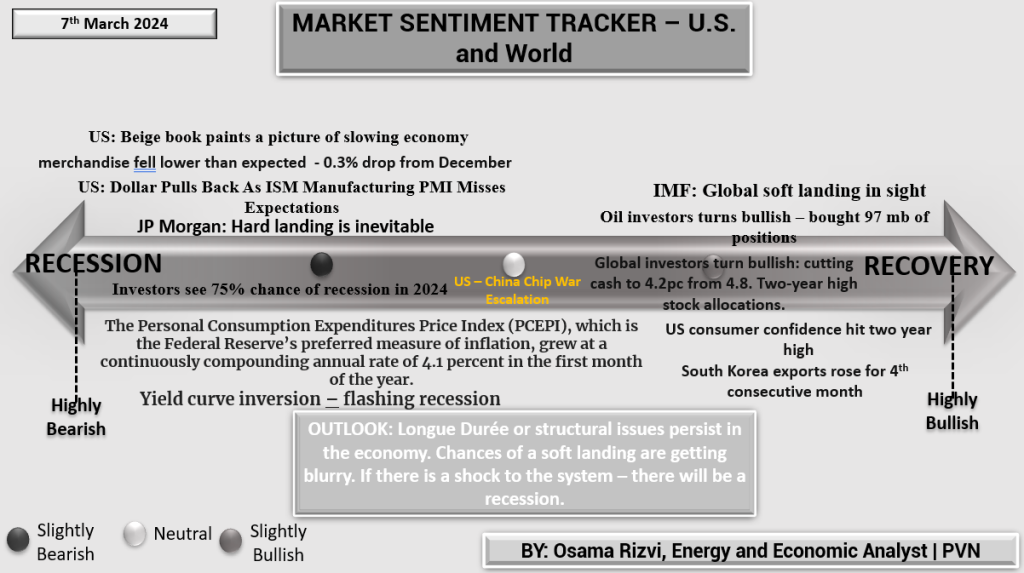

U.S. and World: The U.S. market shows mixed signals. With investor sentiment leaning towards a significant risk of recession, there are clear concerns about economic stability. The yield curve inversion, often seen as a predictor of a recession, adds to these worries. However, on the recovery side, there’s resilience shown in consumer confidence and export growth, indicating potential underlying strength.

Europe: Europe’s economic indicators suggest a persistent cautiousness. A contraction in the money supply (M3) and a decline in the German economy highlight the region’s challenges. Nonetheless, there are signs of a possible turnaround, with PMI numbers improving and the services sector gaining momentum. It indicates that while the economy may be struggling now, the foundations for future growth are being laid.

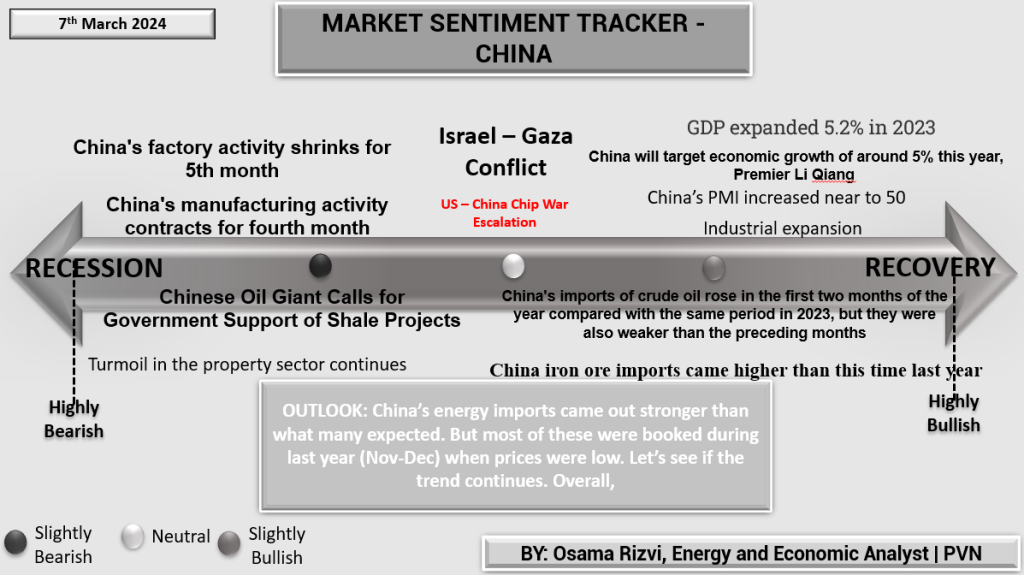

China: In China, prolonged manufacturing contraction and stock market declines point to economic cooling. Yet, China’s significant GDP growth and expanding industrial output suggest an economy adapting to long-term challenges, aiming for balanced growth. The increased PMI nearing the expansion threshold signals potential stabilization ahead.