Israel increased their ground forces into Gaza today, but the official announcement from the Israel Dept of Defense is that this is just the beginning. We go through more of this lower. Next week I will cover more on USD strength and rising rates and how that will impact Emerging Markets, Japan, and China.

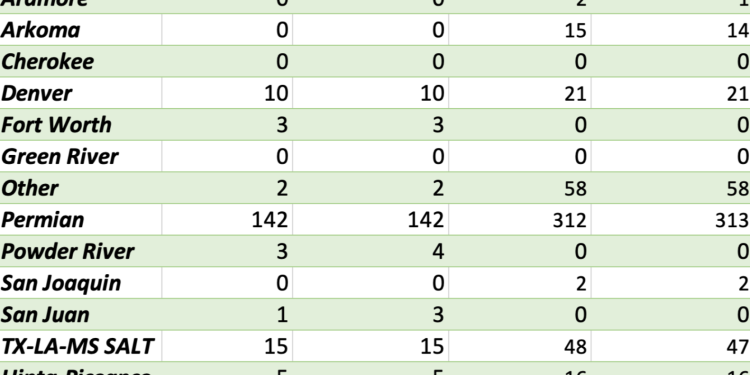

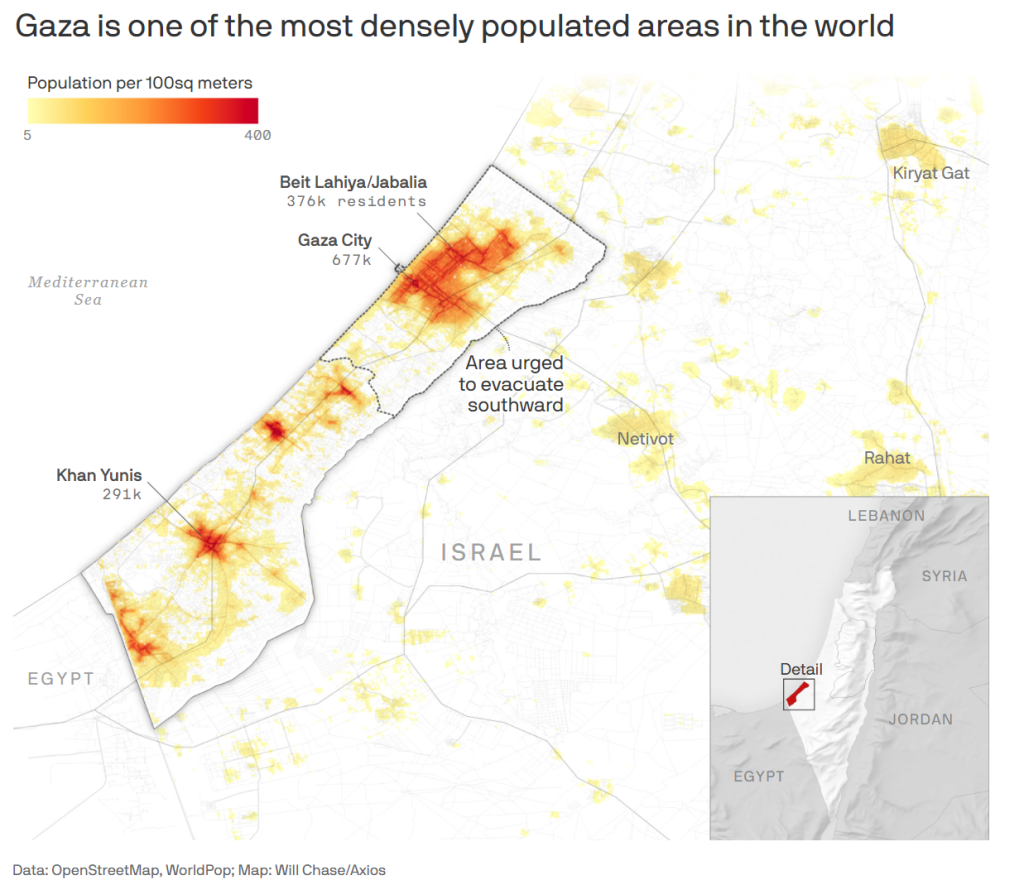

Completion activity bounced inline with our expectations with an increase across the smaller basins. There will be another round of increases in the Permian with another eight over the next week or two. This puts us firmly in the direction of 280-285 before we get the holiday slowdown.

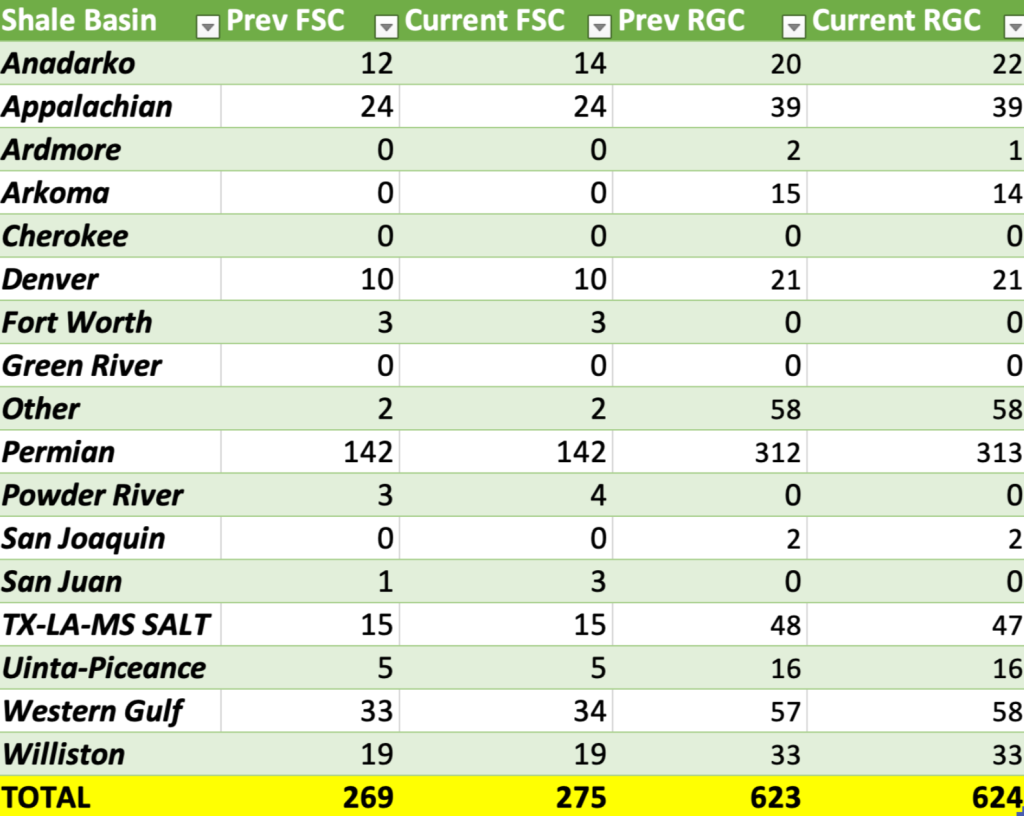

The crude markets have been bouncing around, but we believe there is one more move higher when Israel invades Gaza. There has been a strategic delay to move THAAD, Patriot missile batteries, and other hardware in position ahead of the invasion. This is to protect against a response from Iran as we have already seen the Houthis launch several missiles and about 15 drones over the Red Sea. All of these were shot down by USS Carney as it was transiting the Red Sea. We highlighted the importance of moving military assets into the region, and its key to getting them into strategic positions prior to a broader invasion. There was also a push for additional diplomacy to free hostages prior to a bigger military response. As diplomacy falls flat and assets move into position, the ground invasion will begin. Israel has started to test the border with several night raids, and the U.S. launched to sorties against Iranian backed assets in Syria. U.S. positions in Syria and Iraq have been attacked by drones and rockets, and we expect to see more attacks in the coming few days. Based on current announcements, a total of 12 THAAD anti-ballistic missile systems and Patriot PAC 3 SAM systems will be (have already been) deployed to the ME to protect US military bases and by default Israel. This will be on top of the Naval and Airforce assets that have already been moved into offensive/defensive positions.

As Lao Tzu says in the “Art of War”, “There is no greater danger than underestimating your opponent.” It’s pivotal to have all necessary equipment and manpower in position before engaging in a broader offensive.

This is a long way of saying that crude prices are going to be volatile, but there is still upside risk based on two key factors:

- The initial invasion into Gaza is going to cause a spike.

- The response from Iran and their proxies will be the next.

Here is another example of why we do believe the invasion is imminent: “Israeli Officials have Confirmed that a Large-Scale Ground Raid by the IDF’s 36th Armored Division occurred last night in the Northern Gaza Strip; the Raid appears to have been similar to last nights with multiple Caterpillar D9 Armored-Bulldozers and Puma Armored-Engineering Vehicles being Escorted and Protected by Merkava Mark lV Main Battle Tanks as they move to Clear Paths for the upcoming Invasion.” This comes after all of the U.S. and allied assets have been shifted into position.

When it comes to geopolitical risk, the event is the spike but the market “gets used to the risk” and prices it into their views. This is why geopolitical events are “elevators up and escalators down.” The overarching problem remains demand as Russia brings more barrels into the market.

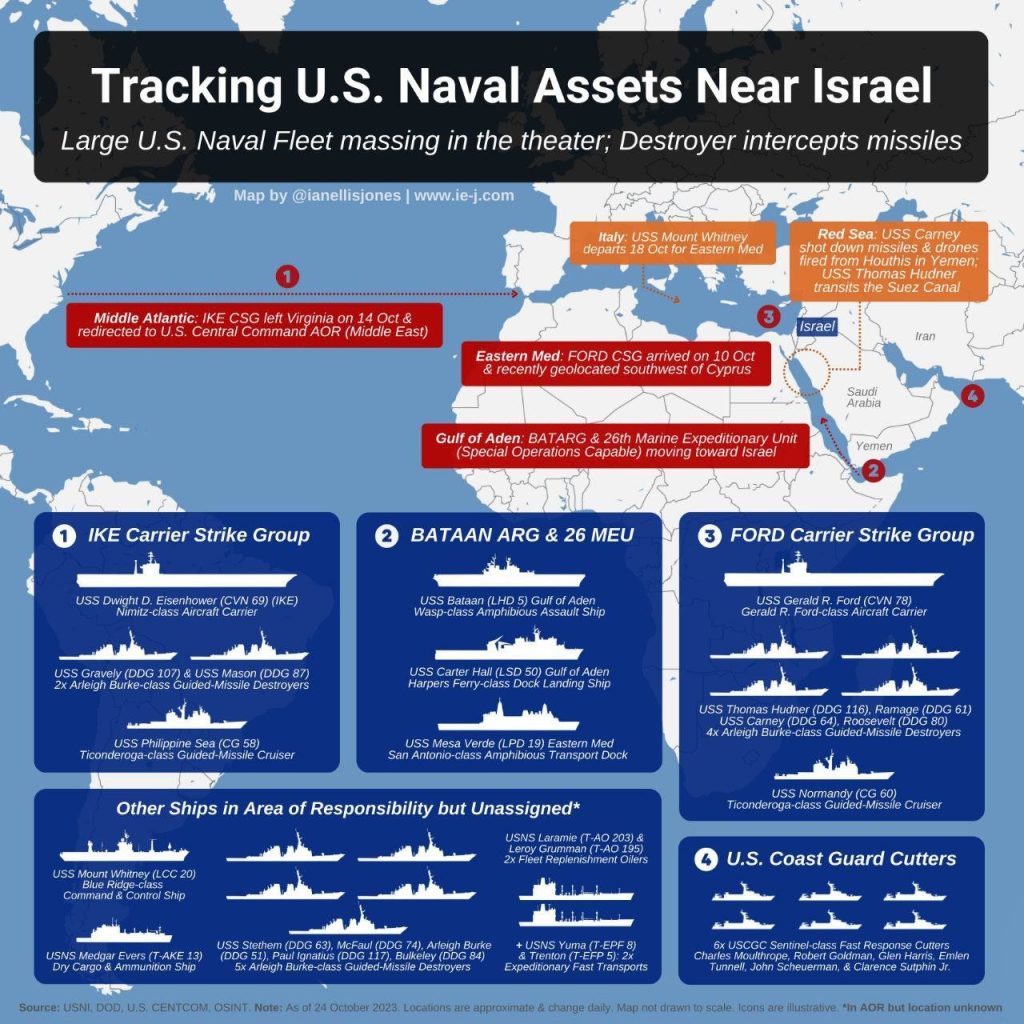

Brent has been bouncing between $88-$90 over the last few days, and we believe there is one more move back to $92 as the two events mentioned above unfold. Depending on the size of the response from Iran, we see Brent pricing drifting lower and settling into the range of $84-$88. The biggest factor will be impacts to the shipping lanes and pinch points that exist in the region. As we highlighted them a few weeks ago: Strait of Hormuz, Gulf of Aden/ Red Sea, and Suez Canal. The Strait can be directly impacted by Iran while the other two would require proxies in the region. The Houthis in Yemen clearly have drones and missiles that can cause problems. Based on Hamas’s reach into the Sinai Pennisula will dictate how much the canal can be hindered. These are questions that have to be addressed once an invasion begins in the Gaza strip. The below chart gives a backdrop of the density with most of the Israel strikes taking place in the North- the area where they advised to evacuate south.

The strikes will continue to take place as Israel looks to eliminate the heads of Hamas operations, destroy stockpiles of weapons, and potential traps/ bunkers/ tunnel entrances prior to a large military push. There is also an ongoing concern about the possibility of a two-front war, but the Lebanese Prime Minister Najib Mikati reaffirmed Beirut’s commitment to a UN resolution that ended a 2006 conflict between Israel and Hezbollah. He is essentially saying that any attack currently from Hezbollah IS NOT sanctions nor represents the government of Lebanon. The Lebanon and Israel governments have been working together on Mediterranean natural gas, and if you look at the populace- the people DO NOT support a war with Israel.

It doesn’t mean that Hezbollah won’t break from the government and attempt guerrilla warfare tactics. Here is another example- I can’t confirm if they were missiles or rockets, which are VASTLY different even though the mainstream media uses them interchangeably.

Israel Defense Forces say their tanks and artillery are striking sources which attacked military posts near border with Lebanon.

- The military reported no injuries

- Earlier, Hezbollah’s Al Manar TV reported that the militant group used guided missiles to attack two Israeli posts near border with Lebanon

- Group said the attacks destroyed technical equipment of Misgav Am post and damaged major parts of the Sadah post

Our main point is- you won’t get a major offensive from Lebanon, but it doesn’t mean there won’t be attacks along the border and moves to breach it. Overall, many of the people in the region are tired of war with Israel, and just general conflict after essentially an ongoing unease since 2011. We don’t believe a second front will open up when Israel pushes into Gaza, but we do expect an increase in missile attacks from Yemen. The unknown will be Syria because Iran still carries significant influence, and it will be a bigger source of concern as Gaza/Israel intensifies. The U.S. has maintained assets on the ground, and Israel has been very effective in striking armament storage and tracking Iranian shipments.

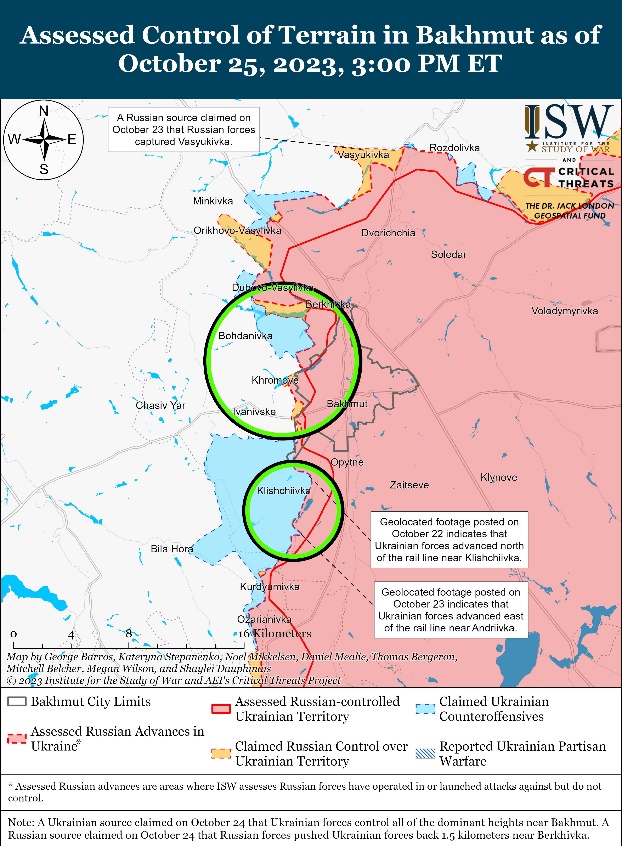

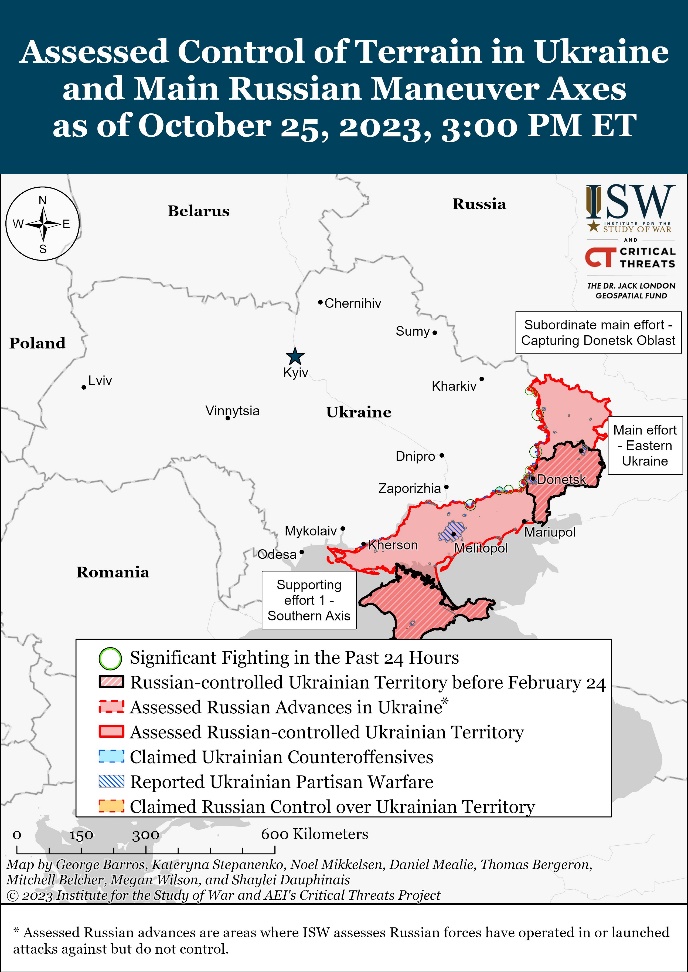

Egypt and Jordan will likely hold their borders and not allow assets to move into Israel.

There remains a consistent Russian offensive and counter-offensive being launched in Ukraine. The region has moved into a WW1 style trench warfare. This is leading to heavy losses on both sides with little ground gained on either side of the war. Here is an example: “Russian forces also conducted offensive operations along the #Kupyansk-Svatove line, near Bakhmut, southwest of Donetsk City, in the Donetsk-Zaporizhia Oblast border area, and in western Zaporizhia but did not make confirmed advances on October 25.” “Ukrainian forces continued counteroffensive operations in western Zaporizhia Oblast on October 25 and made confirmed gains. Geolocated footage published on October 24 indicates that Ukrainian forces made further advances west of Robotyne.”

For those that have been following us throughout the Ukraine/Russia war, we have been saying that the battle would be focused on the West/ Southwest as Russia aims to control the coastal regions.

This stalemate will persist in the region with little pivot as the war of attrition continues. There have been reports of Russians deserting, but it’s hard to gauge the level of people leaving the frontlines. We have seen consistent reports of low morale at the front, but it’s hard to say how much is propaganda vs actual. Regardless, we don’t see much shift along the conflict zones.

India and Pakistan exchanged fire along the working boundary in the Zafarwal sector. There was another incident in Kupwara, Jammu, and Kashmir, as tensions remain elevated in the region- not that have ever really cooled off. This is likely incidents happening ahead of the winter months when the region slows down driven by the tough winters.

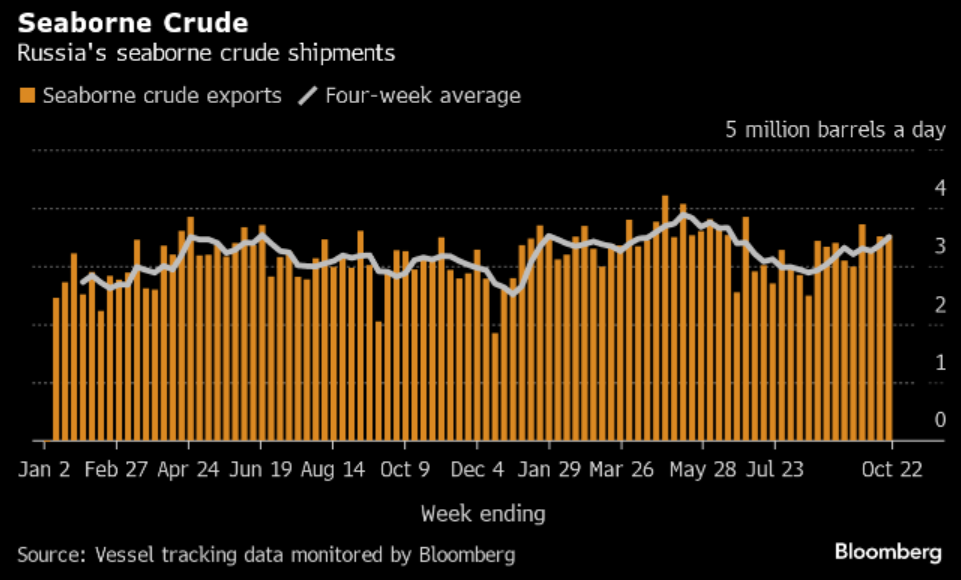

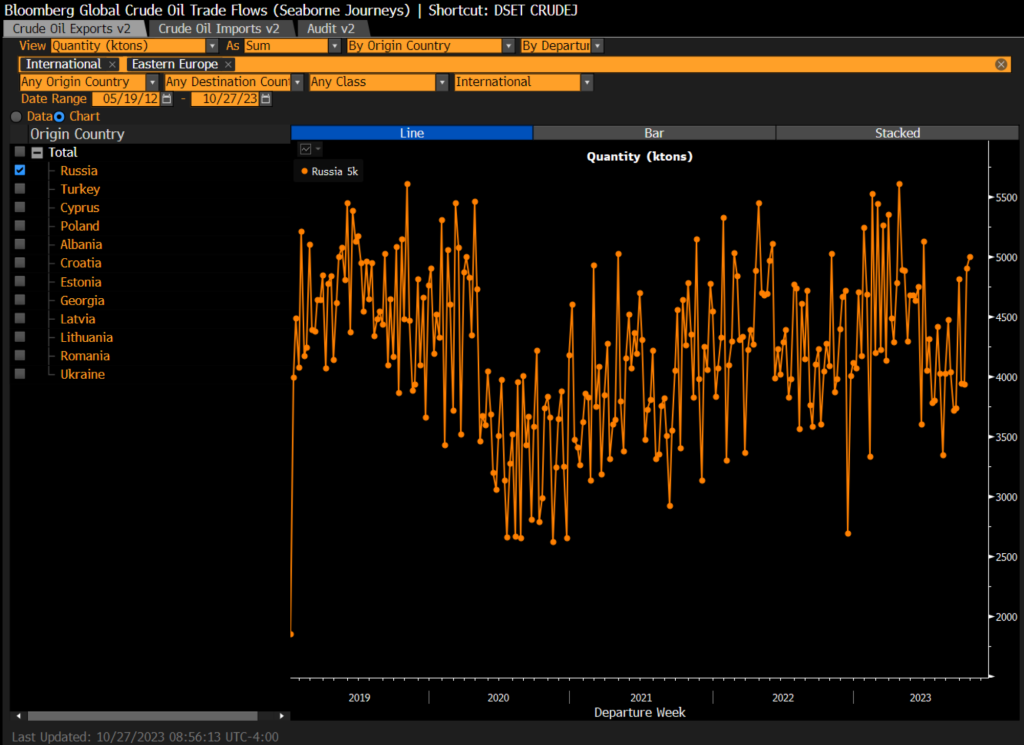

When we shift back to crude flows, we can see Russia pushing crude into the market at a four-month high. “Russia’s oil flows are climbing steadily as Moscow’s adherence to a pact with Saudi Arabia to keep barrels off the global market shows signs of waning. About 3.53 million barrels a day of crude was shipped from Russian ports in the week to Oct. 22, an increase of 20,000 barrels a day from the previous seven days, tanker-tracking data monitored by Bloomberg show. That lifted the less volatile four-week average to 3.5 million barrels a day, the highest since June, and up by about 610,000 barrels a day in the past two months. The small weekly gain reflected increases in flows from the Baltic and Pacific, which more than offset a drop in shipments from the Black Sea.”

Russia is struggling to bring their refiners back online, which is leaving them with more crude to export. They still have some diesel export restrictions, which are unlikely to change given the shortages within the country. The below data is more “real-time” and shows the steady increase of volumes being pushed into the market by Russia. We see this being persistent, and it will be important to see how Saudi reacts to the “breach” of their agreement on voluntary export reductions that were supposed to last till at least the end of this year.

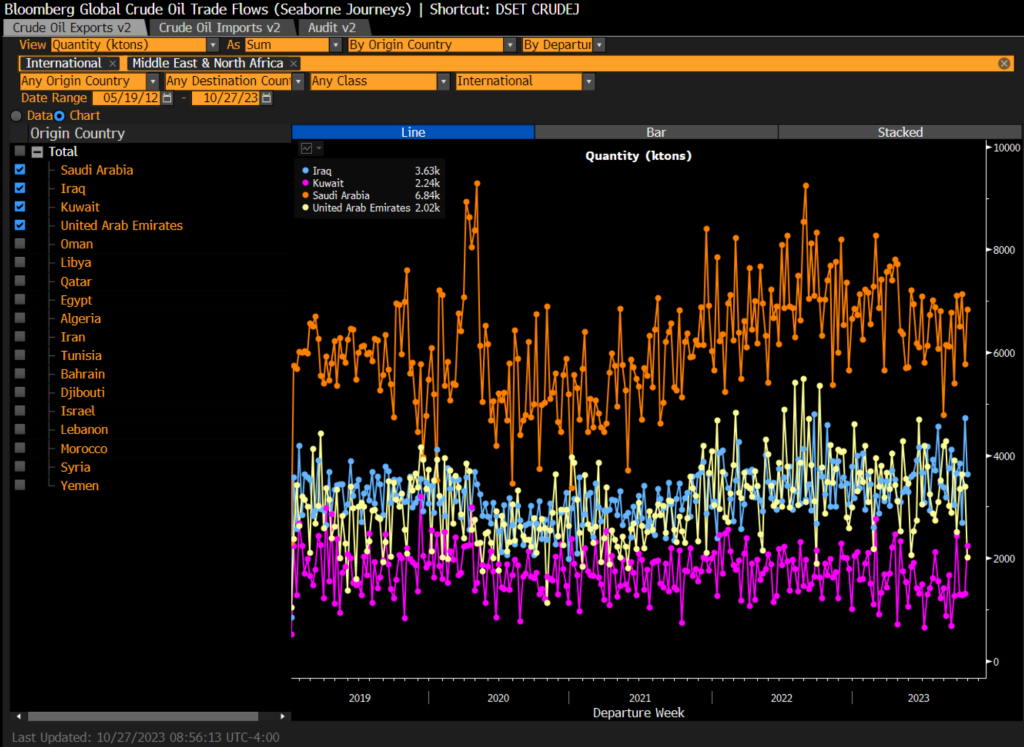

Saudi has been holding to their end of the agreement, which has come as a big benefit to Iraq- as you can see in the below chart.

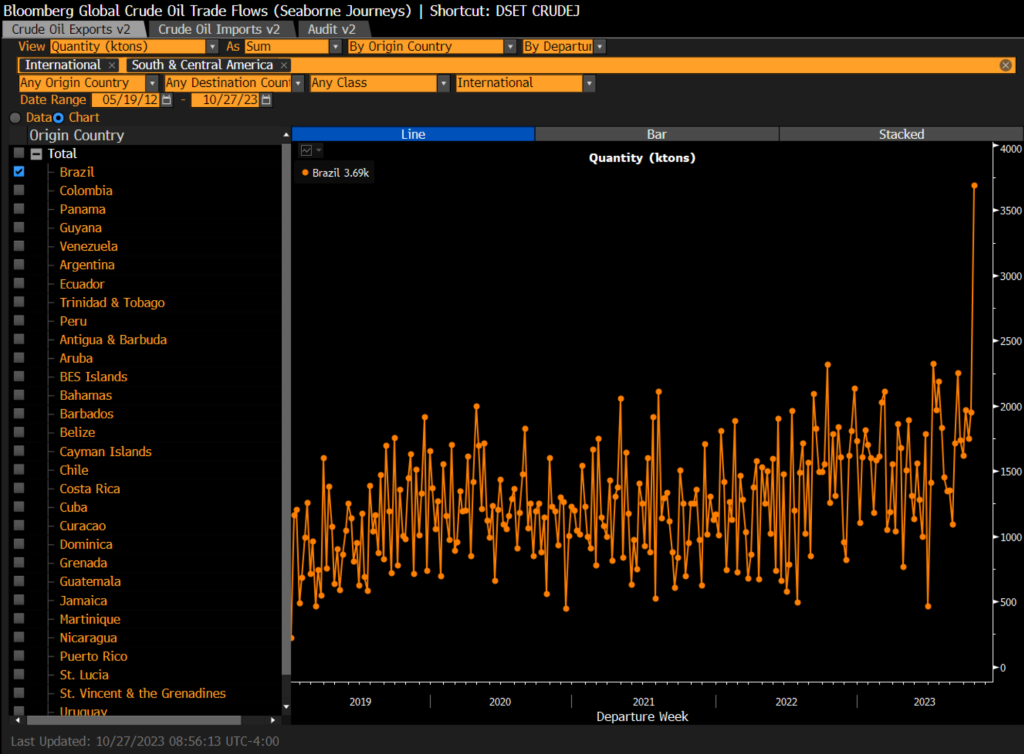

Saudi has pulled medium and heavy barrels off the market which has helped Iraq sell additional crude at a nice premium while still below KSA OSPs. The other big beneficiary has been Brazil, which has seen their exports surge driven by demand and new supply.

Europe has been buying from CPC, U.S., Libya, and recently more Angolan crudes as China has slowed down their purchases of WAF. This has left more Nigerian cargoes in the market that started to move after some recent price reductions. The biggest jump in differentials came on Angolan cargoes, but we are starting to see some additional Nigerian movements as well.

WAF-ASIA TRACKER:

- 47 cargoes of crude are due to load for Asia in October, equating to 1.45m b/d, according to Bloomberg estimates compiled from a survey of traders, loading programs and vessel-tracking

- Drops from a revised 1.7m b/d in September, which comprised 55 shipments

- NOTE: Cargo volumes vary; most shipments are about 900k-1m bbl each

- West African flows to Asia shrank as competition from Europe increased for diesel-rich barrels, while differentials jumped, putting off some Eastern buyers

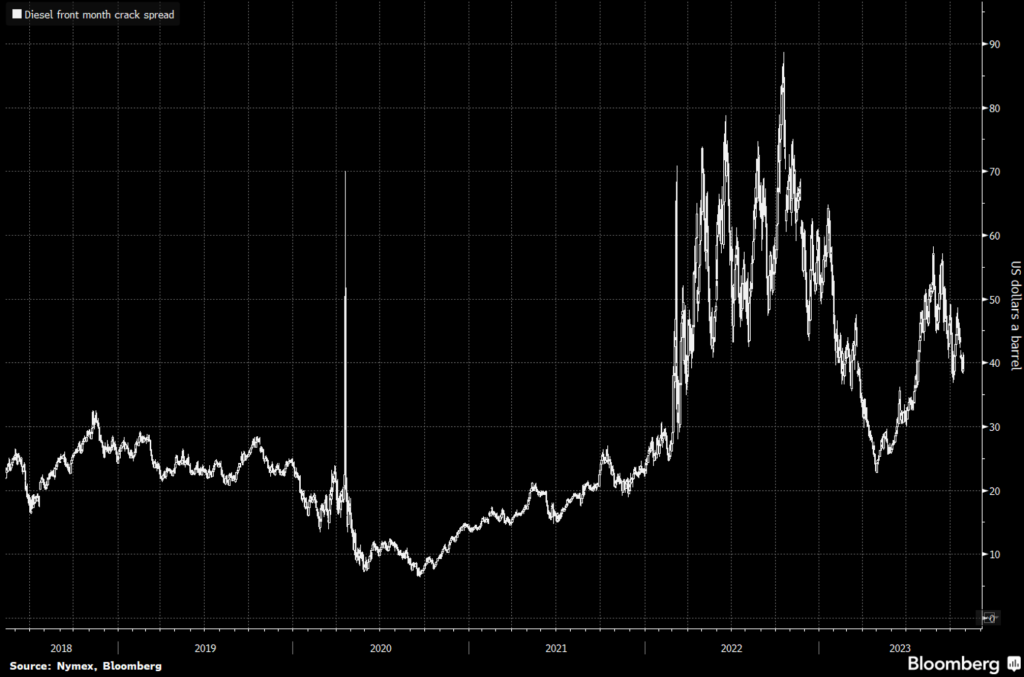

We expect to see additional purchases of Nigerian crude by the U.S. as refiners come out of maintenance season and look to purchase more distillate heavy barrels. The issue remains the disconnect between the gasoline and diesel cracks complicating the winter months. Given the tightness in the diesel storage market, we think there is support at the $37 level- especially given the shortage of available disty heavy crude.

Diesel will have to carry the full weight of the value as the gasoline crack remains stuck at the lows with limited demand and global oversupply of gasoline.

If we get any weakness in the disty crack, it will create a bigger problem with potential economic run cuts. We don’t see this being a problem in the U.S., but there is a growing chance this plays out in the Asian markets.

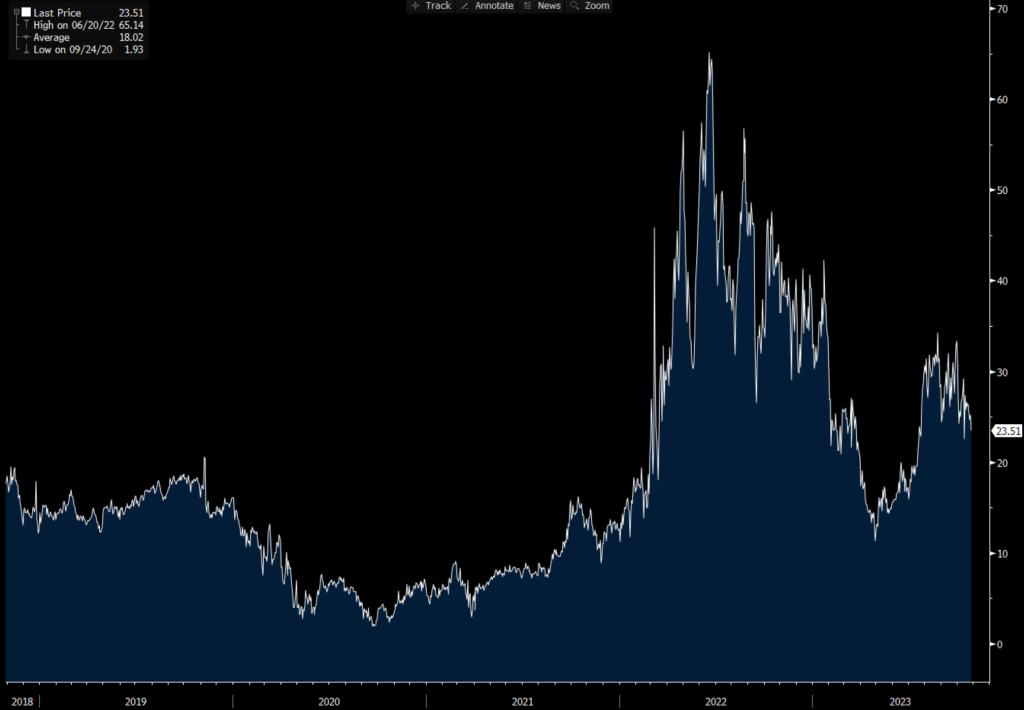

The below chart looks at the Asian distillate crack- it will find support around $21 and should stay between $23-$27 through the winter season. The bigger risk is slowing demand and new supply coming from Indian and Chinese exports. Gasoline/ light distillate will be a broader issue when we look at profitability.

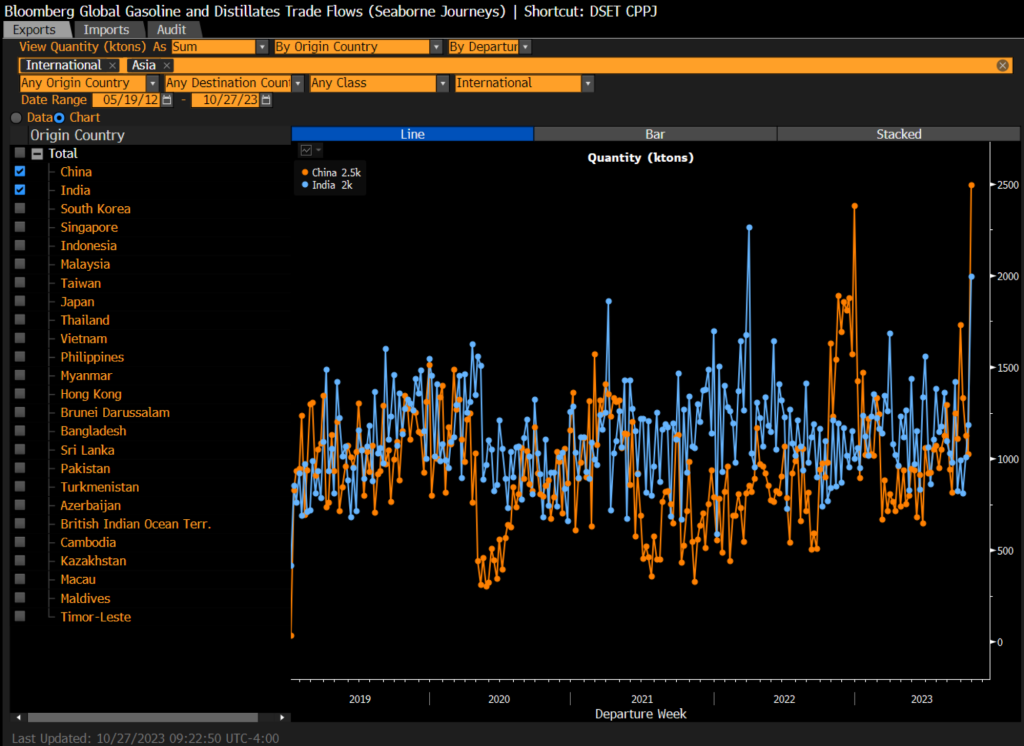

China reached a new record of exports with India reaching a second highest of all time. As economic pressure grows in China, we expect to see more product being exported. This will shift Middle East product away from Asia and into the Atlantic Basin.

With U.S. and European distillate storage so low, we don’t see this causing economic run cuts, but it will cap some of the upside in crack spreads. This is assuming a mild winter- if we get a normal or cold winter- we could see some bigger issues on storage.

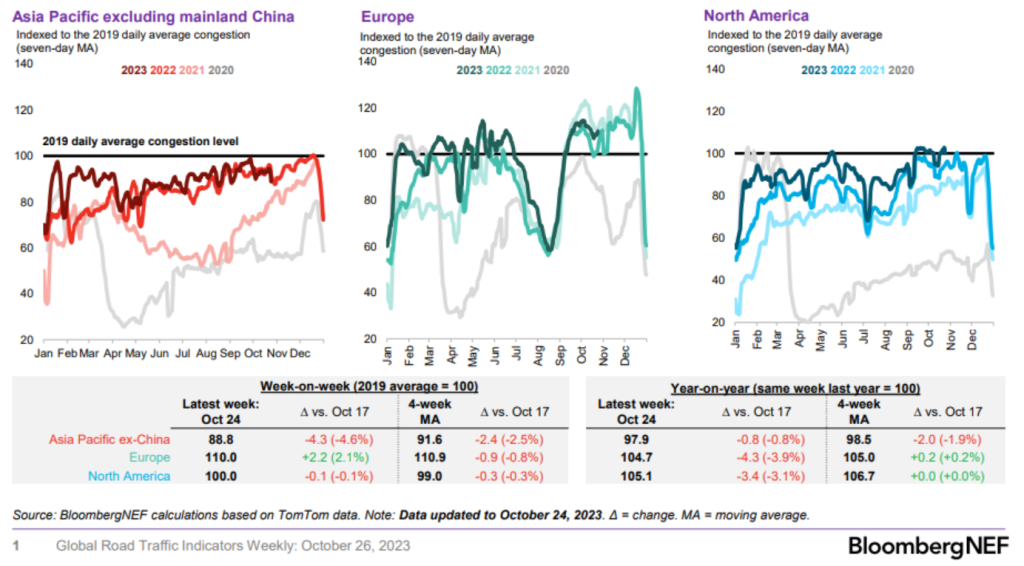

On the gasoline front, we expect to see pressure in Asia as subsidies are adjusted lower. Europe and North America should track “seasonal” norms in terms of traffic, but that will actually consume less gasoline in the same time period.

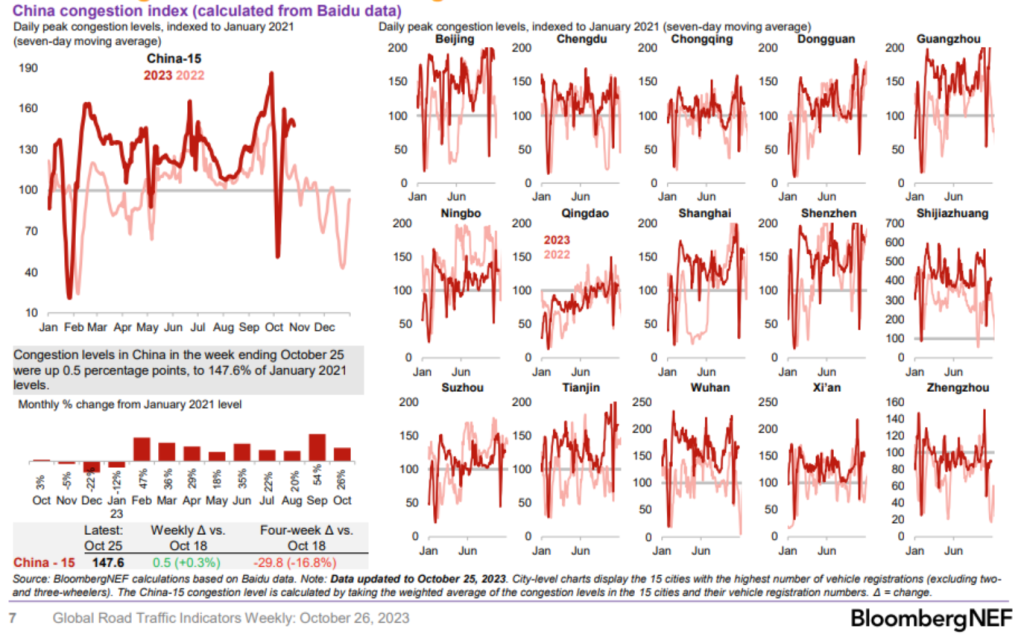

The Chinese driving data is holding firm at the moment vs 2022, which isn’t surprising given 2022 still had “Zero-COVID Policy.” The bigger problem with China is the market’s assumption about underlying economic strength. I will talk more about that in a minute.

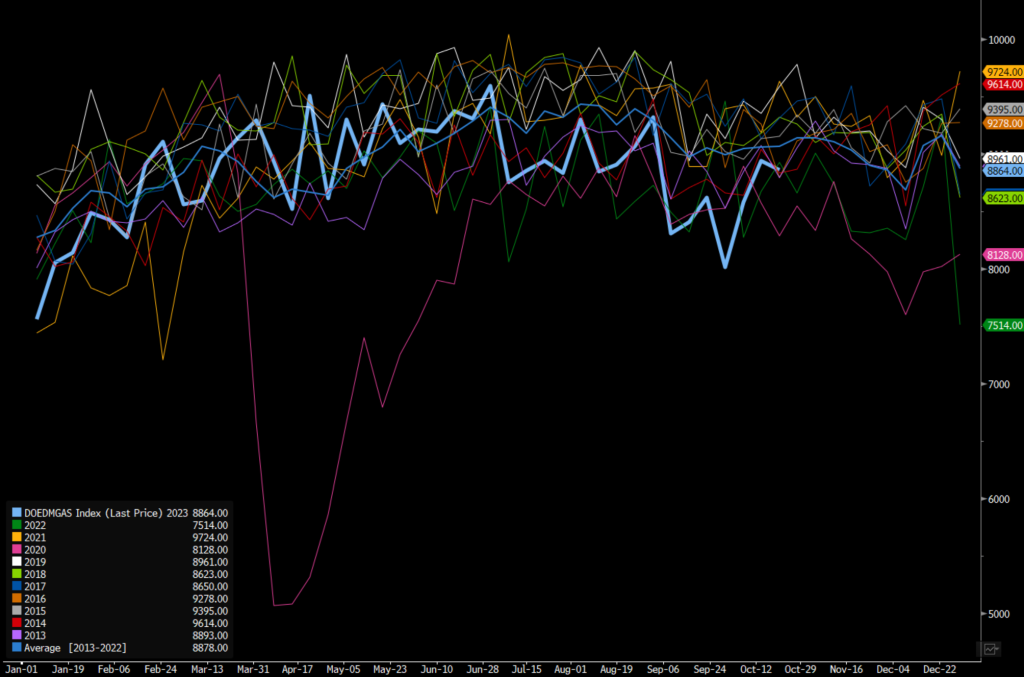

The issues in NaM and Europe will be driven by economic pressures, inflation, and a weakening consumer. This is why we believe that the U.S. will remain below the 10-year average as shown below in the EIA gasoline demand metric.

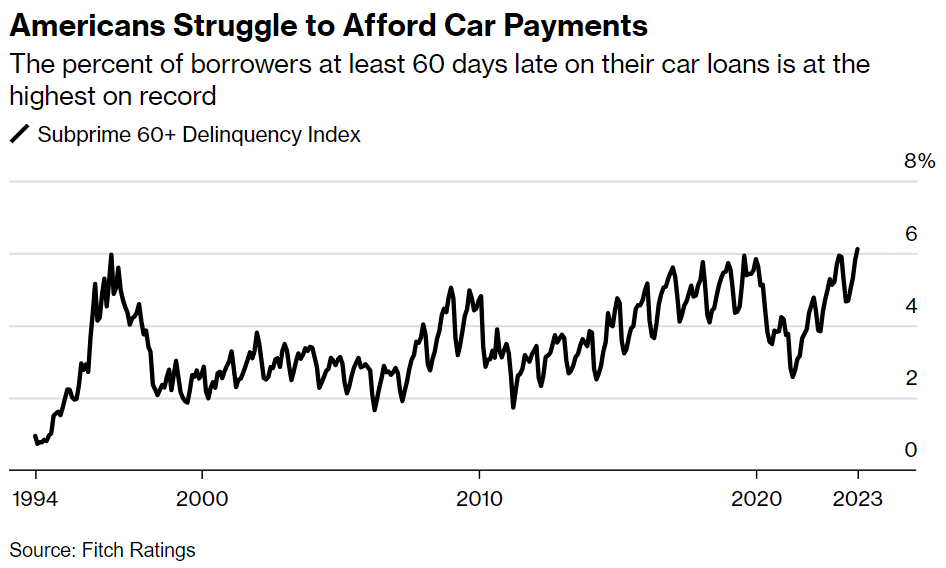

When we look at the consumer, we have gotten some recent data showing pressure in Asia and Europe with the U.S. consumer weakening but at a slow pace. We do see the pace accelerating throughout Q4 as credit pressures mount and leverage adds up rapidly. Typically, people will stop paying for their cars first followed by credit cards and rent/mortgage. As costs continue to rise, it will continue to eat at people’s savings and put more pressure on underlying spending.

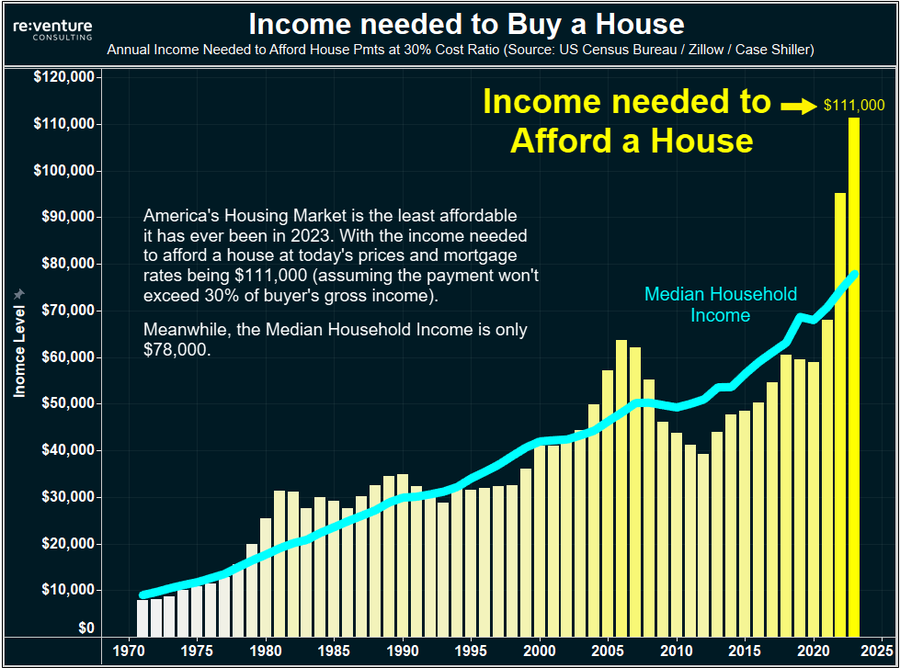

Housing affordability continues to get absolutely demolished, which will put more pressure on the economy going forward.

As we’ve stated from the beginning, the Fed must choose between wages or asset prices. I think the below chart does a great job of putting that into perspective when you look at income vs affordability. The Fed can either deal with a wage price spiral or bring down home prices.

The Fed has chosen to target asset prices (which is the correct option in my opinion), but it will keep rates higher for much longer. I don’t think the market truly appreciates the corner that the Fed and other central banks have backed themselves into. By maintaining easy monetary policy for DECADES, the ability to stimulate the economy is diminished driven by the Law of Diminishing Returns.

When we look at retail credit cards now charging record high average interest rates of 28.93%, you can see how rapidly the pressure can build on the consumer. This is a compounding factor that hits extremely hard when you look at the rapidly accelerating credit card debt.

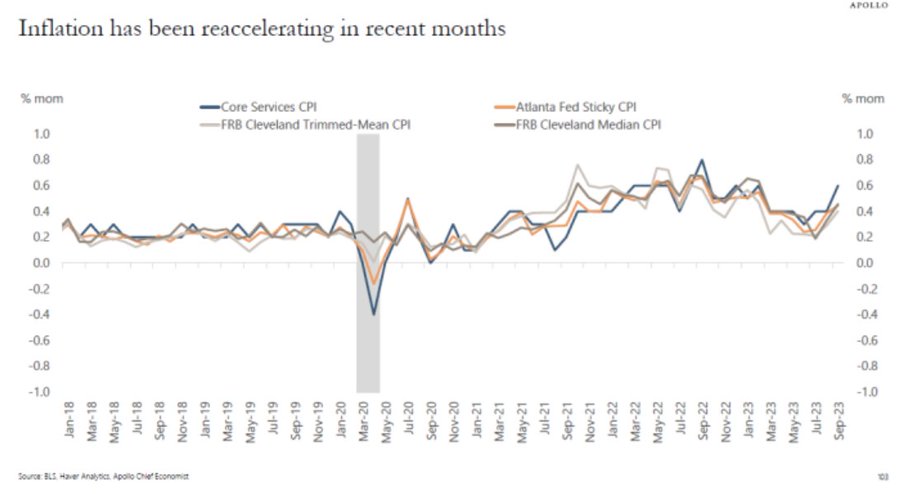

Even as things slow, the problem remains the increase across inflation that is shifting higher again. Rates staying higher will help cap some of the run, but the fact that fiscal spending is staying so elevated will be a broader problem.

Monetary policy is only one side of the equation, and unfortunately, we are seeing a broad bump higher in fiscal spending. Even as wages have fallen, they are still staying at elevated levels across the board, which has kept underlying prices higher. Companies will try to pass through as much of their cost as possible in an attempt to protect margin.

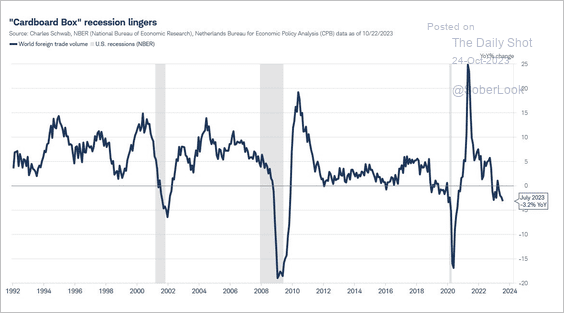

We haven’t even seen a sizeable drop-in U.S. consumer activity. The below shows the broader slowdown in trade, which will hit emerging markets.

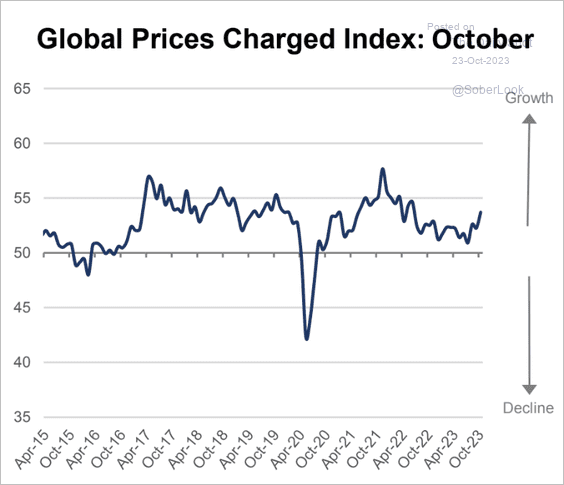

The concerning stagflationary setup is hitting once again as global prices pivoted higher.

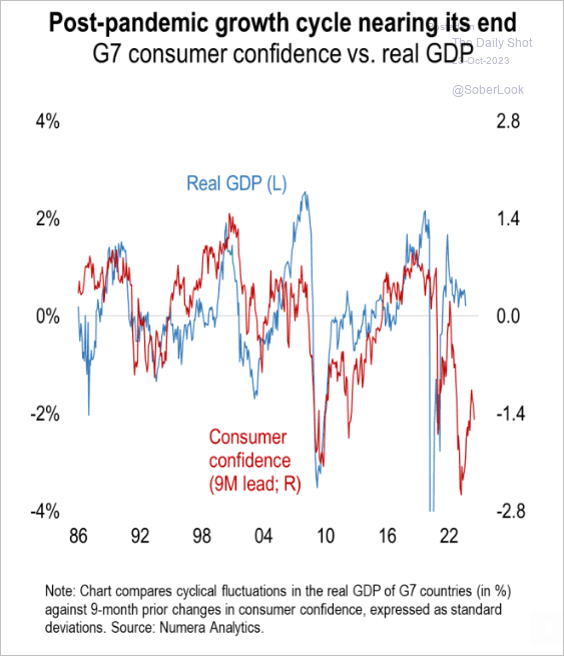

When you put these pieces together, consumer confidence and inflation is pointing to a strong pull to the downside.

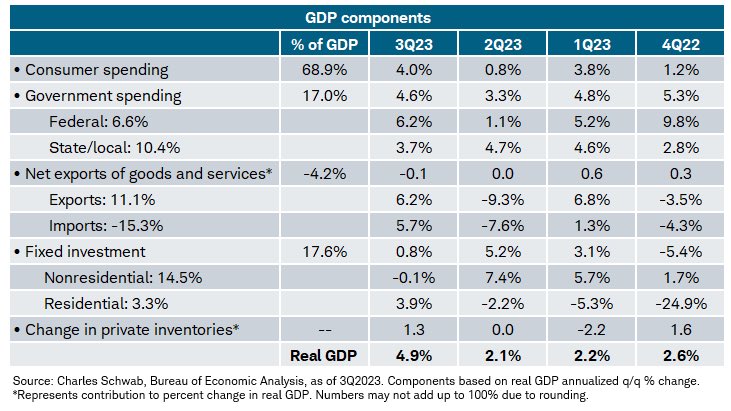

The U.S. posted a strong Q3’23 number, but the pressure remains to the downside when you look at the underlying components. Consumer spending posted a nice pop as did Federal Spending/ inventories. As we have seen to date, inventories remain elevated as consumer spending slowed further. The Federal Spending is a big issue when you look at the “pace” of inflation versus what the Fed is trying to accomplish.

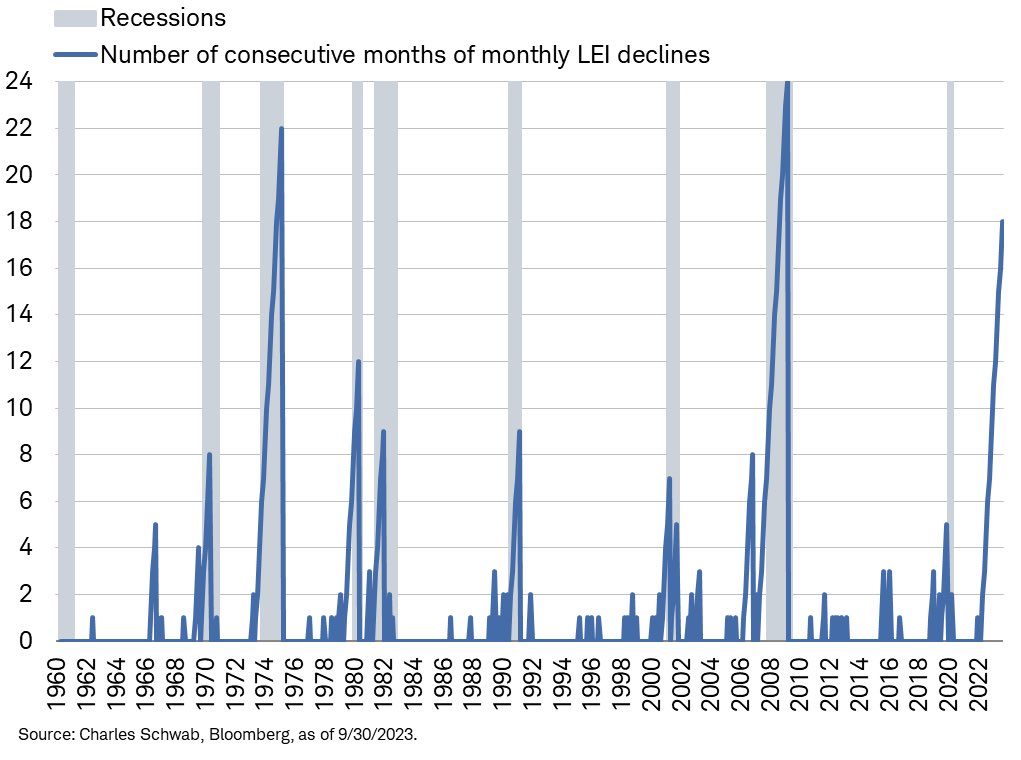

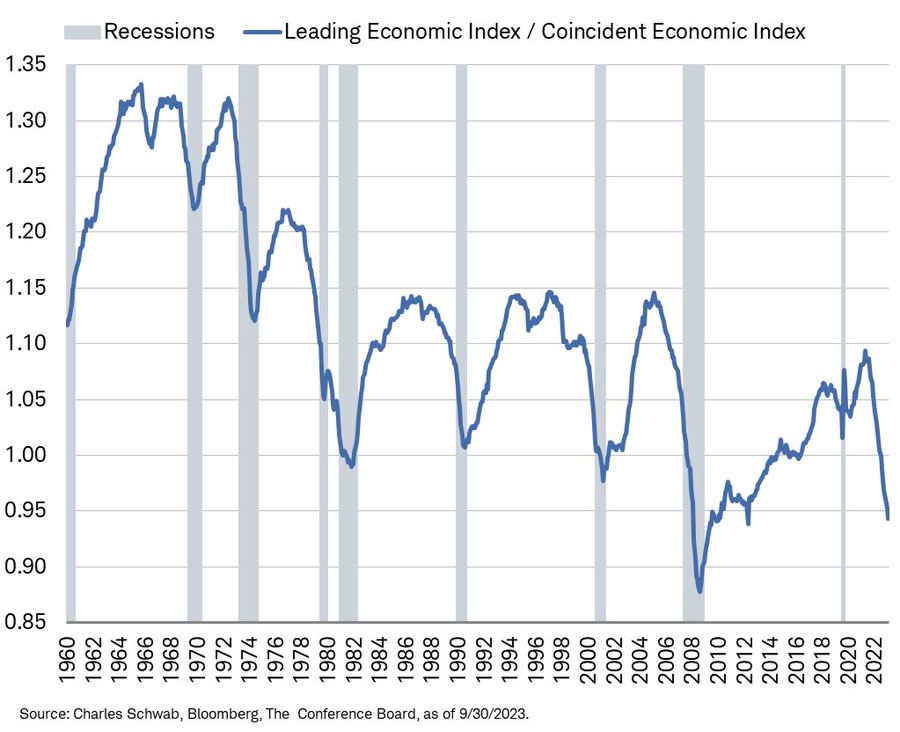

Key leading indicators show that Q4’23 is going to show more pressure to the downside.

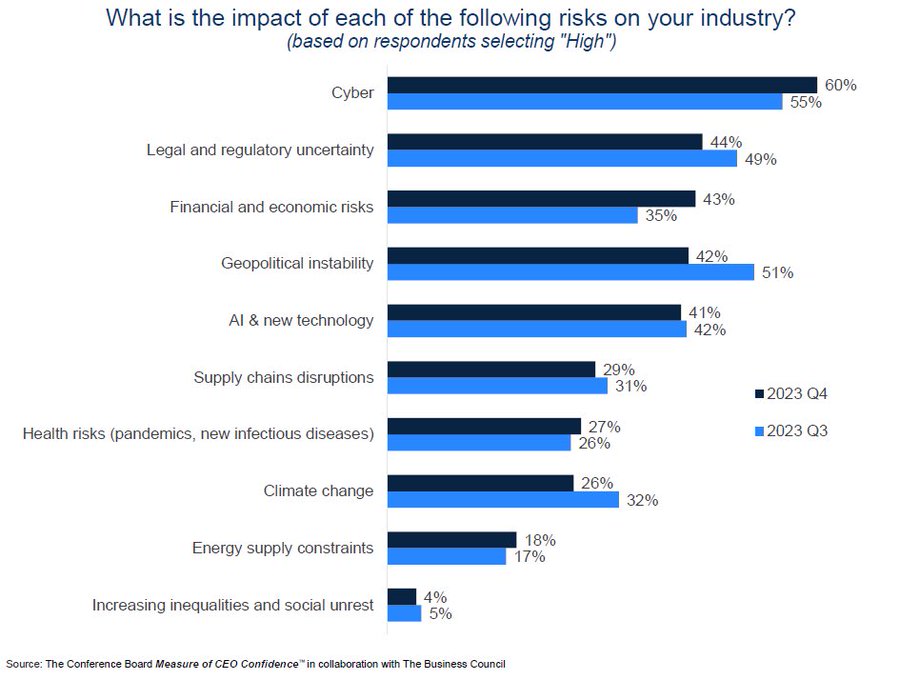

We are also seeing another round of concerns from business leaders on geopolitical instability and additional financial risks.

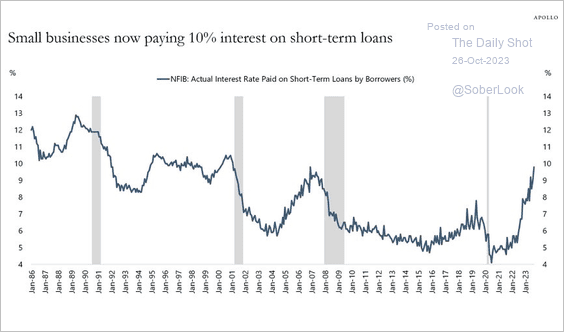

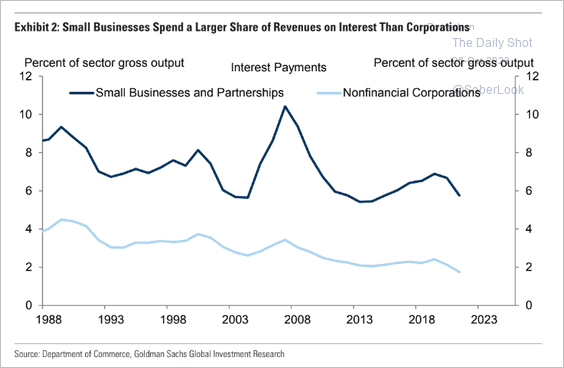

This is being pressured on a different level as well as small business are paying more for short term loans. As small businesses can’t afford the debt, they are forced to reduce employment and CAPEX expansion.

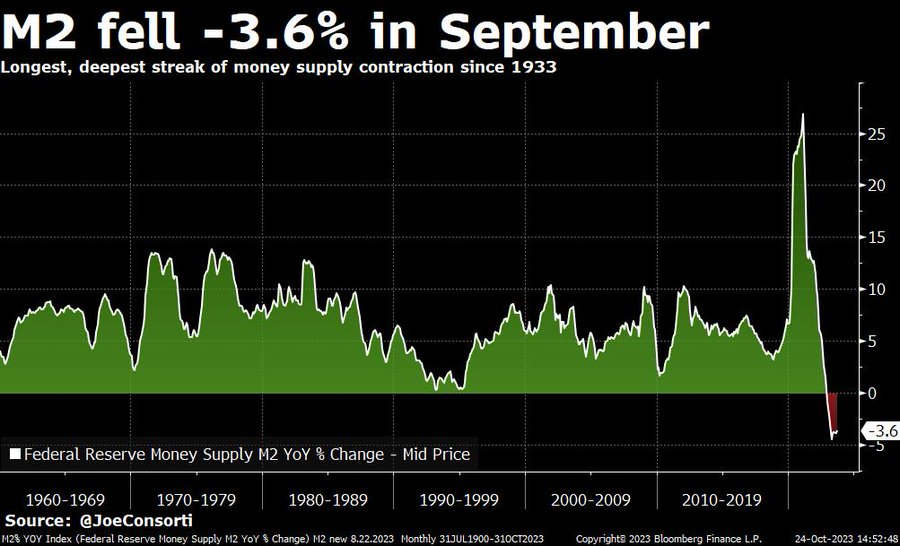

I think it’s funny when people focus so much on the rate of change in M2. In order to bring liquidity under some sort of control, it requires capital to be removed from the system. Some investor believe this points to instant deflation, but ignore the huge amount of liquidity pumped into the market since 1960- let alone the explosion from 2020 till Dec 2022. It will take years to pull this level of liquidity out of the market to “Right size” the M2 situation. The Fed doesn’t want to “Shock” the system by taking it all out at once, instead, they will keep things measured and slow with a controlled reduction by maintaining a small negative or “flat” basis going forward.

Next week I will cover Asia in more detail and how “Chinese Stimulus” will flow through the system. They announce an additional $1T RMB deficit spending targeted at infrastructure. Here is a quick summary of their issues: “Rather than work out how much growth a “stable and healthy” Chinese economy might be able to deliver, given high debt, the property crisis, weak domestic demand, global headwinds and other conditions specific to the Chinese economy, these economists have reversed this process, and are determining what would be a politically acceptable growth rate, and then calling for the spending policies needed to achieve this target. As long as there is debt capacity, there can always be more investment, even if this investment does not increase the real value of goods and services produced by the economy. But while this adds to economic activity (and reported GDP) it is neither healthy nor sustainable. Whenever this has happened before in other countries, the signal (usually ignored) that high growth was not sustainable was that investment-related debt grew much faster than GDP. China shouldn’t repeat this mistake.”

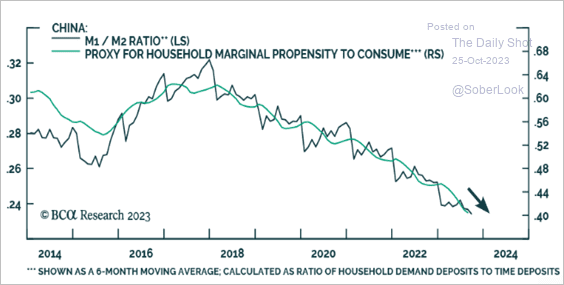

The consumer remains in a tough position as buildings fail to deliver units and the “propensity to consumer” shifts lower.

Here is what they still need to complete:

If a consumer invested in the developer and put a downpayment on the unit, how can they sell to recoup their investment if nothing exists? We only see more pressure within China.