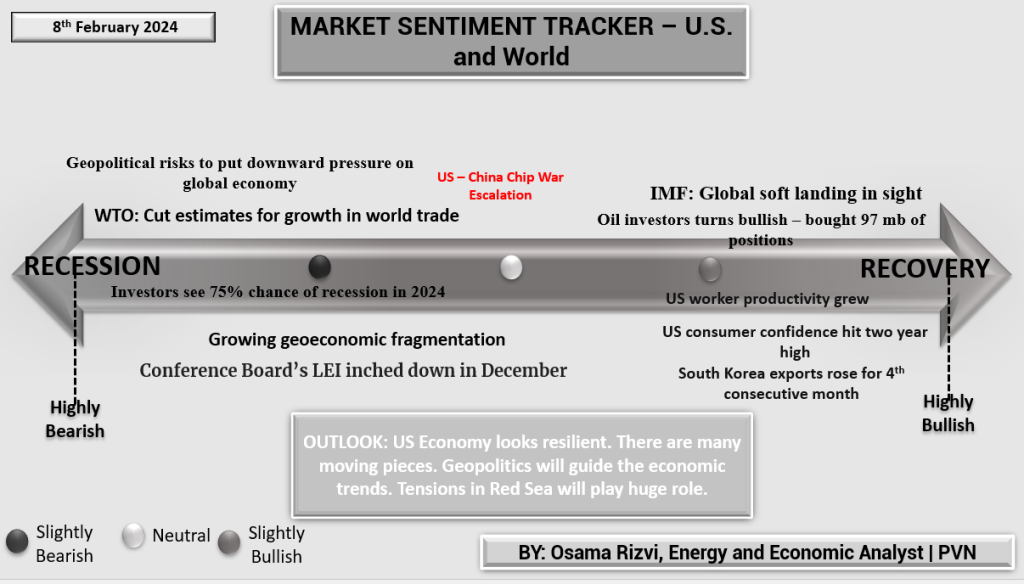

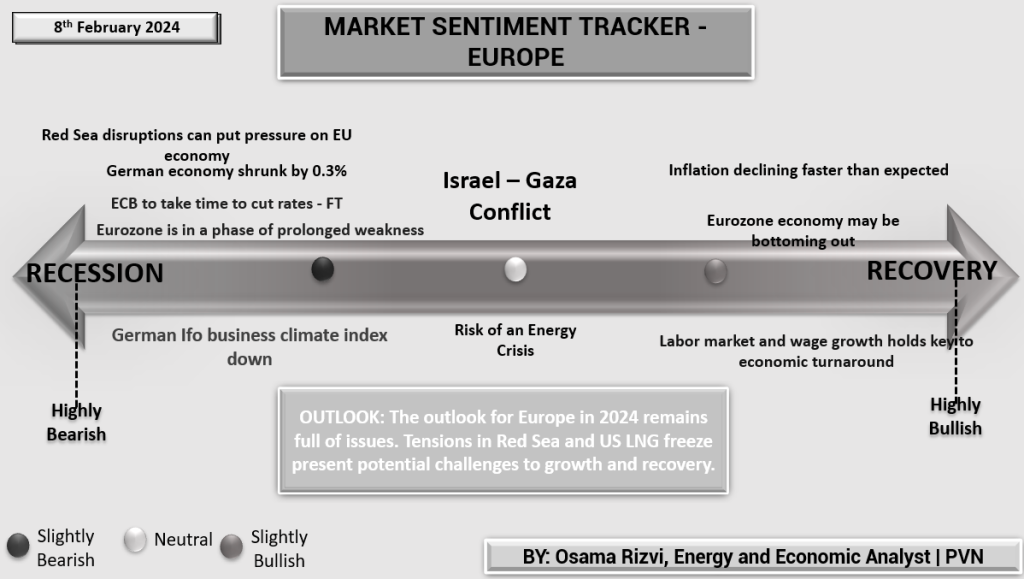

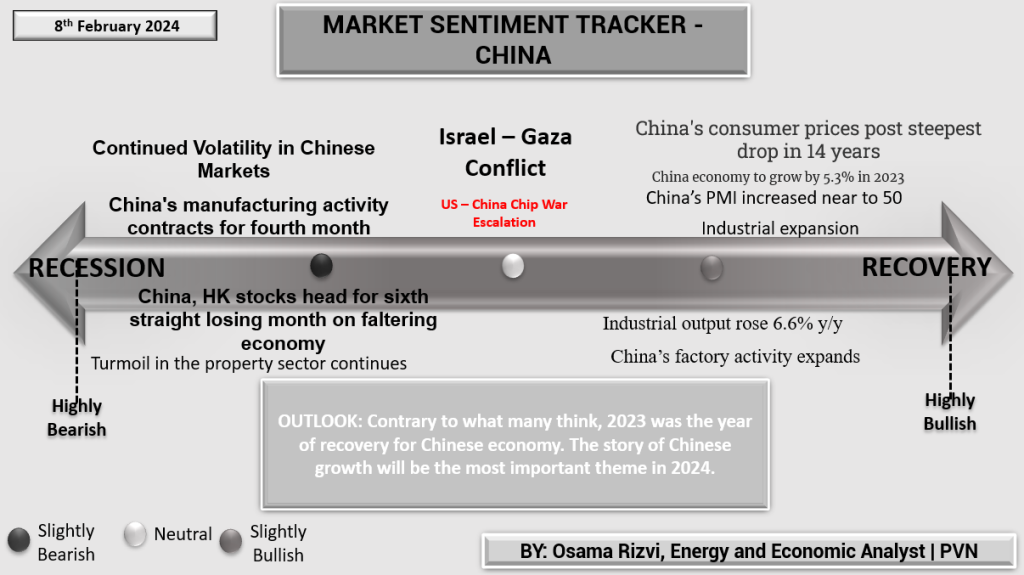

As we step into February 2024, let’s take a moment to check the economic heartbeat of the globe with our latest Market Sentiment Trackers. This week, we’re looking for changes and steadiness alike across major economies. In the United States, caution is the watchword despite some positive murmurs from investors. Europe’s still navigating a rough patch, with no quick fixes in sight. And in China, despite some ups and downs, there’s a hint of stability as the new year unfolds. Here’s how this week’s figures compare to last week’s, giving us a clearer picture of where the world might be heading economically.

United States and World: This week, the U.S. and global markets are somewhat steady with a continued 75% predicted chance of recession. The WTO’s downgraded estimates for global trade growth may raise concerns about international commerce’s momentum. A noteworthy positive shift is in oil investors turning bullish, contrasting with last week’s more cautious sentiment. The Conference Board’s LEI remained relatively flat, indicating that the U.S. economic forecast is consistent with last week’s outlook for a resilient yet uncertain future.

Europe: Europe’s economic narrative is consistent with the previous week, with the Eurozone still showing signs of protracted weakness. The German economy’s contraction points to a deepening recession risk, and ECB’s rate policy remains unchanged, indicating a sustained cautious approach. The Eurozone’s inflation continues to decline faster than expected, suggesting an easing of price pressures, aligning with last week’s trend of a potential bottoming out in the economic downturn.

China: China’s market continues to grapple with significant challenges. The manufacturing sector’s contraction is ongoing, reflecting continuous economic pressures similar to last week. The Chinese and Hong Kong stock markets are enduring a downward trend, which has been the case for several weeks now. Despite these challenges, the drop in consumer prices and steady industrial output growth point to a complex economic landscape that mirrors last week’s cautious optimism for gradual recovery.

Week-over-Week Insights: Across all regions, the week-over-week sentiment reflects a global economy that is on alert for both risks and opportunities. The U.S. market sentiment is cautiously optimistic with an eye on geopolitical risks. Europe remains in the throes of economic fragility, and China’s volatility indicates it’s still navigating through significant headwinds. Overall, the economic indicators suggest that while some stability has been observed, notably in the U.S., the potential for change is ever-present, and analysts remain vigilant.