SLB’s 2024 Outlook

We have already discussed SLB’s (SLB) Q4 2023 financial performance in our recent article. Here is an outline of its strategies and outlook. The company’s management expects its Production Systems and Reservoir Performance division to continue to grow in 2024. New technology platforms will push growth from its digital business by “high teens” in 2024. A combination of increased pricing, technology adoption, and limited capacity expansion in the OFS industry can lead to margin expansion for SLB in 2024.

A favorable geographic mix and operating leverage can lead to an EBITDA growth of “mid-teens” in 2024. From Q3 to Q4, SLB’s share of revenues from international operations increased from 78% to 20%. In the Digital and Integration division, the margin can remain unchanged. However, due to higher technology adoption in the industry, higher amortization expenses can depress margins in the APS division. In Q1 2024, SLB’s revenues can grow in the “low-teens” and EBITDA growth in the “mid-teens.” As upstream activity rebounds in international markets, the growth rate can accelerate in 2H 2024.

Industry Drivers And Outlook

Based on the resilience of global demand in 2023, SLB’s management appears confident in the ongoing multiyear investment cycle. In international markets, it estimates that two-thirds of total investment would go to the Middle East, offshore, and natural gas plays. Saudi Arabia and the United Arab Emirates would primarily attract the most investments. New gas exploration and development is expected to be seen in Asia. Led by the Middle East and Asia, the aggregate global offshore FIDs would touch $100 billion in 2024 and 2025.

The favorable subsea outlook is expected to be resilient to the geopolitical tensions in some of these regions. Also, the long-cycle investment in the Middle East, offshore, and gas markets remain decoupled from short-term pricing. North America, on the other hand, saw a perceptible moderation in energy activity in 2024. So, investment levels in this region may remain unchanged compared to 2023 exit rates. Plus, the adoption of technology will boost efficiency and recovery rates.

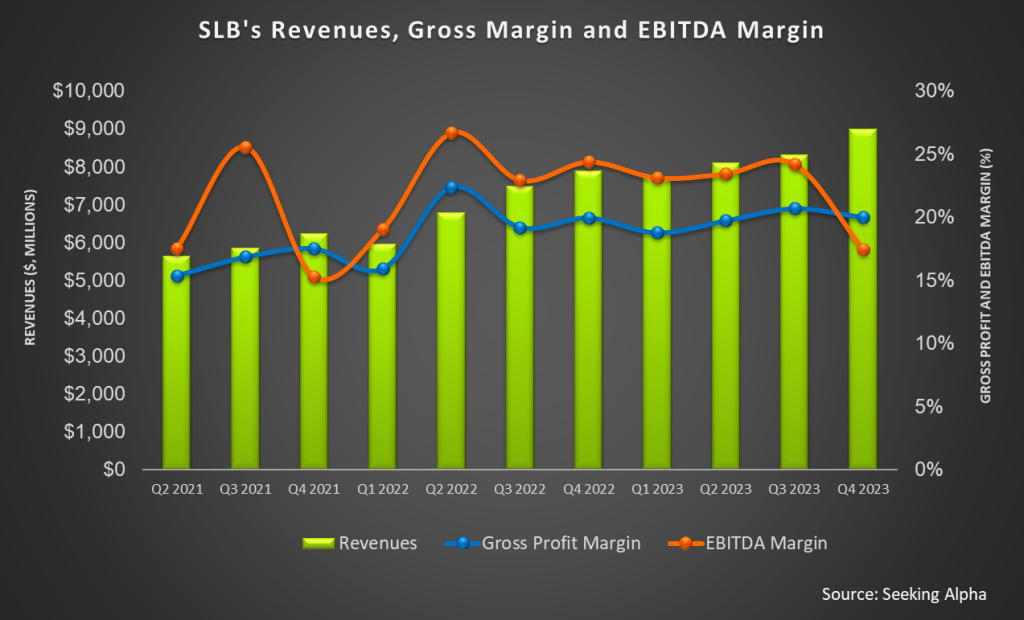

SLB’s Q4 Performance

In our short article, we discussed SLB’s revenue drivers for the operating divisions and key geographic regions. We see an acceleration of investment toward the international territories, mainly in the Middle East, Asia, Europe, and Africa. Many regions in these places have started benefiting from long-cycle developments, capacity expansions, and exploration appraisal activities. In its international operations, the company attained 20% revenue growth in 2023 compared to 2022.

Looking closely at the figures, we see that following robust offshore demand, new technology deployment, and strong product sales, the company’s Reservoir Performance and Well Construction divisions carved out 20% revenue growth and 300 basis point operating margin expansion in 2023. However, SLB’s Production Systems saw the most prolific operating income growth in Q4 (39% up) compared to Q3. Offshore, strong momentum continued in Brazil, Angola, the U.S., the Gulf of Mexico, Guyana, and Norway. It also expanded its business in Norway and Australia through the Aker subsea business acquisition.

Cash Flow & Balance Sheet

We discussed SLB’s cash flow rise in FY2023 versus a year ago. The primary factors for the growth were strong receivable cash collections, increased customer advances, and improved inventory turns. With nearly $4.7 billion in FCF generation, the company reduced its net debt by $1.4 billion in Q4. Debt-to-equity (0.56x) decreased, too. In FY2023, it will maintain capital discipline. But, to keep up with the expected revenue growth, the capex budget is set at the 2023 level ($1.9 billion).

SLB’s leverage is higher than its peers’ (HAL, BKR, and FTI) average. In 2023, SLB returned $2 billion to shareholders through dividends and stock repurchases. With a higher free cash flow generation, it expects to increase its returns to shareholders in 2024 by 25% to $2.5 billion.

Relative Valuation

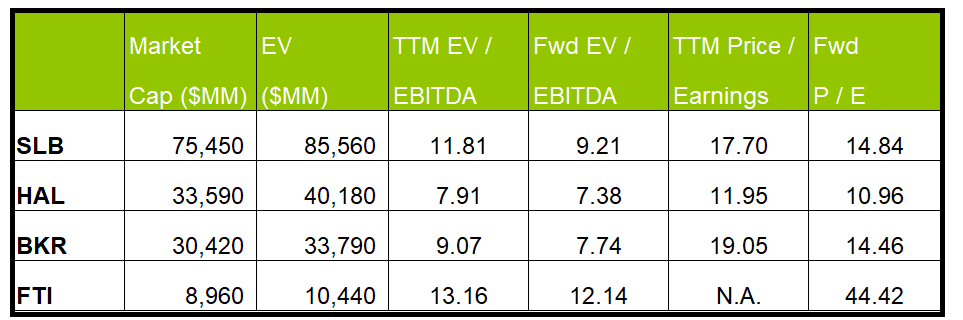

SLB is currently trading at an EV/EBITDA multiple of 11.8x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 9.2x. The current multiple is at par with its five-year average EV/EBITDA multiple.

SLB’s forward EV/EBITDA multiple contraction versus the adjusted current EV/EBITDA is steeper than its peers because the company’s EBITDA is expected to increase more steeply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is slightly higher than its peers’ (HAL, BKR, and FTI) average. So, the stock appears to be marginally undervalued versus its peers.

Final Commentary

SLB reaffirmed its industry outlook in the Q4 call with a slight change in its emphasis. From a “multiyear growth cycle” in its core business of oil & gas in Q3, it now prefers to call it a “multiyear investment cycle.” Middle East, offshore, and natural gas plays will likely consume the majority of new investments in 2024. Recently, there has been an acceleration of investment toward international territories, mainly in the Middle East and offshore projects. In Q4, the company received various projects in legacy operations and diversified more into clean tech and alternative energy sources. This paves the way for a balanced growth in the future. Its Production Systems division benefited the most from the current momentum in Q4.

However, geopolitical tensions and moderation in energy activity in North America can decelerate SLB’s growth in 2024. Nonetheless, its cash flows continue to improve, allowing for rapid debt reduction, which led to lower leverage at the end of 2023. A robust financial structure also allowed for a 10% dividend rise in Q4. The stock is marginally undervalued compared to its peers.