There seems to be two very important developments occurring in the global oil markets. One is the tightening of the oil markets as OPEC+ has prolonged its production cuts. The second is that Russia has called for a ban on diesel exports. Both will have long term consequences. Moreover, I will try to provide a brief overview of the global economy in the light of recent economic indicators.

Saudi Arabia Crude Exports

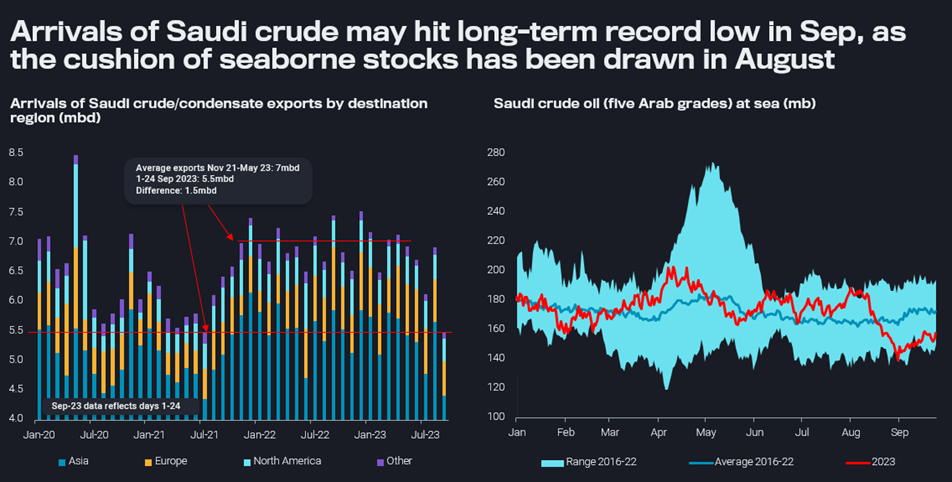

Saudi Arabia’s crude exports have seen a slight uptick, but the global oil market remains constricted. This trend is evident from the consistent oil futures rally observed from late June to mid-September, driven primarily by voluntary supply cuts from major players like Saudi Arabia and Russia. While the momentum in oil prices has recently slowed, there’s speculation about Saudi Arabia’s next move, especially as oil prices approach the $100/b mark. Notably, in September, Saudi crude exports rose by 0.7mbd, reaching 6mbd. This increase, coupled with the bottoming out of VLCC freight rates, suggests a potential sustained rise in exports.

However, the real impact is felt in the consumer markets, where OPEC+ cuts have led to a decline in arrivals. Despite maintaining steady imports earlier this year, the recent OPEC+ reductions are now significantly affecting refiners. Saudi Arabia, in its strategy, managed to supply high volumes in August by tapping into seaborne inventories. But, September might witness one of the lowest arrival rates in decades, comparable to the lows during the peak of the Covid-19 pandemic.

The market’s tightness is expected to persist unless there’s a significant drop in demand, which currently seems unlikely. Given the recent depletion in stocks and potential political pressures from major consumer regions, it’s plausible that Saudi crude exports might continue their gradual rise. However, any increase will likely be cautious and won’t drastically alter the market’s current supportive stance.

Russia Diesel Ban

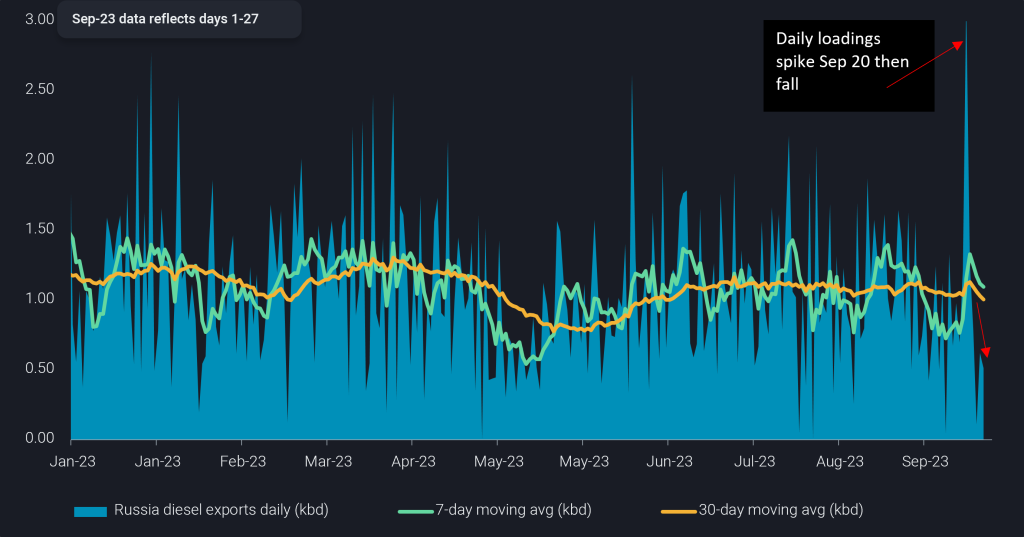

On September 21, Russia temporarily halted diesel and gasoline exports, excluding marine gasoil and high-sulfur gasoil. This led to a 5% spike in October Ice gasoil futures, which later normalized, suggesting the market expects a brief disruption.

Russia’s role in the diesel market is significant. In 2023, it overtook the US as the top diesel exporter, accounting for over 13% of global supply. The central concern is the potential global impact of a reduced Russian diesel export.

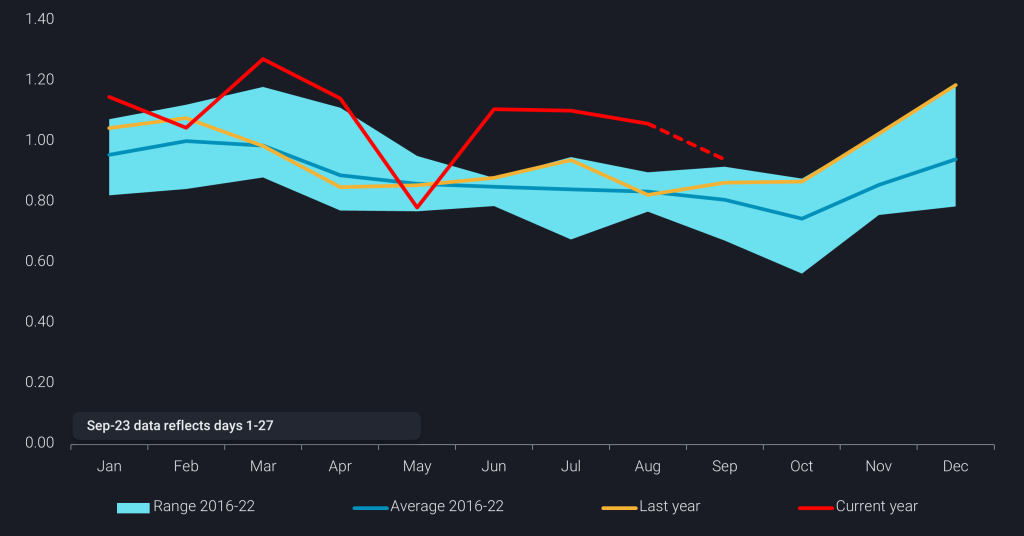

In September, Russian diesel exports dipped, possibly due to maintenance at the Ryazan refinery and Syzran plant. However, from January to September 2023, Russian diesel exports surged by 15% year-on-year, likely to support the wartime economy.

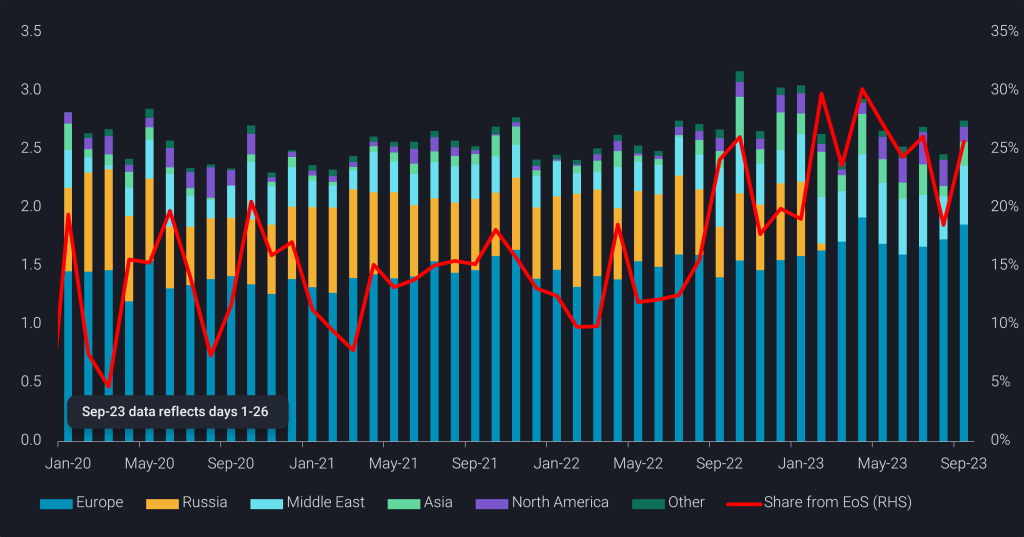

After the European import ban, Russia redirected its diesel exports to Turkey, Brazil, North Africa, and the Middle East. Specifically, Russia’s diesel exports to Turkey jumped from 40% to 80%, pushing India to supply other regions like South Africa and Australia. If the ban continues, Turkey may need to find an alternative diesel source, affecting its European supply capabilities.

Brazil’s diesel imports averaged 250kbd in 2022, primarily from the US and India. Post-March 2023, 50% of Brazil’s diesel imports came from Russia, sidelining US supplies and replacing Indian barrels.

For Russia, an extended diesel export ban poses risks. Their storage is nearing full capacity, and operational issues may arise from refinery shutdowns and reduced pipeline activities. While Russia can increase exports of gasoil and high-sulfur diesel, the demand is limited, and they’d fetch a lower market price.

In summary, the long-term effects of Russia’s diesel export ban are uncertain. If short-term, the market might face supply chain disruptions rather than a significant barrel shortage.

Global Economy

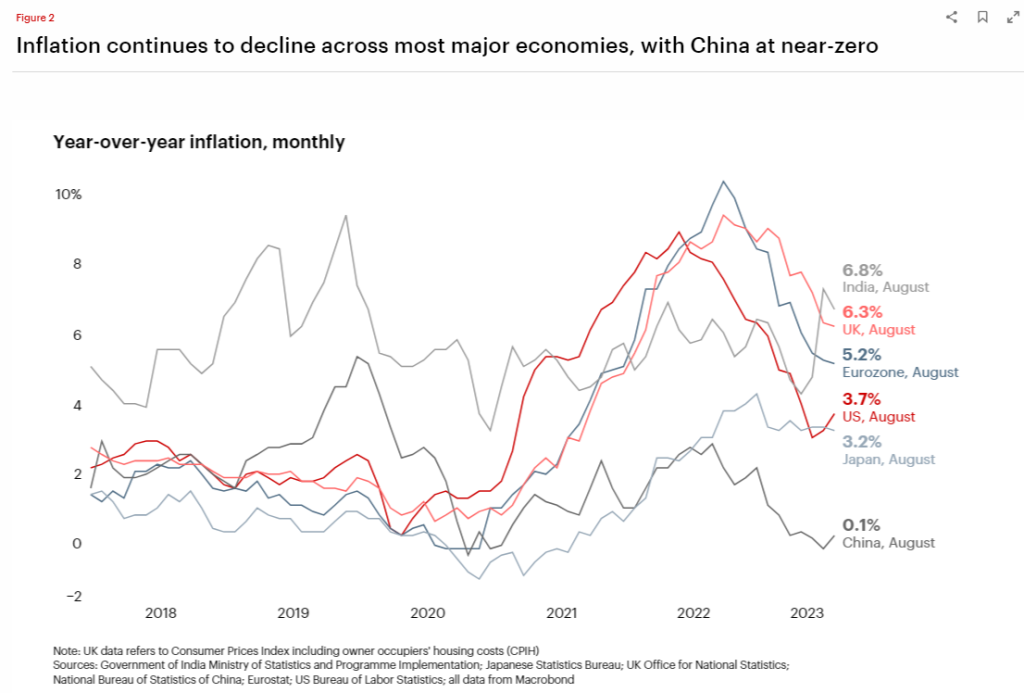

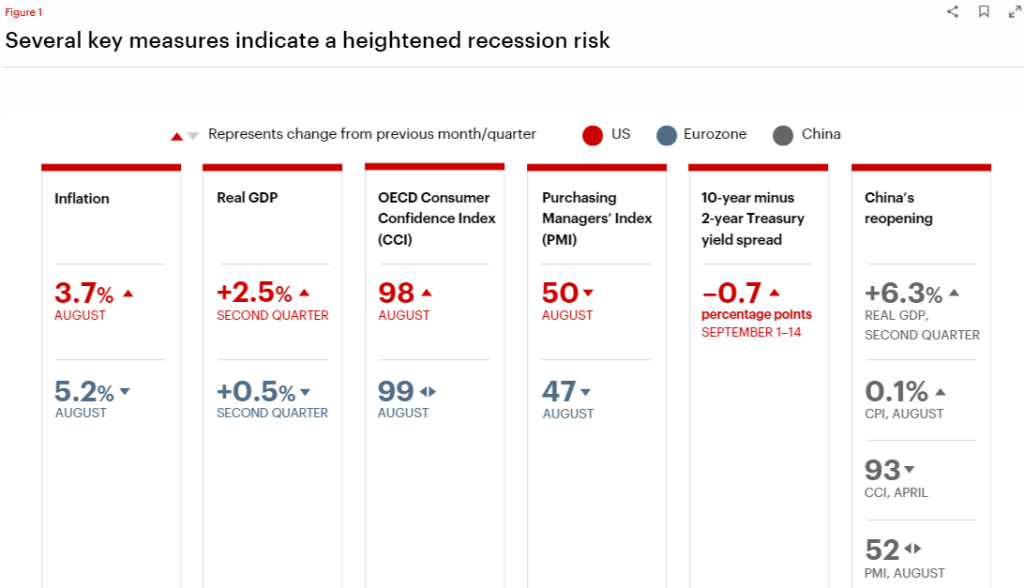

The global economic landscape is marked by significant uncertainty. Polls from economists have indicated a potential recession in the US and eurozone for almost a year. The US, with its 10-year minus 2-year Treasury yield spread inverting since July 2022, hints at a possible recession within a year. Inflation in the US surged to a high of 9.1% YOY in June 2022 but moderated to 3.7% in August 2023, influenced by rising energy prices.

Europe grapples with structural challenges, from demographic shifts to the Ukraine conflict. The eurozone’s GDP growth is decelerating, with a mere 0.5% YOY increase in the second quarter. Its inflation rate, although decreasing, is doing so at a slower pace than the US, registering 5.2% YOY in August. The UK struggles with inflation control, evidenced by a 6.3% YOY rate in August and near-stagnant GDP growth from Q2 2022 to Q2 2023. The OECD projects a modest 0.3% growth for the UK in 2023.

Central banks, including those in the US, UK, and eurozone, have aggressively increased rates to curb inflation. The US Federal Reserve maintained interest rates in its September session, leaving future rate hikes ambiguous. These rate adjustments, combined with central bank unpredictability, pose economic risks, with heightened chances of unforeseen financial or geopolitical events.

In Asia-Pacific, China’s economic growth is tepid, with uncertainties about a significant recovery due to evolving government priorities and inherent challenges. China’s inflation in August was a mere 0.1% YOY. Japan, however, experienced its highest inflation in 40 years, with a rate of 3.2% YOY in August 2023.

The global economy is riddled with vulnerabilities and uncertainty. It’s imperative for businesses to brace for diverse economic and geopolitical outcomes.