Pressure Pumping Market And Challenges

In our recent article, we have already discussed RPC’s (RES) Q3 2023 financial performance. Here is an outline of its outlook. At the end of Q3, RES’s management believes that the drilling and completion activity drop in recent times would not be sustained and expects a resurgence in frac activity through Q4. Since July, the US rig count has declined by 10%, but the US frac spread count has remained unchanged. Pressure pumping, which accounted for the largest share of the company’s Q3 revenues, was weak but other service lines were resilient during the quarter.

Pricing, however, remained soft due to lower crude oil prices and competitive pressure in the market. Several upstream companies delayed completion activities in Q3. As a result, frac assets were idled, leading to lower fixed-cost absorption. However, the management expects the conservative approach to improve cash flows over the long term. The need for pricing concession will likely ease, and the pricing level should improve in Q4. Oilfield service companies will also extend the life of their equipment, maximizing returns from the asset.

In July, RES acquired Spinnaker Oilwell Services, which provides oilfield cementing services in the Permian and Mid-Continent basins. The purchase price was $79.3 million. The acquisition expanded RPC’s cementing business from its presence in South Texas to other regions where it provides other services.

Strategy And Utilization

Following lower capital investments and the introduction of newer pressure pumping technologies, RES has remained “disciplined’ in its approach. Given the changing dynamics in fuel use related to pressure pumping operations (i.e., natural gas and electric frac), it will invest in the transition. It does not plan to add pressure pumping capacity in a volatile market, considering long-term shareholder returns.

In Q4, RES expects that its pressure-pumping fleet will remain well utilized. Also, starting in Q2, it has removed operating costs. As activities begin to improve, it can limit its workforce reduction plans in Q4, but it may still fall short of meeting demand, given the availability of resources. Overall, Q4 still looks unpredictable with the holiday slowdown. However, the current trend has encouraged the company’s management to take a more optimistic view of pricing and asset utilization. It expects steady activity growth in the Permian. Also, the capital discipline among E&P (exploration and production) operators can create opportunities for small players like RES.

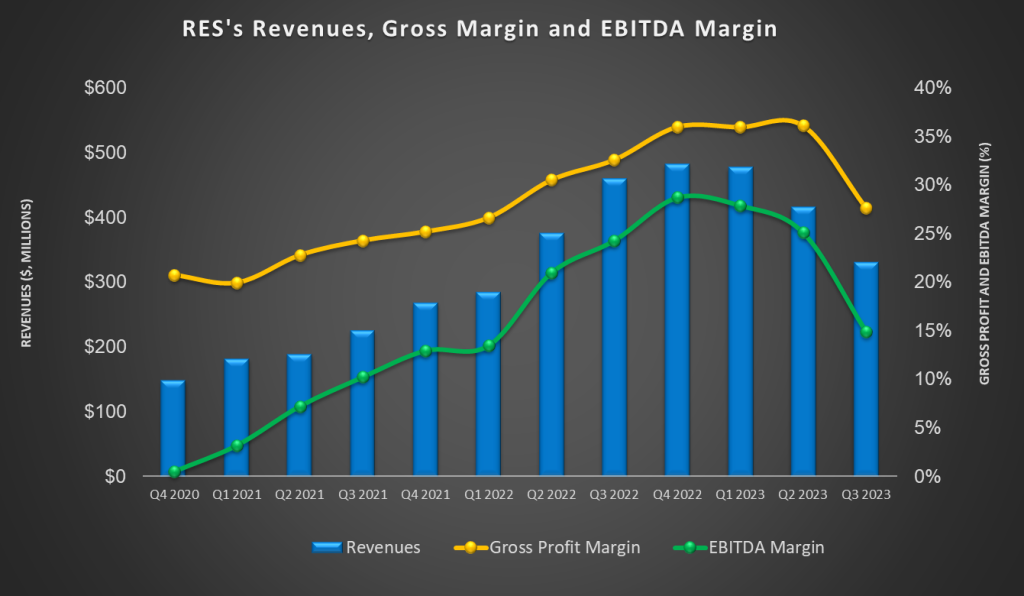

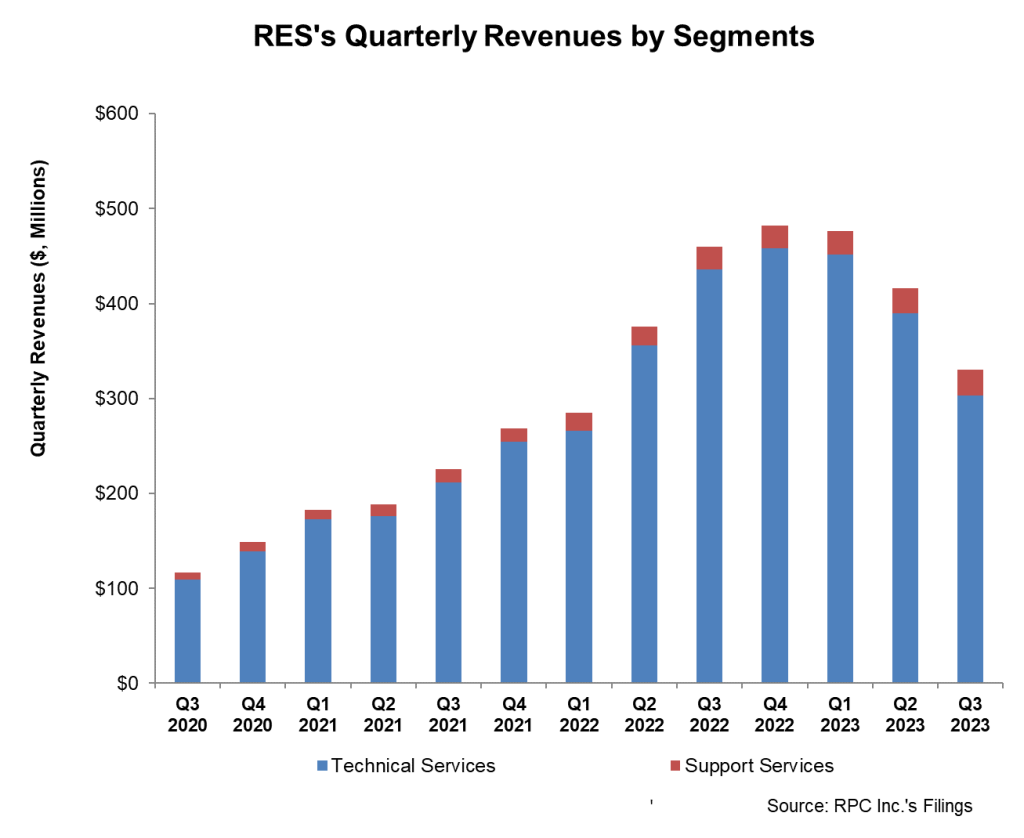

The Q3 Drivers

In Q3 2023, the company’s Technical Services segment revenues decreased by 22% compared to Q2 2023, while the operating income fell by 75%. The Support Services segment, on the other hand, saw revenue growth (6% up) in Q3, and operating income decreased by 13%. Overall, the company’s cost of revenues (as a percentage of revenues) increased due to weaker activity levels.

Cash Flows And Liquidity

As of September 30, 2023, RES had no debt and positive cash & cash equivalents balance ($172 million). To guard against any liquidity strain, the company can tap from its robust liquidity (revolving credit facility plus cash & equivalents) of $255 million. The company’s cash flow from operations improved significantly in 9M 2023 compared to a year ago, due primarily to higher revenues and lower accounts receivable.

Although capex increased in 9M 2023, the sharp increase in cash flow from operations caused the free cash flow to turn positive versus a negative FCF in 9M 2022. During Q3, it kept its FY2023 capex plans unchanged at $200m-$250m from the previous estimates. Investors may note that the company expects a US Federal tax refund of $47 million in Q1 2024.

Relative Valuation

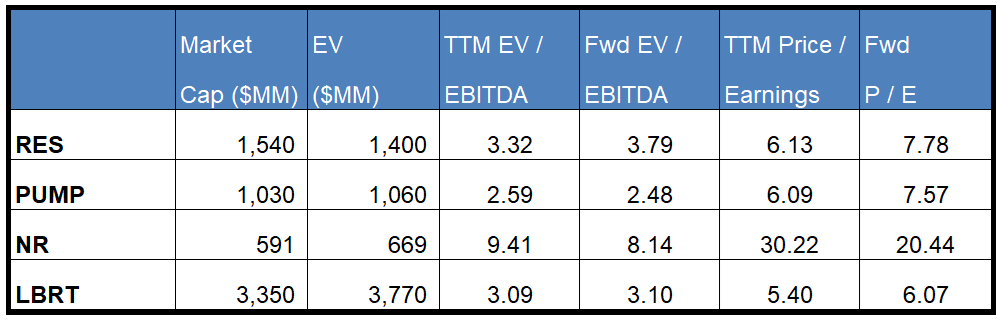

RES is currently trading at an EV/EBITDA multiple of 3.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.8x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 29.2x.

RES’s forward EV/EBITDA multiple is expected to expand versus its current EV/EBITDA. In contrast the multiple is expected to contract marginally for its peers. This implies the company’s EBITDA is expected to decrease as opposed to a rise in EBITDA for its peers in the next four quarters. This typically results in a much lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (PUMP, NR, and LBRT) average. The stock appears to be slightly overvalued versus its peers.

Final Commentary

During Q3, RES’s revenues from pressure pumping activity were weak, but other service lines were resilient. Pricing remained soft due to lower crude oil prices and competitive pressure in the market. Because pressure pumpers idled assets recently, the demand-supply balance can lead to improved cash flows over the long term. RES does not plan to add pressure pumping capacity in a volatile market. Over the medium-to-long term, it expects steady activity growth in the Permian to improve pricing and asset utilization.

RES’s Spinnaker acquisition can expand its geographic reach in the Permian and Mid-Continent Basins. Its cash flows increased significantly in 9M 2023 compared to a year ago due to higher revenues and lower accounts receivable. A robust balance sheet with strong liquidity will allow it to remain relatively financial risk-free. The stock is slightly overvalued compared to its peers at this level.