We expect to see the Brent markets hold about $78-$82 in the near term, but the unknown will be the OPEC+ meeting and Saudi Arabia’s decision. We don’t believe there will be a cut of another 500k barrels a day, instead, KSA will stay the course on the voluntary 1M even though there is growing frustration around cheating. KSA can’t afford in the near term on the price of crude dropping further, instead, we believe there will be some cuts across OSPs (official selling prices.) U.S. flows have increased into Asia with another 7 VLCCs slated to sail because of the discount between U.S. crude and Middle East volumes. KSA can cut these volumes if they slash OSPs and reduce pricing in the Middle East. The risk remains to the downside on Brent with a likely backdrop pushing things to $74-$78, which will give way to the low of $72-$78 but averaging closer to $73-$74. The below shows some of the softness creeping into the physical market, and we see some additional discounts moving into the market. This will impact Middle East (especially KSA sales) given the elevated OSPs against the floating market. The UAE having Murban contracts that track closer to the floating market enables them to be more competitive vs others in the region. Iraq is also maintaining discounts on medium/heavy volumes vs the rest of the ME- which will keep their volumes heading into the market- especially U.S. and Asia. KSA is going to have to get more aggressive in pricing in order to take back market share.

Equinor withdrew an offer to sell Dalia for mid-January loading on the Platts window. Nigeria’s Forcados crude loadings are set to edge lower m/m in January, while Bonny Light exports are steady for that month.

PLATTS:

- Equinor withdrew an offer of 950k bbl of Angola’s Dalia crude for Jan. 17-18 loading at Dated -$2.65/bbl: trader monitoring window

Vitol reduced its offer price again for Okwuibome crude for early December arrival on the Platts window.

- WAF crude for December loading is clearing out partly due to lower prices and better demand in Asia for January deliveries; traders also expect deferrals

- Angola plans to load 1.145m b/d of crude in January, according to a provisional schedule

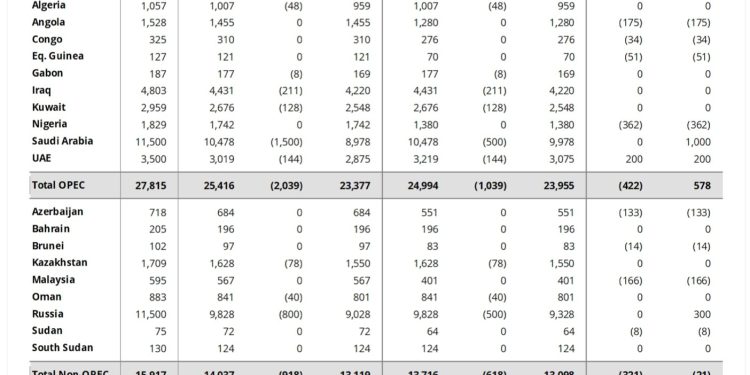

KSA has maintained exports of refined products, but as cracks weaken- they are going to struggle to make up revenue driven by reduced crude sales. We expect a “change in strategy” to come to the market in Q1 as that is the period of lowest crude demand seasonally speaking. There is pressure to come to some agreement for 2024 where WAF refused to accept reduced volumes and rumors that Angola would leave OPEC. We think Angola leaving is a bit overblown, but WAF will get some concessions to keep production/exports elevated in 2024.

“The group is working to tweak the 2024 targets set for Angola and Nigeria to allay unease they expressed in recent days, according to a delegate. Deadlock on the issue compelled Saudi Arabia and its partners to postpone their policy-setting gathering in Vienna this weekend to next week. Talks continue and agreement looks within reach, officials said on Friday.The spat dredged up a disagreement from June, when Angola, Congo and Nigeria were pushed by Saudi Energy Minister Prince Abdulaziz bin Salman to accept reduced output targets for 2024 that reflected their diminished capabilities. The African exporters have struggled in recent years with under-investment, operational disruptions and aging oil fields.”

We believe there is WAYYY more behind the delays in the OPEC+ meeting because the West African issue is over 100k barrels per day. We think the bigger issue is between Saudi, Kuwait, UAE, and Russia with KSA having very little wiggle room to negotiate without carrying out a “mini” price war. Many of the risks going forward will push crude to the downside and NOT the upside. Even with the Houthis capturing a vessel in the Red Sea, the geopolitical risk bounce was very short lived and quickly reversed lower.

The OPEC+ meeting has been postponed due to Saudi Arabia “frustrated” over countries cheating on their quotas. For those that have been following us, this was our base case assumption when evaluating OPEC+ policy heading into 2024. When Saudi announced the voluntary 1M barrel a day cut, we said they just backed themselves into a corner. KSA priced themselves out of the market, and only made it worse by gunning their OSPs (official selling prices). It NEVER made sense to run prices that high as it would push customers to alternative sellers. The increase in pricing also put significant pressure on their main buyers (refiners), forcing them to find different crude blends. This wasn’t the first time Saudi damaged their relationships, but this time there are more alternatives vs just Saudi.

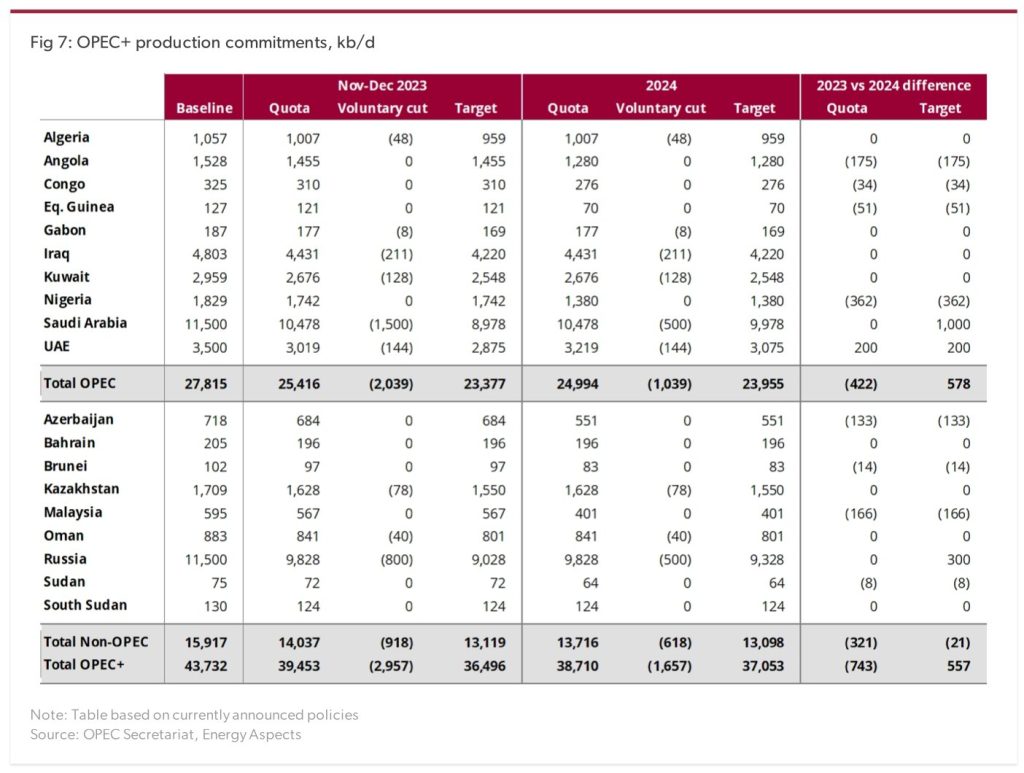

Within OPEC+, there has been a shift in production capacity driven by structural issues as well as economic reasons. In Russia, their refiners are unable to source the necessary components to operate at target run rates leaving more crude in the system. Russian companies are also fearful of shutting down production because there is a concern it will never come back online. These firms don’t have access to outside equipment of consultants to come in and address any problems. This leaves excess crude that can’t be turned into product, so Russia turns around and “breaks” their commitment to reduce production/exports. There was a short reprieve in flows, but it has quickly reversed based on current data. The below chart puts into context how crude exports have accelerated over the last few months.

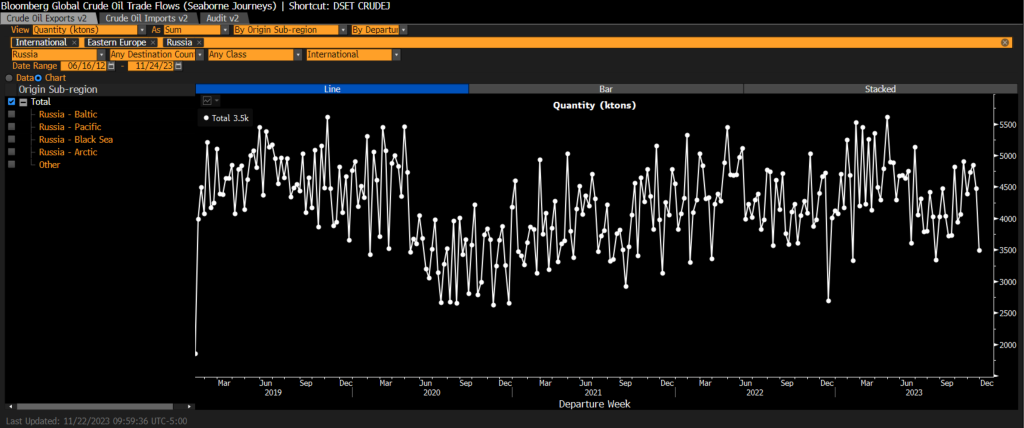

The discounts Russia has offered have helped them maintain flows, but India recently reduced purchases- not because urals were too expensive, but rather because demand was slowing internally. India has been exporting a significant amount of product while also facing some internal headwinds on demand.

China and India have been exporting near the highs for 2023 as local demand slows and margins abroad remained supportive. As the global economy slows, we expect to see more pressure on crack spreads as distillate comes under more pressure. Gasoline has already been extremely weak with many refiners relying on distillate to carry the margin.

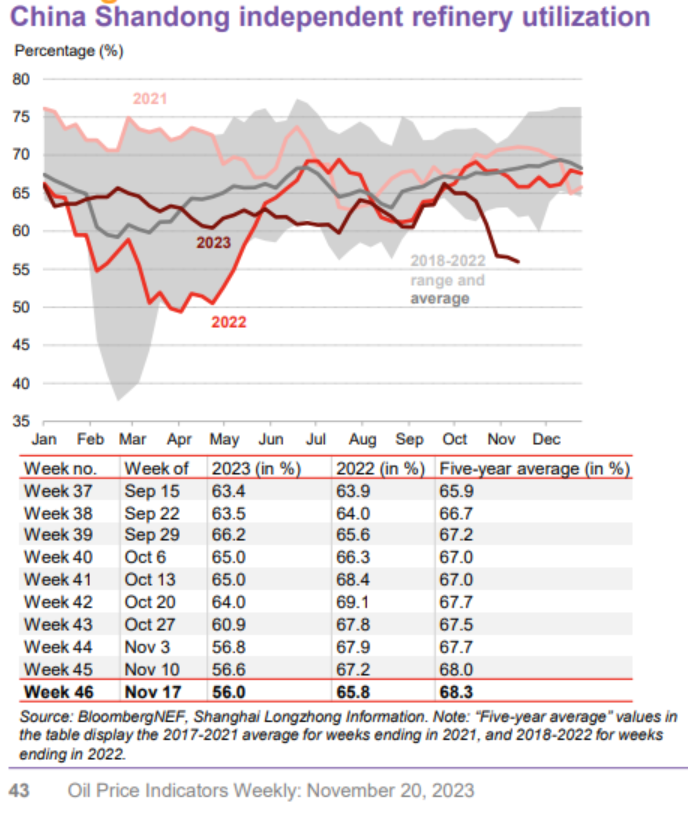

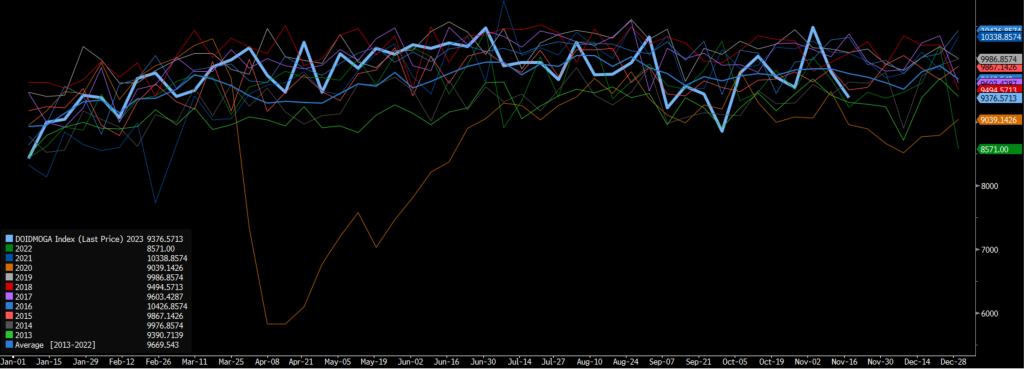

When we review China, there is a much broader slowdown internally causing additional concerns for the market. “Higher crude prices and weakening demand for diesel and gasoline have hit profitability at China’s independent refiners over the past couple of months. Margins at the plants known as teapots, which account for about a quarter of the country’s processing capacity, turned negative in late October for the first time since early January, according to local industry consultant JLC. Run rates at facilities in Shandong province, where most of the teapots are located, were around 57% of capacity in the week through Nov. 3, the lowest since May 2022, OilChem data show.” The below chart puts into perspective the size of the drop, and how it compares on a seasonal basis. This is a bigger drop than COVID and zero-COVID policy, which is a strong indication for internal demand.

Even as exports remain well above normal, crude stockpiles have started rising again in the region. “After falling by about 70 million barrels from late July through late-October, China’s onshore crude stockpiles are ticking up again in a sign domestic consumption is flagging, according to data from Vortexa Ltd. They’ve edged higher, albeit modestly, over the last two-and-a-half weeks.”

As Shandong Independent Refiners (teapots) lose more money, we will see economic run cuts remain, which also points to more pressure at the State-Owned facilities. The below chart shows the average margin for a teapot refiner, and helps highlight why we are seeing unseasonably low rates. It’s important to appreciate that these small builds and pressure on margin are coming at a time with robust exports. This helps put into perspective some of the underlying weakness within the China.

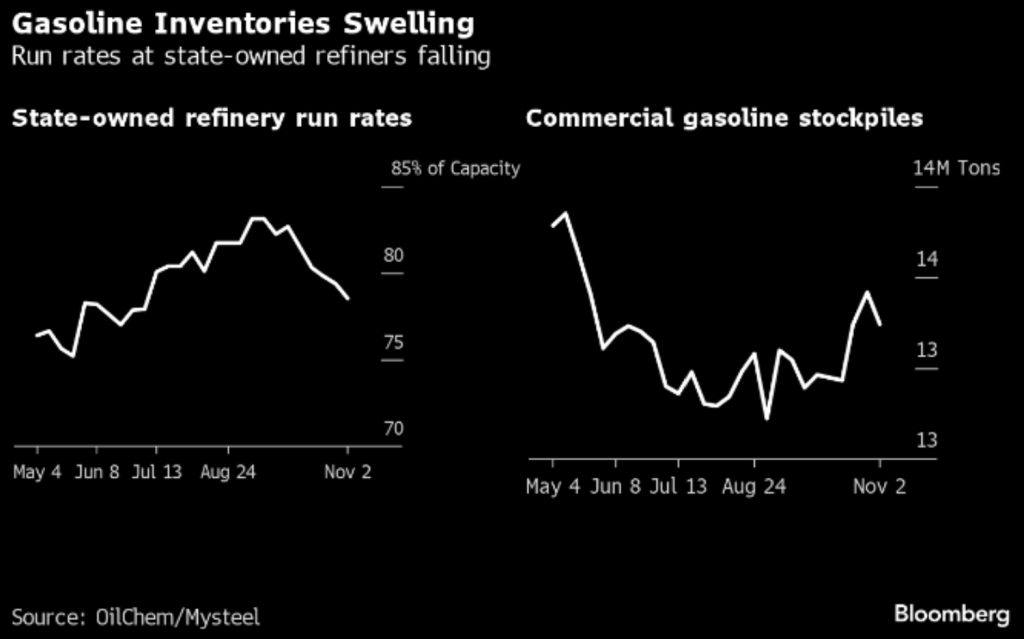

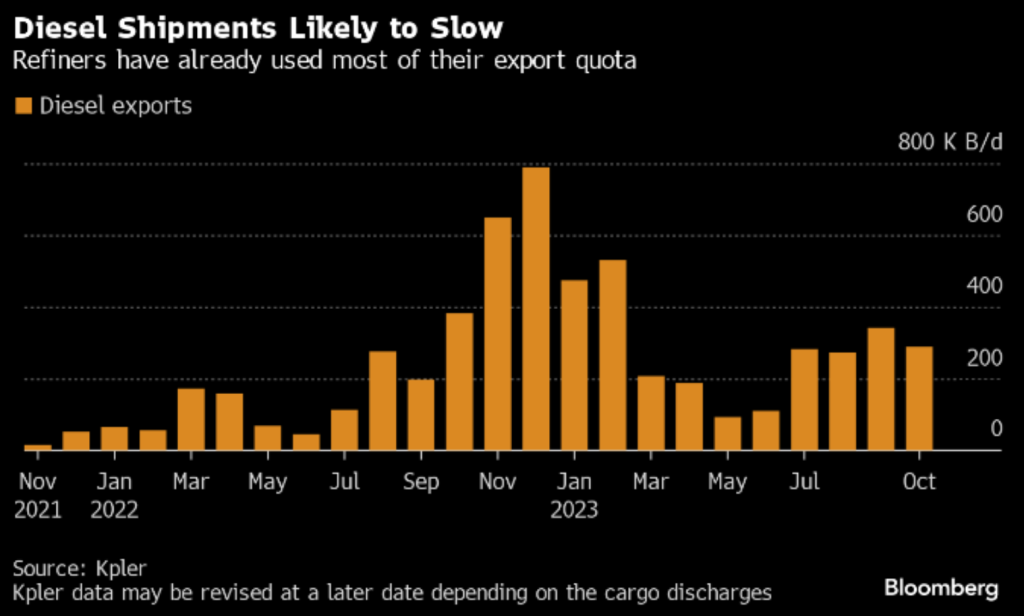

Gasoline is the main struggle around the world, and China is no different when it comes to gasoline storage. Even with exports, there is a glut of gasoline within China that will keep refinery utilization rates under pressure. It will help pull some diesel exports off the market, but the lack of supply will be offset by slowing demand driven by reduced economic activity as well as supply coming from the Middle East.

Even as some of the diesel flows have slowed, they still remain elevated, but should see some additional downward pressure through year end. There hasn’t been a 4th export quota, which is also putting pressure on refiners to reduce runs further into the new year.

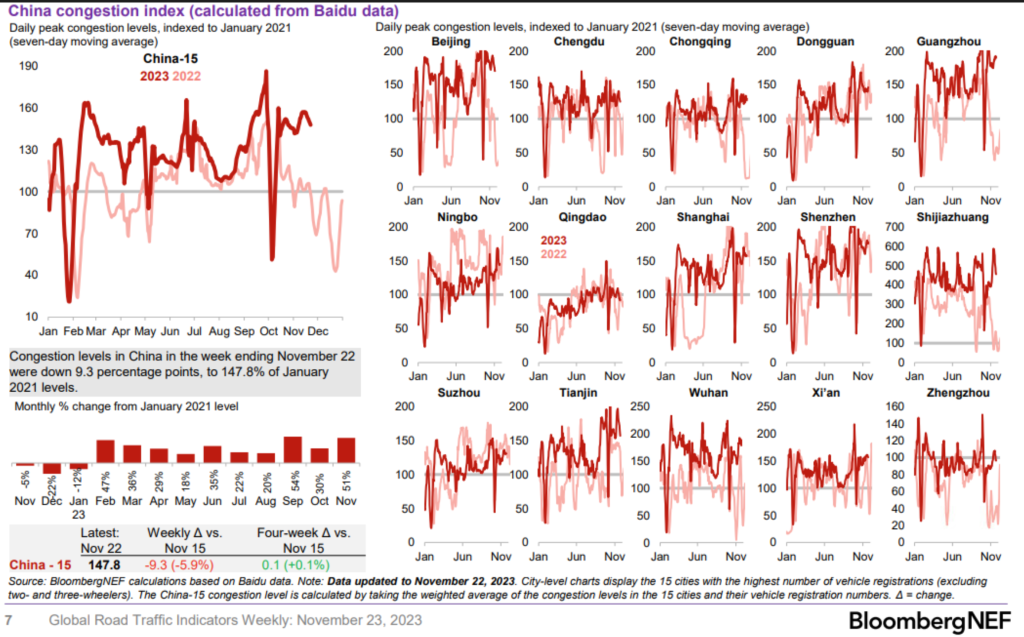

Some of the news agencies are trying to spin Chinese activity bullish, but it’s comparing a period of only COVID restrictions. The current activity is falling within my expectations for 2023, which should be better than previous years. By this time last year, there were a bunch of outbreaks of COVID19 causing lockdowns making the comparison a bit difficult. The builds in gasoline help to compare this to previous years vs the underlying traffic levels.

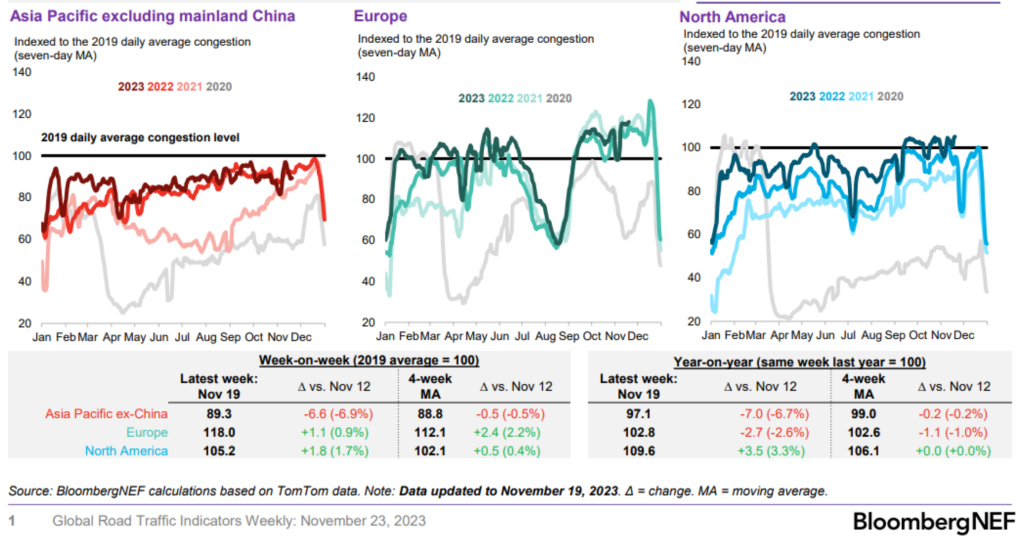

On a global gasoline basis, we have current traffic follow closely with previous years. North America has seen some pressure recently when we look at the Thanksgiving travel backdrop. We will get the normal increase in demand, but it will likely fade as it normally does. It’s also important to factor in the “bump” is smaller versus previous years: “According to near real-time GasBuddy data, Tuesday US gasoline demand jumped 9.4% from last Tuesday and was 9.1% above the average of the last four Tuesdays. Of note, the same numbers in 2022 were +11.0% and +13.2%, respectively.”

The recent data from the EIA shows another disappointing gasoline demand number. The previous increase was a “make-up” number following depressed buying as retailers waited for prices to fall. Once prices normalized, there was some sizeable buying to prepare for Thanksgiving travel.

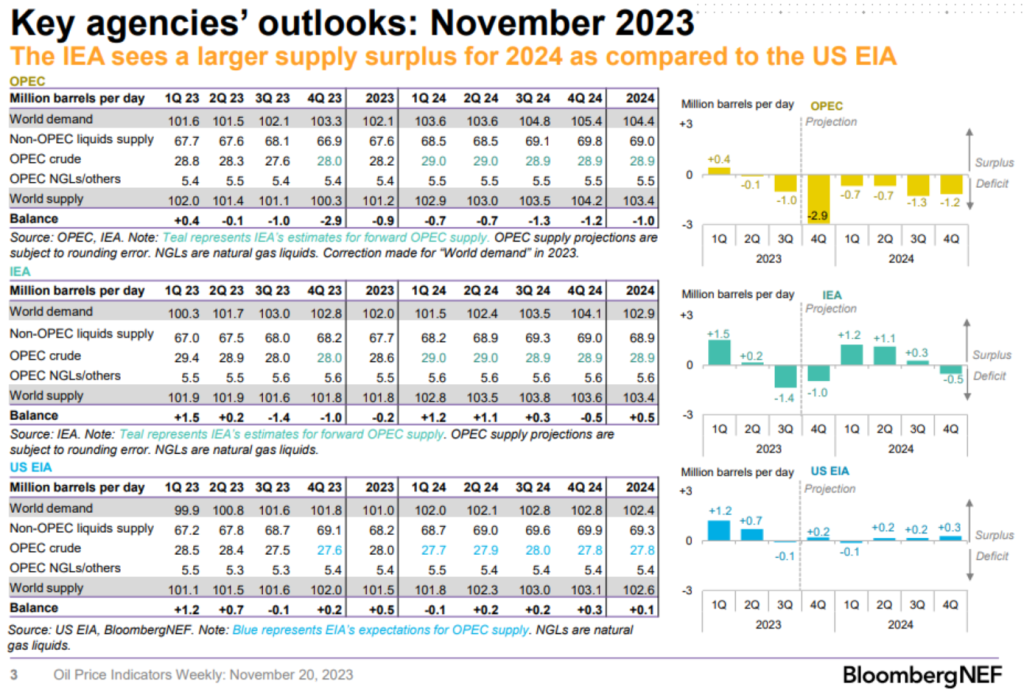

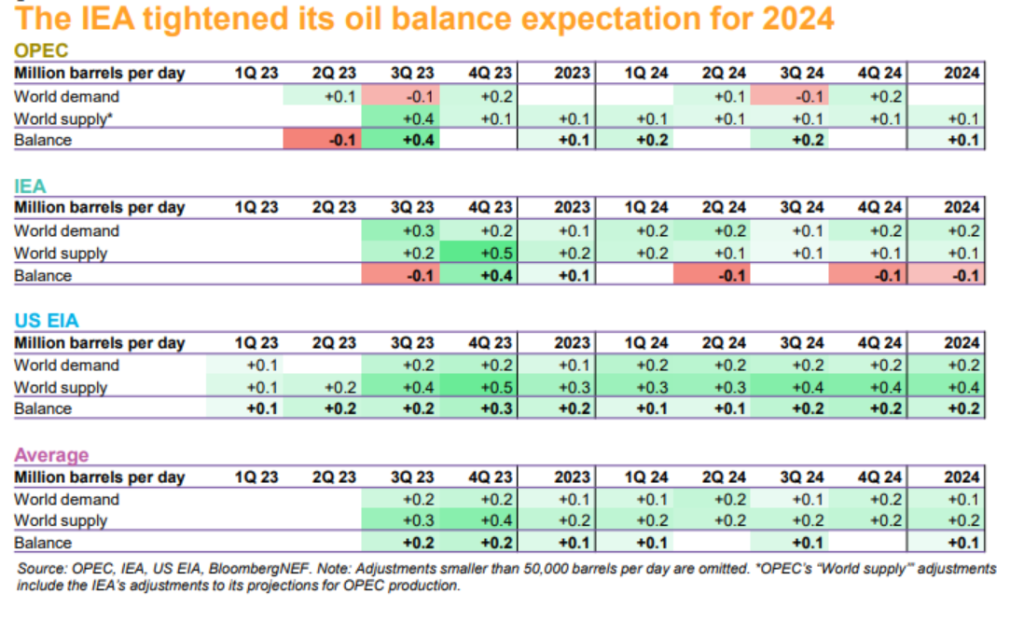

We have been very consistent in our views that global crude demand was overstated, and the big agencies are finally taking down their estimates. Demand numbers keep falling for 2023 and 2024, and even with the KSA cuts carrying forward for the 1st six months- next year is expected to have a surplus. We believe that the surplus will be much larger than what is currently expected because the global economy keeps weakening. There is also some decent increases in supply driven by the U.S. and Latin America, which doesn’t include the “cheating” from OPEC+ nations.

The IEA is expecting reduced supply driven by OPEC+ next year so has tightened their balances, but the uncertainty of the Dec meeting is throwing some of these estimates into question. There is a growing expectation or rather hope in the market that Saudi Arabia will cut further and reduce another 500k barrels per day. The problem is- they have already cut 1M barrels and other countries- including Russia, UAE, Kuwait, and Iraq have increased their production and export levels. This has caused a problem within KSA, and confirms our view that Saudi backed themselves into a corner to provide short term support to the crude markets.

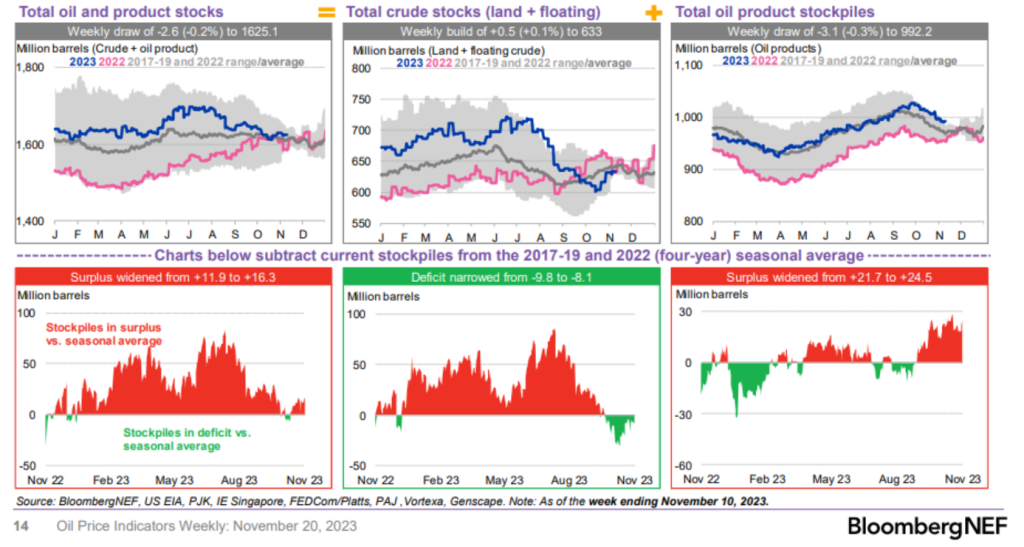

All the while, total products and crude continue to rise higher driven by more refined products. On the crude front- especially floating storage- quantities continue to shift higher, but the bigger issue is the rise in products. This is supportive of weakening demand numbers consistent with a global slowdown and one that will likely lead into a broader recession. Europe is already firmly in a recession with China slowing and the U.S. tipping into it starting next year. We believe the recession will be shallow but long lasting because of the structural issues causing the slowdown. Excess liquidity and poor central bank policy has limited the tools available to help lift the world out of a recession. Instead, there are going to be structural shifts that have to happen in the market and less cyclical adjustments.

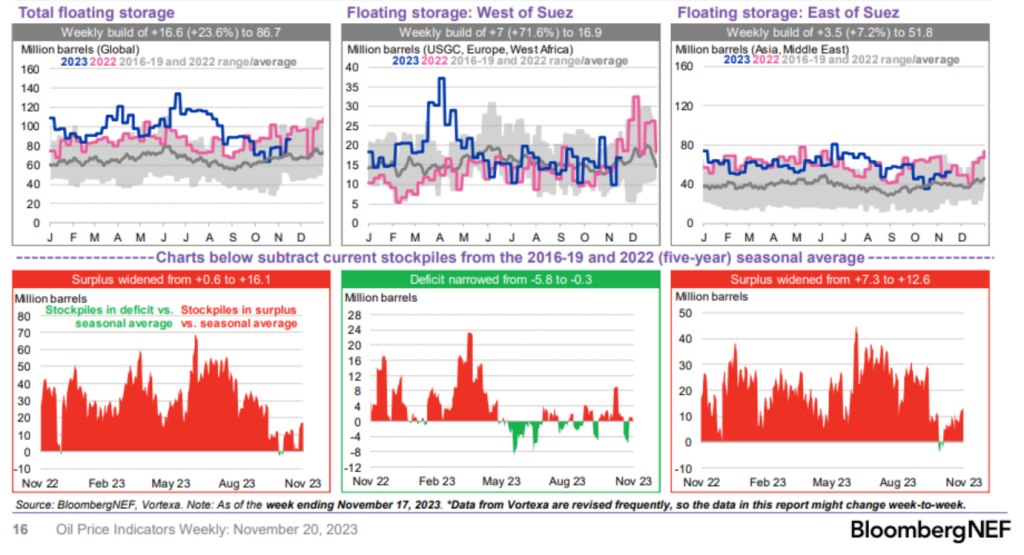

As we have expected, the floating storage number has grinded higher, and the problems will remain in the East of Suez. Asian storage will keep drifting higher as Chinese refining run rates fall well below seasonal norms and leave more crude in the market. This will put pressure on the physical market, and we expect to see more discounts grow to push crude into the market.

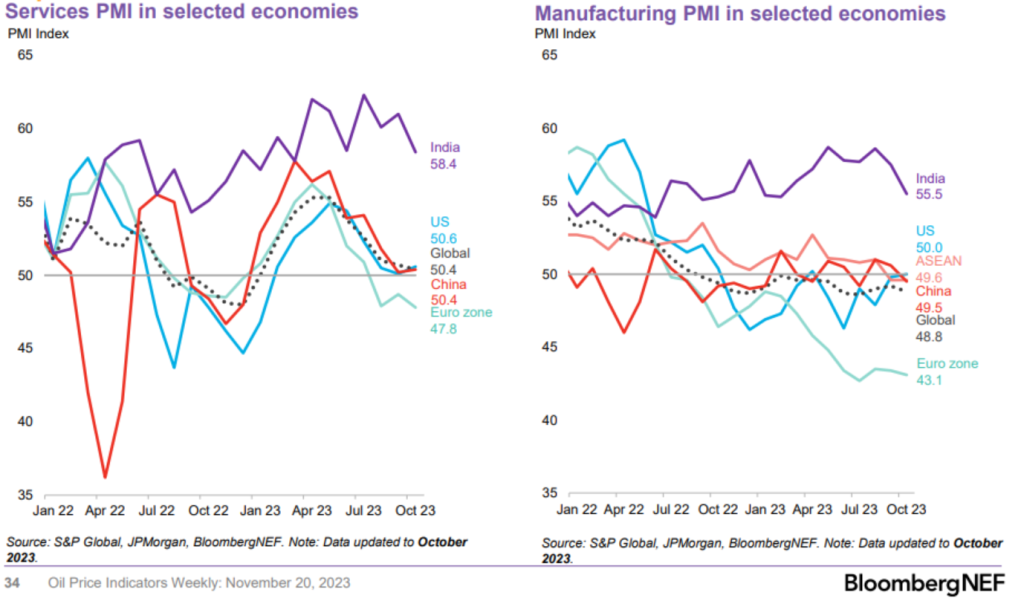

The below data helps show how things are rolling over around the world. On the manufacturing front, the world is already tipped into a slowdown, which will pull the services side down further. We expect to see the world service data tip into contraction beginning in November, and only get progressively worse into 2024.

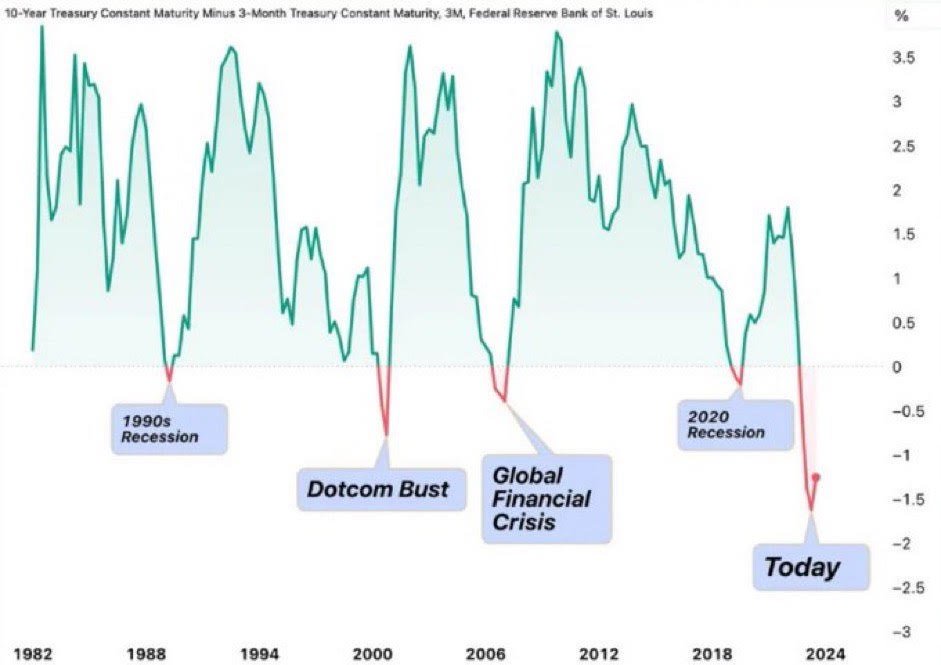

The U.S. treasury markets are signaling pressure in broader markets- especially on the rates market. The U.S. 10-year is the benchmark that many bonds and loans are priced off of and helps to highlight a bigger issue abroad. The depth of the disconnect in the U.S. treasury markets can be seen below, and I believe it shows a MUCH bigger issue than what the market is expecting. Central Banks- especially the Fed- waited to long to tighten and instead kept feeding liquidity into the market.

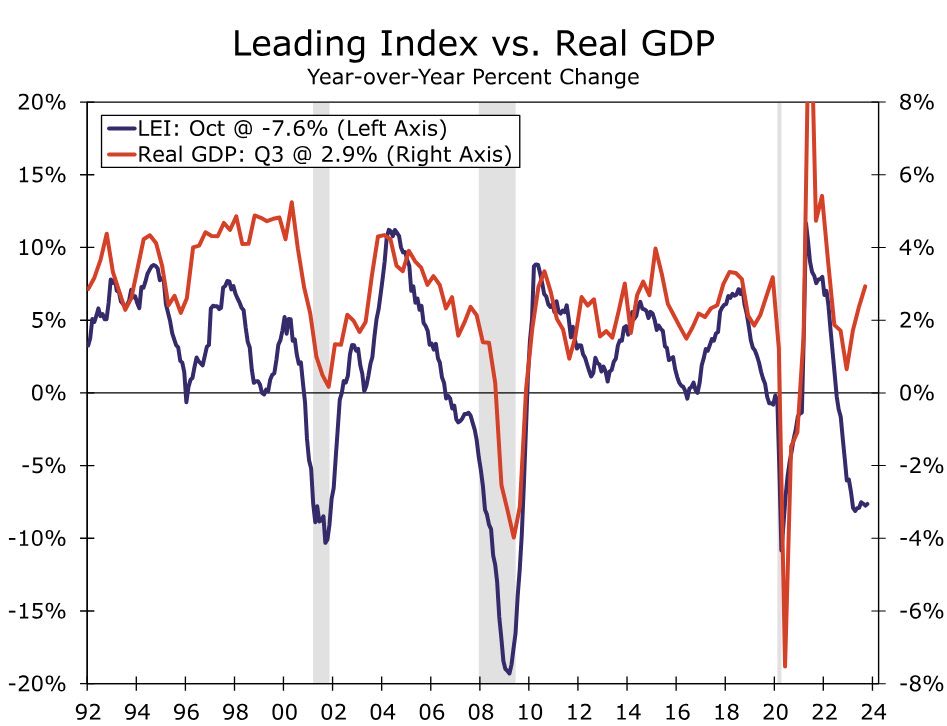

The U.S. leading indicators are also showing further slowdowns, which is already firmly in the manufacturing sector and FINALLY starting to show up in the service data. With the U.S. consumer the largest in the world, when they stop buying- it will reverberate throughout the world.

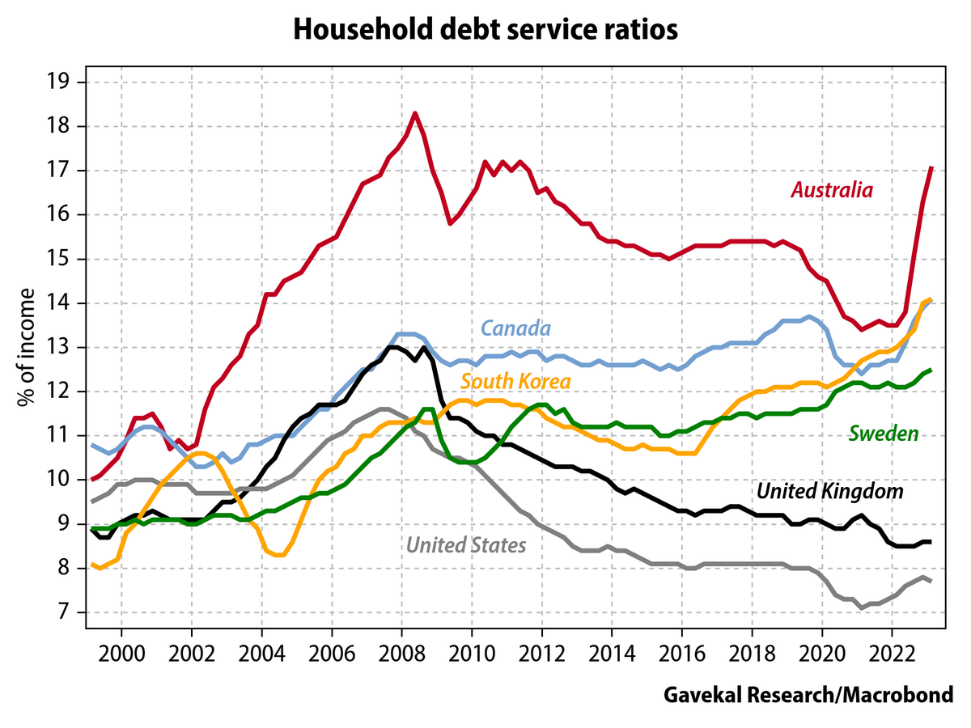

But, it’s not just the U.S. that is seeing pressure on the consumer. Household debt service ratios are elevated around the world with the U.S. not even the worst in the world. This is why we think it will take MUCH longer to move back into growth than what the market expects.

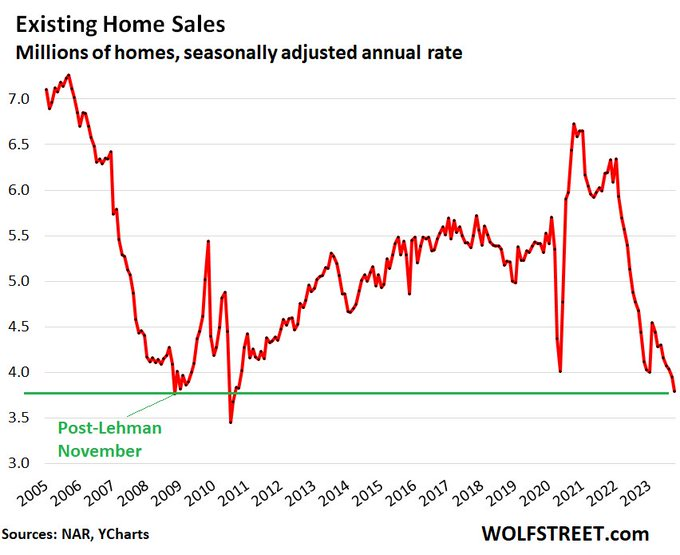

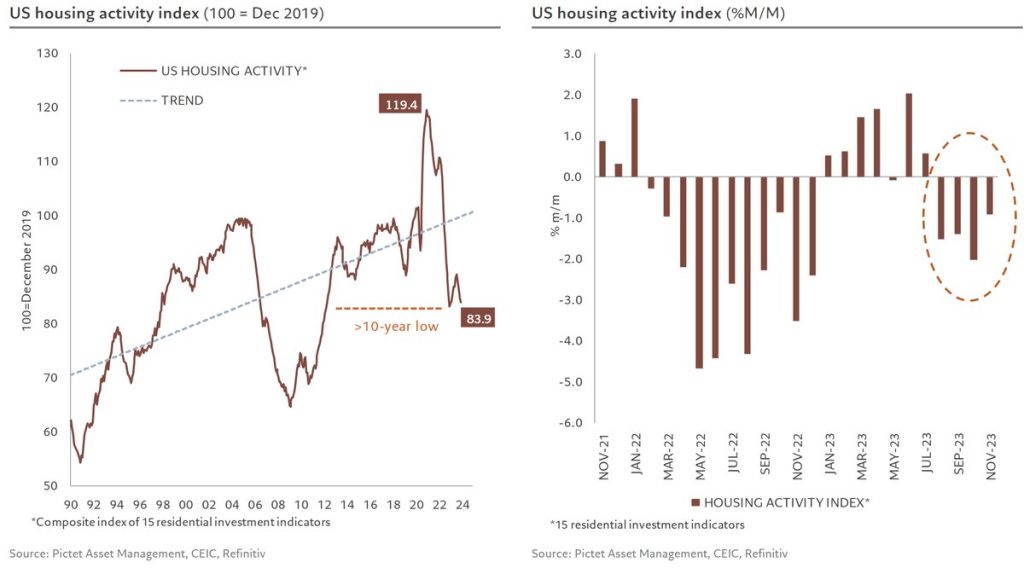

The housing market is another shoe that is “finally” dropping and will pull down the consumer much faster than just Credit Card debt and underlying debt service costs.

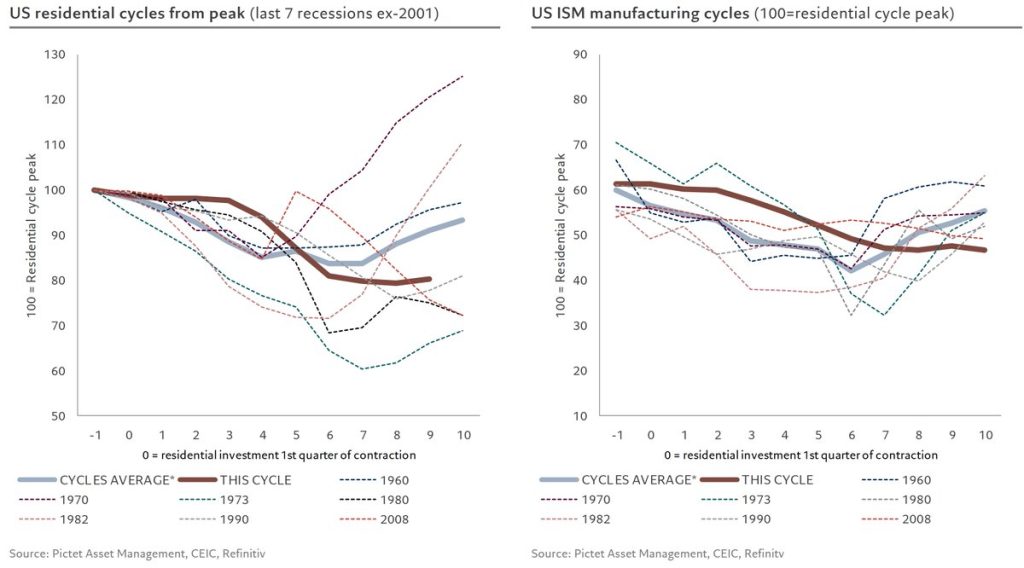

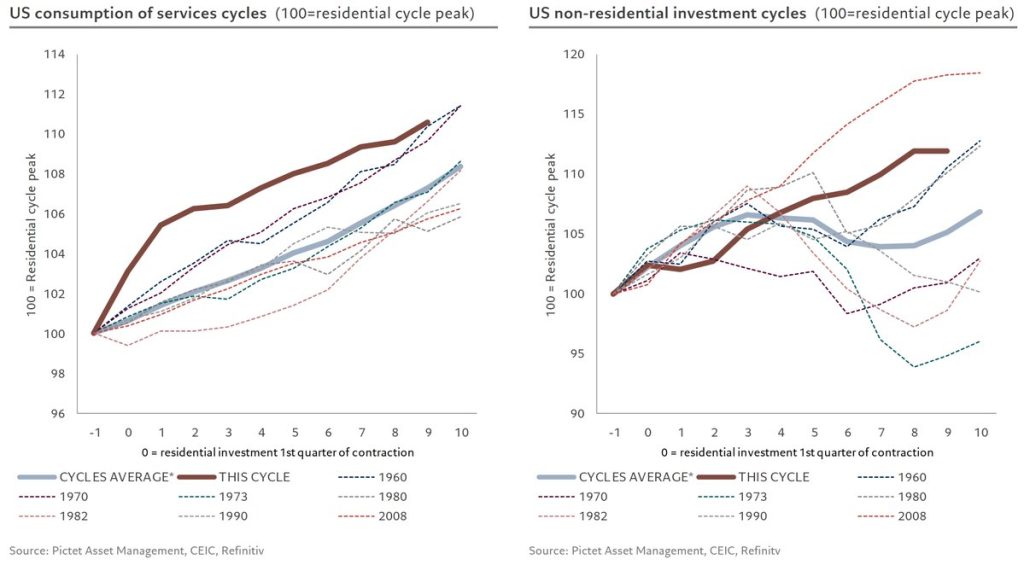

I think it’s important to review the U.S. market first to see how things sit heading into December, and how things are setting up as we head into 2024. “Some US GDP components have behaved differently in this cycle than in the past, Where are we now? Taking the residential peak as a reference for the start of the cycle, the current residential cycle looks like the average of the past 7 recessionary cycles- Same for manufacturing. This is exactly what we have talked about, but the consumer has remained MUCH stronger than expected. Patrick Zweifel did a great job putting together charts, and his commentary marries very close to what we have been discussing.

The below data shows how strong things have been in the consumption side- especially on the service cycle front.

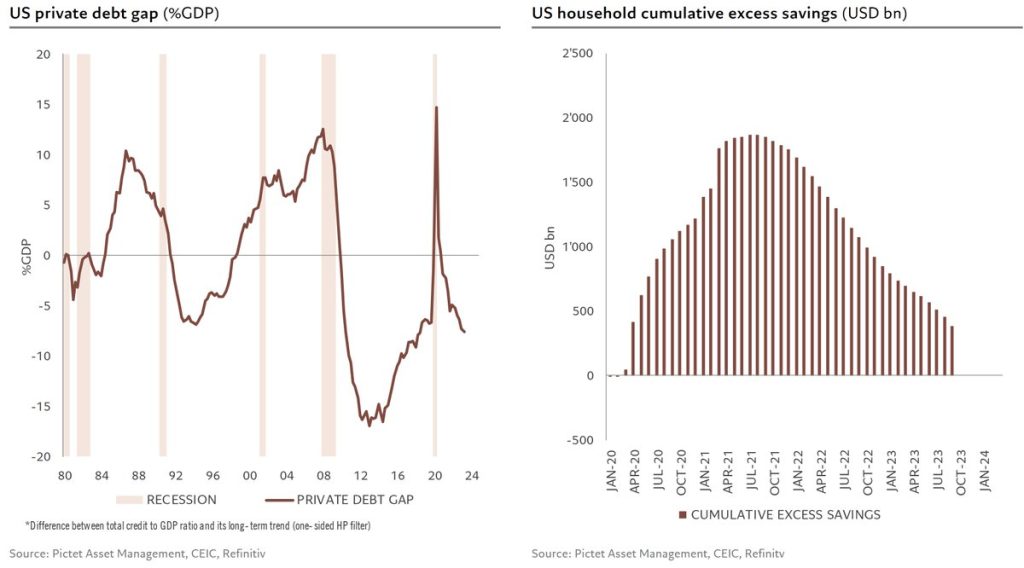

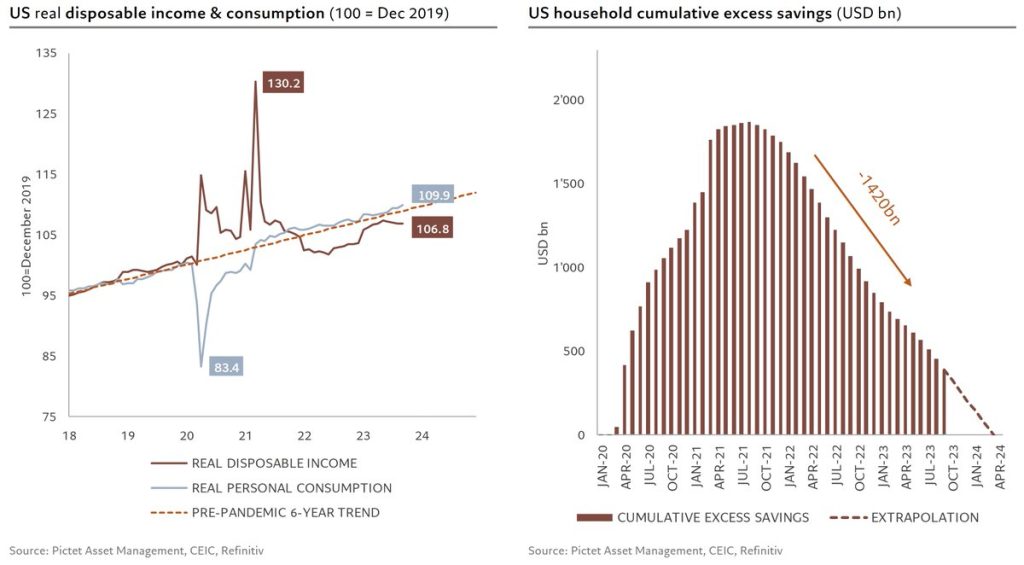

“Two main reasons for this: i) private sector entered this phase of monetary tightening without excess private debt ii) with excess savings Households/corporates are then much less sensitive to rate hikes and price rises, making the monetary transmission longer and smoother.”

Consumption should slow down for 3 reasons:

- real disposable income has fallen below its pre-pandemic trend and growth has slowed, in fact contracted slightly.

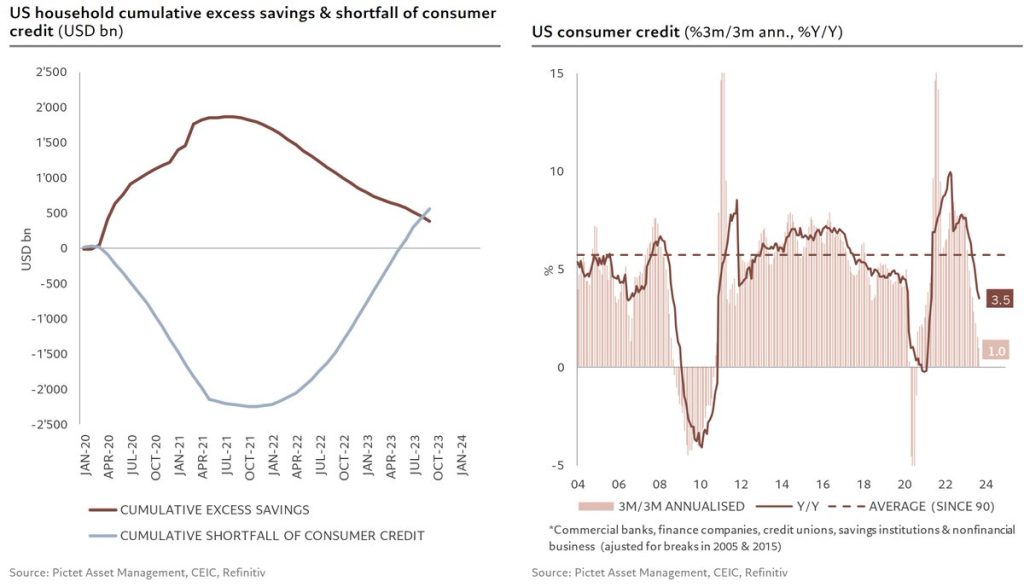

- excess savings should be fully absorbed by the end of Q1 2024

- The recovery in consumer credit that accompanied the fall in excess savings (consumer credit being the mirror image of excess savings in the chart) is also coming to an end: the 3-month rise in credit is now just 1%

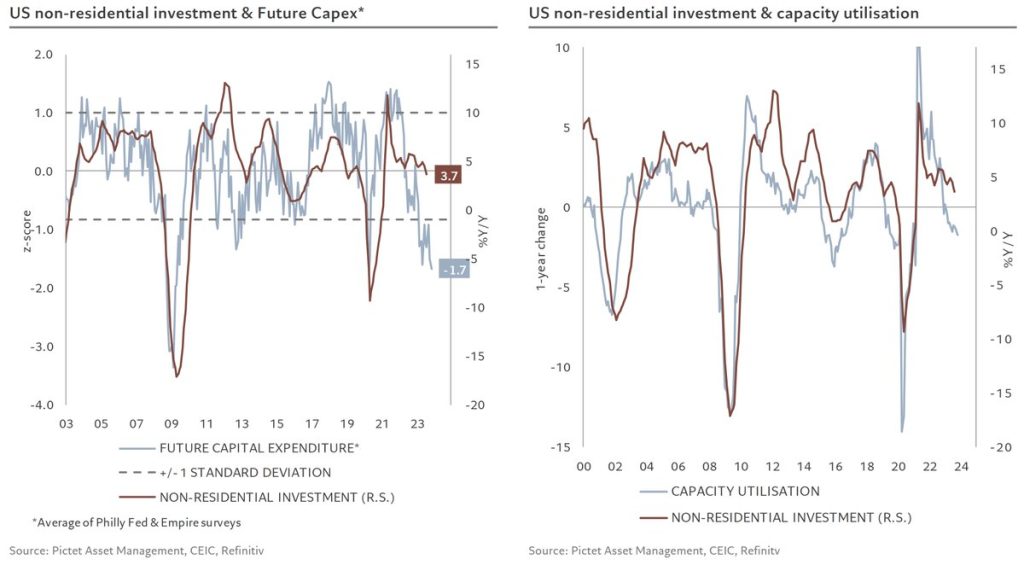

Business investment spending has stabilized (-0.1% q/q ann.), companies intentions to invest more are at their lowest level since the GFC and capacity utilization is declining.

The velocity of money is dropping rapidly, and it will help “pull” things down faster now as the credit cycle impacts accelerate. The issues are far reaching at this point- especially because the U.S. bond markets set the rates for the global economy. As the housing market catches up with the manufacturing slowdown, it will be the biggest headwind for consumer spending.

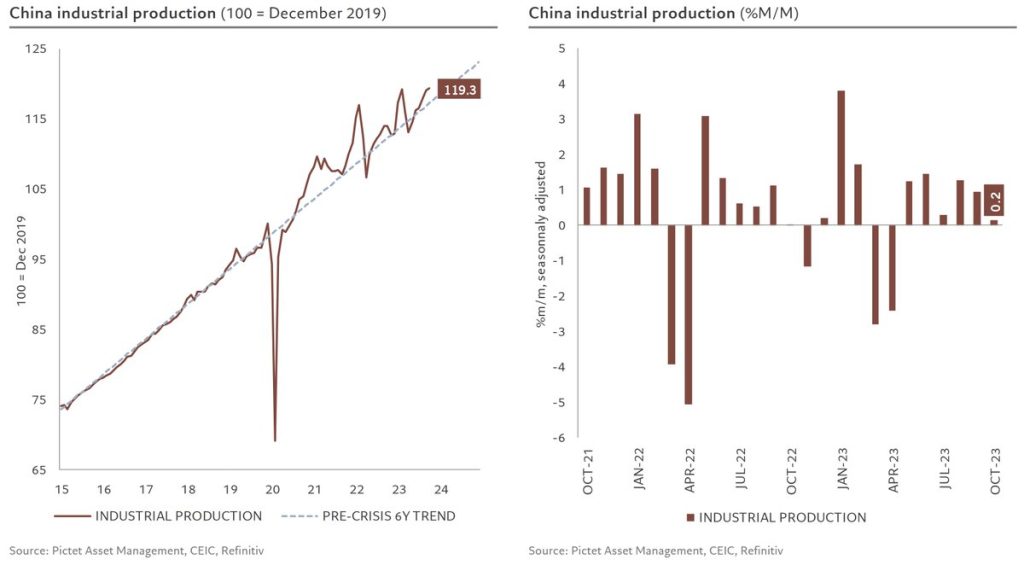

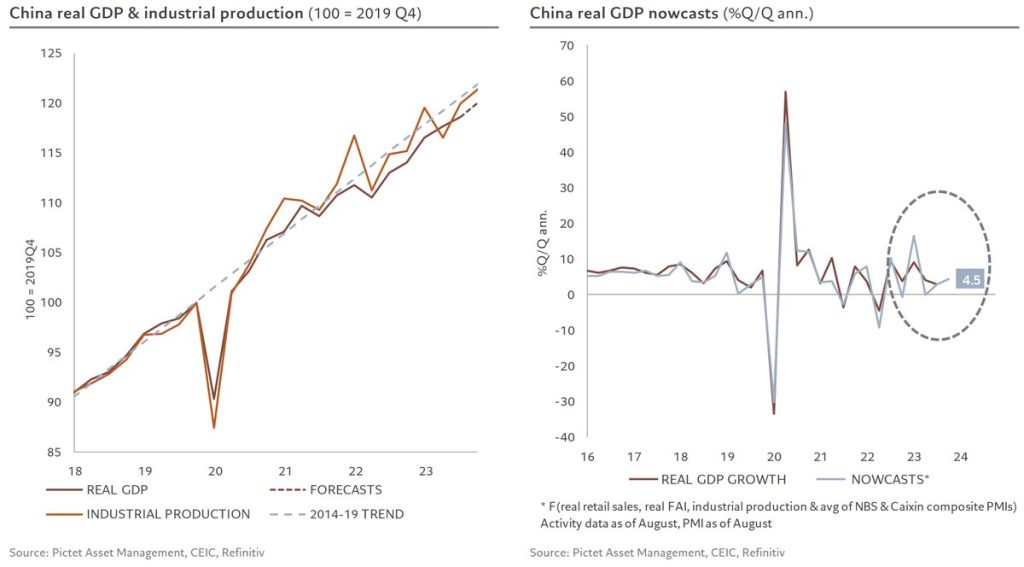

As we pivot into the Chinese markets, the data remains firm but in a depressed backdrop. It sits closely with our views that the Chinese economy is going to stagnate- not so much drop into recession- but have “disappointing” growth against global estimates.

There was some supportive data in October, but it was driven through some seasonal strength by the week long holiday to give off October. Even though it was “stronger” than last year, it was disappointing against estimates especially when you factor in there was more people traveling with EACH person spending much much less.

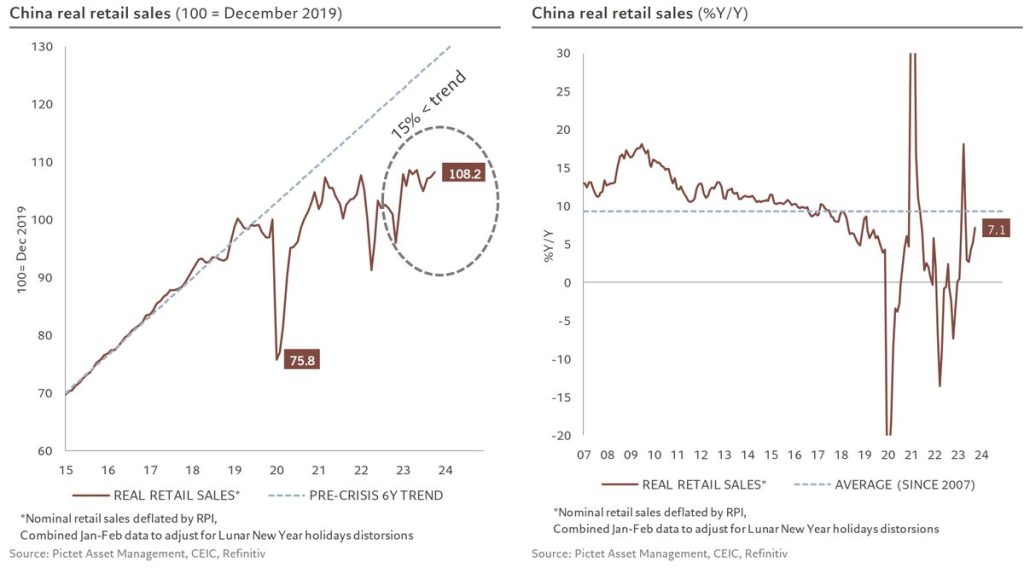

Retail sales remain flat, and we don’t expect to see a rebound back to the previous trend lines. There have been structural changes in the market that have caused more problems for the Chinese economy long term. The debt levels and underlying losses are causing more pressure on the local economy and without long term reform- China is well on their way to being “Japan of the 2000’s.” This isn’t a good thing at all because it means they are shifting firmly into stagflation with more issues forming. While the rise helps to offset some of the declines from the summer, we expect to see a bigger slowdown into the end of the year as consumers stay on the sidelines.

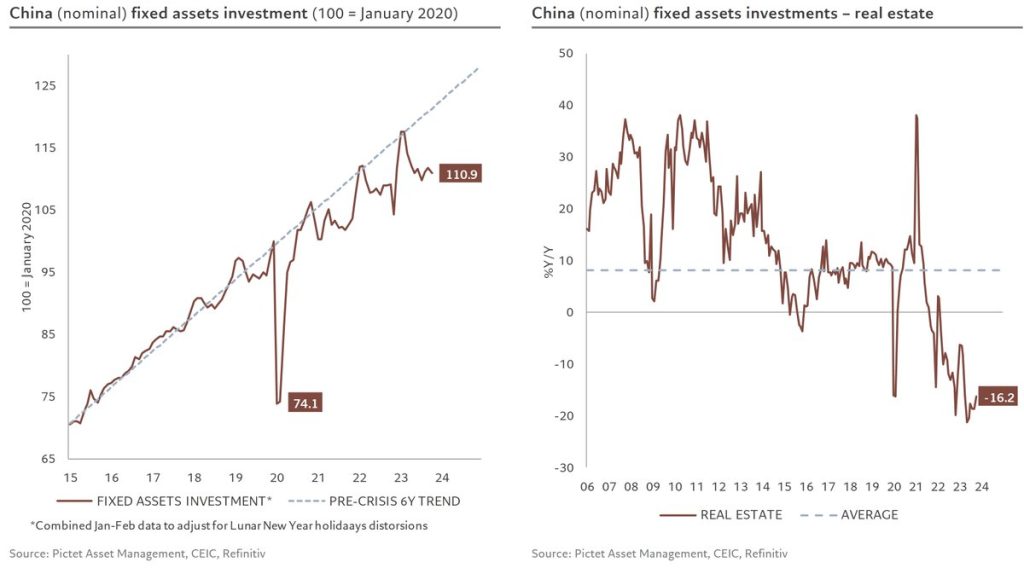

This level of consumption won’t be enough to offset the slowdowns we are seeing in other areas of the economy- especially fixed investment and flagging infrastructure spending. Even as the CCP tries to promote more lending and infrastructure spending, it’s falling flat because companies can’t afford the extra level of debt, and the remaining projects available are well below 1 on the multiplier effect. This means for every dollar invested it will yield something well below .8 and won’t be able to cover principal let alone interest expense. Fixed investment contracted over the month, with the rise in manufacturing and infrastructure investment unable to offset the continuing decline in real estate, down by more than 2 digits year-on-year.

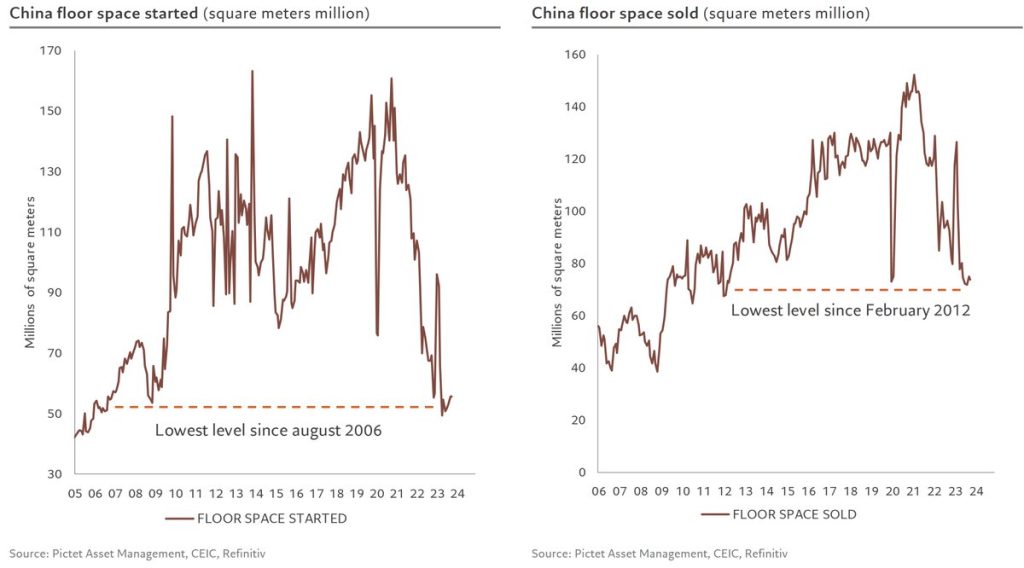

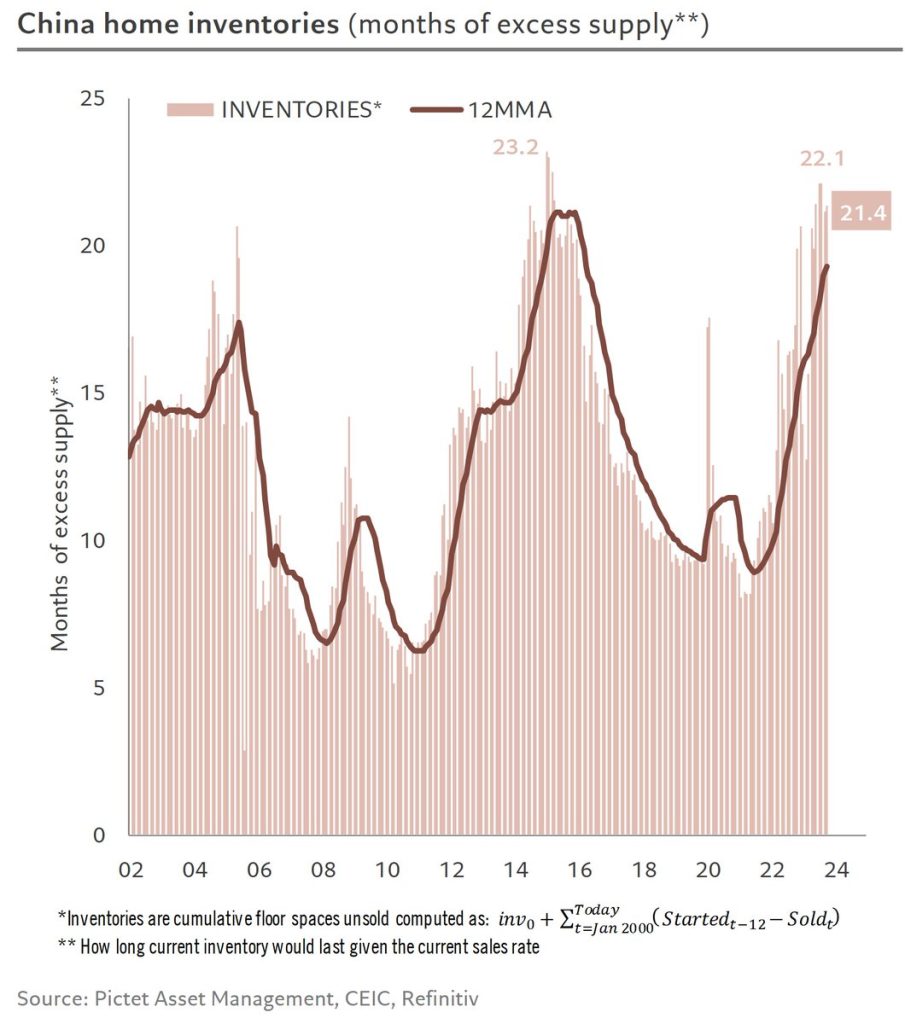

There are some hopes/ expectations that the Chinese economy will manage something closer to 4.5%, but we believe it will fall flat in Nov/Dec and register something closer to 3%-3.5%. This “miss” will be driven by real estate staying very weak, consumers slowing again, and investments missing the mark. “The property market remains largely depressed in October with no sign of recovery yet. The supply of residential space remained unchanged at its lowest level since Aug 2006 while residential demand is at its lowest in more than 10 years.”

As a result, China’s inventory of unsold new homes has barely changed, close to its highest level since January 2015, with excess supply representing 21 months at current sales level.

This is why the below estimates are still lofty- we don’t see the economy dipping into recession, but it will not be very strong and will be well below the global estimates.

The global economy continues to show pressure and underlying cracks, which will keep pulling down crude demand. The market faces many headwinds driven by consumer demand waning, and as the U.S. and Chinese consumer slow further- there won’t be anything in the market to offset. As we say, there is “no buyer of last resort” and it will take years to “purge” the system of excess liquidity. The global banking system has “landmines” all over the place with pressure in the U.S. and China growing exponentially. Here is just one example of a problem brewing in China: “Embattled shadow banking giant Zhongzhi Enterprise Group Co. has revealed the depth of its financial difficulties, telling investors it is “severely insolvent” with a shortfall of $36.4 billion. The privately owned wealth manager said liquidity has dried up and the recoverable amount from asset disposals is expected to be low, according to a letter sent to investors on Wednesday seen by Bloomberg News. Zhongzhi first triggered concern in August after one of its trust-company affiliates failed to make payments to customers on high-yield investment products. The group’s financial difficulties add to President Xi Jinping’s challenges as officials grapple with a property crisis and a weak economy. “The government will have to step in to help, and make sure the asset disposal will be conducted in an open and fair approach,” said Sun Jianbo, founder of Beijing-based asset manager China Vision Capital, adding bad assets are typically sold with a 70% discount. “For investors, it’s a lesson with huge costs.”

These pressure levels are going to impact spending and consumers MORE than what the market expects. “Those affected by Zhongzhi’s troubles are likely to be wealthy individuals. Shadow banks like Zhongzhi are loosely regulated firms that pool household savings to offer loans and invest in real estate, stocks, bonds and commodities. In recent years, even as rival trusts pared risks, Zhongzhi and its affiliates, especially Zhongrong International Trust Co., extended financing to troubled developers and snapped up assets from companies including China Evergrande Group.”

I think there will be more banks to drop and come in illiquid- so the fact that the CCP is pumping 1 trillion renminbi into the system will pale into comparison with the amount of insolvent banks. Because there is so much cross collateral and leverage rations, there will be extensive contagion within and China as well as abroad.