As February wanes, an examination of the global market sentiment reveals a confusing picture of regional economic narratives each with distinct pressures and prospects.

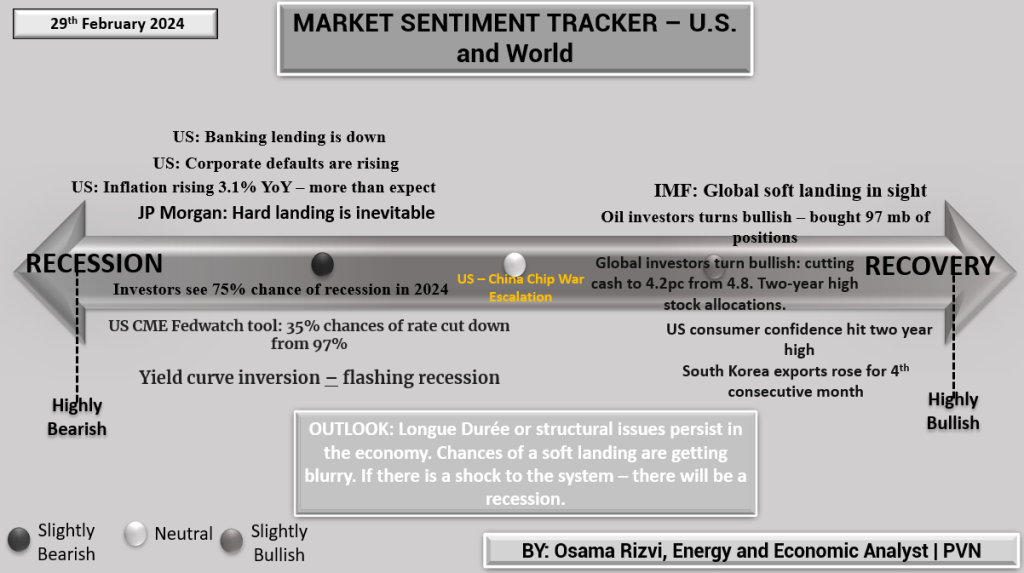

United States and Global Outlook: The US market sentiment is tinged with caution. A potential recession looms with a 75% chance forecasted by investors, while the yield curve inversion, a reliable recession predictor, flashes warning signals. The inflation rate continues to outpace expectations, rising 3.1% year-over-year, emphasizing the cost pressures facing consumers and businesses alike. Corporate defaults are trending upwards, and banking lending has shown a decline, further muddying the economic waters. Nevertheless, global investors are trimming cash holdings and moving back into stocks, a bullish sign indicating a possible recovery horizon. The IMF’s outlook for a global soft landing offers a glimmer of hope amidst the turmoil.

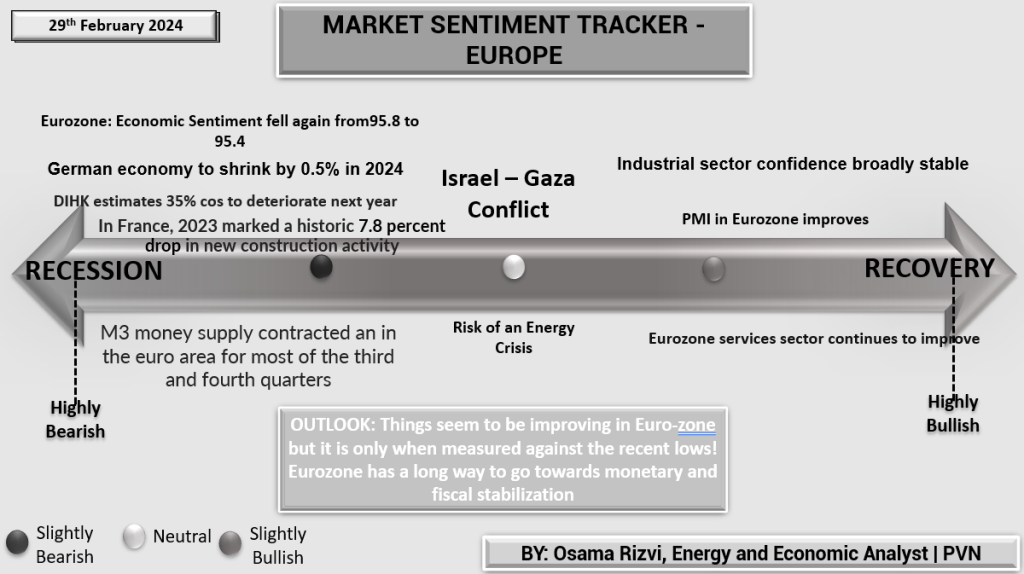

Europe’s Economic Climate: Europe persists in its battle against economic headwinds. The Eurozone’s Economic Sentiment has dipped slightly, and the German economy, Europe’s industrial powerhouse, is projected to contract by 0.5% in 2024. The Monetary supply M3 has contracted, hinting at a tightening in liquidity. However, there’s a silver lining with the industrial sector confidence holding steady and the PMI displaying marginal improvement. Services sector resilience offers a beacon for potential stabilization, suggesting that while the path to recovery may be long and arduous, it is forging ahead.

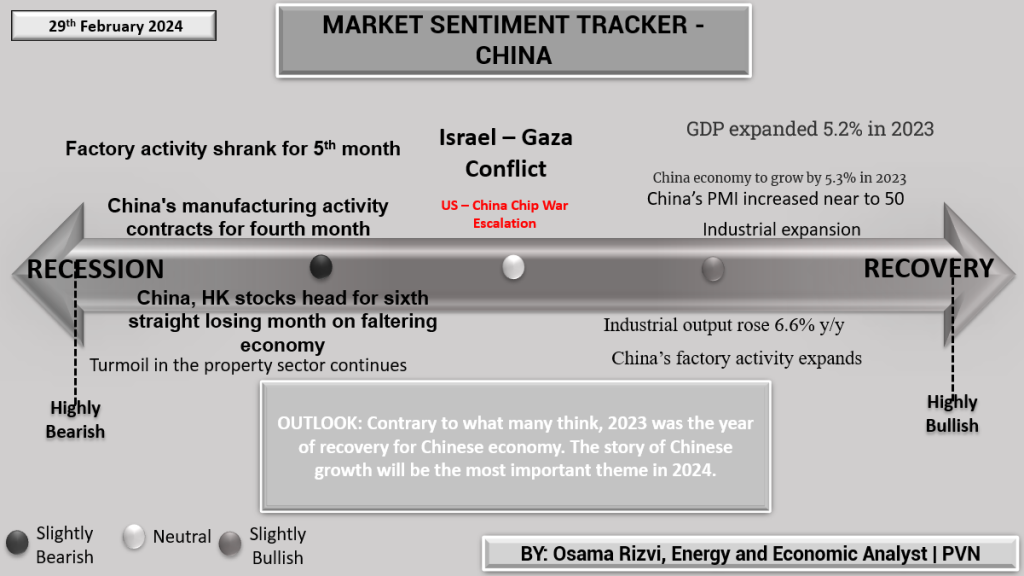

China’s Path to Recovery: China’s economic rebound is slow yet ostensibly steadfast. Factory activity continues to contract, indicating a prolonged industrial slowdown, while stock market struggles reflect investor reticence. However, the GDP growth rate remains robust at 5.2% in the previous year, with industrial output and factory activity showing signs of expansion. These figures may signify that the worst could be over for China, with cautious optimism for 2024 as the overarching theme.

This week’s sentiment trackers juxtaposed with the previous week’s data suggest a global economy at an inflection point. The US grapples with inflation and recession risks, Europe steadies itself for a gradual recovery, and China aims to balance growth amidst ongoing reforms.

The collective outlook remains guardedly optimistic, as signs of recovery intermingle with risks of contraction, painting a complex picture of the global economic landscape for the months ahead.