In this article I try to provide our readers a preview of the global economic developments and also a brief outlook on the global gas prices.

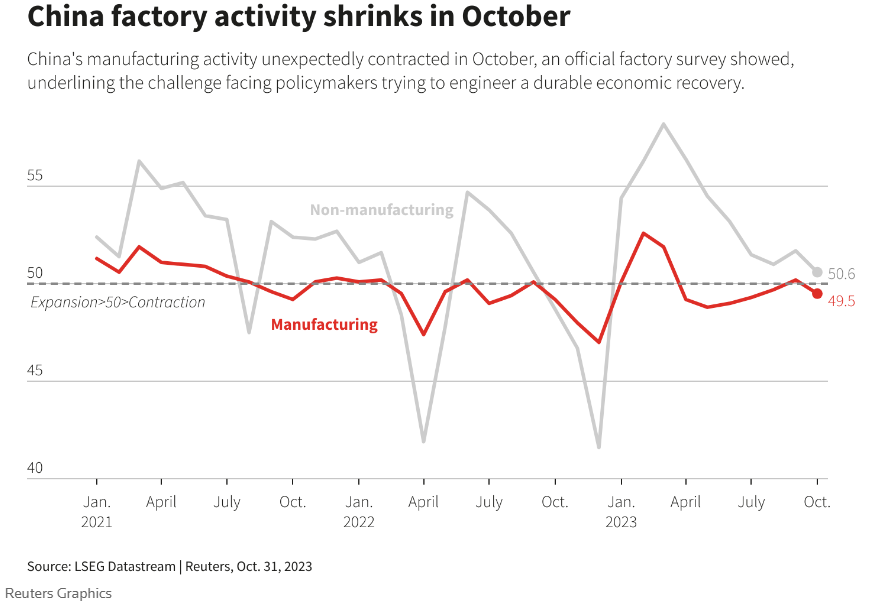

We start with China where a surprising shift in the manufacturing landscape was observed in October. The Purchasing Managers Index (PMI) took a dip, registering at 49.5, placing it in the 15th percentile for all months since 2011. This is a decline from September’s 50.2 (41st percentile). Notably, this marks the first monthly decline we’ve seen in the last five months, with the previous one being in May 2023.

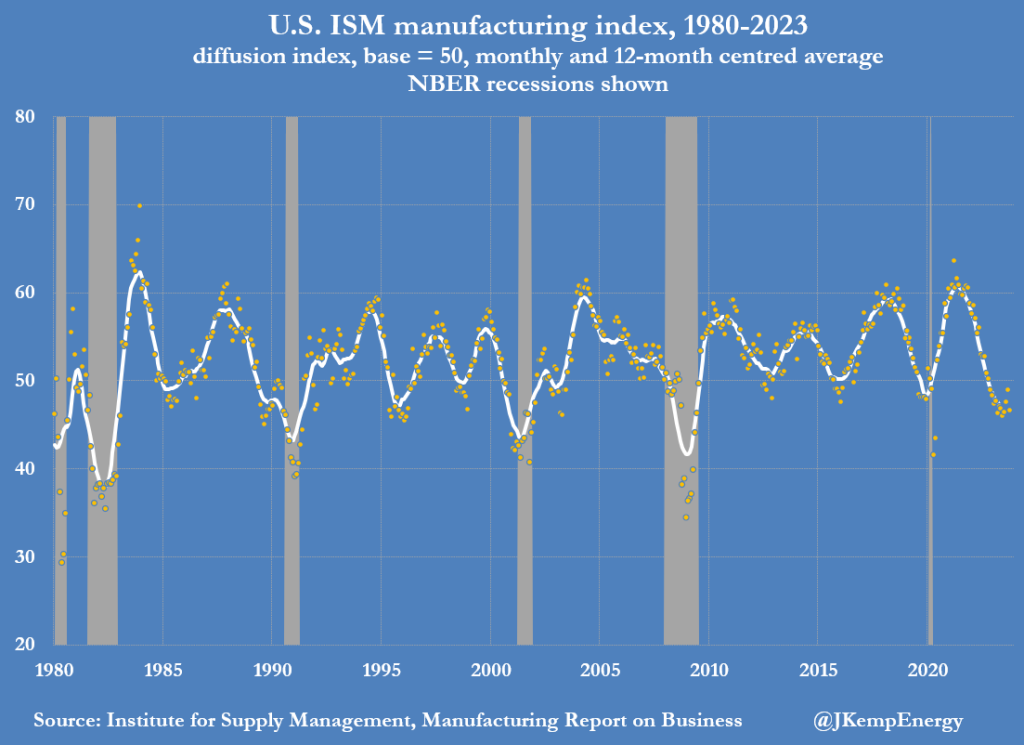

Moving forward to the US, we saw October brought an unexpected and broad-based decline in manufacturing activity. The ISM PMI for the month stood at 46.7, landing it in the 14th percentile for all months since 1980. This is a significant drop from September’s 49. The decline is noteworthy as it’s the largest one-month dip in the past 16 months, signaling a potential loss of momentum. This comes after a three-month streak of rising readings, which had previously hinted at a nearing end to the manufacturing downturn.

In Europe, October wasn’t kind to European markets, recording the poorest monthly performance since September 2022. Despite a boost on the month’s final day, overarching concerns weighed down the markets. The Stoxx 600 managed to close 0.6% higher, but sectors were predominantly in the green. Cumulatively, the index lost over 4% in October, as per LSEG data.

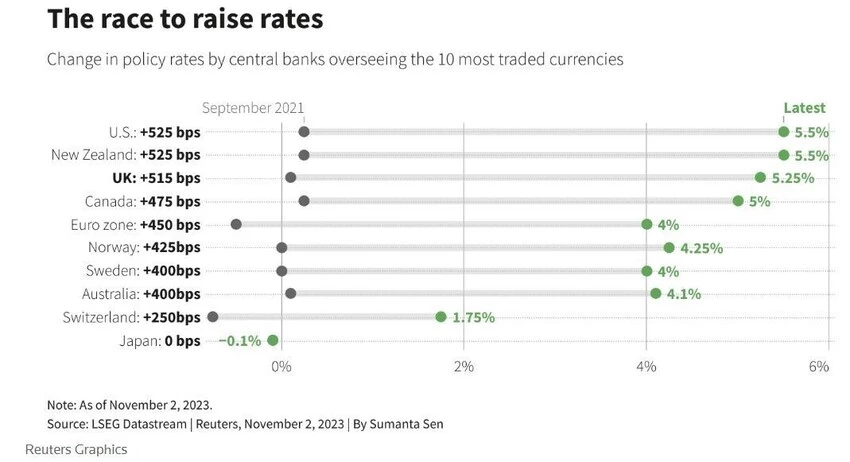

This week, the leading central banks of the world — the US Federal Reserve, the European Central Bank (ECB), and the Bank of England (BoE) — have opted to maintain their current interest rates. They are adopting a cautious approach, choosing to observe the unfolding inflation trends before making any changes. According to Reuters, the Federal Reserve has kept its key overnight interest rate steady within the range of 5.25-5.50%, while closely monitoring employment and pricing figures.

Gas Prices Outlook Amid Israel-Gaza Conflict

The Israel-Gaza conflict has prompted a notable reaction in energy markets, particularly affecting gas prices, which surged by 15% in October, peaking at a 40% increase—an eight-month high. However, the situation’s evolution is crucial for future gas market trends. Should the conflict escalate into a full-blown war, Bloomberg Economics warns of a potential global recession and oil prices soaring to $150, with gas prices expected to follow suit.

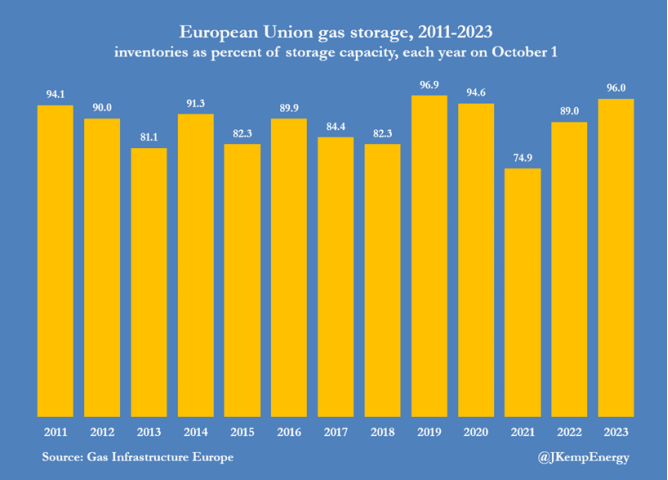

Conversely, European gas inventories are robust at 96% capacity, with levels +172 TWh above the ten-year seasonal average, suggesting a stable supply. Additionally, Europe anticipates “warmer than average” temperatures extending into November, influenced by a prolonged El Niño, which could lead to the hottest year on record in 2024 and unpredictable weather extremes.

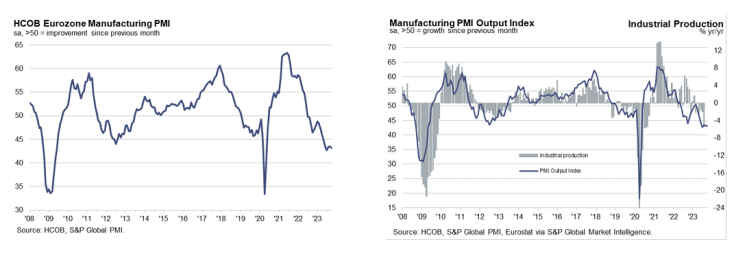

Economic slowdowns, particularly in the Eurozone, may also dampen gas prices. The HCOB’s Eurozone Manufacturing PMI hit a three-month low at 43, and S&P Global’s flash euro zone Composite PMI fell to its lowest since November 2020. Germany’s continued contraction in business activity and reduced gas demand—down by 13% in the first half of 2022—mirror a broader European trend that could see the continent’s largest gas market shrink by over a quarter by year-end.

In Asia, LNG spot prices have normalized, decreasing to $17/mmBtu as Middle East supply disruption fears wane. With hedge funds selling 125 bcf of gas futures recently, if the Israel-Gaza conflict does not intensify, gas markets may stabilize similarly to oil markets, avoiding long-term bullish trends.