Industry Outlook

Baker Hughes’s (BKR) management sees the global capex as “constructive,” characterized by softness in North America and strength in international and offshore markets. The energy companies have strengthened their balance sheets over the past downturn, allowing them to ride through the commodity price fluctuation. Despite the fall in energy prices, even the North American IOCs and independent E&P companies have stuck to their development plans and production discipline.

BKR’s management continues to place its hopes high in LNG, despite a 50% fall in LNG price in 1H 2023. Led by Europe and Asia, it estimates that 53 MTPA of LNG projects have already reached FID and may reach 65-115 MTPA by the end of the year. The momentum in new international opportunities is expected to continue until 2026.

Along with LNG, BKR has established a robust business line in carbon capturing under New Energy. Its solutions include geothermal power and blue ammonia projects used as CO2 compression solutions. In Q2, it booked over $100 million of orders, including multiple orders for Air Products. It also secured numerous orders in the Middle East to supply syngas and ammonia compressors.

Current Strategies

In the near term, BKR will bank on the multi-year upstream growth cycle in international and offshore LNG projects and New Energy opportunities. Over the long term, it will aim to capture the energy transition in subsurface and surface solutions. Over the past few years, the company significantly enhanced its position in the Middle East through LNG, power generation, and compression solutions.

It leverages its core competencies in deepwater projects, such as power generation & compression for FPSOs, subsea equipment, and flexible risers. It will look to integrate subsurface capabilities with surface technologies and its digital offerings. We discussed some of its key growth projects in our short article here.

Cost Reduction Target

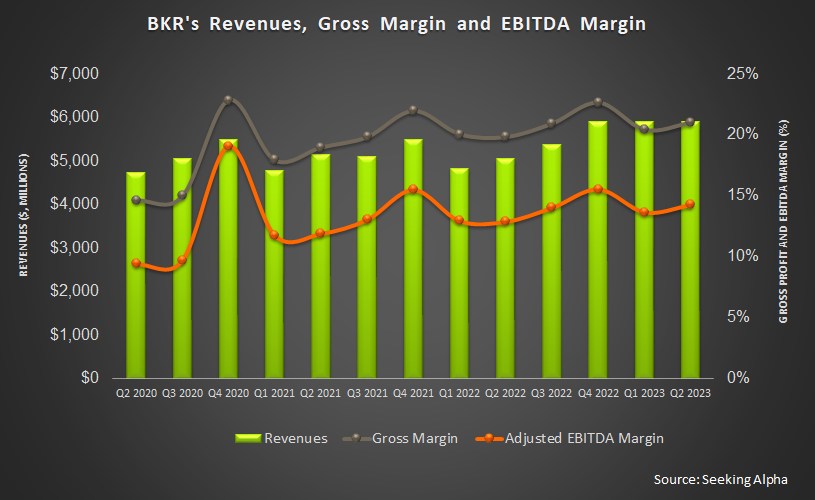

BKR completed its initial $150 million cost reduction target set earlier in 2022. It now sets additional targets for further cost reductions in 2024 and beyond. Over the next few years, it aims to exceed 20% EBITDA levels for each business segment.

As a result of the efforts, BKR’s gross margin and adjusted EBITDA margin expanded in Q2. Sequentially, they inflated by 60 basis points each. Strong growth in Latin America and the Middle East in the OFSE segment primarily benefited the topline and margin expansion, despite pressure from North America onshore.

Baker Hughes’s Q3 and FY2023 Outlook

In the IET segment, the management has revised its FY2023 order expectation by $11 billion to a range of ~$12 billion (at the guidance mid-point). It expects to generate $10 billion (at the guidance mid-point) in revenues, while EBITDA can be $1.5 billion. The pace of backlog conversion and supply chain issues can affect the operating income. In Q3, the segment revenue can reach $2.6 billion, 6.6% higher than in Q2. In Q2, Gas Tech Equipment achieved $1.6 billion in orders, including an order for three Main Refrigerant Compressors for NextDecade. Higher backlog conversion in Gas Tech Equipment, increased investment in New Energy, and supply chain issues will impact the segment performance in Q3.

In Q3, the company’s OFSE segment can see $3.9 billion in revenues, which would be a marginal increase compared to Q2. It can also record $665 million of EBITDA in Q3, nearly unchanged from Q2. In FY2023, it can generate $15.4 billion in revenues (at the guidance mid-point) and an EBITDA of $2.6 billion. The outlook reflects growth in international markets. Product-wise, its Chemicals business line would benefit the most. We also expect higher backlog conversion and the benefits of restructuring initiatives in the SSPS business to result in a steady margin in FY2023.

Cash Flows & Balance Sheet

BKR’s cash flow from operations witnessed a spectacular rise in 1H 2023 (236% up). Lower working capital requirements primarily led to increased CFO. Capex increased modestly in 1H 2023. As a result, free cash flow (or FCF) turned positive from a negative FCF a year ago.

Baker Hughes’ debt-to-equity (0.44x) decreased marginally from a quarter ago. The long-term debt did not change much since the start of 2023. Its annual dividend is $0.76 per share, amounting to a 2.15% forward dividend yield. Halliburton’s (HAL) forward dividend yield (1.73%) is lower than Baker Hughes’s.

Relative Valuation

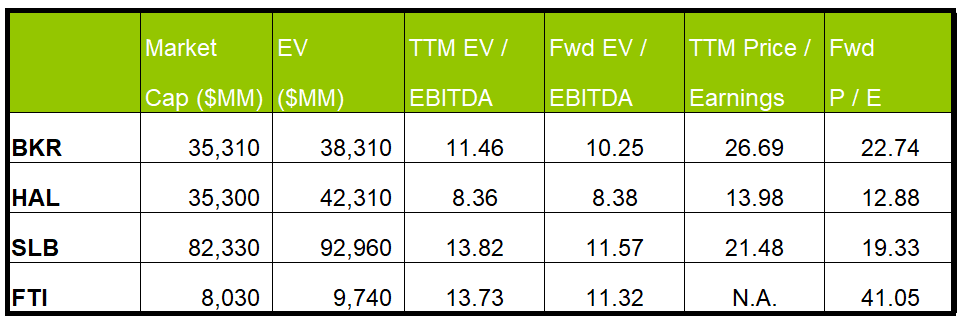

Baker Hughes is currently trading at an EV/EBITDA multiple of 11.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 10.3x. The current multiple is slightly higher than its past five-year average EV/EBITDA multiple of 10.9x.

BKR’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is nearly the same as its peers because the company’s EBITDA is expected to increase as sharply in the next four quarters. This typically results in a similar EV/EBITDA multiple compared to its peers. However, the stock’s EV/EBITDA multiple is higher than its peers’ (HAL, SLB, and FTI) average. So, the stock is slightly overvalued versus its peers.

Final Commentary

BKR’s management has a “constructive” outlook for the energy sector due primarily to its strength in international and offshore markets. Despite North America’s relative softness and a steep LNG price fall, it expects LNG project FIDs to increase significantly by the end of 2023, led by Europe and Asia. Its Gas Tech Equipment business achieved significant order growth in 1H 2023. The company has also opened up a new growth avenue related to the emerging carbon-capturing business, especially in geothermal power and blue ammonia projects.

Over the long term, it will aim to capture the energy transition in subsurface and surface solutions. In deepwater projects, it plans to provide services related to power generation & compression for FPSOs, subsea equipment, and flexible risers. BKR continues to improve its operating margin through various cost-reduction initiatives. Over the next few years, it aims to exceed 20% EBITDA levels for each business segment. The company managed its working capital well, and its cash flows improved dramatically in 1H 2023. However, with a ~20% stock price rise over the past month, the stock appears to be relatively overvalued versus its peers.