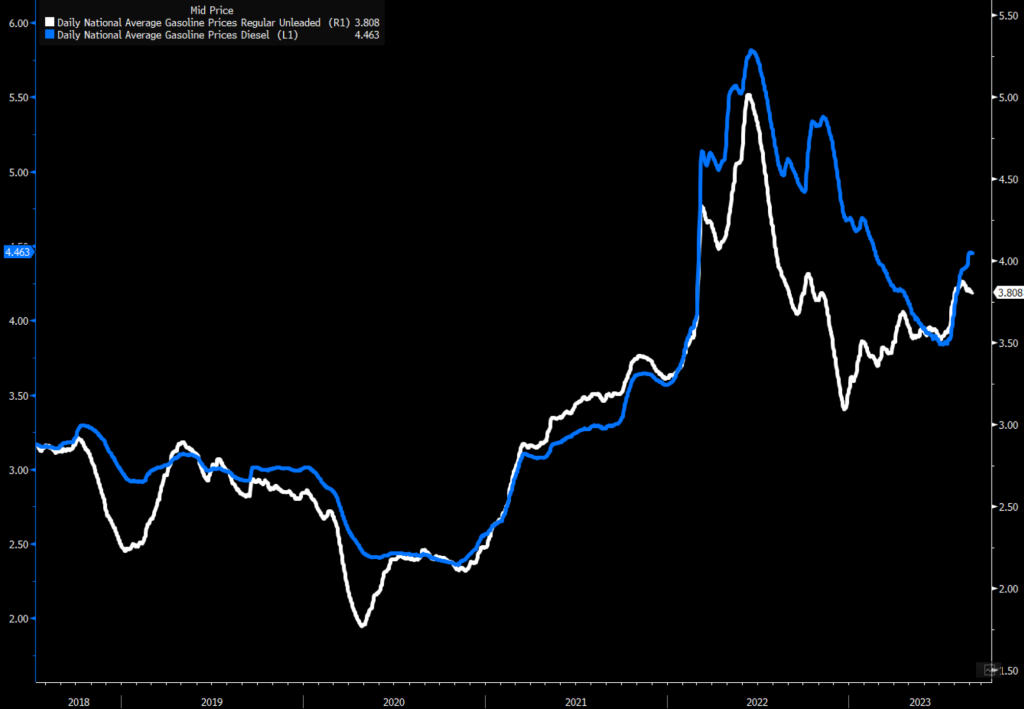

Saudi Arabia and Russia officially announced the extension of their cuts through the end of the year. This means KSA will maintain their 1M barrel a day cut while Russia keeps their 200k barrel a day reduction. The shift by KSA and Russia will keep the brent trading range between $88 and $96, but will likely settle closer to the $91-$92 level. When you look at the previous times in this area, above $92 the next point of resistance is $94 with $96 acting as a previous point of exhaustion. The move by KSA will keep the middle distillate barrels tight by keeping the medium/heavy crudes off the water. It will also support flows from the U.S. as we remain competitive into the European and Asian markets. These moves will keep prices elevated for consumers- especially diesel- which is a big problem as we head into the winter months. The below chart helps to show the level of pricing that remains for diesel and gasoline with the upward trend continuing on the diesel front.

The move by OPEC+ will provide a near term bump but will accelerate the pain for the consumer/industrial facility resulting in slowing demand at an accelerating pace. We are already heading into shoulder season, and the “reset” of crude prices higher will create another round of pain. It will also complicate inflation for central banks as the “easy comps” are falling away, so we will start to see some re-acceleration of “flexible” inflation on a year over year basis. The month over month move in prices has been relentless, and we will see the pace start to pick-up again. The “sticky” side of inflation has never really slowed down, and now it’s also picking up the pace- which is a much bigger issue for the Fed and other central banks.

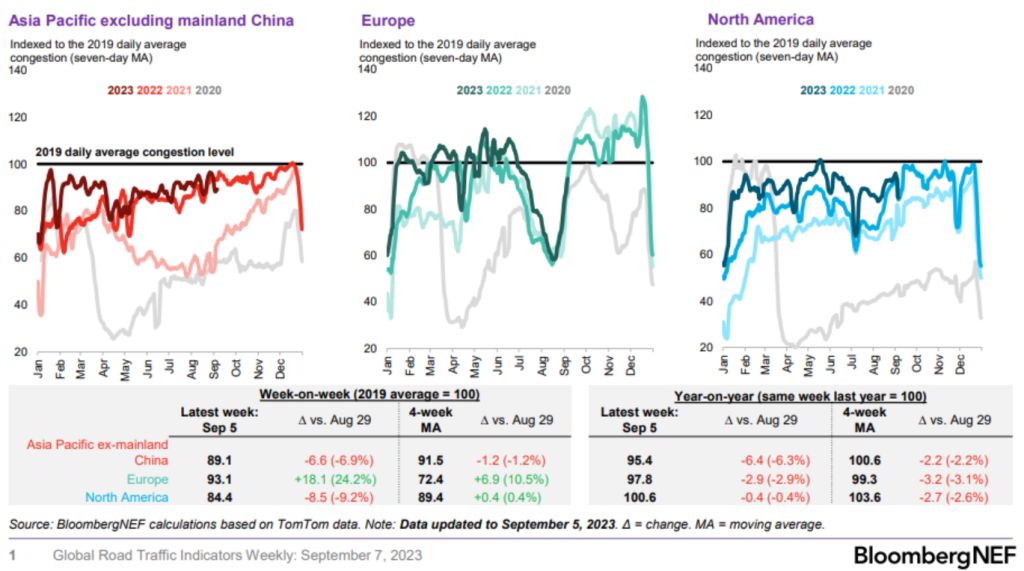

On a regional level, gasoline demand is following the previous seasonal trends in Europe and North America, while Asia is slowing against 2022 levels.

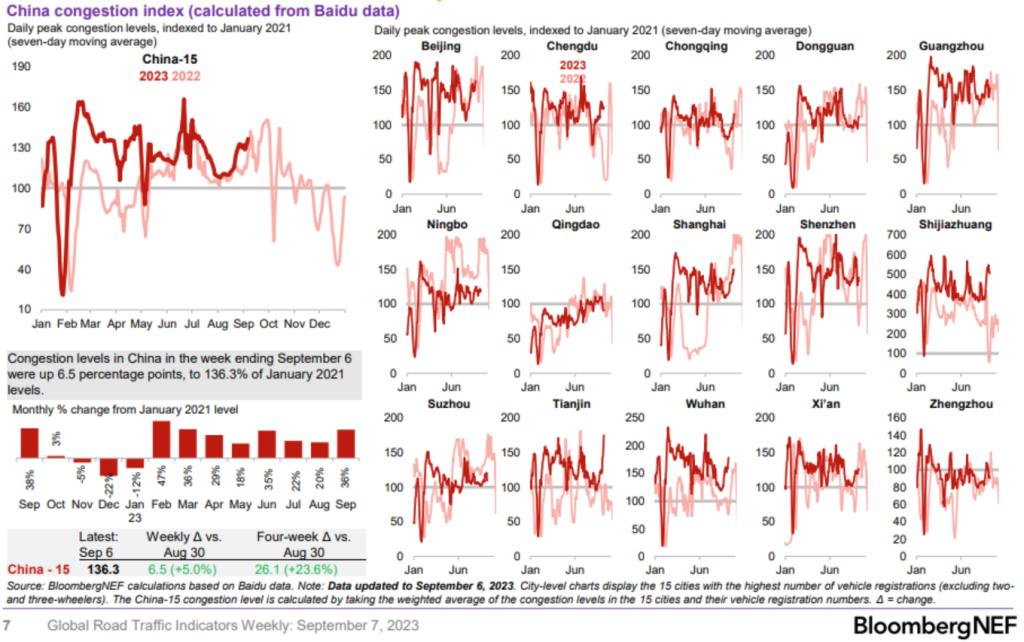

China is following similar trends from 2022, but we don’t see it moving much above last year. Even though last year was impacted by COVID, this year’s issues is more economic with a mixture of cyclical and structural challenges.

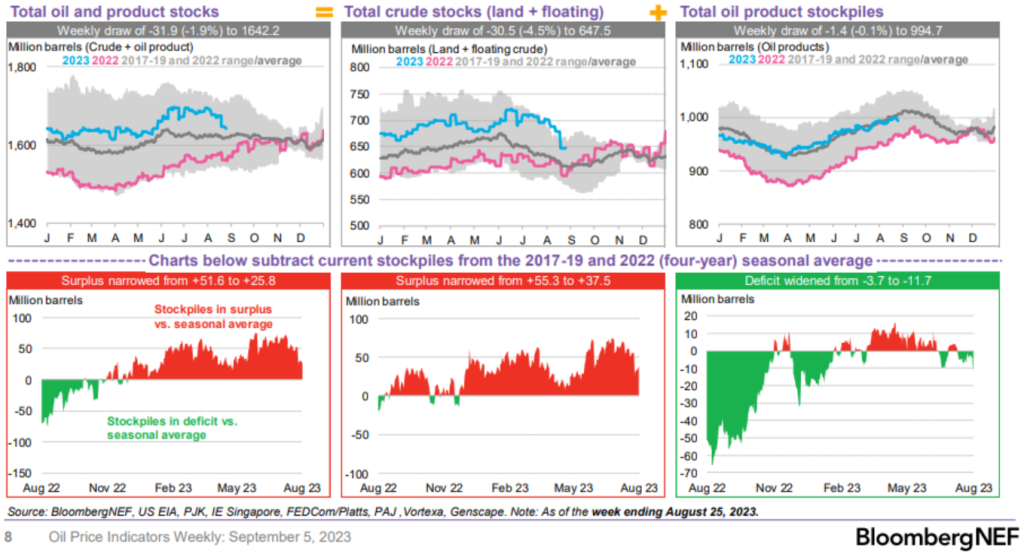

There have been some improvements on the storage situation as crude and refined products have seen reductions. Crude is still above the running 5 year average, while refined products hold closely to the current average levels. There are normally crude draws at this point of the year, but the bigger factor will be the pace of reduction- or rate of change. As you can see, the drops have been sizeable, and this will be a very important trend to track over the coming few weeks.

Crude stockpiles on land have drawn down faster- but there has been some sizeable increases in crude on the water. We see a nice adjustment on the local floating storage levels, but given the rise in “crude oil in transit” some of the reductions in floating storage is driven by cargoes going into motion.

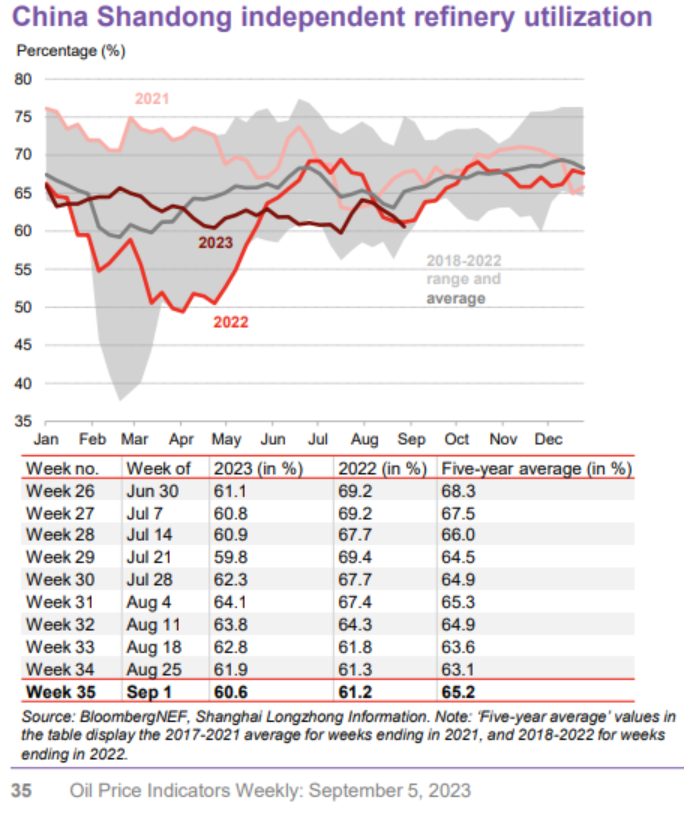

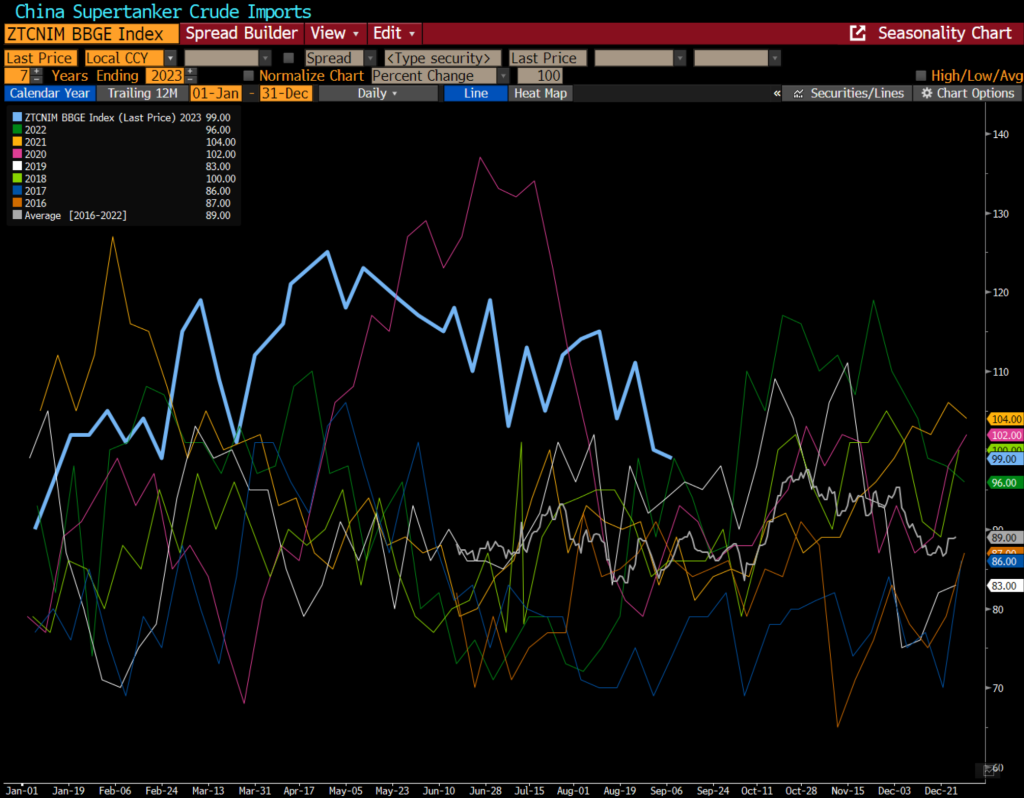

A key area to watch over the next few weeks will be China as refiners are slowing much faster than we initially expected. Our view was that China would ramp refining activity to fill local demand and export product to capture the healthy arbitrage. We believe China will continue to export, and the slowdown in refining activity is being driven by weak local demand.

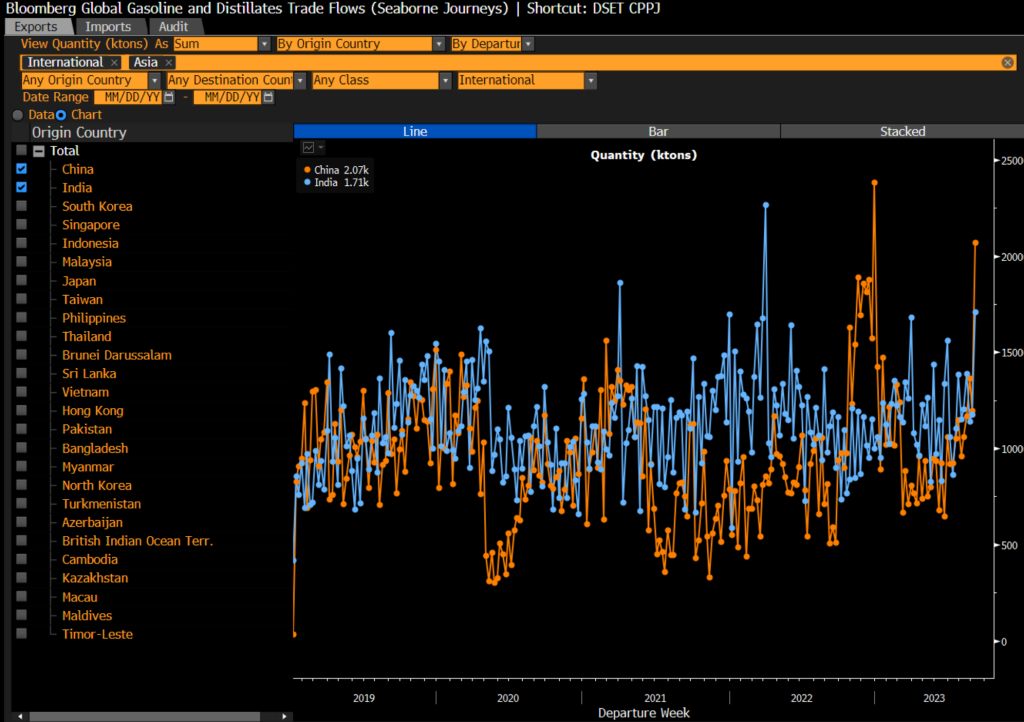

China is still sitting on a sizeable amount of crude in storage, so it will be important to see how they keep purchasing from WAF and Russia during this spike in crude pricing. There continues to be a sizeable amount of product being exported from China and India, which will show up in storage. “The Chinese government has issued 12 million mt (95 million barrels) in export quotas for clean oil products and 3 million mt for fuel oil in its third batch of allocations for 2023, enabling oil companies to implement their export plans for September. The allocation brought the quota volume for gasoline, gasoil and jet fuel exports to 39.99 million mt, up 7.4% from the overall quota allowance of 37.25 million mt for 2022.” These new export quotas will keep product moving from China, and there are some rumors another batch could be issued towards the end of the year. It will likely depend on what domestic demand looks like and how much product remains in storage.

“The domestic recovery is slower than expected, so it is possible for the government to issue more export quotas to spur GDP growth in the rest of 2023,” a refinery source said.”[1]

We expect exports to stay robust- especially as pricing remains so strong abroad for middle distillate.

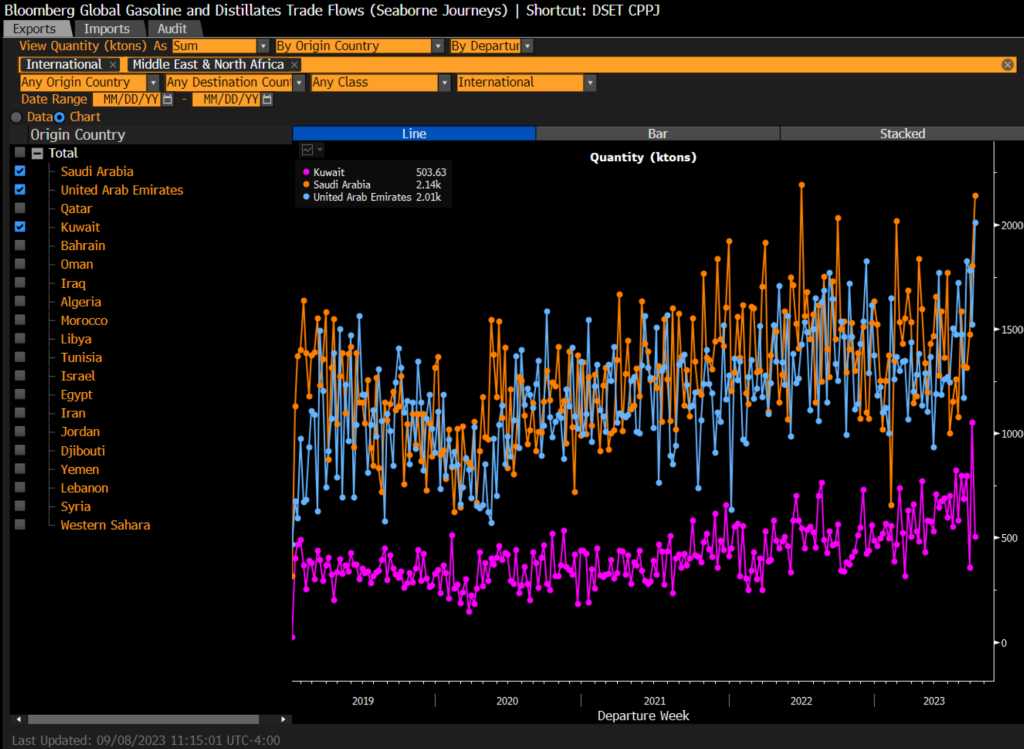

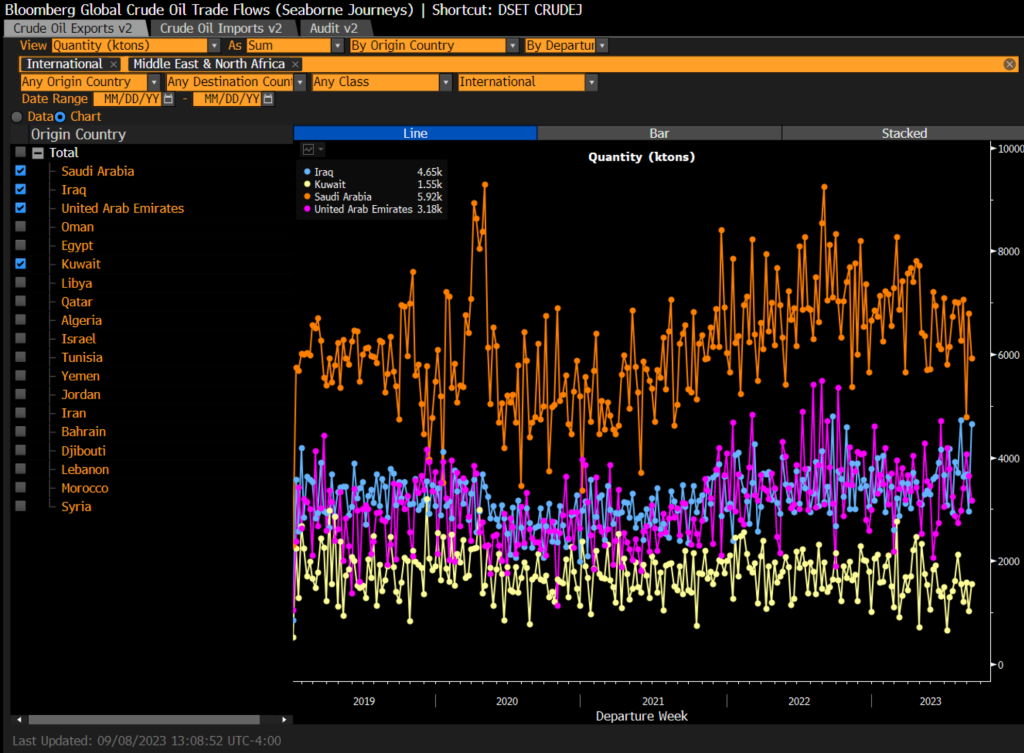

While KSA has cut crude exports, you can see there is still a sizeable amount of product currently being exported.

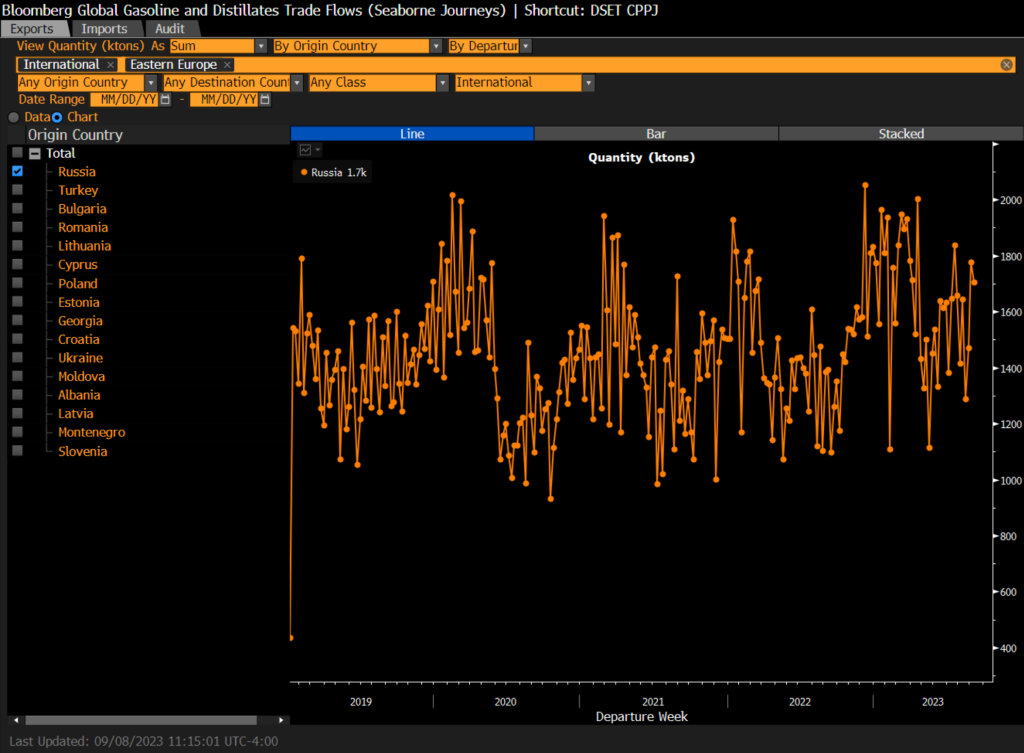

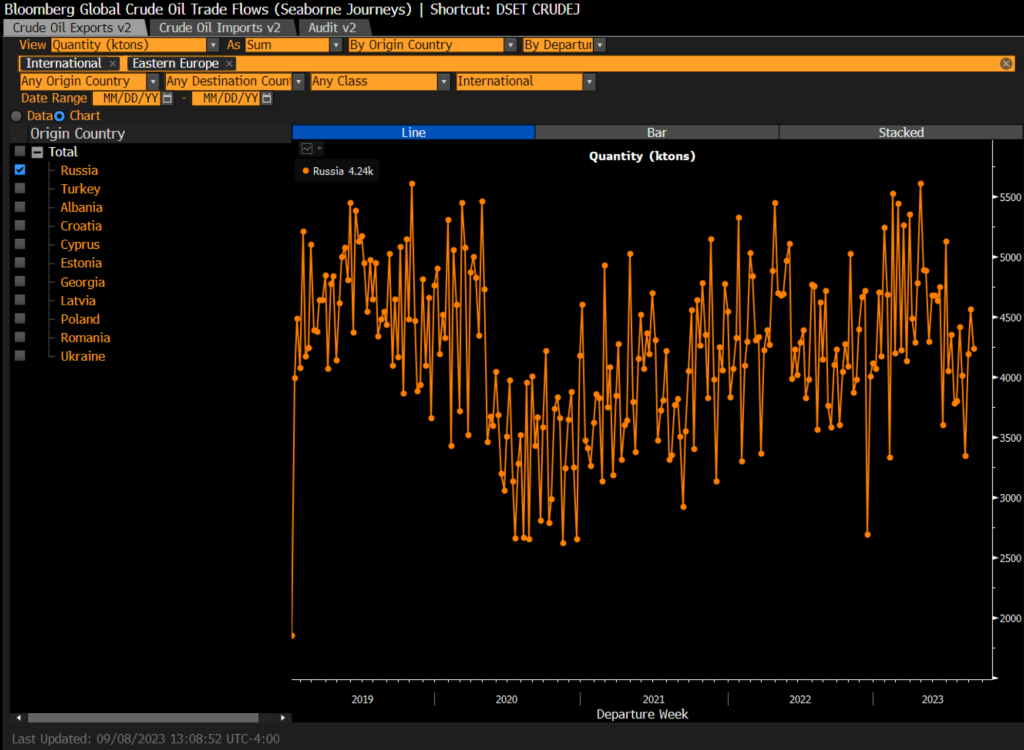

Russian refined product exports remain elevated, but they have announced some reductions coming up for maintenance. “Russia plans to reduce diesel exports from its key western ports by a quarter this month amid seasonal refinery maintenance and government efforts to keep more fuel at home to ease growth in domestic prices. Diesel loadings from Russian ports on the Black and Baltic Seas, including some batches from Belarus, are set at 1.874 million tons this month, down almost 25% from August’s plan, according to industry data seen by Bloomberg. That’s equivalent to 466,000 barrels a day, down from about 600,000 barrels a day from last month’s schedule, Bloomberg calculations show. It is also Russia’s lowest diesel-exports plan since May, when the nation’s refiners held their spring maintenance season, according to historic data.”

We will likely see some reductions, but given the current global pricing- we will likely see more flows from the country.

While KSA exports more product and less crude, Iraq is taking advantage of the situation by exporting more into the market. They can raise OSPs (lower than KSA), and given the demand for medium/heavy- they are benefiting in a big way.

China shifts will be important when we look at floating storage and crude on the water. There has been a sizeable stepdown in Chinese buying- BUT- it’s still very elevated from a seasonal standpoint. The trend remains lower, and we believe that China will continue to pull down more crude from storage and reduce their international buying. The discounts for Urals are not as attractive right now, and based on these Chinese shifts- Angola (and WAF in general) will be an important tell on how active China is over the next few weeks.

These shifts in the market are important to watch, because if China slows it would leave more crude in the water. I think this is a good summary of potential overhangs, and also supports why we think there is another quota if storage keeps building. The government wants flexibility in case there is a cold winter or other impacts, which is why they will wait before issuing that final piece.

Chinese refiners may have to cut 800k b/d of crude refining runs through the end of the year unless Beijing issues more export quotas for products, industry consultants ESAI Energy says in Sept. 8 note to clients.

- That cut would lower the nation’s processing rates to under 14m b/d, ensuring that the surplus in product stocks would match existing quotas; avoids a further build in diesel stocks

- Quotas are especially critical for diesel as China has amassed unsustainable levels of stocks in that product

- China will need to grant more export quotas to allow at least 260k b/d more diesel exports than ESAI’s estimates of 320,000 b/d under the existing quota allowances

- High diesel spreads in Singapore does provide a further incentive to issue more quotas, it adds

- China will need to grant more export quotas to allow at least 260k b/d more diesel exports than ESAI’s estimates of 320,000 b/d under the existing quota allowances

- If China does not cut throughput, then its oil imports should average 10.7m b/d for crude stocks to remain at current levels