Sniff Of A New Merger

On January 5, media reports suggested that natural gas producers Southwestern Energy (SWN) and Chesapeake Energy (CHK) were contemplating a merger deal. Combined, these two companies would create a ~$17 billion market cap natural gas-producing behemoth. Following the news break, both stocks moved up (SWN +5.7% and CHK +2.2%) in the after-market trading. The two energy producers have a strong presence in the Appalachia shale formations and the Haynesville basin in Louisiana.

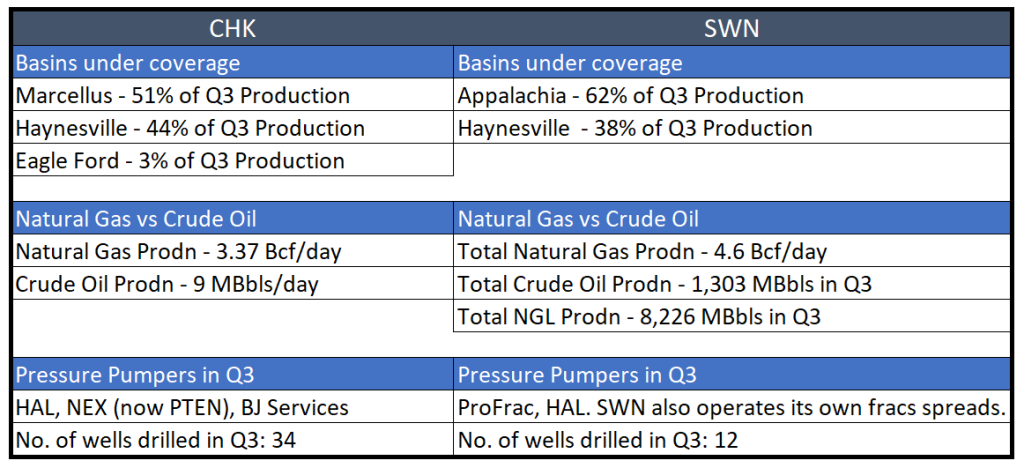

Operations Comparison And Growth

SWN is one of the largest suppliers of natural gas to LNG exporters. In Q3, it invested $454 million of capital and placed 23 wells to sales, of which 15 were in Appalachia and 8 in Haynesville. It also operates two frac spreads in Appalachia and two in Haynesville. In comparison, CHK invested $357 million in Q3 as it looks to rely on LNG exports. In an agreement signed in Q3, CHK will supply up to 1 million tons per annum of LNG to Vitol. It plans to maintain its current rig count of five rigs in the Haynesville and four rigs in the Marcellus. Combining these two will provide tremendous scope for shared infrastructure and cost synergies.

Chesapeake reported production of 3.5 Bcfe (billion cubic feet of natural gas equivalent) per day of natural gas in Q3 2023, while Southwestern reported production of 4.6 Bcfe per day. Operating in three shale Basins, CHK drilled more wells than SWN in Q3.

Natural gas [producers are poised to benefit from the potential LNG export opportunities. According to SWN’s estimates, more than 20 Bcf/d global LNG demand growth is expected through 2030. The US is robustly positioned to meet the supply gap. Currently, it has 13 Bcf/d of export capacity in service, with a projected increase of ~12 Bcf/d for projects under construction.

Production Guidance

CHK’s guidance for Q4 2023 production is slightly lower than its Q3 (0.4% down). The company expects its natural gas production in the Marcellus to decline by 11% in Q4 compared to Q1. In Hayesville, however, the company expects production to remain resilient. In Q3, it deferred nearly 60% of its planned TIL (turn in-lies) into Q4. It extended curtailment and TIL deferrals by 50 MMcf/d to 75 mmcf/d due to weak demand in the Northeast. The company also expects to maintain its current rig count of five rigs in the Haynesville and four rigs in the Marcellus in 1H 2024. If natural gas prices stabilize in 2025, an additional rig can be added in Haynesville during 2H 2024, positively impacting volumes in 2025.

SWN, too, expects energy production to fall in Q4 (1.2% down) compared to Q3. The company expects LNG demand to increase in 2H 2024 and into 2025. It expects FY2024 capex to remain relatively unchanged.

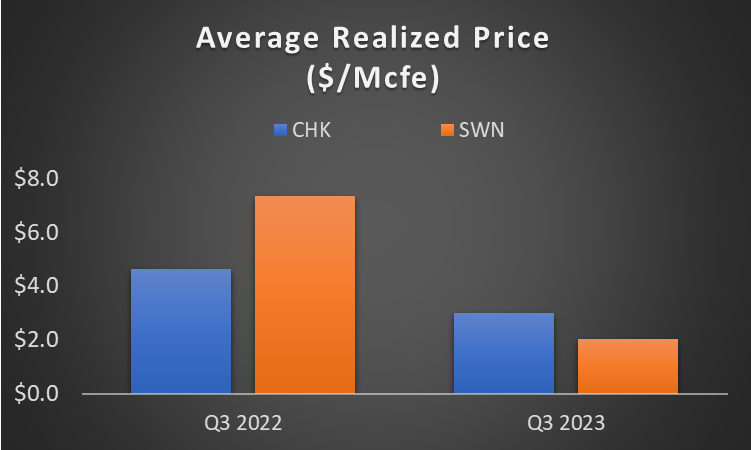

Average Realized Price Comparison

Natural gas prices dipped sharply in Q3 2023 over a year ago. Although natural gas prices continued to tumble, crude oil prices steadied in 2H 2023. The company’s average realized price, in effect, decreased by 36% in the past year. In comparison, SWN’s average realized prices took a sharper downturn (72% down) in Q3 over the past year.

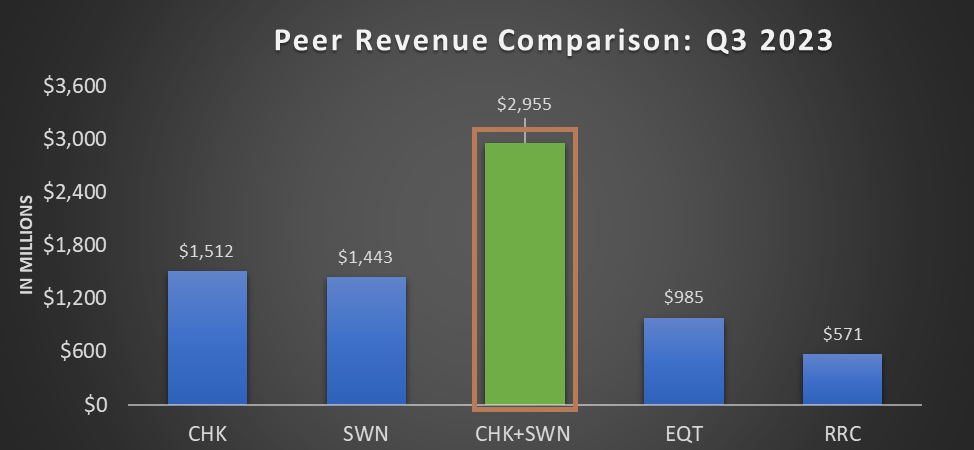

Revenue And Net Income Comparison

In Q3 2023, SWN’s total revenues amounted to $1.4 billion, marginally lower than CHK’s $1.5 billion revenues for the quarter. SWN’s and CHK’s natural gas revenues declined similarly (~78%) over the past year until Q3 2023. However, CHK’s marketing revenues were more resilient than SWN’s (-40% vs. -57%). Combined, it would become one of the largest natural gas producers in the US. From Q3 2022 to Q3 2023, net income fell similarly for CHK and SWN (~90% down).

Debt And Cash Flows

SWN plans to reduce total debt to $3.5 billion – $3.0 billion in FY2023 from $4.1 billion in Q3. It also aims to maintain leverage of 1.5x-1.0x. Most of SWN’s long-term debt maturity lies in the long-term, with only $389 million falling in the next four years. It recorded approximately $200 million in free cash flow in 9M 2023, which is not conducive to its debt-reduction plans.

CHK had a lower long-term debt of $2 billion as of September 30. Its net debt-to-EBITDAX was also lower (0.4x). Although positive, CHK’s free cash flow fell sharply in 9M 2023 (74% down).

Relative Valuation

CHK’s forward EV/EBITDA multiple is expected to contract versus the current EV/EBITDA. The rate of contraction is in contrast to SWN, for which the multiple is expected to rise steeply. This implies that CHK’s EBITDA is expected to rise as opposed to a fall in EBITDA for SWN in the next year.

This should typically result in a significantly higher EV/EBITDA multiple for CHK. The company’s EV/EBITDA multiple (4.6x) exceeds its peers’ (SWN, EQT, and RRC) average. So, CHK appears to be reasonably valued compared to its peers. CHK’s and SEN’s current EV/EBITDA multiples are at a significant discount compared to their past five-year averages.

How Does The Rumored Merger Look?

Both CHK and SWN, being natural gas producers, did not have a good 2023. Their average realized prices decreased, so their revenues and net income took a sharp downturn in Q3.

However, in 2024, the outlook can brighten. In Haynesville, production will likely remain more resilient. The LNG market has huge export potential for US natural gas producers. In this background, it makes sense for the producers to combine to create a strong contender to gain market share when natural gas prices recover. This is especially true for two companies entrenched in similar shale basins and share infrastructure. CHK’s stock price dropped steeply, although SWN held steady over the past year. Nonetheless, both shares are trading at a steep discount to their past 5-year average, which can provide a timely opportunity for a combination at an advantageous price level. Much, however, will depend on the movement of natural gas prices.