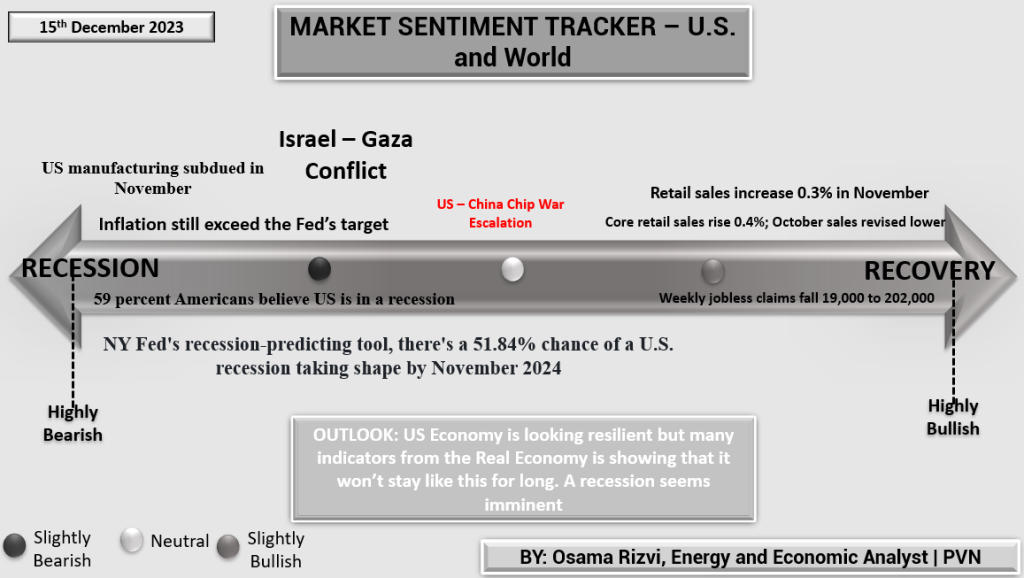

The Market Sentiment Tracker for the U.S. as of December 15th, 2023, presents an economy at a crossroads, with indicators pointing to both caution and moderate optimism.

Signs of Economic Caution:

- Manufacturing activity has been subdued, with November showing a continuation of the recent lackluster performance.

- Inflation rates persist above the Federal Reserve’s target, indicating continued cost pressures for consumers and businesses.

- Public sentiment is wary, with 59% of Americans believing the country is already in a recession.

- The NY Fed’s recession-predicting tool suggests a 51.84% chance of a recession by November 2024, signaling that economic challenges could be on the horizon.

Indications of Resilience:

- Retail sales have seen an increase of 0.3% in November, with core retail sales rising 0.4%, though there’s a note of caution with October’s figures being revised downward.

- Jobless claims have fallen by 19,000 to 202,000, which could reflect a robust labor market.

Overall Outlook: The tracker’s outlook acknowledges the resilience in the U.S. economy, but with a caveat that the strength seen in some economic indicators may not be sustainable in the long term. The mixed signals from the retail sector, alongside inflationary concerns and a potential rise in recession probability, suggest that a careful approach is warranted as the economy moves into 2024.

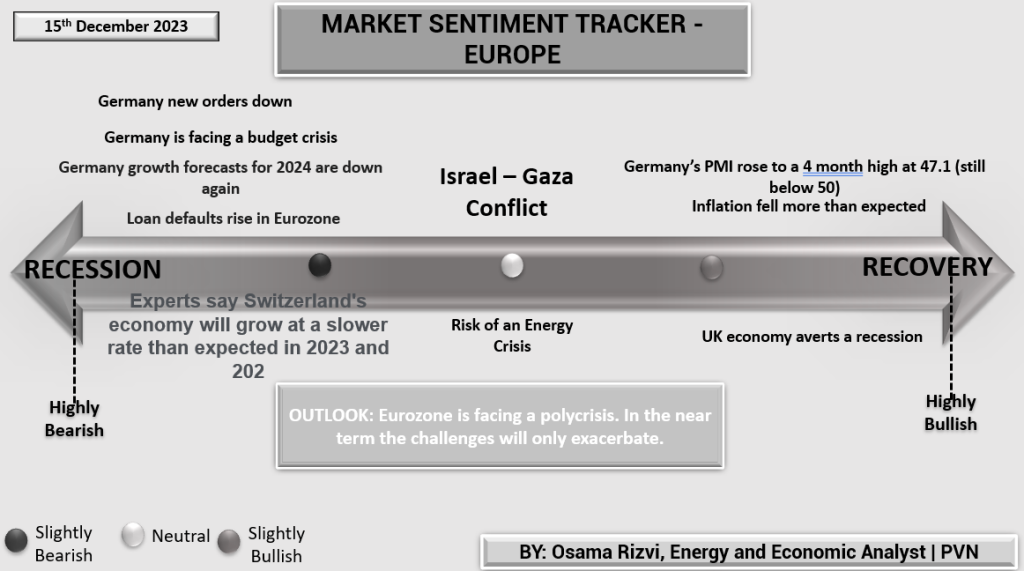

The Market Sentiment Tracker for Europe as of December 15th, 2023, conveys a cautious stance on the region’s economic health.

Signs of Economic Stress:

- Germany, Europe’s economic powerhouse, is showing worrying signs with a decrease in new orders and looming budget issues.

- Growth forecasts for Germany in 2024 have been revised downward, reflecting broader economic concerns.

- The rise in loan defaults across the Eurozone signals increasing financial distress among consumers and businesses.

Mixed Economic Indicators:

- While Germany’s PMI has increased to a four-month high, it remains below the 50 mark, indicating contraction in the manufacturing sector.

- Positively, inflation has decreased more than expected, which could ease some pressure on the European Central Bank’s monetary policy.

Regional Outlook:

- Switzerland’s economy is projected to grow more slowly than anticipated in 2023 and beyond, suggesting a region-wide trend of subdued economic performance.

- The Eurozone is facing what is described as a ‘polycrisis’, with no immediate resolution in sight, and the challenges are expected to intensify.

Overall Outlook: The sentiment tracker underscores a complex scenario for Europe with signs of recovery offset by significant risks, including the potential for an energy crisis. The mixed signals indicate that while parts of Europe like the UK are averting recession, overall, the Eurozone must navigate a precarious economic environment that could see conditions worsening in the near term.

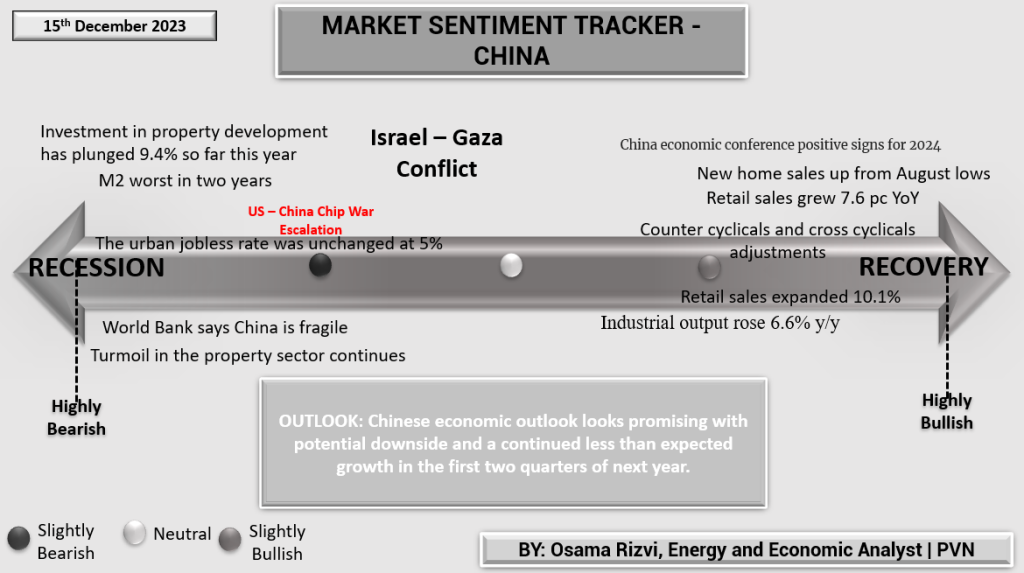

The Market Sentiment Tracker for China, dated December 15th, 2023, illustrates a dual narrative of economic concerns and growth.

Economic Challenges:

- The property development sector has seen a sharp decline in investment, falling 9.4% this year, reflecting continued stress in a key economic area.

- The broad measure of money supply (M2) is at its worst in two years, signaling potential liquidity issues.

- The urban unemployment rate remains static at 5%, failing to show improvement.

- The World Bank has labeled China’s economy as fragile, with ongoing turmoil in the property sector, highlighting significant risks.

Signs of Economic Strength:

- Looking ahead, the China economic conference has forecasted positive signs for 2024.

- There is an uptick in new home sales from the lows of August, indicating some recovery in the housing market.

- Retail sales have increased by 7.6% year-over-year, and industrial output has seen a rise of 6.6% year-over-year, suggesting robust consumer demand and manufacturing activity.

Future Outlook:

- The sentiment tracker notes that despite potential downsides, the economic outlook for China appears promising with counter-cyclical and cross-cyclical policy adjustments that could help sustain growth.

- The retail sector, in particular, has shown resilience with a significant 10.1% expansion, indicating strong consumer spending.

Overall Sentiment: The juxtaposition of a strong retail sector and industrial output against the backdrop of property sector woes and liquidity concerns presents a complex economic landscape for China. The outlook remains cautiously optimistic but recognizes the challenges that might suppress growth in the first half of the next year.