Optimistic Outlook In 2024: During Q3 2023, NINE Energy (NINE) commercialization of its new Pincer Hybrid Frac Plug, which can help increase market share in the plug market. After Q3 2023, NINE’s management “anticipate 2024 activity to increase”. However, for Q4, it expects activity level and pricing to remain stable. With an improving market, it will base its strategy on its asset-light business. Read more about this in our recent article here.

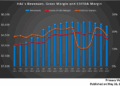

Revenue And EBITDA Margin Contracted In Q3: Quarter-over-quarter, NINE’s revenues decreased by 13% in Q3, while its adjusted EBITDA margin contracted by 521 basis points. Weather and fracking activity delays adversely affected the company’s asset utilization, deteriorating performance in Q3. Also, the continued rig declines in Q3 reduced revenues from the cementing business, especially in Haynesville and Eagle Ford.

NINE’s Cash Flows And Negative Equity: NINE’s cash flow from operations turned negative in Q3 2023 compared to a quarter ago. As a result, free cash flow turned negative in Q3 compared. Due to negative shareholders’ equity, its debt-to-equity remained negative as of September 30, 2023. So, a reasonably high net debt ($307 million) and negative equity render the stock financially risky.

Thanks for reading the NINE Take Three, designed to give you three critical takeaways from NINE’s earnings report. Soon, we will present a second update on NINE earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.