In our exploration of the oil and gas sector this week, we navigate through the intricate weave of market dynamics, environmental imperatives, and geopolitical strategies that are shaping the present and future of global energy. Our focus pivots on analyzing recent trends, backed by robust data, to understand the evolving landscape of this crucial sector.

Surge in Market Optimism: The Catalysts Behind the Recent Buying Spree

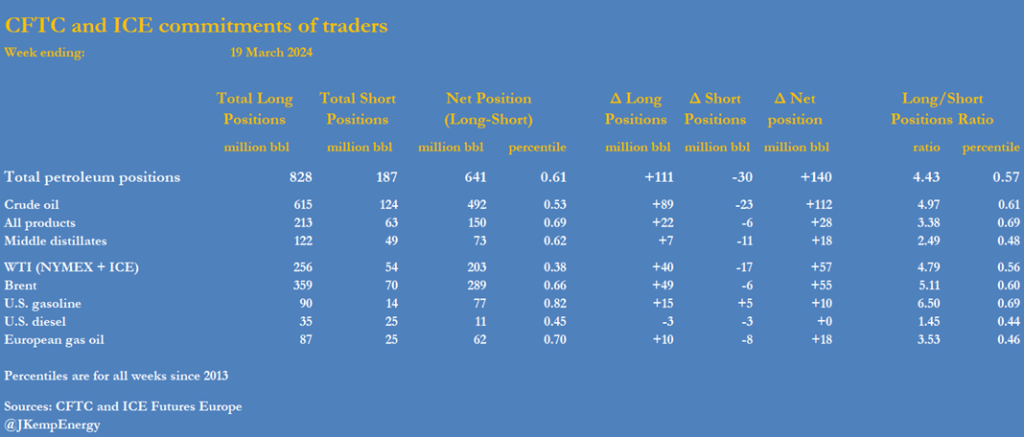

Beginning with the latest sentiment in the oil market, a significant uptick in hedge fund buying has been recorded, marking the most accelerated pace since December 2019. This bullish trend, as evidenced by the purchase of 140 million barrels in key futures and options contracts over a single week ending March 19, is propelled by two main factors: the anticipation of continued production restraint by OPEC+ and an optimistic outlook on global oil consumption buoyed by economic recovery signals. The strategic strikes on Russian oil infrastructures by Ukraine have further bolstered market optimism, pointing towards a tighter supply and heightened prices. It’s noteworthy that the investor bullishness is predominantly driven by the establishment of 111 million barrels in new long positions, indicating a strong faith in the petroleum sector’s resilience and growth potential.

Climate Concerns and the Paradox of New Oil and Gas Projects

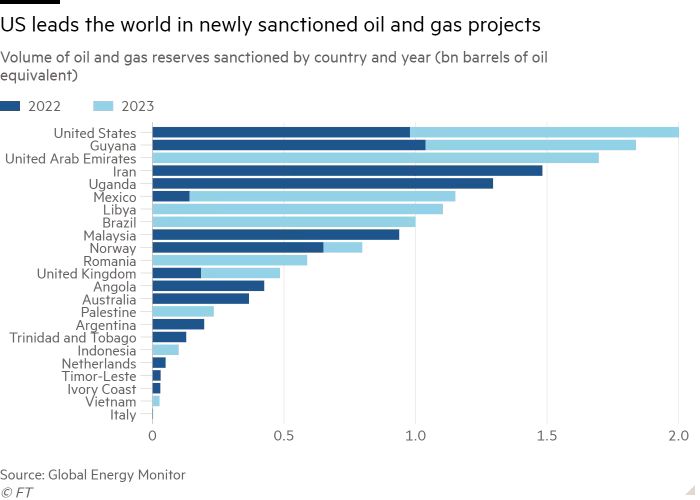

Transitioning to the environmental dialogue, the sector faces critical scrutiny under the lens of climate change and sustainability goals. Despite clear warnings from the IEA regarding the incompatibility of new oil and gas projects with the 1.5°C global warming limit, projections suggest an ambitious fourfold increase in such ventures by the end of the decade. This expansion, particularly with the approval of significant reserves in regions like the US, Guyana, and the UAE, underscores a glaring contradiction between the industry’s growth aspirations and the urgent climate mitigation needs. The persistence of hydrocarbon exploration and development, as illustrated by the sanctioning of 20 new fields with 8 billion barrels of oil equivalent in reserves last year, raises pressing questions about aligning global energy policies with the Paris Agreement objectives.

Strategic Considerations in the Global Oil Market for 2024

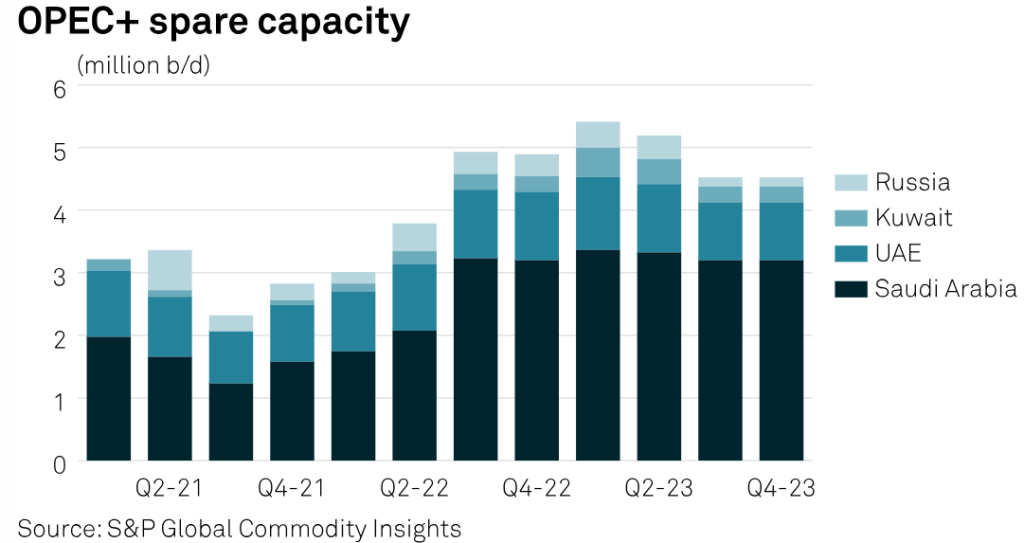

Delving deeper into the strategic undercurrents for 2024, the oil market is at a critical juncture. The OPEC+ bloc is wrestling with the dual challenges of safeguarding its market share while striving to meet pricing targets, amidst a backdrop of fluctuating supply commitments and geopolitical tensions.

Meanwhile, North American oil production, spearheaded by the US and Canada, is set to continue its ascendancy, contributing significantly to meeting the global liquid fuel demand growth, expected to account for nearly 90% of the increment in 2024.

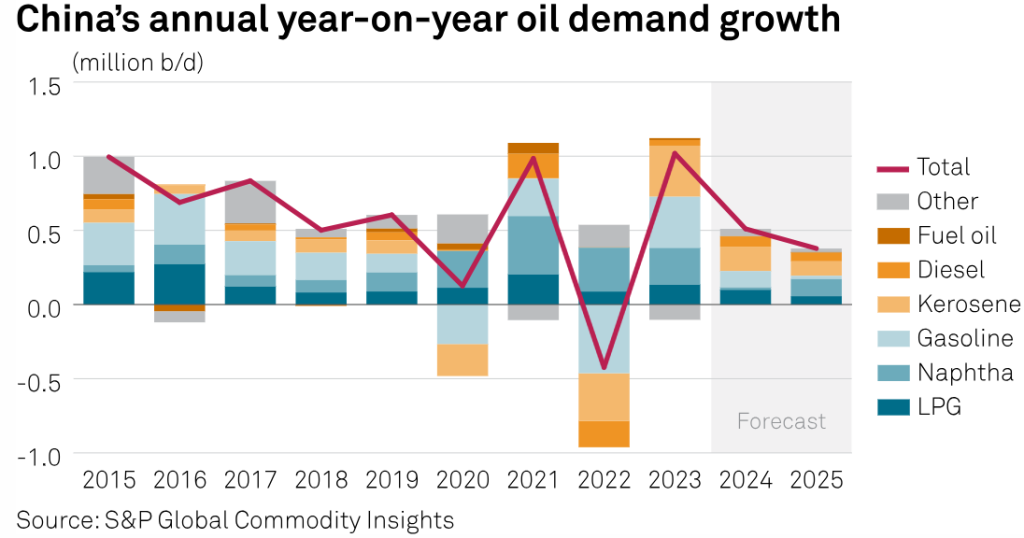

In contrast, China’s oil demand trajectory signals a slowdown, with projections indicating a reduction in growth from 1.02 million barrels per day (b/d) in 2023 to 490,000 b/d in 2024, reflecting broader economic shifts towards a service-oriented economy and increased electric vehicle adoption. This anticipated deceleration in demand juxtaposes the rapid expansion in EV market share in China, a trend that is gradually gaining momentum in Europe and the US, potentially reshaping the global energy consumption patterns.