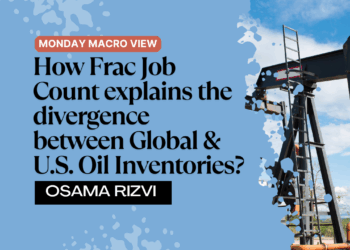

As we head into year-end, the oil and refined products are closing out closely to how we laid it out. Our views were for net builds as demand fell flat and production grew around the world. We are sitting well above seasonal norms across crude and refined products, and the backdrop for 2024 isn’t a bright one. This is why we believe that the risk to crude prices remain to the downside and crack spreads will weaken as we progress through Q1’24. It’s important to note that these builds are occurring with OPEC+ cuts- especially KSA’s voluntary reduction. The first quarter is always the weakest period, and as the economy weakens further- the builds will worsen as we head into March. There is some growing hope that March/April will see an “above average” seasonal bump but given the economic pressures in the market- we think this is a very low probability. There is a chance for another KSA cut, but it’s unlikely without others joining in as well. KSA won’t cut unless there are deeper reductions done by the UAE and Kuwait. Angola already said they refuse to cut further, so the lion share of the reduction will be driven by the GCC nations if it happens. Russia may promise deeper cuts, but it’s VERY unlikely they follow through on them. Crude on the water has been reduced, which is broadly a positive- but the builds in refined products is the bigger problem at this point. It will lead to slowdowns in refining activity, which will cause bigger builds in onshore stockpiles.

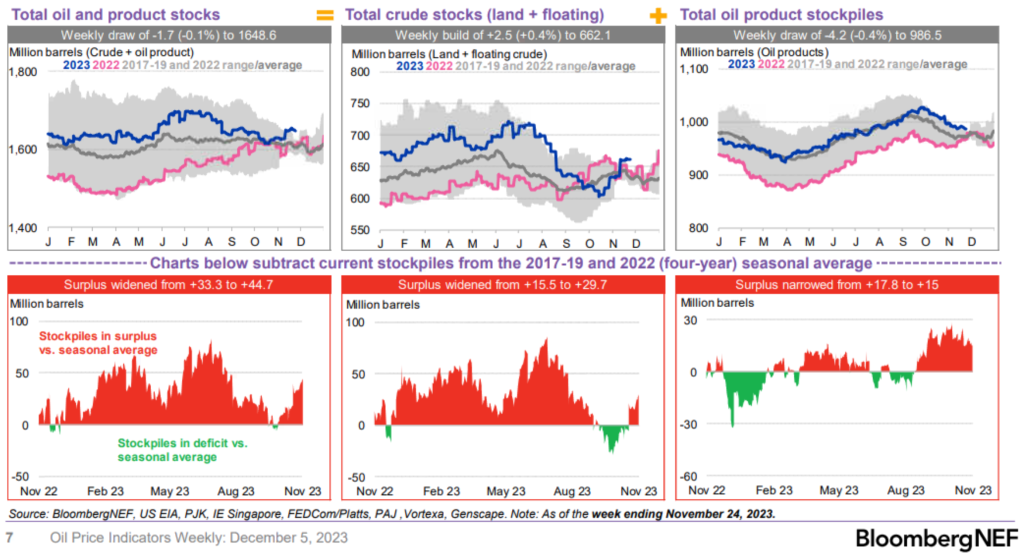

As prices have fallen, we have seen a drop in storage costs, which has pulled more crude into onshore storage. The costs of storage has fallen with contango rolling throughout parts of the crude curve that incentivizes more storage. This will leave more crude in onshore storage and pull more crude off the water. We still have a significant amount on the water due to the amount in transit, but it’s moving much quicker off the water and into onshore storage. As refiners slow activity, it will put much more crude into storage over the longer term. This will cause additional problems for OPEC supply into Q2’24, and it will make it much harder for OPEC+ to bring back crude from the cuts. Unless they are willing to keep production low for over a year, there will be a “small price war” to bring the crude back and take back market share. We do see some increases in floating storage in Asia as demand wanes and more Russian crude heads to the coast. The one to watch will be West Africa where prices have fallen to compete with a slowing physical market. It has enabled some crude to clear, but it will be short lived without some additional reductions in price.

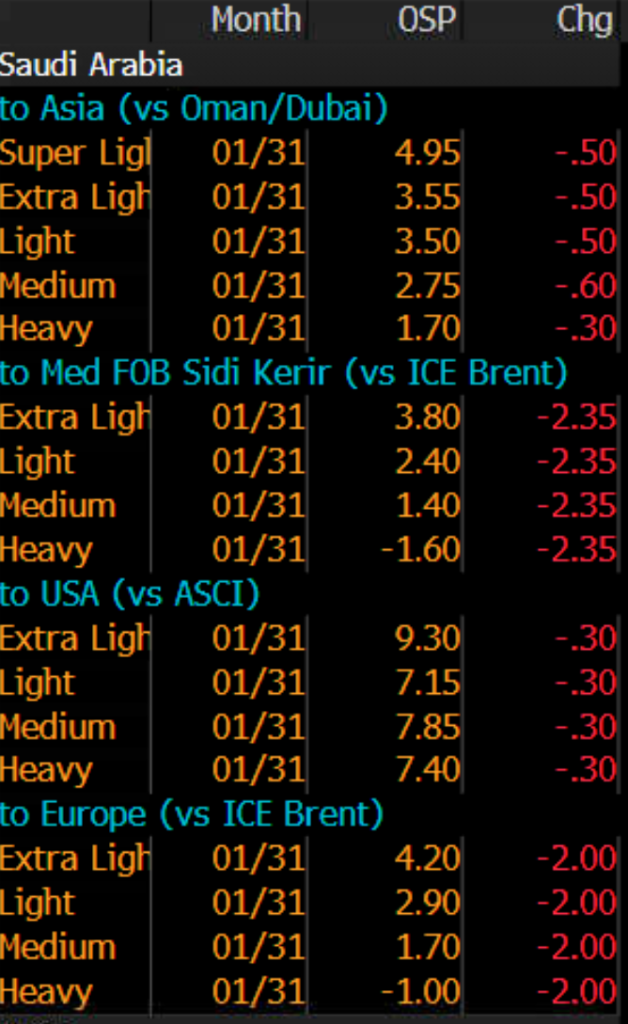

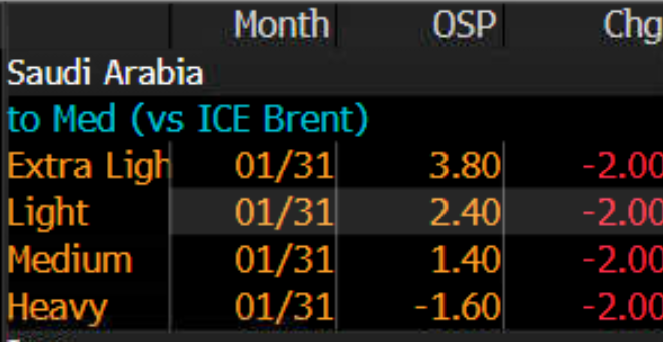

KSA has cut some of their prices (OSPs- Official Selling Prices), but they still remain well above seasonal averages. In some of the key crude grades, the only time it was higher was last year- so even though the prices were “reduced” they are still expensive and NOT support additional buying.

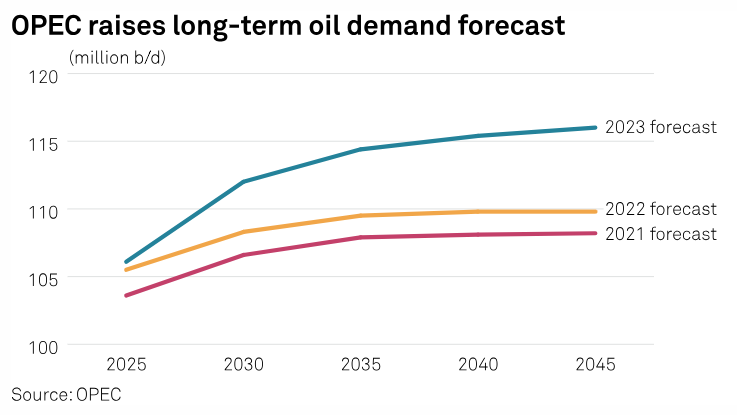

A funny happening at COP28 is the talk about reducing fossil fuel production, but as we have said MILLIONS OF TIMES the green movement is driven by liquids production and petrochemicals. The green agenda is the largest demand driver for liquids and inherently crude demand. The number below is not just black oil but also encompasses liquids- which is the main driver of this demand cycle. OPEC could very well be overstating the below numbers, BUT we do agree with the underlying direction.

The OPEC+ cuts are far from advertised with little change to current production levels as we head into 2024. There was a significant amount of frustration heading into this meeting with many sides unwilling to cut further. Saudi Arabia was already annoyed that countries have been cheating, and I don’t believe we are going to see much of a change in Q1’24. Russia is going to struggle since they can’t shut-in production, and their refiners have failed to come back online. Due to sanctions, the Russians are unable to source a necessary equipment to bring ramp refinery throughput. This will hinder their ability to process crude, which will inevitably set more crude for export.

Here is a breakdown of how we see the cuts:

- 1mbpd from Saudi Arabia. This is just a rollover of the Lollipop or voluntary cuts they made.

- 500kbpd from Russia. This is a mixture of crude and fuel oil with the following breakdown: 300kbpd of crude and 200kbpd of fuel oil. Russia was supposed to cut by 300k, which they failed to do the last few months while fuel oil cuts will inherently be reduced. Russia usually reduces fuel oil exports in winter for power burn, and they are already struggling to increase their refinery throughput. So nothing changed here.

- The UAE’s baseline crude production will rise from 2.88mbpd to 3.219mbpd in January. The “cut” of 160kbpd is basically just reducing growth so their production won’t change next year from current levels. Instead, UAE should still grow 180kbpd in January.

- In January, the fresh cuts amount to about 151kbpd (when adding in UAE increase) and 200kbpd of fuel oil. It really suggests there is nothing left to cut if demand growth further weakens.

- Angola has already promised to “break” their production quota because they didn’t agree to any reductions.

- Iraq was already producing 180kbpd above quota so the “cut” just takes them back to their previous levels.

- It’s also worth mentioning that Iraq has failed to send any crude through the Ceyana pipeline, which already takes down production by about 400K barrels per day.

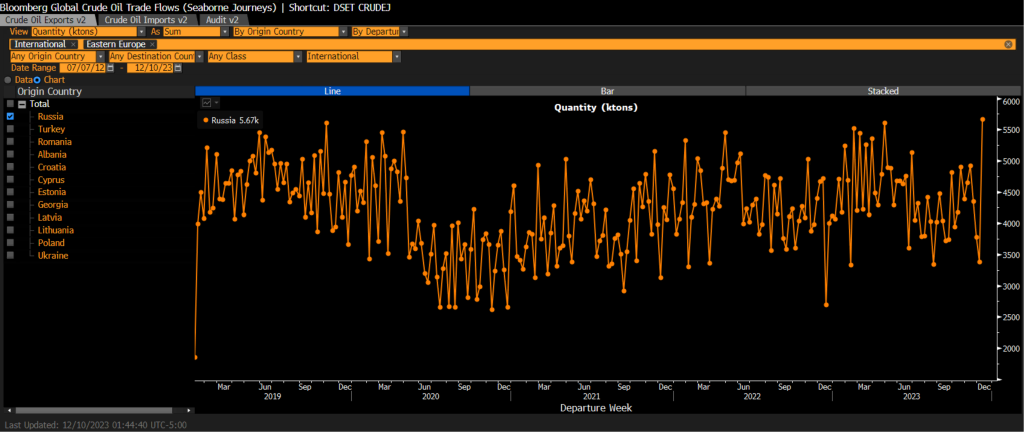

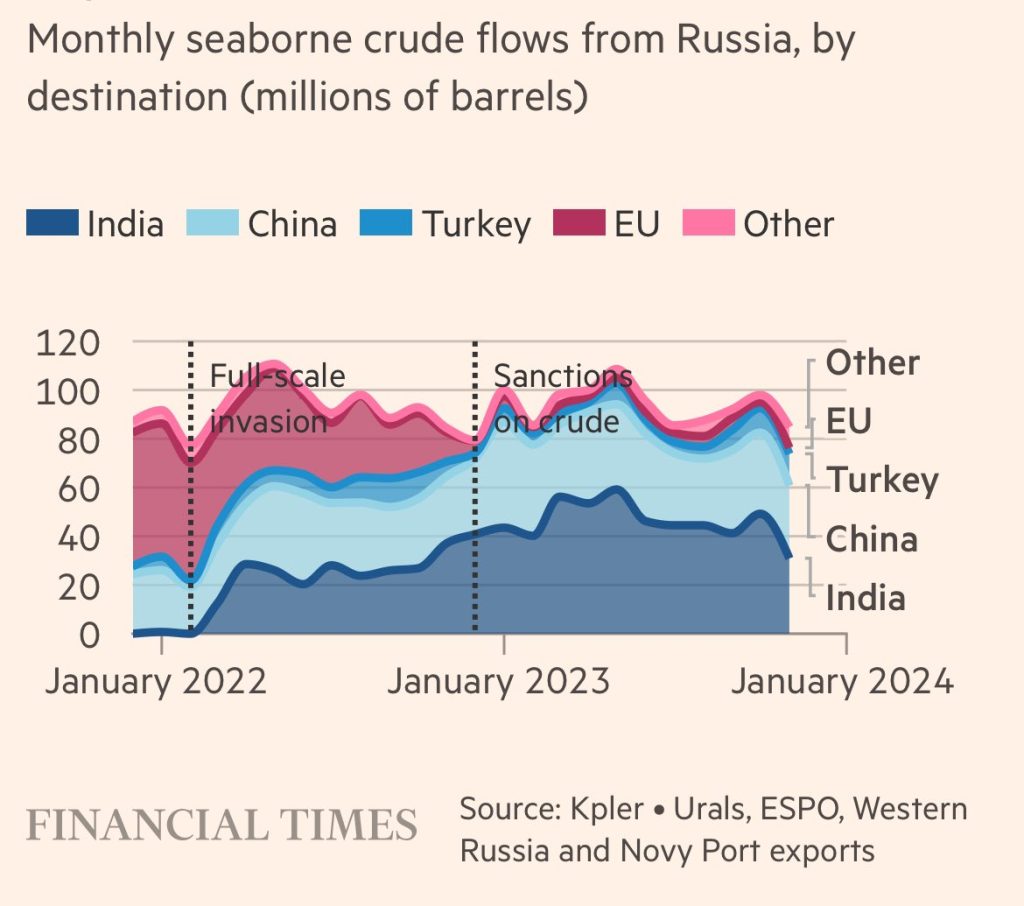

When we look at the total flows from key OPEC countries, you can see that the volumes still remain elevated. Russia saw a big increase (again) in crude exports even after the OPEC+ agreement. We believe that Russia will continue to cheat on their export levels- especially as they struggle to manage their refinery throughput.

When the sanctions were announced against Russia, we explained the many ways that Russia could skirt any attempts to stop their exports. Asia remains a major destination for product, and they have been able to take market share from KSA over the last few months. Based o the above chart, we are going to see another increase in underlying flows as we head into 2024. This will keep volumes heading into India and China that are exporting refined products at an elevated level. We don’t see India or China slowing down their exports as internal economic pressures mount and refined product pricing support flows.

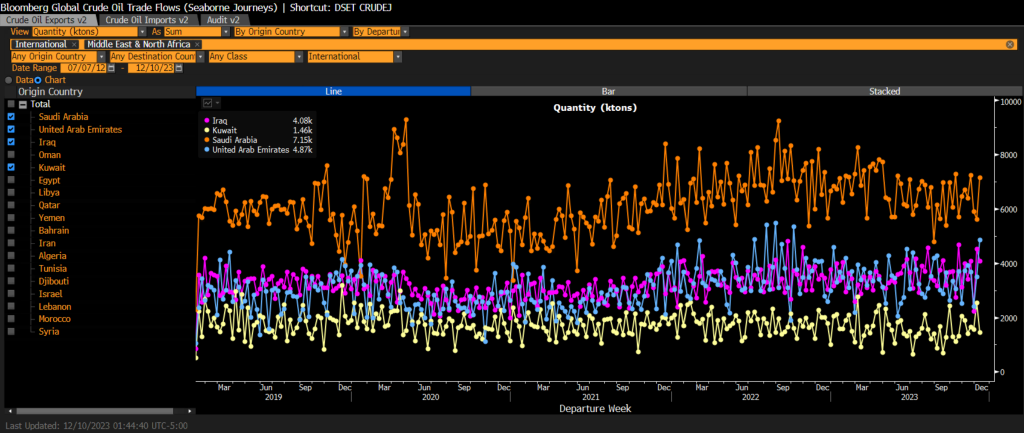

Exports from the other key oil producers continues to flow with UAE moving back to the highs. The UAE’s baseline is moving higher in 2024, and we should see a bit more of a run up over the next several weeks. We believe the market is starting to understand the situation regarding flows staying elevated as demand pressures mount.

We described how the UAE has put themselves in a very good position to capture more market share beginning in 2021. The UAE negotiated hard against KSA and the rest of OPEC to have their baseline shifted higher several times. The most recent shift higher starts next month, and we see at least one more bump as more production comes online through 2025. Iraq is another winner in the KSA cut as they’ve been able to increase exports of medium/heavy, which is why they were incentivized to cheat. Given the current pricing regime for heavy/medium, there is no reason for Iraq to stop producing above their current levels.

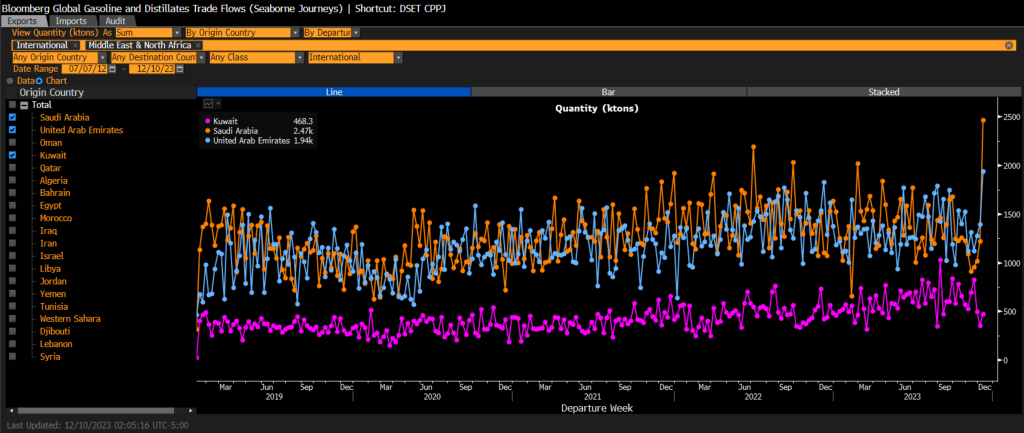

KSA, UAE, and Kuwait are also accelerating their exports of refined products. The below chart puts into perspective the “surge” in exports. KSA and UAE have hit new record exports of refined products with more to follow on the back end. There is typically an increase in Q4 and Q1 as power burn is at it’s lowest and refiners are operating at elevated run rates. KSA has also brought new facilities online, which is putting more product into the market. Given the elevated exports from China/India, refined products from the Middle East will work its way into the Atlantic Basin and put more pressure on margins in the region. As gasoline builds and crack spreads weaken, refiners are relying more on the distillate crack- which is falling and will cause some economic run cuts- specifically in Asia. The margins in the U.S. will come under pressure, but there should be enough support to keep us operating at seasonal norms.

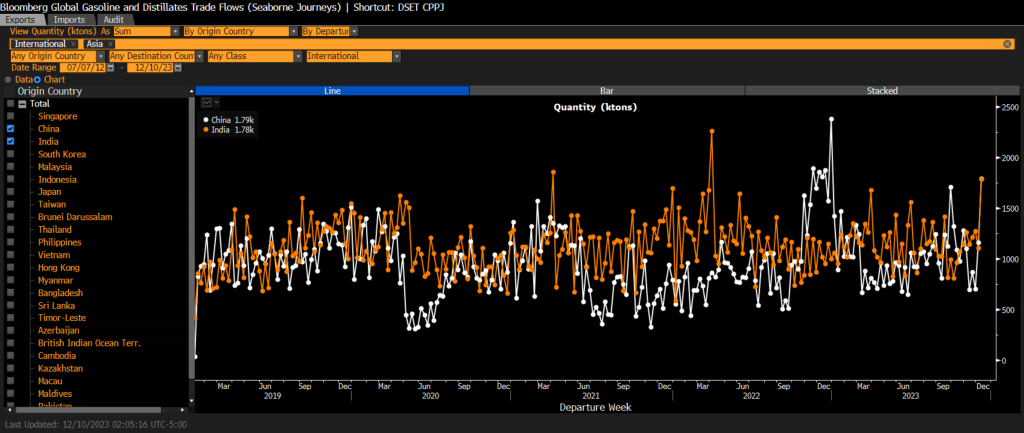

The below chart shows the exports from China and India, which we see increasing over the next month. China increased their import quota for oil/fuel oil, which will help support additional exports in Q1’24. “China has issued an additional 3 million metric tons in fuel oil import quotas in 2023 for non-state firms, according to a notice released by the country’s Ministry of Commerce on Monday. The additional quota takes the total for 2023 to 19.2 million tons, following the 16.2 million tons in non-state fuel oil import quotas issued at the start of the year.” India has been capturing a healthy arbitrage in the region, which should carry through the rest of December. The issue will be Q1’24 as distillate prices come under pressure- this will reduce the arb. It will also reduce the price of Urals and ESPO- as long as India sources Russian crude- they will be able to maintain current export rates. India and China will be able to undercut the rest of Asia given their source crude. This is a core reason we expect to see run cuts hitting some other areas in Asia- especially Southeast Asia.

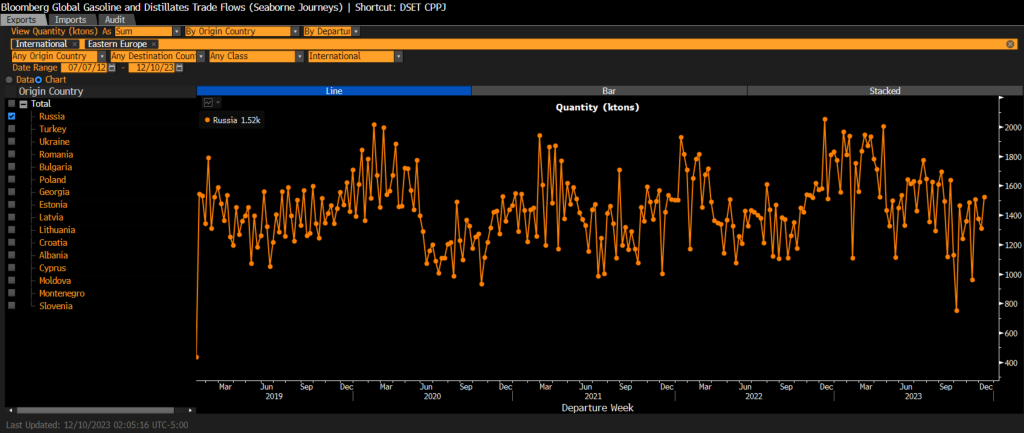

We see Russia maintaining their current level of refined products with some downside risk. During Q1’24, there are typically seasonal reductions in exports due to the increase in heating oil demand. So the additional cut they agreed too- is just one that normally happens this time of year.

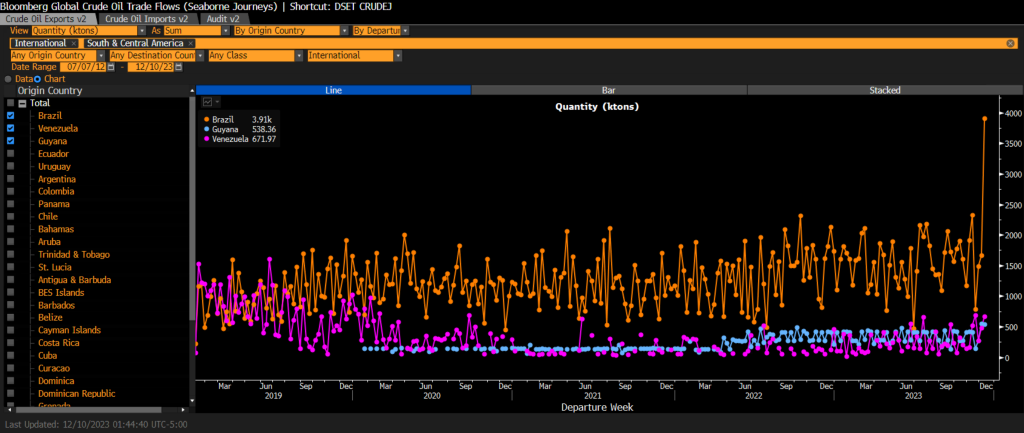

Latin America continues to export more crude at an increasing rate with Brazil leading the charge. We don’t see this changing, but rather accelerating throughout 2024. The Venezuela commentary around “claiming large parts of Guyana as part of their country” is purely noise for several reasons:

- Venezuela doesn’t have the military power to take the land

- They don’t have the navy to protect energy assets operating offshore

- The U.S. military won’t let it happen given the interests of the U.S. economy and Chevron/Exxon.

- Guyana has been the driving force for increased production for Exxon and Chevron (following their purchase of Hess).

Latin America will be the key driver of crude growth over the next several years- at a minimum. Brazil will join OPEC officially next year and complete a goal for Lula since his initial presidency. We don’t see this being a huge factor- especially given their underlying energy growth and exports. Energy and agriculture are the two top industries in Brazil, and it’s unlikely Lula will do anything to risk those industries.

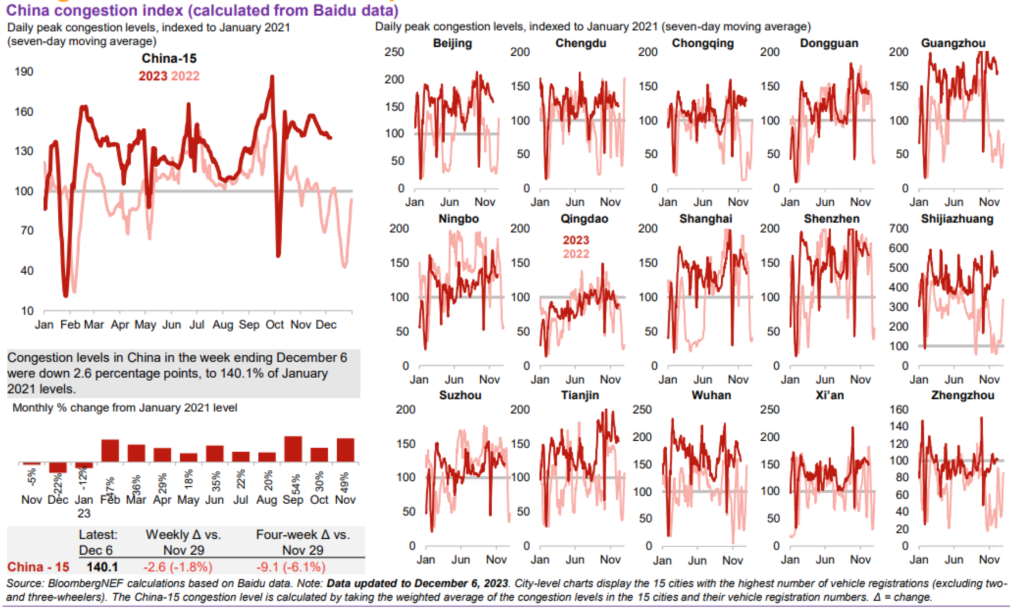

Chinese demand and economic activity continue to bleed lower with little ability to drive near term activity. China faces structural problems that can’t be fixed with more stimulus and infrastructure spending. As the consumer weakens, we expect gasoline demand to slowly drift lower. The comps are “easier” because of last years “Zero-Covid Policy.” The comparisons will be much harder as we get into next year, and will highlight just how weak the current economic situation is in China.

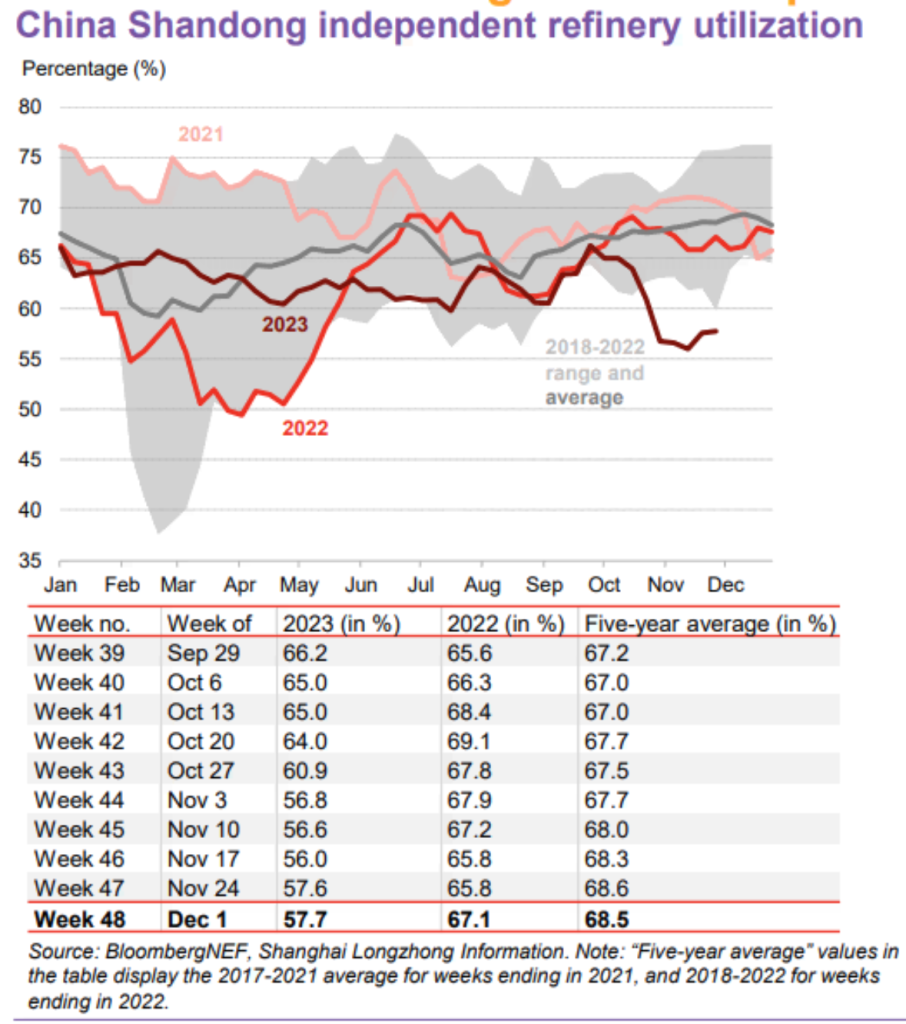

The slowdown in consumers and general activity in China will keep refinery utilization rates WELL below seasonal norms. The below chart puts into perspective just how low activity is across the board. The reductions are taking place in both independent and state-owned entities because of the slowing demand.

When we look at the global market, there was another broad slowdown in world manufacturing, which is the biggest driver of diesel demand and economic growth.

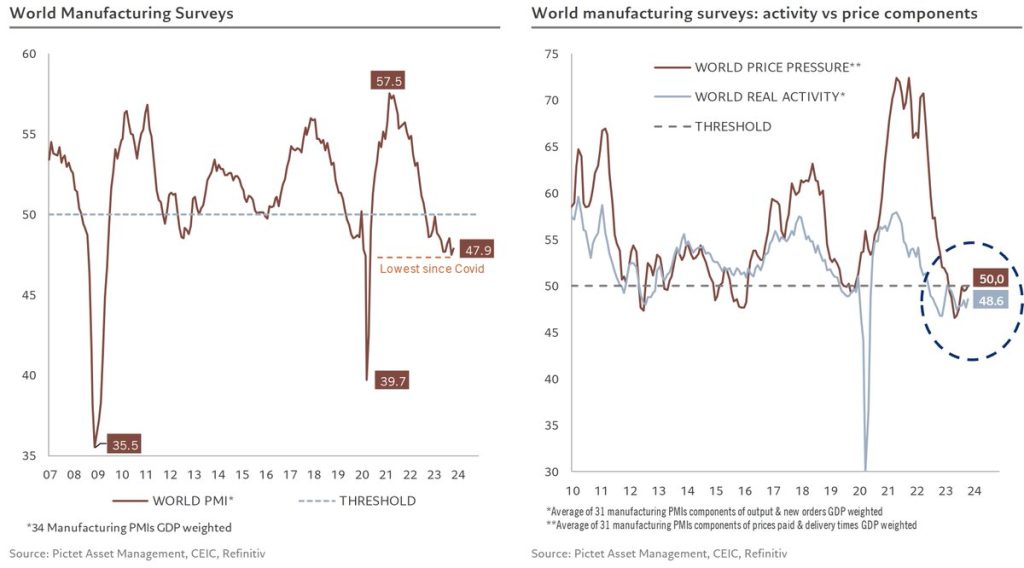

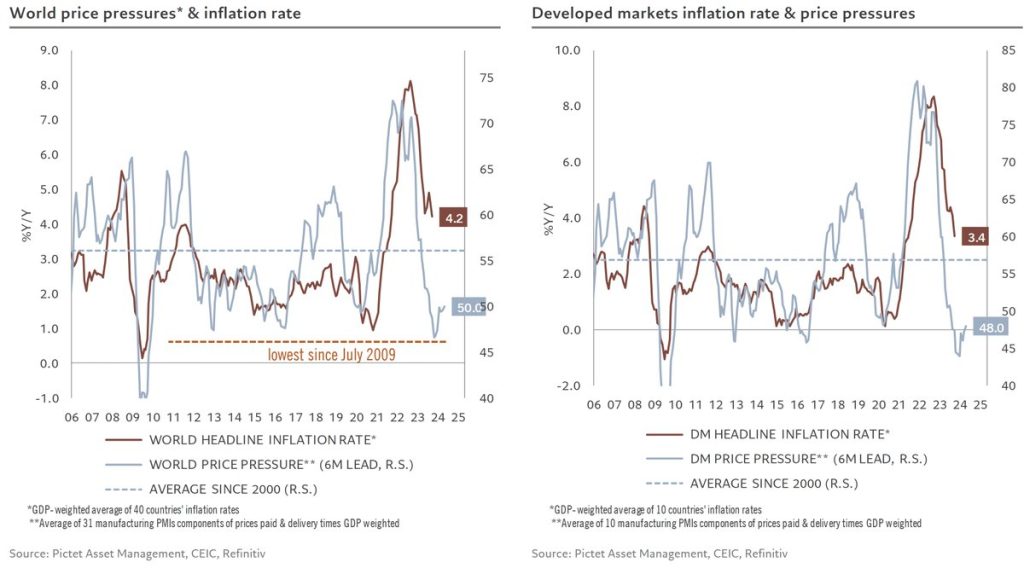

Not only is real activity flatlining in contraction BUT price pressures have shifted back into expansion. This is highlighting the underlying RISE in inflation and how any “deflation” narratives have been very short lived. Food prices, service, and underlying “sticky” inflation metrics have risen once again. “November global manufacturing PMI slightly rebounded from its the lowest level since covid by 0.4pt to 47.9, remaining though below the 50 threshold for 15 months, still suggesting a global slowdown- both activity components and price pressures rebounded.”

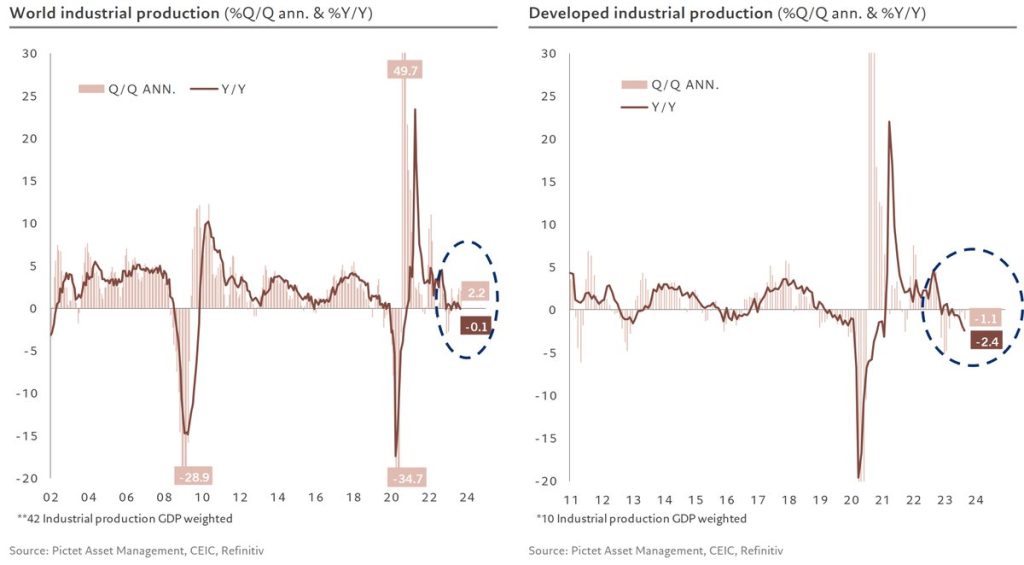

While global industrial production has been flirting with recession since the start of the year, that of developed markets has been in recession since May this year, with 2 quarters of negative growth. As we have been saying, it takes time to see the “Developed market” slowdown/ recession to show up in the developing world. As the developed market slips deeper into a recession, it will pull down world industrial production and developing markets much faster.

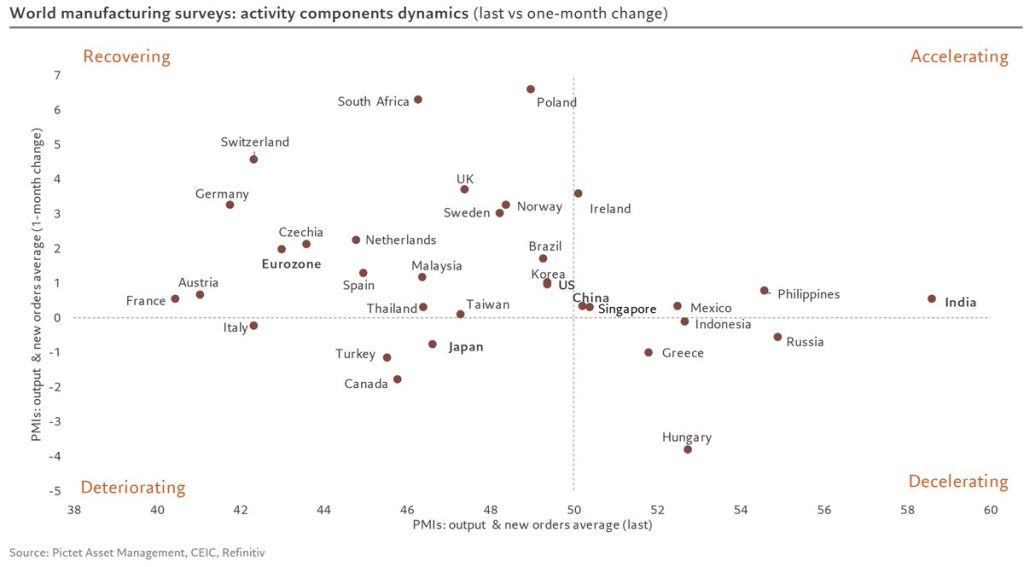

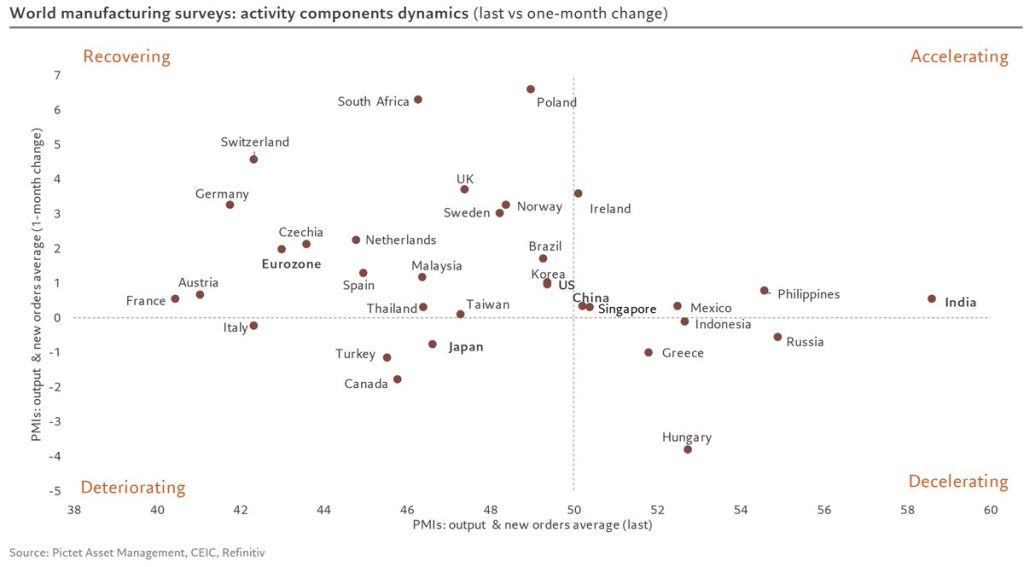

China saw a small bounce in activity, but so far in December and towards the end of November things slowed back down. India remains strong, but it has weakened a bit while still staying the strongest in the region. The activity components of global PMIs rebounded by one point to 48.6, with all regions recording an increase. In terms of levels, emerging Asia remains comfortably in the lead at 53.5, while the developed regions lag behind (46.7).

By country, activity components show: 30% of countries stay in expansion (>50) of which 18% are accelerating: Ireland the most while India has the highest score. 58% are recovering, S. Africa & Poland the most, 12% deteriorating, Canada the most.

Broadly speaking- Global inflation components show that short-term pressures have rebounded from very low levels but remain below the long-term average. The problem is- we see some acceleration, but mostly “staying power” at these elevated pricing regimes.

In China- even with stimulus- we aren’t seeing a meaningful bounce in activity. “Caixin: “China’s inventory of new homes has climbed significantly, especially in smaller cities where it will take more than two years to sell them. Developers sharply reduced prices of new homes in 3rd and 4th-tier cities, but could not attract buyers.” There remains no clear demand for debt even as interest rates get pushed lower.

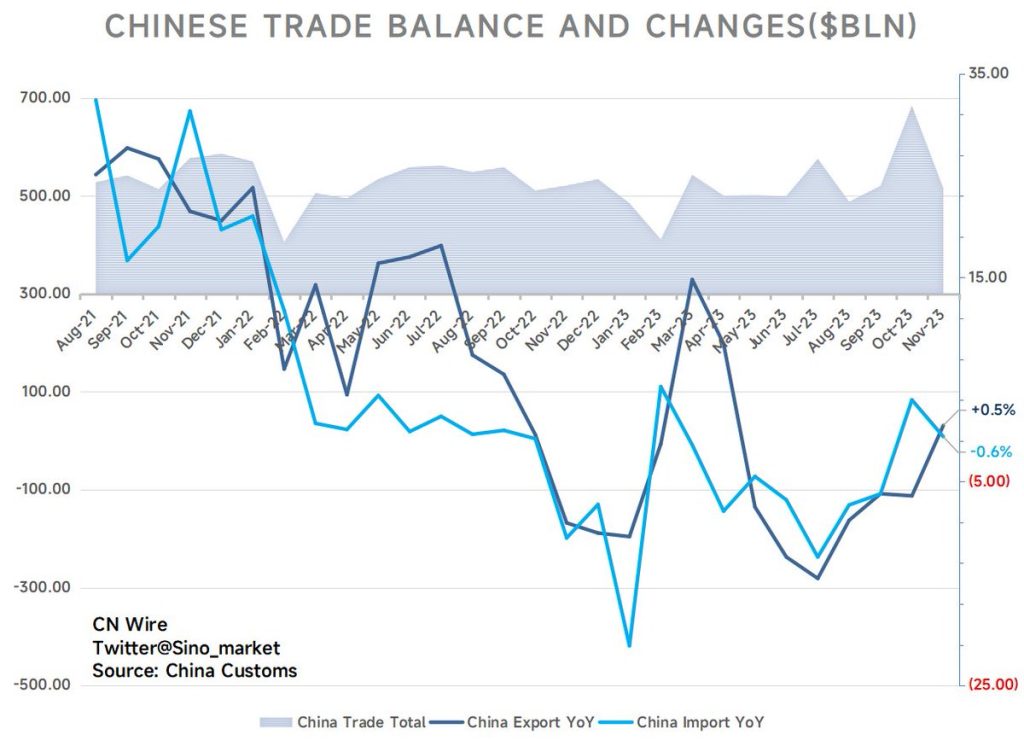

When you look at the Chinese trade data, we predicted a “pop” driven by the sizeable jump in imports last month- but as you can see by the current import “miss”- trade has slowed again.

China’s November trade balance at 490.82 billion yuan:

- Exports +1.7% y/y, Prev. -3.1%

- Imports +0.6% y/y, Prev. +6.4%

- Trade balance at $68.39 bln in USD term

- Exports +0.5% y/y, Est. +0.0%

- Imports -0.6% y/y, Est. +3.9%

The miss on the import side highlights the problem with local demand as well as future export expectations.

Chinese inflation also missed estimates by a wide margin- pointing to another slowdown in underlying buying activities.

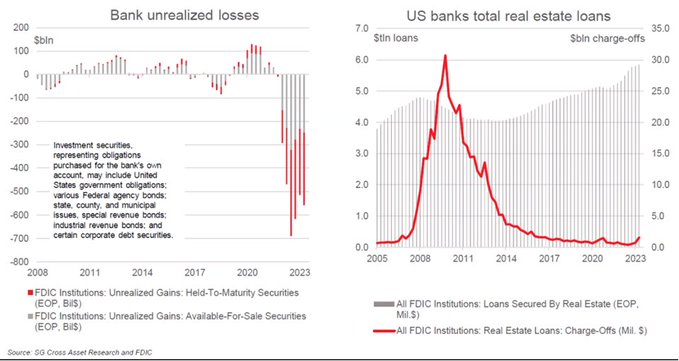

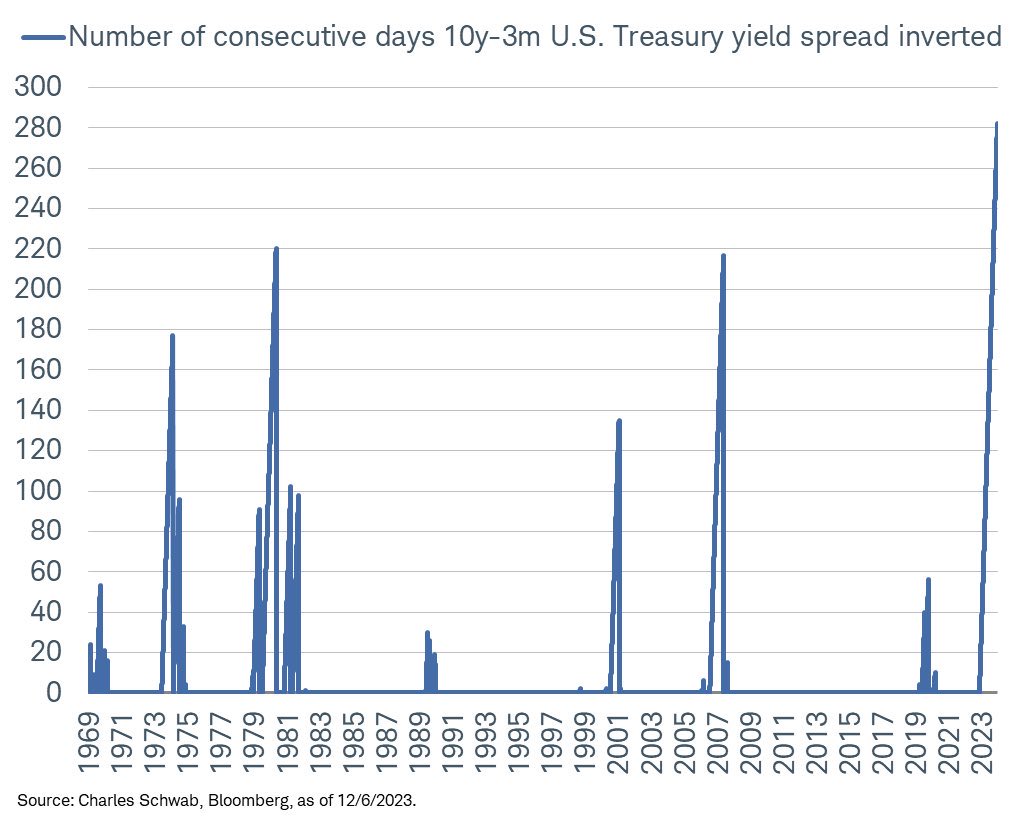

In the U.S., we see the slowdown accelerating with more pressure around the corner. There are still sizeable unrealized losses, but we still don’t believe the Fed has the ability to cut rates.

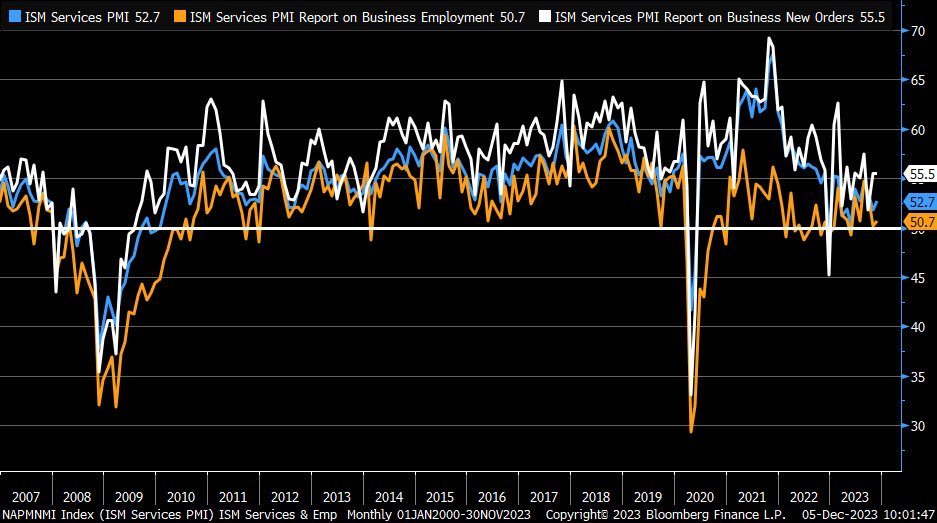

The market is starting to understand that the fed is “Stuck” and won’t be cutting rates anytime soon. The ISM data came in stable with some expansion in “new orders”- so why would the Fed look to cut? “November ISM Services PMI up to 52.7 vs. 52.3 est. & 51.8 prior; new orders same as last month at 55.5; business activity stronger; prices paid eased marginally; employment moved up a touch.”

While we still see the U.S. slowing into contraction in 2024- Europe is already steeply in a recession.

The above chart puts into perspective just how bad the growth engine is sputtering.

We described the “death of the bond bull market” back in 2020/2021, and the below chart puts into perspective just how unprecedented the shift is right now.

It takes time for monetary policy to work its way through the system, and the Fed is at a point where they will pause rate hikes. There could potentially be one more, but we are likely nearing the end of this current cycle. But, it doesn’t mean we are any closer to a broad cut- instead we are going to have to live with these rates for at least 12 months from the point of the stop. The best thing the market can do is NEVER get rates to those levels again because it has caused so much pain and mis-allocated funds- it will take years to undo the underlying damage. The central banks have created a “lost decade” but with proper monetary policy and structural reform- we can setup the 2030’s for exponential growth.