Analyzing the latest Market Sentiment Trackers, we see a multifaceted picture of the global economy.

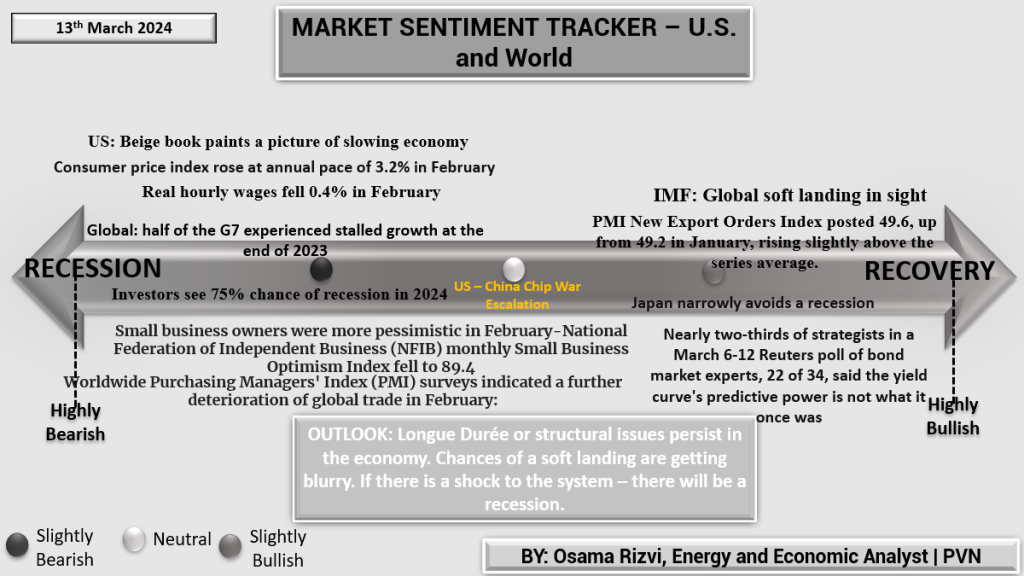

U.S. Outlook

The U.S. is navigating through economic slowdown signals, with a slight uptick in inflation to 3.2% and modest wage growth, which could pressure household spending. The Federal Reserve’s inflation gauge, the PCEPI, has risen, signifying inflationary trends. Yet, recovery signs are visible with global investor bullishness and steady consumer confidence, suggesting resilience in market sentiment despite a cautious outlook on interest rate cuts.

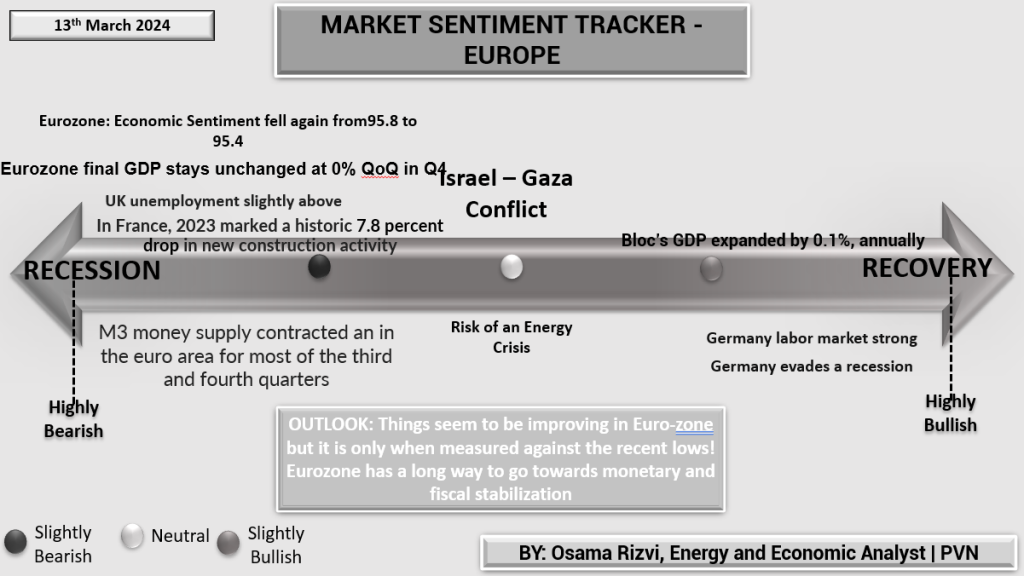

Europe’s Economic Pulse

In Europe, the economic sentiment has dipped slightly, indicating a cautious business environment. Despite this, there’s no change in the quarterly GDP, and Germany shows some economic strength with a minimal GDP increase, suggesting the possibility of dodging a recession. The job market in Germany remains robust, which can drive economic stability in the region.

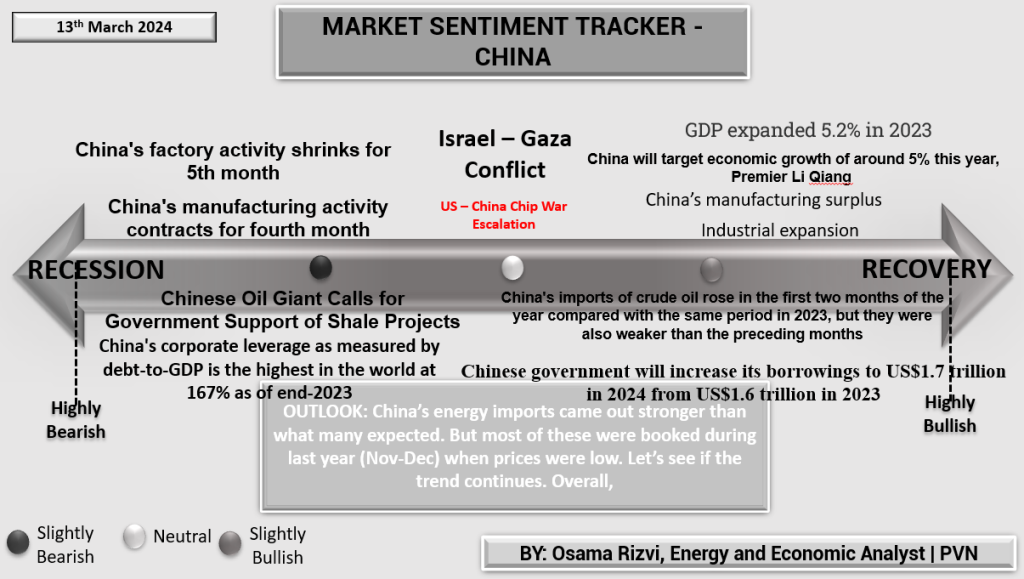

China’s Path

China’s economy is on a gradual path to recovery with its GDP growing by 5.2% in 2023, despite the manufacturing sector’s contraction for several months. Government support for energy projects and an increase in iron ore imports indicate investment and activity in industrial sectors. China’s PMI nearing the 50 threshold reflects stabilization in manufacturing, offering a cautiously optimistic outlook.

In summary, the global economy is showing mixed signals, with the U.S. displaying robust market sentiment against potential monetary tightening, Europe maintaining stability despite subdued sentiment, and China slowly recovering with strategic governmental interventions. This composite analysis underscores a global economy that is still on a recovery path, with each region showing varied degrees of resilience and caution.