U.S. completions activity had a slight bounce as the smaller basins saw additional activity. The major basins still maintained their reduced activity following the 4th of July Holiday, but now face some SCORCHING heat that will keep activity limited. We expect to see some additional spreads entering the Permian, East Texas, and Bakken as the month progresses- especially with some of these bumps in the crude price. The shifts in flows will also be supportive as disruptions in the Med/Europe will be supportive of U.S. exports.

The crude markets have been hit by a slew of negative supply news over the last few days.

- Libya will be shutting down several fields driven by protests:

- Sharara- 250k barrels a day

- El Feel- 70k barrels a day

- Kazakhstan is carrying out planned maintenance on their facility reducing flows into the Mediterranean for several weeks.

- Loadings of CPC Blend crude oil for August are expected to drop to about 1.15m b/d, according to traders with knowledge of the schedule.

- Compares with estimated 1.35m b/d for July, they said

- NOTE: Chevron-led Tengiz oil field will carry out planned maintenance in August with a consequent drop in output, according to Kazakhstan’s energy ministry

- Turkey has said that the Ceyhan pipeline will remain shuttered until Kurdistan and Baghad come to a solution.

- Nigeria announced a halt at Forcados oil terminal due to a possible leak

- This accounts for about 225k barrels a day.

Iraq has been offline for several months now, but the others are new data point cutting near term supply from the market. CPC being reduced will be supportive of U.S. exports into the market given the crude quality is comparable. Forcados is medium sweet and will be more difficult to replace in the longer term. Currently, 80% of Nigeria’s August cargoes are available for sale- so the impact won’t be felt in July/Aug, but could be a bigger issue as we head into September. Our base case is KSA brings back their reduced production levels in Sept, which would help buffer some of the broader issues on the supply side. Libyan lost volumes also fall int the same range as WTI and LLS, which will keep our exports robust into Europe. As we said on the EIA show, we never believed there was going to be a reduction of flows into Europe, but we did expect to see some slowdown into the Asian markets.

Instead, there has been a sizeable purchase of about 36M barrels of U.S. crude into Asia. Refiners in South Korea, China, India, Southeast Asia and Japan have purchased ~36m barrels of US crude for mostly Oct. arrival, according to traders who asked not to be identified.

- Big portion of grades purchased was WTI Midland

- Large purchases of US oil such as WTI may put pressure on spot prices of grades including Abu Dhabi’s Murban in the physical market, traders said

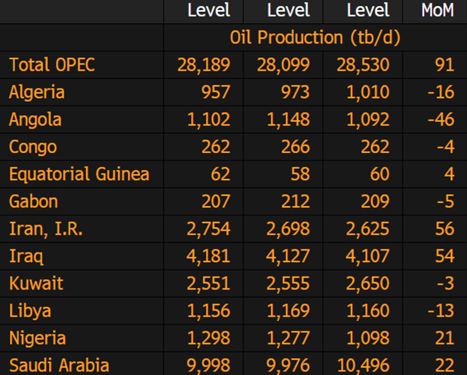

This will help support U.S. flows, but put some pressure on several lighter grades- including WAF and UAE. OPEC saw a small increase in production for June, but we should see about 1M to decline as KSA goes from about 10M barrels a day to 9M.

Even as the market is looking tighter- the WAF floating market still has a plethora of cargoes waiting to clear. WAF has taken their prices higher, but so far nothing has transacted at these levels. Typically, WAF will set their prices much higher and slowly take down the price to find the “best” clearing price. This usually starts slowly- $.05 to $.15 at a time but accelerates as the cargoes languish heading into the end of the month.

SPOT MARKET:

- Only 8-10 out of 35 Angolan cargoes for August are still available, including those being re-offered, according to traders involved

- Pace of sales is roughly the same as a month ago

- Sales of Nigerian cargoes remain slow, with more than 80% of August cargoes still available, but prices have shown sign of rising: traders

- Forcados and Escravos were discussed at premiums of about $4/bbl, up by nearly $1 from late June, traders said

- Forcados added 75c/bbl m/m against North Sea Dated to a $1.41/bbl premium

- Qua Iboe increased by 65c/bbl to +$1.08/bbl

- Brass River and Bonny Light had only marginal increases of around 26c/bbl m/m against North Sea Dated, reflecting their higher naphtha content

- Bonny Light reached a premium of $0.64/bbl, while Brass River narrowed its discount to -$0.33/bbl

- Angolan Girassol premiums increased by 24c/bbl to $1.57/bbl while Cabinda premiums softened by 72c/bbl to $1.22/bbl

- Forcados added 75c/bbl m/m against North Sea Dated to a $1.41/bbl premium

- Qua Iboe increased by 65c/bbl to +$1.08/bbl

- Brass River and Bonny Light had only marginal increases of around 26c/bbl m/m against North Sea Dated, reflecting their higher naphtha content

- Bonny Light reached a premium of $0.64/bbl, while Brass River narrowed its discount to -$0.33/bbl

- Angolan Girassol premiums increased by 24c/bbl to $1.57/bbl while Cabinda premiums softened by 72c/bbl to $1.22/bbl

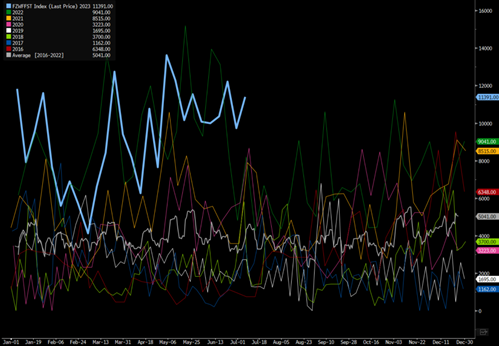

There is nothing stopping you from asking for the price, but it doesn’t mean that people will transact at these levels. The below chart looks at the amount of WAF cargoes sitting in the market right now, which is at a seasonally adjusted record. Most of these are Nigerian cargoes- so it will be interesting to see how the market treats some of these flows.

The shift higher in crude and KSA OSPs has put the Urals above the European/ G7 cap. The rise to over $60 isn’t going to deter the current buyers- mostly India and China given the cost savings. “Urals in the North and out of Novo are assessed at $60.32 FOB. When you compared to Arab Light, which is assessed at $82.00 FOB, and you can see why Chinese buyers are lowering demand for Saudi crude. $22 is a lot more than difference in freight which is about $8-9.” When you look at ESPO, pricing is over $70 and has been for some time.

Several cargoes of ESPO crude for Aug. arrival were purchased by Chinese teapots at a discount of $4-$4.50/bbl to the ICE Brent price on a delivered basis to Shandong, according to traders who asked not to be identified.

- China’s Unipec also bought some ESPO cargoes for Aug., although further details were unclear

- Discounts for Russia’s ESPO cargoes to China have shrunk m/m, with many shipments for July traded at $5-$6/bbl discount to ICE Brent on a delivered basis, the traders said

The buying spree from China is slowing as we see domestic economic problems and a broad glut of crude sitting onshore and offshore. Seasonally speaking, China typically slows their purchases throughout July, and we see it continuing well into August. The below chart shows the supertankers flagging China as the final destination. State owned refiners are only operating at about 77% utilization rate with teapots (Shandong) around 62%, which is all well below seasonal norms. All of the economic data (especially in the manufacturing sector) is well into contraction with more pain coming on the service/consumer front.

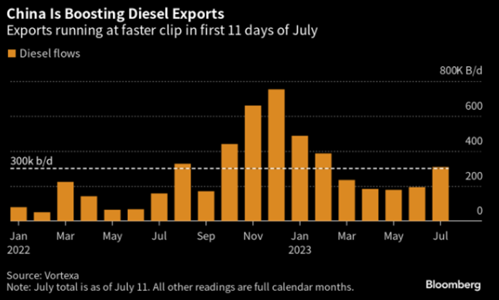

This is why we see a sizeable increase in exports coming from China as they look to capitalize on recovered margins and utilize the cheap crude they have been purchasing. They still have a significant amount of product sitting on the water that can be utilized to increase runs without denting current onshore storage.

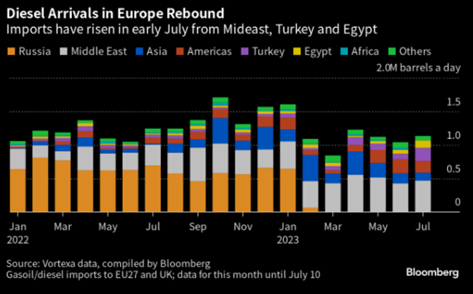

Europe has seen a sizeable increase of diesel arriving from the Middle East, which has replaced most of the Russian flow. You can also see the Americas also makes up a sizeable amount of the shifts, but the other flows will be impacted by the arb. The arb was wide open last month, and a lot of those cargoes have made their way into the European market. Those will slow and it will pull additional U.S. cargoes over into Europe.

“Europe’s imports from the Middle East have climbed to roughly 470,000 barrels a day this month, a 10% gain from June. Separately, flows from Egypt jumped to about 110,000 barrels a day. Those shipments are mainly from the Mediterranean port of Sidi Kerir, where there has been a jump in arrivals, primarily from Saudi Arabia. Rising diesel flows to Sidi Kerir are “making it an ideal point to position future diesel exports into Central and West Mediterranean markets,” Munger said.”

Chinese flows have increased so far in July, which will have a much bigger impact on the Singapore markets. This is why we have talked so much about the gasoil crack spreads in the Asian region.

“At present, processors in southern China make almost 280 yuan ($39) a ton more by exporting diesel to Singapore than selling it domestically, according to an estimate by industry consultant OilChem. That’s highest since the start of the year and compares with losses over most of the second quarter.

Refiners in China ship their products overseas under a nationwide quota system, with allocations issued in stages to processors by product. This month, state refiners are set to raise runs to 10 million barrels a day, the highest rate this year, after seasonal maintenance came to an end.

“China certainly has the capacity to ramp up diesel exports later this year,” said Zameer Yusof, senior oil analyst at Kpler, although he cautioned that the actual level depends how much additional quota firms receive. The data analytics firms’ latest supply-and-demand projection is for a monthly diesel surplus of around 750,000 to 800,000 barrels a day for the rest of the year, he said.“

This is fully inline with our views that we discussed on the EIA show.

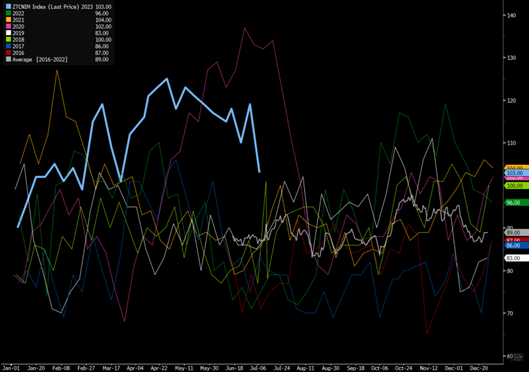

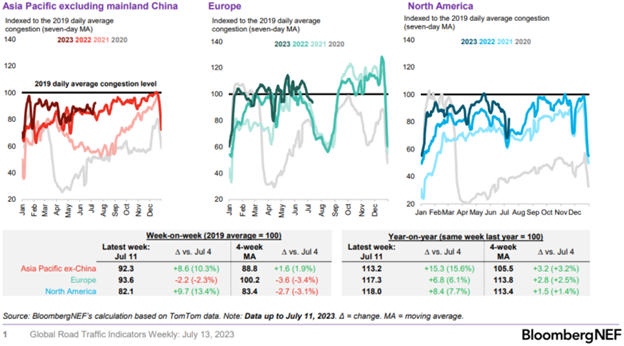

Chinese travel has stabilized at these levels with some downside trends likely coming over the next few weeks. It will outperform 2022 that experienced some sporadic lockdowns last year, but it won’t be at the elevated levels the market has been expecting.

When we look at other areas, the same thing is playing out on the travel front. All areas are now below their 2019 levels, and we don’t expect any of the regions to close the gap. Pressure is building on Asian economies and consumers keeping people reduced while North America and European drivers spend/travel less this summer season. It won’t be to the same degree as 2022, but it also won’t be close to the levels of 2019.

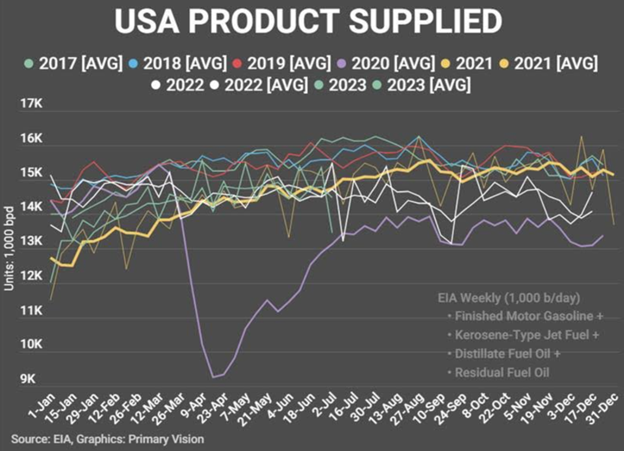

When we look at total mobility fuels, there is a clear breakdown vs pre-COVID periods as gasoline demand stays below normal and diesel demand slips further. The 4-week rolling average has now dipped below 2021/2022 levels with little to pick it back above those periods. They were both supported by a surge in trucking that isn’t coming around this time as inventories rise and sales slow. The pace of the retail slowdown is going to accelerate with some already predicting the worst “back-to-school” period in over a decade.

Gasoline has fallen back below 9M barrels a day, but the drop below will be short lived as demand settles around the 9.3-9.4M barrel a day level. It will fall short of our “normal” level of demand as less people take vacations, WFH/flexible schedules stay prominent, and economic stress reduces underlying spending. Gasoline will likely settle at the 10-year average, but it’s unlikely to see a meaningful bounce as cracks are forming in the summer travel view. We had the normal spike for July 4th, but the fade was hard and fast. It will absolutely bounce, but fail to gain any real traction back to the highs driven by structural and cyclical impacts.

First the structural:

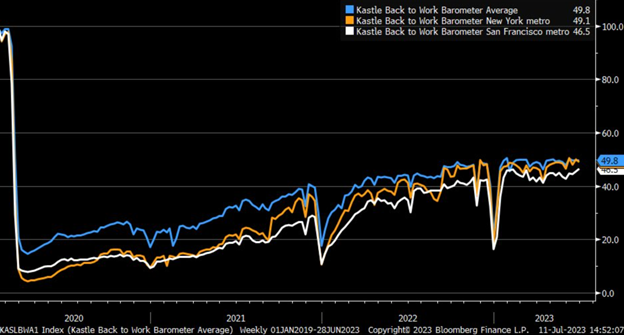

Kastle back to work barometer is showing that we are still 50% below “normal” activity in the office. This is inline with our views that we would get to a “ceiling” and go sideways from that point as flexible schedules are adopted nationwide. This will be a pervasive shift in the system as we get less weekday traffic.

The average vehicle is getting better gas mileage now than ever before. The average fuel economy for a model year 2020 vehicle increased to 25.4 MPG, which is not something that is going to reverse. The cars are getting more efficient, which will inherently reduce the total gasoline consumed even if the mileage remains the same.

Cyclical:

The economy has softened with manufacturing and industrial activity already in contraction and services/consumer starting to slow at an accelerating rate. The consumer/services have been able to hang in much longer, but the impacts of rates, slowing wages, inflation, and general cost of living increases have finally taken their toll. The rental market for the summer has been lagging versus last year with average occupancy down about 15%. As the revenue of these homes dries up, it will be interesting to see how many come for sale.

“What’s scary for the US Housing Market is just how many Airbnbs there are. Data from AllTheRooms shows 1 million Airbnb / VRBO rentals. Compared to only 570k homes for sale. Creates huge home price downside if struggling Airbnb owners elect to sell.” There is a significant amount of inventory sitting in under utilized rentals that may find their way to the market as rates rise and individuals decide to no longer rent.

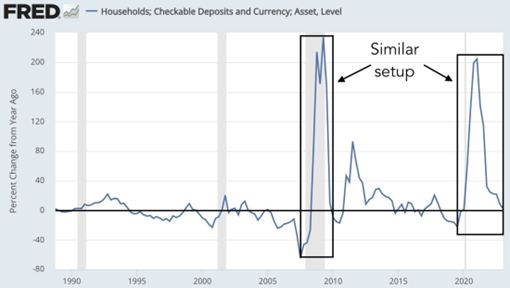

When we factor in general “checkable deposits and currencies,” the spending capacity of the consumer is dwindling.

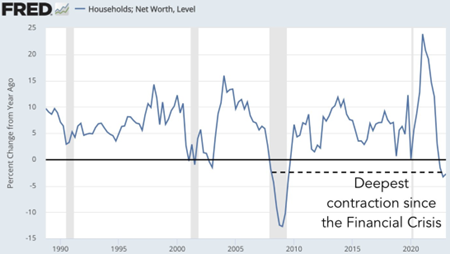

We can drill down a little further to see a step down in general “net worth.” This is all signaling a general reduction of spending capacity as excess savings has now dried up- no matter the metric you use.

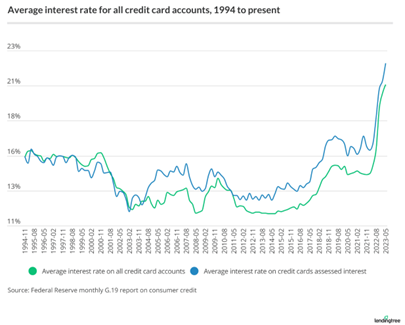

Households have had to borrow greater quantities to maintain their current lifestyles, and a large trip or vacation is a tough pill to swallow as pressure mounts. It’s difficult to see this level of spending to increase when credit card rates have now taken out the all-time highs.

Here are a few charts highlighting the level of credit card rates.

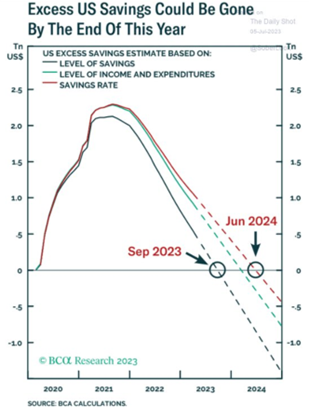

As rates have exploded higher and wealth has diminished, the next thing to factor in is the underlying excess savings. We have said from the beginning that the savings are dropping “much faster” versus expectations. We always believed the numbers were overstated, and as inflation continued- it would compound and pull down the savings much faster.

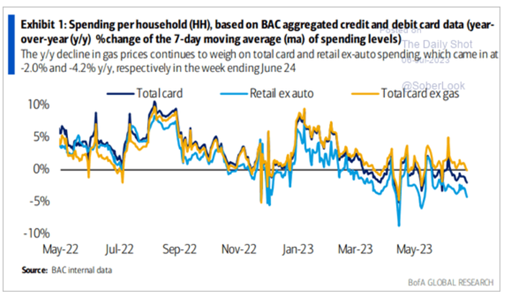

All of this has finally led to a slowdown in underlying spending that has “finally” turned firmly negative. We stated that the consumer “peaked” in March, and the spending was decelerating rapidly. It has now crossed over into negative territory, and will pick up steam over the next few months.

“Redbook Retail Sales fell for the first time since COVID. Consumers are taking on less credit thanks to tighter standards, now they are spending less at retailers. This has marked the start of the last 3 recessions.”

When you look at credit card spending, it has finally cracked with spending moving negative across total card spending on any level. This was bound to happen as rates rose and savings dwindled, which has finally come to pass.

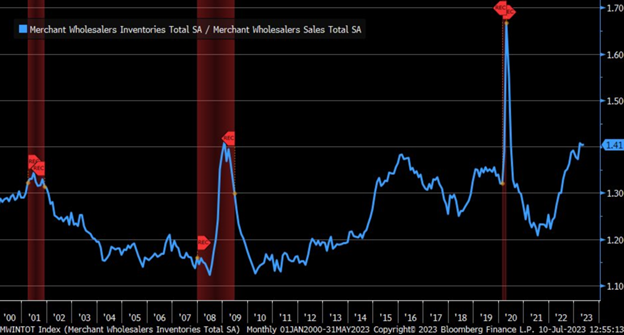

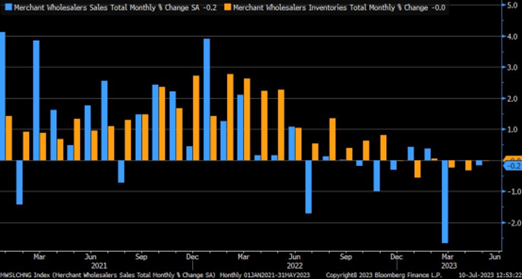

These pivots are leaving more goods on the shelves and increasing general inventory levels. It’s being reflected in the inventory numbers- especially the inventory/sales ratio. There has been a steady increase in what is left on the shelves, but given the deceleration in sales- it’s getting worse across the board.

Wholesale inventory/sales ratio has held steady over past couple months after surging throughout 2022.

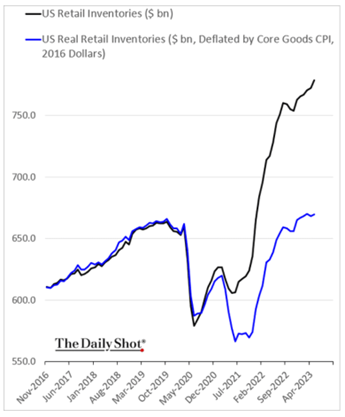

It’s happening at the wholesaler as well as the retail centers.

Even when you adjust for inflation, we are still seeing a big spike in inventories, which has now crossed the pre-COVID levels.

Below is another example of the drop in total wholesale sales- it gives some color on how this is impacting the broader picture when it comes to activity.

When we put this all together, how much product is actually moving around the world? Are we really going to see a massive boost in shipments? I struggle with the view that we are going to see a demand surge as the broader market- especially the consumer- sees a much broader slowdown.

The market is looking directly at supply, but the bigger issue that will impact on the market over the next few months is demand. The demand side of the equation has been deteriorating over the last few months, and it’s set to accelerate over the summer months and well into the shoulder season. It’s always important to look abroad when we are talking about total imports and shipping activity.

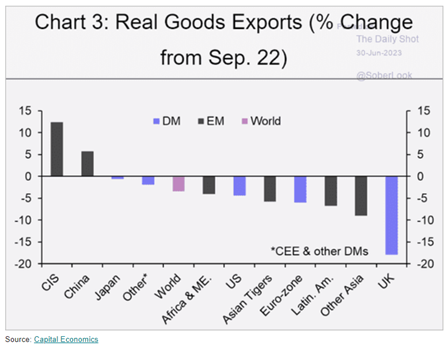

U.S. import of goods has started to slow again after a small bounce as “peak” ordering was pulled forward this year. When we look abroad, there has been a drop in real good exports, which is why it’s important to consider the fact the chart above is reflecting “nominal” activity. The price of goods have surged so the actual volume continues to roll over as reflected in the below chart.

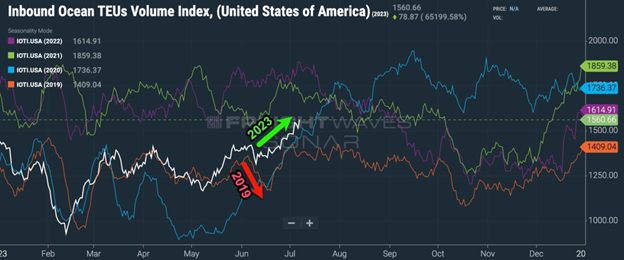

When we look at some recent inbound TEU volumes, you can see we had a nice bounce off the lows. Our view is that peak ordering has shifted earlier this year after over 12 months of depressed orders. Given the inventory builds, slowing sales, and consumer pressure- we don’t think this is going to continue. Companies were also able to take advantage of the strong dollar, which provided an additional incentive.

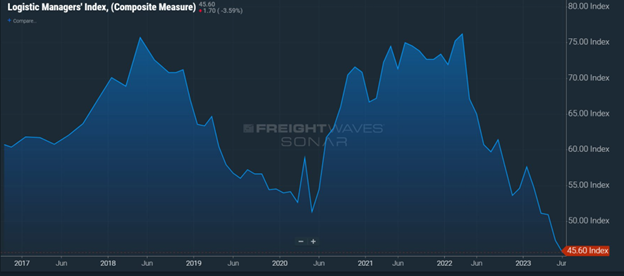

The above chart gives one perspective, but when we look at global trade and other metrics for trucking activity. There hasn’t been a meaningful or consistent increase over the last few weeks. The Logistics Managers Index (LMI) is sitting at its lowest level since data tracking began in 2016 A sub 50 indicates contraction in the US Logistics markets which include (transportation, inventory, and warehousing KPIs). The below data is a big concern when we consider the implications it has for broader economic implications.

There has also been another reduction of internal U.S. trucking activity after a small increase over the last few weeks.

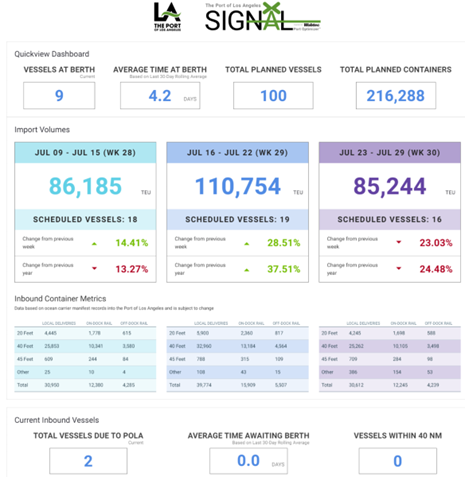

The TEU’s is at the front end of the shipping spear, so it’s important to look at what is currently on our coast and what is likely to head our way. The below data shows how the level of activity at the coast remains well below normal ranges. The important piece to watch is “average time awaiting berth” and the schedule changes versus last year.

This is just illustrating that even if we have a bit more TEUs coming to us in the short-term; we are still below average with much less activity on the road. Even as we believe things slow, stores still need products and inventory, but because of the deteriorating situation- it will be more “lumpy.” The destocking has ended, and now we are left with companies trying to manage cost and inventory levels as consumer activity falls rapidly.

When we look abroad, the manufacturing side of the equation has weakened further, and given many of the above implications- it won’t be recovering anytime soon. The world continues to slide further into recessionary territory with both activities as some inflationary pressure pares back. On the inflation front, it’s a bit of a mixed bag as the manufacturing side improves, but the service side and other “sticky” factors remain very elevated. I will discuss the inflation impacts later in this report.

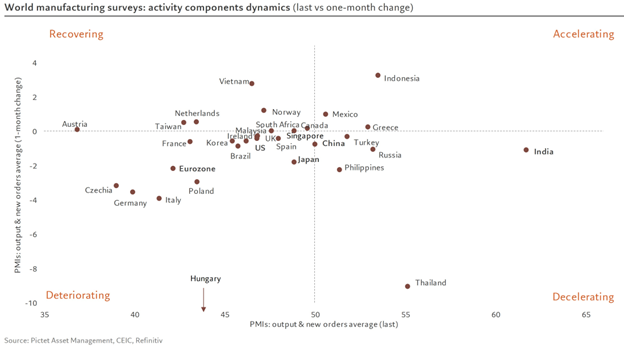

Another very important factor are the activity components which declines for a 4th consecutive month to 47.6 driven by advanced economies. The Emerging Markets have been able to hold in a bit better as it takes time for the pain to work its way down. As orders slow, it will directly impact the manufacturing that occurs within the country as well as the raw materials that may originate from them.

By country, activity components show: 27% of countries stayed in expansion (>50) of which 19% are slowing down and 9% are accelerating. Indonesia saw the biggest bump while India remains well positioned. There was another 12% that are recovering with Vietnam seeing the most growth. The bigger issue is the 59% that are deteriorating with Hungary the most. When you look at the different quadrants, you can see many countries are deteriorating and shifting from decelerating further left. It’s a bigger problem when you look at China that is sitting right on the cusp, but is falling “backwards” as a lot of the stimulus and other measures to improve their economic situation fall flat. Given it’s the 2nd largest economy in the world, points to how it can tip the scales for the broader economy and general global GDP estimates.

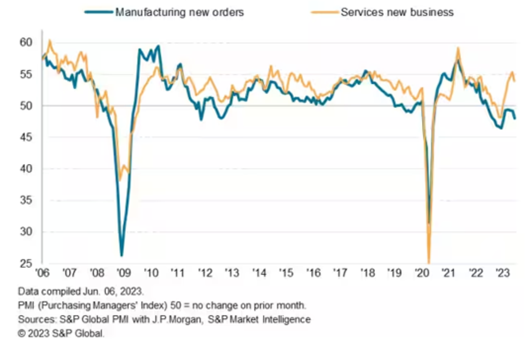

When we look at new orders, the manufacturing side is getting worse and not better. We saw new orders fall again, which gives us more confidence that the increase in TEUs is just peak buying being pulled forward. We had a bit of a bounce (still contracting), but now things are rolling over again. We don’t think it collapses, but rather stays between that 46-48 line if contraction. “June PMI data revealed that resilient worldwide economic growth remains driven primarily by demand resurgence in the services economy while manufacturers struggle to secure new orders. Divergence between the two remains among the widest on record.”

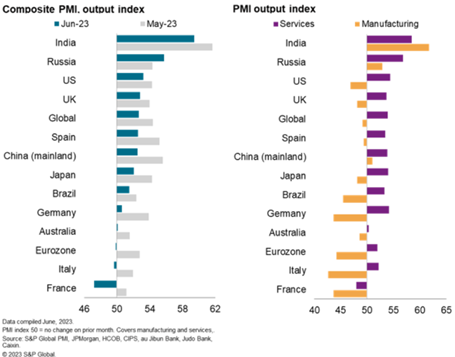

The service side is finally starting to crack, and we see the decline happening rapidly over the next few months. It will take time before it moves into “contraction”, but when we look at national numbers- Europe is already in contraction as China and the U.S. cool rapidly. The below chart looks at things a bit more nuanced- because consumer goods have rolled over while the consumer service front is seeing a steeper decline. This is inline with what we have seen on the June regional numbers.

Data split by country highlighted that India continued to lead global growth in June. However, the slower than anticipated post-COVID-19 recovery across China (mainland), which seems to now be waning, is a growing concern for the global economy.

When we put all the pieces together into the composite, we are still seeing positive growth but it’s starting to roll over much quicker. Manufacturing won’t provide support to the upside, and as services slip further- we will see a much bigger drop. Global private sector growth cooled in June, the PMI at a four-month low of 52.7 (May: 54.4). The slowdown resulted from a softer expansion in activity at service providers and a contraction in manufacturing production.

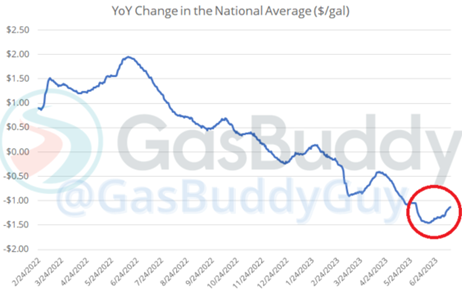

The resilience on global output will be derived from the service side of the equation, which has seen a much faster deceleration. The view that inflation cools faster will help central banks to shift policy and start cutting rates. We don’t see inflation “rolling over” the way the market is indicating it will happen. The Fed will maintain their current rate hike for July, but we don see at least one more hike this year- so a total of two remaining. The issue is the stickiness factor and some important indicators actually turning back higher. The pivot in energy prices will pivot some of the “flexible” numbers as costs rise. We also have the “benefit” of the gasoline anchor falling away over the next few months.

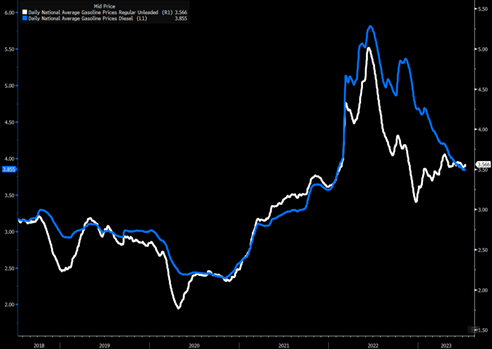

Year over year data is just showing the rate of change, while the month over month data is showing the real pain to the underlying consumer. The steady rise of prices is relentless when we factor in how steady the rise has been. “The YoY comps for average gas prices has bottomed at $1.48/gal, and is starting to narrow. The gap will narrow to less than $1/gal next week. YoY gasoline figures won’t be pulling CPI down as hard in the months ahead.” The “drop” in how gasoline is viewed in the inflation calculation has helped pull it lower, but those benefits will fade at a much faster rate.

We expect to see gasoline prices creep higher while diesel holds flat on a national average basis.

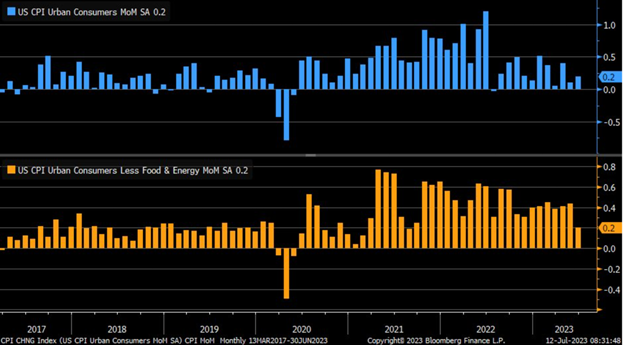

The biggest impact for the consumer sits at the month over month levels: “On month/month basis, CPI (blue) +0.2% vs. +0.3% est. & +0.1% prior; core (orange) +0.2% vs. +0.3% est. & +0.4% prior.”

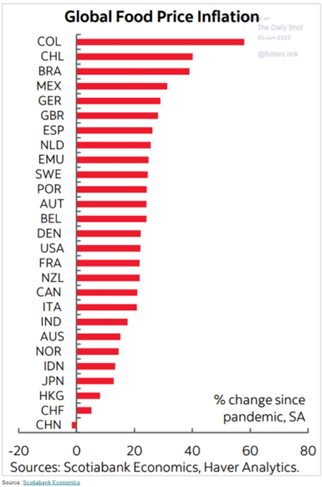

The chart above shows a compounding impact as the cost is going up against the previous month. You can see how quickly the issues can add up- especially when you factor in the cost of living. Global food prices is just one very important iteration of the issues that have seen prices surge by over 20% in most places with additional pain this year. Commodity prices have surged, which haven’t been fully reflected (again) in the UN Food Price Index. This is just another inflationary measure that is starting to pivot higher again, and we have seen several nations declare a State of Emergency over food security.

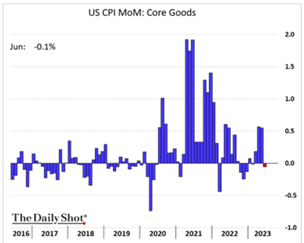

Core goods had a quick rollover as core services slowed, but we see support in the near term on the core goods front as core services pulls back a bit more. We see it “stabilizing” around the .1-.2 level- which is not going to provide relief for anyone.

One of my favorite charts is looking at wages vs the purchase price of a home. Home prices or the owners equivalent rent (OER) had a small pause, but it has continued it’s movement higher increasing the stress on the homebuying market. Home prices and services remaining resilient is going to be a huge headache for the Fed trying to fight “sticky” inflation. Either wages have to go up- risking a wage price spiral- or we need to see home prices falling. Mortgage rates are sitting at over 7%, which has slowed the purchase of homes given the MBA data. But- it doesn’t mean that much new inventory has entered the market yet- back to our earlier comments on Airbnb and the record amount of assets under construction.

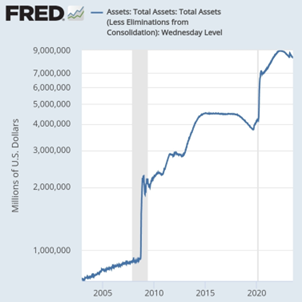

Wages have started to “rise” as the pace of inflation has adjusted, but it still isn’t enough to account for the drawdown in savings and the rise in credit expense. Even as the Fed “claims” to be running QT (quantitative tightening), they have created several programs that pushed more liquidity back into the market.

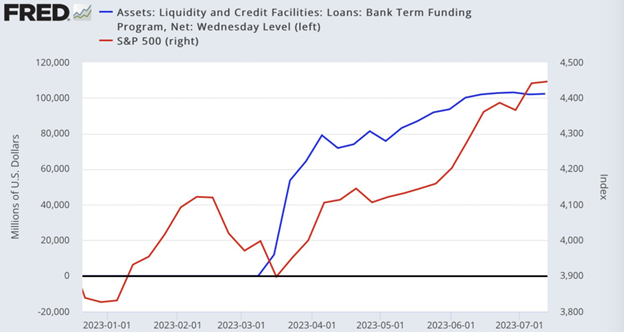

The below chart gives you an idea how this “new” credit facility was able to breathe new life into the S&P 500.

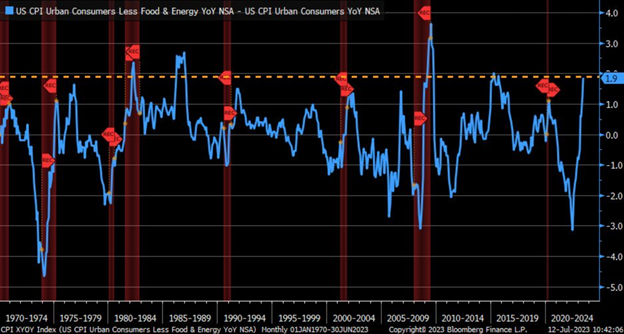

This will also be a bit more inflationary as the money sloshes around the market. “Spread between Core CPI and headline CPI (both year/year) at highest since September 2015 … no particular relationship with recessions when looking at history, given large spread in 2009 was at end of recession and largest spread before that (in 1986) was not during recession.”

We don’t see a bigger drop on the sticky side- especially as we get some near term support on wages.

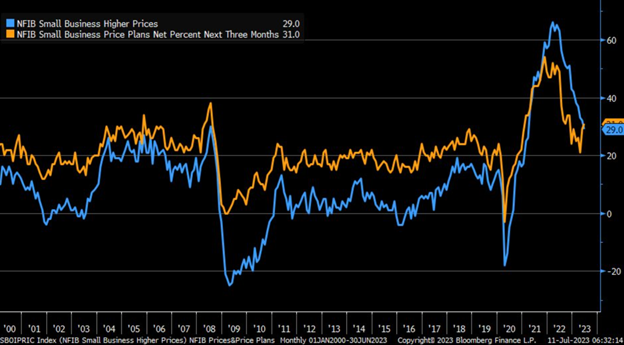

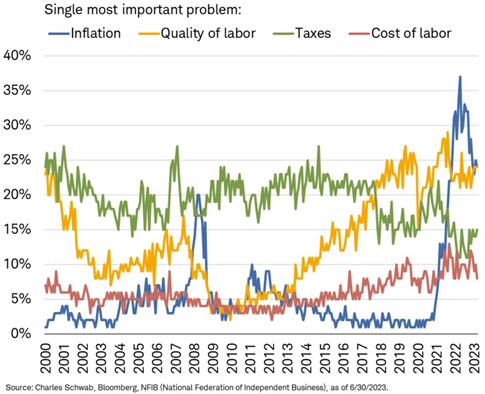

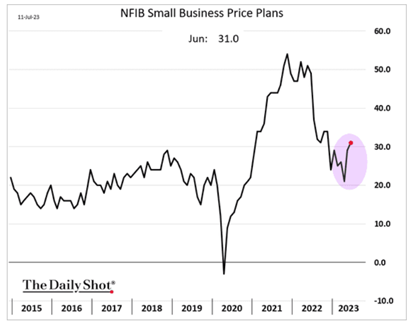

Small businesses have said they will be increasing prices once again, and it will be to protect margins as they see wages moving a bit higher once again. They still see a big problem with labor quality problems.

There is still tightness in the labor system as “prime age” is above pre-pandemic levels with retirements staying well ahead of pre-COVID.

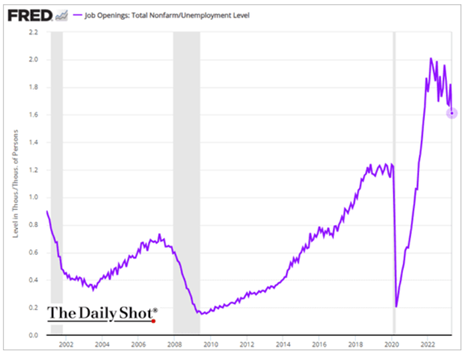

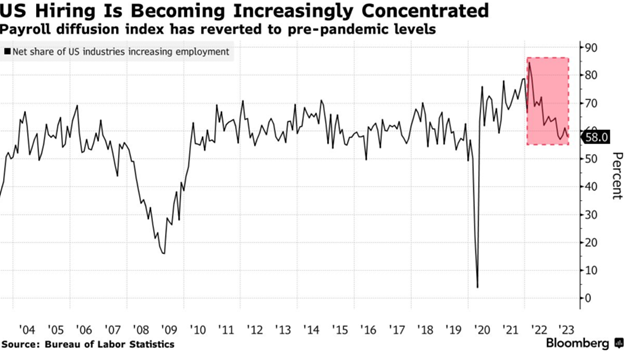

There still remains a sizeable amount of job openings, but the breadth of openings is dropping which is a positive for the Fed. They still have a LOT of work to do when trying to bring down inflation and balance unemployment.

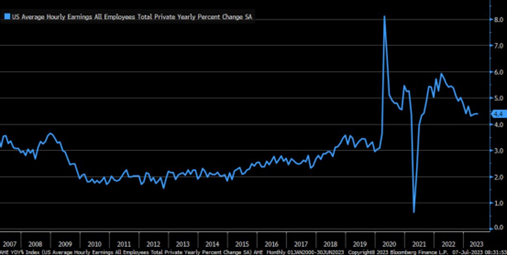

The below helps to show the amount of average hourly earnings: “June average hourly earnings +4.4 year/year vs. +4.2% est. & 4.4% in prior month (rev. up from 4.3%).”

Here is a great chart summarizing the shifts in the small business data.

The problem remains the pricing plans shifting back up, which is being used to essentially protect margin. Small businesses still have the opportunity to raise prices because they haven’t seen much (if any) drop off in the demand for their products according to the sales data.

We have been very adamant from the beginning that China was going to miss all of their estimates and continue to slow. Our view was that manufacturing was going to remain in contraction as the service side stays in expansion but starts to drop faster.

We started to see a sizeable drop on the service front:

There was some improvement in orders on the domestic side, but it’s still well below the pre-pandemic levels and more of a replacement. When you factor in the slowing CPI and imports/exports, we don’t see a strong rebound in the local consumer.

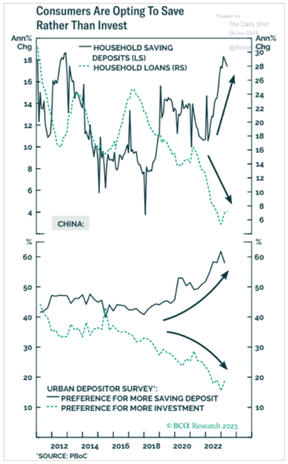

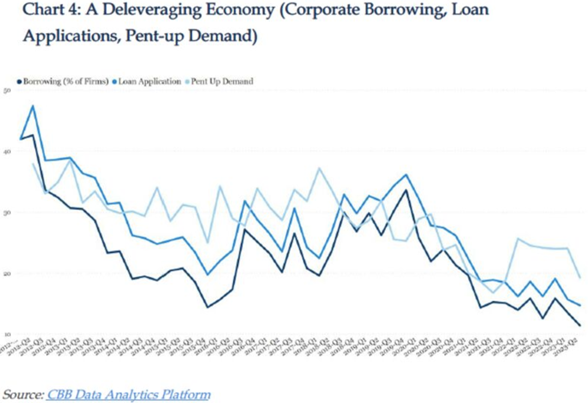

The consumer continues to focus on restoring their losses from the huge real estate write-downs and losses. We did get some spending and a very small adjustment on the savings front, but it was all very minimal movements especially as private borrowing starts to roll over again.

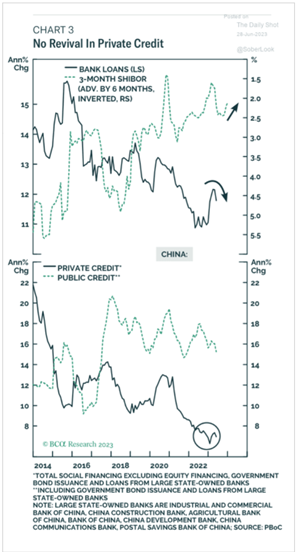

The credit impulses within China are rolling over as there is no demand for loans. The government keeps pushing the narrative of “stimulus,” but it won’t happen as long as there is no demand for the leverage.

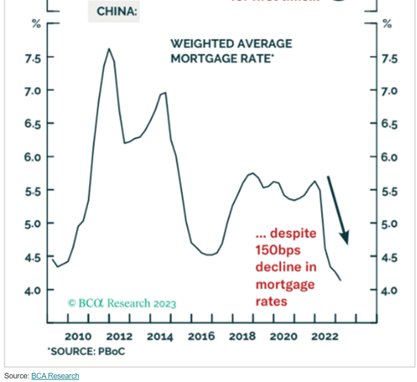

The reduction in rates will have no impact in driving the private sector to pick up additional borrowing. Many of the leverage ratios have blown out, and there is no apetite to take in more capital.

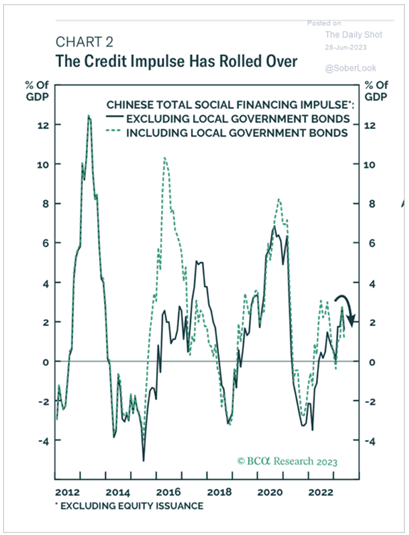

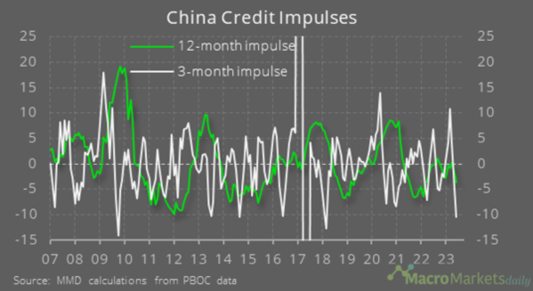

No matter the time frame you look at the credit impulse there is a sizeable contraction: “”Looking at China’s credit impulse on a three-month basis shows a big contraction up to June, the largest since early 2018 and underscoring the disappointing nature of China’s recovery.” Our view has always been that the PBoC wants to get credit impulses between 0 and -1 to help pull down some of the extreme liquidity in the market. When you look at the 12-month impulse- they have walked the line very well on purpose and because of market dyanmics. Now as the pressure mounts to “push” credit impulse higher- they are going to find out just how bad the market dynamics are for additional leverage.

Here is how overall credit growth (total social financing, TSF) looks in China after the June data published yesterday. Credit demand is not recovering, on the contrary and excess savings are piling up. Based on the chart earlier, the local populace is in no hurry to drawdown those savings- especially factoring in the losses from real estate.

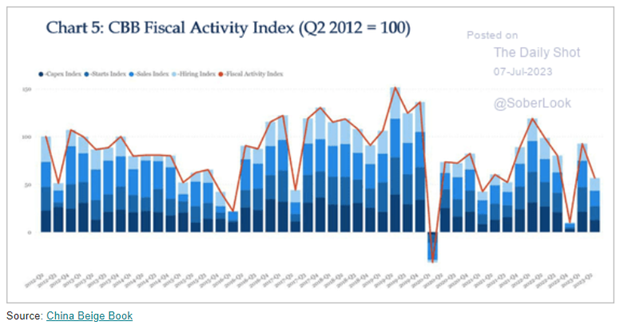

It should be no surprise that the fiscal activity rolled over in Q2, and we haven’t seen any improvement in Q3 showing any pivot. If anything, things have continued to slow downin Q3 with little shift to the upside.

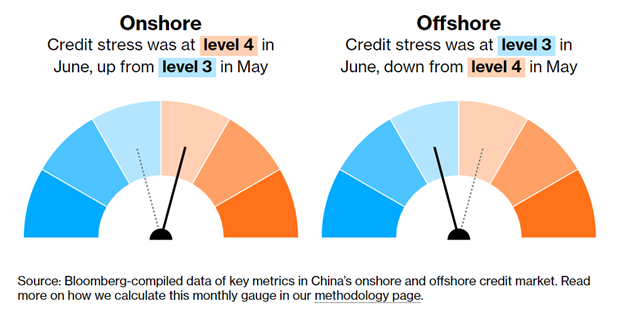

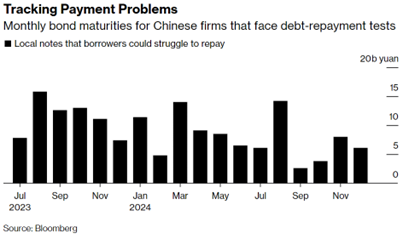

We are also finally getting some “realization” around to the fact that the “onshore” bond market is facing a lot of problems- especially as the PBoC “uncovers” a lot of off-balance sheet debt.

Here is just one recent example: Chinese Builder’s $1.8 Billion Distressed Asset Gets No Bids

- Shimao’s portfolio was offered 20% lower than appraised value

- Investors are becoming more cautious about acquisitions

A $1.8 billion project by defaulted Chinese developer Shimao Group Holdings Ltd. failed to find a buyer at a forced auction, underscoring the lack of investment appetite amid a weakening economy.

No buyers bid for a land portfolio spanning an area equivalent to 34 football fields, even though the asset was offered at a price 20% lower than its appraised value, according to results posted on online auction site JD.com. Investors have become more cautious about acquisitions after the country’s real estate sector failed to sustain a recovery. Globally, commercial property markets from New York to Hong Kong are struggling due to a fragile economic outlook and work-from-home preferences.

It’s funny when you look at what the CCP just rolled out as the new “stimulus.”

“The “long-awaited real estate market stabilization policy” unveiled this week, known as “the fourth arrow”, seems mainly to be an extension of maturing real-estate loans to the end of 2024. According to this article, to resolve the real estate problem the markets need to bring prices down slowly, improve sales significantly, increase the strength of cash flow returns, and reduce inventory gradually. It would be a strange market if it did those things. In a speculative market as highly overvalued as China’s, people buy rather than rent mainly because they expect prices to rise. If they expect prices to decline, whether slowly or quickly, they aren’t going to buy.”

So you have a populace that was just dragged through the ringer on real-estate write-downs, and now the CCP will just extend loans waiting for the market to “bring prices down?” If prices fall further- consumer will be taking a BIGGER haircut and prompt LESS spending… not more.

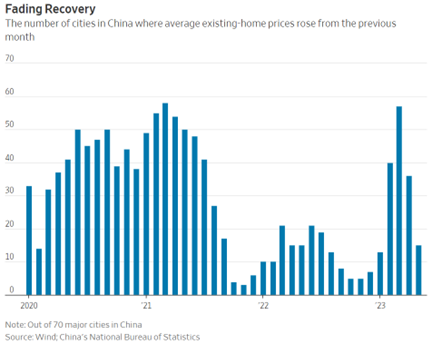

We have already seen a huge drop in new home sales after a brief bounce following the COVID lockdowns- this isn’t something that will drive additional borrowing or economic activity.

“New housing sales fell 28.1% in June, against a low comparison base a year earlier. In the first six months, new home sales rose 0.2% from the same period last year, mainly boosted by the release of pent-up demand in the first quarter.“ Caixin cites analysts calling for new measures to support demand, but I’ve long argued that in a speculative market, demand mainly comes from expectations of rising prices, and once that is gone, it is almost impossible to revive demand.

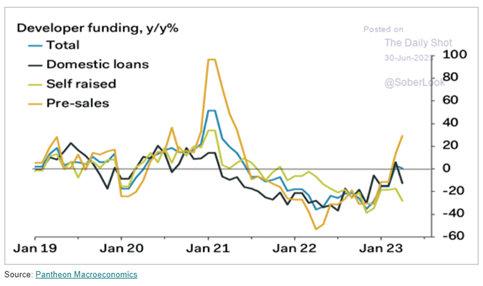

This drop comes on top of additional “rate cuts”, which is why this obsession over RRR reductions and other rate adjustments won’t deliver the desired effect. Developers have found some ability to do pre-sales, but that market has also dried up as home prices have dropped once again.

“China should certainly “shift the focus of its stimulus from investment to consumption,” and some of us have been arguing this for over a decade, but its important to understand that this doesn’t mean just shifting the direction of subsidies from one sector to another. It means completely reversing the direction of subsidies. For 2-3 decades implicit and explicit transfers from households allowed Beijing to direct subsidies in greater or lesser amounts to a whole series of manufacturing and investment sectors. Shifting the focus of stimulus to consumption means reversing the transfers that once subsidized the manufacturing and investment sectors and that made Chinese manufacturing so internationally competitive. This would greatly undermine China’s manufacturing competitiveness. This “shift”, in other words, doesn’t mean strengthening consumption and leaving everything else the same. It means strengthening consumption while sharply undermining Chinese manufacturing competitiveness.”

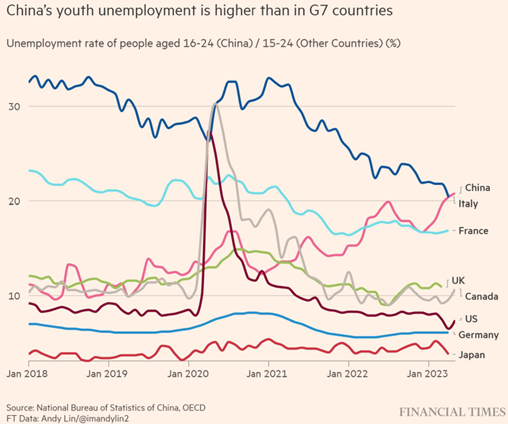

The pivot is going to hit many problems as subsidies were paramount to be competitive in the market. Now that their labor advantage has gone away- they need to find other ways to compete- and one of them was subsizied produciton. “During “Great Moderation” period from late-1990s to COVID pandemic, 3 key forces “GELed” (abundant/cheap access to goods, energy and labor … goods and labor courtesy of China’s move into WTO) … those ships have likely sailed … massive pool of undervalued Chinese labor is now history in may 2023, 21% of chinese 16-24 year olds were unemployed, china’s largest percentage since the data series started (& passing italy).”

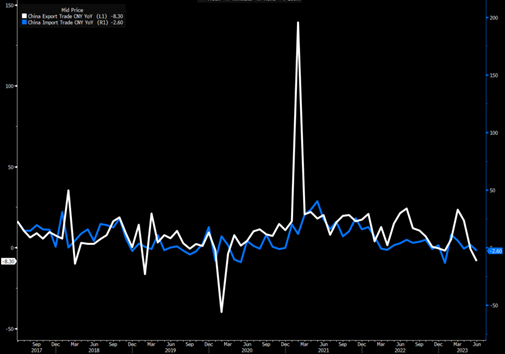

One of the last strong points was exports, but that has seen a sizeable drop. There was a bit of a bounce (which we saw in the FreightWaves TEU data), but it has quikcly faded as imports continue to languish.

Even when we factor in an potentially elevated export market going forward- it is just masking the bigger issues that continue to form domestically: “But in fact China’s rising exports and the surge in its trade surplus are indications that while production is sputtering along, consumption has been unable to keep up, the result of which is that Chinese exports must rise and its trade surplus surge. There is an inveterate mercantilist view that any increase in exports and in the trade surplus is a good thing. But a surge in exports is only a sign of good economic health if it is driven by rising productivity and is accompanied by a surge in imports. When it is driven by a rise in supply-side subsidies for manufacturers and accompanied by weaker imports, it is a sign of domestic imbalances. When China’s share of global exports rises while imports lag, it mainly means that China is externalizing weak domestic demand.”

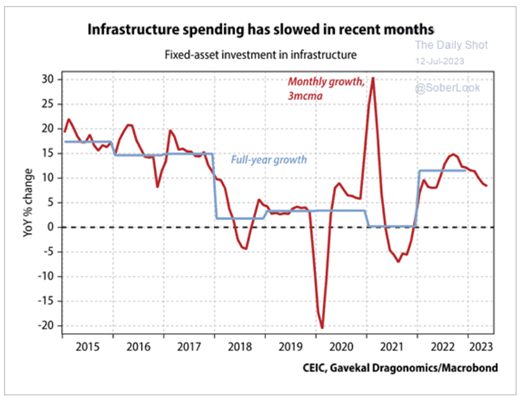

The infrastructure spending side has also rolled over as the governments struggle under the weight of LGFV and SPB volumes. Even local firms want to reduce their broader risk to this market:

China Banks Offer 25-Year Loans to LGFVs to Avert Credit Crunch

- Tension has risen in $9 trillion debt market of LGFVs

- China’s mega banks are used as key tool to support economy

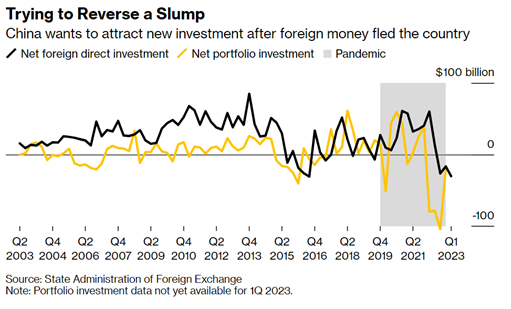

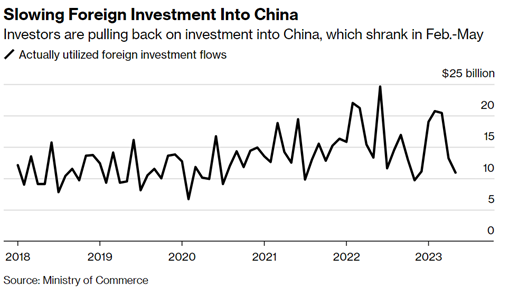

As infrastrcture spending slows, we are also seeing a roll over in Foreign Direct Investment (FDI).

Xi’s renewed push to attract foreign capital is another attempt to plug a hole in their leaking GDP growth potential. As more countries invest outside China (under the near-shoring and onshoring), we will see more money exit the Chinese markets. Mexico is now the largest importer into the U.S.

And as the overall credit growth remains compressed- the ability to show any growth is shrinking rapidly.

“As for LGFVs, the potential loss of a financing channel comes at a time some located in poorer areas are having trouble accessing the public bond market. LGFVs from districts and counties with fiscal revenue of less than 5 billion yuan are relying almost exclusively on private-debt issuance this year, according to Tianfeng Securities Co. analyst Sun Binbin.

Authorities are trying to balance steps to manage hidden debts with efforts to prevent any impact on the broader economy. China’s biggest state banks are offering some LGFVs 25-year loans and temporary interest relief to prevent a credit crunch in the sector. Bloomberg News also reported authorities are weighing plans to support cash-strapped cities and counties by allowing additional local-bond issuance to help pay down hidden debt in higher-risk areas.”

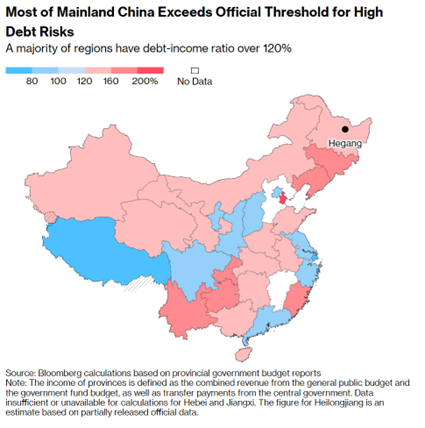

A majority of the regions have debt-income levels that are over 120%- it’s likely to be much worse as the PBoC does more of their due diligence on provincial data points.

As the “land related income” fades, the provinces are going to struggle to find ways to close an exponentially growing gap.

“Another critical point, according to ChinaBeigeBook is that there is no sign of increasing demand for or use of credit by firms even though authorities have been easing credit. This implies they may be pushing on a string and such old-fashioned stimulus wouldn’t work this time“

In short, the view that Chinese stimulus is going to rescue the world from a broad slowdown/recession is grossly overstated.