We have been tracing and tracking the trajectory of global economy under the light of various indicators. however, in this article we will be looking at a wider, bigger-picture theme that will shape the future of many countries. Geopolitics seem to be gaining an extraordinary importance especially post Russia-Ukrainian war that bifurcated the world into two blocks. What are the repercussions of this geopolitical/ideological divide? This article explores it briefly.

In recent years, the term “geopolitics” has risen to prominence in corporate dialogue, being cited almost 12,000 times in 2023 by major global companies. The increased focus on geopolitics is evident in the shift of capital investments by Western multinational firms, which are now increasingly investing in nations that share similar geopolitical views.

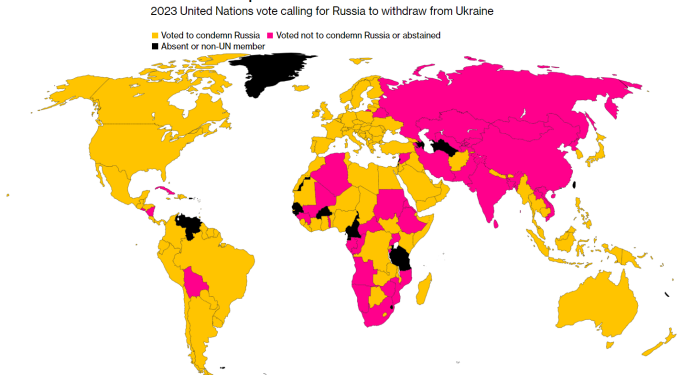

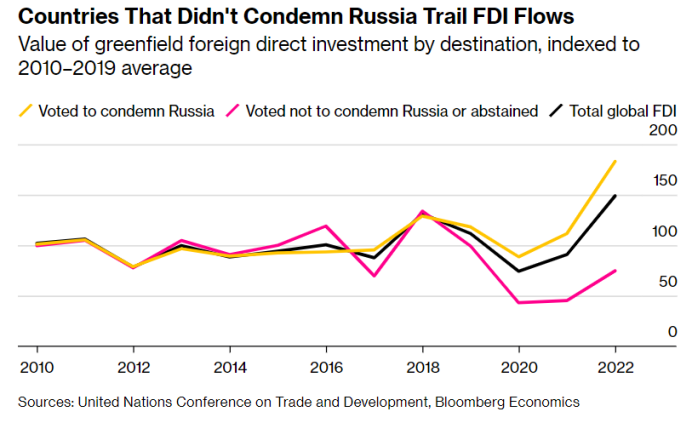

According to a Bloomberg Economics study using UN foreign-direct investment data, there’s a noticeable shift in greenfield investments (long-term investments in new facilities). Of the $1.2 trillion invested in 2022, nearly $180 billion was relocated based on the UN’s stance on Russia’s invasion of Ukraine. Such shifts underline a move towards a bifurcated global economy, reorganizing into separate but interlinked blocs that mirror UN voting patterns.

Several catalysts have sped up this shift:

- Governments, recovering from the pandemic, are emphasizing national interests and offering incentives to repatriate production.

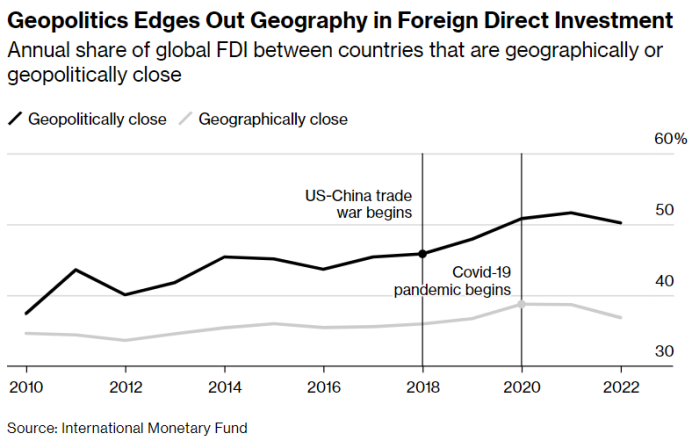

- The Russia-Ukraine crisis and the growing US-China rivalry challenge the post-Cold War era of flourishing globalization.

European Central Bank President Christine Lagarde and the IMF have both expressed concerns over this emerging “fragmentation” in global economics. The potential repercussions of a divided world could include a decrease of up to 7% in global output, equivalent to losing both the French and German economies.

Despite this division, the split isn’t even. Nations condemning Russia’s invasion represent over two-thirds of the global GDP. However, global trade remains resilient, showcasing the intricacy and adaptability of modern international relations. Both Western and Chinese firms are keen on establishing a presence in emerging economies, such as Vietnam and Mexico, that try to maintain a neutral stance.

The shift in global investment is apparent in the reduction of funds directed towards countries that did not condemn Russia. China’s share, for example, decreased from an average of 11% between 2010-2019 to less than 2% in 2022. Concurrently, nations like the US, Germany, Italy, and the UK have witnessed an uptick in foreign investments.

This evolution, while influenced by the current geopolitical climate, traces its roots back to initiatives prior to Trump’s presidency, such as China’s Belt and Road Initiative. The future landscape may deviate from the simple Cold War analogy, as many nations resist the pull to align exclusively with one bloc.

Economist Jim O’Neill believes that classifying countries into distinct blocs is an oversimplification. However, data demonstrates the tangible effects of geopolitical influences on trade and investments. BlackRock Chairman Larry Fink emphasized the enduring nature of this “fragmented geopolitical landscape,” a sentiment echoed by Tesla’s Elon Musk, who proposed a diversified global production strategy as a safeguard against geopolitical uncertainties.

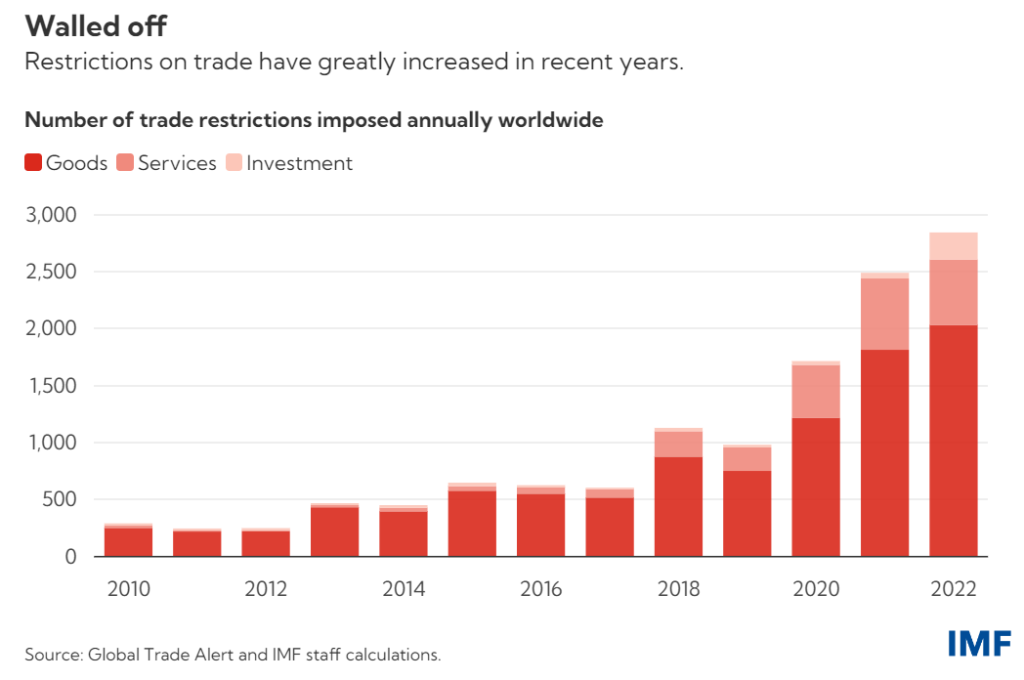

IMF has also said something of the same sort. Observe the chart below:

The potential decline of up to 7% in global economic output (as a result of this fragmentation), equivalent to a mind-boggling $7.4 trillion, is not just a theoretical number. It represents jobs, livelihoods, and the economic future of entire nations. When one contextualizes this figure by comparing it to the combined economies of powerhouses like France and Germany, or the entire annual output of sub-Saharan Africa, the gravity of the situation becomes palpable.

As such it is mandatory for investors, observers and policymakers to keenly follow the geopolitical trends (whether incipient or mature) as they tend to play a very important role in shaping the future of global economy.