Industry Outlook

We discussed our initial thoughts about NOV’s (NOV) Q3 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

After Q4, NOV’s management remained “constructive in our global outlook” due to increased activity in global offshore and international markets. The offshore exploration market saw a resurgence in several countries like Namibia, Suriname, Norway, West Africa, the Gulf of Mexico, Brazil, Guyana, and Australia. Following higher demand for floating rigs, dayrates doubled for the high-spec floaters, according to NOV’s estimates. Utilization, too, improved. Some headwinds, however, are expected from Saudi Arabia’s postponements of plans to grow production capacity. Nonetheless, the country will continue to drill to offset declines in conventional oil wells, providing NOV with sufficient opportunity to increase revenues in that region.

On the other hand, North America will likely remain muted due to the volatility in energy prices and the continued capital discipline from the operators. The bar imposed on the US LNG export facility can threaten the anticipated growth in natural gas supply in the medium term.

Completion And Frac’ing Outlook

On the completion side, NOV’s Completion & Production Solutions segment saw a 6% revenue rise in Q4, although operating profit declined by 6% from Q3 due to a fall in deliveries of pressure-pumping equipment. Strong capital equipment sales and an improvement in project backlog caused the increase. Improved activities in international and offshore markets resulted in 28% higher orders in Q4 compared to Q3. The segment book-to-bill was 1.32x as of December 31. The backlog at year-end was $1.82 billion, up 12% sequentially.

During Q4, the company booked a replacement DGB frac spread in the US. It is currently in discussions with customers for additional DGB and e-frac spreads. However, in Q1, its revenues from the completions business can decline marginally from Q4 as revenues marginalize after the year-end sales boost in Q4.

Q1 and FY2024 Outlook

In Q1, NOV’s Completion & Production Solutions and Rig Technologies segments will likely face headwinds due to seasonality, supply chain normalization, and energy operators’ cautious outlook for North America. So, its revenues can decline in these segments. The Wellbore Technologies segment can see even deeper revenue cuts because the orders for high-spec drill pipe and MPD capital equipment may not repeat in Q1.

In FY2024, NOV’s revenues from North America can decrease by “low- to mid-single-digit” percentage points, while its revenues from international markets can grow by “low double-digits.” As a result, its aggregate revenues can increase by 4% to 8% in FY2024 over FY2023. Due to improving quality of backlog and cost-reduction programs, its EBITDA margin can also improve.

Technology Adoption And Benefits

During Q4, NOV made gains in cloud data delivery and the new high-frequency data services. In December, NOV’s high-speed data streaming was widely utilized by an NOC in over 100 rigs. During 2023, its users for remote monitoring tools for completion operations increased by 70% compared to a year ago. It has introduced new frac monitoring capabilities through the Max Edge platform. Over the past year, Max Edge product revenue more than tripled in Q4 2023. Customers increasingly used its wired drill pipe and high-speed data delivery system in the North Sea.

The consistent investments in new products and technologies helped NOV grow revenues by 90% over the past three years until Q4. The Max Edge compute solutions, AI-powered optimization software, and other advanced drilling tools can see demand rising quickly. As revenues and operating profits rise by adopting new technologies, NOV can focus on optimizing shareholders’ capital. To that effect, it can divest a couple of its businesses in the coming quarters and redeploy capital into growing operations, e.g., electrical submersible pumps. Recently, it acquired Extract, a provider of artificial lift technologies and services. Extract’s focus on maximizing the run-time of electric submersible pumps can improve the economic returns of their assets.

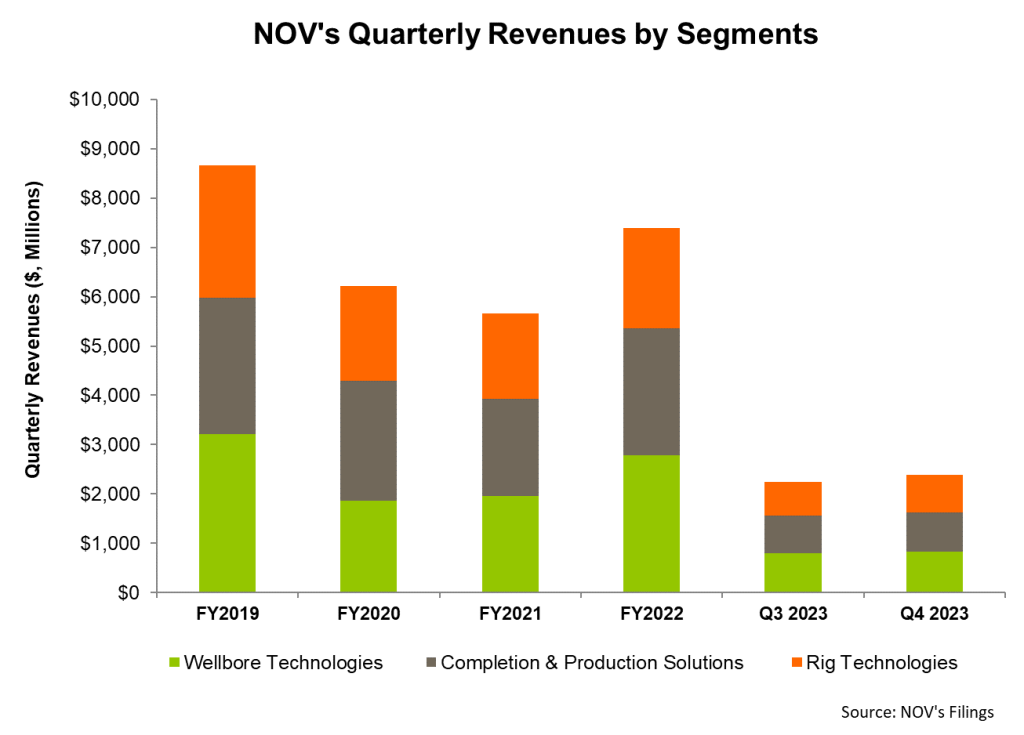

Revenues And Backlogs

In Q4, NOV’s new orders from Downhole Tools increased sharply from Q3 because these related primarily to offshore and Western Hemisphere customers with high activity growth. However, there will be a lag of a few quarters before the back converts to revenues. So, lower volumes and a less favorable sales mix can result in a sharp revenue decline from its Grant Prideco business. In the Rig Technologies segment, backlog increased marginally in Q4 2023 compared to a year ago to $2.87 billion. The strong fundamentals in the offshore and international industry will continue supporting improved aftermarket operations results. By Q4, revenues doubled compared to two years ago.

Overall, NOV’s revenues for North America onshore declined by 5% in Q4. In comparison, offshore revenue grew by 7%, while international land revenues grew by more than 20% sequentially. So, sales of drill, composite, stimulation, and drilling equipment in the Middle East increased substantially. Read more about this in our short article here.

Capex And Leverage

NOV’s cash flow from operations turned significantly positive in FY2023 compared to a negative CFO a year ago. Although FCF remained negative, it improved. NOV prioritizes organic investment opportunities. It plans to accelerate the introduction of new products. The company expects to increase capex by 17% in 2024 to approximately $330 million.

In 2024, the company expects to generate FCF above 50% of EBITDA, which would significantly improve compared to a negative FCF generated in FY2023. This also reflects the company’s anticipated turnaround in its operating profit in 2024. Its debt-to-equity (0.28x) exceeds its competitors (CHX, FTI, and WHD) but declined (i.e., improved) compared to a quarter ago. It also had robust liquidity ($2.8 billion) as of December 31, 2023.

Relative Valuation

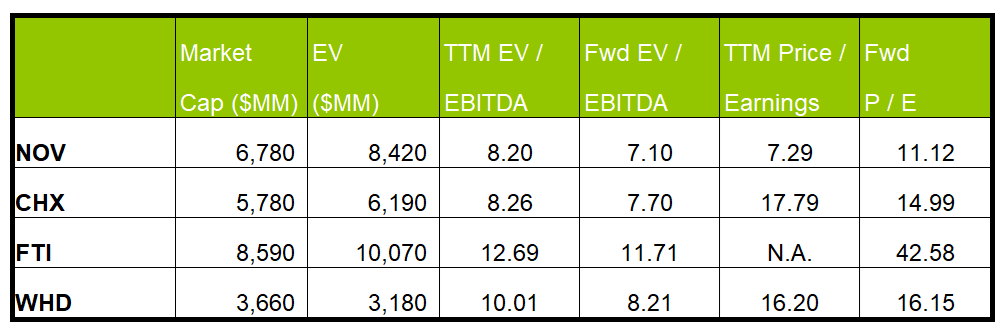

NOV is currently trading at an EV/EBITDA multiple of 8.2x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 7.1x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 30.8x.

NOV’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is marginally steeper than its peers because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (CHX, FTI, and WHD) average. So, the stock is undervalued versus its peers.

Final Commentary

NOV is “constructive” in its outlook” due to increased activity in global offshore and international markets. Despite the volatility in energy prices and the continued capital discipline, higher demand for floating rigs and a resurgence of the international offshore exploration market led to higher revenues in Q4. NOV’s backlog was up 12% sequentially, which indicates a healthy order environment and revenue visibility.

However, the seasonality, supply chain normalization, and energy operators’ cautious outlook IN North America can hinder its growth in Q1. The company’s medium-term outlook is stable as it recently booked a replacement DGB frac spread and is discussing additional DGB and e-frac spreads with customers. Its cash flows can improve substantially in FY2024. Its leverage is low, and the company has robust liquidity. The stock appears undervalued versus its peers.