Industry Outlook: US

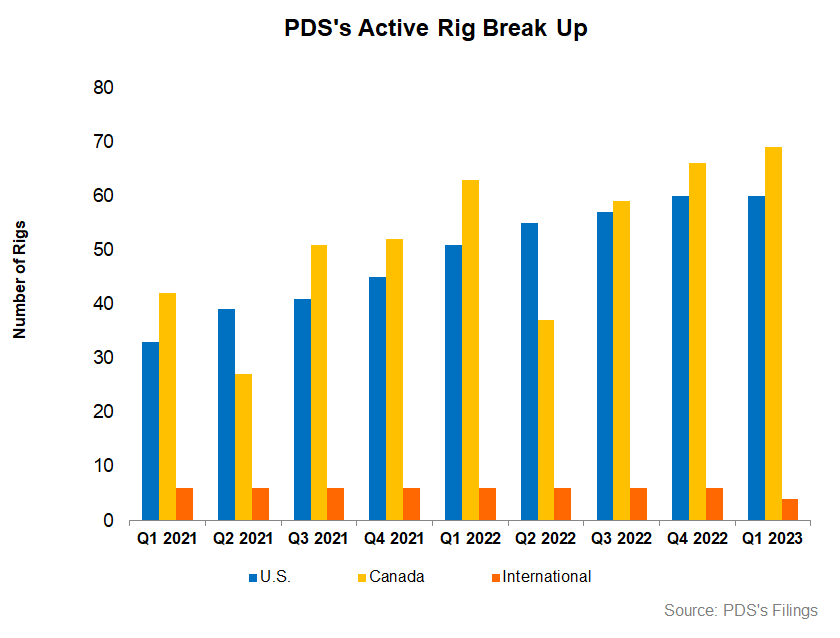

We discussed our initial thoughts about Precision Drilling’s (PDS) Q1 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. The company’s near-term views have diverged in the US between natural gas-heavy and crude oil-heavy basins. The crude oil price has remained relatively firm compared to the natural gas price. So, the management expects short-term activity shifts to oil-rich regions. From Q1 2022 to Q1 2023, Precision added nine rigs in the US onshore.

In the long term, however, the company expects LNG exports to ramp up and demand to improve in oil and gas-directed drilling. PDS has several contracted rigs for oil-based projects. It estimates 58 discreet rig bids in the past months and 109 outstanding bids for its Super Triple rigs from July through Q1 2024. In aggregate, the investment will remain disciplined, and the company will look to maximize cash flows in this region.

Outlook In Canada

PDS has strong expectations from the Coastal GasLink pipeline in Canada for LNG Canada and Trans Mountain oil pipeline expansion. These projects will drive demand for its Super Triple rigs, which already remain “sold out.” It has added six rigs in Canada over the past year. It expects demand for Super Triples to increase by five to seven rigs in Q2 following British Columbia’s settlement with the Blueberry First Nation.

As PDS’s demand for Super Triple rigs grows, it will look to strike multi-year take-or-pay contracts to lock in multi-year drilling programs by 2024. So, the company’s medium-term outlook in Canada appears robust.

Outlook: International Markets

In Saudi Arabia, PDS has recently re-contracted seven rigs on five-year contracts, including reactivating two previously idled rigs. One of the rigs started operating in April, while the reactivation of the rest three is expected to be spread over the next 12 to 15 weeks. So, in Q3, PDS will have eight rigs operating, up from five operating in Q1. It may activate one idle rig in Kuwait in late 2023 or early 2024. So, the company sees a sufficient opportunity to increase drilling activity in the Gulf region.

Automation And Clean Energy Strategy

In Q1, PDS invested in CleanDesign, its battery energy storage vendor partner. The company expects broader adoption of CleanDesign’s solutions inside and outside the oil and gas industry. In our previous article, we discussed how it promotes high-performance, high-value products like Alpha and EverGreen, driving field margins in North America and maximizing free cash flow. AlphaAutomation improves drilling efficiency, and EverGreen reduces rig emissions and fuel costs. These products form the company’s basis for a high-performance, high-value competitive strategy in an industry that strives to lower emissions.

US And Canada Market Guidance

In Q2, PDS expects normalized margins to be relatively flat, with Q1 in the US. In Canada, daily operating margins can reduce to $10,000 in Q2, down from $13,558 in Q1, due to the adverse effects of seasonality and lower fixed cost absorption.

Analyzing The Q1 Drivers

As we discussed in our short article, from Q1 2022 to Q1 2023, revenues from the company’s Contract Drilling Services increased by 55%, while revenues from the Completion and Production Services segment nearly doubled. An increase in well service hours, improved pricing led by enhanced industry activity, and higher demand resulted in the improvement. Adjusted EBITDA in both these segments increased by 166% each over the past year. In the US and Canada, revenue per utilization day exceeded the rise in operating cost per utilization day, resulting in higher operating margins in these regions.

Cash Flows, Capex, And Leverage

PDS’s cash flow from operations (or CFO) turned positive in Q1 2023 compared to a negative CFO year ago. But free cash flow remained negative. It recently revised its FY2023 capex to $195 million, which would still be 43% higher than FY2022. The majority of the capex would be spent on sustaining infrastructure and the rest on upgrades and expansion. The capex revision reflects fewer expected rig upgrades, maintenance deferrals, and lower input costs.

PDS’s liquidity was $540 million as of March 31, 2023. Its debt-to-equity (0.87x) is lower than the average of that of its competitors (HP, NBR, and PTEN). Given the high debt level, we think the company carries moderate financial risks.

Relative Valuation

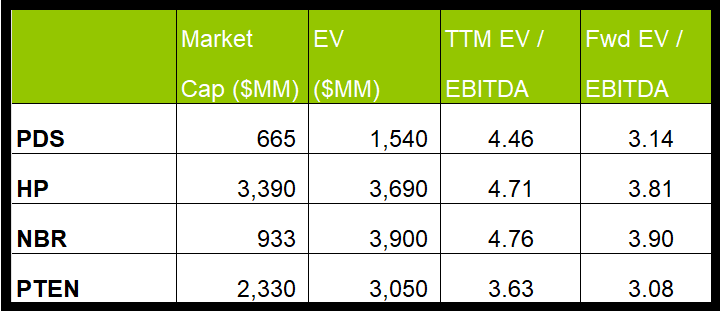

PDS is currently trading at an EV-to-adjusted EBITDA multiple of 4.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.1x. The current multiple is lower than its five-year average EV/EBITDA multiple of 8.5x.

PDS’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than peers because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple aligns with its peers’ (HP, PTEN, and NBR) averages. So, the stock is relatively undervalued versus its peers.

Final Commentary

Crude oil price’s relative stability and natural gas price’s fragility have created a rift in PDS’s outlook concerning resource basins. In the short term, the action can shift to oil-rich basins. Nonetheless, US’s LNG export potential has created a robust foundation for drilling activity improvement. The situation appears even more conducive in Canada, with various long-pending projects coming online. Similarly, the company may add more rigs in the Gulf region by early 2024.

Diversifying into clean energy, PDS invested in CleanDesign – its battery energy storage vendor partner, in Q1. It has also been investing in technology products like high-value products like AlphaAutomation and EverGreen, which will drive field margins in North America and maximize free cash flow. Free cash flow generation, however, remains a concern. So, it has reduced its FY2023 capex budget to address the issue. Its leverage is also fairly high. The stock is undervalued compared to its peers.