The global economic landscape at the dawn of 2024 is a patchwork of resilience and vulnerability, according to the Market Sentiment Trackers for the U.S., Europe, and China. As the new year begins, let’s delve into the economic prospects of these regions, which are instrumental in shaping global market dynamics.

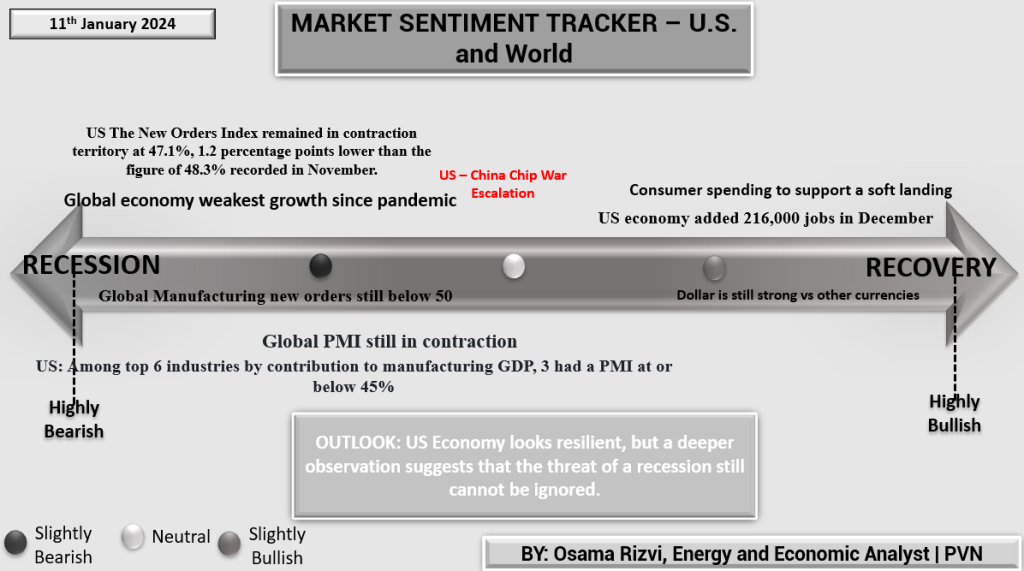

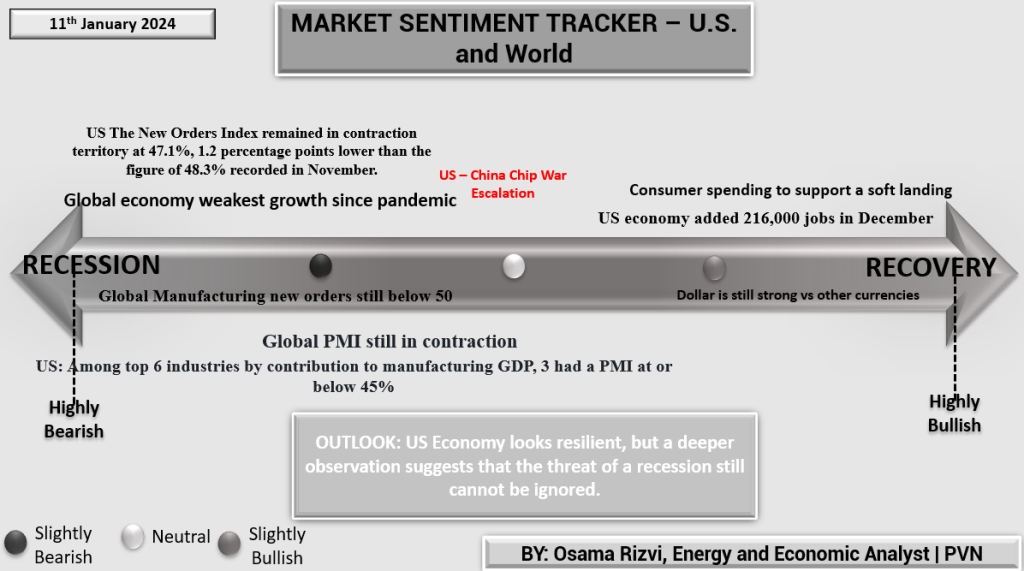

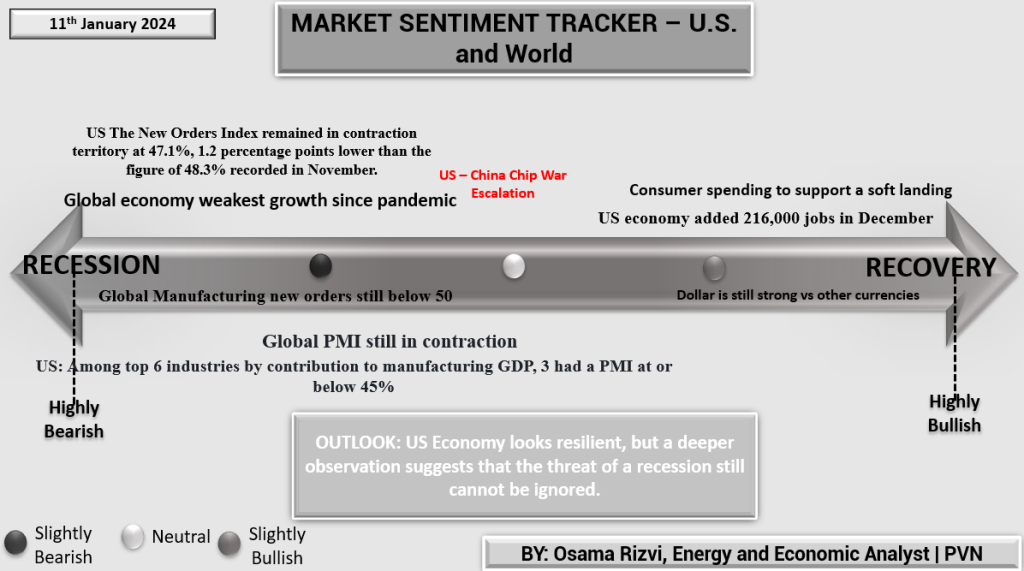

United States: Mixed Signals as a New Chapter Unfolds

In the U.S., the New Orders Index suggests that manufacturing is still contracting, with the Global PMI also in contraction, indicating widespread industrial malaise. Despite this, the U.S. economy remains resilient, adding 216,000 jobs in December. With consumer spending expected to cushion the economy, the hope is for a soft landing rather than a full-blown recession. Yet, the indicators warrant caution, with a balanced view of the robust labor market and a strong dollar against the backdrop of a potential economic slowdown.

Europe: Struggling to Find Its Footing

Europe faces a more tumultuous start to 2024, with Germany’s wholesale sector hitting pandemic lows and French service sector PMIs indicating contraction. Amid subsidy cuts and farmer protests, Europe is performing worst among advanced economies. The UK’s modest 0.5 percent economic growth stands out as a positive note. However, the Euro area inflation rate’s slight ease to 2.9% offers little comfort against the broader risks, including the looming energy crisis and the potential for prolonged economic sluggishness.

China: A Contradictory Path to Growth

China’s economy tells a story of contradiction and potential. Structural issues and a lackluster response to stimulus are cause for concern, as is the ongoing turmoil in the property sector and geopolitical tensions exemplified by the Taiwan elections. Nevertheless, the Chinese economy is expected to grow by 5.3%, with retail sales and industrial output rising by 7.2% and 6.6%, respectively. The strong increase in LNG imports and the possibility of growing exports contribute to an optimistic outlook for China, positioning it as a critical engine of growth in 2024.

Looking Ahead: A Year of Economic Crossroads

The year 2024 stands as a crucial juncture for the global economy, with the U.S., Europe, and China navigating their unique challenges and opportunities. The U.S. is grappling with manufacturing downturns but shows labor market strength, Europe continues to wrestle with economic pressures amid modest recoveries, and China, despite internal and external pressures, projects significant economic expansion. These divergent narratives underscore the interconnected nature of global markets and the delicate balance that will define economic trajectories in the coming year. Stakeholders worldwide will be watching closely, ready to adjust to the shifts and trends that 2024 will undoubtedly bring.