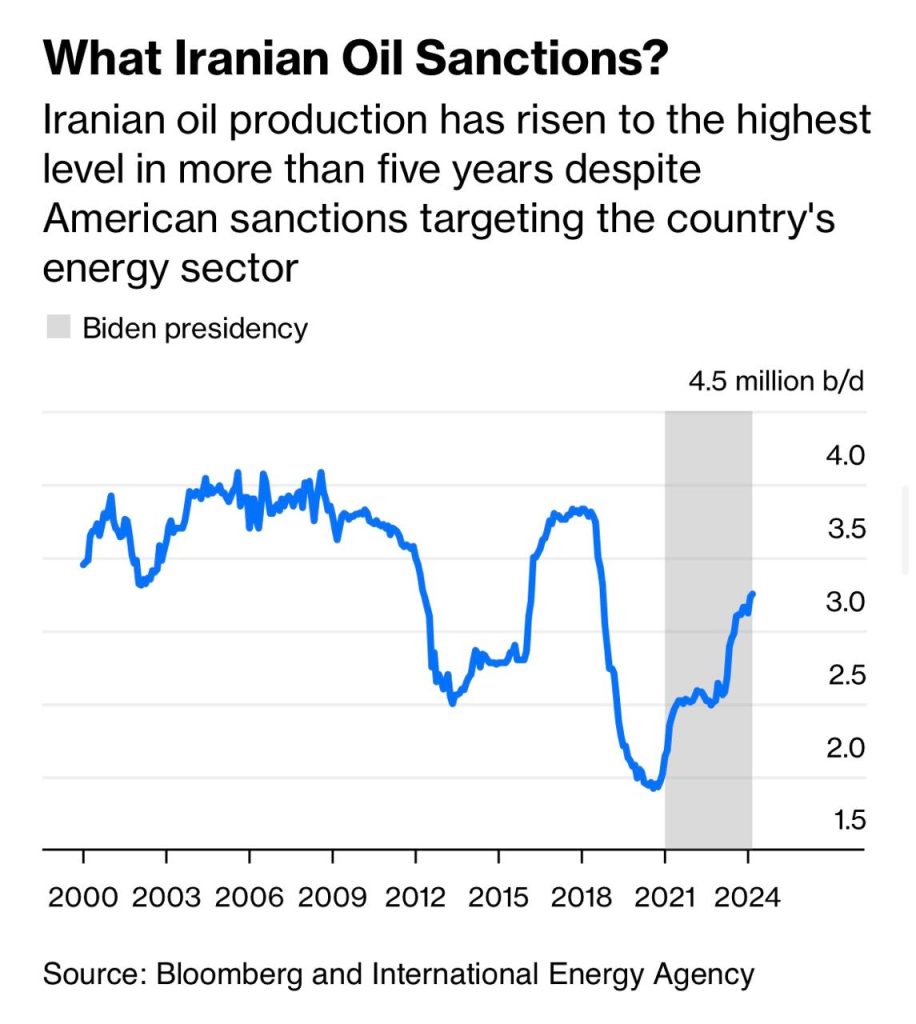

As the dust settles on the recent escalation between Israel and Iran, the world watches anxiously, not just for the geopolitical fallout but also for the ripple effects across the global oil markets. Sunday was replete with estimates of what will be the impact of this latest development on global oil markets be. However, many anticipated that we might see a sell-off as the prices already had a geopolitical risk premium included in them. The same was highlighted by Mark Rossano in his latest insights which are worth reading – as always. It is important to note that despite sanctions, Iran’s oil production remains robust and so does the global oil supply dynamics therefore the muted reaction.

According to the International Energy Agency (IEA), Iran’s oil production reached 3.25 million barrels per day in March 2024, the highest in over five years, despite the international sanctions targeting its energy sector.

The conflict escalated significantly when Iran launched a calculated attack against Israel, using approximately 170 drones and 30 cruise missiles, along with 120 ballistic missiles, in response to Israeli strikes on Iranian positions in Syria. This massive deployment aimed to overwhelm Israel’s missile defense systems, testing their limits.

Despite the scale of this military engagement, the global oil markets reacted with surprising restraint. Brent crude only dipped slightly to $90.22 a barrel immediately following the conflict, according to Bloomberg data. This reaction underscores the market’s resilience, built on strategic reserves and robust global supply chains that help buffer immediate shocks. OPEC+, owing to their voluntary production cuts, have a 5 million barrels per day of cover that can come online whenever there is a need to.

Moreover, the Strait of Hormuz, a critical gateway for about 20% of the world’s oil supply, remains unaffected by the hostilities. The continued open passage through this strategic chokepoint is vital for maintaining the stability of global oil prices. Any disruption here could lead to significant global economic repercussions.

However, the derivatives markets experienced a noticeable shift. The options market saw increased activity in deep out-of-the-money call contracts, reflecting a surge in hedging activities as traders prepared for potential escalations that could disrupt the oil flow, as reported by financial analysts observing market trends.

Economically, the region remains on high alert. The potential for further escalation could have severe consequences not only for regional stability but also for the broader global economy. Energy market experts from OPEC+ have expressed concerns about the need for increased vigilance and potential adjustments in oil output should the situation worsen.

Investors and policymakers are closely monitoring the developments, aware that the geopolitical dynamics of the Middle East are intricately linked to the global energy markets. Any significant change in the status quo could swiftly transform from regional conflict to global economic turmoil.