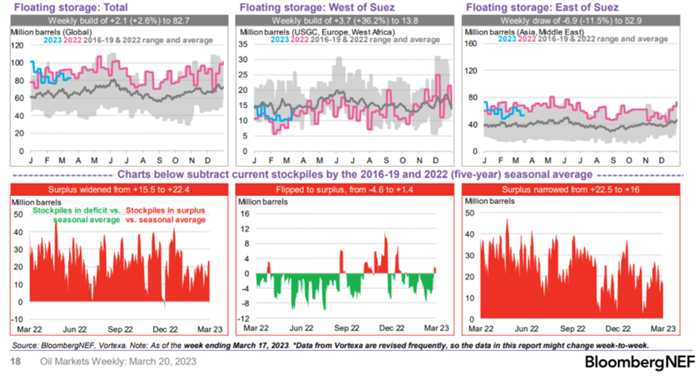

A large part of these shifts are driven by way more Russian product being dumped into he market and broader economic slowdowns. We expect to see land crude storage to move along seasonal norms, but the issue will be a rise in broader floating storage. The slowdown in buying is going to put more crude in floating storage, especially in the Middle East and West Africa as India/China increase purchases from Russia.

The Middle East floating storage had a counter seasonal build, which was much closer to 2020 vs other years. As demand wanes further, we expect to see additional builds in floating storage across the board- especially in the ME and WAF.

PLATTS:

- Vitol offered 500k bbl of Agbami for April 10-20 delivery on CFR Rotterdam basis at Dated +$2.10/bbl

- Dropped from +$2.40 on March 20, +$2.50 on March 17, +$3 on March 16, +$3.50 on March 15

- Cargo to be unloaded from Nissos Kythnos

- Vitol also offered 340k bbl of Dalia for March 21-25 arrival to Rotterdam at Dated -$5.50/bbl

- A shipment with similar arrival dates was offered at -$5 on March 20, -$4.50 on March 17, -$4 on March 16

- Cargo for discharge from Ardeche

There is also additional weakness in products as French strikes leave more product on the water and reduces underlying demand within the country. Russian product also keeps flowing into China, which is reducing broader buying from other regions.

Beijing’s spending on Russian energy, including crude oil and products, coal and natural gas, ballooned to $88 billion in the year through February, according to Chinese customs figures, replacing other buyers that have shunned Russian exports because of the war. That compared to $57 billion in the previous 12 months. China’s growing share of Russian exports is key to the increasingly asymmetric relationship between China and Russia, laid bare during President Xi Jinping’s visit to Moscow this week. Russia receives a reliable source of funding for its war machine in spite of international sanctions, while its energy-hungry eastern neighbor gets to gorge on vast flows of fossil fuels, often bought at discounted rates.

Russia is also offloading more crude and product into Fujairah, which will keep driving builds higher in the Middle East. The Russian flows are impact land storage just as much as floating storage and general supply chains keep shifting along with the slowdown in underlying demand.

Crude prices are going to remain range bound with a “new” trading range for Brent. The chart is putting the floor at $70 on an extension to the downside, but the buying spot is around $72 with first line of resistance $75. If we get $75 breaking, the next level is $78 but it’s hard to get to $80 given the underlying economic pressure.