Frac Spread Strategies And Outlook

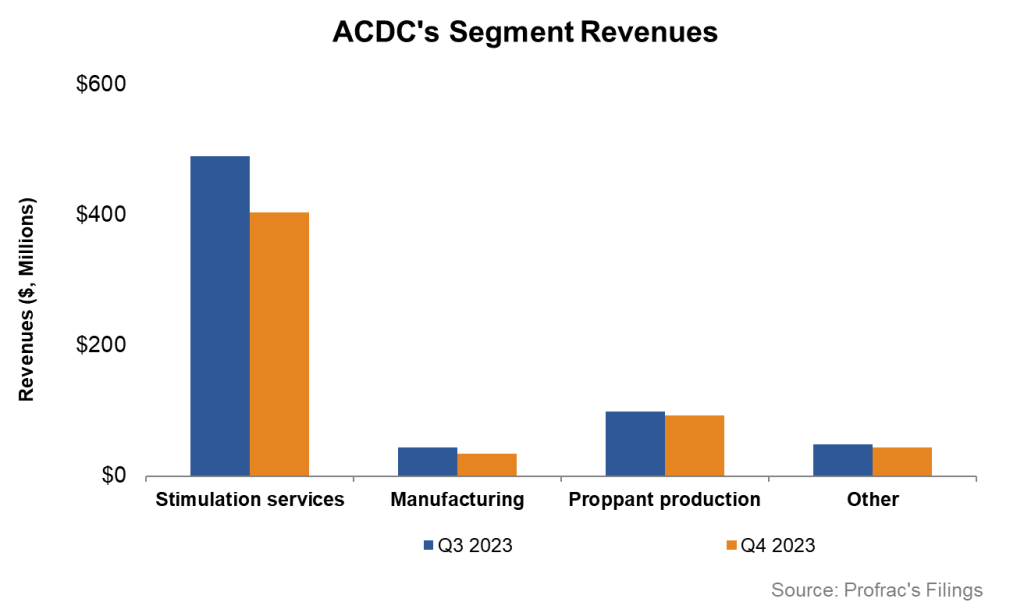

Our short article discussed our initial thoughts about ProFrac Holding’s (ACDC) Q4 2023 performance a couple of weeks ago. This article will dive deeper into the industry and its current outlook. In a rehashed strategic framework, ACDC focuses on improving efficiency instead of looking at the total fleet count, fleets deployed, and utilization of manufacturing facilities and sand mines. Although the company has 45 frac spreads, ACDC’s fracking operations deteriorated through 2023. But it backed up again when it activated ten frac spreads. Currently, we estimate that it operates ~35 active frac spreads.

As discussed in our previous article, ACDC reduced its fleet count in Q3 to accommodate increased utilization but did not appear to remedy the situation fully. Also, pumping hours per active fleet dropped in Q4. In 2024, the company plans to improve utilization by ~30%. By February, its pumping efficiency was 20% higher than the Q2 and Q3 average. As the demand for fracking flattened in Q4, the company’s utilization dropped even more sharply as it kept pricing tight. The company now realizes the strategy has underperformed and plans to rectify it in 2024.

Currently, ACDC is preparing for frac spreads to be reactivated in 2024. Its focus is on signing dedicated agreements with operators at favorable prices. It targets to deploy 80% of its fleet on a dedicated basis. Due to higher utilization and the company’s optimal cost structure, the current pricing levels are construed as “constructive.” It also plans to target the larger multi-basin operators who are present in natural gas-heavy basins.

Proppant Sand Plans

ACDC sees increased demand for a percentage of demand contracts, which is helpful for long-lasting partnerships with its customers. As the customers expand their completion activity, such contracts become more useful for ACDC. However, these contracts are not as profitable as the take-or-pay contracts.

In the proppant business, winter and low natural gas prices will adversely impact ACDC’s Q1 results. In January and February, ProFrac lost 300,000 to 400,000 tons of sales. The company plans to increase production into the warmer months. Utilization can improve modestly in Q1 but may reach 65% to 75% in Q2. Through higher throughput, higher utilization, and lower cost, the company intends to become a leader in the frac sand market in 2024.

M&A And Refinancing Strategies

in 2023, ACDC grew its asset base and improved its capital structure as part of its strategy. The higher asset base resulted from the acquisitions of REV Energy Holdings, Performance Profits, filing Form S-1 for its subsidiary Alpine Silica, and refinancing its secured term loan. Rev added frac fleets and expanded its geographic footprint in the Rockies and Bakken. Performance Profits strengthened its vertical integration strategy.

Following the acquisition, ProFrac became one of North America’s largest providers of in-basin sand. The debt will mature in 2029 following the refinancing. This recapitalization will help ProFrac realize the full value potential of the profit segment and enhance the company’s financial flexibility.

Cash Flows And Debt

ACDC’s cash flow from operations increased by 33% in FY2023 compared to a year ago. As capex decreased, its FCF increased even more significantly, by 3.8x, in the past year. The cash flow improvement reflects lower receivables and inventory. In FY2024, the company plans to incur $175 million in capex (at the guidance mid-point), which would be 34% lower than a year ago. On top of that, its inventory can decrease in 2024, which means its cash flows can increase in FY2024.

Of the $1.1 billion of debt, the majority will mature after 2029, which means its financial risks are low in the near term. As of December 31, 2023, ACDC’s leverage (debt-to-equity) was 0.83x. It had $103 million in liquidity as of that date.

Relative Valuation

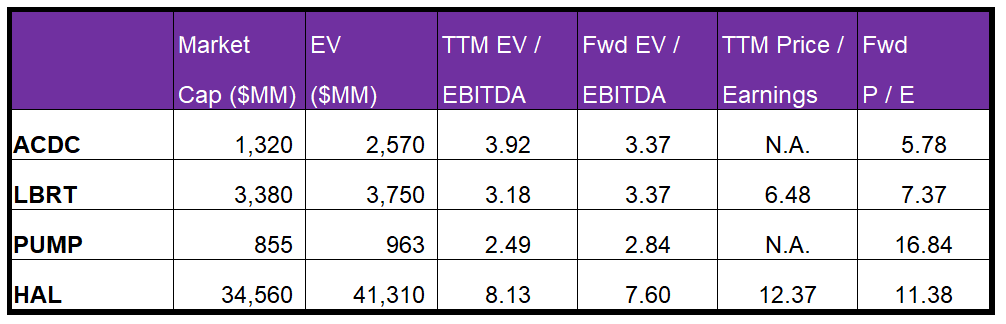

ACDC is currently trading at an EV/EBITDA multiple of 3.9x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.4x.

ACDC’s forward EV/EBITDA multiple is expected to contract versus the current EV/EBITDA, while the multiple is expected to remain unchanged for its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (LBRT, PUMP, and HAL) average. So, the stock is relatively undervalued versus its peers.

Final Commentary

ACDC activated ten frac spreads in Q4 after operating a much smaller frac spread count in Q3. Its pumping hours per active fleet also dropped in Q4. Lower demand and the company’s relatively rigid pricing policy led to such deterioration.

Currently, it looks to sign dedicated agreements with operators at favorable prices. By February, its pumping efficiency had improved, and it aims to improve utilization rapidly in 2024. The proppant business plans to increase production and utilization through Q3 2024. In 2023, ACDC acquired several companies and restructured its debt. This recapitalization will help it realize its full value potential in the coming months. With higher cash flows and lower capex, it can lower its leverage ratio, which was quite high at the end of 2023. The stock is relatively undervalued versus its peers.