Last week there were some important reports. The most important one being the IMF world economic outlook. I will try to summarize some of the main points of it but before that it is important to mention the developments in the oil markets. OPEC+ and IEA both shared their views vis-a-viz the oil demand and supply scenario. I think that IEA’s bullish case is misplaced while OPEC+ has hinted towards the upcoming reduction in oil demand (albeit it can be worse than what has been predicted).

Here are some important points from the IMF Economic Outlook:

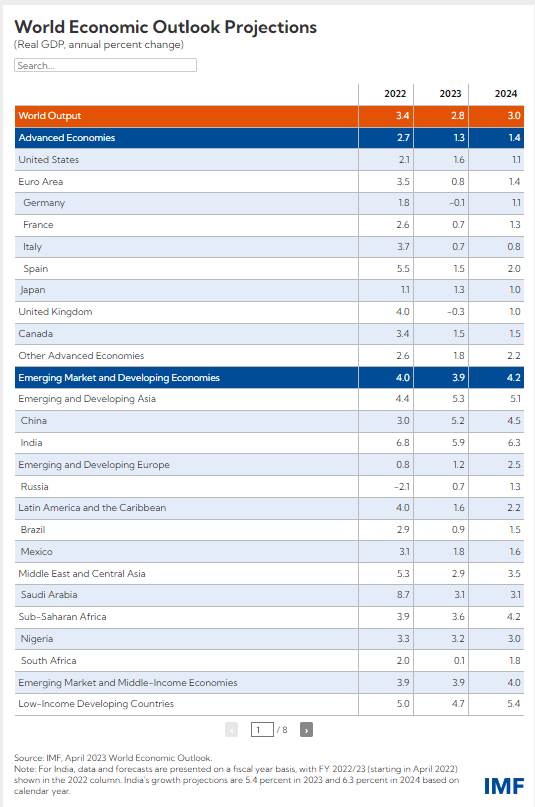

The global economy is expected to gradually recover from the impact of the pandemic and Russia’s war on Ukraine, with China rebounding strongly following the reopening of its economy. In the latest forecast, global growth is expected to bottom out at 2.8 percent in 2023 before rising to 3.0 percent in 2024. While global inflation has declined, core inflation, which excludes the volatile energy and food components, remains high in many countries. Tighter fiscal policy might play an active role in supporting monetary policy, while a sharp tightening of global financial conditions could have a dramatic impact on credit conditions and public finances – this is highly concerning given the precarious conditions in developing countries. The outlook also provided some guidelines for the policymakers:

Policymakers will need a steady hand and clear communication to navigate these challenges. In addition, medium-term growth forecasts are also expected to slow down due to the scarring impact of the pandemic, a slower pace of structural reforms, rising trade tensions, less direct investment, and a slower pace of innovation and technology adoption.

There is however some hope too. Despite some adverse developments jeopardizing the global economic growth and imperiling the recovery, activity in many economies has been better than expected, as per IMF, with strong labor markets in advanced economies such as the United States. However, with the recent increase in financial market volatility and multiple indicators pointing in different directions, the uncertainty around the world economic outlook has increased. Private and public debt in most economies has reached levels not seen in decades and remain high. Crude oil prices are projected to fall by about 24 percent in 2023, and a further 5.8 percent in 2024, while nonfuel commodity prices are expected to remain broadly unchanged. The baseline forecast for global output growth in 2023 is estimated to be 2.8 percent, 0.1 percentage point lower than predicted in the January 2023 WEO Update.

The International Monetary Fund (IMF) prediction about global growth of around 3% in five years is the lowest medium-term forecast since 1990. The IMF sees the United States economy expanding by 1.6% this year and the eurozone growing by 0.8%, but expects the United Kingdom to contract by 0.3%. China’s GDP is expected to increase by 5.2% in 2023 and India’s by 5.9%, while the Russian economy is expected to grow by 0.7% this year (despite the sanctions).

Now moving on to the oil markets: OPEC+ recently announced new voluntary production cuts that will take effect in May, causing a rise in oil prices. OPEC has now acknowledged downside risks to summer oil demand, suggesting this was a factor behind the output cuts. To remind, this was exactly what I noted in my recent article for Oilprice.com.

The Organization of the Petroleum Exporting Countries (OPEC) has cited factors such as building oil inventories, less tight product balances than the previous year, challenges to global economic development, and a decline in global refining intake of crude. Despite these challenges, OPEC maintained its forecast that oil demand will rise by 2.3% in 2023. OPEC+ agreed to voluntary production cuts of 3.66 million bpd, equal to 3.7% of global demand. The report showed that OPEC’s March output fell by 86,000 bpd to 28.80 million bpd, with declines in Iraq and Angola. The report kept its estimate of the amount of crude OPEC needs to pump in 2023 to balance the market steady at 29.3 million bpd. However, the report’s release led to a weakening of oil prices, with Brent crude falling below $87 a barrel.

The International Energy Agency (IEA), on the other hand, predicts that global oil demand will reach a record high of 101.9 million barrels per day (bpd) in 2023, representing an increase of 2 million bpd. This is largely due to a surge in Chinese consumption following the lifting of COVID restrictions, with jet fuel demand accounting for 57% of the growth. Analysts suggest that rising Chinese demand is helping to offset these warnings from OPEC. The IEA has warned that the OPEC+ decision could harm consumers and the global economic recovery, as it is likely to lead to inflated prices for basic necessities. The agency also predicts that global oil supply will decrease by 400,000 bpd by the end of 2023, with a production increase of 1 million bpd expected outside of OPEC+. Meanwhile, the weakening of the US dollar is making dollar-denominated oil cheaper for investors holding other currencies, which could boost demand.

So, The Fund is clear about the headwinds that the global economy will face in the comings weeks and months but there are some conflicting signals regarding the oil demand. However, if we are to go with the assessment forwarded by IMF, there is reason to believe that OPEC+ was right and acted proactively.

We will talk about it further in our Monday Macro View tomorrow.

Happy Reading and Happy Sunday!