Our target for completion crews still remains around 285 as we head through the first part of November. As we move closer to the holiday season, there will be a typical slowdown between Thanksgiving and New Years. There has been a steady rise in crude production that has put us at around 13.2M barrels a day according to the EIA. Our expectation was for about 12.7M barrels a day, but the rapid adoption of dual frac (simulfrac) accelerated faster as well as some of the liquid production driving up the larger number. We are approaching a “terminal” crude production that we put at about 13.4M barrels a day back in 2019 based on demand for U.S. light/sweet crude and pipeline/ port restrictions. There is only so much light crude that U.S. refiners can process, which pushes the remainder into the global market. The restriction on Russian flows pulls more U.S. crude into Europe and Asia, which isn’t something that will slow in the near term.

There were some seasonal uplifts in the Appalachian market while some of the smaller basins saw a bit of a retraction. We still expect to see one more push higher in the Permian and Western Gulf ahead of the holiday crunch.

Global Diesel Markets

The global diesel market has tightened over the last few years driven by reduced refining activity, shortages of crude blends, and geopolitical disruptions. North America is facing a broad middle distillate (diesel) shortage that is structural in nature and won’t be corrected without the construction of new assets. In June 2019, the Philadelphia Energy Solutions refinery exploded, taking 335k barrels a day of refining capacity off the market on the U.S. East Coast. In just the last two years, the U.S. has shuttered over 1M barrels a day of refining throughput tightening the market further with limited new capacity coming to market. Due to the closures, U.S. and Europe have relied heavily on the Atlantic Basin to provide necessary diesel flows as storage dipped significantly on both sides of the ocean.

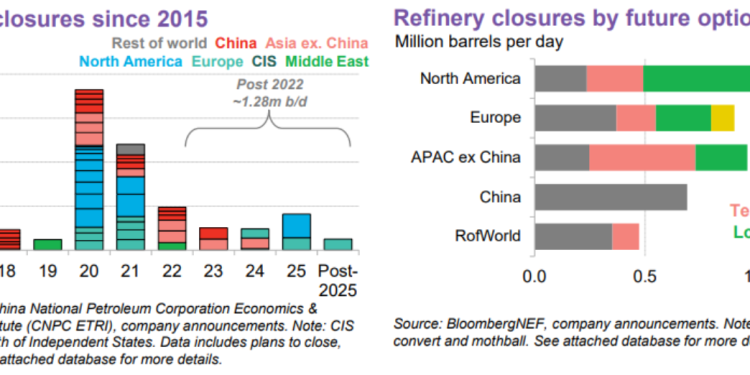

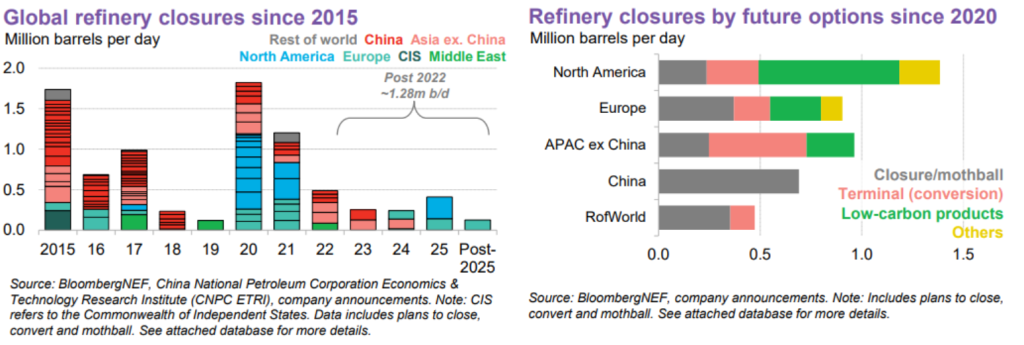

The U.S. and Europe have been the largest drivers of refining closures over the last few years, with additional capacity slated to be mothballed. There is about 1.28M barrels of oil throughput earmarked for closure in the coming years, which is on top of the 3.51M barrels a day already decommissioned between 2020–2022. This has led both sides of the Atlantic to rely heavily on imports to make up for the loss of capacity and dwindling storage.

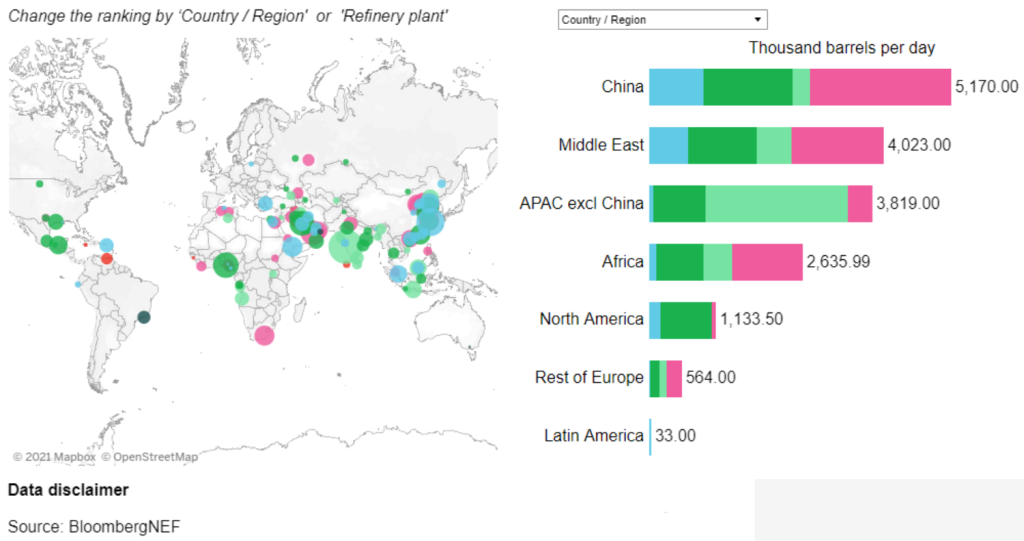

The Atlantic Basin was supplied by Russian volumes to make up the difference—specifically for the U.S. and Europe. As those barrels fall out of the market, the global complex becomes more competitive and expensive to purchase floating barrels in the market. Refining expansions are being carried out in China, Asia, and the Middle East, which will increase the underlying cost for buyers- primarily the U.S. and Europe. There are significant additional costs attached to these barrels including day rates, sailing time, insurance, and other ancillary charges attached to shipping. This also exposes a country to the whims of geopolitical shifts, political alliances, state owned operators, and other uncertainties—all of which will reduce energy security. For example, China doesn’t allow companies to export refined products freely, instead they issue export quotas to ensure there is enough volume within the country. This artificially tightens the market and provides political concerns to the availability of refined products in the market. The whims of China are important because refined products and oil are mobile cargoes that can sail anywhere in the world. Products will flow to the highest bidder, and the West is being left behind- forced to outbid all of the stops along the way from the Middle East or China to the Atlantic Basin.

Even as Asia builds more refiners, there is a shortage of “distillate heavy” crudes that can be used to create the desired products. Each crude grade yields a specific amount of refined products (i.e. gasoline, diesel, aromatics, jet fuel). The heavier grades have a higher cut of distillate, but as OPEC+ withholds barrels, there is now a shortage in the market, which drives up the price of the specific grades. This is creating a shortfall that expands beyond just the Atlantic Basin and increases competition.

The logistical issues, OPEC+ reductions, and shrinking refinery capacity have resulted in distillate storage being at one of the lowest points in history. There are key demand centers that are already scraping the bottom of the tanks; this is currently the case on the East Coast, and is particularly problematic as we prepare for winter with little ability to address the shortfalls. In Europe, the same scenario is playing out; levels are touching 2022 lows with limited options to close the gap without purchasing volumes from the Middle East and the U.S. The majority of the U.S.’s refining capacity is on the Gulf Coast, and they rely heavily on the Colonial pipelines to send product into the East Coast, but this has a specific operational limit. Refiners can also utilize rail capacity, but this is a high-cost option. The last option is shipping, but due to the Jones Act, there are only a finite number of vessels that meet the classification, making it very expensive and prohibitive to ship product from the Gulf of Mexico into the East Coast. This leaves the East Coast competing in the floating market with Europe.

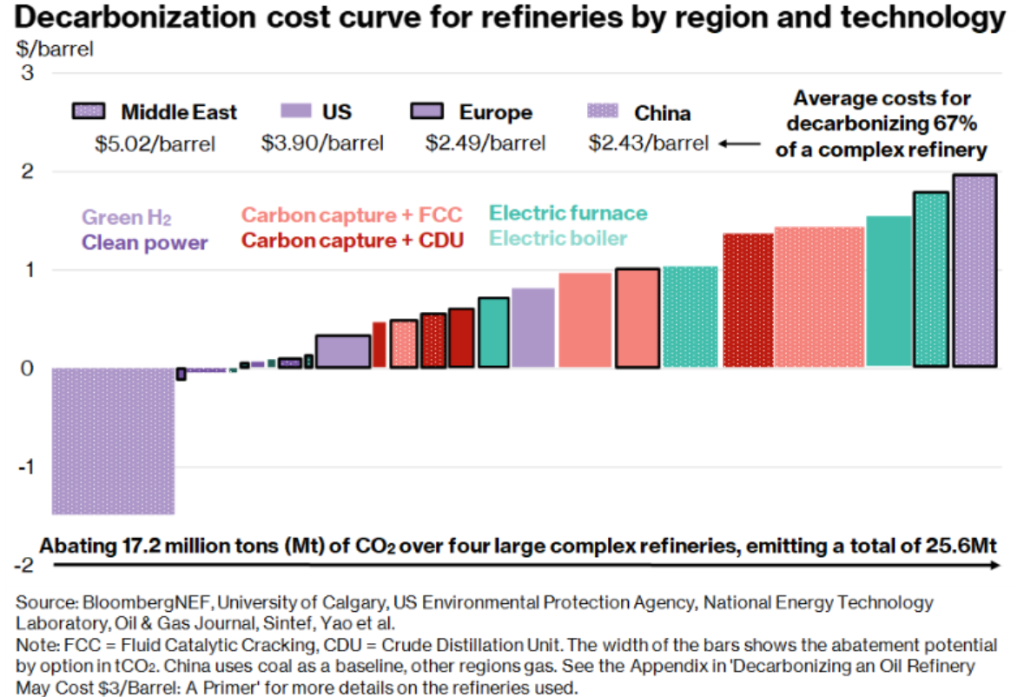

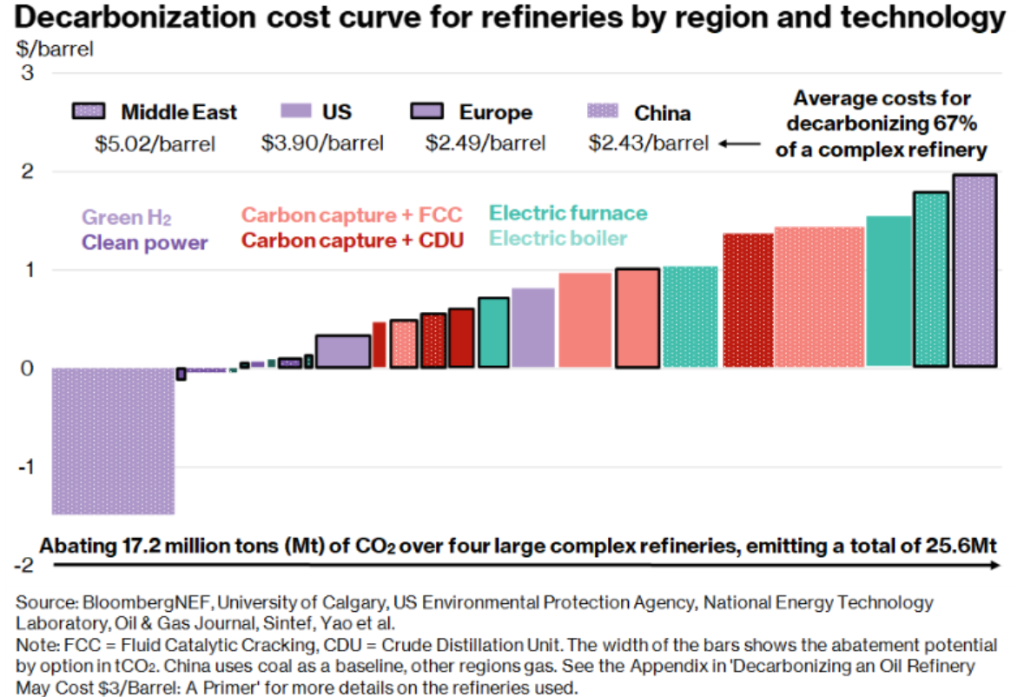

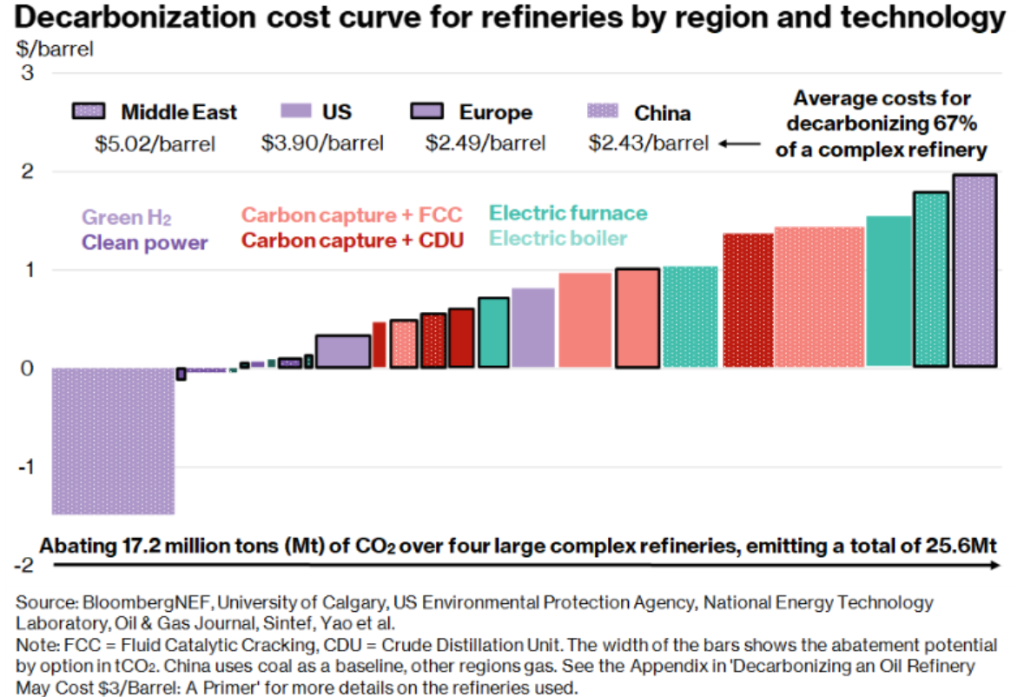

There is also a push to decarbonize the remaining refining assets, which will increase the cost per barrel produced. As the CAPEX is spent, companies will look to recoup as much of this underlying cost as they can by passing it through to the end user. As competition grows for the remaining barrels produced, consumers won’t have much choice and will end up being price takers. This is a pivotal point where SustainAgro steps in and utilizes wood and farm waste to create localized carbon-negative diesel. We enable a location to disconnect from the uncertainties of availability by building in regions that need fuel security.

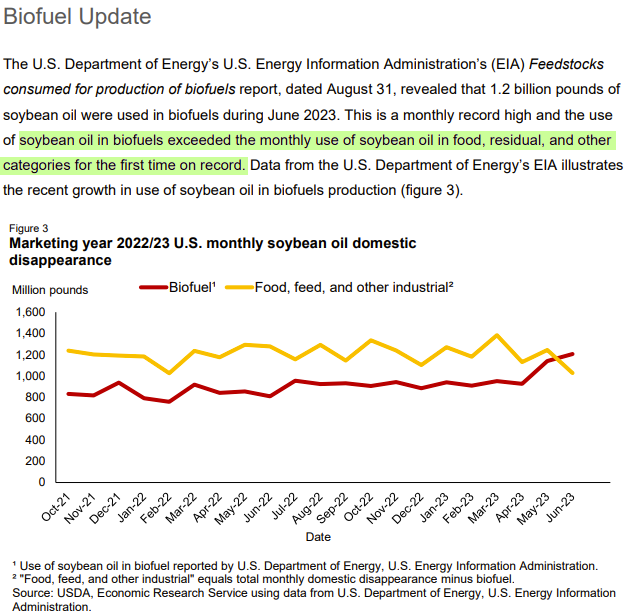

North America and Europe are building biofuel facilities, but they are relying heavily on agriculture oils and waste oils. This takes food away from human and livestock consumption and puts it into fuel tanks. It also creates a sub-optimal product with logistical problems, equipment damage, and operational issues based on extensive water contact. The excess water creates issues with functionality, icing concerns (pour point/cloud point), and additional costs in shipping/handling/ logistics. As the food situation globally deteriorates further, the limitations of biofuels will only become more pronounced.

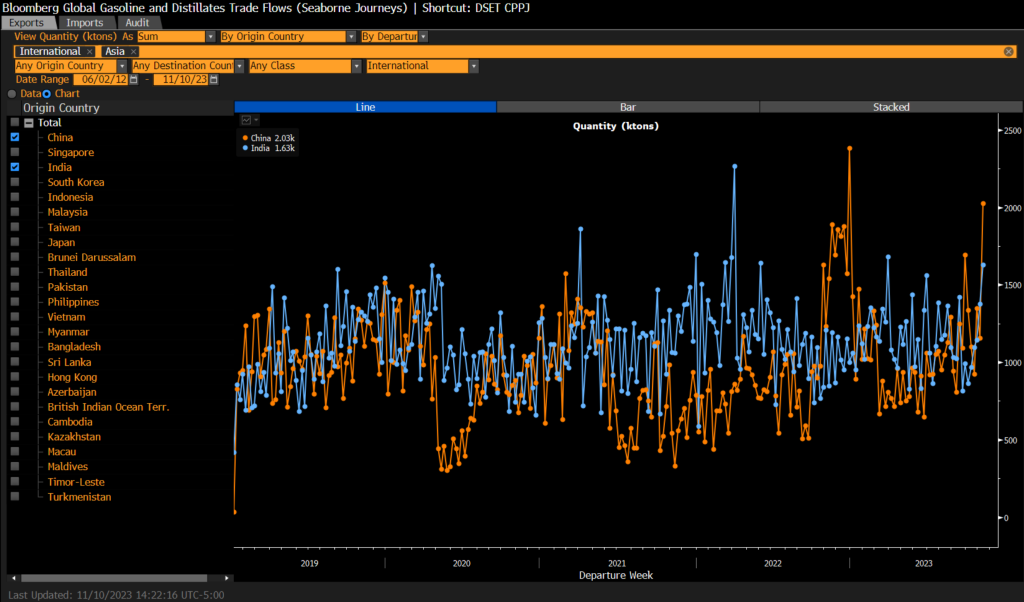

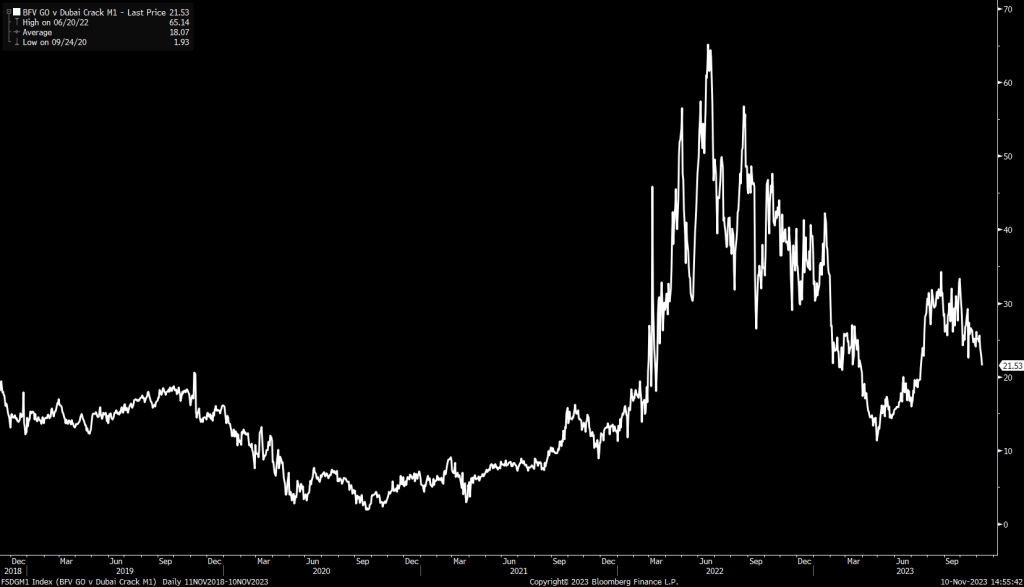

Crack spreads have weakened as Chinese and Indian exports have surged in the Asian markets. The additional volume in the market mixed with declining economic activity has pushed crack spreads lower.

The below chart shows the crack spread that has fallen to support levels. There should be some support at these levels, but it’s unlikely we get a meaningful bounce as India/China continue to push more product into the market.

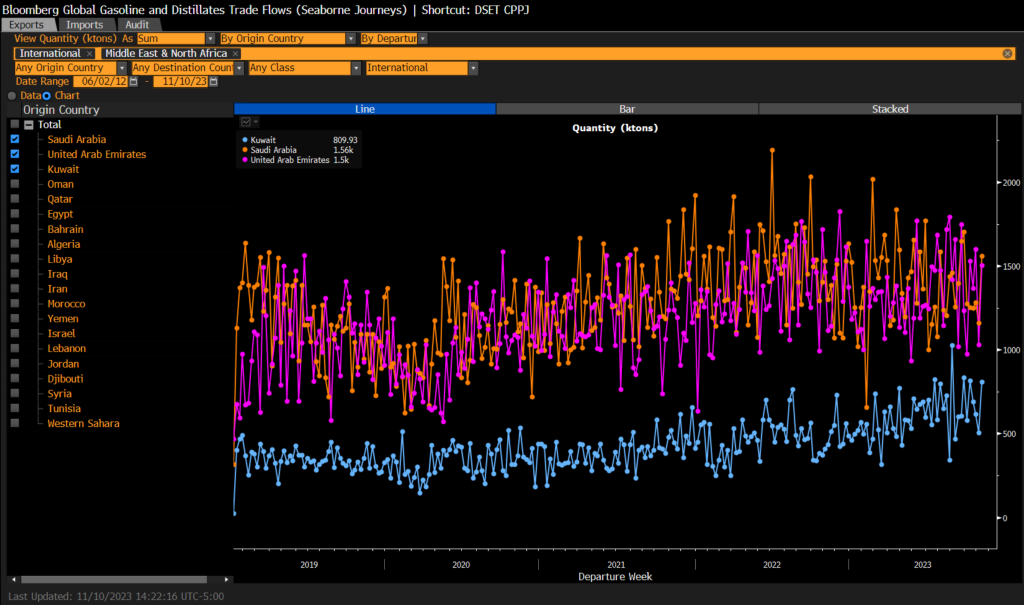

The Middle East has also increased their exports of refined products with more of it heading into the West Suez (Atlantic Basin) market. This will cap crack spreads in the U.S. and Europe and shift them lower even as storage stays depressed.

There won’t be enough volume to really pivot the storage levels meaningfully higher, but there will be enough to compress some of the crack spread benefits- especially in the U.S. We are seeing the crack spread drop to support levels where it will likely pause and likely consolidate.

Crude pricing has also found a bit of support just below $80 with a quick bounce back to about $82. We believe there is some additional upside with $80-$84 holding at this juncture. We could get an extension to $86, but any bounce like that would be driven by some sort of bigger catalyst- along the lines of an additional cut from OPEC+ or a broader escalation in the Middle East. The “big drop” in Brent was driven by Hezbollah essentially yelling fire and brimstone but held firm on not invading Israel from the North. This is consistent with our views that there is ZERO government or local support for Hezbollah action, and they know nothing can be meaningfully sustained. Another action that took some of the air out of the geopolitical balloon was the “limited” resistance put up by Hamas as Israel entered North Gaza. This is by no means saying there weren’t attacks or fighting- it’s just highlighting that the invasion into Gaza was faster.

We are now seeing more and more actions of local Palestinians that they are turning on Hamas with some reports of attacks on citizens moving south. The Houthis on the other hand have continued to launch missile and drone strikes at Israel, which will continue in the region. So far, the countermeasures have been enough to stop most of the attacks. Many of these items are flying over Saudi territory or the Red Sea, which is causing problems within KSA. I don’t think the Saudis will tolerate some of these actions much longer, which will create more pressure points as we progress.

The U.S. has also been subjected to consistent rocket/drone attacks in Iraq and Syria, which is creating a bigger problem in the Biden government. There’s also evidence that a missile attack also occurred, which has resulted in some bigger reactions from the U.S. military. I still expect a much bigger response from the U.S. over the next several weeks once we move all of the key infrastructure into position.

In the near term, the lack of geopolitical escalation has allowed the slowing demand side of the equation to “pull down” crude pricing. The physical market has softened a bit with barrels from West Africa slowing a bit more resulting in some price cuts. Here is just one example:

“Vitol reduced its offer price for Gabon’s Rabi Light on the Platts window. Spain doubled crude imports from Nigeria on a y/y basis in September to 806k tons, the highest level since August 2022.

PLATTS:

- Vitol offered 950k bbl of Rabi Light on CFR Augusta basis for Dec. 1-5 arrival at Dated +$3.15

- Cargo to be discharged from Euronike

- Decreased from +$3.30 on Nov. 3, +$3.50 on Nov. 2, +$3.65 on Oct. 31”

SPOT MARKET:

- All three of Ghana’s Jubilee crude cargoes for December are still for sale at discounts to Dated Brent: traders

- That’s a slower pace than a few months ago, when cargoes sometimes sold within a couple of days of the program’s release

These shifts in the market help to highlight the pressure points on the physical side. There has been a big drop in Chinese crude purchases as refining activity in the regions slows.

As the economic pressure grows globally, we will see more reductions in refined products that will result in slowing crude demand. I hold to the fact that OPEC is still overestimating demand, and KSA/Russia will have to maintain their cut well into 2024. If they look to increase production, it will result in a sizeable decline in crude pricing. This leaves OPEC+ carrying the reduced production over a much longer period of time.

The U.S. is also taking advantage of the OPEC+ reduction as well as KSA keeping their OSPs (official selling prices) at very high prices. “he record number of supertankers sailing toward the shores of the US is getting ever larger. There are 51 ships headed to the nation’s ports over the next three months. That’s the most in at least six years, climbing by three from the previous week’s record. About 80% of the vessels are empty, indicating that they intend to pick up cargoes in the US. The growing volume comes after US crude exports surged this year to a record. Overseas shipments have averaged 4.1 million barrels a day, based on the Energy Information Administration’s weekly data, up from 3.5 million in 2022. That’s helped offset some of the supply losses arising from output curbs by the Organization of Petroleum Exporting Countries and its allies.” These shifts are also supportive of U.S. ngl sales into the market as LPG volumes from the Middle East stay depressed. Given the low price of our propane, it keeps flows supportive and maintaining a floor in the current price in the U.S.

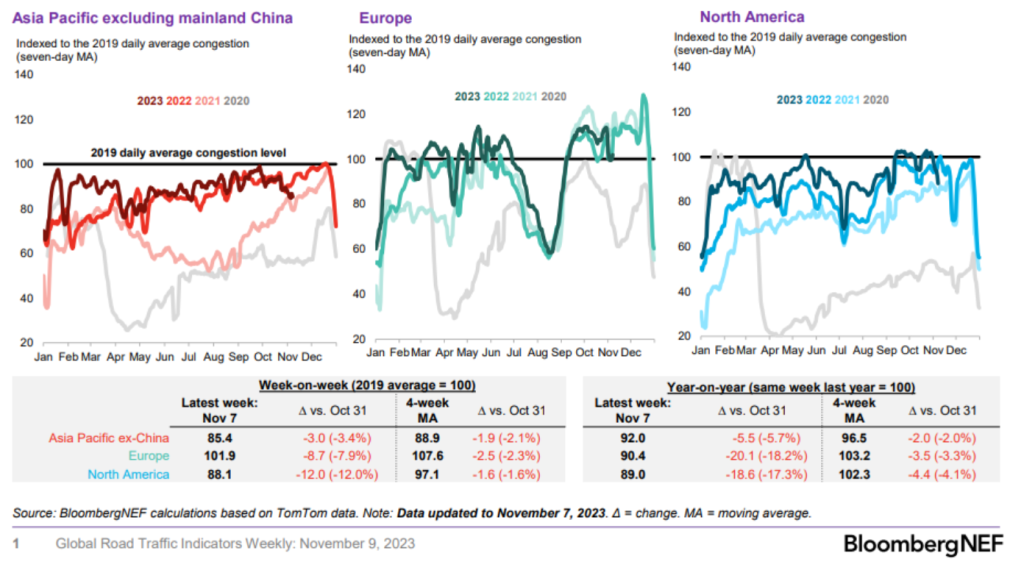

Driving activity around the world has taken another dip, which is happening ahead of normal declines in mobility. These reductions are inline with our expectations and supports our view that the gasoline crack is going to remain under pressure. The diesel crack (middle distillate) value will have to carry the full refining margin in order to maintain current refining activity. As China/India exports stay elevated, it will cause more pressure on distillate cracks potentially causing economic run cuts. We don’t expect these run cuts to materialize until at least Jan, which could be pulled forward if economic activity declines further.

This chart above helps drive home the reasons we see much bigger issues with consumers, and the pressure they face on spending/ activity. There is rapid degradation on consumer spending, which is causing a stark slowdown that will only intensify into year end. We also see this extending well into 2024 driving our expectation of a broader slowdown in the global economy.

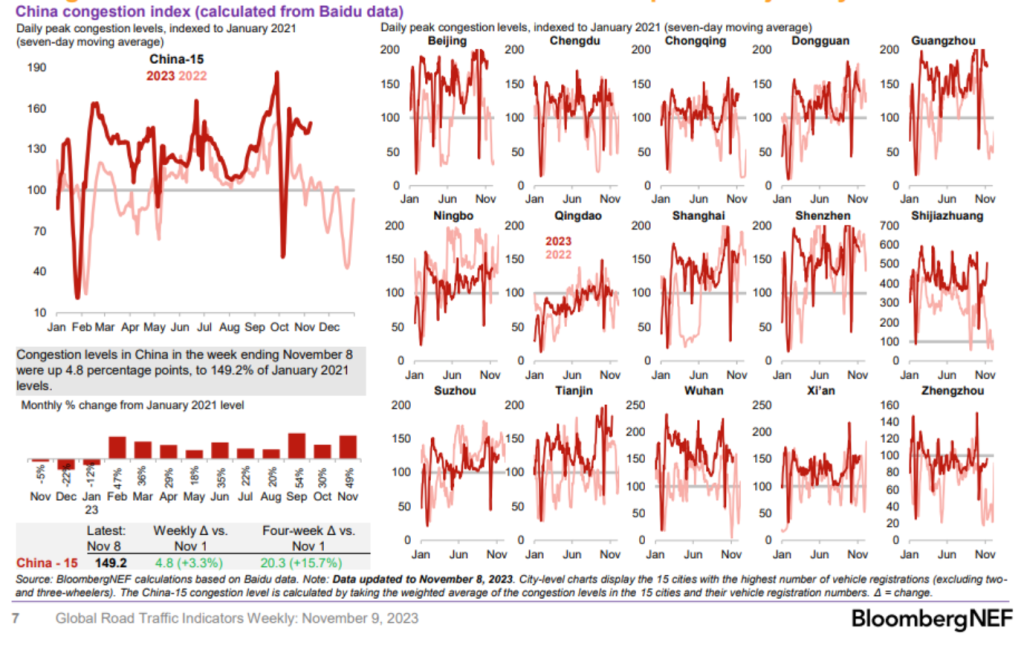

China did see a bit of a bounce in driving activity, but this bounce has been more than offset by the reduction in demand across middle distillate and heavy disty/ asphalt.

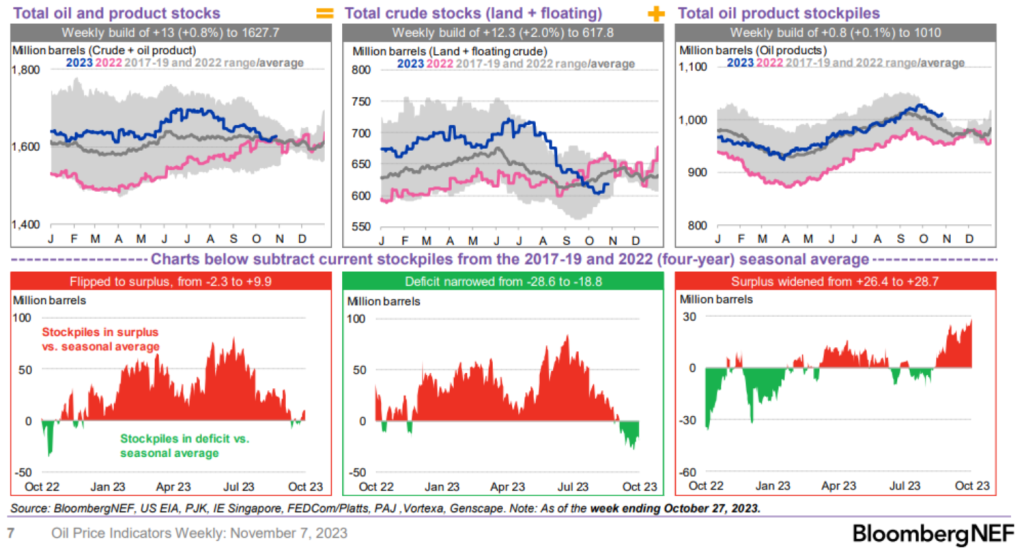

The pressure remains in the crude markets has we have a flip to surplus in the global crude/product markets driven by oil products. As we have been stating, crude products were going to be the biggest overhang as economic activity dipped further.

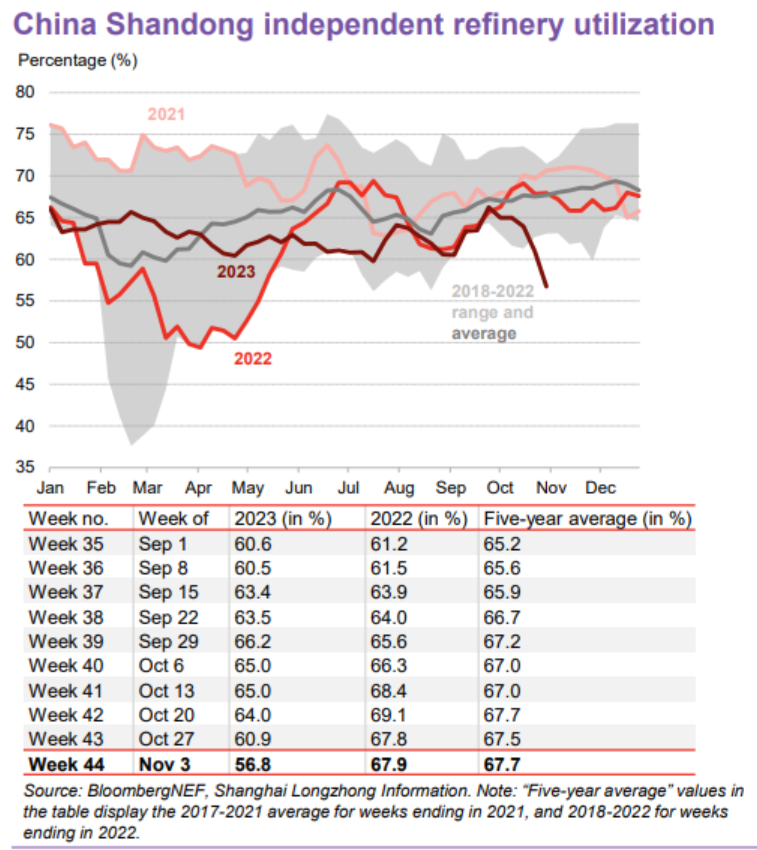

The market needs to start pricing in a much bigger slowdown in China’s crude demand. As we showed earlier with VLCCs targeting China, we are getting a large slowdown in both State-Owned Chinese refiners as well as Shandong Independents. The below chart helps highlight a much bigger slowdown in the Chinese markets, which will leave even more Middle East and West African crude in the market. We still expect China to be a buyer of cheaper Russian cargoes, but many of the ME and WAF will be left in the market. Europe and U.S. will absorb some, but we expect to see a bigger reaction to the downside in the physical markets.

These shifts in the Chinese market will cause some of the large forecasting agencies to reduce their expected Chinese demand numbers. We expect this to be the larger driver of reduced demand in Q4’23 and all of 2024.

The market is starting to sniff out the economic pressure as new global economic data comes out. We will discuss in more detail next week the impacts of recent economic data, and what that means for crude pricing.