In this week’s Monday Macro View we get a little nerdy and explore David Rosenberg’s 7 reasons why we might still be heading towards a recession and then we reconcile it with S&P’s Credit Cycle Indicators. What emerges is a future that is facing serious headwinds but also some promise towards stability (at the end). Let’s start with Rosenberg’s 7 reasons!

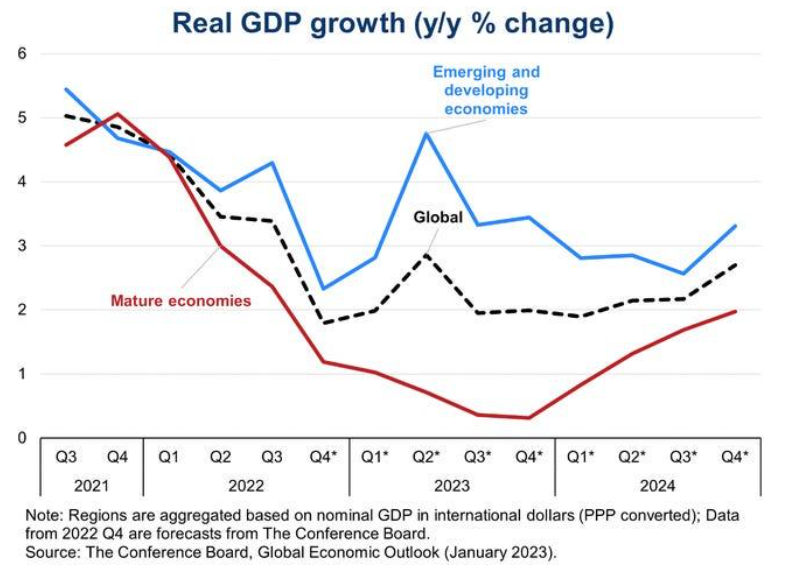

Misleading GDP Growth Amid Global Trade Slowdown

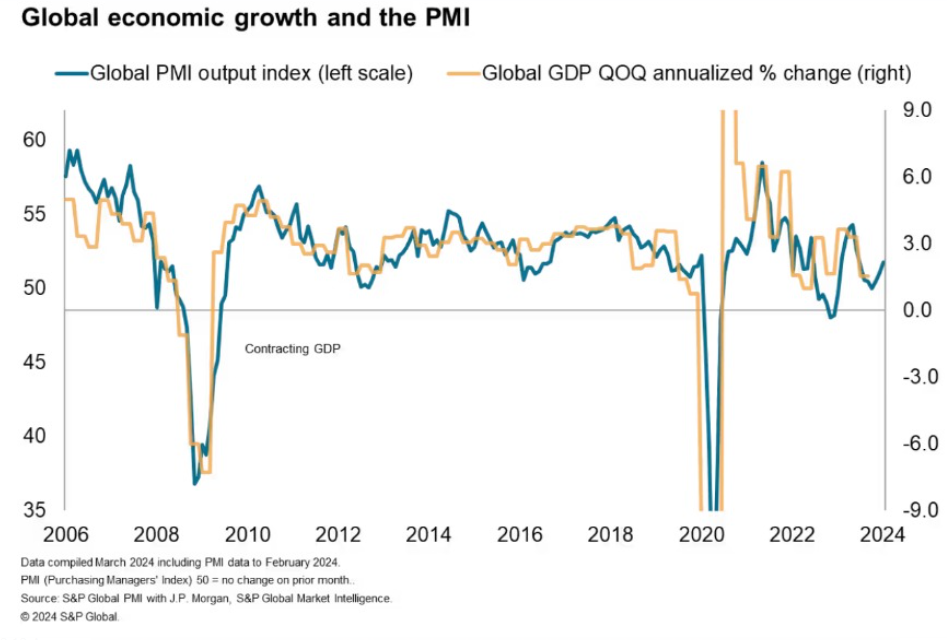

Rosenberg critiques the seemingly robust U.S. GDP growth of 3.2% in the last quarter, juxtaposed with personal income growth that barely nudges at 0.2% to 0.3% year-over-year, not keeping pace with a population growth estimated at 0.5%. This scenario of stagnant per capita income growth is reflective of broader economic challenges, mirrored globally by the PMI New Export Orders Index which, while improving slightly to 49.6 from 49.2, remains below the growth threshold for two consecutive years, signaling a protracted global trade slowdown.

Fiscal Stimulus and Its Artificial Influence on Growth

The U.S. economy’s reliance on fiscal stimulus is evident in the fiscal deficit’s expansion by 23% last year, from $1.38 trillion to $1.7 trillion. Rosenberg underscores this unsustainable growth vector, analogous to global economic conditions where stimulus measures have temporarily buoyed markets. The juxtaposition with the global credit outlook, suggesting a potential credit recovery in 2025, underscores the temporary nature of stimulus-driven growth.

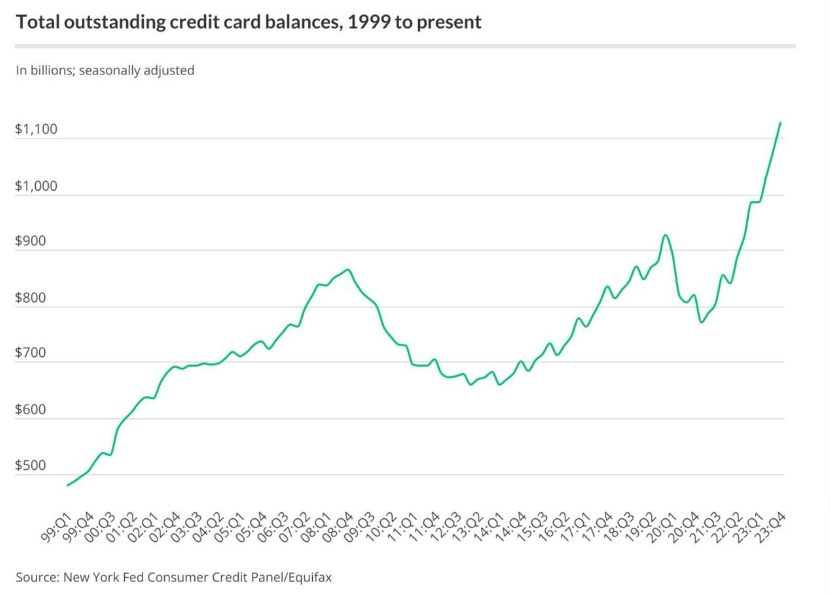

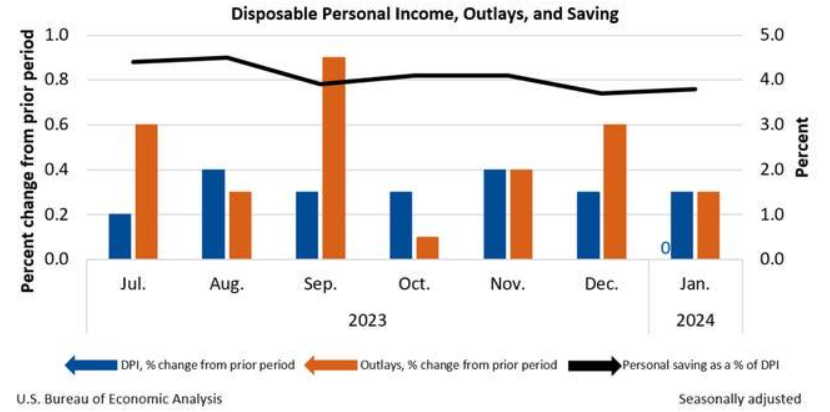

The Household Debt Conundrum

In the U.S., the alarming rise in household debt, with credit card balances hitting record highs, is a stark indicator of consumer vulnerability. This is echoed in the global credit perspective, where, despite signs of a potential credit recovery by 2025, high borrowing costs and selective lending practices remain prevalent, increasing the risk of nonperforming loans and defaults. Such financial strains are universally observed, impacting economies at varying degrees of severity.

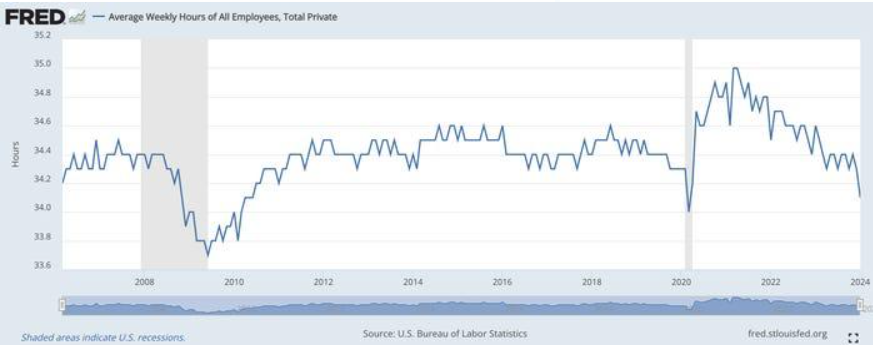

The Decline in Work Hours: A Labor Market Warning

Rosenberg’s observation that U.S. work hours have reduced to an average of 34.1 hours per week—a near one-hour drop over two years—signals a subtle yet significant labor market stress. This reduction in labor engagement reflects broader economic undercurrents that are also evident in global markets, where labor productivity and employment stability have become pressing concerns amid economic slowdowns.

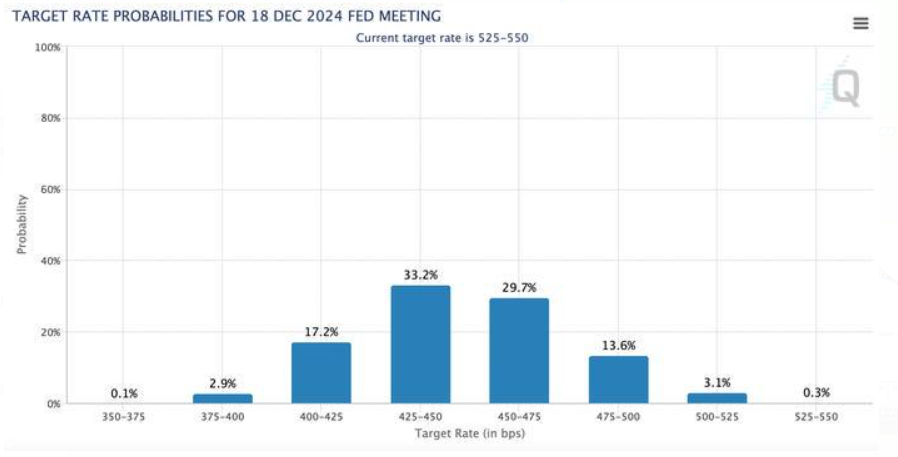

The Fed’s Policy Lag and Its Global Counterparts

The Federal Reserve’s interest rate hikes have yet to fully manifest their impact, with Rosenberg hinting at more profound future repercussions. This anticipation aligns with global economic sentiments where central banks’ policy adjustments are expected to unfold their effects gradually. The S&P 500’s 11.3% return contrasted with the S&P 500 Low Volatility Index’s 5.3% rise during a period of low volatility underlines the market’s delayed reaction to policy shifts.

Persistently High Interest Rates: A Universal Challenge

The persistence of high interest rates, a concern raised by Rosenberg, is a global economic hurdle. With the Fed unlikely to lower rates soon, economies worldwide grapple with similar challenges. High interest rates stifle growth by increasing the cost of borrowing, a condition that is reflective of the broader global financing climate where high rates and selective lending have become commonplace.

Sparse Growth Catalysts in a Fractured Global Economy

Rosenberg’s search for growth catalysts in an economy where major regions like Europe, Canada, Japan, and China face recessions or slowdowns is particularly poignant. The lack of compelling drivers for economic acceleration in the U.S. mirrors a global scarcity of growth catalysts, with many economies struggling to find sustainable paths to recovery amidst a landscape of contracting global trade and cautious credit markets.

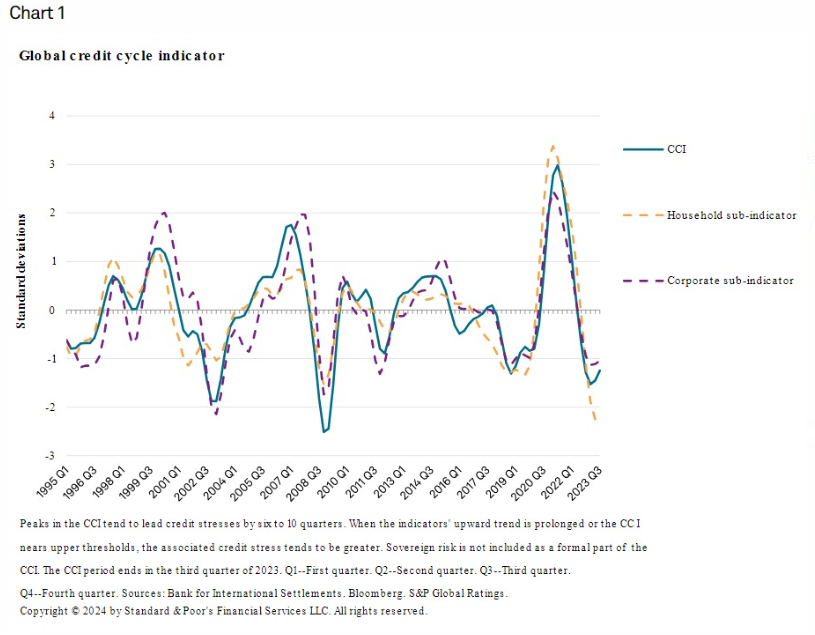

The Credit Cycle Indicators (CCI) analysis provides a data-driven glimpse into the evolving landscape of global credit markets, underpinning expectations of a nuanced recovery trajectory toward 2025. Here’s a breakdown emphasizing the numerical insights

Global Trade and PMI Data

The PMI New Export Orders Index slightly improved to 49.6 from 49.2, signaling a moderation in global trade contraction over a two-year period. This marginal increase, while below the growth benchmark, indicates a nuanced recovery in international trade dynamics.

S&P 500 Performance: Between the previous rebalance on November 17, 2023, and the most recent on February 16, 2024, the S&P 500 showcased an impressive return of 11.3%. In contrast, the S&P 500 Low Volatility Index posted a gain of 5.3%, reflecting its historical trend of underperformance during periods of low volatility for the broader market. This period recorded an annualized daily standard deviation for the S&P 500 at a mere 10.1%.

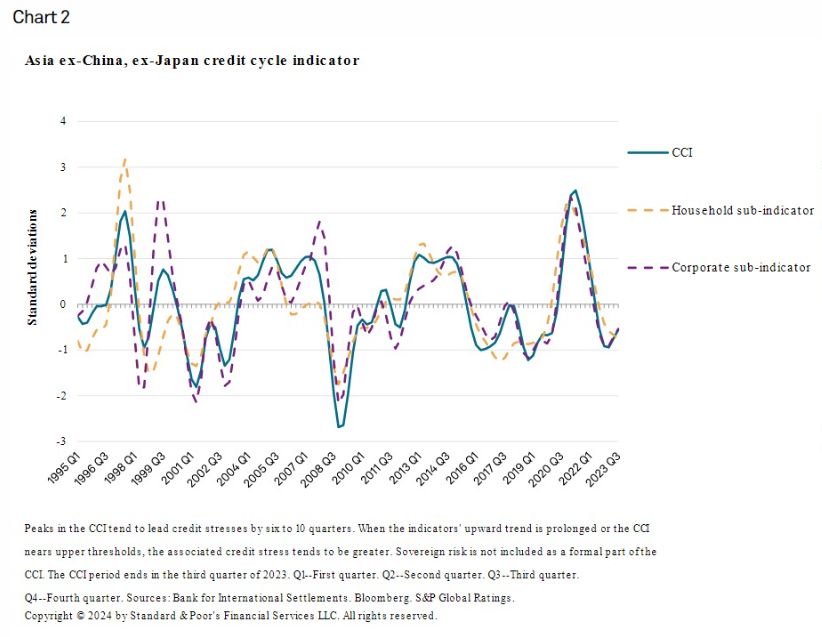

The anticipation of a credit recovery by 2025 is partly based on the moderation of the decline in private sector debt-to-GDP ratios. This trend began to stabilize in early 2021, illustrating a gradual shift in credit dynamics amidst changing market sentiments and policy landscapes. Asia-Pacific, particularly outside China and Japan, exhibits signs of an upcoming credit recovery, with the CCI suggesting positive momentum into 2025. This outlook is bolstered by growth forecasts for India and Southeast Asia, despite the overarching challenges posed by rate hikes and potential economic decelerations.

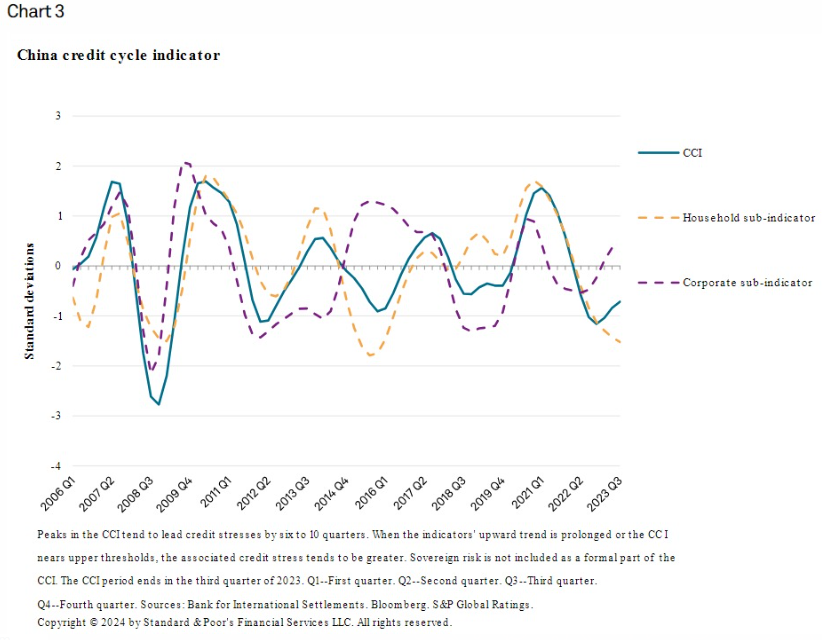

China: The corporate sub-indicator for China indicates a rebound in corporate indebtedness, despite the nation grappling with a debt-to-GDP ratio peaking at 167% by the end of 2023. Government borrowing in China is expected to increase to US$1.7 trillion in 2024, up from US$1.6 trillion in 2023, highlighting significant fiscal measures aimed at supporting economic recovery.

Japan: Exhibiting a contrasting trend, Japan’s CCI suggests a delayed recovery, with a cautious monetary policy approach impacting corporate debt dynamics and consumer spending abilities.

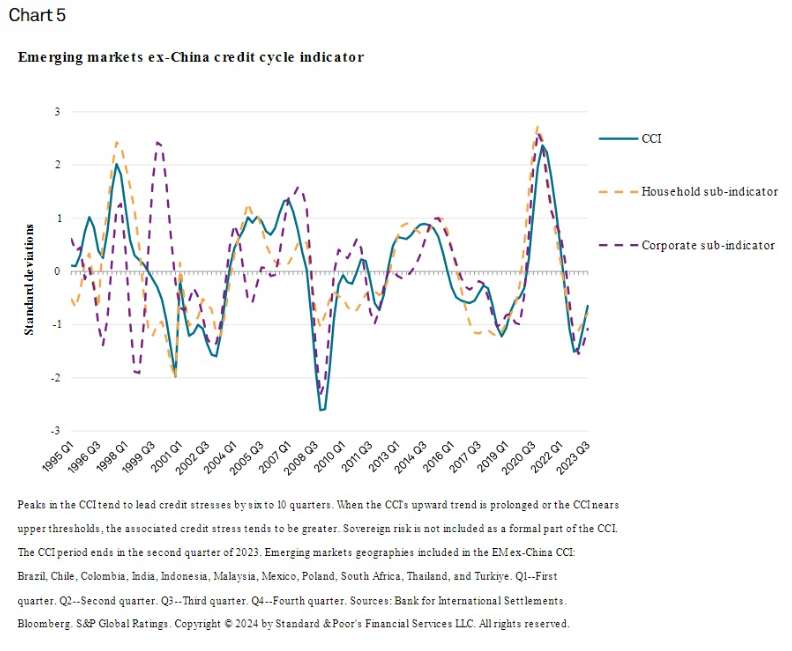

Emerging Markets: Emerging markets show potential for credit recovery, driven by resilient economic growth and falling inflation rates. The indicators suggest a recovery could materialize in 2025, following a trough in the CCI at -1.5 standard deviations in the fourth quarter of 2022. This improvement follows a peak of 2.3 standard deviations in the first quarter of 2021, illustrating the cycle of credit stress and subsequent easing across these economies.

So, while Rosenberg has his reasons for an impending recession – and I agree with them – we still cannot ignore the fact that CCI are now improving after touching their troughs! It is a race between factors that keep getting worse and those which are gradually getting better. I still believe that even an objective analysis of the global economy tells us that it is too early to be optimistic about a “no recession” scenario.