Global oil markets are facing a tumultuous time as volatility seems to be rising as conflicting news item keeps the market players confused. Oil prices were riding on back of prolonged production cuts, falling CPI numbers and rising hopes of global economy avoiding a hard landing. Still, the prices didn’t manage to breach the psychologically important ceiling of $90. Moving forwards what will be the direction of oil prices? I will try to present my case using global economic indicators.

First of all, China continues to disappoint the world. We have done numerous shows on the topic and it is important to do so given the country’s contribution to global GDP. I encourage you to have a look at the following links.

I wrote about the same topic in the following research article.

Deflation in China – Primary Vision Network

Chinese exports have fallen along-with imports signaling not only domestic weakness but also a muted economic activity around the world. The latest news is that China has tapped into its inventories, that it has been building from months – and it can mean that the future figures of Chinese imports of crude oil can form a dent in the prevalent bullish sentiment.

In July, Chinese refiners processed 63.13 million metric tons, translating to 14.87 million barrels per day (bpd) as reported by the National Bureau of Statistics on Aug. 15. This figure marks a 17.4% increase from July 2022. It’s the joint second-largest monthly rate, with March having the highest at 14.9 million bpd and April equaling the 14.87 million bpd. The crude supply available to refiners in July totaled 14.36 million bpd, with 10.29 million bpd from imports and 4.07 million bpd from domestic production.

After deducting the refinery throughput from the total available crude, there was a shortfall of 510,000 bpd. This July marked the first instance since November 2021 where the refinery processing surpassed the available crude, with the November deficit being 375,000 bpd.

The primary reasons for the July deficit were a decrease in imports and high refinery processing rates. Imports fell by 2.38 million bpd in July, down from June’s 12.67 million bpd, making it the lowest monthly import rate since January.

Turning to Europe, we have Germany – the supposedly economic powerhouse of the region – which seems to be falling back into recession.

Germany faces a potential recession due to challenges in its automobile sector. In June, the country saw a 1.5% decrease in industrial production compared to May, with its vast automotive sector experiencing a notable 3.5% decline. This sharper-than-expected fall in industrial output has heightened concerns about Germany’s possible return to recession later in the year. Another contributing factor was the construction sector, which saw a 2.8% dip in output.

The automobile industry, comprising about 5% of Germany’s economy, has been finding it difficult to rebound post-pandemic and due to disrupted supply chains. In the first half of the year, 2.2 million cars were produced, which, despite being an increase from 2022, remains 10% less than the first half of 2019. Hildegard Müller, from the German Automotive Industry Association, indicated that reaching pre-pandemic production levels might take time and that the rapid growth pace could decelerate soon. Notably, Volkswagen, Europe’s leading car manufacturer, has faced declining sales in China, its largest market. In the first half, the company’s deliveries to China were down by 1.2% compared to the same period in 2022.

U.S. – the largest economy in the world – is also facing issues.

Traders in the U.S. interest rate market are increasingly anticipating that the central bank will maintain higher interest rates for a prolonged period to curb inflation’s return. The yields on the 10-year benchmark notes have risen significantly, reaching nearly 4.30%. This is an increase from 3.83% at the close of 2022 and 1.50% by the end of 2021. The escalation in yields for these “risk-free” securities is likely to result in a decreased valuation for various assets and may hinder business investments.

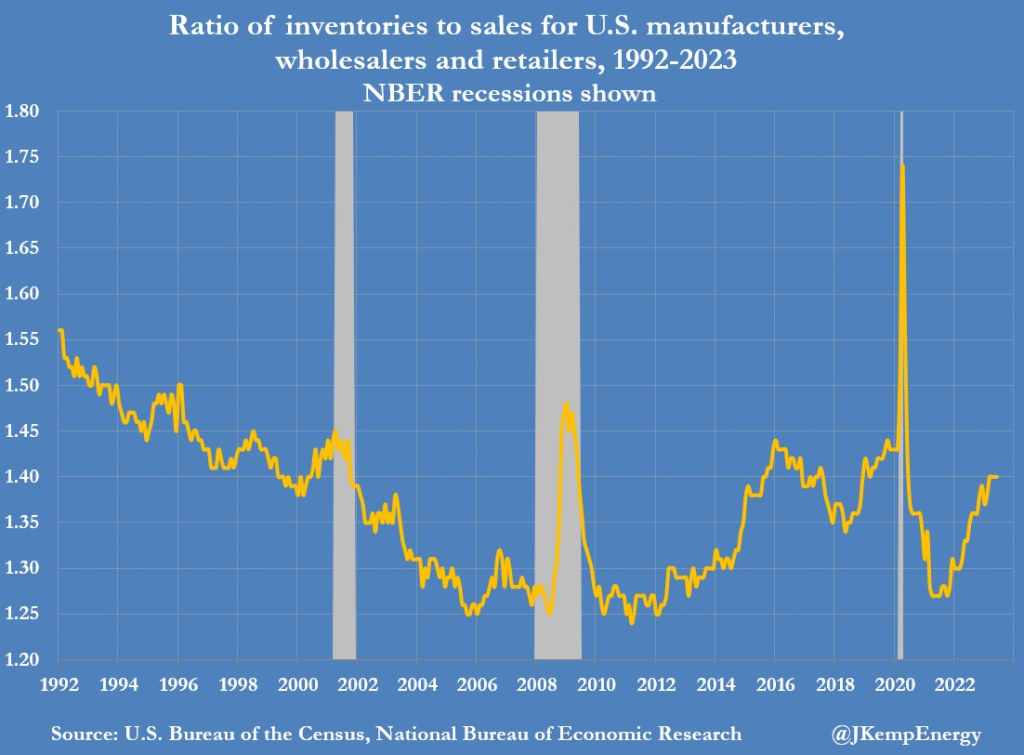

Furthermore, U.S. businesses showed little advancement in reducing their surplus inventories as of June’s end. Inventories, which encompass raw materials, work-in-progress, and finished products held by manufacturers, wholesalers, and retailers, were equivalent to 1.40 months of sales in June. This inventory-to-sales ratio has remained unchanged since March and has seen an increase from the 1.33 months recorded in June 2022.

Tightening oil supply?

Saudi Arabia and its OPEC⁺ partners have declared production reductions which are likely to influence the global oil market slightly for the rest of 2023 and into early 2024.

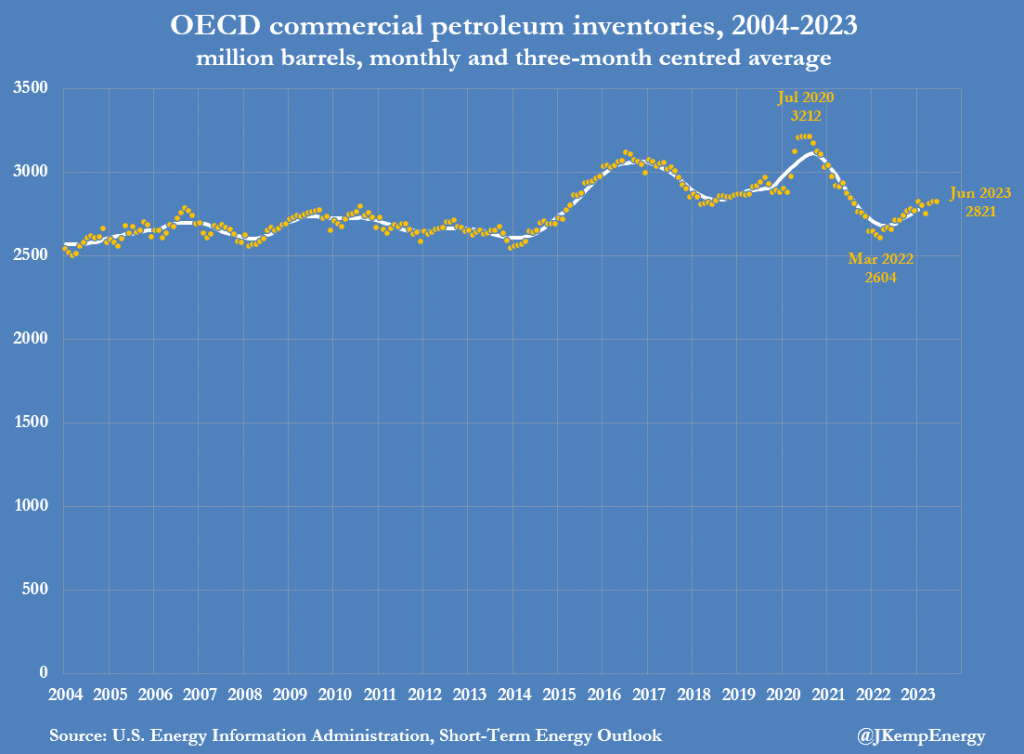

Data from the U.S. Energy Information Administration (EIA) reveals that as of June’s end, commercial stockpiles of crude oil and refined products in the OECD developed nations stood at approximately 2,821 million barrels.

These stockpiles were marginally lower, by around 45 million barrels or 2%, than the average of the preceding decade for the same season. Post this period, further cuts by Saudi Arabia are set to decrease the supply by another 90 million barrels from July to September.

Moreover, Russia has declared its intentions to reduce its output by 25 million barrels over August and September, contingent upon full execution of this plan.

But so far the threat of a supply constraint remains thin given the fact that the global economy still hasn’t caught momentum. Time will tell. I remain bearish on oil markets.