Completion activity picked up across regions highlighted- except the Permian. It looks like there was another pivot from Midland to Delaware that resulted in some of the reductions this week. We expect to see a shift higher, which will take Permian activity back above 140. As we shift into winter, there will be some additional activity in Appalachia and Haynesville- while activity ramps in the Permian. The Anadarko will level off around here, but the Eagle Ford should see one more bump and hit closer to 35. Seasonally speaking- we will see another increase in the smaller basins with 1 or 2 spreads coming back to cap off growth before the holiday season.

Crude prices took a beating the last few days after breaking higher into the end of September. I had the question posed: “Now that Brent has broken above the top of your range $88-$96- are we going to break up to $105.” My answer was simple- No. The physical market wasn’t showing the same strength as the paper market, rates are going higher, USD is staying strong, traders are net long contracts and will be net sellers, and we are heading into shoulder season. All of this screams a correction back to the lows of the range to settle at around $90 in the near term.

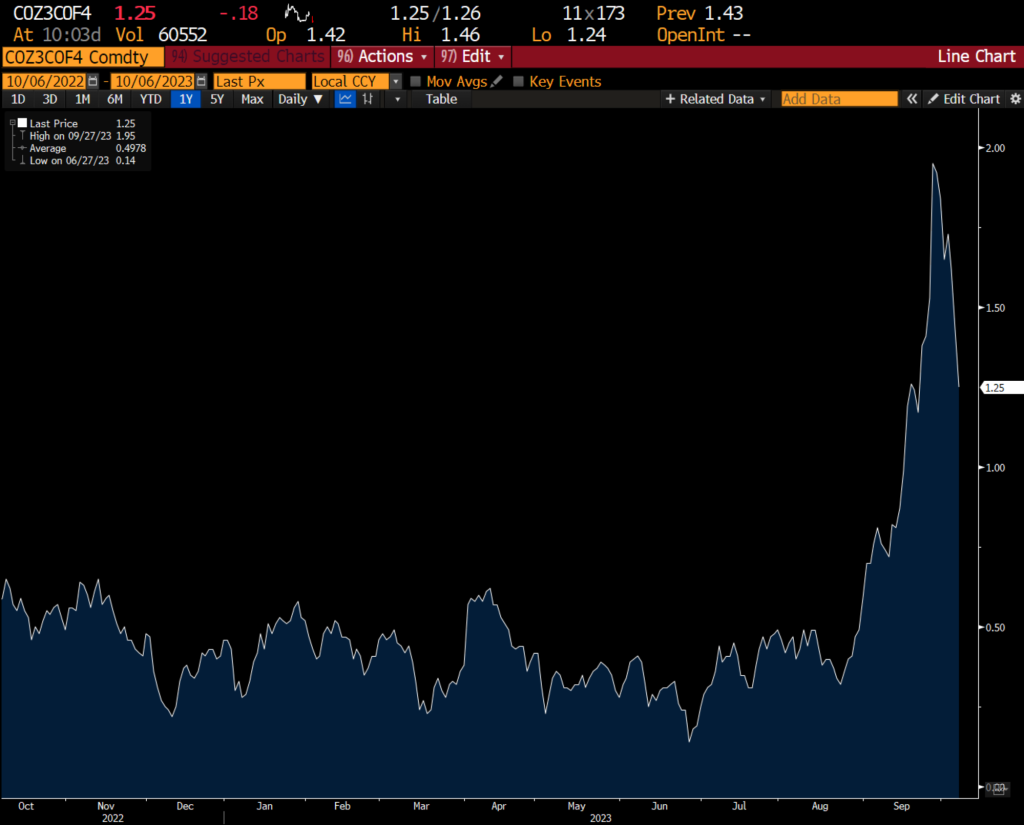

As you can see from the chart- Brent CRASHED through the $90 level (big level of support) and rang straight to the last ranges “support.” Before Saudi extended the cut of 1M barrels till the end of the year, we said the range for Brent was $82-$87, which held for an extended period of time. Even after KSA first introduced the cut, we weren’t able to break above the key $88 level with any real volume. But when KSA extended those cuts, we had a lot of money flows shifting long and accumulating contracts giving a ton of push to the upside.

When you follow futures, it’s important to look at money flows because it will create a lot of pressure and overreactions in both directions. We expected to see volume come to market above $96 as funds “right-sized” positions, but you had a lot of different pieces happening at the same time.

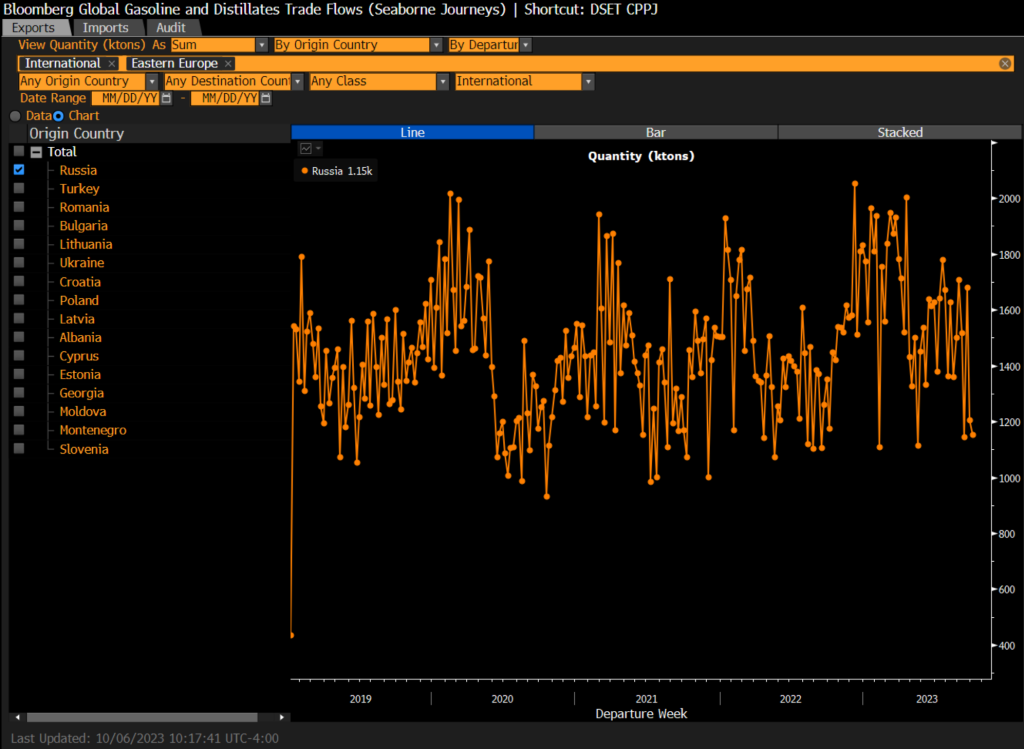

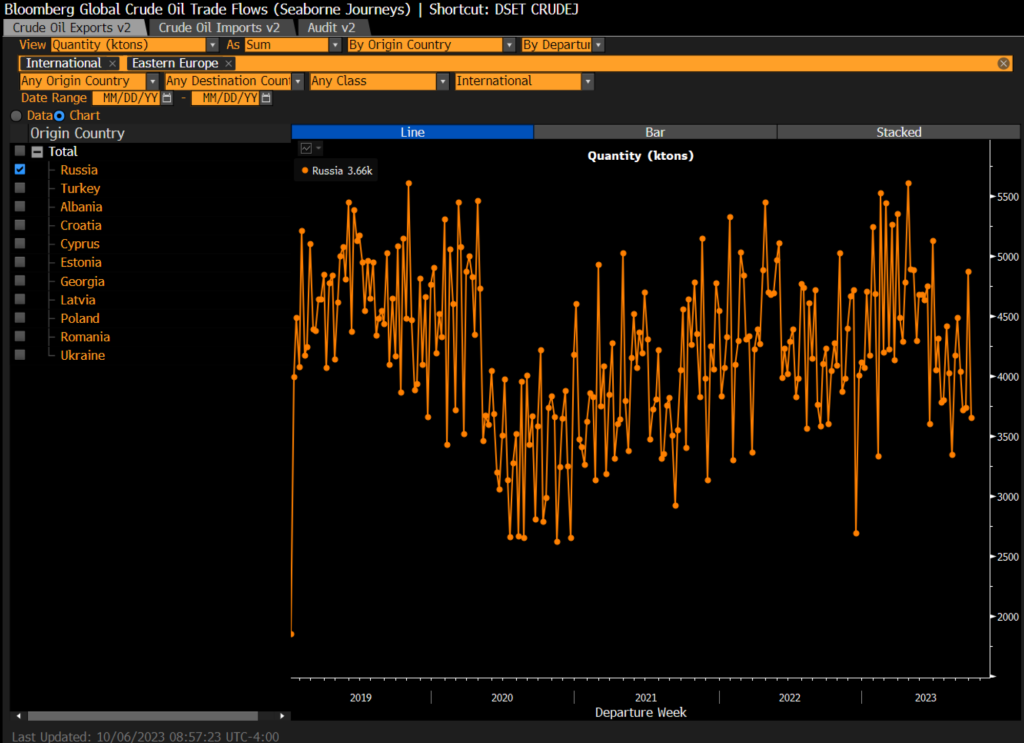

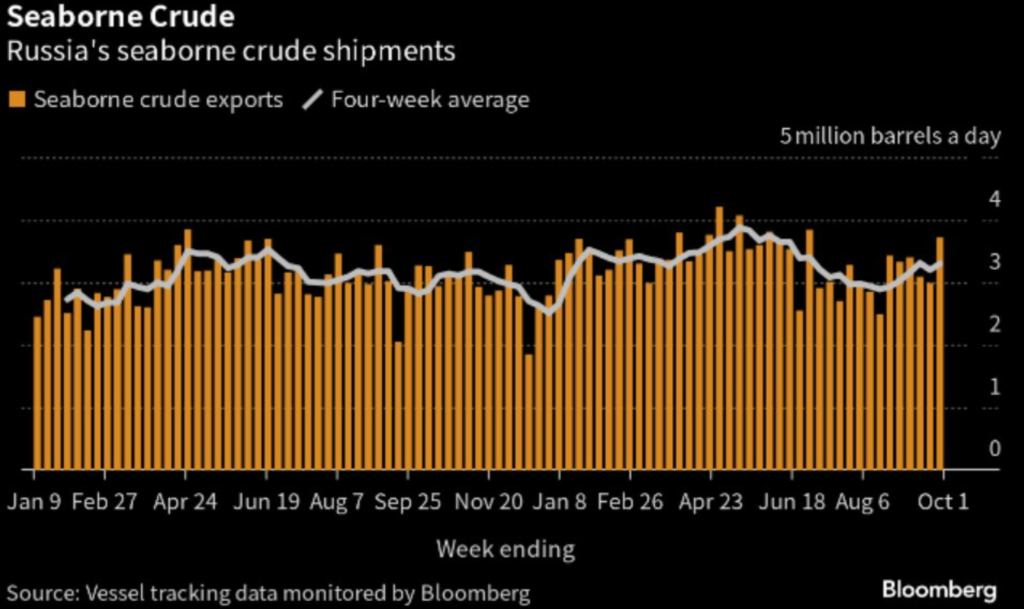

- Russia exporting crude at a 3-month high because of refiner maintenance and a diesel export ban. The restriction has been loosened, but we are still seeing an increase of total crude flows.

- Yields surging across the board as the market price in “higher for longer” and an increasing likelihood of another rate hike.

- Slowing crude demand driven by seasonal refiner maintenance season.

- The dollar hasn’t mattered “as much” as previous cycles, but the DXY ripping from 103-107 as the Yen and other currencies weakened definitely didn’t help the crude crash.

On the other side, the physical market didn’t move anywhere near as much as the paper market. The physical crude markets also never supported a spike from $96 to $105, and the same can be said for a decline from $96 to $84 Brent. We had some offers pulled and some discounts of up to a $1 on physical differentials but they are still higher vs where we were in September. I think Brent finds a footing here and drifts higher to hit $90 as the market stabilizes a bit at these levels.

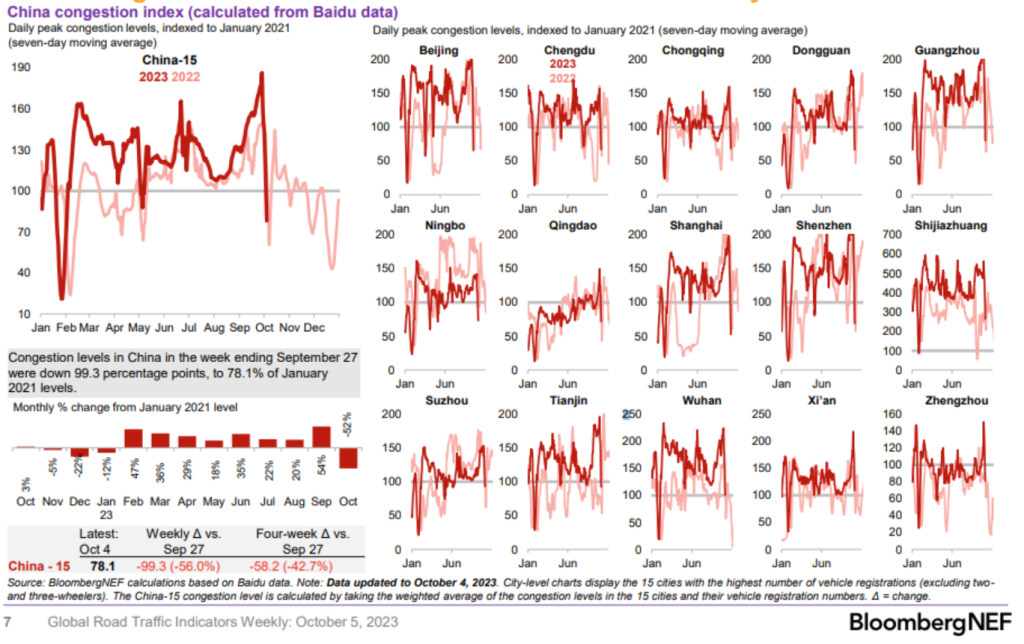

Over the medium term, the risk remains to the downside as slowing economic activity points to weakening demand, but there are some near term uplifts. China is having a very strong “Golden Week” which will be something that the market points too as support. KSA also increased their OSPs again and will be another thing the market can point to showing “Strength”. The market is still in steep backwardation, which is falling, but still well above “normal.” On the refined product side, global gasoline storage is still oversupplied, but the distillate market is in a very different position. KSA won’t be bringing back 1M barrels any time soon, but we see Russia pushing the envelope on their agreement. The pressure on Russian ports has caused a reversal of the diesel export ban: “Russia allowed a return to seaborne exports of diesel just weeks after imposing a ban that roiled global markets, taking other steps instead to keep sufficient fuel supplies at home. Shipments can resume provided that the fuel is delivered to the nation’s ports by pipeline, according to a statement on the government’s Telegram account. Such flows to Russia’s western ports account for the bulk of exported volumes.

The move will be a relief to importers after Russia, the single largest seaborne exporter of diesel-type fuels, slapped a near-total ban on deliveries Sept. 21. That followed a surge in domestic fuel costs that stoked inflation — a potential political problem for the Kremlin ahead of March presidential elections..”

It will be important to see how this develops over the coming weeks and if we see a sizeable jump in exports. Stay tuned on this one because it could push down crack spreads a bit faster versus our initial expectations.

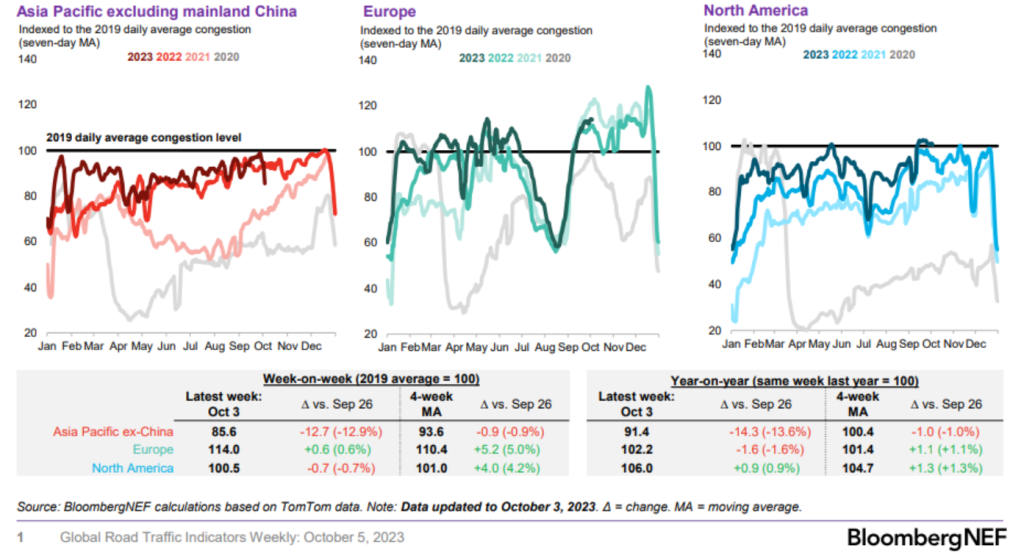

We believe that the Golden Week pop will be short lived because many Chinese consumers weren’t allowed to travel over the last three holidays. There was some significant pent-up demand, but once this passes, we see consumers cutting back on travel, activity, and general consumption as economic pressures remain. It will be important to see how this driving data develops over the coming few weeks to see if we are right or wrong when it comes to underlying demand. Right now, the drop is inline with people already at their locations, but we want to see how the 2nd half of October develops.

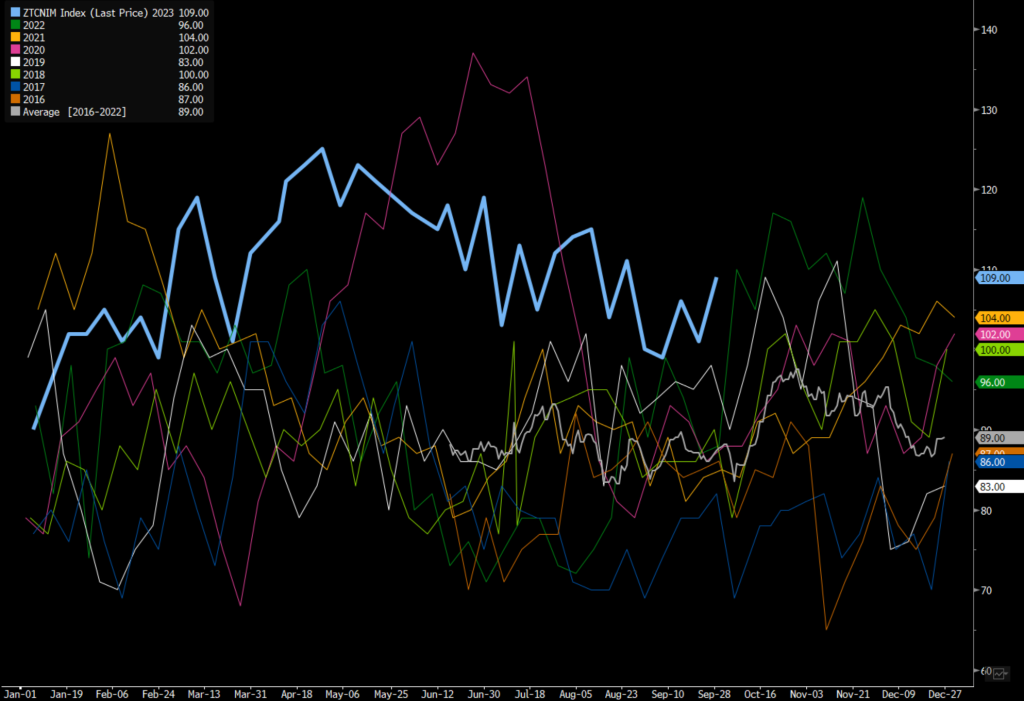

We have seen strength in the North America market, but it’s still well below what is “normal” during this time of year. The EIA demand data came in much weaker than it actually is as retail delays purchases in an attempt to get better pricing. This delay resulted in an artificially low number on the EIA demand number, and we are closer to about 8.4M-8.5M in total gasoline demand per day.

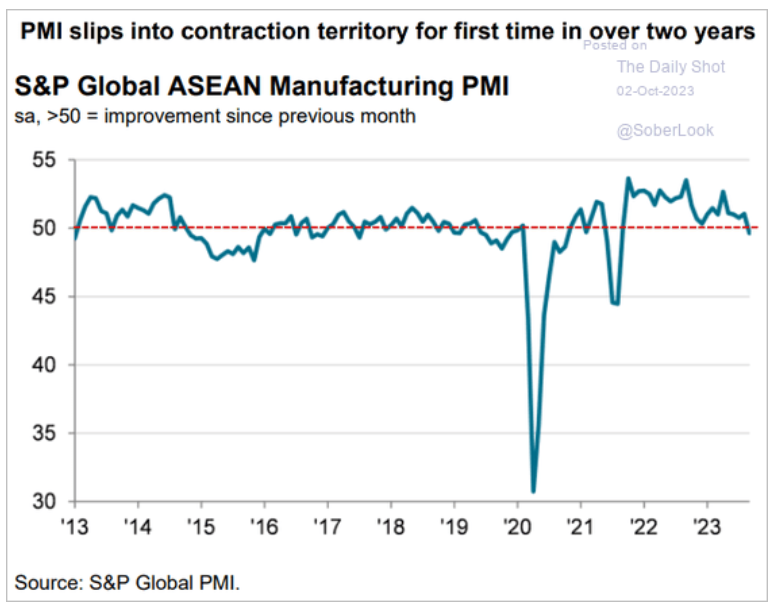

Europe is showing some strength, but still falling below the 2021 spike as all of the economic data firmly points to a recession. Asia Pacific is also seeing a sizeable drop driven by the holiday season, but we have also seen economic pain accelerate in this pivotal region. The PMIs unexpectedly dropped well into contraction as exports slowed and inflation picked up again.

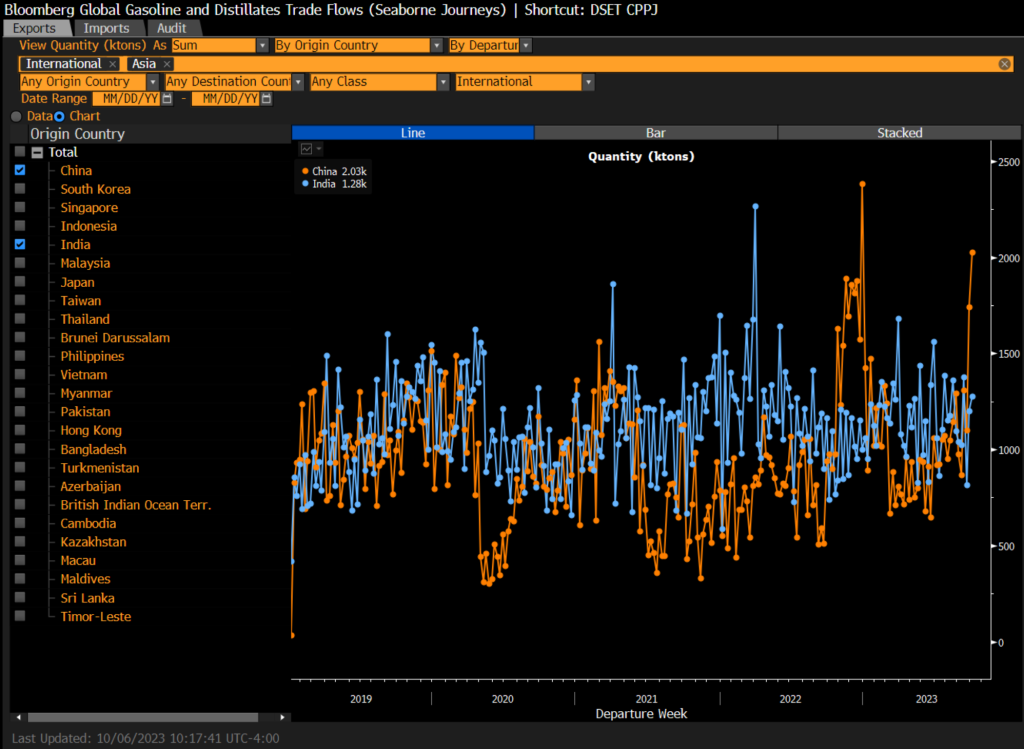

There was some additional buying ahead of Golden Week by China, which is keeping them with imports at seasonally adjusted highs. As Russia increases flows, we expect to see some additional purchases in the near term as Russia tries to manage storage and refiner maintenance. We already saw some reductions from 109 to 103 cargoes, and it will likely flatline over the next week.

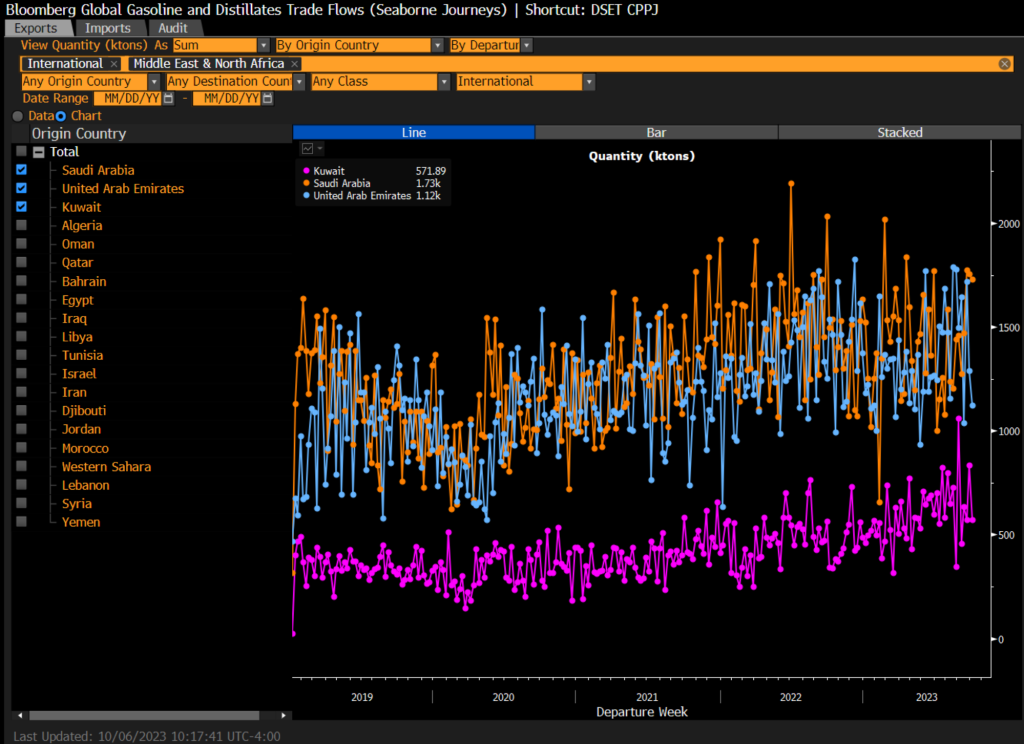

China continues to export a significant amount of refined product into the market as they take advantage of the strong distillate crack. The crack spread has weakened, but still remains unseasonably strong and will support additional exports. As Russia pulls back on refined product exports, it offers up more opportunity for China and the Middle East (mostly KSA, UAE, and Kuwait) to capitalize on the strong cracks in Asia. The arbs have pushed more ME refined product into Asia and away from the Atlantic Basin.

KSA is back to the recent highs for exports with more coming to market over the next few weeks. Even as cracks softened and storage built in Singapore, there is still way more support in Asia vs the Atlantic Basin for refined product flows.

Additional support comes from Russia exports hitting recent lows, and there is little support to see this bounce in a meaningful way.

This will result in some additional crude being pushed into the market from Russia. There was a bit of a timing delay to kick off October, but we believe how Sept closed is something closer to what we can expect throughout this month.

I think this below bar chart does a good job putting this into perspective.

Within the ME, we see a fairly steady amount of crude being exported inline with recent levels. This is normally a “slow” period of buying given the Asian holiday and we will see some reductions. There has already been a slowdown across WAF with reductions in Nigeria and Congo interest near term, while Angola has seen a steady increase of activity. “Republic of the Congo’s Djeno crude cargoes for November are selling more slowly than October barrels did this time last month. The number of supertankers signaling Angola as their next destination in the coming 90 days climbed to the highest in more than three months.”

- About 12-13 Angolan cargoes for November are still searching for final buyers, from a planned 35

- Represents 34%-37% of the total

- That’s in line with a month ago when 29%-39% of the October-loading supply was still hunting for purchasers as of Sept. 4

- Five shipments of Djeno remained to be sold out of six scheduled, the people said

- That’s slower than a month ago, when three October Djeno shipments were left out of seven planned as of Sept. 4

- NOTE: The Angola trading cycle runs from the 16th of the month; Djeno’s trading cycle starts a week later from about the 24th of each month

- Nigeria’s November sales have got off to a slow start, with high offer prices putting off buyers, according to one of the people; tally not immediately available

- NOTE (Oct. 4): Nigeria’s offer levels were being touted at $1 to $2/bbl in excess of the country’s latest OSPs, which already were boosted to 13-month highs for Qua Iboe and Bonny Light, traders said earlier this week

The physical market still remains supportive of a move in Brent back to $90.

Singapore and Europe had another round of builds on the light distillate side (gasoline), and points to more issues on the consumer side. The build in gasoline will also complicate the production of additional distillate as you need to do “something” with the gasoline. This is why the market is going to be in a complicated place- especially if we have a normal or cold winter.

The Asian disty crack has found some support in the near term- inline with our expectations from Wed’s EIA show. We see it hovering here, and the next potential leg down would be a big surge from Russia which seems unlikely- but still something to pay attention to.

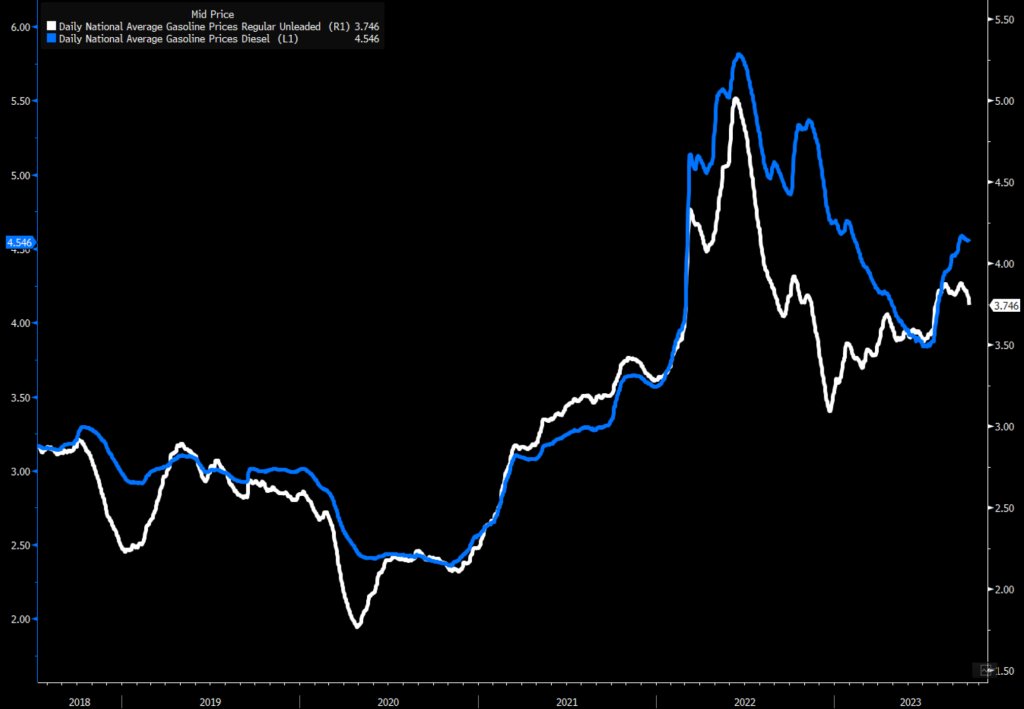

U.S. prices for diesel and gasoline continue to fall, but the pace of gasoline price drops is accelerating. We expect to see further softness in gasoline while the diesel decline will be much slower.

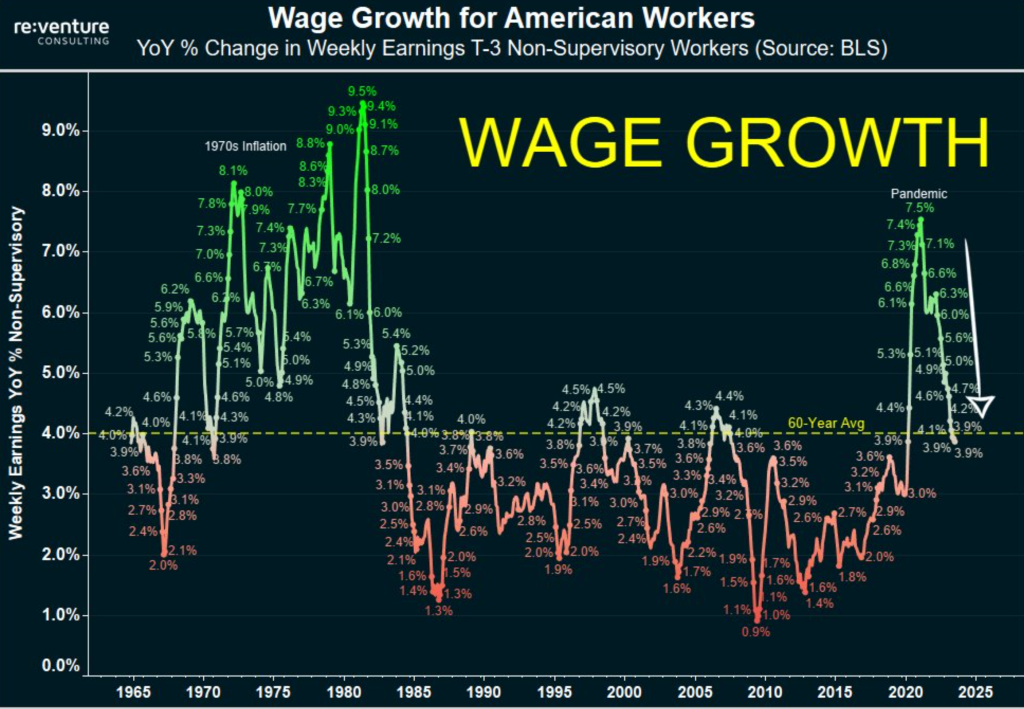

The consumer is slowing on a broad basis with more pressure from weakening wage growth. We know it’s already problematic, but it’s now flipped into a “dangerous” territory on a nominal basis. “Wage growth is dropping fast. Down to 3.9% YoY for American Workers. That is now the lowest rate of wage growth since the pandemic started. And also below the 60-year average. Bad news for US Economy & Housing Market.”

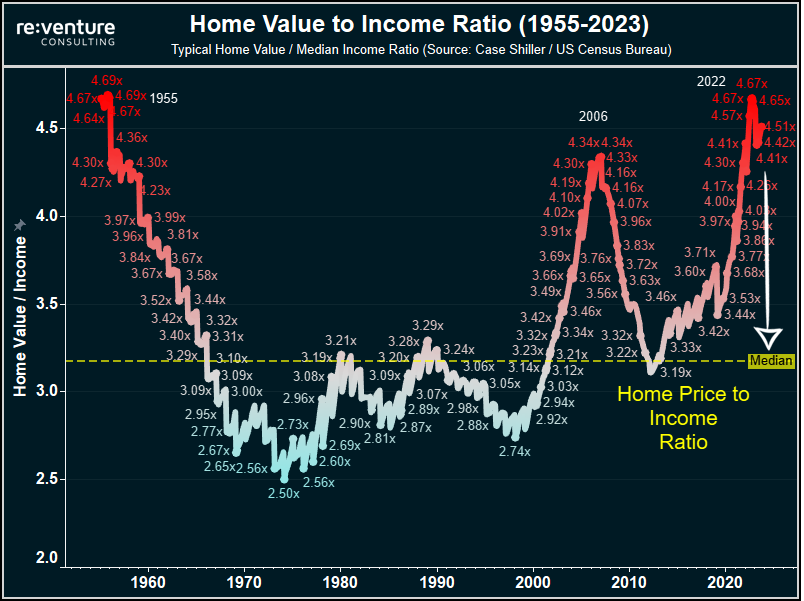

The Fed remains focused on trying to bring down asset prices. As we have been discussing for several years, the Fed “decided” with good reason that it’s better off to bring down asset prices instead of allowing wages to rally. The biggest concern for the Fed remains a wage price spiral, and the actions they are taking will get in front of it. The slowest adjustment will be home prices, but the gravity of the pull will only increase over the next few months. “Home value to income ratios just ticked higher again and are now above 4.50%. To put this in perspective, even in the 2006 peak home value to income ratios topped out at 4.34%. The last time we saw home value to income ratio this high was in 1955. Meanwhile, mortgage rates just hit 7.9% for the first time since 2000 and house payments are nearing $3,000/mo. This is officially the least affordable housing market in the world.”

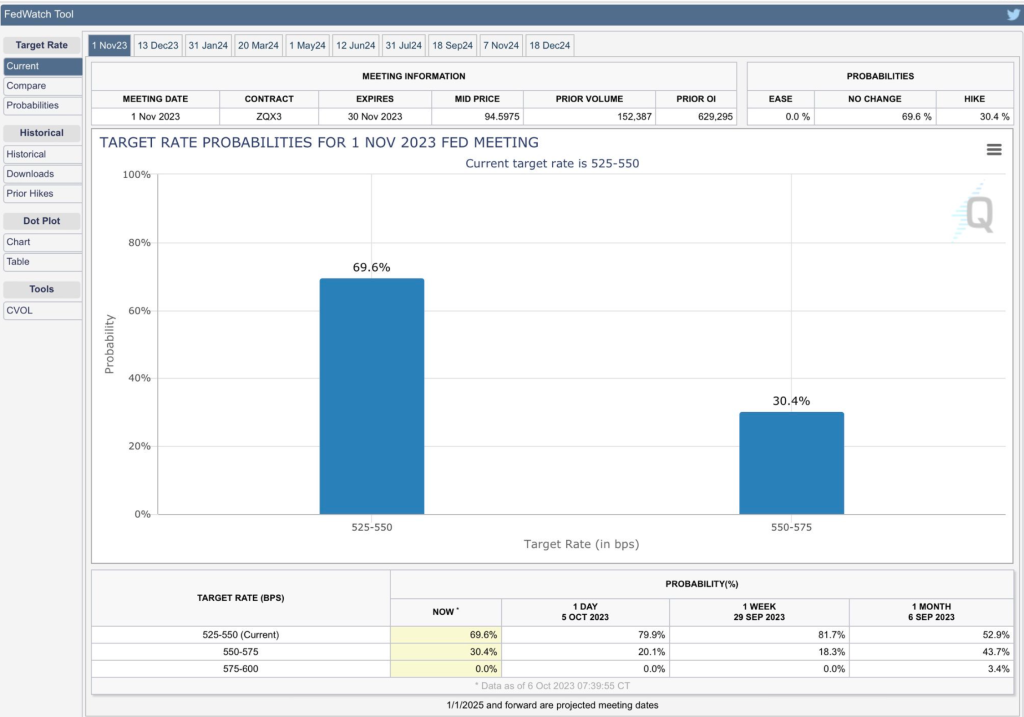

Between the re-acceleration in inflation (especially sticky) and the better-than-expected jobs report, will keep the Fed on the path of raising rates. The market is starting to price the chance of another rate hike, which we see as likely. We expect the data to maintain a story of elevated inflation and asset prices keeping the “higher for longer” strategy intact.

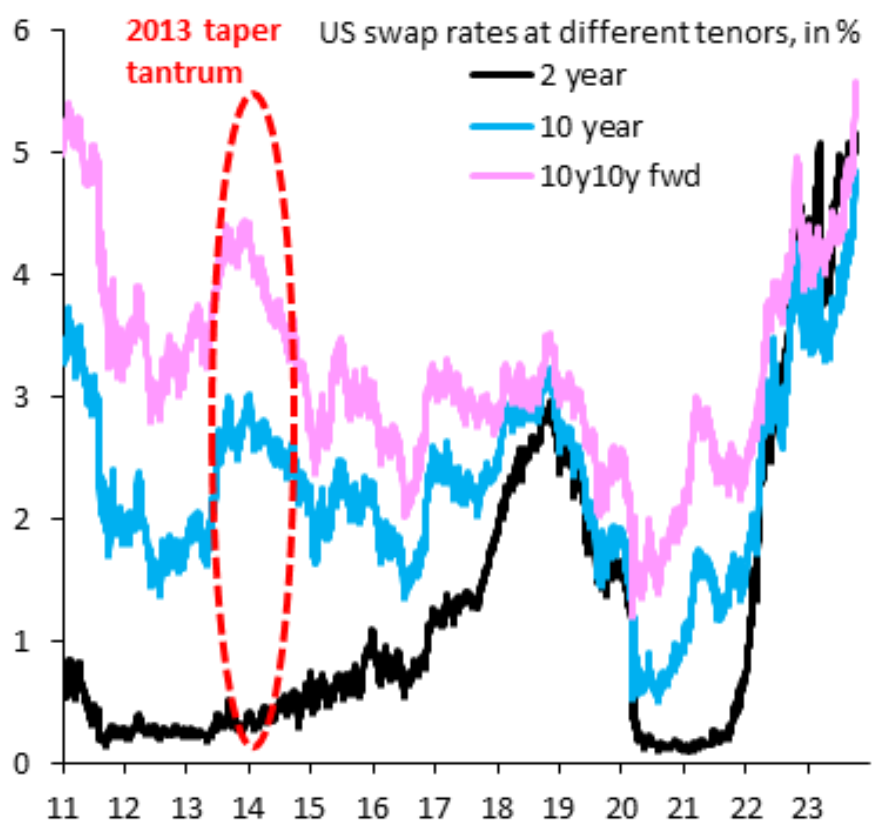

I think the below chart puts their focus in perspective- the rise in US swaps based on rate of change and yield BLOWS the “taper tantrum” out of the water. It helps to highlight how the Fed is “trapped” because the taper tantrum led to an almost immediate YCC and QE to bring the market back into an easing standpoint. For those that knew me back in 2014- I said this was a terrible idea and regardless we were going to face the music of continuous QE. The longer we delayed the realization- the worse the final outcome was going to become. I think the inaction and continuous push of rates higher by the Fed in the face of this rate of change- shows the dedication (or inability) of the Fed to pivot.

We made the case back in Feb 2021 that the Fed had no choice but to push rates higher regardless of what happened to yield. The U.S. yield curve has had a parabolic move that has seen a huge gap up in long duration of the curve, which is what I discussed on twitter with some of my followers earlier this week. In our view, the yield curve inversion was going to resolve itself more by long duration surging higher and NOT because short duration was going to see price appreciation. Over the next few months, we will likely see some more buying in shorter duration- but the lion share of the flip will be supported by a long duration increase.

The DXY and U.S. yield shift is complicated by the problems the Yen and BoJ is facing as they defend the currency and 10-year bond. The BoJ stepped in to take the Yen from 150 back to 147 but within 48 hours the market moved the Yen right back to 149. We believe there is going to be a quick break of 150 that will see a rapid appreciation to 160 forcing the BoJ to abandon their 10 year 1% cap. It’s a bit ironic (but not surprising) to see QE come to an end at the same place it started.

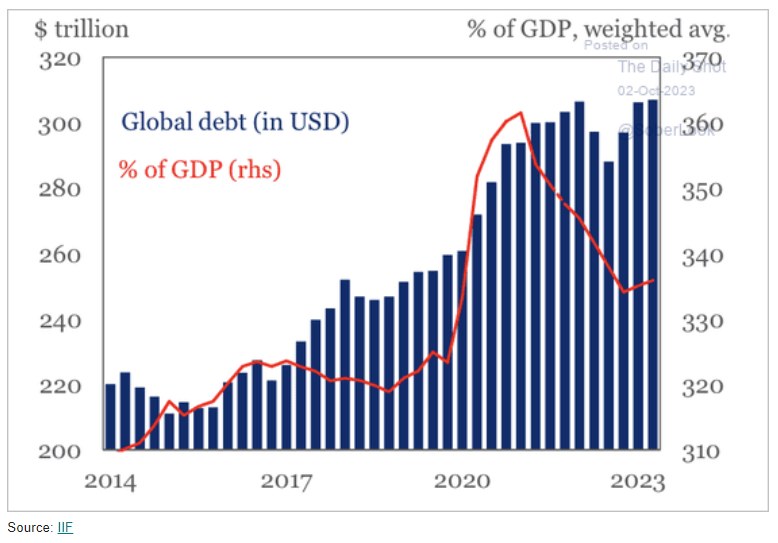

The bigger issue will be the contagion that spreads from that impact with the most likely hits being Italy followed by China. The pivot of the market will be countries that are running a huge deficit in relation to debt-to-GDP with weakening internal metrics. China has been a net seller of U.S. TSYs to help shore up their near-term capital, but they will be hit with some renewed fear driven by the Yen situation. This will result in a round of purchasing, but not enough to drive our yields lower. Our treasury is increasing the amount of bonds being issued, so the sheer volume will offset any benefit that will arise from additional purchases in the market.

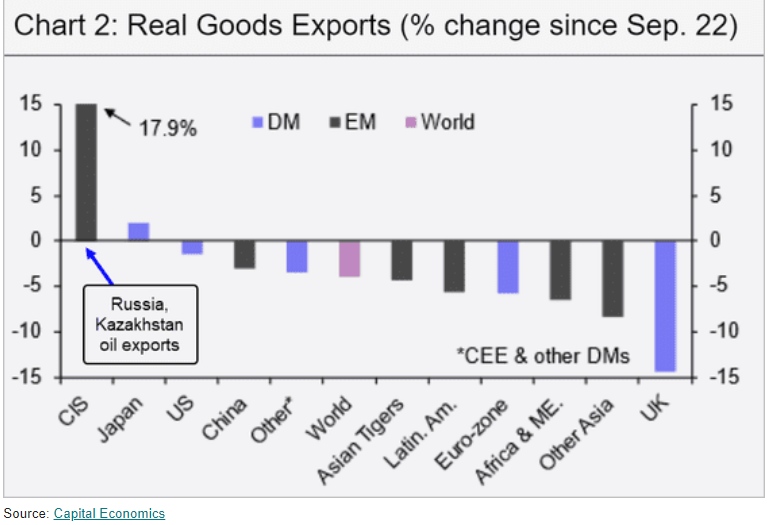

The shift higher in yields is a huge headwind for Emerging Markets, especially as we have seen a pickup in inflation and a slowdown in exports/economic growth. We have now seen ASEAN PMI shift into contracting territory with more pressure coming on the GDP weighted perspective.

The pressure will get worse as we see real goods shrinking further with another drop on the horizon:

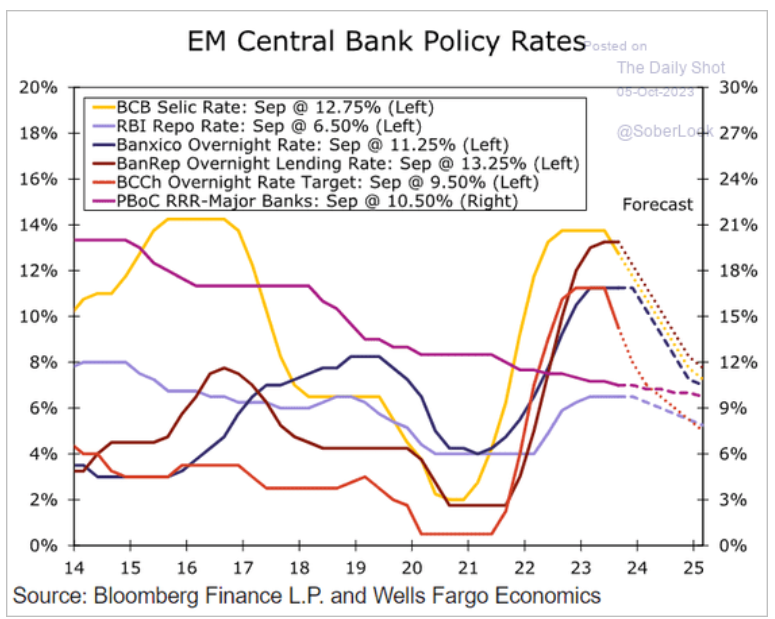

The pick-up across the inflation front is going to make it difficult to see a meaningful pivot lower in rates. The market expects to see rates starting to get reduced at the CB level, but we have seen a marked increase across PPI and CPI leaving central banks in a tough position.

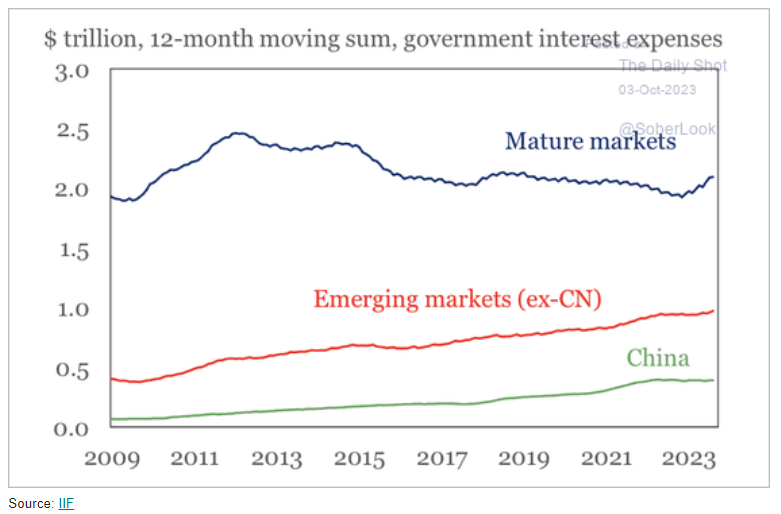

Many governments are already going to see their interest expenses rise and will be a big overhang as countries look to maintain subsidies. As governments pullback further on local support- it will bring another pressure point on spending.

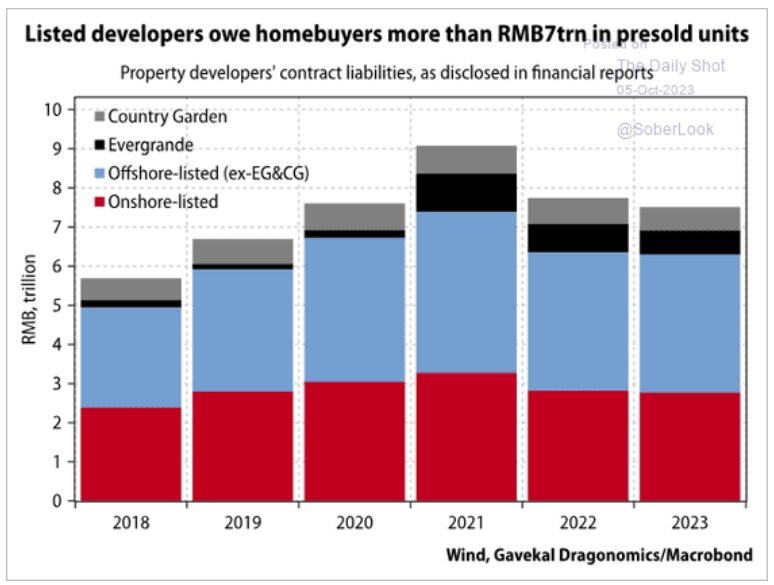

I think this is a very important point when we look at China, and the broad issues the country faces- especially on the real estate front. Developers “owe” consumers over $7T RMB worth of assets that were presold. This is a key reason why we have highlighted the need for “new” cash injections from an outside source. China can’t magically make money appear in the system without outright printing, and they already have a liquidity problem from over a decade of stimulus. China was the source of outside capital for many countries (including the U.S.) since 2008- but now the “buyer of last resort” is gone. There is no one left to inject fresh capital, which means that defaults and write-downs are going to pick up aggressively over the next 6 months. This will be a major headwind for growth and not just for ‘23/’24. Instead, this is going to take multiple years to address and reform, and I still question the CCP’s resolve to address the issues. Many of the solutions fly in the face of the communist mantra, which is why this quote captures some of the major issues: “”China’s banks have seen an influx of bad assets in their once-thriving property-loan business, and more could be reported amid the restructuring of Evergrande and other struggling developers.”

I will do another write-up early next week discussing some of the economic issues in more detail, but in the meantime- I leave you with this great quote:

“While we are unlikely to see a financial collapse, or anything so spectacular, we’re instead likely to see a creeping ossification of the banking system as the gap between revenues from assets and the cost of servicing liabilities widens. This gap can only be resolved by default, which is very unlikely, or by explicit or hidden transfers, including in the form of repressed deposit rates. One thing worth adding. The article notes that “Authorities are well aware of the risk to rural banks and local government finances. They have been aggressively recapitalizing small banks since 2020. “This is true, but we must distinguish between recapitalization at the individual bank level and at the systemic level. When local governments borrow from other banks to increase the capital of a specific bank, that bank’s capital is increased, but the capital of the overall banking system isn’t. If there is a problem with an individual bank, in other words, the additional capital will help that bank survive. If there is a systemic problem, however, the additional capital will be useless. That’s because problems in one bank will automatically spread to other banks directly or indirectly through its debt to those other banks. You can only capitalize a banking system with capital from outside the system, never from capital within the system. Unfortunately, in China with its closed and highly integrated financial system, and the tight relationship between banks, SOEs and local governments, it is hard to see where outside capital can come from.”