Recently we have been talking a lot about the Chinese economy and the disappointing data coming out of it. There is an important difference in saying that Chinese economic indicators are coming out below expectations and that this can dampen the global sentiment which can further exacerbate a slowdown versus that Chinese economic model has failed

and we will soon see a full blown economic crisis in the country and there is no saving China anymore – in essence calling for the country to fail economically. The latter is an exaggeration and merits further inquiry and this is exactly what I am trying to do here. I’ll keep it short and include some interesting charts and readings for the readers reading pleasure.

In a very insightful and timely piece in Asia Times, David Goldman, explains why the fears of a structural Chinese economic failure are overblown. He considers many factors starting with credit default swaps, functioning as a form of bond insurance post-default and it has exhibited stability. Expressed in basis points above interbank funding costs, China’s default protection cost stood at a modest 80 basis points on August 18, residing on the lower end of its historical spectrum.

Source: WorldGovernmentBonds

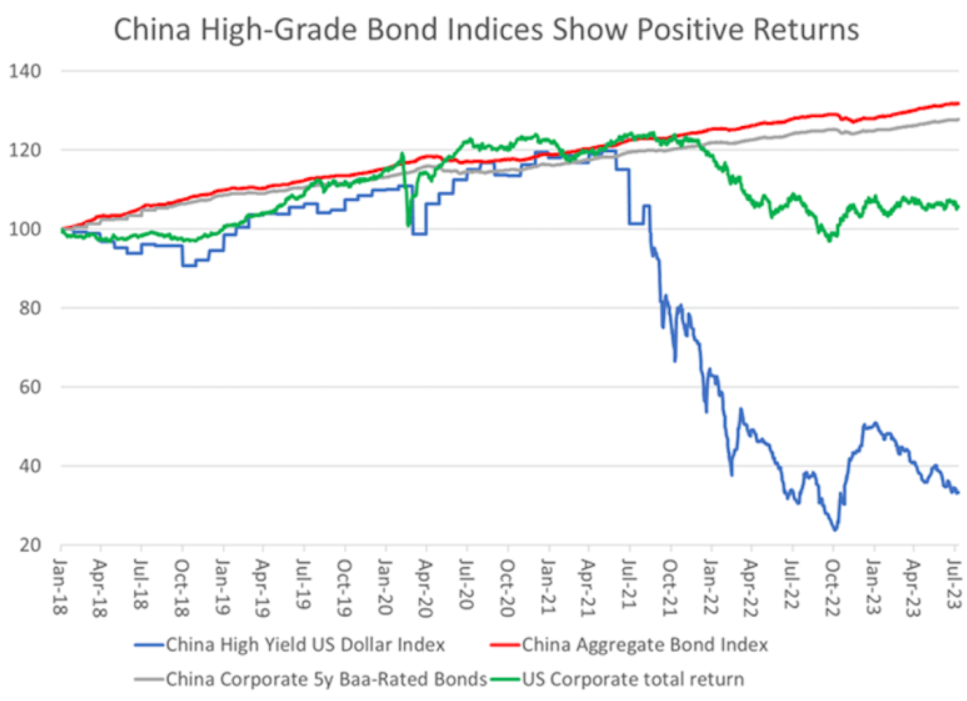

Investors and traders, whose money is on line haven’t shown any panic in the supposed case of China contagion. This can be seen by the fact that the broader Chinese corporate bond market remains unaffected by the property market’s aftershocks. A marked distinction emerges between property bonds, constituting the majority of Bloomberg’s China High Yield US Dollar Index, and the trajectory of investment-grade Chinese corporate bonds. As the chart shows, the high-yield dollar bond index has encountered substantial depreciation since mid-2021.

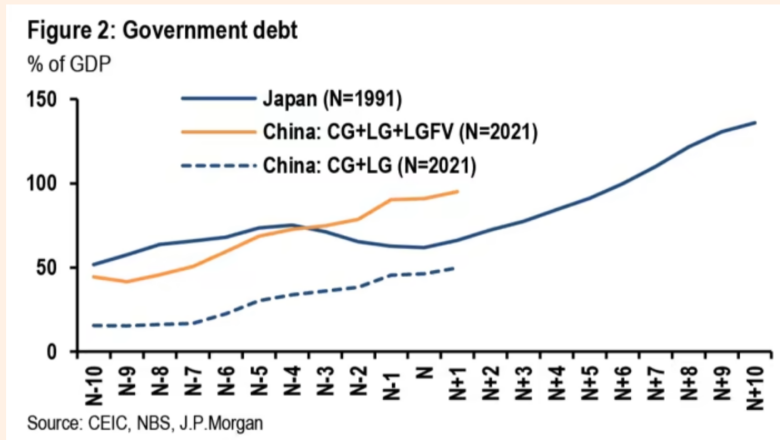

China’s central government could manage defaulted local government debt’s interest payments with a mere 1% of tax revenues. The ongoing property market adjustments, along with the financial instruments linked to it, particularly Local Government Financing Vehicles, do not amount to a genuine financial crisis. Instead, they represent Beijing’s assertive stance in reclaiming control over local administrations that have long thrived on escalating land values.

The article further highlights that Chinese bond index has consistently yielded positive returns, with Bloomberg’s index of moderately lower investment-grade Chinese corporate bonds (rated Baa by Moody’s) also experiencing gains. Conversely, the US corporate bond market underwent devaluation due to elevated US interest rates, with bond prices inversely correlated to yields.

China’s RMB (CNH) reflects a decline against the US dollar, a consequence of heightened US dollar interest rates rather than intrinsic RMB frailty. Notably, the Chinese currency’s performance closely mirrors that of the Japanese yen over the past year.

Furthermore, short-term interest rate volatility in China currently rests near the lower bounds of its extended historical range. This is notable, as instances of genuine turmoil, such as the Great Financial Crisis or the 2020 Covid-induced recession, incited a notable spike in rate volatility in China. However, the past month has witnessed minimal fluctuations.

Significantly, Chinese financial equities have maintained an upward trajectory throughout the last year, a trend unexpected if the financial system was genuinely in jeopardy. Notably, countries boasting substantial trade surpluses and remarkable savings rates are not susceptible to financial crises. China’s government possesses the fiscal resources to address the obligations of questionable local government debt and the banking system retains ample reserves to facilitate fresh loan issuance. The impending decision in this regard, therefore, is more aligned with political considerations than financial imperatives.

Guardian’s Larry Elliott had similar views opining that “China is too big for a Soviet style collapse” but admits that it is “on shaky grounds“. China’s economy is facing challenges including slowing growth, a burst property bubble, and rising unemployment. Despite this, the belief in eventual recovery echoes the cyclical nature of economies. The author suggests an alternative perspective that China’s economic boom might be ending, given recent signs like currency weakness, price drops, and financial stress in the housing sector. These issues could demand substantial structural changes, which could require the Chinese Communist Party to ease political control.

China’s significance in the global economy sets it apart from the Soviet Union. In the past decade, China generated 41% of global growth, compared to the US’s 22% and the Eurozone’s 9%. However, China’s growth rate has halved, leading to a decreased contribution to global growth, and it is projected to continue declining.

The following articles are really interesting:

- https://www.reuters.com/world/china/why-is-china-not-rushing-fix-its-ailing-economy-2023-08-17/

- https://amp.theguardian.com/business/2023/aug/20/china-too-big-soviet-union-collapse-growth

- https://www.economist.com/leaders/2023/08/24/why-chinas-economy-wont-be-fixed

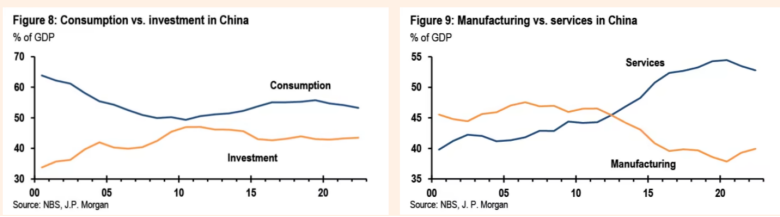

Especially this one which compares China and Japan’s economic problems. Key takeaway – China fares better on many indicators.

https://www.ft.com/content/52c805d5-c759-46cc-a0fe-2de2f2d71850

Following charts also merits a look: