China’s economic scenario in November presents a complex picture, with growth in some areas but underlying weaknesses that raise concerns about the overall health of the economy. Despite some positive official data, the reality suggests a need for more robust economic support from Beijing.

Fixed-Asset Investment and Urban Joblessness: Growth in fixed-asset investment was modest, at 2.9% in the first 11 months of the year, just shy of the forecasted 3% gain. This indicates a tepid investment climate, which is crucial for sustaining long-term economic growth. The urban jobless rate remained static at 5%, reflecting stability in urban employment but not necessarily capturing the full scope of employment challenges, especially in the context of a slowing economy.

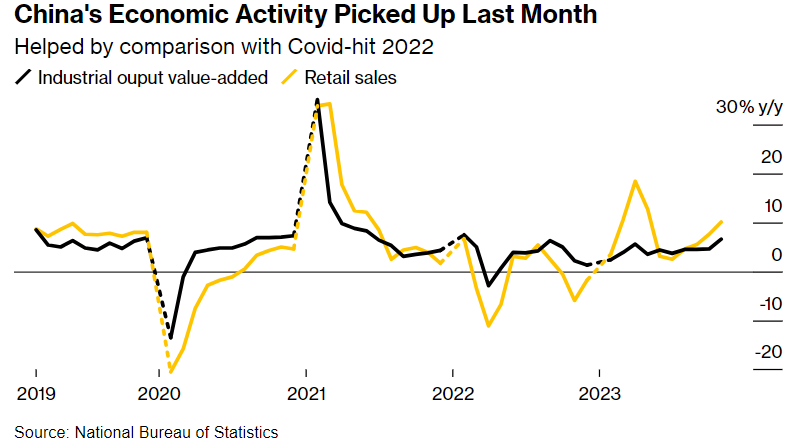

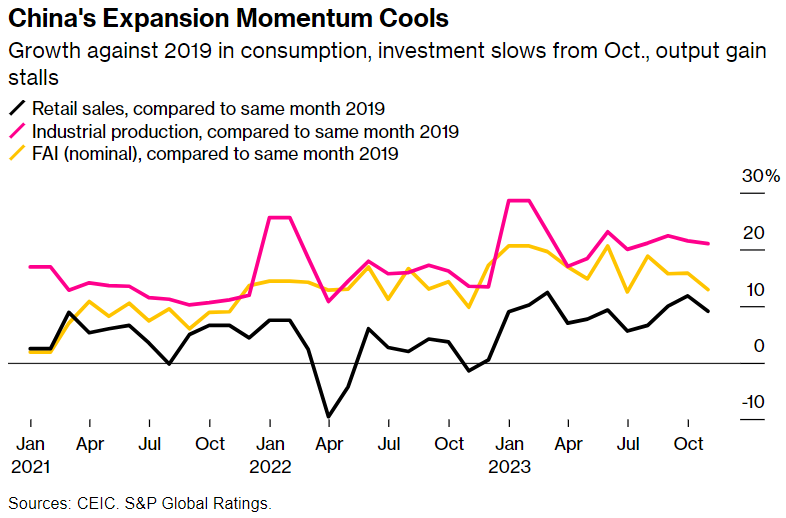

Industrial Output and Retail Sales: Industrial output in November rose by a notable 6.6% year-over-year, surpassing the median estimate of 5.7%. This suggests some resilience in China’s industrial sector. However, retail sales expanded by only 10.1%, falling short of the anticipated 12.5% jump. This slower growth in retail sales is particularly concerning as it indicates weakened consumer confidence and demand, crucial drivers of economic growth.

The property sector continues to be a significant drag on the economy, with a 9.4% plunge in property development investment this year and the most significant drop in secondary market home prices in nine years. These factors, combined with the skewed nature of recent economic data due to low base effects from 2022’s Covid lockdowns, paint a picture of an economy struggling to gain momentum.

The People’s Bank of China’s recent liquidity injection, while substantial, may not be sufficient to counteract the low corporate and consumer confidence. Analysts suggest that more targeted measures, such as ensuring the delivery of pre-sold houses and further mortgage rate cuts, are needed to stabilize the property sector and boost economic activity.

As China looks towards 2024, the Communist Party’s growth strategies will be under scrutiny. While there are hints of an ambitious growth target and an expanded budget deficit, the effectiveness of these measures in the face of current economic challenges remains uncertain. The central bank is expected to take more aggressive steps to address these issues, but the November data, despite meeting this year’s targets, underscores the urgency for more decisive action to bolster China’s economic growth in the coming year.

Global Diesel Markets

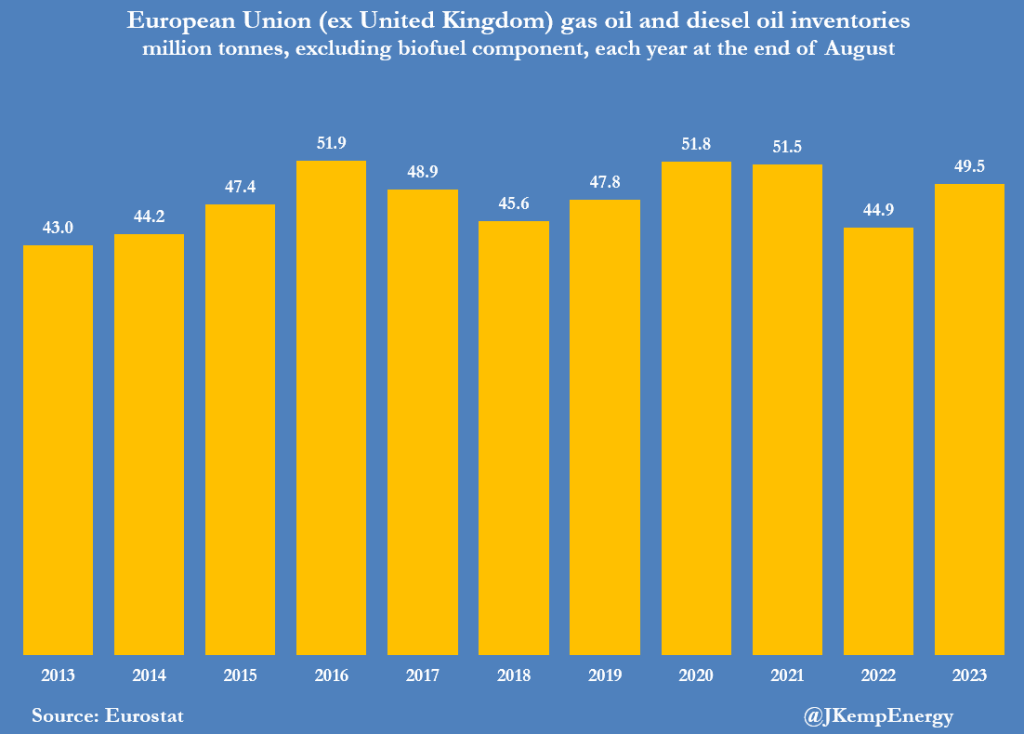

The global diesel and distillate fuel oil shortage has begun to ease following a summer surge in prices, as indicated by recent inventory data. In the European Union, diesel oil and gas oil inventories rose to 49.5 million tonnes at the end of August 2023, up from 44.9 million a year earlier, surpassing the ten-year seasonal average by 1.8 million tonnes. In the United States, stocks increased to 119 million barrels by September’s end, up from 111 million a year prior, with the deficit to the ten-year average narrowing significantly. Similarly, Singapore saw its distillate stocks rise to an average of 9 million barrels in September from 8 million the previous year, reducing the deficit to the ten-year average.

This accumulation of diesel and distillate stocks is attributed to high crude prices and refining margins during the third quarter, which encouraged maximum refinery processing and reduced fuel usage. Benchmark crude prices rose by $124 per tonne between May and September, while the gross refining margin more than doubled in the same period.

Diesel and gas oil consumption, closely tied to the business cycle, particularly in manufacturing, freight transport, and construction, slowed down due to the surge in fuel costs, rising interest rates, and tightening credit conditions. This slowdown in industrial activity has led to a retreat in benchmark crude prices and a decrease in the crack spread since September, offering some relief to various sectors and easing inflationary pressures.