Primary Vision Insights – September 1st 2023

The crude market was pushed to the top of the current trading range as Russia made an announcement “agreeing” to support the oil markets with OPEC+. There are rumors that there is a new agreement that will be announced this month. The market expects Saudi Arabia to maintain the 1M barrel a day voluntary cut into October, while Russia is slated to bring back 200k barrels a day of their 500k barrel a day cut in August/ September. The Russian and KSA cuts are all set to expire next month, and we expect an announcement that KSA will extend their 1M barrel a day cut, and Russia extended their 300k barrels a day cut. The market is currently pricing in the extension, which has pushed brent up to about $88. We believe this is at the very top of the range, and unless we get bigger cuts- the market should settle back down to about $85 in the near term.

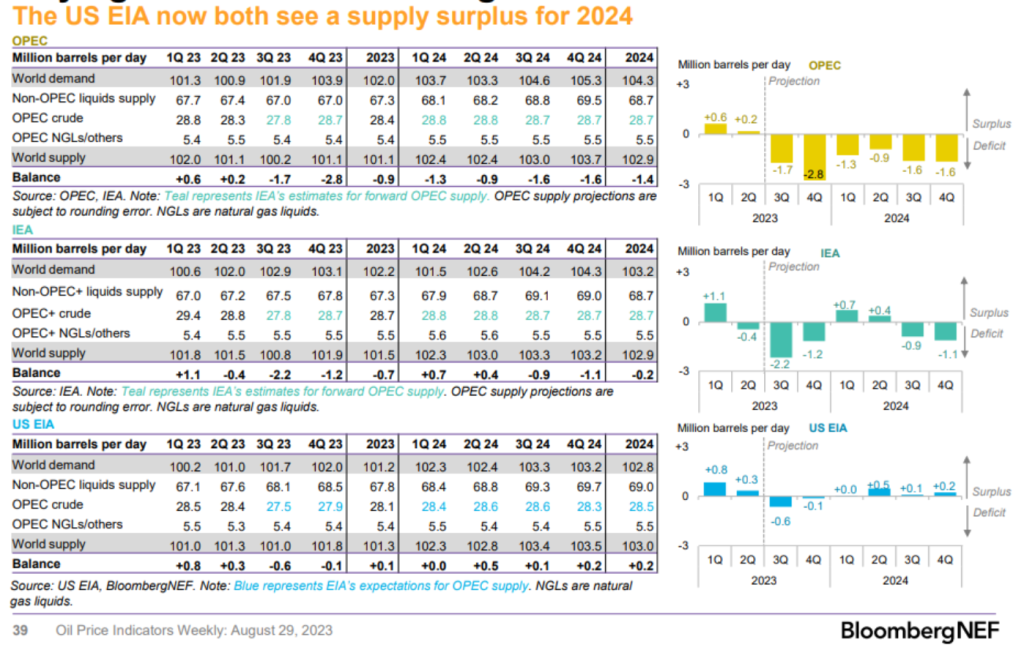

There is also growing expectations that KSA will extend the 1M barrel a day cut through year end, but this poses a bigger problem for KSA into 2024. Q1 is a very slow period for crude demand, and Q2 isn’t much better until we get into the back end of the quarter. All of the expectations currently show surpluses in 2024, and this is with (what we believe to be) overstated demand levels. There is a bit more production coming online around the world, which helps to offset the expected higher demand. If KSA extends these cuts to year-end, do they bring it back in the face of growing storage? Storage normally rises at the beginning of the year, but another 1M barrels mixed with global economic weakness would cause some additional headaches.

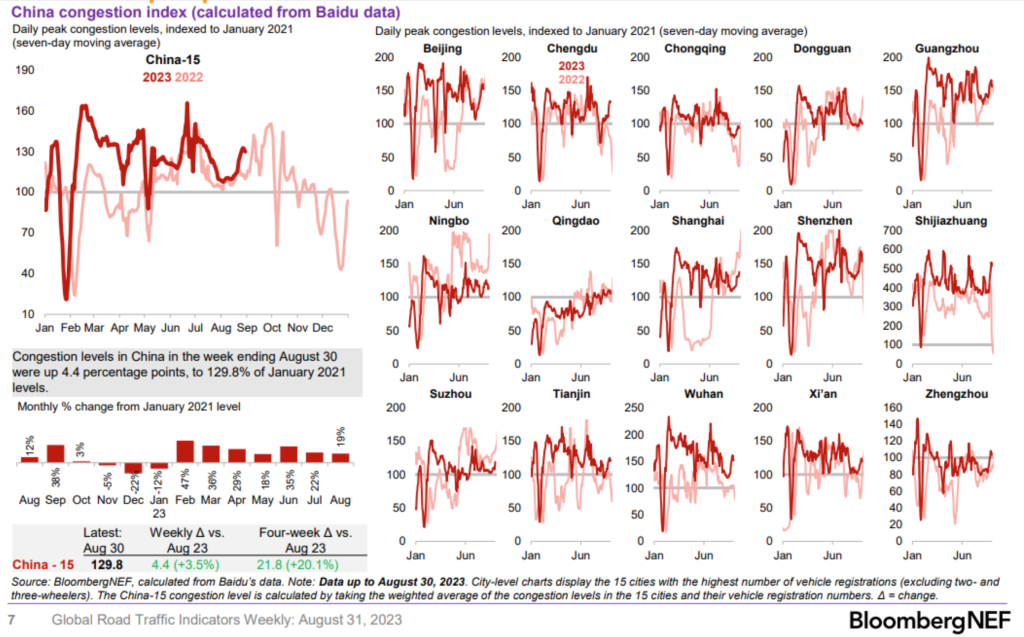

As we have said from the beginning, it will be very difficult for Saudi to bring back that crude anytime soon because the market is now expecting it to remain the case. Refined products exports have increased on a global level and some physical crude barrels have been slow to clear. We don’t see this improving into shoulder season, and it’s likely to get a bit worse on the gasoline front. Distillate and gasoil will remain well positioned, but as exports increase from China and India- the strong premiums will erode on middle distillate. It will still remain elevated, but not at the current levels we have seen over the last few weeks.

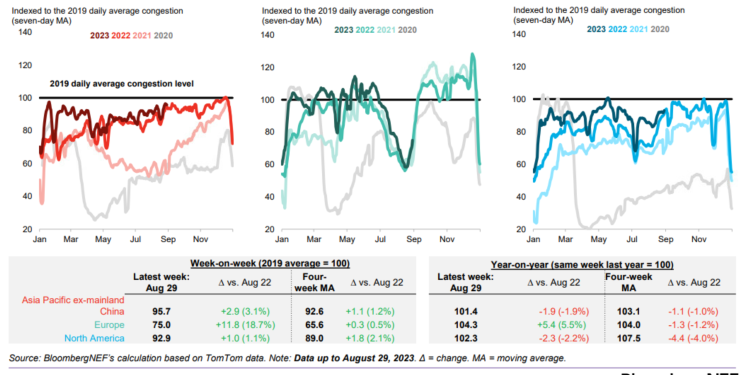

Driving has followed closely to the 2022 trends, and given the economic pressure in 2023 heading into 2024- we don’t see any support for stronger gasoline demand. The PMIs and leading indicators are following the path we laid out at the beginning of the year. Manufacturing was going to weaken and find a floor in contraction while the service sections strengthened- but would start to weaken considerably as we got into summer months. Our view was that summer activity was going to disappoint, and problems at the consumer level were going to start mounting after March of this year. This was timed with depleted savings, Fed consistently raising rates, credit card rates surging, and tapped out consumer balance sheets. Wages have started to fall as inflation has re-accelerated with a lot of staying power over the next few months.

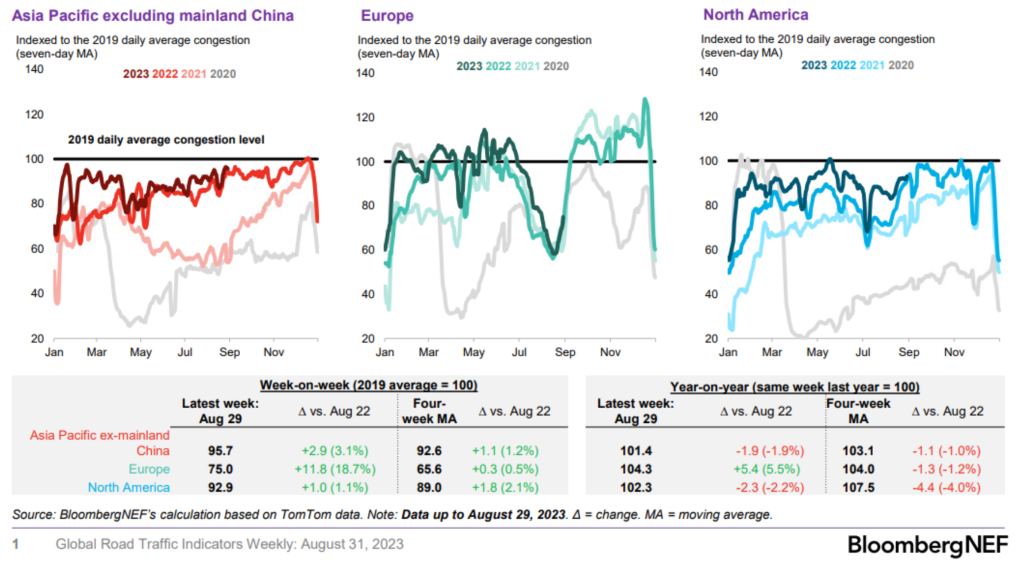

The energy markets were also excited about more Chinese stimulus, but it all continues to fall flat and focus on the wrong side of the market. All of the stimulus has been focused on making mortgages and debt “cheaper” by reducing rates BUT there is NO DEMAND FOR DEBT! Everyone is already leveraged to the gills so no matter how cheap you make the debt- you won’t be creating more cash momentum or spending.

The Chinese consumer is over levered and broadly exposed to the real estate market that is far from recovering. The realized and unrealized losses are going to keep the consumer on the sideline, and won’t be the driving force for demand as the market expected.

As we always say, it’s important to look at crude and refined product to understand broad flows. There has been a large increase of refined product exports from India and China. India tied their recent record in 2022 while China is exporting close to their record in 2022. Several of the large refiners in China have mentioned they have received their quotas for the 3rd batch of exports, and the indications are that it’s going to be very large and likely top last year. This will support a similar surge in exports that we got in 2022, because things accelerated around the same time last year. The “hope” is that Chinese demand for product will rise and absorb some of the excess product in the market. The problem is- refiners have been capitalizing on discounted crude, and they are well supplied to capture both the domestic and international markets.

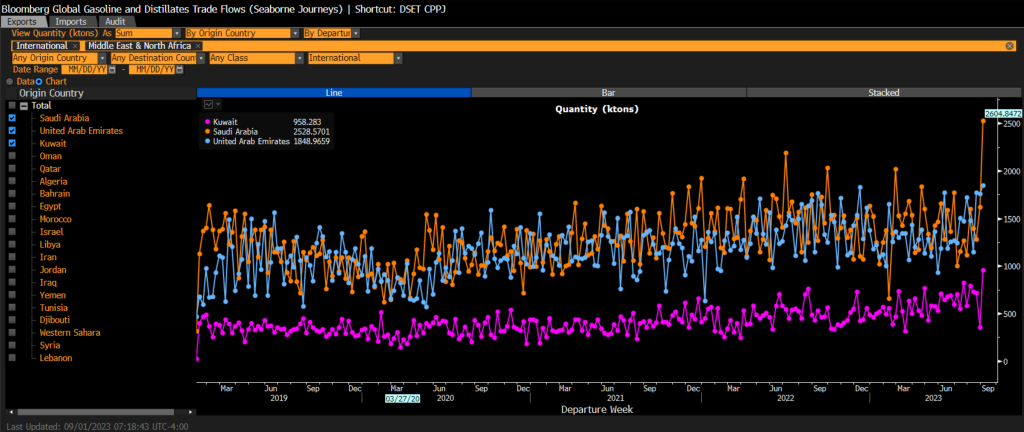

While there is significant focus on OPEC+ crude production, it’s also important to follow their refined product exports. Many of these countries- especially KSA, Kuwait, and UAE- have focused on building out more petchem and refining capacity. Even as KSA has reduced their crude exports, we have seen a huge spike in product exports.

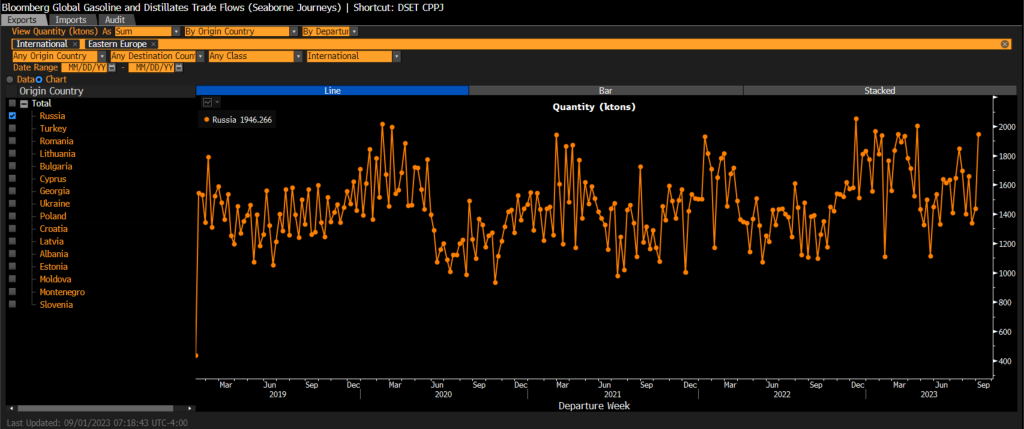

Russia is also exporting more product even as their crude exports have slowed down. There are always two sides to the energy markets, and here you can see product exports spiking.

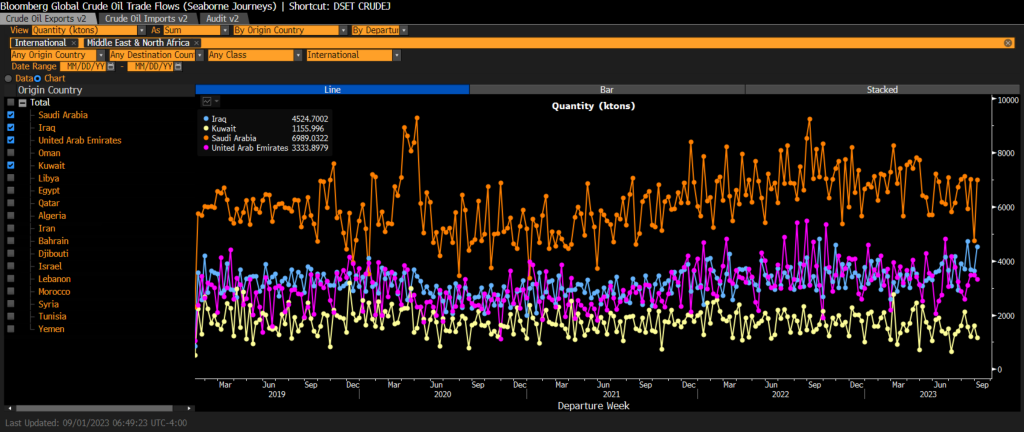

When we look at the crude side, you can see that things have slowed for KSA, but other nations have seen steady increases over the same period. Iraq is taking advantage of the situation by raising OSPs, but much less than KSA so they can make a bit more money while still undercutting Saudi. KSA will likely hold this current level of crude exports while they capitalize on the healthy refined product margins driven my middle distillate. Many of the new refining assets in the Middle East were specifically built to capitalize on this part of the stack.

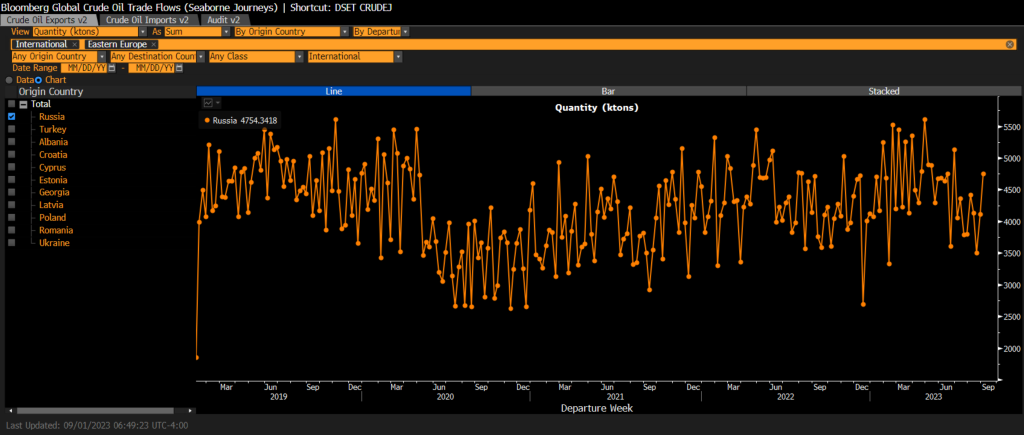

Russia has seen a small increase in their crude exports, and it will likely trend a bit higher as they bring back some additional capacity in September.

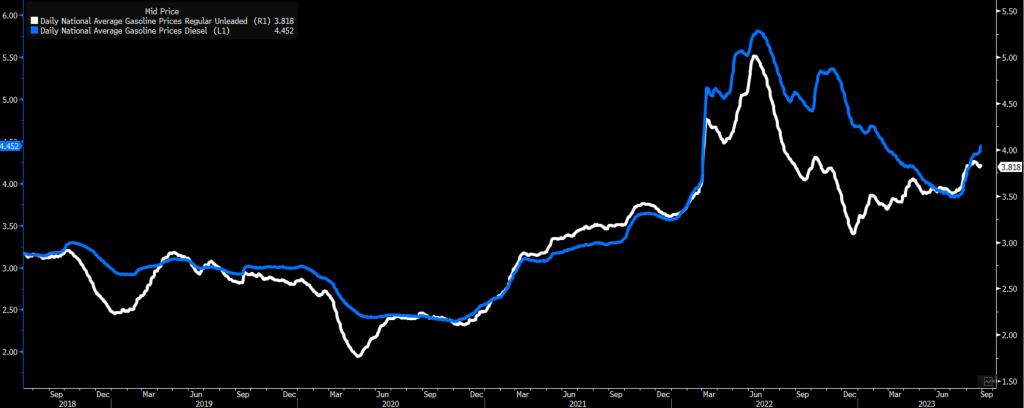

The price of gasoline has stabilized in the U.S. while we have seen a continued grind higher of diesel. Most of the KSA crude removed from the market is on the medium/heavy side, which is helping to support cracks. The below chart also helps to highlight the inflation pressure that is increasing in the market. The “easy” comps from the 2022 spikes are fading, while month/month the march higher in prices have been relentless.

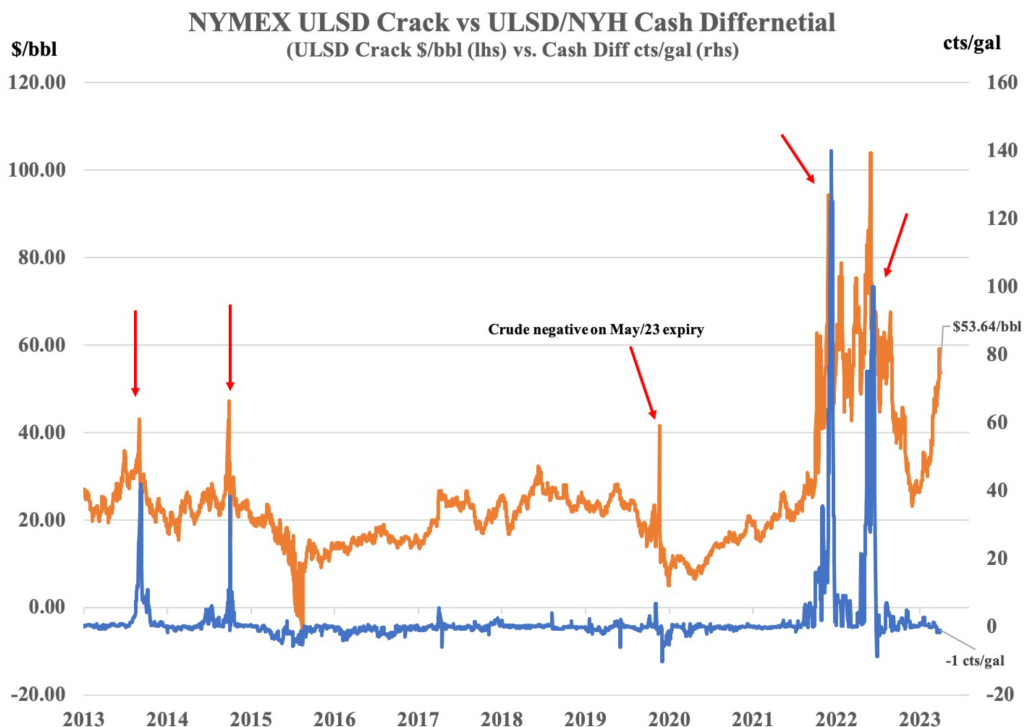

The diesel/gasoil cracks are still showing strength, but the physical market isn’t reflecting something as strong. The physical market is trading a bit below the screens, but not to a point that makes sense to create contango or builds in storage. The level of exports have started to hit the market that has driven down crack spreads inline with our comments in the EIA show.

Here is a chart we discussed on the show that called out the overextended nature of diesel cracks. You can see the fact that cash diffs never rallied to the same degree as the ULSD crack, and acted as an anchor to the downside.

The elevated crack pulled in a ton of new flow, which is why we have seen extensive flow from KSA, UAE, China, India, and Russia of product into the market. The crack spread for diesel will remain elevated, but will continue to cool off over the next week or two. Europe has seen another spike in gasoline while Singapore and Fujairah are starting to build as well. Middle Disty is in a better position and will remain the case given the underlying cracks and low level of storage.

The market has started to see some sizeable increases in 2024 as new production comes online in Latin America and Middle East. It will impact underlying storage, and this is with overstated demand. This is what will cause the problem for KSA when they look to bring back production.

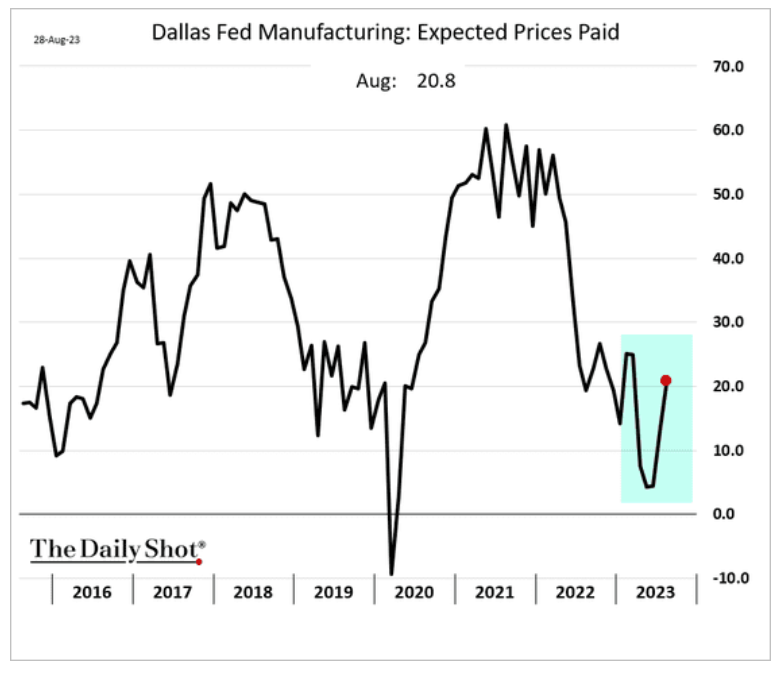

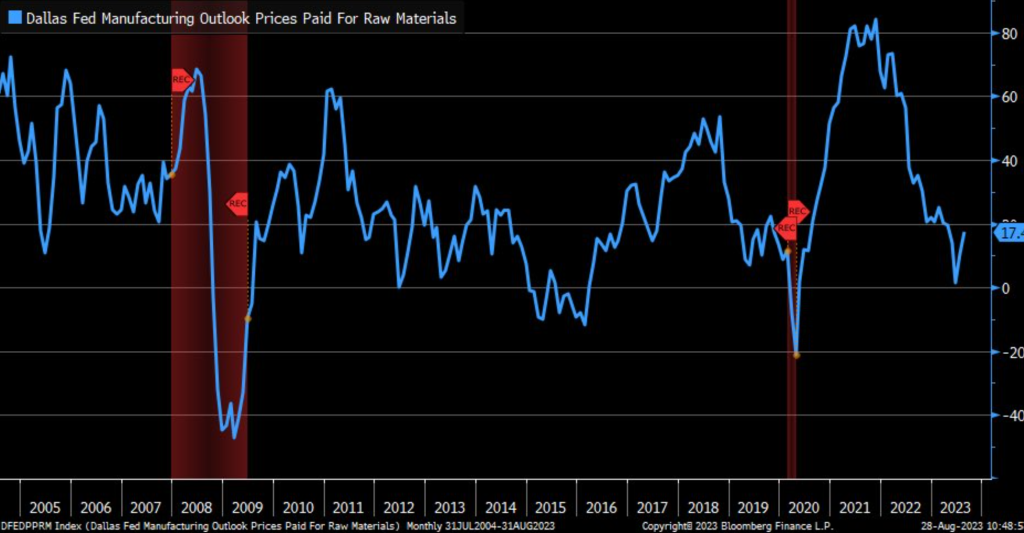

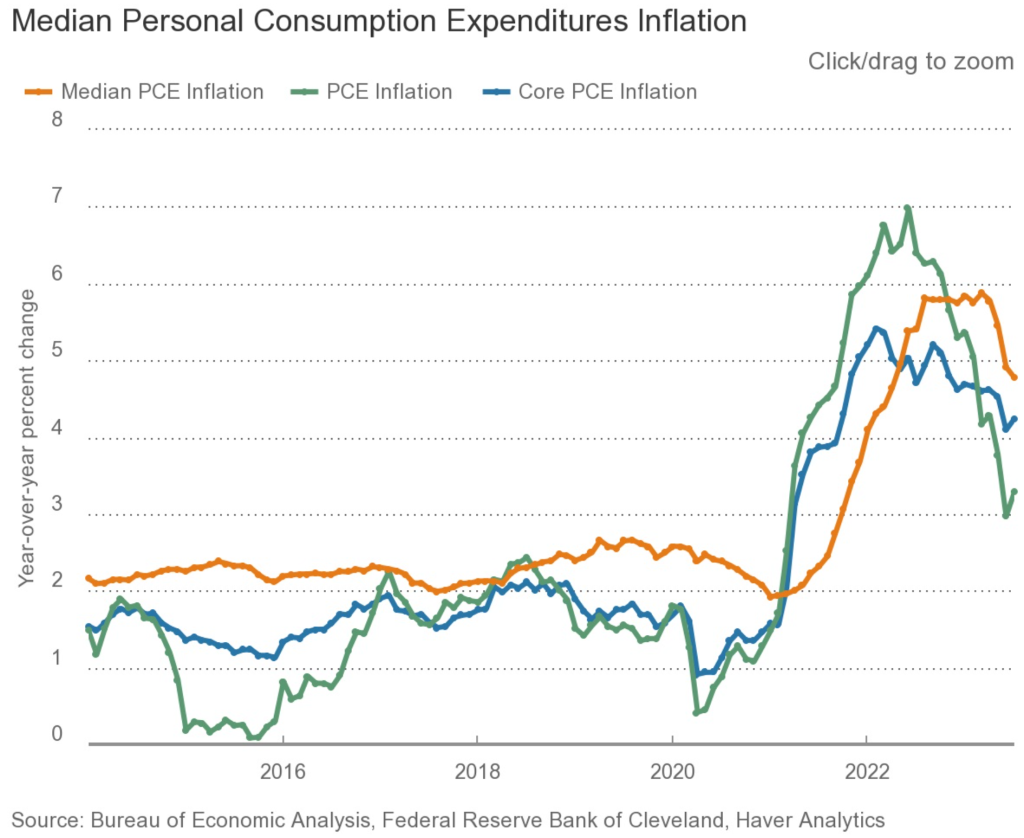

Here are some key issues when we look at inflation and underlying prices re-accelerating. We have already talked about some of them, but here is another round of data showing inflation picking back up. “Worth keeping an eye on prices paid components within regional Fed manufacturing indexes … bounce for Dallas Fed component is consistent with rebounds in other regions (though not yet worrisome in terms of prior high).”

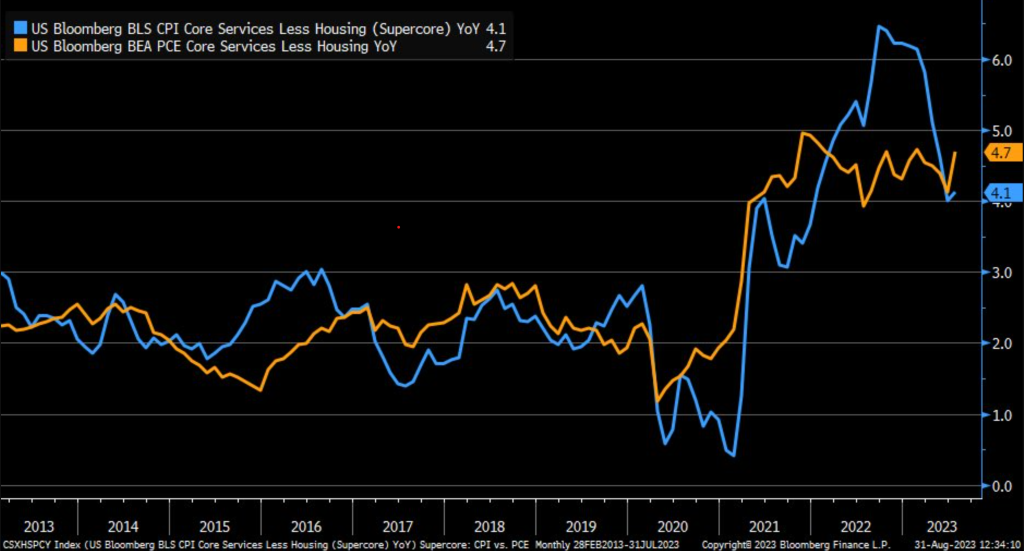

These are all leading indicators that show August and following into September prices ramping higher. A key metric followed by the Fed also showing the re-acceleration of inflation across the board. “Even though there are “supercore” versions of both CPI and PCE, former’s year/year rate (blue) move up only slightly in July to +4.1%, while latter’s (orange) jumped more to +4.7% (back where it was in February).”

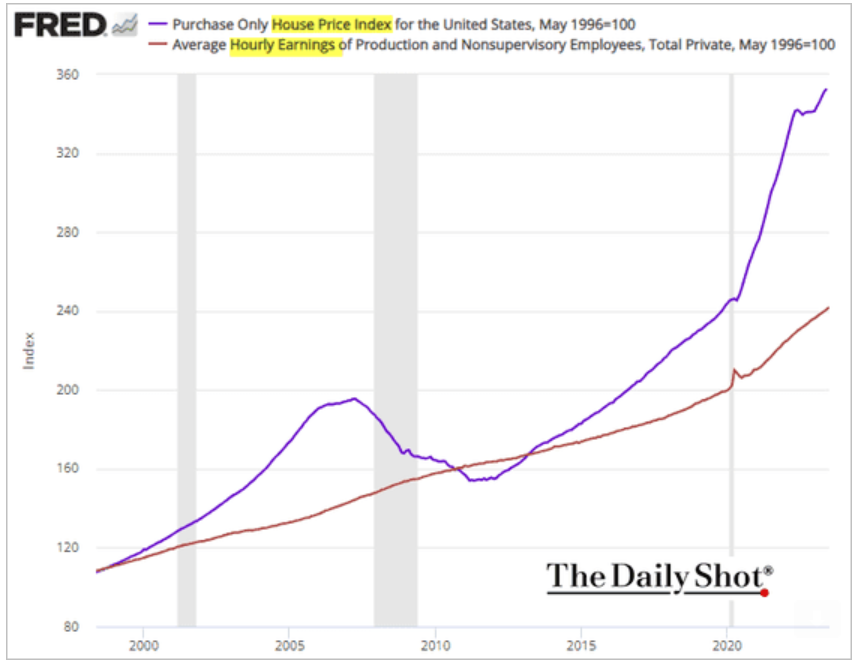

I think this is really important because it highlights the “stickiness” of inflation, and one of many reasons the Fed is stuck with higher rates for much longer than what the market expects. Price increases are being driven by wages and stickier components versus the view of supply chain disruptions. Supply chains ABSOLUTELY played a part, but it was only a piece of the problem and no where near the whole thing. The re-acceleration of home prices and wages will keep the Fed raising rates (one more time at least) with “higher for longer” firmly intact.

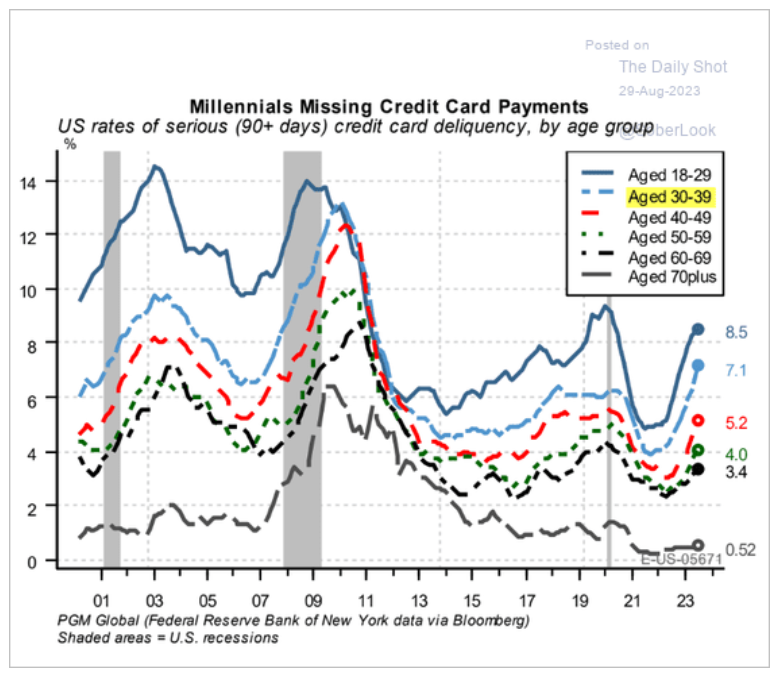

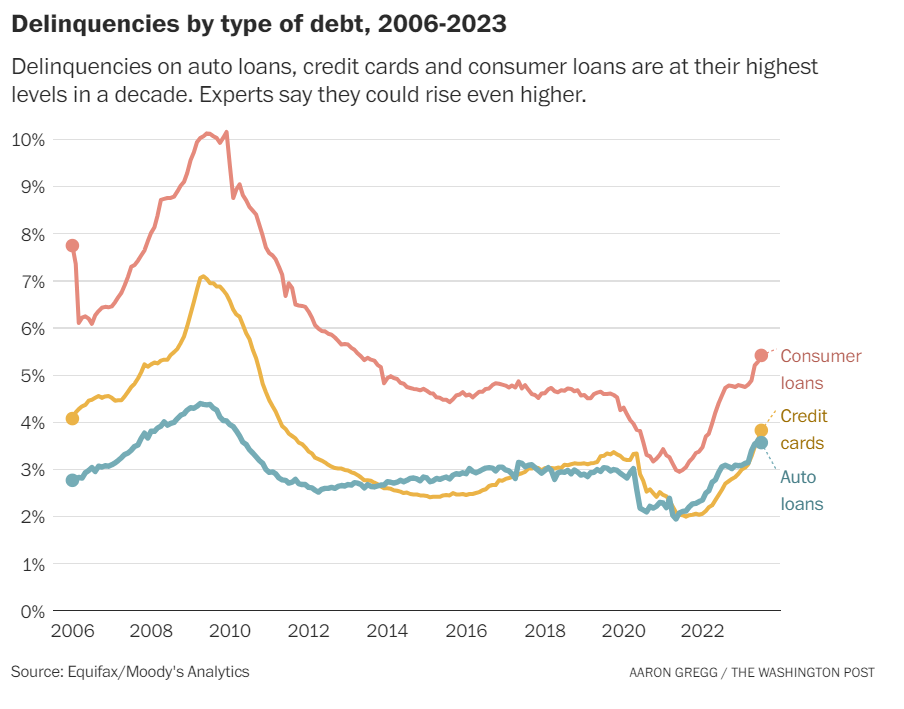

Wages are starting to rollover, but it will take time for this to filter down through the companies. Credit card and delinquency pressure continues to surge higher, and we don’t see that abating any time soon. Visa and Mastercard announced increases to their fees, and it will put another layer of pressure on the consumer that is already drained.

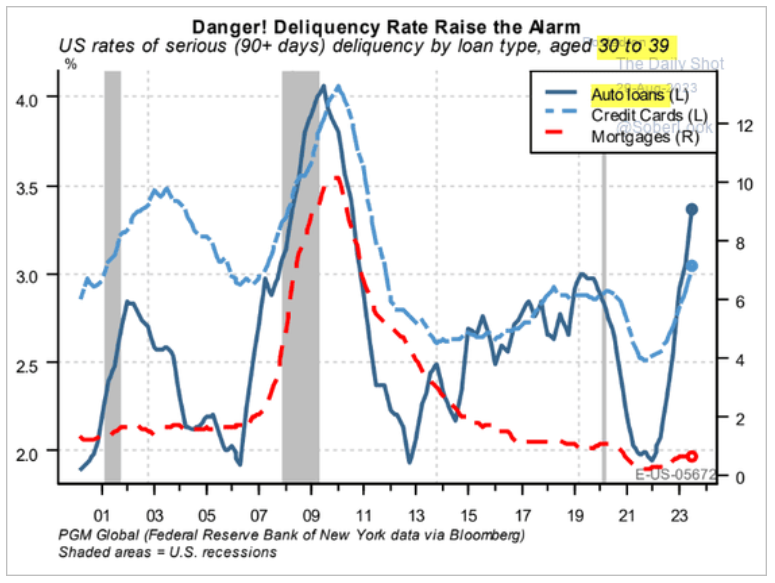

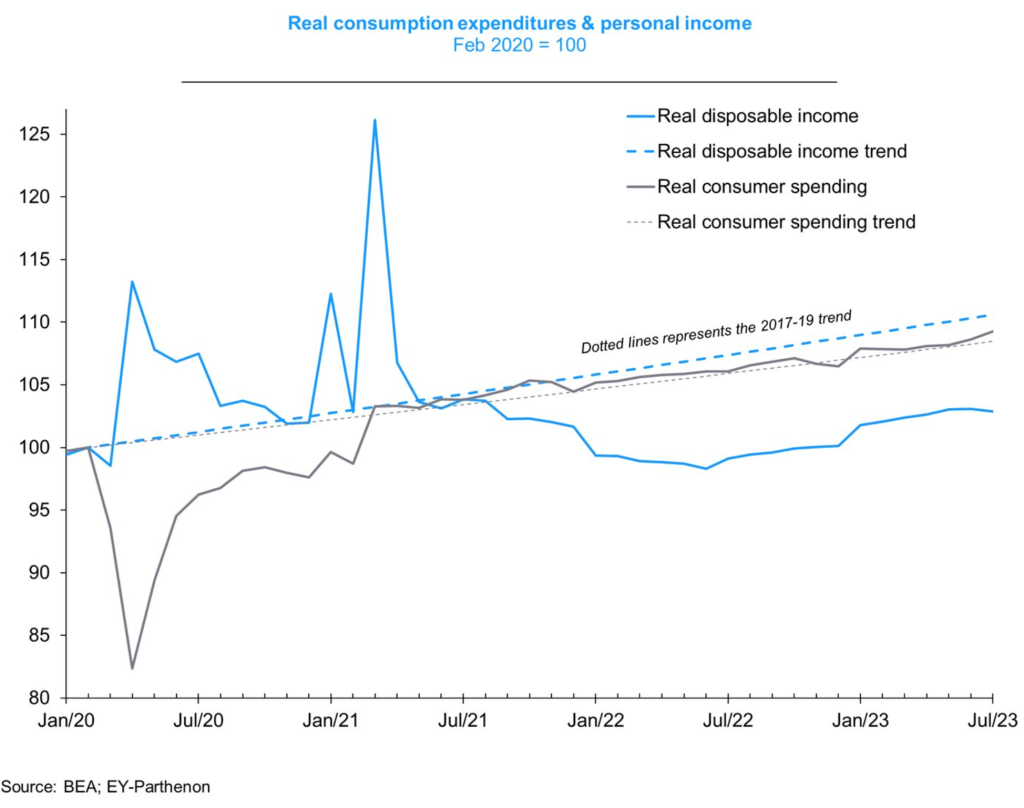

Historically, auto loan delinquency leads credit cards, and you can see how quickly things are running up at an alarming rate. This is why when you look at the “internals” of spending, the problems are becoming more pronounced. The biggest concern is in the inflation adjustments that have seen a big decline in disposable income. Wages have been well below inflation over the last 28 months and just eeked out positive in July, which will reverse in August. But, it’s now fully present in disposable income, and will drive down the savings rate faster.

Spending +0.8% in July

Inflation-adj +0.6%

Disposable income +0%

Inflation-adj -0.2% first decline in 13months)

Savings rate 3.5% (-0.8pt not sustainable

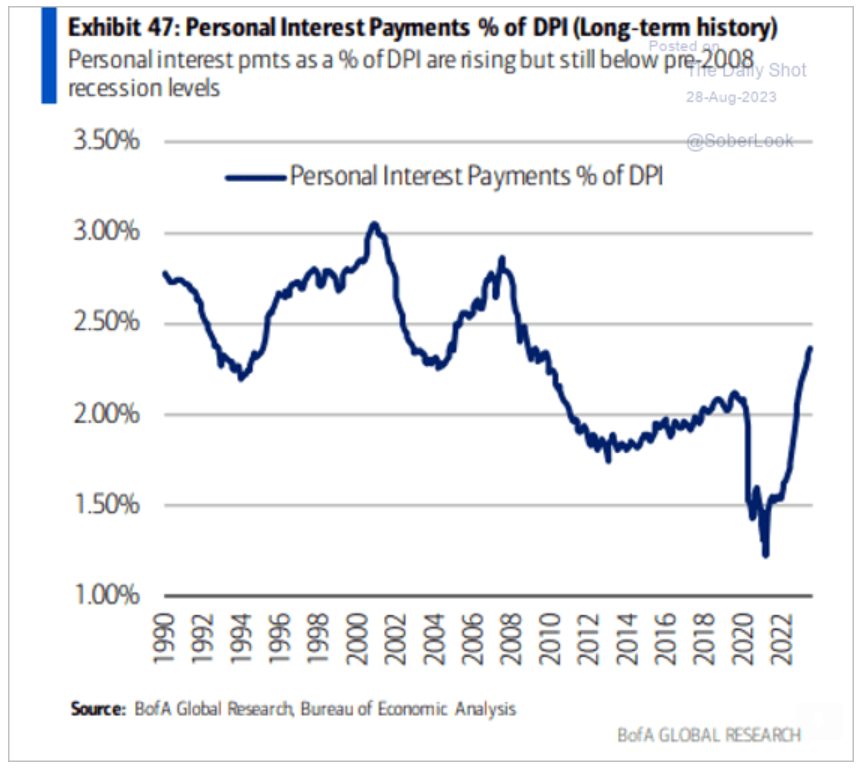

The consumer risks are also becoming more and more prevalent in the “Personal Interest Payment” metric.

The pain on Personal Interest payments is being driven by Credit Cards but also Consumer loans. We only see the problems worsening as the missed interest payments only compound on top of the principal.

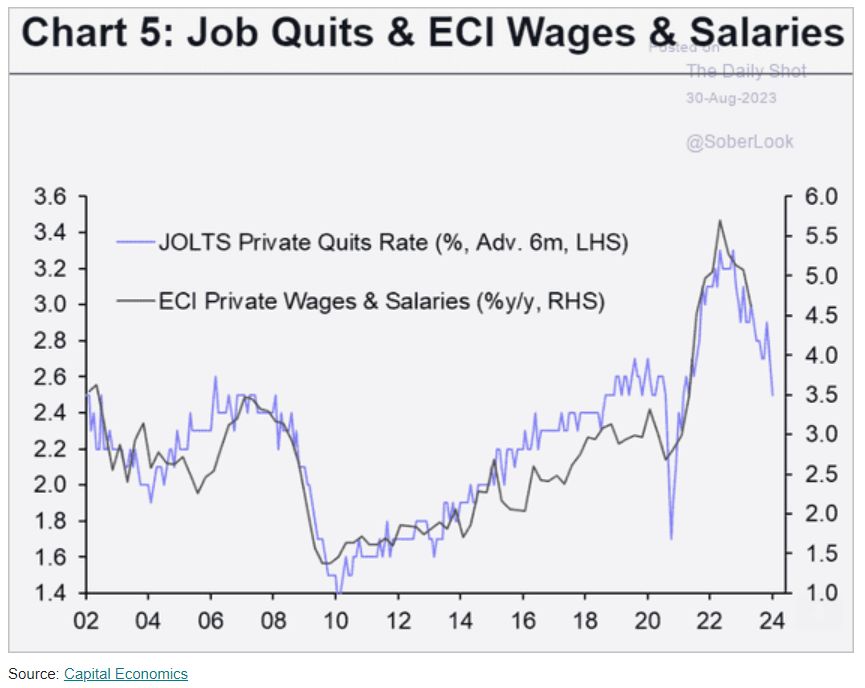

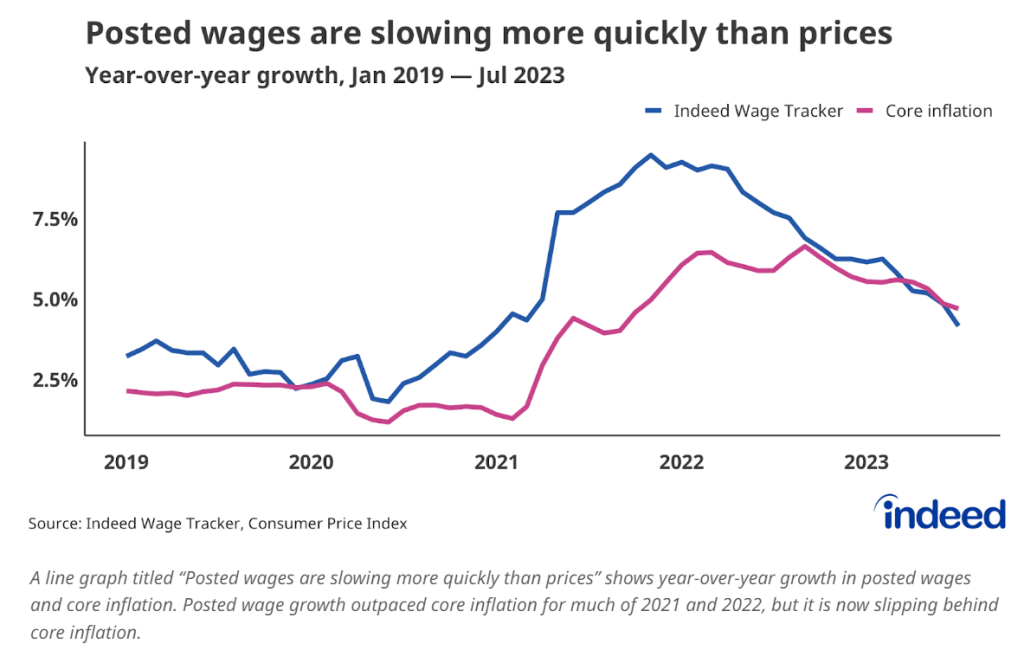

Wages are expected to roll, but they have still remained sticky to date. We do expect to see some weakness, but it won’t be as quickly as the Fed would like and keep them “Fearful” of a wage price spiral.

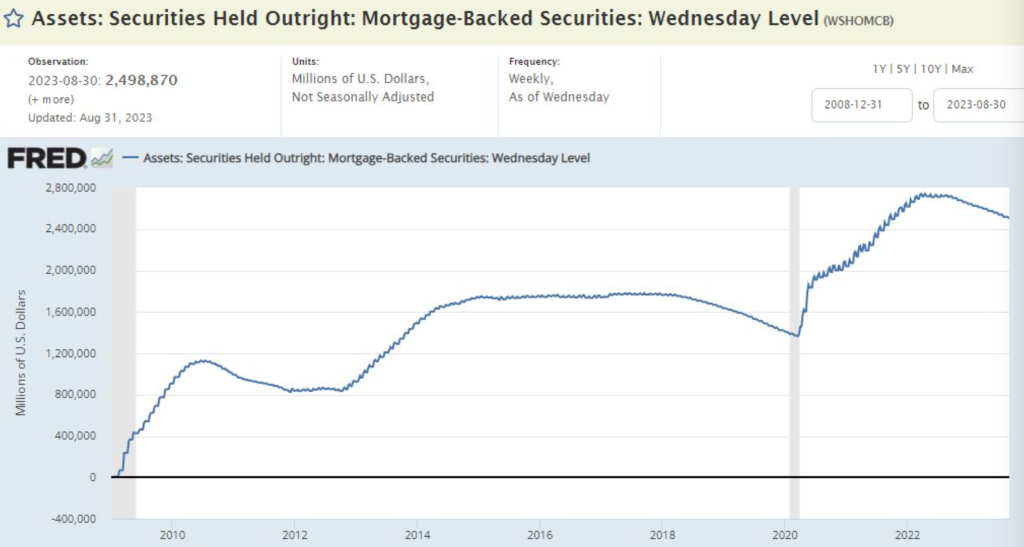

I think this chart does a great job highlighting how home prices have re-accelerated and will pull it higher. We believe that the Fed is going to get more aggressive on bringing down home prices, and the “Fastest” way to do that is by dumping MBS back into the market.

Here are some key metrics left:

“Since the Fed’s peak (so far) holdings of MBS hit $2.74T in April 2022, they’ve “run off” $242B, about 8%, over 16 months. In just TWO months in 2020 they monetized $500B. At that time, Case-Shiller home prices were up near 5% YOY, on their way to 22%. They owned $0 MBS in 2008.”

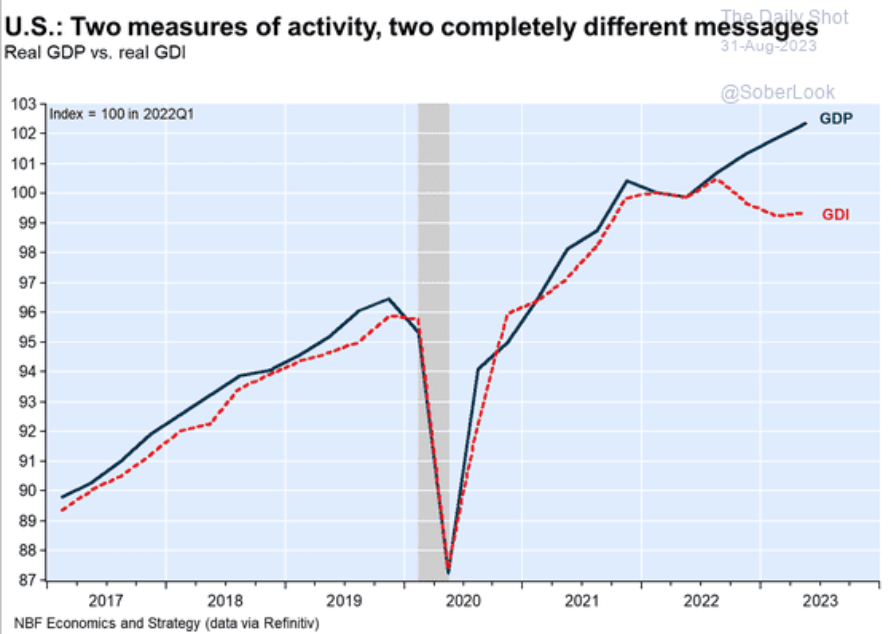

The mixed issues in the market- I think are covered beautifully when you look at GDI vs GDP. This is the slow stagnation that we have been highlighting over the last few quarters, and it will pull down GDP.

The income levels will continue to diminish when you look at wages falling beneath core inflation.

If wages keep this track- which we believe will be lower but at a very gradual pace- inflation is positioned to remain higher.

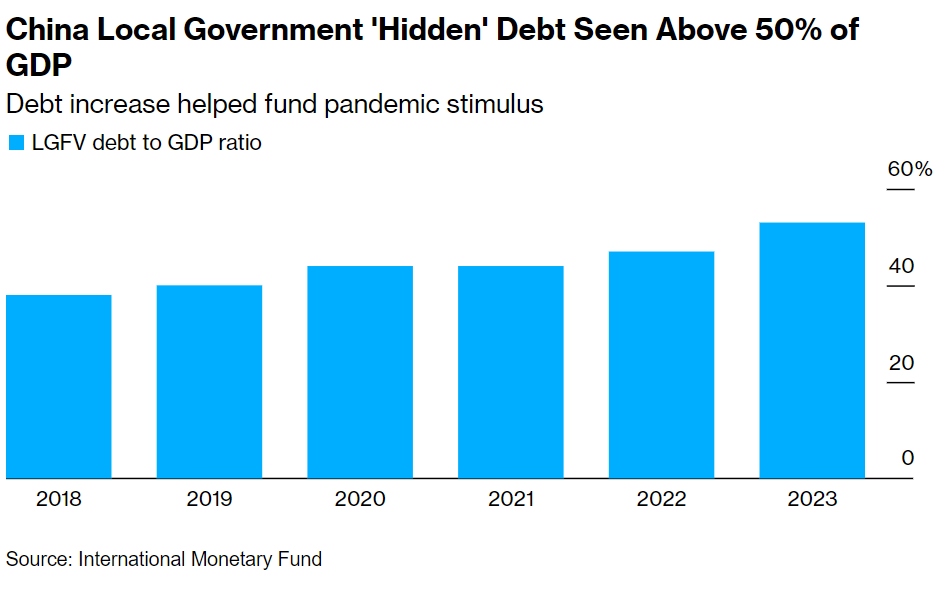

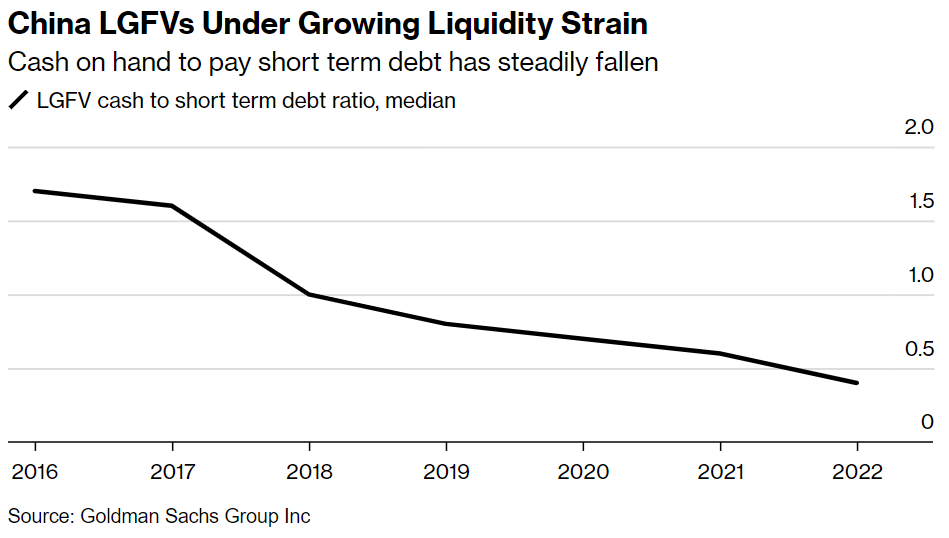

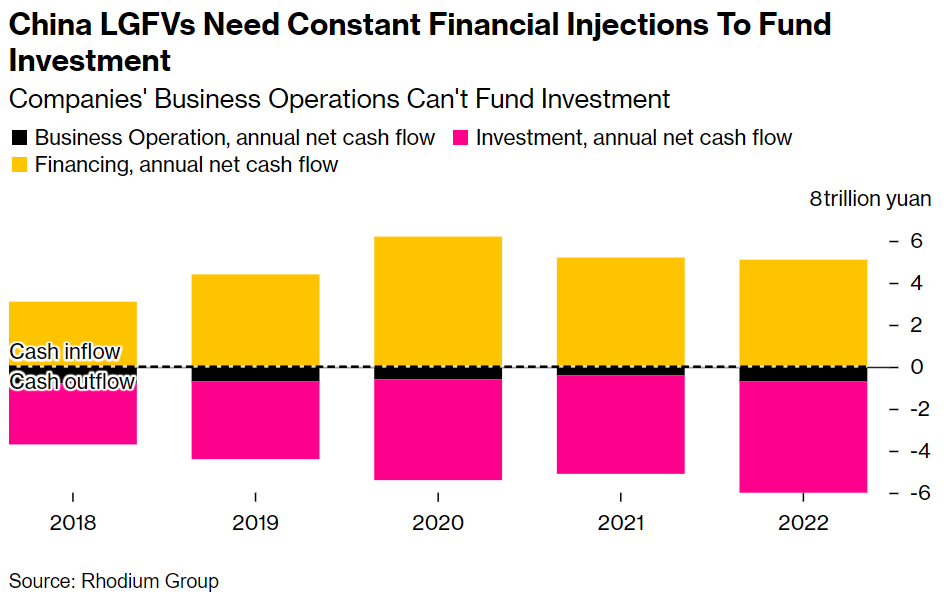

Just to touch on China before the long weekend- Local hidden debt is adding more stress to an already problematic situation.

Especially as they fall well below coverage rations:

And post negative multiplier effects, which will drain resources even faster.

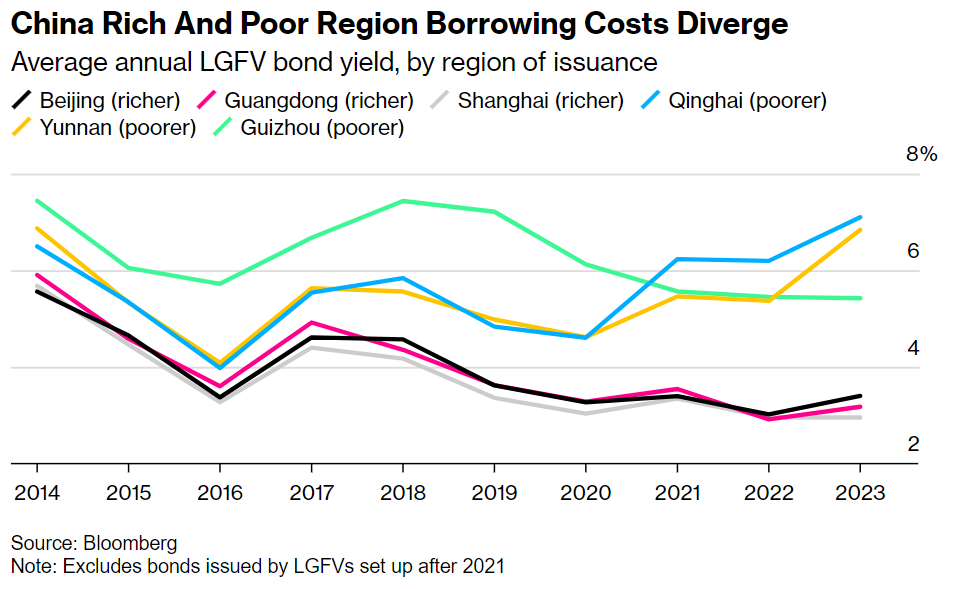

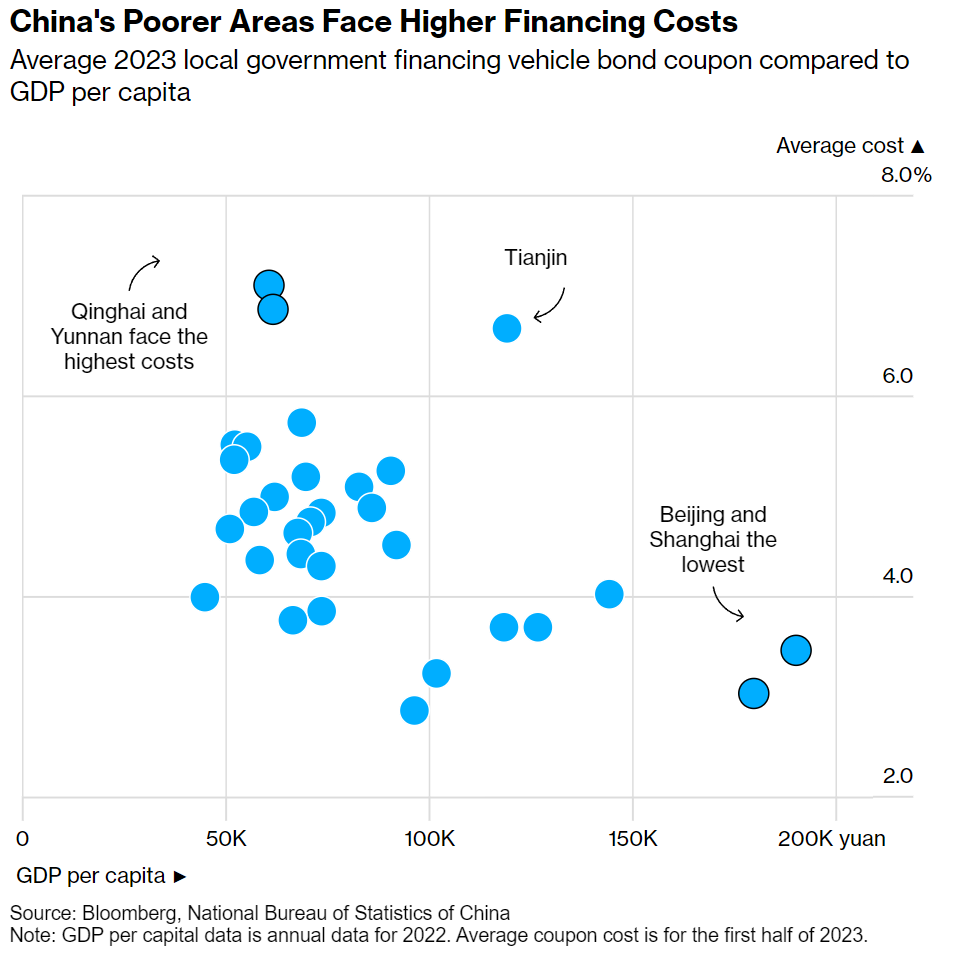

There is also a bifurcation in the market between Rich and Poor provinces.

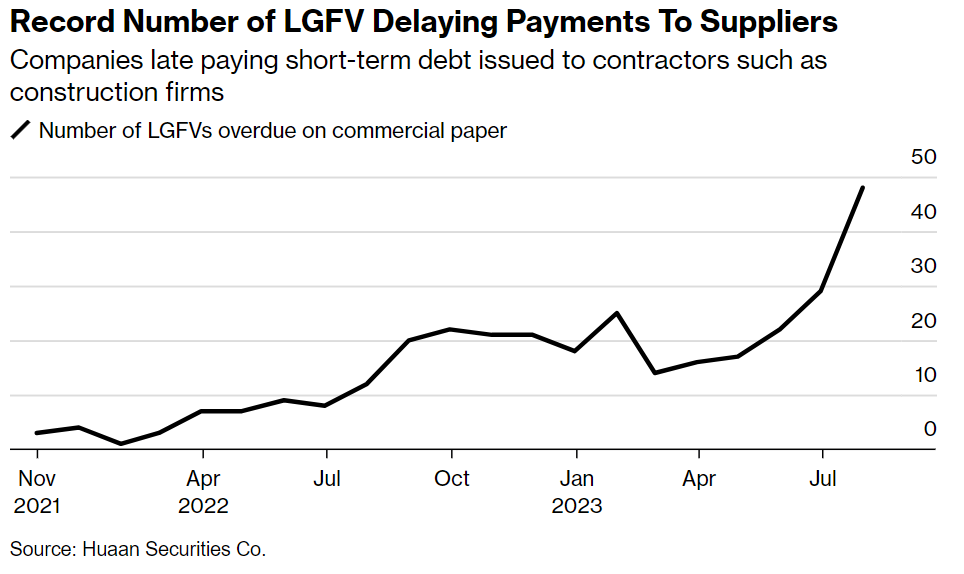

This is causing a RECORD amount of delayed payments,

The problems will persist as housing shows no sign of improvement:

There is just NO DEMAND FOR DEBT so even the reduction in rates won’t shift the market:

“China allowed large cities to cut down payments for homebuyers and encouraged lenders to lower rates on existing mortgages in its latest attempts to halt a slide in the country’s residential property market.

The nationwide minimum down payment will be 20% for first-time buyers and 30% for second-time purchasers, according to a joint statement from the People’s Bank of China and National Administration of Financial Regulation on Thursday. The mortgage-rate cuts will be negotiated between banks and customers. Both policies go into effect Sept. 25.

China is accelerating efforts to reverse a real estate downturn that’s threatening to derail growth in the world’s second-largest economy and roil markets. Home sales slumped for a third straight month in August, and one of the country’s biggest developers is on the brink of default.

Beijing is betting that lower mortgage rates and down payments will revive demand for homes. Down payments vary by city, but can be as high as 80% for a second-time buyer in the capital. More than a dozen larger cities in China currently set the minimum on new homes at 30% or higher, according to Huatai Securities.

Falling sales have led to mounting financial distress, with giant developer Country Garden Holdings Co. this week posting a record first-half loss of almost $7 billion and warning of possible default. Moody’s Investors Service downgraded the embattled developer three notches Thursday, to Ca. A group of creditors meanwhile is seeking to declare a default on a yuan bond, a fresh complication for a company whose liquidity crisis has shaken the nation’s financial markets.”

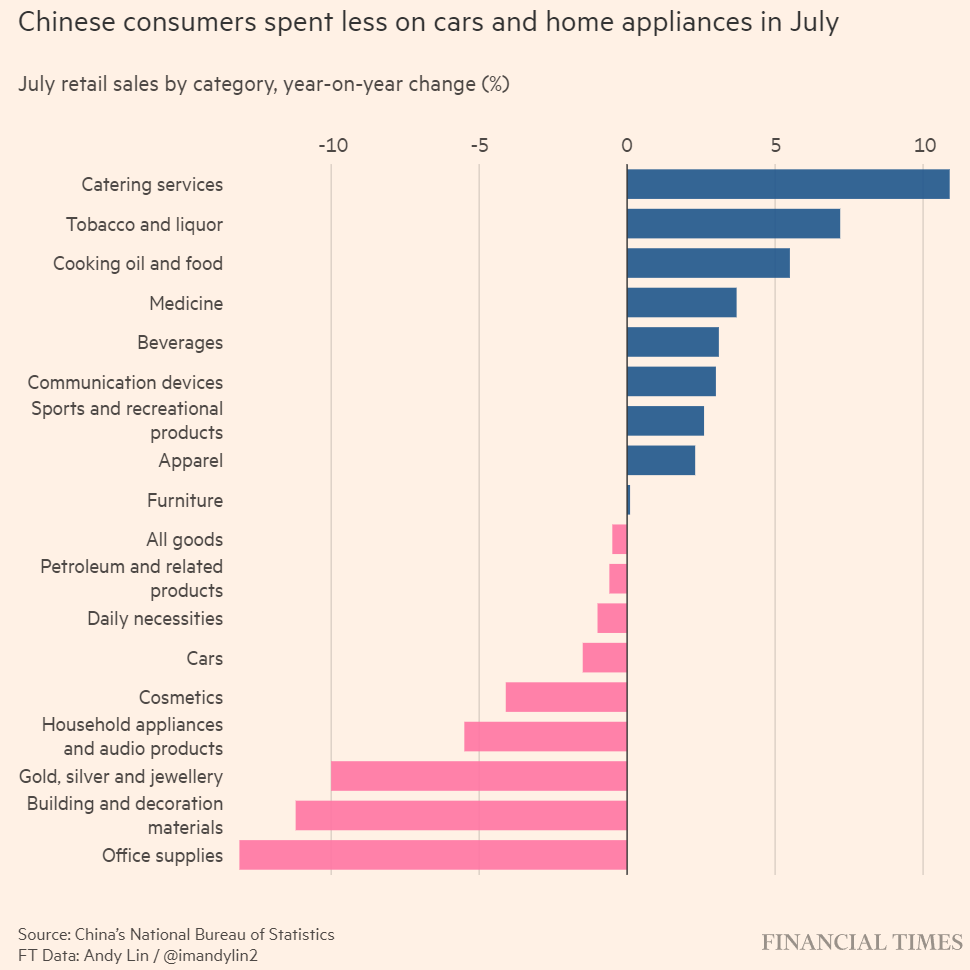

Consumers will continue to spend less:

I leave you with a great summary of the trade pressure in China with little change to the better- especially as trade diminishes faster:

The claim that”Tariffs are good” or “Tariffs are bad” is ideology, not economics. What should matter instead to economists are the conditions under which tariffs can boost or restrain productive growth within the economy.

When tariffs simply interfere with the efficient distribution of production, they can indeed reduce global productivity. But when they are designed mainly to reverse mercantilist policies abroad that repress demand, they can boost total productivity and growth.

In a well-functioning trade environment, the purpose of exports is to increase imports, in which case free trade tends to shift production to where it is most productive, and countries will not run large persistent trade surpluses or deficits.

But in a world of huge, persistent imbalances, policies in countries that achieve “competitiveness” through measures that subsidize domestic production at the expense of domestic demand, more exports result in trade surpluses rather than in more imports.

These measures can include direct subsidies as well indirect ones, such as undervalued currencies, repressed interest rates, “window guidance” for credit allocation, repressed labor rights, and overspending on business-related infrastructure.

In that case the main purpose of trade in surplus countries is to allow them to externalize the cost of weak domestic demand by exporting more than they can import.

But they are able to do so only to the extent that the deficit countries are willing to absorb this demand repression through higher higher investment, if they are developing countries, or higher unemployment or, more likely, higher debt, if they are not.

That is why if the purpose of tariffs and other trade and industrial policies is to protect an economy from having to absorb this repression of demand, they boost total production by forcing the surplus countries to reverse their own demand-suppressing policies.

The fact that advanced and developing economies run very large, persistent trade surpluses, balanced by trade deficits mainly in advanced economies, is prima facie evidence that global trade is demand-suppressing rather than productivity-enhancing.