Outlook And Strategy Explained

After Q2, NexTier Oilfield Solutions’ (NEX) management thinks newly built frac equipment will fall short of the frac spread attrition. As demand softens, it may stack or redistribute horsepower soon. However, frac demand can exceed the supply of frac equipment by 2024. During Q2, it idled two frac fleets and redistributed horsepower to the remaining fleets. It can idle up to three additional fleets in Q3.

NEX has a robust wellsite integration strategy, which aims to lower the well completion costs and reduce emissions when combined with the NexHub Digital platform. It has integrated its natural gas-powered frac fleets with natural gas fueling service. On top of that, its wireline and the last-mile logistics business can enhance margins. So, the addressable market for its integrated services has expanded following the application of the strategy.

Natural Gas Price & Outlook

Despite the recent volatility of natural gas, NEX’s management sees Industry utilization remains high or “sold out.” The natural gas price has declined by 43% year-to-date, which led to a steep activity decline in Haynesville shale. Overall, natural gas fleets are “approaching the trough.” Haynesville, however, has been resilient and has started to see a significant increase in DUC wells. We can expect to see higher completion activity by 2024.

In comparison, completion demand has softened and is likely to remain so in the near term. Over a long time, the management expects higher global oil demand despite the economic uncertainty. The frac spread supply bottleneck can limit the US onshore production growth, which can ease by 2024. So, the US rig count and frac demand will likely stay depressed in the next couple of quarters. The fall, however, will be less steep than the previous cycles, indicating the continued uptrend in the industry.

PTEN Merger

NEX is set to merge with Patterson UTI Energy by Q4 2023. Combining the assets will allow it to accelerate the transition to a more fuel-efficient and emissions-friendly fleet, enhance digital capabilities, and grow its addressable market for wellsite integration. The merger has an expected synergy of $200 million. The acquisition of Ulterra drill bits will accentuate the benefits. The investment will help it leverage a fully integrated package to improve the process, while its international exposure will expand NEX’s geographic footprint.

Segment Result Drivers

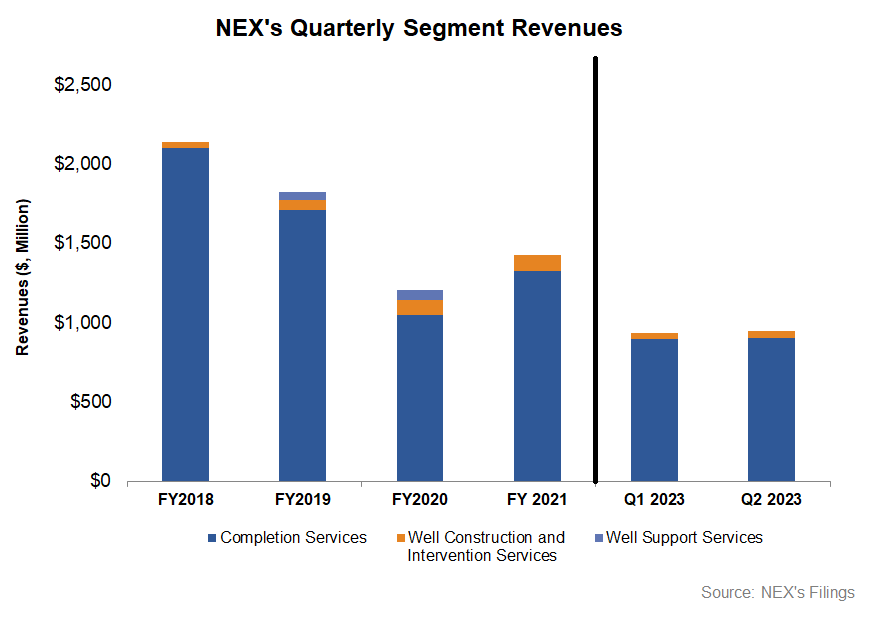

NEX’s revenues remained nearly unchanged quarter-over-quarter, while its adjusted EBITDA margin improved marginally (by 43 basis points). A slight increase in net pricing led to margin growth. Its fleet-level profitability also enhanced due to higher average pumping hours per fleet following two frac fleet reductions during Q2.

Operating segment-wise, the Completion Services segment saw a 3% adjusted gross profit rise in Q2, while the Well Construction & Intervention Services segment saw a 4% adjusted gross decrease in Q2. You can read more about the company’s performance in our article here.

Cash Flow & Balance Sheet

NEX’s cash flows improved in Q2 2023 compared to a year ago. In Q3 2023, it expects $85 million in capex, 16% lower than in Q2. Capex can be reduced further in Q4.

NEX has recently suspended its share repurchase program following the pending merger with PTEN. As of March 31, 2023, its total liquidity was $721 million.

Relative Valuation

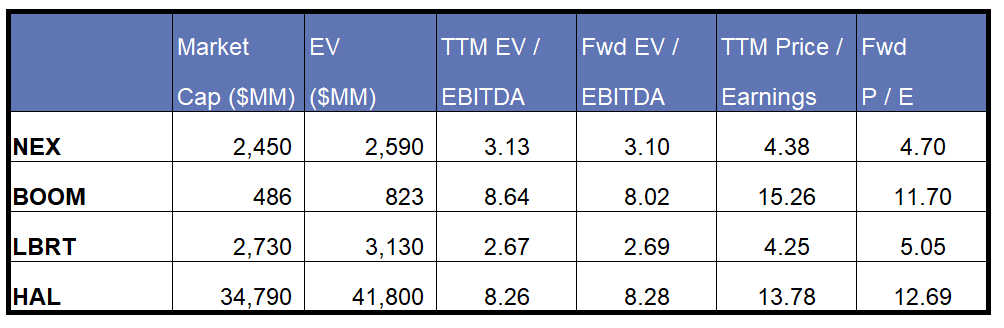

NEX is currently trading at an EV/EBITDA multiple of 3.1. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is also 3.1x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 21.7x.

NEX’s forward EV/EBITDA multiple contraction versus the adjusted current EV/EBITDA is nearly as steep as its peers because its EBITDA is expected to increase as sharply as its peers in the next four quarters. This typically results in a similar EV/EBITDA multiple compared to its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (BOOM, HLX, and DRQ) average. So, the stock is undervalued versus its peers.

Final Commentary

NEX’s management has turned cautious after Q2 as it stacks or redistributes horsepower following a completion demand slowdown. In Q2, it retired two fleets and may stack up to three more by 2023. The natural gas price’s precipitous fall led to a steep activity decline in the Haynesville shale. The frac spread supply bottleneck can limit the US onshore production growth.

On the positive side, the trough appears to be in sight, and over a long time, higher global oil demand will likely dispel the current economic uncertainty. NEX has a robust wellsite integration strategy. It has integrated its natural gas-powered frac fleets with natural gas fueling services, which are more fuel efficient and will likely see higher demand. The process will receive a further boost following the pending merger with PTEN. It will accelerate the fleet transition, enhance digital capabilities, and grow its addressable market for wellsite integration. Also, PTEN’s recent acquisition of Ulterra drill bits can accentuate the benefits. The stock appears to be relatively undervalued versus its peers.