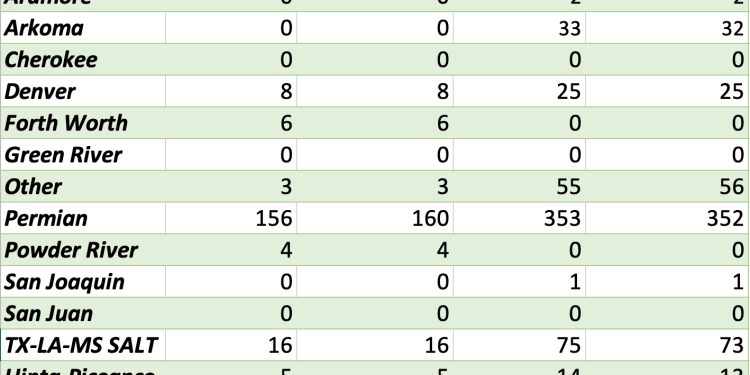

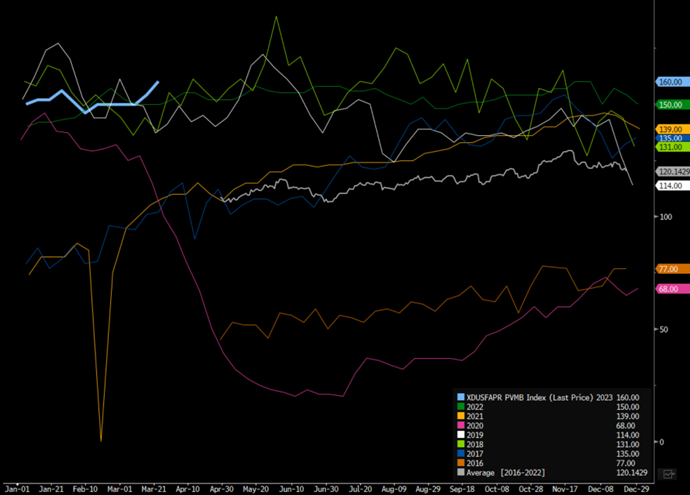

The completion market in the U.S. increased again as the Permian saw a nice jump this week. There is normally an increase that happens right around this time when you look at 2018 and 2019. It isn’t surprising to see this kind of increase as we progress through March, but we should now hold steady between 285-295 throughout April. Normally, May into June is when we see another bump in activity on a seasonal basis. So far, completion activity is following the seasonal trend beautifully.

The below chart gives you a look at the Permian and you can see that the increase happened right around what is seasonally normal. We expect activity to remain robust in the Permian and Western Gulf as we progress through the rest of the year.

The physical crude markets saw another round of cuts to pricing as volumes struggle to clear- especially in West Africa. France is normally a big buyer of WAF crude taking about 110,000 barrels a day over the past year. As strikes continue throughout France, demand has

“Nigeria is struggling to find buyers for its oil as strikes in the French refining sector and seasonal maintenance at plants elsewhere in Europe cut into the OPEC producer’s sales. Between 20 and 25 shipments of Nigerian crude for April loading are still searching for buyers, according to four traders specializing in the West African market. That’s a much weaker position than normal for this time of the month — when trade should be moving on to May’s barrels — and the prices the shipments can fetch are dropping, they said.”

While Nigeria is struggling to sell their crude, so is Angola, which has reduced prices in an attempt to send more product into the market.

- Sonangol reduced its offer price for a cargo of Angola’s Gimboa crude for May loading, while maintaining the level of a separate Girassol shipment for the same month

- 600k bbl of Gimboa for May 3-4 loading offered at Dated Brent -$4.10/bbl

- Decreased from -$3.50 in a list from March 22

- 1m bbl of Girassol for May 23-24 offered at Dated +$3

- Unchanged from March 22

Angola’s Sonangol reduced its price for a cargo of Girassol crude for May loading, while offering a separate cargo of Saturno for the same month, according to a price list seen by Bloomberg.

- 1m bbl of Girassol for May 23-24 offered at Dated +$2.50

- Reduced from +$3 on March 27

- 950k bbl of Saturno for May 11-12 loading offered at Dated -$3.50

Flows into Asia have been very low over the last few months with little change in March. Crude flows from Angola to Asia to edge higher to 587k b/d in March from 548k b/d in February, which was the lowest since at least August 2011.

The volume of crude processed in China is forecasted to increase +7.8% y/y this year, reversing a historical -3.4% decline in 2022

- Supply of oil products +8.4% y/y to 433m tons, while net fuel exports seen at 35m tons, similar to last year’s level

- Overall refined-product supply may exceed domestic demand by 35m tons in 2023

- Total refining capacity will stay unchanged at 924m tons, after overtaking the U.S. last year as the world’s largest

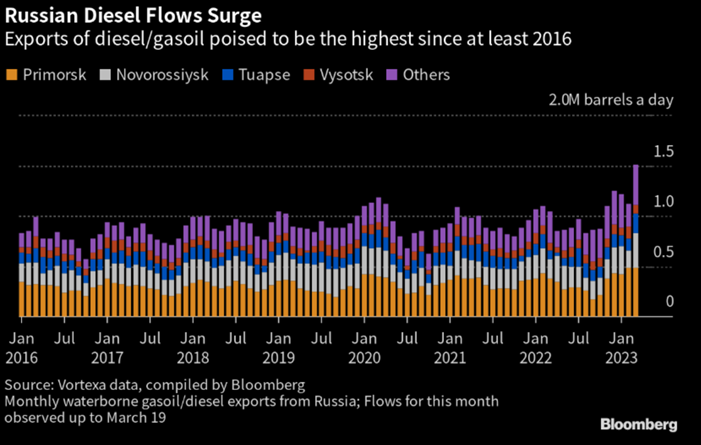

We expect to see a steady flow of exports from China this year as the excess gets sent into the market while demand wanes in some core Asian nations. As Chinese exports remain steady, we already have another surge in Russian diesel flows into the market. “Shipments of diesel-type fuel out of Russia during the first 19 days of March stood at about 1.5 million barrels a day, according to Vortexa Ltd. data compiled by Bloomberg on Friday. If that rate is maintained, this month will see the highest exports in data going back to the start of 2016.”

The discounts also remain steep vs competitors in the region. This will pull in more volume from Russia as we have already seen in the Middle East and Singapore.

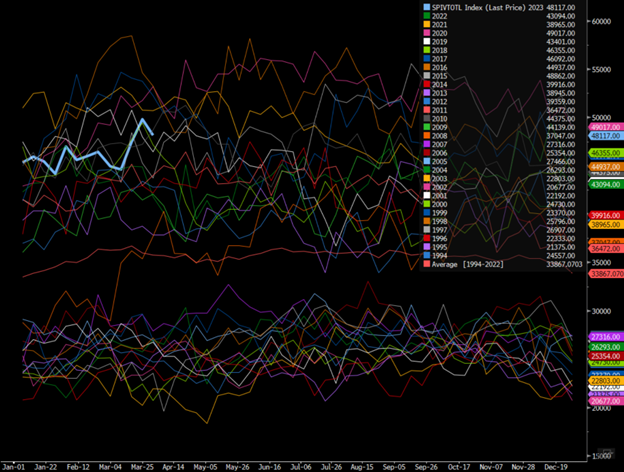

Storage levels of product in Singapore rose substantially over the last few weeks, and we don’t see that stopping in the near term. The below shows the total amount of product building across the board: Light distillates are at a seasonal record, Middle distillate has moved back towards the 29 year average, and Resid keep moving higher. Russian product increases will impact the heavier side of the barrel, which will depress crack spreads further in the region.

The above highlights a large amount of the bearish side of the crude trade, while there are some supply level bullishness on several fronts.

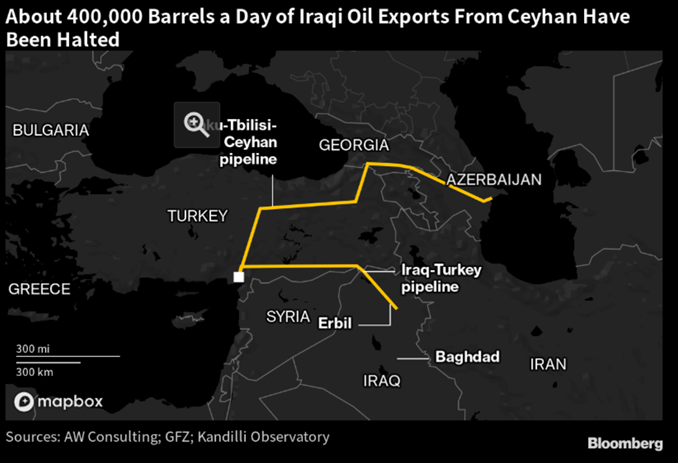

- Iraq crude exports from the North (Kurdistan) are halted.

- Venezuela’s crude exports feel recently.

- There was a new oil tax introduced in Brazil.

- Chad nationalized Exxon assets.

- Colorado is suing oil companies for reparations claiming they caused climate change.

Saudi Aramco has agreed to acquire 10% of a Chinese oil refiner for $3.6B in a second deal between the two. “Under the arrangement with Shenzhen-listed Rongsheng Petrochemical Co, Saudi Aramco will supply 480,000 barrels a day of Saudi crude to China’s largest integrated refining and chemicals facility in Zhejiang province. The investment comes a day after Saudi Aramco announced a joint venture with two other Chinese companies to build a new 300,000 b/d refinery and petrochemicals complex in China’s north-east. The combined deals promise to increase Saudi Aramco’s supply contracts with China by up to 690,000 b/d just as Saudi Arabia’s share of the world’s largest oil import market is coming under pressure from a rise in shipments of discounted crude from Russia.”

This is a way for KSA to compete against Russia taking a significant amount of market share. China is also struggling with the operation of their state-owned refiners that have underperformed operationally. China needs operational support, and KSA wants to embed themselves within one of their largest buyers. It’s important to note that KSA is playing the political game to make sure that China and India are both happy with their trade agreements. I will explain later on why the petrodollar and the dollar as the reserve currency isn’t going anywhere.

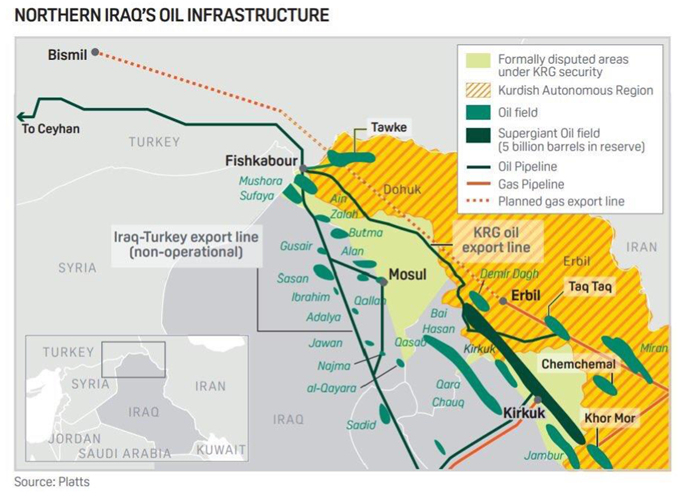

It’s important to understand what’s happening with the Iraq shutdown of Kurdistan crude flowing through the Ceyhan pipeline. “Turkey closed a pipeline running from the northern Iraqi region to the Mediterranean port of Ceyhan on Saturday. That was after an international business tribunal said the Kurdistan Regional Government shouldn’t export oil from the terminal without Baghdad’s approval.” Iraq started to take more control of Kurdish production back in May 2022, but there has been a lot of frustration on both sides with little progress towards a long-term deal. “Baghdad says it’s up to the KRG to break the deadlock by accepting that Iraq’s state oil-marketing firm, known as SOMO, should handle Kurdish shipments from Ceyhan.”

Relations between the KRG and Baghdad have improved since Al-Sudani became the prime minister in October. Our expectation is that the pipeline is operating by the end of April. There will likely be another 1-2 weeks of negotiations with a restart agreed upon by the third week of April. The below chart puts into perspective where the pipeline runs and where the crude originates from in Iraq. Kurdistan has always been a semi-autonomous region, and after the fall of ISIL- they voted for independence which brought the Iraq military to their doorstep. This created a lot of animosity between the two entities especially because the previous Iraq government also pulled in Iranian troops to “help.” Those Iranian units have been expelled (for the most part) over several years following the clash. I will post a Kurdistan report I wrote a few years ago at the end of this report for context of all the major players.

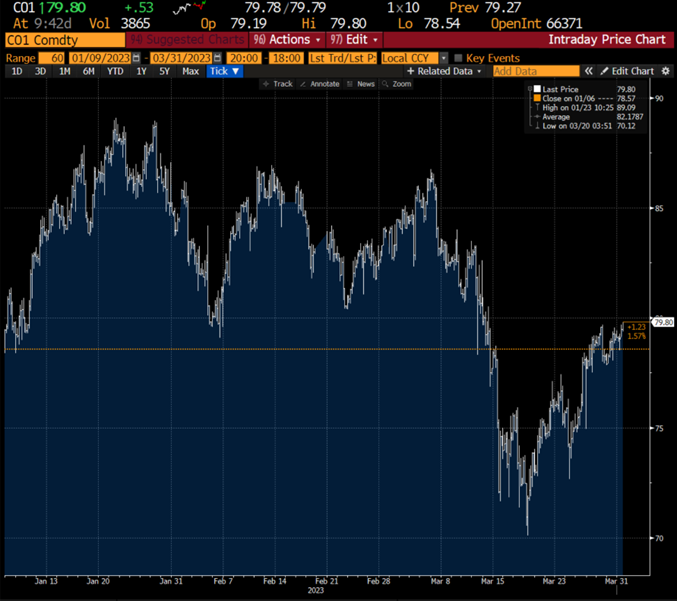

The crude markets mixed between supply disruptions and falling physical prices will remain in clear trading ranges. Brent is flirting with $80 again, which has become short term resistance. If it can retake $80, it will move back within the previous range of $80-$85.

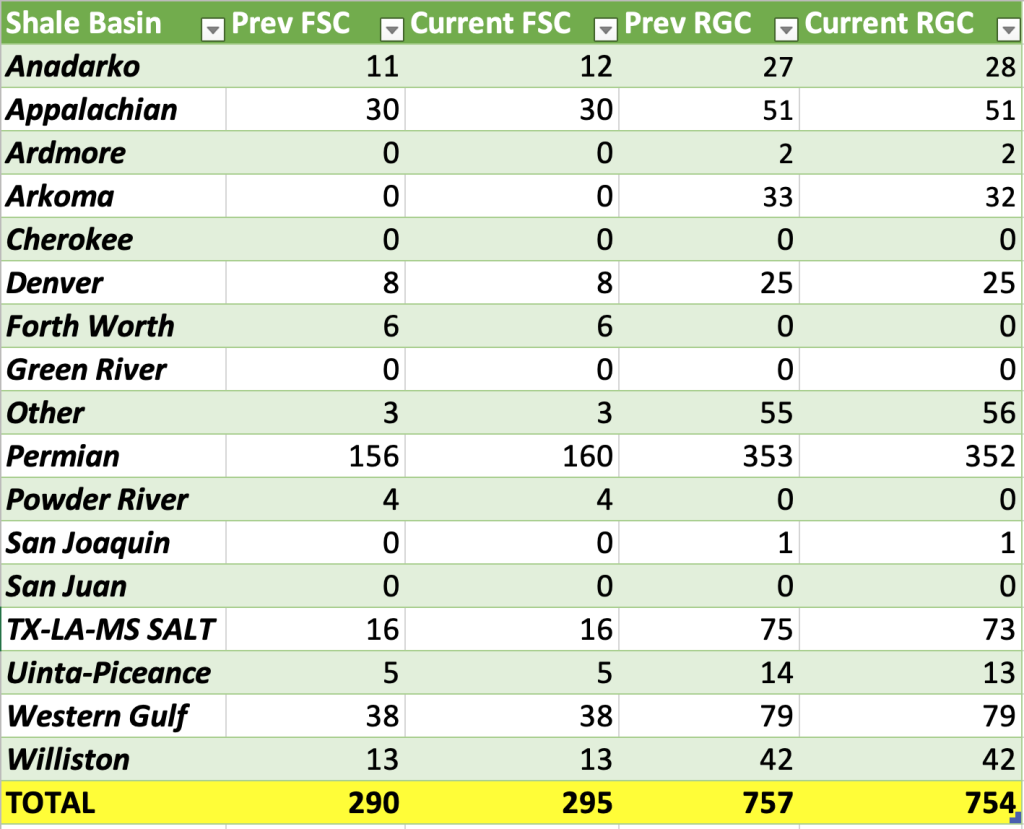

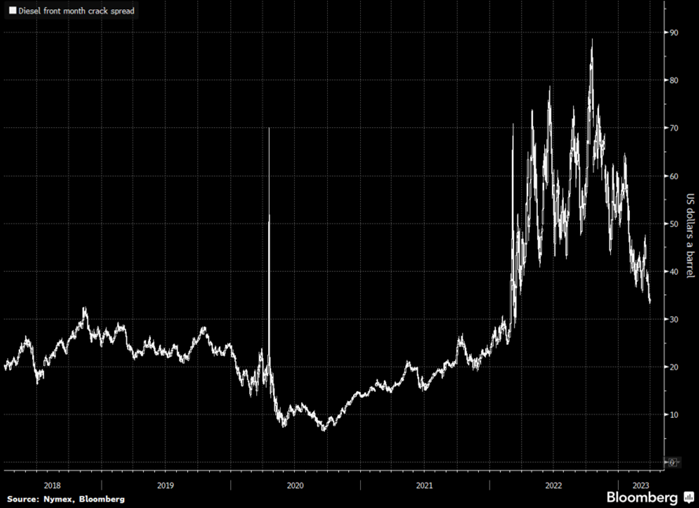

The overhang to watch will be diesel demand and underlying crack spreads around the world. In the U.S., crack spreads have weakened, while still remaining above average when looking at ’18-’21. It will be a battle between gasoline and diesel as we head into the summer driving season, but we are already seeing cracks around summer driving.

Diesel cracks in Asia have already broken lower and are flirting with $20, which is a big problem when you start looking at refinery margins. Light distillate (gasoline) storage is already at record levels, and as builds of middle distillate, heavy disty, and resid rise there will be more pressure on cracks to the downside. The amount of Russian product entering the market is putting a lot of pressure in Asia, which is worsened by the slow down on the economic side of the equation. Refinery utilization rates will be very important to watch in Asia as crack spreads get pushed lower and builds rise.

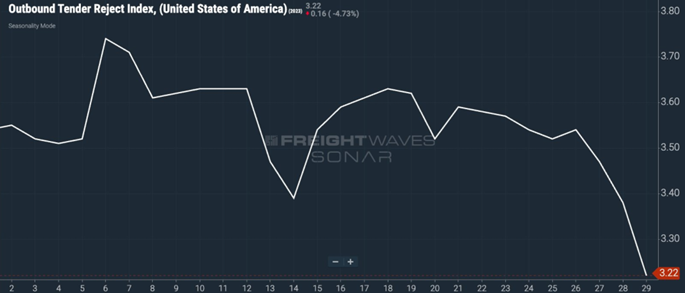

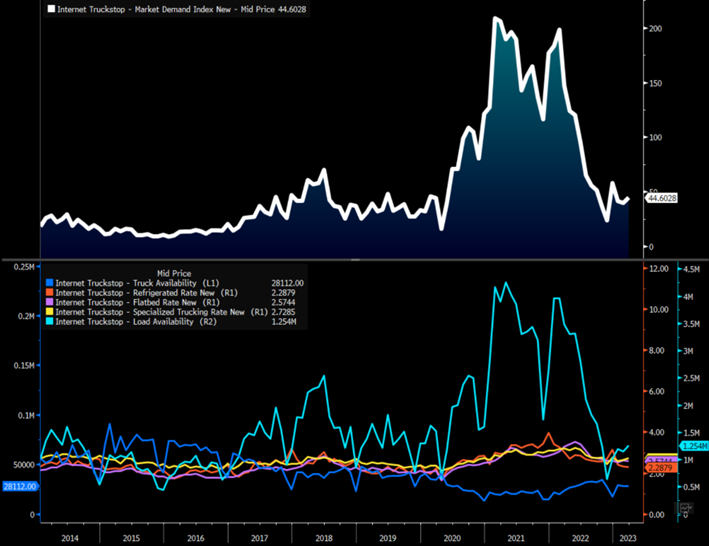

Diesel demand in the U.S. remains under a lot of pressure when you look at leading indicators and current shipping data. “This is frightening – tender rejections have collapsed to all-time lows (outside extreme COVID lockdowns) to 3.22% at the end of the quarter! Tender rejection index measures pricing power that fleets have in the market. Capacity is abundant at a time when RFPs are being awarded.”

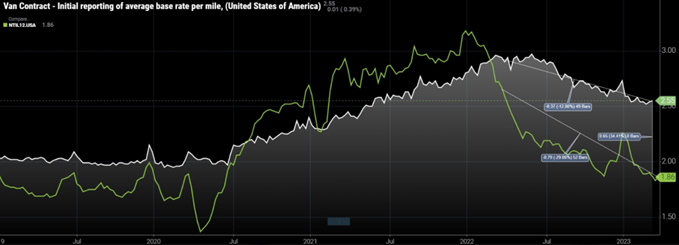

The below shows the delta between spot and contract rates, which shows how much pressure remains across the system. Rejection rates have dropped to lows as demand struggles at this point.

“Spot truckload rates in the US (green line) are now lower than they were Pre-Pandemic of March 2020 (less fuel). Costs are much higher for truckload carriers and with rates continuing to fall, this will push much capacity out of the market. Spot rates are down 11% since October vs. Contract rates are down 6%! This suggests operating margins for spot carriers have moved into the negative margin environment. While this provides many companies with cheap transportation, it is not sustainable. Midzise carrier exits are beginning to gain traction. If this continues, it could cause a capacity crunch in the next 8-12 months and force the freight markets to tighten up again!”

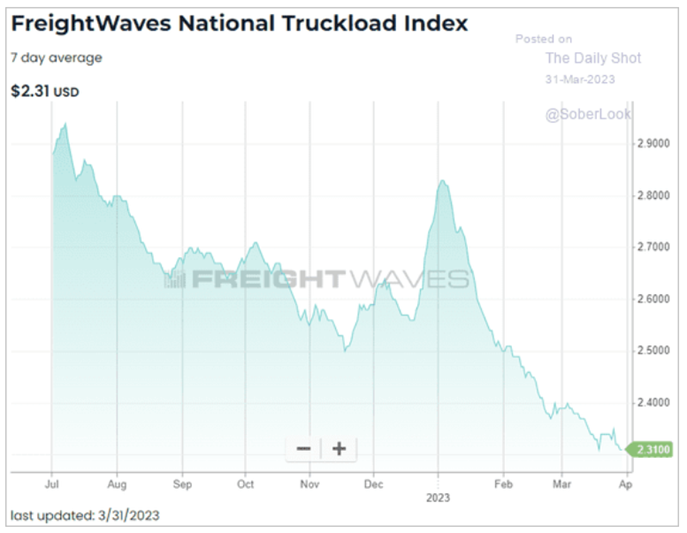

When we look at the 7-day average, you can see the trends are moving in the wrong direction.

Looking at another metric and data aggregator, you can see the same theme playing out with weak demand and little recovery in demand.

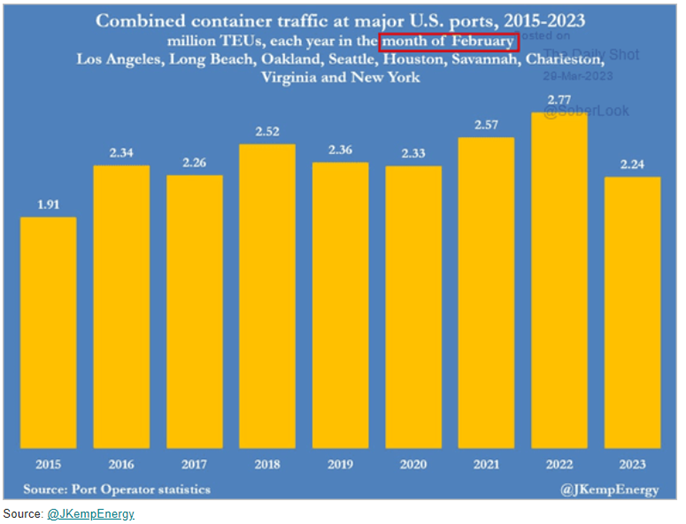

The pressure is going to remain when we look at all the container traffic coming into U.S. ports in February. We saw 2.24M TEUs in Feb of 2023, which is the lowest going back to 2016.

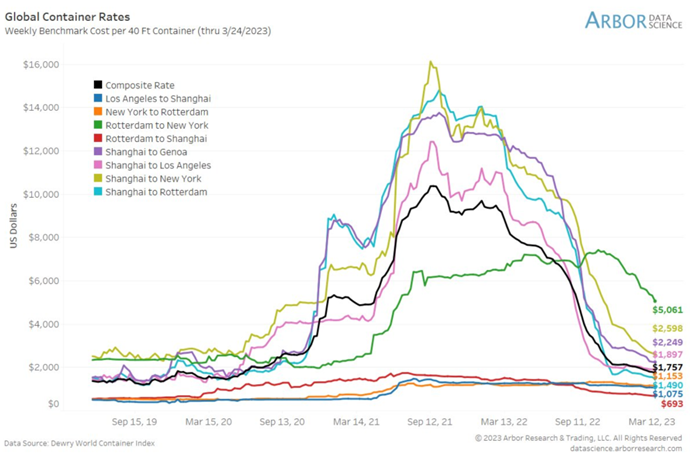

The cost of shipping is no longer the overhang as we have seen prices drop significantly across the board. “Global shipping rates continue to edge lower, emphasizing that worst of supply chain crisis is definitively behind us … price boom looks to be almost completely over for nearly every major route.”

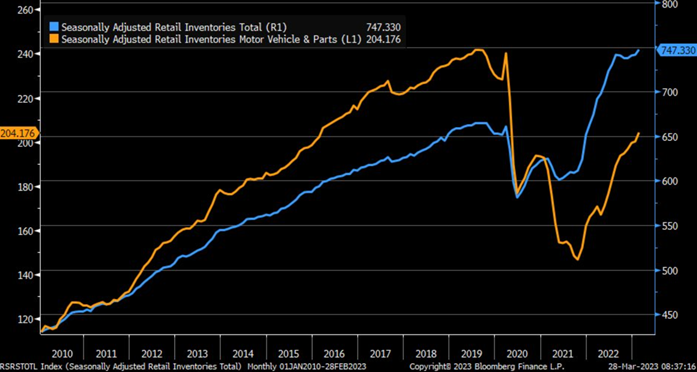

The same structure is playing out within retail sales and inventory builds. Retail inventories have climbed back to a record high while auto inventories are still climbing back towards 2019 levels.

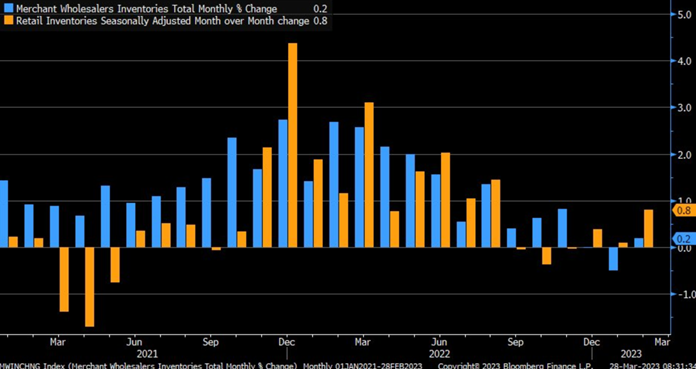

The wholesale side of the equation doesn’t look any better with a steady rise in total inventory levels. February wholesale inventories (blue) +0.2% m/m vs. -0.1% est. & -0.5% in prior month; retail inventories (orange) +0.8% (strongest since August) vs. +0.2% est. & +0.1% prior

When we put it all together, you can see that inventories still remain well above normal following as sales have slowed down and inventories continue to build up at the wholesale and retail level.

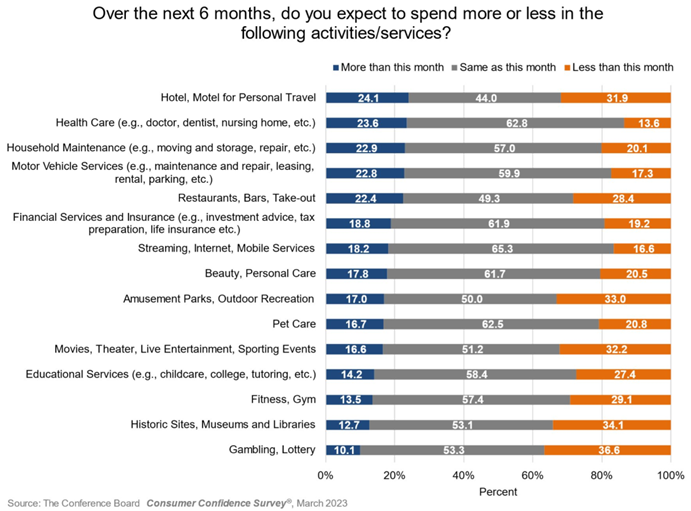

We are also concerned over demand growth expectations heading into spring/summer based on the health of the consumer based on credit backdrops and surveys. The March Consumer Confidence Index asked some interesting questions regarding spending over the next six months, and it should come as no surprise that consumers plan to spend less on highly discretionary categories. Some of these categories are normally purchased during the summer months including personal lodging and amusement parks.

The above chart is a point of consumer for vacation season, and the level of spending we can expect for core “summer demand.”

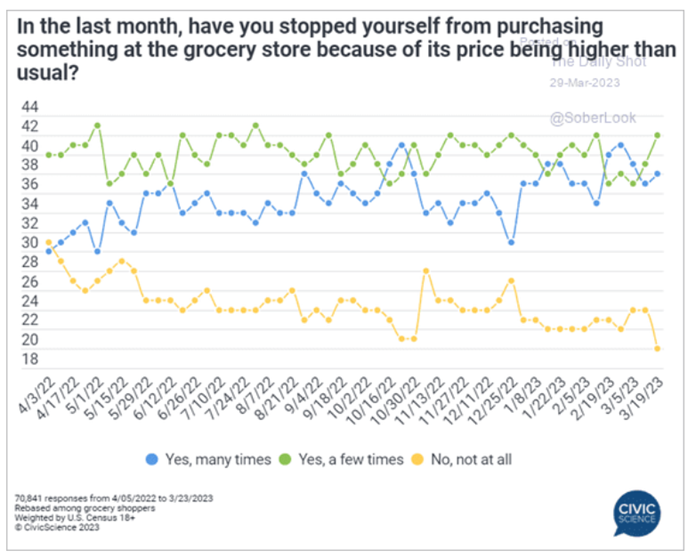

It should come as no surprise when we having people adjusting their grocery store purchases because of price. It’s difficult to rationalize a vacation when you are adjusting what you buy at the grocery store. There are more and more people adjusting their food purchases driven by the underlying costs.

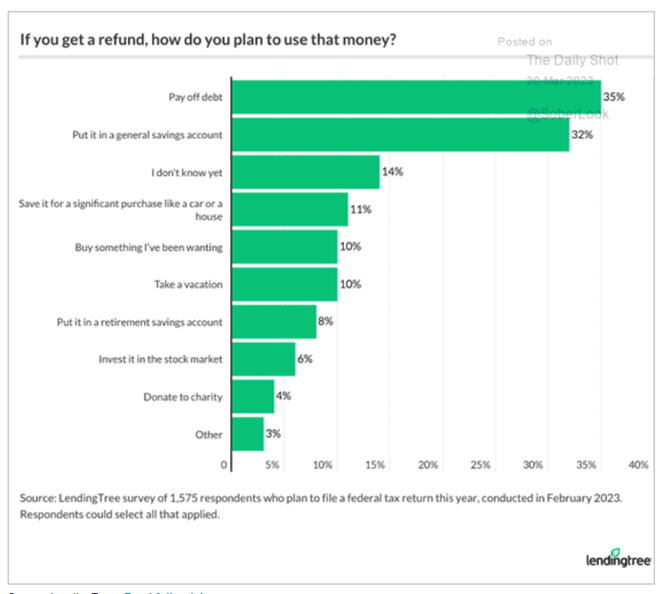

There is also a clear change in the way people are spending their refunds. The focus has shifted to paying off debt or putting the cash back into savings. It’s a broader shift on how money is being consumed at the consumer level.

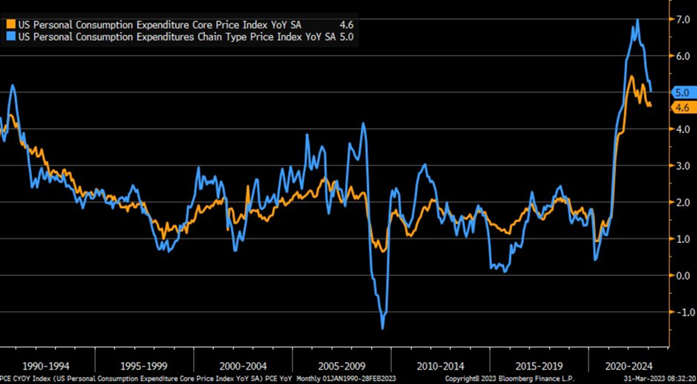

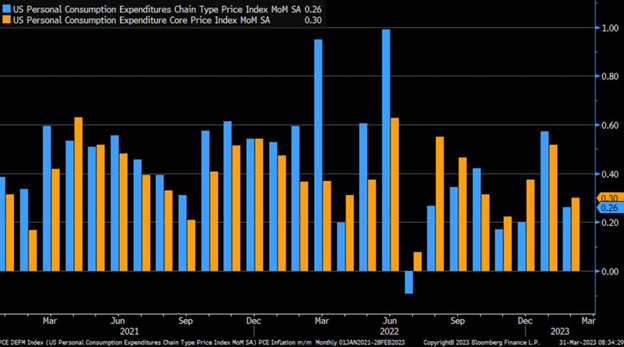

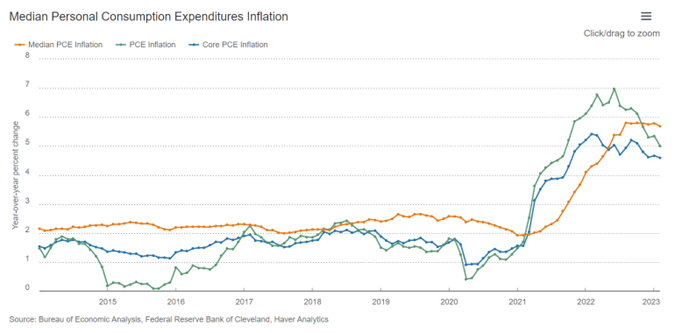

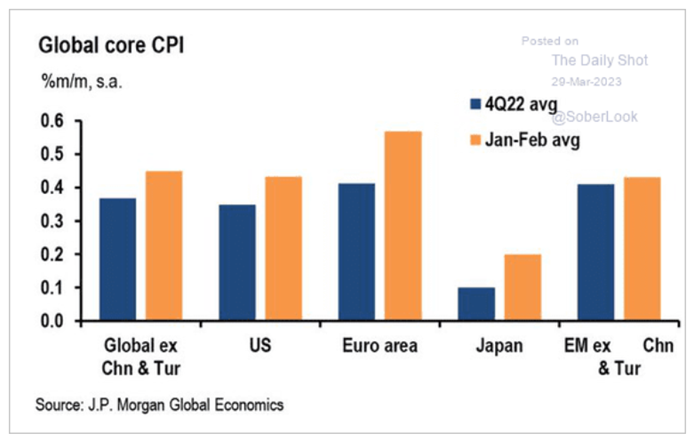

The most recent data also supports another round of Fed rate hikes following an increase in the PCE- especially on the core front. We have said from the very beginning that core inflation was going to be very difficult to combat and result in a very prolonged cycle of rate hikes without a pivot in 2023.

No matter how you break it down, you are seeing inflationary pressures “level off” and not fall off a cliff like many of the estimates predicted as far back as 2020. The expectations this was “Transitory” was always a lie or at least an incorrect view of stimulus. This is something we have been VERY consistent on over the last few years. Here is an excerpt from the Cleveland Fed: “Inflation measures that exclude outliers, such as median PCE, are better able to capture the underlying trend in inflation. Monthly median PCE inflation was 0.4% in February, above the reading of 0.3% for headline and core PCE inflation.”

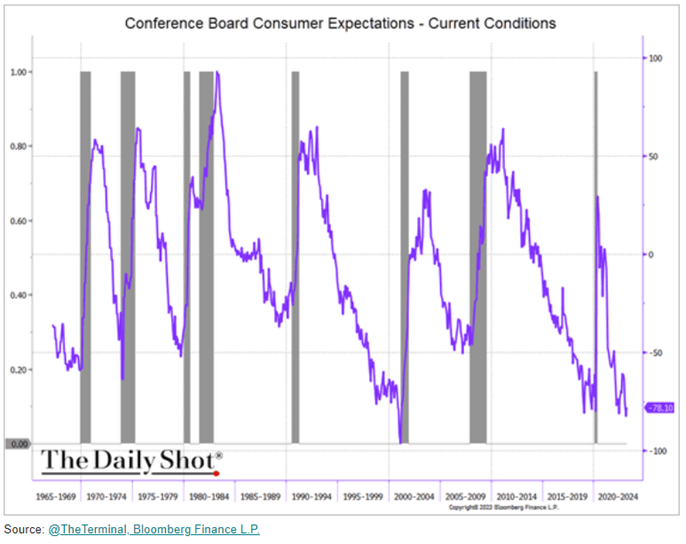

This stickiness and pressure on core is going to keep the consumer on the sidelines, which is a problem as their expectations are already at very low levels- and levels that normally signify a recession.

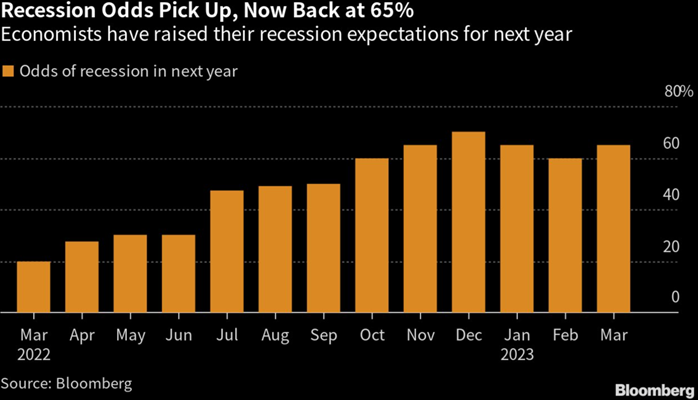

It’s why there is no surprise to see economists increasing their estimates for a recession in the next 12 months. The latest Bloomberg survey of economists (conducted after SVB and other closures) shows probability of a recession in next 12 months has risen to 65%, up from 60% in February.

One of the bigger overhangs for the market remains inflationary pressure in the global market. No matter what region you look at- there is a clear trend higher around the world and reacceleration (month over month). This is going to complicate how Central Banks and Governments try to counter the broader slowdown in the economy. AS we have said from the beginning, CBs waited too long to act and are now caught raising rates in the face of a recession.

The inflation pressures around the world is going to SUPPORT the dollar hanging around for a lot longer. There has still been a significant amount of USD buying to backstop currencies and try to alleviate some of the fears around inflation. I think this was a good article highlighting some of the nuances within the dollar structure: https://www.ft.com/content/f8f3b2cd-6690-4f26-b81e-e972751c8799.

“But the dollar still dominates debt markets, and the volume of dollars held overseas has soared this century. And one striking, and overlooked, detail about this month’s turmoil is that the currency has retained its “near record strength vs the G10 and emerging market currencies”, as Robin Brooks, chief economist of the Institute for International Finance, recently tweeted.” There was also a very good quote from Jim O’Neill “the former Goldman Sachs economist who launched the “Brics” tag (short for the Brazilian, Russian, Indian and Chinese bloc), published a paper this week arguing that “the dollar plays far too dominant a role in global finance”, and calling on emerging markets to cut their risks.”

In theory, it would actually be good for the U.S. if the BRICS nations managed to cut back the role of the USD. That’s because a less dollarized world would mean that the US would not have to run such large deficits in order to balance the world’s demand for dollar assets, which itself is a consequence of very weak domestic demand in the surplus countries. We have said from the beginning that countries LOVE to complain about the US Dollar, but it’s very difficult to replace a reserve currency.

Here is a great breakdown from Michael Pettis regarding the US Dollar, and how it would shift the underlying structure of global trade… essentially- the U.S. dollar isn’t going anywhere

“Imagine for a moment that BRICS decided not just to index some trade in one of their currencies but to balance trade surpluses, perhaps with RMB. This means that foreign countries must be allowed to buy and sell RMB at will to match their current trade and capital needs. By definition China would have to give up control of its capital account, which ultimately means reversing its excess of savings over investment, something it hasn’t been able to do for decades. It also means, of course, giving up control of its trade account. It would also mean China reverses its structural excess of savings over investment ultimately means choosing between surging unemployment and even more debt as it completely transforms the structure of its economy. Is China eager to do either? No. On the contrary, during a period of (still very small) net financial inflows in 2020-22, the PBoC warned many times about the potential risks these posed for China. And yet some analysts say that the PBoC wants to remove all restrictions. It is surprising to me that so many analysts think that changing the dominant global currency is like changing the color of your shirt: aside from looking a little prettier, nothing fundamental in your life will have changed. I think it is because they believe shifting from structural surpluses to structural deficits is a minor thing, a matter of importing a little more. That shows how little they understand the relationship between a country’s internal account and its external account. A shift away from USD requires a major shift in the patterns of global trade and global imbalances. I can see why the US would benefit from such a shift, but why would the BRICS undermine the very system that accommodate their mercantilist growth polices? If the structure of global trade and capital hadn’t been so profoundly determined by the role of USD, it couldn’t have become so entrenched and so difficult to dislodge. But if it is, then how can anyone talk of dislodging USD as if it were just a matter of preference?”

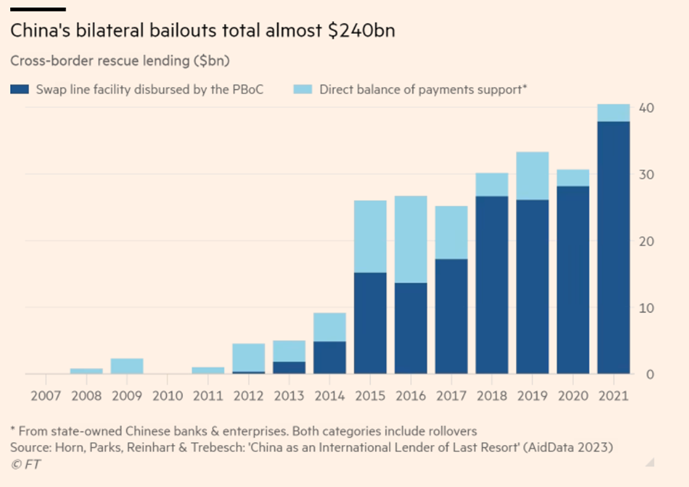

China is also fighting a slew of issues when we look at Belt and Road Investments that have continued to be a drain on Chinese resources. We have said that the BRI opened up China to a large amount of international exposure- especially at the Emerging Market level. China has take possession of several projects over the last several years, and none have them have even remotely come close to their revenue generating estimates. This resulted in broad shortfalls and write-downs at the bank level, because even though the foreign nation is on the hook for payment- it’s a Chinese bank that underwrote the bond/loan that now has to be written down.

China is ramping up its bailout lending to poorer countries serve to highlight a potential debt crisis in the developing world. The stress in Emerging Markets is growing, and the above chart highlights how it began well before COVID. A new study shows China’s rescue lending surged to $104bn between 2019 and the end of 2021 to participants in its Belt and Road Initiative, the world’s largest-ever transnational infrastructure program. This figure, while striking, is minor compared to the overall debt levels in emerging markets. The Institute of International Finance, a financial industry association, estimates that total developing world debt rose to a record of $98tn at the end of 2022, after governments and corporations filled their boots in recent years. With so much debt weighing on the world’s weakest economies, it will not take much to push several into default. Pressures are building. A stronger US dollar is increasing the domestic currency valuation of external debts. Higher interest rates, required to fight inflation, are also raising debt service costs. All of the above points aren’t new to anyone that has been tracking our view of China’s exposure as well as the stress at the EM level. It’s also important to note that this Chinese debt and rescue funds aren’t cheap. So if a country is turning to China, they have exhausted many cheaper alternatives.

“Rising global interest rates and the strong appreciation of the dollar have raised concerns about the ability of developing countries to repay their creditors. Several sovereigns have run into distress, with a lack of co-ordination among creditors blamed for prolonging some crises. Sri Lanka’s President Ranil Wickremesinghe called on China and other creditors last week to quickly reach a compromise on debt restructuring after the IMF approved a $3bn four-year lending programme for his nation. China has declined to participate in multilateral debt resolution programmes even though it is a member of the IMF. Ghana, Pakistan and other troubled debtors that owe large amounts to China are closely watching Sri Lanka’s example. “[China’s] strictly bilateral approach has made it more difficult to co-ordinate the activities of all major emergency lenders,” said Parks. Several of the 22 countries to which China has made rescue loans — including Argentina, Belarus, Ecuador, Egypt, Laos, Mongolia, Pakistan, Suriname, Sri Lanka, Turkey, Ukraine and Venezuela — are also recipients of IMF support.”

The above quote from the Financial Times highlights exactly what we have been saying- rising rates is going to put renewed pressure on developing markets. Mixed with inflation and a slowing economy- they are facing a coming disaster that is ignored by the market (still).

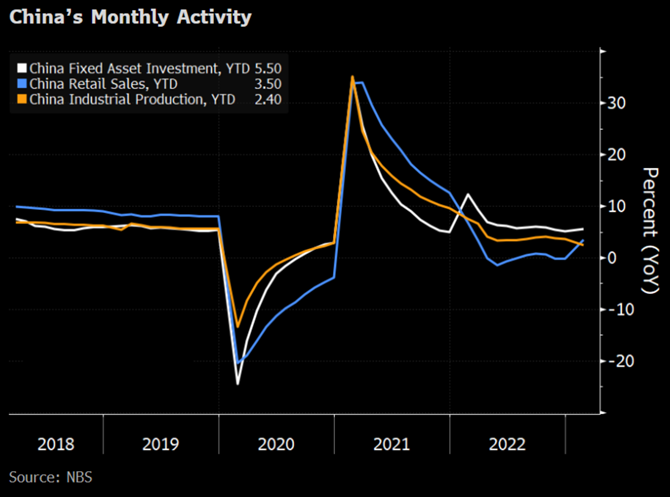

We also received some new economic data from China that shows things are moving along on the manufacturing as well as non-manufacturing front. But first, we have some updates on recent data released. A large part of the data was positive, but still missed many estimates. Our view has been that the Chinese data would be positive, but won’t live up to lofty expectations from the market.

- Industrial production growth picked up to 2.4% year on year in the January-February period from 1.3% in December. This was below the consensus forecast of 2.6%. We projected 4.5%.

- Retail sales strengthened significantly, rising 3.5% from a year earlier in the two-month period after a 1.8% decline in December. That was in line with consensus. We expected a 4.0% increase.

- Fixed asset investment rose 5.5% in the first two months of the year, picking up from a 5.1% expansion in 2022. This was higher than the 4.5% rise projected by the consensus and Bloomberg Economics.

- Service-sector output clocked a faster expansion than industrial output, expanding 5.5% year on year after a 0.8% drop in December 2022. But a lower base of comparison was a large factor so it’s not necessarily a convincing sign of private-sector strength.

- Based on the activity indicators, we estimate the economy tracked 4.1% growth in the first two months of the year — putting it on pace so far to undershoot our projection of 4.5% for the first quarter.

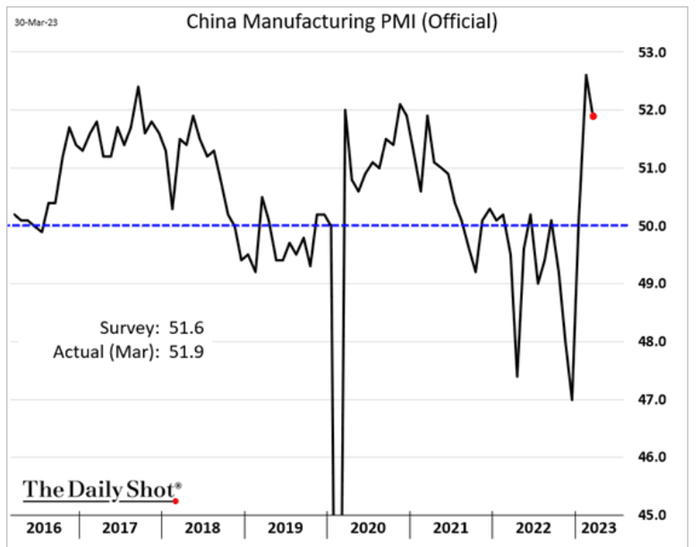

As we turn to the recent PMI data, manufacturing beat estimates by a small amount while also still running strong vs historics.

New export orders are showing declines, which is something that we expect to continue decelerating. Global demand is weakening further (especially from the US), and this will press new export orders into contraction territory once again.

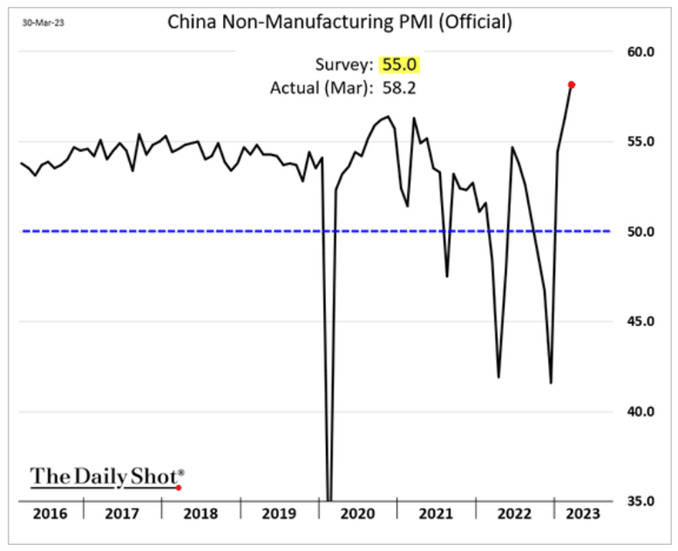

The non-manufacturing side still remains robust with another spike higher, but this level of activity is going to keep the PBoC firmly on the sidelines. The below level of activity should be driving some inflationary pressures, and the PBoC is currently trying to avoid adding too much liquidity in light of these positive pushes.

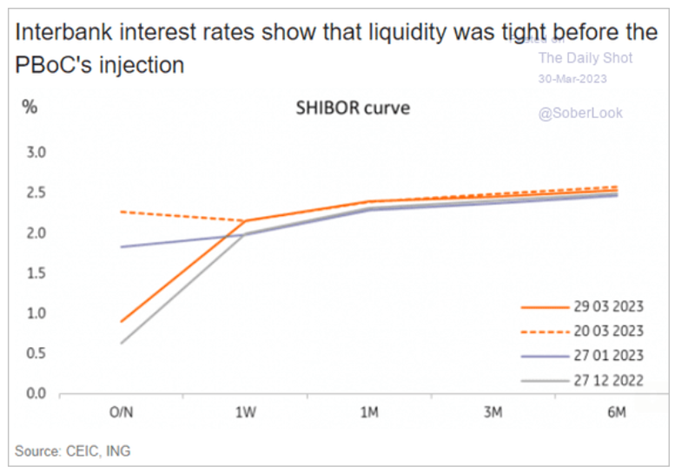

They had to add some liquidity recently given the SHIBOR curve, but they will wait to see how the domestic activity progresses over the next few weeks.

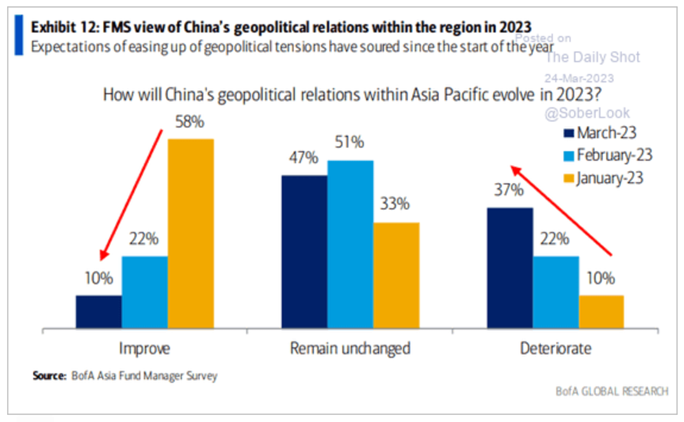

A big overarching theme that is important to watch will be the perception of China abroad. Every year there is a view that China will “play nice” with those in the Asia Pacific and other regions of interest. As the year progresses, people realize very little has changed and sentiment shifts… and it shifts quickly.

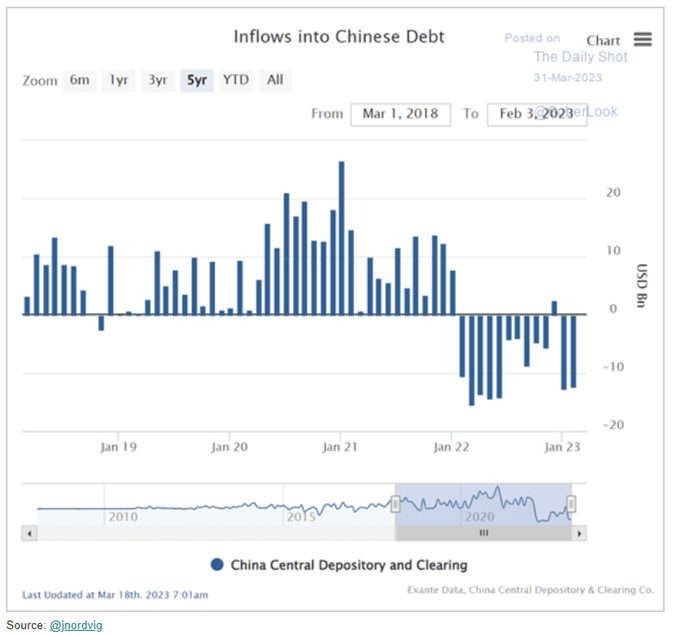

This type of movement was something that could be tolerated when the market believed the Chinese market was big and frothy with a ton of opportunity. Reality and time have proven something vastly different, and we are now watching a broader slowdown on investing in the country.

We don’t see flows increasing into China any time soon.

Quick Index

KRG (Kurdistan Regional Government)- Runs the Kurdistan government and carried out the referendum

• KDP (Kurdistan Democratic Party)- majority and current leader of the KRG

• PUK (Patriotic Union of kurdistan)- a competing political faction that retreated after making an assumed deal with Baghdad

• Peshmerga- armed forces of the KRG

PYD (Democratic Union Party)- Kurds in Northern Syria

• YPG (People’s Protection Unit)- the armed faction fighting ISIS in Syria

PKK (Kurdistan Workers” Party)- labeled terrorist faction of Kurds within Turkey (loosely affiliated with the PYD)

Iran Kurds- have not made much noise thus far

The Kurdistan situation has moved into the next gear as Iraq moved assets into position outside Kirkuk throughout last week and began the attack over the weekend for the strategic assets. The PUK were in charge of defending some strategic points in Kirkuk including a refiner, airport, and essentially the North Oil Co. Instead, the PUK made some sort of deal with Iraq and retreated leaving behind equipment handing control over to the Iraqi military. The move from Baghdad was swift as they moved military assets into place and ran some military drills prior to initiating the strikes on the strategic town of Kirkuk. The city is very important as a gateway into Kurdistan, a point with massive oil riches, and a very diverse local population. The local Turkmen in the city started to ban together and speaking out against KRG control (which drove some Turkish interest but more on that later).

Prior to this weekend, I assumed that a large part of Baghdad’s moves were an attempt to create a strong negotiating base against the KRG following the successful referendum vote, and that Iraq wouldn’t make a move without backing from a foreign entity. I underestimated the motivation Iran would have to support such a campaign, but it seems that Iran has been providing some incentivizes to move the Shia agenda forward. Turkey has had a good working relationship with the KRG over the years as they have been the only efficiency way to get crude to market. The growing commentary from Kirkuk’s Turkmen helped to embolden Erdogan to give the silent go ahead for Baghdad to move against the KRG. Turkey just needs the oil to keep flowing through the Ceyhan pipeline, so whoever owns that crude is utterly meaningless to them as long as they get paid. I have been saying for over 2 years that once ISIS fell the loose alliances would fall apart and infighting would began. I assumed the collapse in agreements would take longer, but given the escalating agendas in the region the situation remains fluid and has deteriorated quicker than expected. In the near term, there haven’t been any disruptions to the flow of oil out of Kurdistan. We will need to see if Iraq continues to advance north of Kirkuk, or if they just look to secure the “super field” that is estimated to hold over 5 billion barrels of oil. The field walks the border between Iraq and Kurdistan with a portion in a hotly disputed region. The oil field relies on the Ceyhan pipeline at an increasing clip in order to get crude to market as the portion to the west is not operational.

The current setup is interesting as both the Kurds and Iraqis are fighting each other with US equipment and training. Iran may have taken the opportunity to utilize US assets against them as the relationship deteriorates in the region. Iran has increased its influence within Iraq as the US has looked to remove itself from the quagmire over the last few years. This created a clear power vacuum that Iran was quick to jump upon. Turkey closed the border with Kurdistan while they began part one of their roll out plans into Syria. Turkey has been supportive of the moves that Iraq has taken to secure the region, but if they start to cut flows north it would begin to hit the Turkish bottom line. Turkey’s focus is on the roll out into Idlib with a surprising turn as the HTS actually escorted them into the region. So it appears there is a loose agreement between Turkey and the HTS, but it is unlikely that last long as the SDF becomes a bigger component of the fighting force in the region. While Turkey has a vested interested in limiting the advances of the YPG, they also need secured flows from Iraq to keep oil traversing to their ports. The map below gives a good breakdown of how the interests converge given the overlap of the major oil field. Iran is the one pulling the strings in the background, and the ability to use US equipped and trained assets against each other are a great slap in the face to US foreign policy.

Baghdad/Iraq

The now Shia dominated government has been working closely with Iran with some high level positions/advisors within the Iraqi government being held by Iranian individuals. This has helped the cooperation ranging from military cooperation all the way to jointly developing oil fields. As ISIS continues to fall in core Iraq/Syria strongholds, the Shia militants are focusing on protecting their assets that they fought to take back- including Mosul south. Kirkuk was defended by the Peshmerga successfully against ISIS, and in the referendum the city was to be included in their independence movement. The large oil reserve, strategic position, and flowing barrels (while limited at the moment) present an opportunity for Baghdad while taking advantage of the disagreements between the PUK and KDP with the added bonus of Turkmen not wanting to be part of Kurdistan. Rosneft has invested to take the Ceyhan pipeline to 1M barrels a day, so with the investment already made in the region- why not secure it on a go forward basis.

Turkey

The country has been in a battle against the PKK for years as they carry out terrorist attacks within Turkey. Erodgan believed that a free Kurdistan would embolden the PKK to claim Turkish land as their land and looking to secede. Turkey has typically had a very good working relationship with the KRG given the flow of oil and how the KRG would condemn the PKK actions. As the referendum came closer, the PKK fear reached a fever pitch driving Erodgan to side with Baghdad on many cases including- closing airspace/ borders/ allowing Iraqi troops access to specific choke points. This is unique as Iraq/Iran always feared Turkish motives in the fight against ISIS with the idea that once Turkey sent military assets and proxies into the region they would look to claim it for the Turks. Instead, we have seen increasing cooperation with the Shias in Syria and Iraq. The growing cooperation is multi-dimensional but is driven by a growing cooperation amongst Iran, Russia, and Turkey with the resulting goal of removing US/ and by extension NATO influence in some of these core regions. Turkey has started moving assets into Idlib essentially keeping the YPG from moving any further towards the Turkey/Syria border and from moving further West to the Mediterranean. There was a belief that the growth of Kurdistan would drive the YPG in Northern Syria and Southern Turkey to band together and create a solidified group with new control to the Mediterranean. This would have been a long term strategy but a solidified country would have enabled the new Kurdistan to reach the Mediterranean and control much of the southern border with Turkey. Baghdad most likely gave some key assurances to Ankara that they would stand in the way of the referendum and force compliance with the Iraq constitution. Kirkuk was a perfect jumping off point to head west to the Mediterranean. Turkey moving south into Idlib allows them to create a “safety zone” to ebb the flow of migrants crushing their economy while blocking the YPG moving West and earning political points with Russia and Iran by not attacking al-Assad forces. US and Turkey relations hit a new low with more finger pointing and now a news story indication Turkey helped Iran skirt sanctions. Everyone knew that Iran was selling oil and acquiring equipment illegally and through false flags, but now that a NATO member breached the sanctions shows that the Turkey/Iran relationship runs deeper than many give it credit. As all geo-political relationships ebb and flow, Turkey and US relations will get worse before they get better just as there still remains overhang between Turkey and Russia following the military jet being shot down.

Iran

Iran has to protect al-Assad because if they were to abandon one of their proxies it would have negative ramifications across their whole system. Iran effectively supports varying factions with the idea an enemy of my enemy is my friend. This has driven a large part of their support system allowing them to show non-aggression while manipulating politics in the background. They have slowly worked their way into Iraq’s government while rolling out more control within Syria. The growing actions are enabling Iran to surround Saudi to the North (Iraq)/ South (Yemen)/ and with East (Qatar). Russia has been working closely with Turkmenistan and Armenia to have more joint military access. As Russia looks to increase its influence- Iran and Turkey become bigger components to that puzzle. Russia wants to control as much of Kurdistan oil flows as possible while limiting US influence in the region. Russia has been able to do this with their influence in Syria, cooperation with Iran, and now growing Iraqi influence. This leaves little wiggle room for the US to maneuver in the region. By Iran supporting the move into Kurdistan, it is another feather into their cap breaking apart US foreign policy and supporting their proxies. Iran was able to use US equipment (initially used to defeat ISIS) to turn on other groups supplied by the US- nothing like using someone else’s money, equipment and training. The US has muddled the lines with Iran and Saudi with more commentary surrounding the Iran nuclear deal. As US relations with Iran worsen, it will embolden Iran to take more actions to engrain their power and influence in the region to minimize the effect any new sanctions will have in the region. Iran also has its own Kurdish population to attend to, and historically they have had a very good working relationship- but as the economic advancements took place throughout Iran- they feel left behind. At the moment, Iran Kurds have been silent but there have been rumblings of growing support for the independence movement. This will also help Iran’s motives to squash the movement sooner rather than later.

Russia

The country continues to press forward on its directive to limit the expansion of NATO and US influence within the Middle East by working with Iran, Iraq, and Syria with a growing cooperation with Turkey. While Turkey is Sunni, Erdogan’s end goal is to recreate the Ottoman Empire while Russia wants to control the European/MENA component to the Silk Road. Russia’s economy has struggled and been on the decline for years- so in order to offset these shortcomings Russia has invested time and money in projecting power and influence in the region. The focus is to expand the Russian economy into bordering countries to increase their economic prowess while minimizing dollar denominated trading. China continues its push into the region through places such as Pakistan and Saudi while the US tries to remain relevant through Afghanistan and India. Russia has outmaneuvered large parts of US foreign policy, but their control is limited (specifically in Turkey) as long as they are useful. Iran/Iraq need their abilities to increase oil production, and their fight against Saudi (Sunni) influence. This puts their usefulness with an expiration date just as most international relationships- it just remains unclear how long.

Syria

The YPG remain effective fighters, but the lack of unity among the Kurds limit their effectiveness delivering a blow needed to create an independent Kurdistan. The wide distances between some of these factions with little infrastructure/communication them limits the overall effectiveness on the global stage. Varying powers use them as proxies for specific agendas, but remain without a clear “sponsor” when it comes to independence. It is only a matter of time before al-Assad becomes a liability for Russia and Turkey while Iran needs/wants him to stay in power. It will always be the elephant in the room as the fate of Assad and the Syrian people remain in flux as the competing agendas play out. The YPG ties to the PKK will always keep Turkey weary of their actual intentions while al-Assad indiscriminately killing Sunnis and the Turkish allies of SDF indiscriminately.

Kurdistan and Conclusion

A free Kurdistan is still very far away from occurring given the political instability and lack of unity within the Kurdish people. Kurdistan lacks any real international support and a sponsor to help drive independence. Russia/US/Turkey/Iran all have their reasons and agendas in the region with an independent Kurdistan not being one of them. While there is a resolve for independence, the KRG was looking for a growing negotiating chip to challenge the status quo within Baghdad. As competing factions fight for their specific agenda across the KDP/PUK/PKK/PYD it will be hard to create a unified rally cry. ISIS still presents a challenge with unknowns in parts of Syria and Iraq- while their strong holds continue to tumble. Crude continues to flow out of Kurdistan through Turkey, and the end result of any cooperation will be for an increase in production not a decrease. Northern Iraq presents countries/companies with low hanging fruit when it comes to production growth. Rosneft is already in the process of expanding the capabilities in the region, and the current players Iraq/Iran/Turkey are friends to Putin (at the moment)- which puts the Kurdistan movement in jeopardy. On the surface, this appears to be a negative for crude production and a positive for pricing- but the end result (whether or not there is a free Kurdistan) will be for more oil the flow from Northern Iraq. Russia will let their proxy friends figure this out while they stay silent regarding their stance on the KRG movement.