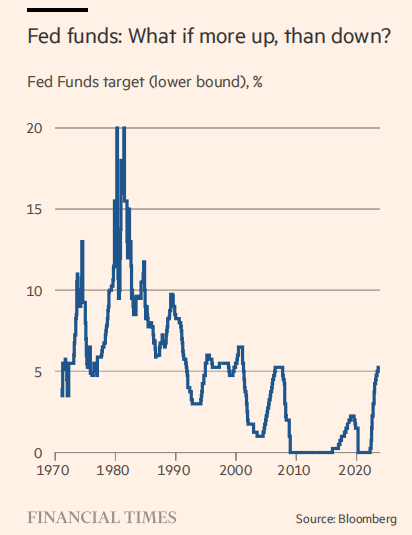

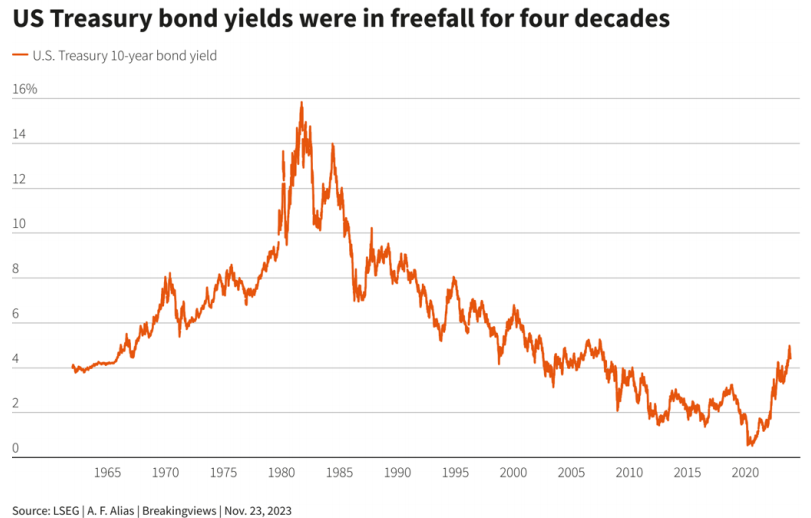

Recent soft US inflation data has led investors to believe that the Federal Reserve will not raise interest rates in December. This shift in market sentiment follows the release of October’s core inflation rate, which fell to a two-year low of 4%. As a result, the S&P 500 surged, and Treasury yields dropped significantly.

Market expectations have drastically changed, with a 100% probability now placed on the Fed maintaining its current rate range in December, as per the CME’s FedWatch tool. This marks a significant shift from previous expectations of a rate hike by year-end. This change in outlook is the seventh instance in this rate cycle where investors anticipated a dovish turn from the Fed, often influenced by various economic concerns, including US banking turmoil and global market instability.

Recent US economic indicators, such as a slight increase in unemployment, slowing retail sales growth, and weakening manufacturing surveys, suggest an economic cooldown. These factors, along with cautious remarks from Fed Chair Jay Powell, reinforce the belief that a rate pause is imminent.

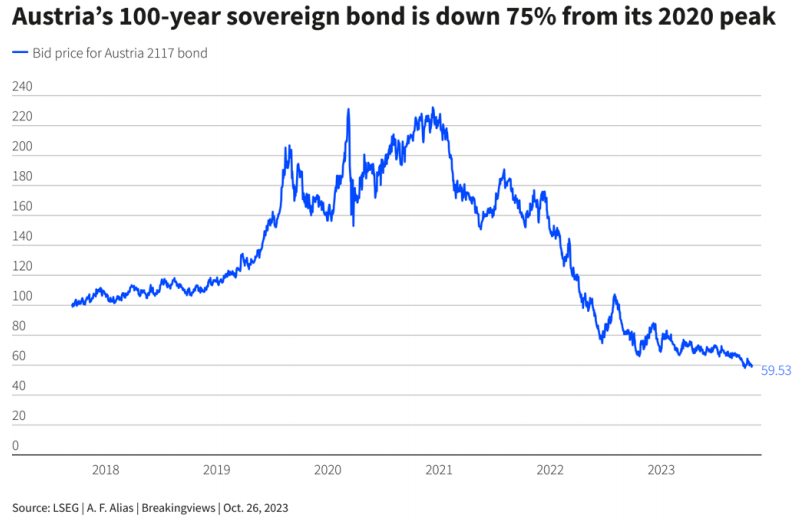

However, there’s speculation about rapid rate cuts in the future, with predictions of a significant rate reduction by the end of the next year. This expectation is reflected in the current bond market, where investors are heavily favoring bonds, anticipating benefits from both high yields and potential rate cuts.

Analysts suggest that the Fed’s future actions might resemble the cautious approach seen in the 1990s, with potential for both rate increases and decreases depending on economic conditions and inflation levels. This uncertainty poses challenges for both equity and debt markets, as the Fed continues to navigate a complex economic landscape.

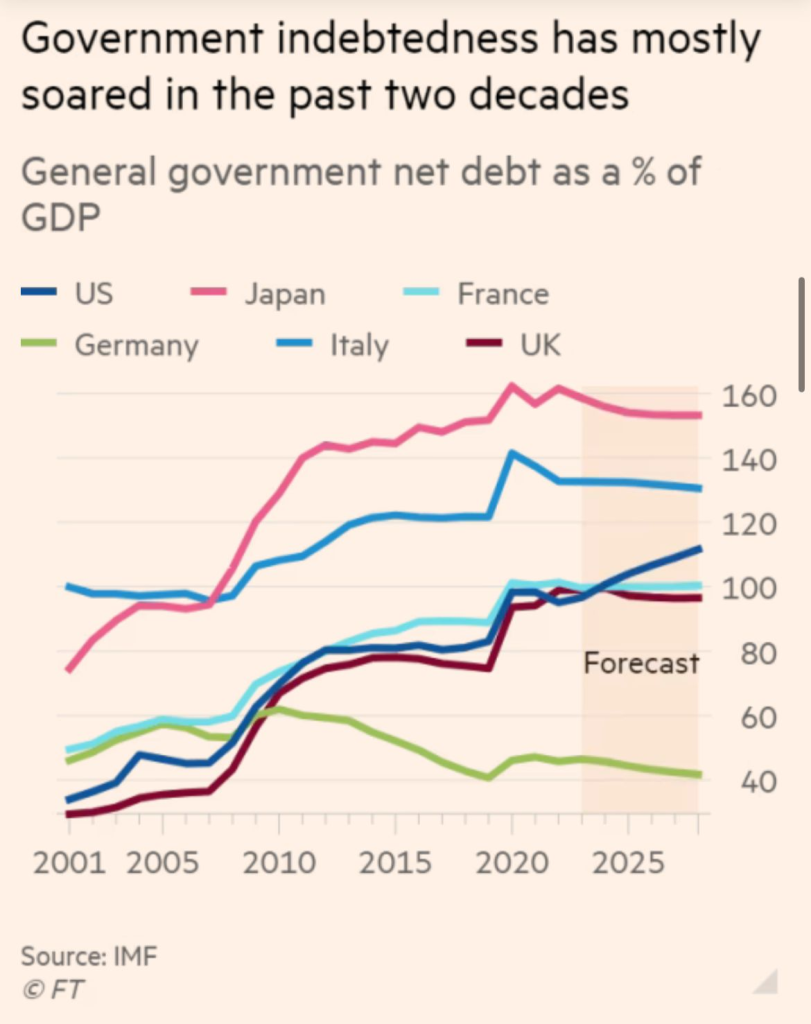

Same story in Europe

Recent data suggests that the European Central Bank (ECB) and the Bank of England may start reducing interest rates sooner than expected, possibly by mid-2024. This shift in investor expectations follows signs of economic stagnation in the eurozone and the UK. Despite the US Federal Reserve, the ECB, and the Bank of England maintaining current rates, slowing inflation and the lagging impact of previous monetary tightening have influenced their stance.

ECB President Christine Lagarde and Bank of England Governor Andrew Bailey have cautioned that inflation control efforts are ongoing, indicating that rate cuts are not imminent. However, recent weak retail sales in the UK and disappointing industrial production in the eurozone have strengthened market beliefs that rate cuts are on the horizon.

Investors are now largely discounting further monetary tightening, expecting rate reductions in the eurozone, the UK, and the US by June 2024. This marks a significant shift from earlier predictions of rate cuts in early 2025 for the BoE and September 2024 for the ECB.

The timing and severity of anticipated recessions in Europe and the UK will influence the timing of these rate cuts. Chris Teschmacher of Legal & General Investment Management suggests that central banks might cut rates more aggressively in response to a worsening economic downturn.

Other data points paint a bleak macroeconomic picture. The European Commission forecasts only a 0.6% growth for the eurozone in 2023, a downgrade from previous estimates. France’s unemployment rate has risen to 7.4%, and British retail sales have dropped significantly. However, a sharper-than-expected slowdown in UK inflation to 4.6% in October from 6.7% in September raises the likelihood of rate cuts in 2024. Tomasz Wieladek of T Rowe Price believes that weak economic data could prompt an earlier rate cut by the Bank of England, possibly by May.