The crude markets remain very volatile but provide us with a ton of opportunities to play energy from the long and short perspective. We believe the correction to the downside is a bit overstated, but the general trend will be to the downside. In the very near term, we should see brent bounce from $77 back to $80 before we see the move back to $75 and likely stopping at around $73. This provides a great opportunity to position for the next downswing as pressure mounts on demand.

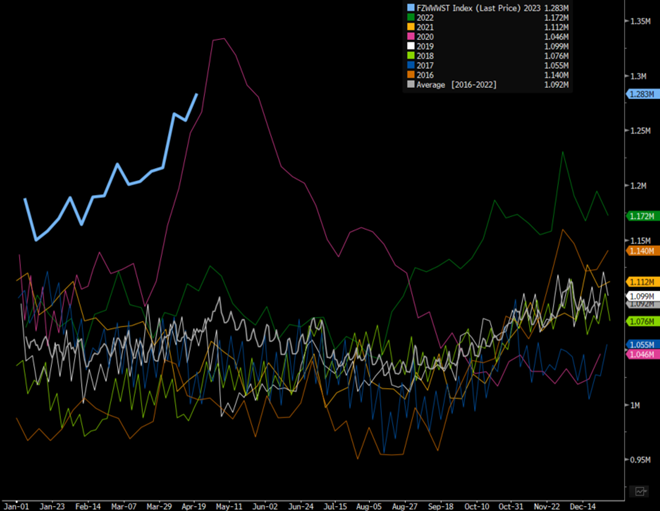

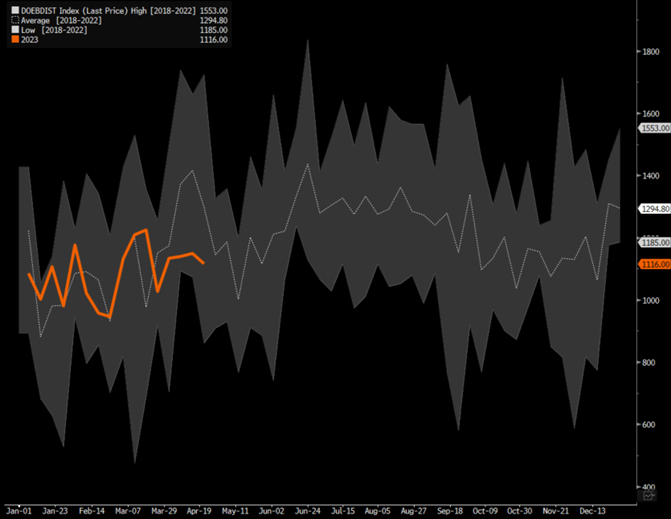

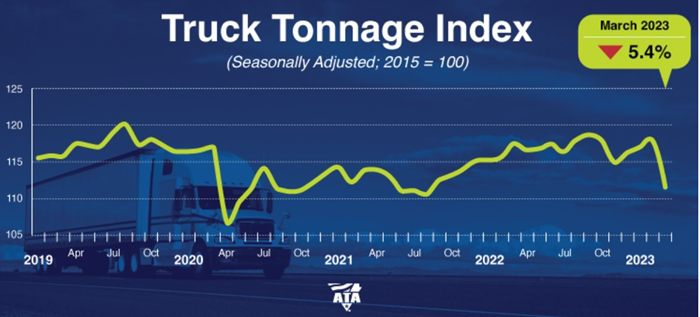

We have highlighted in the past how difficult it is to truly nail down demand levels, but we are clearly seeing problems emerge when we look at some core leading indicators. Crack spreads (how refiners make money) have been in a downward spiral as crude and products on the water surge. An interesting fact here- we have a RECORD amount of crude oil in transit (above 2020 levels) while still having a very elevated amount of crude in floating storage.

Crude Oil in Transit

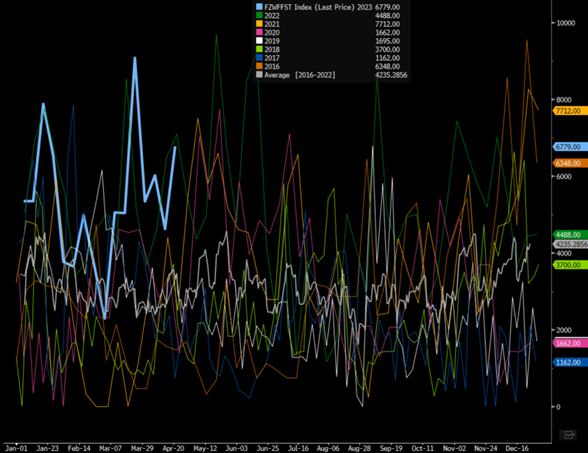

Crude Oil in Floating Storage

This is significant for several reasons:

- Crude in transit can originate from floating storage- so when something in floating storage is sold it starts sailing towards its final destination changing how we categorize it.

- If there is so much crude in transit, there is no need to purchase additional cargoes in storage.

- As shipments in transit get to its location, it will transition to floating storage

Each of these points to a breakdown in demand, which is supported by softness in physical spreads. When we put all of these facts together, there is no shortage of crude available for the global market. There is a significant amount sloshing around but not all crude is created equal. Even with these levels available, we are seeing premiums for heavier grades- especially ones that have an elevated distillate cut. This is only leading to further degradation of crack spreads for refiners around the world- especially the U.S. Gulf Coast and Southeast Asia.

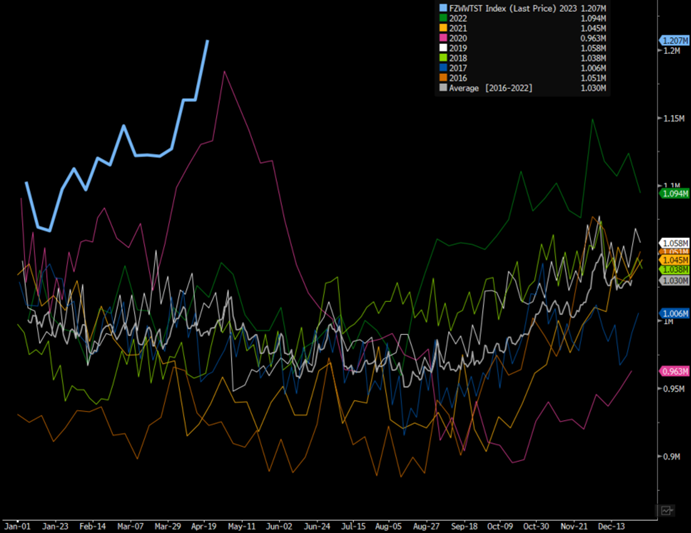

Crude Oil on the Water

Russian crude that can no longer flow by pipeline has to find a home on the water. So you can think- well Russian crude is flowing to Asia and not Europe therefore Europe should be buying more. BUT- when we look at European purchases, they are very lackluster given the economic pressure within the region. This means that U.S., CPC, and Libyan volumes are sufficient to meet their reduced demands. Between China and Europe (main buyers of West Africa), there is no real buyer for Angola and Nigeria cargoes, which has caused floating storage to remain elevated. The lack of sales is also happening with broad price cuts and VERY reduced production levels. We (finally) saw some purchases of Angola cargoes pick-up slightly when distillate heavy crude demand picked back up and buyers refused to pay Saudi prices. The next closest crude quality is Angola, and even with that need- Angola cargoes weren’t able to get any type of premium.

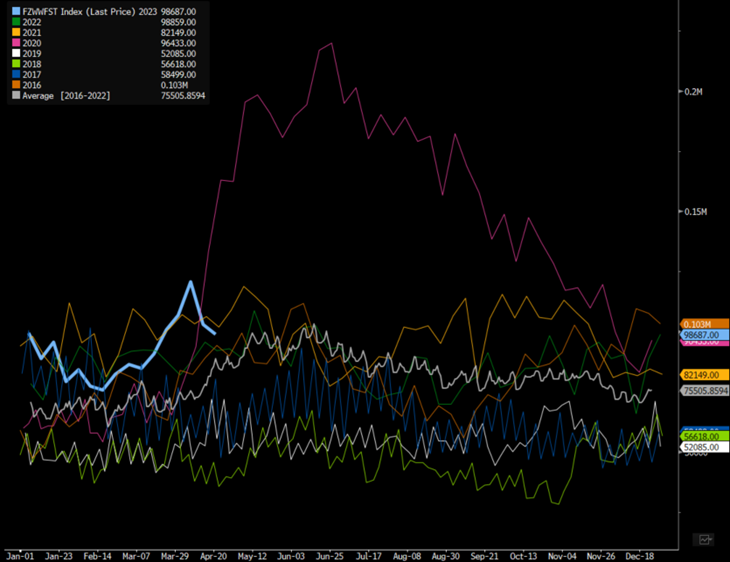

West Africa Crude Oil in Floating Storage

It’s interesting that China is importing crude at record levels, yet we are seeing West African and Middle East flows languish with more crude sitting in storage. It means that Russia is filling Asian needs and other buyers are facing a slowdown that more than offset the production cuts in these regions.

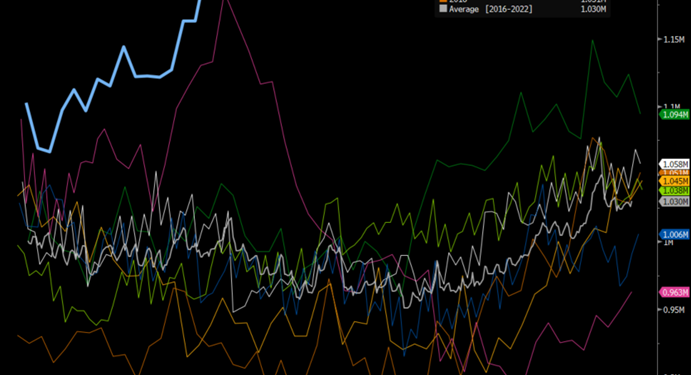

China Supertanker Crude Imports

Builds are hitting every aspect of the crude supply chain- especially in the refined product side. The biggest tell is gasoil/distillate stockpiles, and how that is impacting crack spreads in these key locations. The confidence in that view stems from flows originating from Russia, China, and builds/spreads in Fujairah. Here is a good quote summarizing the builds in Fujairah and the driver behind deteriorating spreads: “Stocks of middle distillates, including diesel and jet fuel, increased by 945,000 barrels or 37.9% on the week to 3.439 million barrels. The East of Suez gasoil complex remained under pressure April 18, weighed by supply-side fundamentals. Brokers pegged the front-month Singapore gasoil time spread at plus 20 cents/b during intraday trading April 18, narrowing slightly from a more than 19-month low of plus 21 cents/b at the Asian close April 17. The spread was last narrower at 20 cents/b on Aug. 31, 2021, S&P Global Commodity Insights data showed. “Asian demand is stable but the market is not good with more gasoil in the region,” said an Asian refinery source. Asian gasoil traders said Persian Gulf- and Indian-origin gasoil cargoes were being directed to the region, driven by poor East-West arbitrage economics. The possibility of incremental volumes adding to Asia’s supply weighed on the market.”

We are already seeing this product show up in Southeast Asia, which is putting pressure on the crack spreads and displacing more diesel and gasoline flows. It’s keeping product stuck in the Middle East and the Atlantic Basin, which is killing the arbitrage coming from West-East Suez and vice versa. This is only made worse by Russian product dumping into the market at pennies on the dollar. Russia has about 5M barrels of diesel sitting in floating storage that is waiting to find a home, which is going to hurt U.S. exports out of the Gulf of Mexico.

Crack spreads in two key hubs are getting hit hard- Asian gasoil being the most important and secondary the Gulf of Mexico. The below chart looks at Asian gasoil, where you can see crack spreads have gotten hit hard. For example, Singapore all in margins have gone from $8 to $2, and we see another leg down in the gasoil crack spread from $14 to $10. This additional drop will move Singapore- and realistically the rest of Asia- negative forcing economic run cuts. The added volumes from China and Russia make it much worse and will exacerbate the problem.

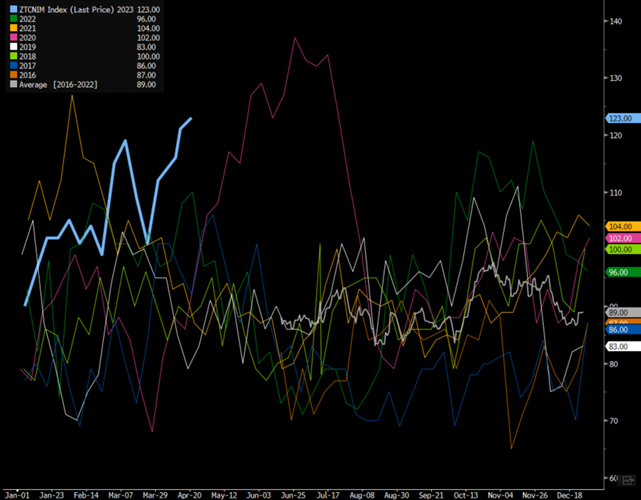

The U.S. is no different as we expect exports from the Gulf of Mexico for diesel and gasoline to come under pressure and fall well below the 5-year average.

Gasoline Exports from PADD 3 (Gulf of Mexico)

Distillate Exports from PADD 3 (Gulf of Mexico)

The slowdown in exports is going to push storage levels higher quickly and ahead of seasonal norms. Said another way- the rate of change is going to send things higher MUCH faster than what happens every spring season. This is sending crack spreads on the Gulf down to $24 with another leg down to $20 causing more problems for coastal margins.

The lack of exports and limited demand within the U.S. is going to push margins down for refiners- especially the coastal entities. We have also seen shipping rates soften for product tankers, which has unlocked an armada of gasoline from Europe into the U.S. This will further weaken coastal margins.

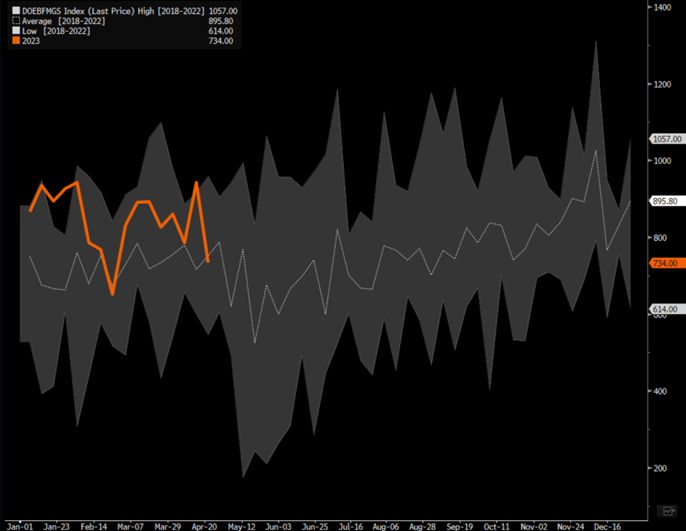

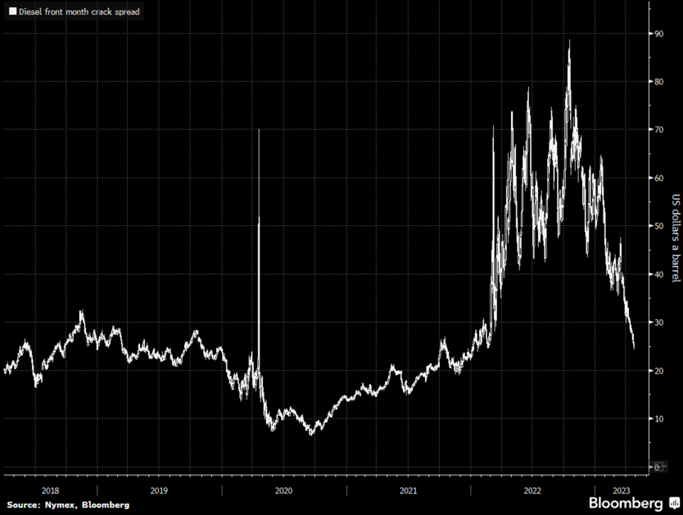

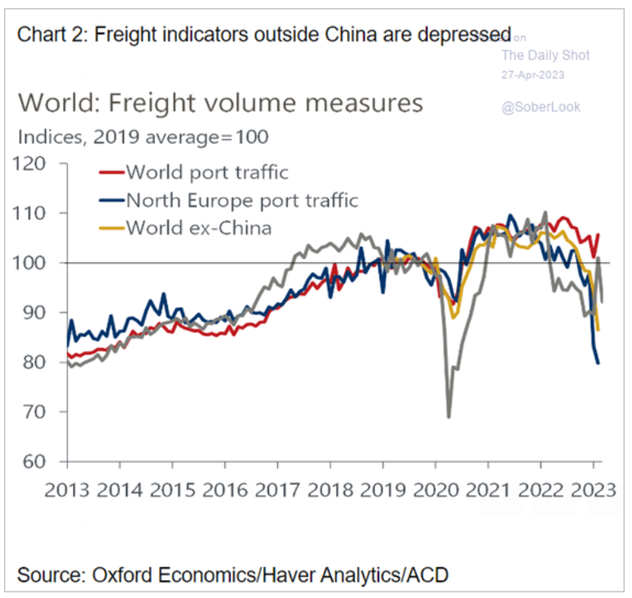

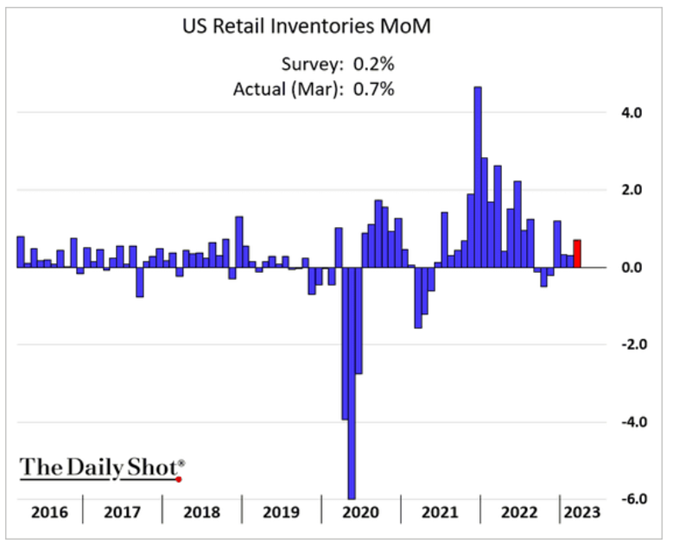

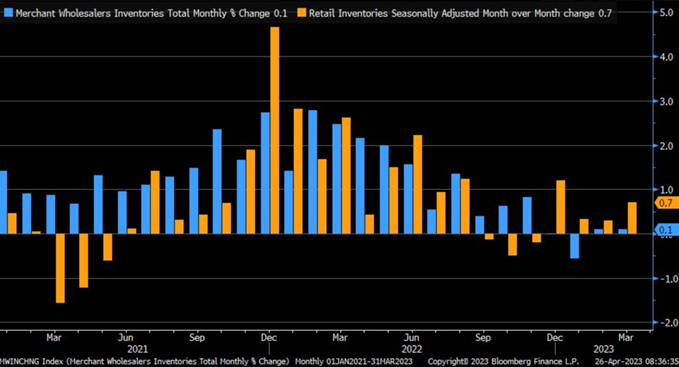

The demand data for the diesel markets continues to slow on a global basis, and the U.S. is not exempt from those issues. It speaks to the problems for the energy markets, but also supports a broad economic slowdown that is currently sweeping the market. The below chart looks at freight indicators around the world, which are registering some steep declines. We don’t see this pivoting in the near term, especially given the shipping movements we are following. There have also been some sizeable increases m/m of increases across U.S. inventories at the retail and wholesale level.

The U.S. is seeing a sizeable drop across the truck tonnage index, which supports all of the underlying data we have seen to date. This also points to renewed declines across the diesel demand levels heading into Summer, and between a drop in exports and slowing internal demand- we see more downside risk on distillate crack spreads and builds rising.

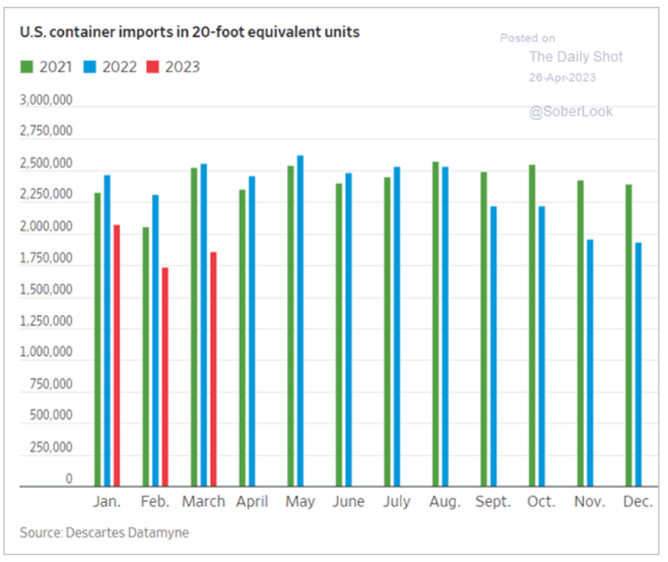

When we look further out in the shipping supply chain, we don’t see it getting any better. The imports into the country have fallen well below ’21 and ’22, and is actually below 2019 levels- one of the first places we got bearish prior to COVID.

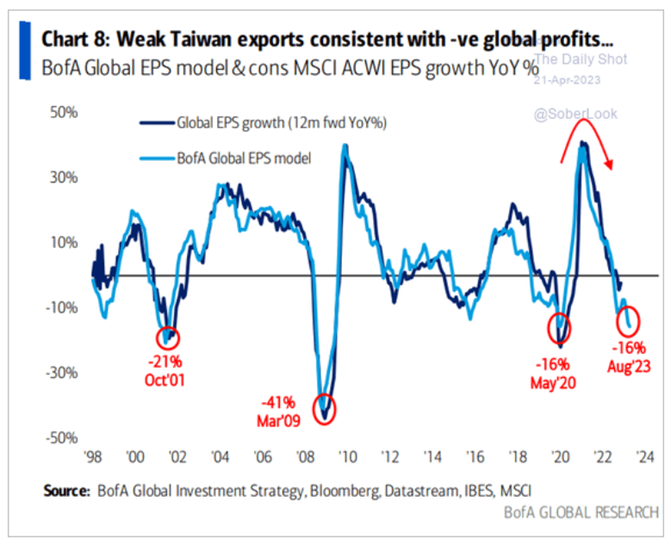

A lot of the key export/trading indicators are supporting this additional slowdown as well. Taiwan, South Korea, Japan, and China are great bellwethers for global trade, and all of them have shown a broad reduction in flows. Below is the most recent breakdown of Taiwan exports, and the board ranging slowdowns coming from the country.

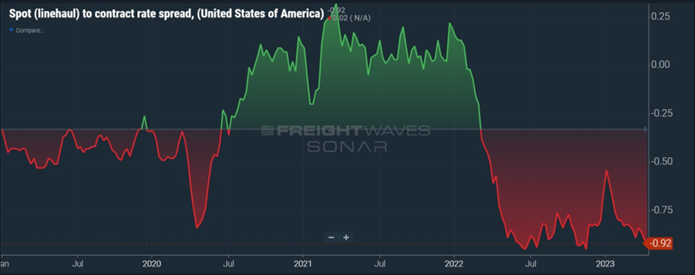

When we factor in the current pricing, you can see there is another rerating coming on the trucking front. “The spread between contract and spot rates is near all-time highs at -$.92/mile. It is almost a dollar cheaper to ship a truckload through the spot market than it is to ship it in the contract market. These two markets are fungible. Contract rates have a lot further to fall.”

When we look at current production levels of OPEC+, early indications is a small drop of 60k barrels a day for April.

Kpler: OPEC Output Falls 60k B/D This Month to 28.16m B/D

Nigeria and Iraq led the declines, offsetting a jump in Saudi Arabia, market intelligence firm Kpler said in a report.

- Nigeria declined by 240k b/d to 1.05m b/d

- Iraq dropped by 230k b/d to 4.2m b/d

- Saudi Arabia increased by 360k b/d to 10.6m b/d

As we have been highlighting, Nigeria is struggling to sell crude so it isn’t surprising to see a drop in production again. Iraq is still struggling because they can’t get crude through the Ceyhan pipeline, which is resulting in a drop in flow. Essentially, Iraq is already producing at what they agreed to May 1st while Saudi ramped it up ahead of next months cut.

This is why we don’t believe the “total cut” next month will be underwhelming given the current flows.

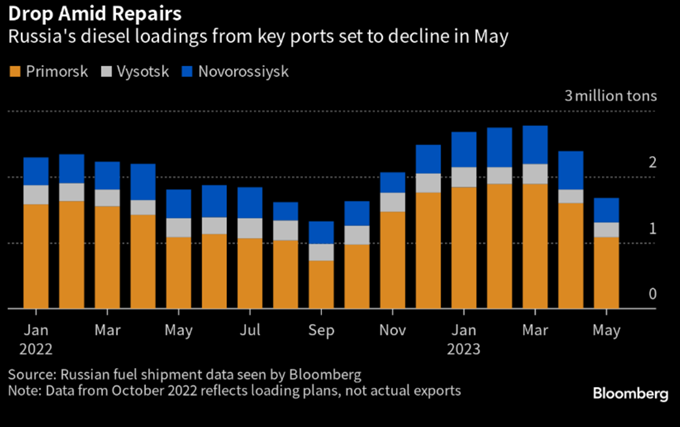

Russia has also announced a “pause” in the publishing of crude, refined product, and condensate data. Ahead of that stop, Russia published a sizeable drop expected in diesel exports in May.

“Sharp declines in the May flows happen every year, but the plans for the month are visibly below the seasonal norm. Russia pledged to cut its oil production by about 500,000 barrels a day from last month but the curbs have yet to materialize in most official data. A major decrease in diesel shipments would offer a hint that the output reductions are starting to be felt. Loadings of the fuel from Russian ports in the Black and Baltic seas, some of which originate in Belarus, are planned at 1.67 million tons next month, according to industry data seen by Bloomberg. That’s equivalent to more than 400,000 barrels a day, a 32% decline from the daily April loading plans and well below the same month last year, Bloomberg calculations show.”

This may seem like a problem, but there is about 5M barrels of Russian diesel floating in the market that is struggling to find a home. “The projected May volumes are below the seasonal norm of about 600,000-650,000 barrels for the ports in question. Diesel shipments from the three locations exceeded 790,000 barrels a day so far in April, staying roughly at the same level as at the start of the year, according to Kpler. Seaborne diesel flows have been robust in the past several months despite sanctions, which ban nearly all imports of its petroleum products by the European Union. Russian oil firms have been able to find new customers, with much of the diesel-type fuel now heading to Turkey, North Africa and Brazil.”

Even with these run cuts, we don’t see the market improving from a crack spread or storage perspective. It also puts into context why the cuts next month won’t be as severe as was initially expected, and more inline with our expectations.

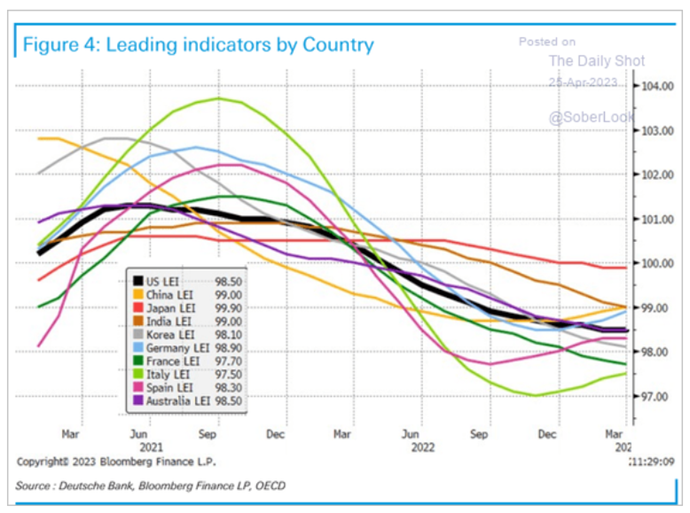

When we look at global leading indicators, things are starting to flatline a bit but still in a contracting perspective. We believe that things level off for a bit in this depressed level before falling further driven by timing and some restocking following weak orders around the globe. For example, some regional Fed data sets pointed to a small increase in new orders- BUT they still remain in net contraction. The next shoe likely drops in June when Summer spending and driving never really materializes.

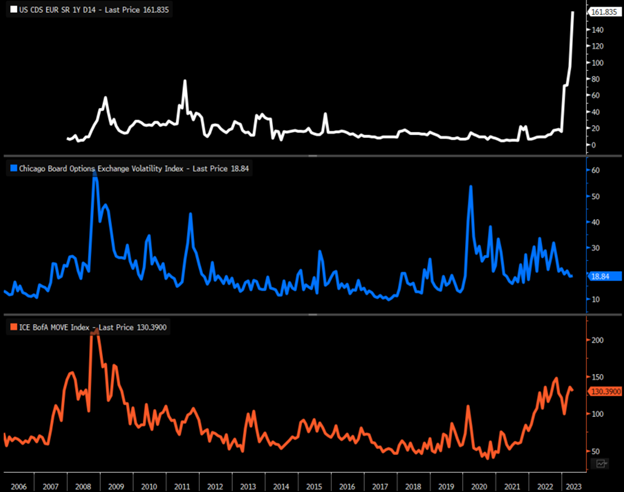

The below chart shows you how the bond and CDS (Credit Default Spread) on U.S. treasuries are pricing in a serious problem as the equity market is asleep at the wheel. The fixed income markets (globally for the most part) are signaling a huge problem that the equity market has been ignoring. The issues are not just relegated to the U.S. with more pain coming on multiple fronts.

China is trying hard to attract and retain foreign investment that has started to adjust supply chains at a much faster pace. They have gone back to promising IP protection, but the CCP so far has just rehashed some promises made previously. We have said for years that a lot of this protection would fall flat as local provinces look to shield local industry- even if the IP is stolen.

Beijing wants foreign businesses to feel safe about their intellectual property in China.

On Wednesday, Executive Vice Premier Ding Xuexiang delivered a speech about IP protection to a World Intellectual Property Organization (WIPO) event in Beijing.

Some context: Beijing aims to turn China into a global IP powerhouse, as part of its tech innovation drive.

- To get there, China must have a robust IP protection regime to attract foreign technology.

Ding said China would play by the rules (Gov.cn):

- “[We will] firmly uphold the multilateral IPR [intellectual property rights] system with the WIPO at its core and make the global IPR governance system fairer and more equitable.”

He also promised to continue improving IP protection in China by:

- “Strengthening the building of IPR institutions”

- “Improving [IPR] administrative and judicial protection systems”

- “Improving patent and trademark review policies”

Our take: The central government may be serious about IP protection, but local governments are to inclined to protect their local champions over foreign businesses.

- Beijing has battled local protectionism for many years, with little success.

- Without progress on this issue foreign businesses will remain skeptical about China’s IP protection regime.

China is trying to win friends in the local region as food becomes a bigger focal point. There have been broad shortfalls in the area, so China is looking to push a bit harder on providing some support to win hearts but also stomachs.

The fastest way to an ally’s heart is through their stomach.

That’s why Beijing is backing a year-long effort to boost cooperation on agriculture and food security with the Association of Southeast Asian Nations (ASEAN).

On Tuesday, Vice Premier Liu Guozhong, who oversees food security, kicked things off in Beijing, calling the new campaign (Gov.cn):

- “Conducive to…safeguarding global food security, coping with agricultural risks…and promoting high-quality agricultural development.”

Liu promised to work closely with ASEAN members over the next year, to boost regional food security through:

- Better coordination of agricultural policy

- Further opening up agricultural markets

- Expanding personnel exchanges

Premier Li Qiang also wrote in with recs, calling for cooperation on (Gov.cn 2):

- Green, smart, and digital agriculture

- Poverty alleviation and rural revitalization

That’s all pretty vague. But ag ministry reps from all 10 ASEAN member states flew in specially – suggesting more concrete deliverables, like expanded market access, will follow.

Get smart: China’s Southeast Asian neighbors have mixed feelings about Beijing’s rise – but China’s massive market and successful rural development approaches are both highly attractive.

Get smarter: It’s a tasty win-win if Beijing can firm up regional diplomatic relationships while boosting food security.

Another important fact… and likely one of the most important pieces when evaluating economic expansion- government spending. Local governments have accelerated their use of Special Purpose Bonds (SPBs), but even at the accelerated rate- it still is a bit weak vs last year. It gives you an idea on how the law of diminishing returns is catching up to growth.

The fastest way to an ally’s heart is through their stomach.

That’s why Beijing is backing a year-long effort to boost cooperation on agriculture and food security with the Association of Southeast Asian Nations (ASEAN).

On Tuesday, Vice Premier Liu Guozhong, who oversees food security, kicked things off in Beijing, calling the new campaign (Gov.cn):

- “Conducive to…safeguarding global food security, coping with agricultural risks…and promoting high-quality agricultural development.”

Liu promised to work closely with ASEAN members over the next year, to boost regional food security through:

- Better coordination of agricultural policy

- Further opening up agricultural markets

- Expanding personnel exchanges

Premier Li Qiang also wrote in with recs, calling for cooperation on (Gov.cn 2):

- Green, smart, and digital agriculture

- Poverty alleviation and rural revitalization

That’s all pretty vague. But ag ministry reps from all 10 ASEAN member states flew in specially – suggesting more concrete deliverables, like expanded market access, will follow.

Get smart: China’s Southeast Asian neighbors have mixed feelings about Beijing’s rise – but China’s massive market and successful rural development approaches are both highly attractive.

Get smarter: It’s a tasty win-win if Beijing can firm up regional diplomatic relationships while boosting food security.

We continue to see China underwhelming against estimates as the global market slows around them. They will see some growth as local spending and demand picks up, but it will be localized and still disappointing vs what the market expects.

I covered a lot in the FSC show with some recent data that came out today in the U.S. On the econ show, I go deeper into retail and wholesale inventories across segments 2/3, which I think covers things well. Let me know if you have any questions, and here are some charts for your records- especially ones I mentioned above.

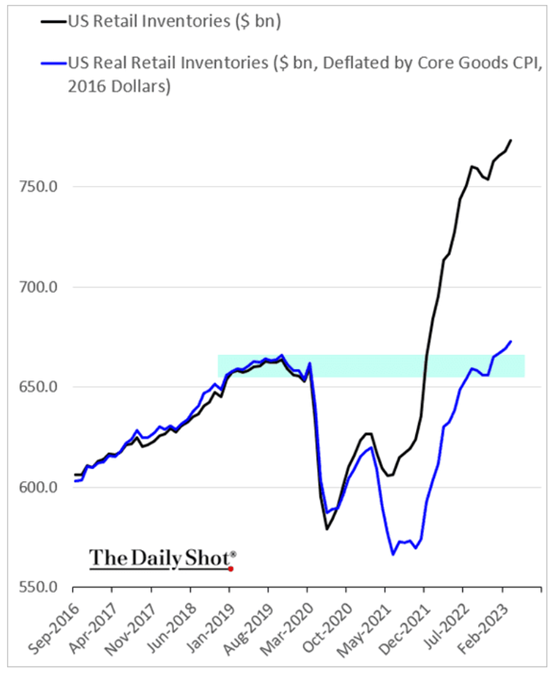

Another beautiful thing- if you look at it adjusted for inflation- it’s actually MUCH worse. This helps highlight more of the slowdown in the U.S. we have seen, which hits China as the U.S. is their largest trade partner.

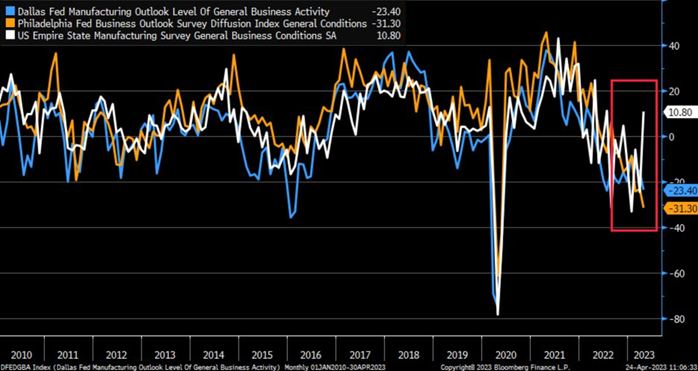

Here are some of the breakdowns of regional fed data:

Empire is the only real outlier, which we think will shift lower. The rest of the data sets have gotten worse.

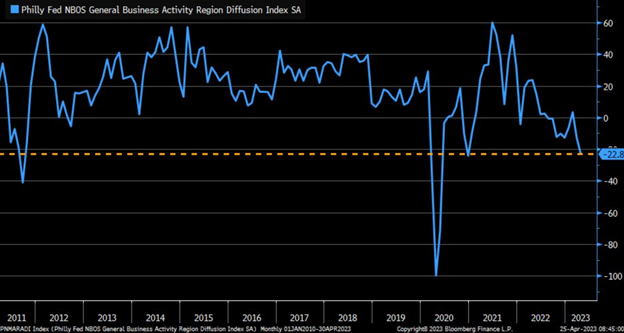

April Philadelphia fed Services Index down to -22.8 vs. -12.8 prior … new orders, sales, and workweek all deteriorated; prices paid fell but prices received moved slightly higher … full-time employment moved to highest since February.

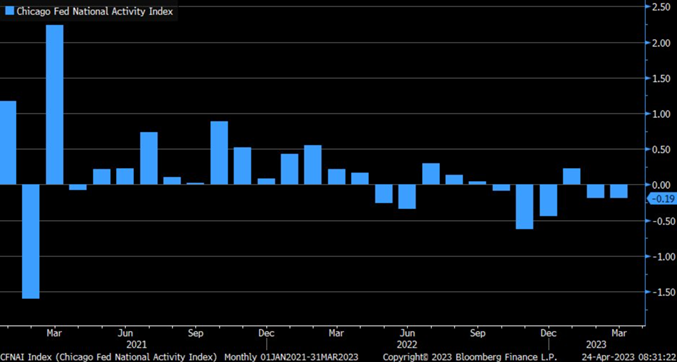

March Chicago Fed National Activity Index at -0.19 vs. -.20 est. & -0.19 prior … production-related indicators contributed -0.08 while employment-related indicators contributed +0.01 (notably, up from -0.09 in February).

Sales have slowed in some areas into contraction with some showing a small improvement but still shrinking.

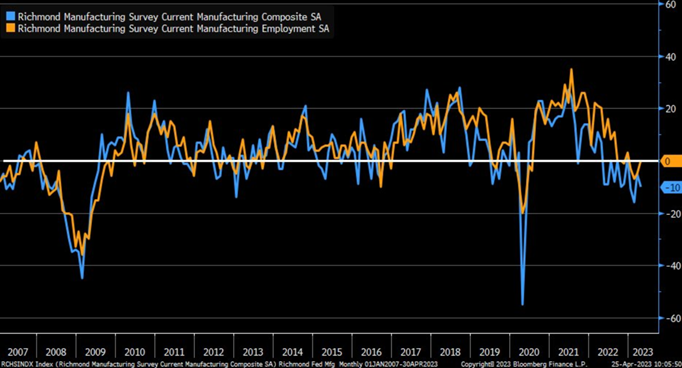

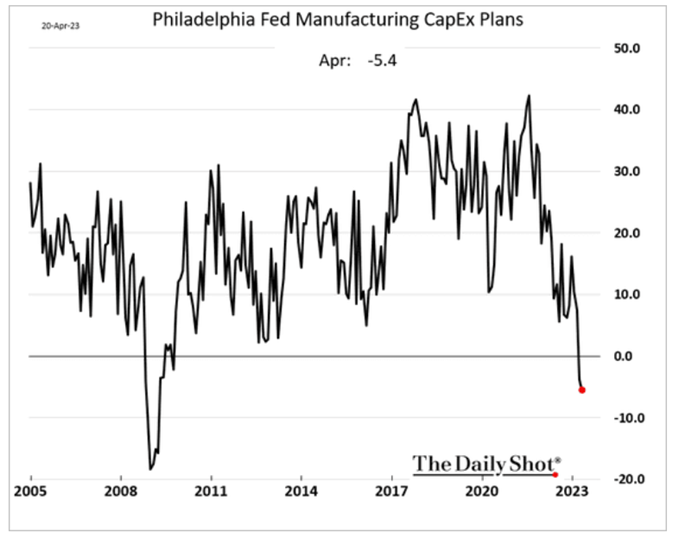

April Richmond Fed Manufacturing Index fell to -10 vs. -8 est. & -5 prior … new orders fell further into contraction, lead times moved up a bit (but still contracting), capex dipped into contraction, and wages still expanding … employment (orange) back to 0.

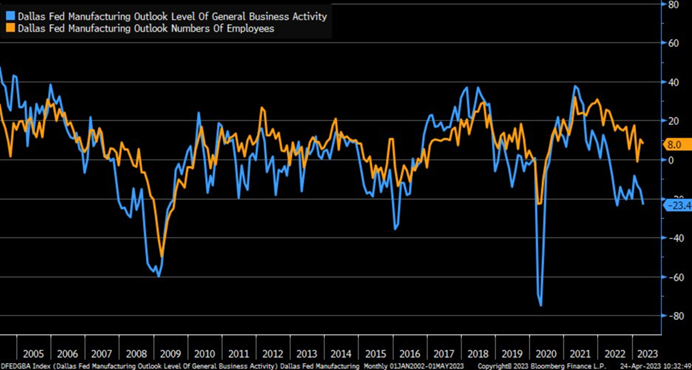

April Dallas Fed Mfg Index fell to -23.4 vs. -11 est. & -15.7 in March; new orders improved but still contracting, outlook worsened (contracting), hours worked dipped into contraction, shipments improved (still contracting), employment ticked slightly lower (expanding).

April Kansas City Fed Manufacturing Index down to -10 vs. -2 est. & 0 in prior month … new orders, production, exports, and shipments all sank into contraction; prices paid ticked slightly higher; employment dipped into contraction for first time since June 2020.

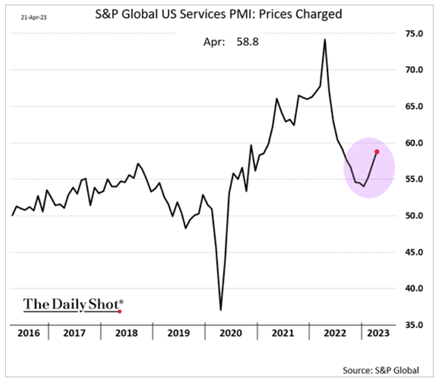

Any interesting point though- even as some things have slowed- leading inflation indicators actually INCRAESED.