Frac’ing Outlook

We discussed our initial thoughts about Patterson-UTI Energy’s (PTEN) Q1 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. In Q2, the company witnessed plenty of white spaces in its fracking calendar and utilized 11 compared to 12 frac spreads in the previous quarter.

However, the share of dedicated work is increasing. If the momentum keeps up, it may revert back to utilizing 12 frac spreads in Q4. During Q3, the cost of operating the frac spreads may increase, and the operating margin may fall. Because energy prices appear to be strengthening, the fracturing schedule can get busier by the end of 2023.

Rigs Versus Fracs

By June, PTEN’s management believes that the frac spread count’s decline has outpaced the rig count fall and has already reached a trough. Rig count, on the other hand, can fall further from the current level. By 2024, the US rig and frac spread count will likely recover as energy operators increase drilling and completion activity. The recovery will affect the natural gas-heavy basins more, which can lead to a sharp rise in LNG export in 2025.

NEX Merger

PTEN, following the pending NEX merger in Q4, will strengthen its position as a key provider of drilling and completion services in the US. Apart from the upcoming NEX merger, PTEN has recently acquired Ulterra, which provides PDC drill bit. The acquisition has broadened its geographic footprint in the Middle East.

PTEN’s Drilling Outlook

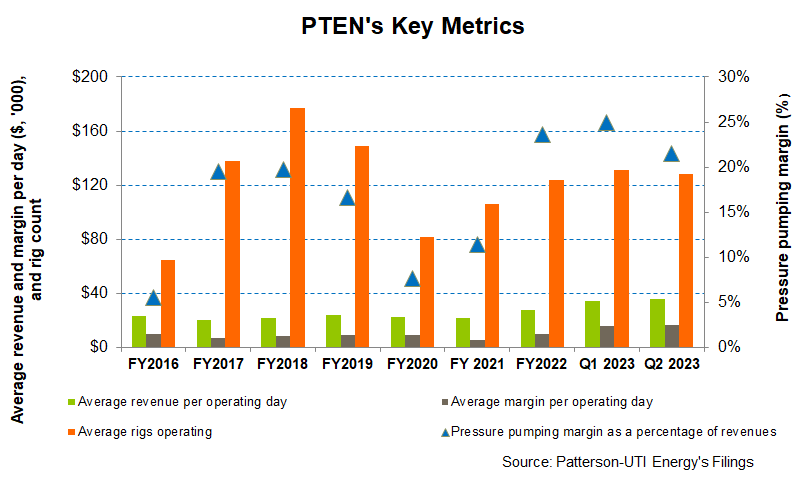

The recent strength in oil prices may positively impact drilling activity. PTEN recently renewed contracts for average revenue for the super-spec rigs in the “low to mid-30s” (‘000). It expects ~71 rigs operating under term contracts in Q3 and 44 rigs in Q2 2024. Its average rig count will be 119 in Q3, or an estimated loss of nine rigs from Q2. In pressure pumping, it has accelerated the conversion to Tier-4 dual fuel. After the process is complete, ten of its 12 spreads will be dual-fuel capable. This will include four Tier-4 dual fuel spreads.

The average revenue per operating day can remain nearly unchanged, while operating costs per day can increase marginally. The higher operating costs are associated with the number of rigs stacked in Q2. You may read more about the company in our article here.

Analyzing The Q2 Drivers

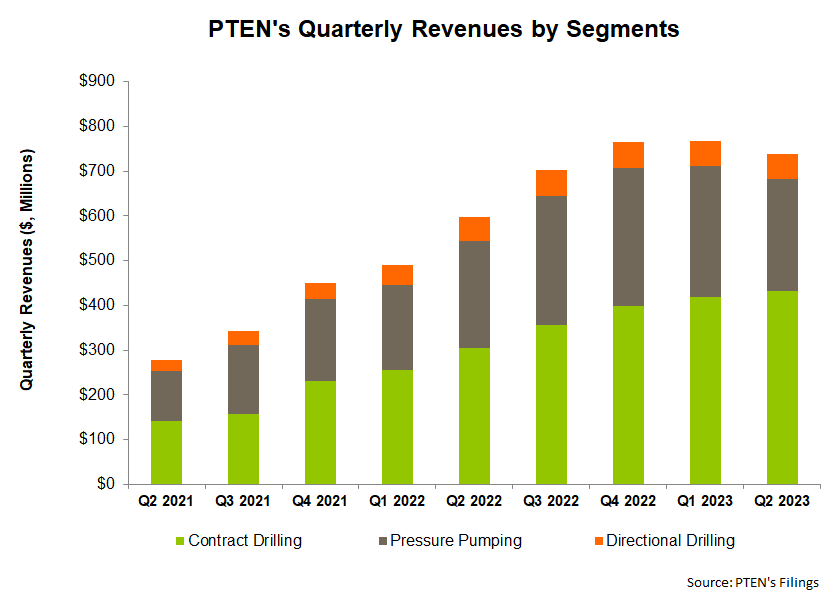

As discussed in our short article, PTEN’s revenues in the Contract Drilling segment increased (by 3%) in Q2 2023, while its revenues from the Pressure Pumping declined steeply (15% down). Revenues from Directional Drilling segments also decreased. The average adjusted rig margin per day in the US increased by 6% in Q2. On June 30, 2023, its term contracts for drilling rigs in the US provided $7600 million of future day rate drilling revenue, up from $890 million a quarter ago.

Capex And Leverage

In Q2, PTEN revised its FY2023 capex guidance to $485 million. But it would still be 18% higher than FY2022. Contract drilling investment would cost ~$280 million, or 57% of its FY2023 capex budget. Its cash flow from operations increased by 3.7x in 1H 2023 compared to a year ago, leading to a positive and healthy free cash flow from a negative FCF a year ago.

PTEN’s liquidity was $750 million as of June 30, 2023 (excluding working capital). Its debt-to-equity (0.50x) is much lower than its competitors (NBR, HP, and LBRT). In Q2, it repurchased 1.8 million shares. So, share repurchase plus dividends resulted in shareholder returns of $126 million in 1H 2023. It targets a return of 50% of free cash flow to shareholders. As of June, $281 million remains under the share repurchase authorization. However, the program is limited by the pending merger with NEX.

Relative Valuation

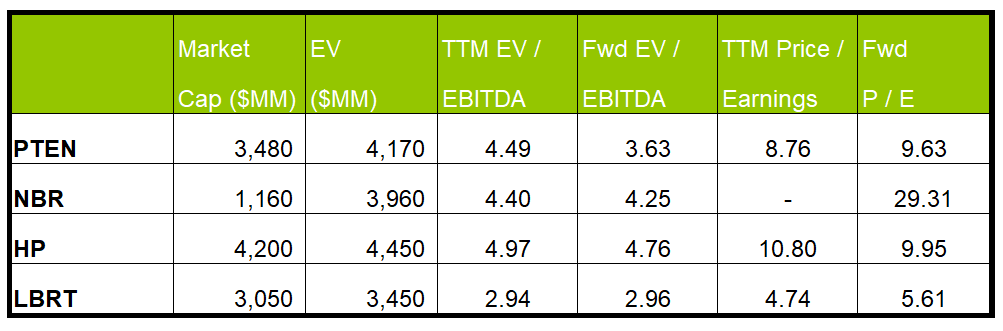

PTEN is currently trading at an EV/EBITDA multiple of 4.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.6x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 8.6x.

PTEN’s forward EV/EBITDA multiple is expected to contract versus the current EV/EBITDA. This rate of contraction is steeper than its peers because the company’s EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple. The stock’s EV/EBITDA multiple is marginally higher than its peers’ (NBR, HP, and LBRT) average. So, the stock is reasonably valued, with a positive bias, versus its peers.

Final Commentary

In Q2, PTEN utilized 11 compared to 12 frac spreads in the previous quarter due to increased white spaces in its fracking calendar. As completion activity slowed, it concentrated on expanding the share of highly efficient ESG-compliant pumps. So, it has accelerated the conversion from diesel to Tier-4 dual fuel pumps. It believes frac spread may have reached a trough, while rig count can fall further from the current level. By 2024, the US rig and frac spread count will likely recover as energy operators increase drilling and completion activity.

Investors may note that the pending merger with NEX can significantly change its performance in the coming years. On top of that, PTEN has recently acquired Ulterra. The acquisition has broadened its geographic footprint in the PDC drill bit business in the Middle East. The pending merger can also affect its ongoing share repurchase program. The stock appears to be reasonably valued versus its peers.