Fracking Outlook

We have already discussed STEP Energy Services’ (STEP) Q2 2023 financial performance in our recent article. Here is an outline of its strategies and outlook. STEP is currently upgrading 16 US Tier 4 fracturing pumps to dual fuel capability. It has a fleet of 26 Tier 2 dual fuel pumps. On top of that, it can bring in additional deep-capacity coil tubing units. By the end of 2023, it plans to convert 17% of its Canadian and US fracturing capacity into Tier 4 dual-fuel engines. The dual fuel units burn cleaner natural gas and offer up to 85% diesel displacement rates.

In Canada, STEP faced challenges following the energy price volatility in 1H 2023. Due to the uncertainty, some of the company’s clients deferred project works into 2024. Its completion jobs also took a hit as one of the operators laid down drilling rigs. Despite that, its management remained optimistic and expected activity to remain resilient in Canada. Also, crude oil prices in the international markets have strengthened over the past few months. This can sustain a busier completion activity in Q3. As a result, the company’s new Tier 4 fracturing fleet, which will have a full-quarter operation in Q3, may yield profitability.

Current Strategy

In the US, STEP actively pursued a policy of maximizing fracking utilization by sacrificing pricing gains. A relatively sedate completion activity schedule in the US prompted this. The US drilling rigs dropped by ~15% in Q2. So, STEP may continue to re-align its asset utilization as dictated by the industry in Q3 and Q4. In 2024, however, the management expects the outlook to be “constructive” when the natural gas price stabilizes. Coiled tubing, STEP’s other core activity, saw activity plateauing in Q2. In 2H 2023, coiled tubing operations can improve.

Medium-term Outlook

In Canada, LNG completion activities are growing, which augurs well for STEP’s medium-term outlook. Shell will likely commission an LNG project in 2024 and start exporting in 2025. With Phase 2 of the project, the company will likely add 2 BCF/day to the Western Canadian takeaway capacity.

In the US, the Next Decades Rio Grande project is scheduled to start in Q3, adding 2.5 BCF/day of export capacity. The gas pipeline projects (from Haynesville to the Gulf Coast) will also get a boost following the capacity ramp-ups. According to the estimates, the US is projected to double its LNG export capacity by the next decade.

A Brief Performance Analysis

Our short article discussed STEP’s year-over-year topline decrease in Q2 2023 in Canada and the US. While natural disasters were primarily responsible for Canada’s poorer performance in Q2, a reduction in the posturing days and proppant pump also affected its result. In the US, its performance in coiled tubing was promising following the company’s diversification in the Northern and Southern US.

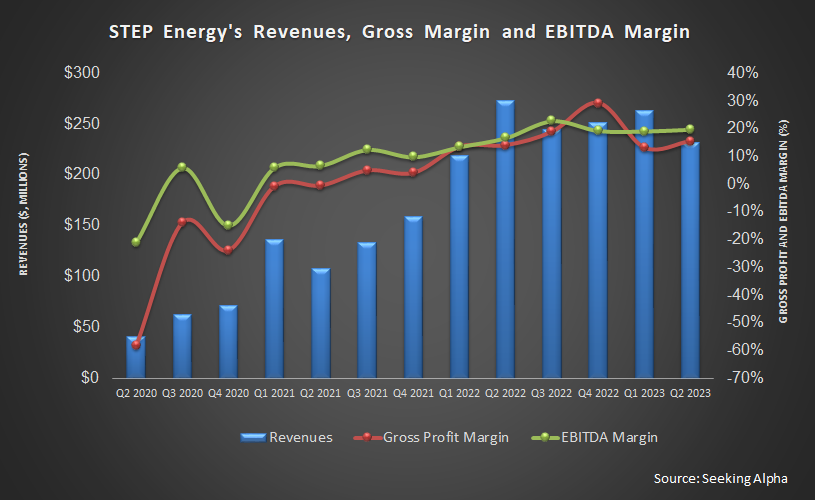

The number of fracturing days declined by 25% and 19% in Canada and US, respectively. The number of active coiled tubing units increased over the past year in Q2. The company’s gross margin and adjusted EBITDA margin from Q2 2022 to Q2 2023.

Cash Flows And Debt

STEP’s cash flow from operations increased steeply in 1H 2023, and FCF turned positive compared to a negative FCF a year ago. It has accelerated the build-up for more Tier 4 dual fuel pumps, which increased its FY2023 capex by $6 million. It reduced long-term debt by 16% in the first six months of 2023. As of June 30, 2023, STEP’s leverage (debt-to-equity) was 0.35x.

Relative Valuation

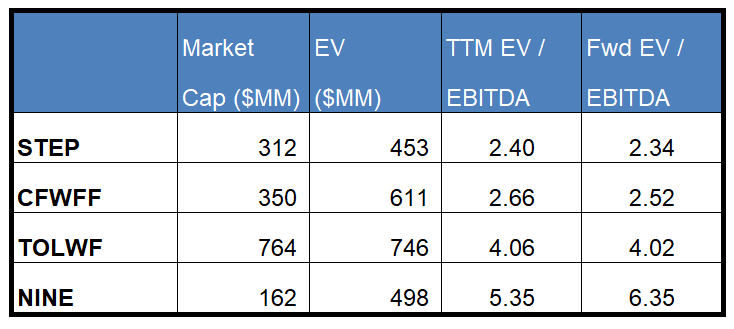

STEP is currently trading at an EV/EBITDA multiple of 2.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 2.3x.

STEP’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is in contrast to its peers because its EBITDA is expected to increase versus a fall in EBITDA for its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (CFWFF, TOLWF, and NINE) average. So, the stock is undervalued versus its peers.

Final Commentary

A relatively sedate completion activity schedule in the US prompted a policy of maximizing fracking utilization by sacrificing pricing gains. Due to the uncertainty, some of the company’s clients deferred project works into 2024. Because energy activity is constrained, it plans to upgrade its infrastructure to increase efficiency. By the end of 2023, it plans to convert 17% of its Canadian and US fracturing capacity into Tier 4 dual-fuel engines.

In the medium term, robust growth in LNG production and export opportunities in North America augurs well for STEP’s medium-term outlook. The company’s natural gas outlook is constructive for 2024. Its cash flows improved remarkably, and debts were reduced in 1H 2023. The stock is undervalued versus its peers.