Frac’ing Outlook

In our previous article, we discussed NexTier was planning to decommission ~150,000 horsepower from the start of 2023 through the middle of 2024. Owing to the natural gas price decline, it planned to release 14 frac fleets, resulting in a significant decrease in production. By the end of Q1, its management lined up another eight natural gas-oriented frac spreads for retirement in response to the price cut. Most of these frac spreads were working on the spot rate. As a result, it will have limited exposure to the spot market and be relatively insulated from lower near-term natural gas prices. However, the company could hold on to the dedicated customer longer. It devised a wellsite integration strategy.

The spread relocation from natural gas into oil basins will rebalance the demand-supply situation. It is also converting its frac spreads to natural gas-powered spreads such that the best unit-level economics are achieved, and returns on the available horsepower are maximized. Overall, the management considers the current outlook encouraging and expects the frac market to operate near capacity into 2024. Its NexHub Digital Center and Power Solutions business in the Permian Basin has enhanced compression capacity with a sold-out CNG fleet capacity.

NEX is not investing in low-return diesel fuel pumps. Out of the 150,000 HHP reduction target, its deployed capacity has fallen by 20,000 horsepower year-to-date. It plans to replace the retired capacity with a similar horsepower of electric pumps. The conversion will improve returns while transitioning to eFrac technology without increasing the overall frac capacity. It currently expects to have two customers utilizing eFrac technology by Q3.

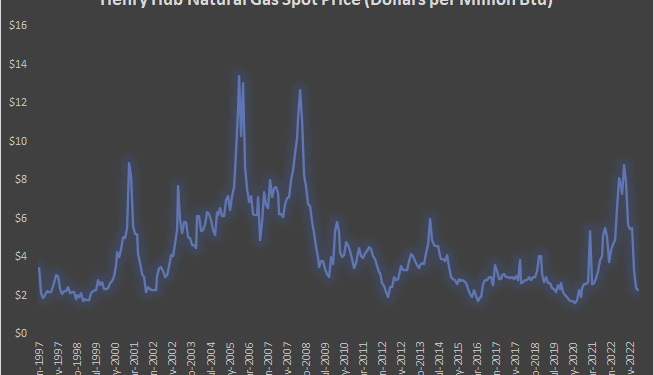

Natural Gas Price & Investment

Despite the recent volatility of natural gas, NEX’s management sees Industry utilization remains high or “sold out.” The crude oil price has remained range-bound within the $70-$80 mark, which, according to the management, should be sufficient for strong returns. So, the company’s long-term outlook has remained positive, encouraged by positive global oil supply and demand macro. The energy operators will remain disciplined regarding investment and capex, but the US onshore fracking activity will remain steady in 2023. Based on the positive outlook, NEX’s management believes its share price is undervalued. Investors may note that the stock price declined by 26% over the past year while the VanEck Oil Services ETF (OIH) remained unchanged.

Outlook Explained

NEX’s management was encouraged by the steady profitability in March, which paved the way for a solid opening for Q2. The weather disruption is expected to have a limited effect in Q2, resulting in moderate sequential revenue growth and a moderate rise in adjusted EBITDA.

The company’s management expects capex to remain within 8%-9% of revenue in FY2023. In comparison, capex was 6.7% of its FY2022 revenues. The capex would be weighted more in 1H 2023 because the company plan to invest more during this period.

Segment Drivers

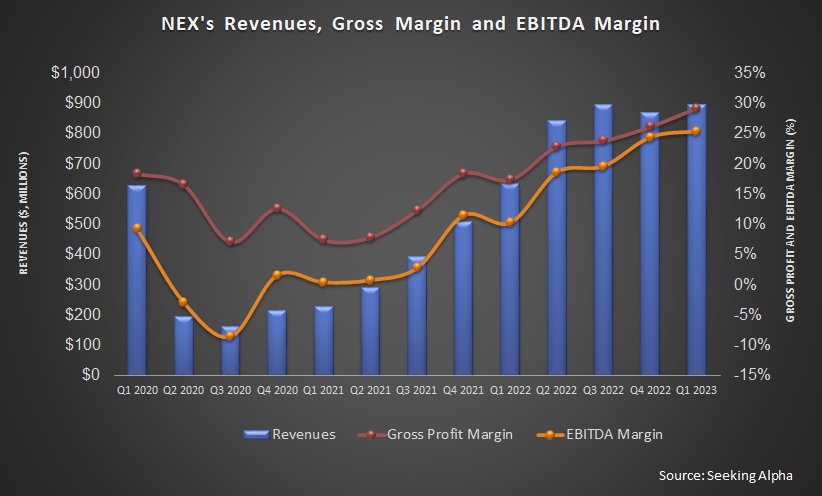

Quarter-over-quarter increased pumping hours and higher sequential pricing led to a 65 basis point increase in gross profit and a 100 basis point EBITDA margin expansion in Q1. Higher margin jobs and lower downtime prompted the increase in pumping hours. During Q1, the company implemented another round of price hikes resulting from strong macro and high-quality dedicated fleet operations.

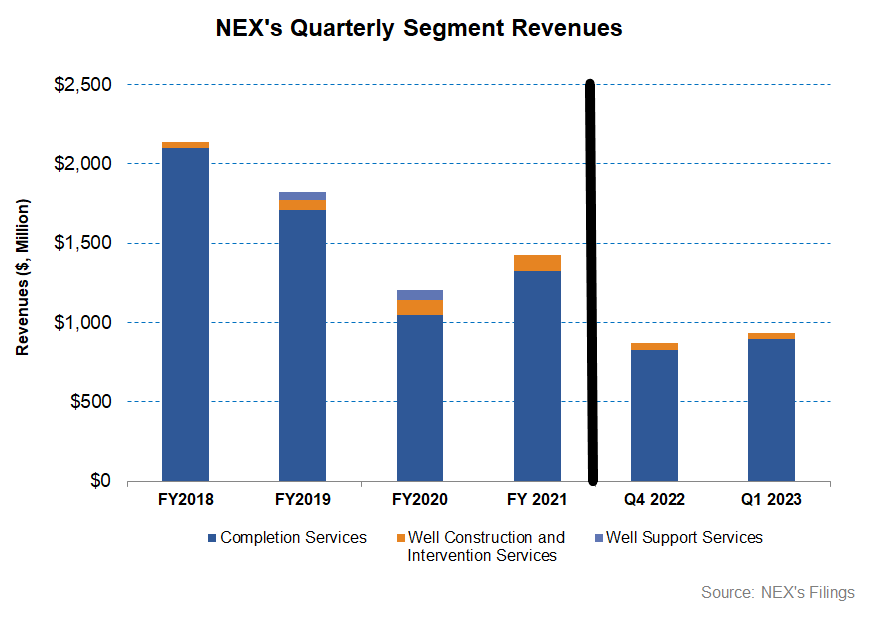

Operating segment-wise, the Completion Services segment revenues and gross profit improved in Q1 due to better pricing. The Well Construction & Intervention Services segment revenues remained nearly unchanged in Q1. You can read more about the company’s performance in our article here.

Cash Flow & Balance Sheet

NEX’s cash flows improved tremendously in Q1 2023 compared to a year ago. In FY2023, it expects to generate ~$500 million in FCF in 2023. However, as discussed above, its capex-to-revenue can increase in FY2023 because its electric fleet and natural gas transition strategy are capital-intensive.

In Q1, NEX repurchased $53 million under a $250 million shareholder return program. The program is funded by its FCF generation. As of March 31, 2023, its total liquidity was $631 million. It plans to achieve zero net debt in 2023.

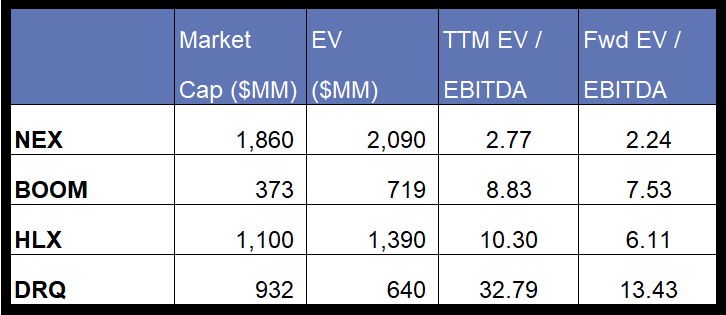

Relative Valuation

NEX is currently trading at an EV-to-adjusted EBITDA multiple of 2.77x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 2.2x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 22.4x.

NEX’s forward EV-to-EBITDA multiple contraction versus the adjusted current EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (BOOM, HLX, and DRQ) average. So, the stock is reasonably valued versus its peers.

Final Commentary

NEX has been relocating its frac fleets from natural gas basins to crude oil-heavy basins of the steep decline in the natural gas spot rate. It believes the supply and demand balance in the US will allow these relocated fleets to find new spot work with multiple partners. However, its outlook on natural gas over the long term remains encouraging. LNG capacity additions through 2025 can create significant demand for incremental frac fleets. Until then, the supply chain issue can hamper growth, at least till 2024. It focuses highly on converting and introducing e-frac spreads and expects two customers to utilize eFrac technology by Q3. So, integrating the dual fuel frac fleets, with natural gas fueling, wireline, and the last mile logistics business has created significant value for the company.

During Q1, the company implemented another round of price hikes, leading to an increase in gross profit and an EBITDA margin expansion. Higher margin translated into significant cash flow improvement in Q1 2023. In 1H 2023, it may face pressure on the capex due to the electric fleet and natural gas transition. But the pressure can ease by the end of the year as it expects to generate $500 million in free cash flow. The stock is reasonably valued versus its peers at this level.