Industry Outlook

We discussed our initial thoughts about Nine Energy Service’s (NINE) Q4 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

Typically, NINE’s larger energy customers mostly deal in crude oil, while its relatively small customers control natural gas-centric activities. Although both have been entrenched in their respective industries, the past six months have seen volatile shifts. The depression in natural gas prices and relative stability in crude oil prices might have caused such rapid transitions. The steep fall in natural gas prices might have caused natural gas producers to slow down.

However, some operators have been resilient, and instead of cutting down operations, they have focused on returning cash to those investors. Overall, we will likely see natural gas production fall by the end of Q3 2024, adversely affecting NINE’s performance revenues.

NINE’s Outlook

In FY2024, the two prominent trends in upstream energy will be flat capex guidance and industry consolidations through M&As. The environment can lead to drilling and completion service growth, so the company’s long-term outlook remains positive. However, depleting Tier 1 acreages in North American onshore means production growth would be challenging, leading to further production-efficient tools and equipment opportunities.

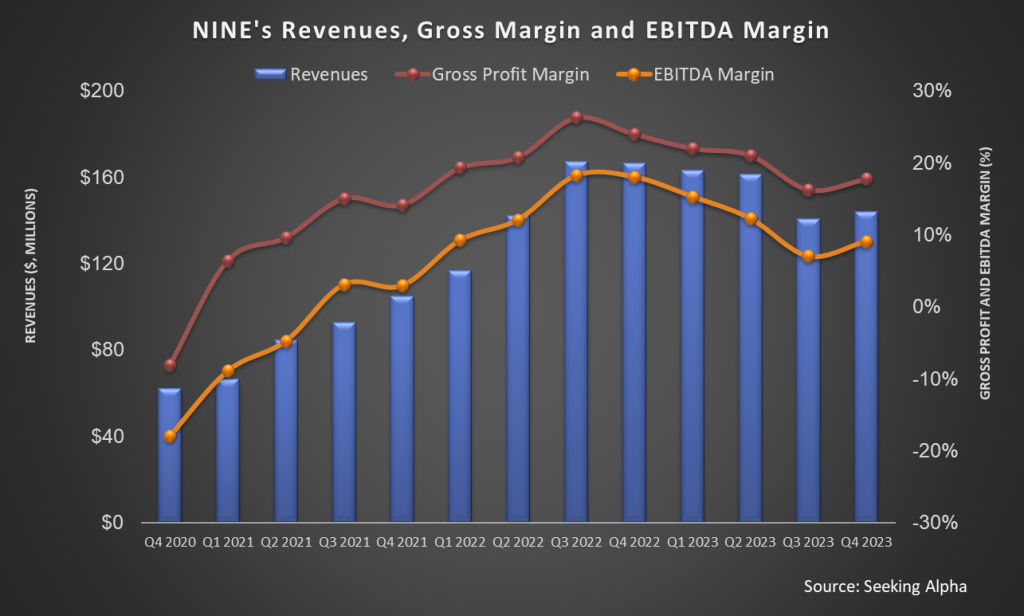

In Q1, NINE’s operating performance would remain nearly unchanged as the rig count stabilizes. So, pricing and activity levels should remain flat. It is estimated to generate revenues between $135 million and $145 million in Q1, which would be 3% lower than Q4 2023. In the long term, planned LNG projects will spring growth.

How Does NINE Achieve Growth?

NINE is one of the leaders in dissolvable plugs in the US and is now looking to replicate it in international markets. Its sales of multi-cycle barrier valves increased by 16% in FY2023. Due to the valve’s robust sales in the Middle East, it can increase its market share and customer base in 2024. In Q3, as we discussed in our previous article, its newly introduced Pincer hybrid frac plug required 47% less material than the Scorpion fully composite frac plug that it previously used. The pincer plug offers lower drill-out times and significantly reduces bit wear. So, more plugs can be drilled on a single trip. The number of dissolvable Stinger units sold increased by 18% in 2023 over 2022.

Although the company’s cementing revenue was down by 2% in FY2023, its average revenue per job increased by 10% year-over-year. NINE has significant exposure in the natural gas-heavy Haynesville Basin, where activity has slowed down. Despite that, its revenues from coiled tubing and wirelines in that region increased by 3% and 9%, respectively. You can read more about its performance in our short article.

Cash Flows And Liquidity

NINE’s cash flow from operations increased by 1.7x, which led to its free cash flow turning significantly positive in FY2023. Increased accounts receivable from higher product and service sales increased cash flow. Due to negative shareholders’ equity and a reasonably high net debt ($293 million), the stock is financially risky. Its liquidity (cash and cash equivalents plus availability under the revolving credit facility) was $59 million as of December 31, 2023. In 2024, it has paid down $5 million of debt.

Relative Valuation

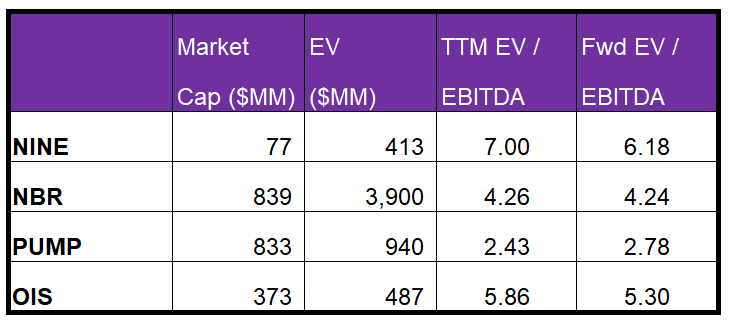

NINE is currently trading at an EV/EBITDA multiple of 7.0x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 6.2x.

NINE’s forward EV/EBITDA multiple compared to the current EV/EBITDA is expected to contract more steeply than its peers. This implies that its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is higher than its peers’ (NBR, PUMP, and OIS) average. So, the stock is reasonably valued versus its peers.

Final Commentary

Nine’s Pincer hybrids dissolvable plugs, replacing the Scorpion fully composite frac plugs, witnessed a sales rise in 2023. It will likely gain market share in 2024 due to increased penetration in international markets, particularly in the Middle East. Its performance has defied the general depression in natural gas prices, adversely affecting activities in the natural gas-heavy basins. In this scenario, higher sales of NINE’s coiled tubing and wireline in the Haynesville Basin in 2023 were noteworthy. However, the company’s management anticipates that natural gas production will keep falling until Q3 2024.

Despite that, the demand for production-efficient tools and equipment will rise as operators consolidate and pricing and activity remain flat. NINE’s cash flows improved significantly in FY2023. However, the stock is financially risky due to negative shareholders’ equity. The stock is reasonably valued versus its peers.