Pressure Pumping Outlook

In our recent article, we have already discussed RPC’s (RES) Q4 2023 financial performance. Here is an outline of its outlook. At the end of Q4, RES’s management believes the hydraulic fracturing intensity can increase or the frac spread count can fall. So, the company plans to “keep all of those fleets appropriately staffed.” Since September, the US rig count has declined by 20%, but the US frac spread count has remained relatively resilient, falling by only 5%. Pressure pumping, which accounted for 47% of the company’s Q4 revenues, improved in Q4 compared to Q3.

Crude oil prices have been volatile but appear to head downwards in the near term. During Q1, the recent crude oil price fall can trigger a completion activity slowdown, especially during the winter drilling & completion activity pullout. So, RES’s pressure pumping activity was a bright spot in its performance, but the energy pricing pressure kept it under a leash. Nonetheless, the company’s pricing in this business improved in Q4 versus Q3.

Business And M&A Opportunities

Among RES’s service lines, it has a recognizable market share in downhole tools, cementing, and coiled tubing. It also believes that it can expand its market share in downhole tools. Larger customers dominate some end markets with a lot of activity, which can provide solid growth opportunities. So, RES will primarily focus on these activities in the near term.

With strong liquidity and expected cash flow generation, RES can look for further M&A opportunities in 2024, following up with its success in the Spinnaker acquisition. In July 2023, it acquired Spinnaker Oilwell Services, which expanded RPC’s cementing business from its presence in South Texas to other regions. The company offers its services to both large and small E&Ps, which gives it opportunities to increase the scale of operations.

Frac Fleets

Currently, RES operates ten horizontal frac spreads and two vertical spreads. It plans to apply “contingent cost actions,” which can translate into stacking the spreads if necessary. In 2024, the company can deploy a new Tier 4 DGB pressure pump, replacing a Tier 2 diesel pump. After the addition, it will have three Tier 4 DGB, two Tier 2 DGB, and three Tier 4 diesel pressure pumps.

This means eight of its ten horizontal fleets will be ESG-friendly. It is slowly upgrading its pressure pumping spread mix where the dual-fuel and lower-emission equipment have a higher share in a “disciplined approach.” However, it does not plan to foray into the electric pump solutions until the cost-effectiveness of introducing these pumps is meaningful to the management.

The Q4 Drivers

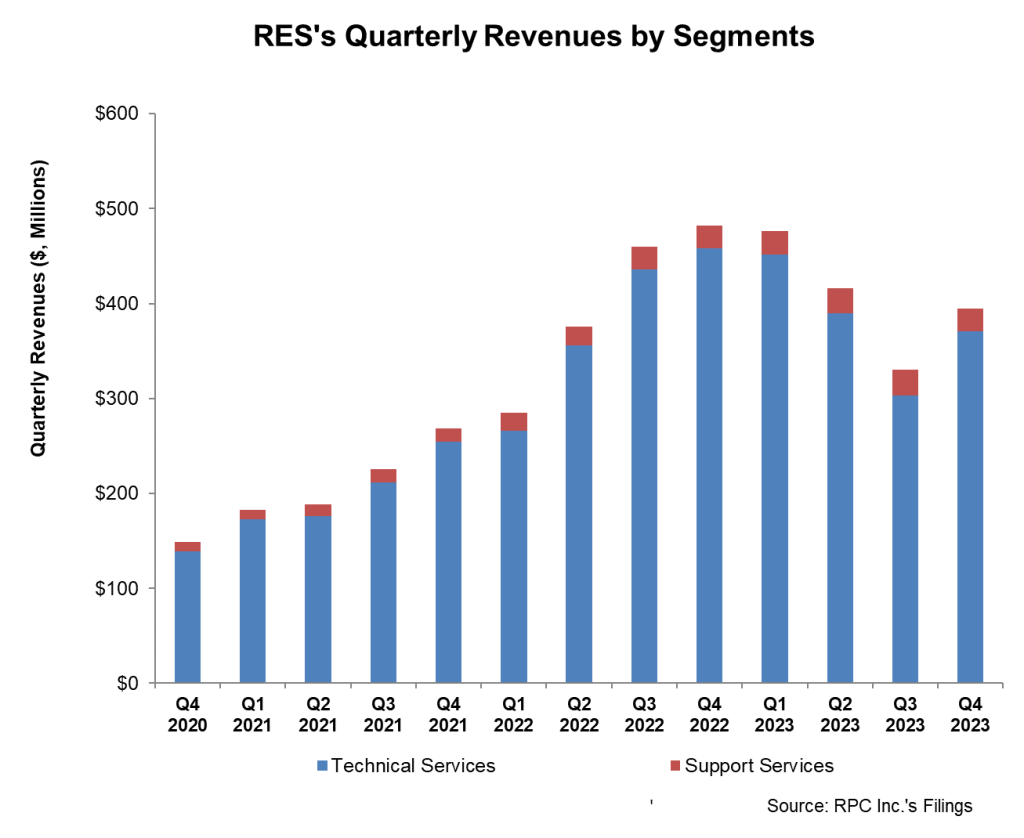

Quarter-over-quarter, RPC’s (RES) revenues increased by 19% in Q4 due primarily to higher pressure pumping revenues, recovering from the 20% fall in the previous quarter. Overall, the company’s cost of revenues (as a percentage of revenues) increased. SG&A expenses were down by $4 million in Q4 from Q3 due to various discretionary cost controls and lower incentive compensation.

Cash Flows And Liquidity

As of September 30, 2023, RES had no debt and positive cash & cash equivalents balance ($223 million). To guard against any liquidity strain, the company can tap from its robust liquidity (revolving credit facility plus cash & equivalents). The company’s cash flow from operations nearly doubled in FY2023 compared to a year ago, due primarily to lower working capital requirements.

RES’s capex increased by 30% in FY2023. However, the completion of some projects was delayed into early 2024. In FY2024, it expects capex in the range of $200 million to $250 million, which would be a 24% increase compared to FY2023. Much of the capex would go into delivering a new Tier 4 DGB fleet, expected to be in service in Q2 2024.

Relative Valuation

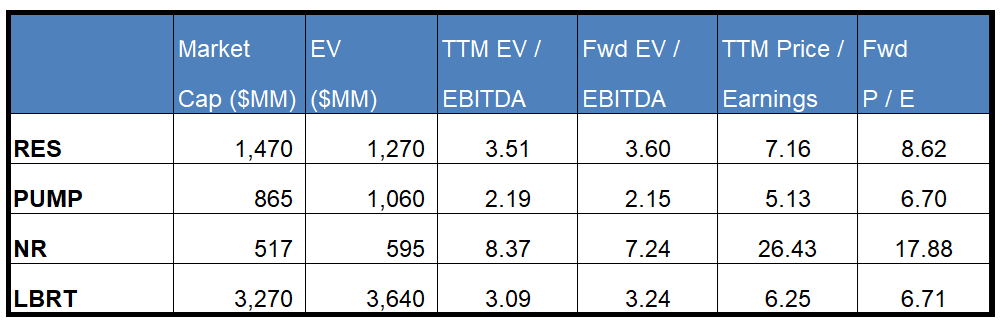

RES is currently trading at an EV/EBITDA multiple of 3.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.6x. The current multiple is significantly lower than its five-year average EV/EBITDA multiple of 29x.

RES’s forward EV/EBITDA multiple is expected to expand versus its current EV/EBITDA. In contrast the multiple is expected to contract marginally for its peers. This implies the company’s EBITDA is expected to decrease as opposed to a rise in EBITDA for its peers in the next four quarters. This typically results in a much lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (PUMP, NR, and LBRT) average. The stock appears to be slightly overvalued versus its peers.

Final Commentary

RES’s management appears pragmatic in its outlook as it weighs the imminent slowdown during the winter and the ongoing energy price downtrend. It does not expect to add to its frac fleet count in the foreseeable future. On the bright side, the company’s pumping business performed well in Q4. The company plans to improve the quality and efficiency by introducing Tier IV DGB pumps and replacing the legacy pumps. So, the company’s pricing and utilization can improve in the medium term.

On top of that, solid cash flow generation and robust liquidity will continue to provide it with opportunities to grow through the inorganic route. The company focuses on downhole tools, cementing, and coiled tubing business for future growth. A robust balance sheet with no debt will allow it to remain relatively financial risk-free. The stock appears to be slightly overvalued compared to its peers.